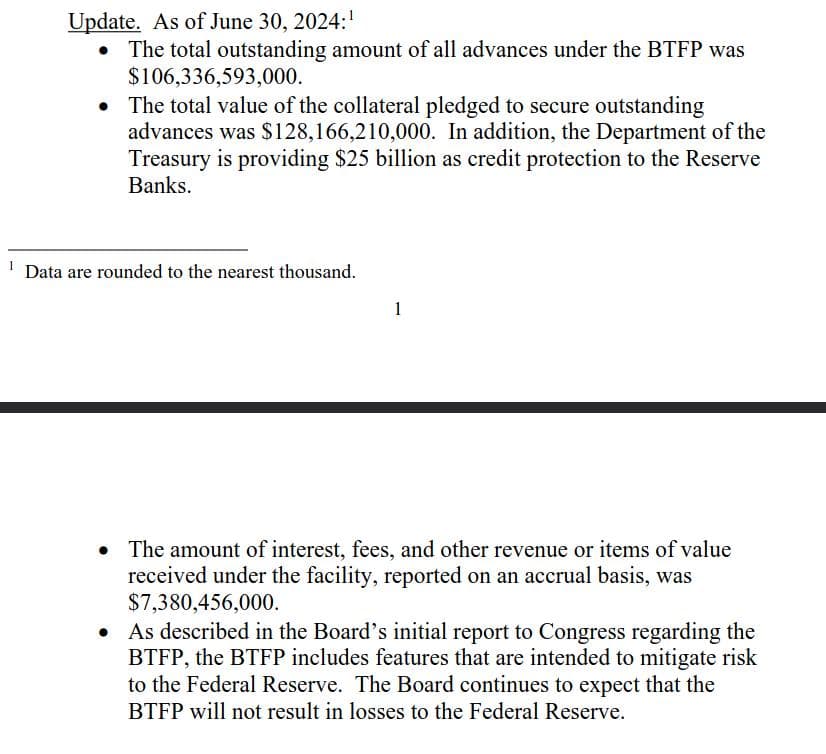

As of June 30, 2024 the total outstanding amount of all advances under the BTFP was $106,336,593,000. The amount of interest paid to live another day? $7,380,456,000.

Back in January, the Fed announced that the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11 and that the program will continue to make loans until that time and is available as an additional source of liquidity for eligible institutions.

As the program ends, the interest rate applicable to new BTFP loans has been adjusted such that the rate on new loans extended from now through program expiration will be no lower than the interest rate on reserve balances in effect on the day the loan is made. This rate adjustment ensures that the BTFP continues to support the goals of the program in the current interest rate environment. This change is effective immediately. All other terms of the program are unchanged.

I have posted multiple times about BTFP but from December 2023 to January 2024, its usage EXPLODED.

These numbers are reported to the public via two ways: Reports to Congress and weekly via the Fed's balance sheet at a 'Wednesday level'.

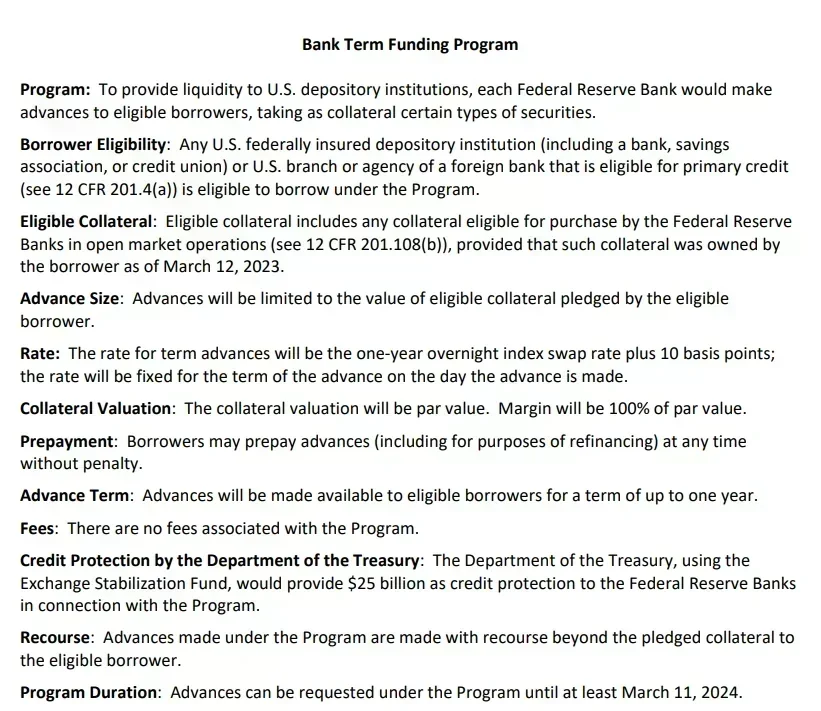

- Association, or credit union) or U.S. branch or agency of a foreign bank that is eligible for primary credit (see 12 CFR 201.4(a)) is eligible to borrow under the Program.

- Banks can borrow for up to one year, at a fixed rate for the term, pegged to the one-year overnight index swap rate plus 10 basis points.

- Banks have to post collateral (valued at par!).

- Any collateral has to be “owned by the borrower as of March 12, 2023."

- Eligible collateral includes any collateral eligible for purchase by the Federal Reserve Banks in open market operations.

Richard Ostrander (one of the architects of BTFP) spoke about implementing the program:

When the Federal Reserve established the BTFP, the lawyers of the New York Fed played an important role in facilitating its rapid implementation. I was responsible for coordinating among my team of attorneys at the New York Fed and the Board of Governors to ensure that our actions complied with applicable statutes and regulations.

Over the weekend of March 11 and 12, the Fed designed the BTFP to support the stability of the broader financial system by providing a source of financing for banks with Treasury, Agency and other eligible holdings whose market value had significantly diminished given interest rate increases.

There was not enough time to set up special purpose vehicles as the Fed had done for some of the pandemic programs. The only way to have the program up and running so quickly was to leverage our discount window facilities.

As a result, we turned to Section 13(3) of the Federal Reserve Act, which authorizes specialized lending in unusual and exigent circumstances. The BTFP extends the maximum term of lending from the Section 10B limit of four months up to a special limit of one year.

Additionally, unlike traditional discount window operations, the BTFP authorizes banks to borrow against eligible holdings up to their par value rather than their market value less a haircut

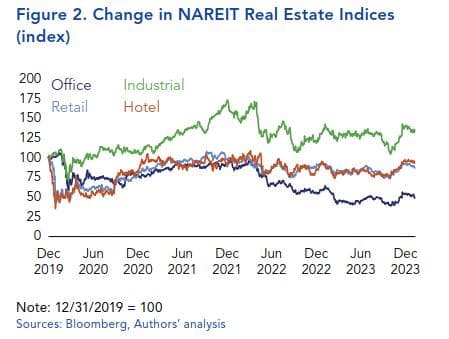

Why have Banks borrowed from BTFP so heavily? Commercial deposits have been shrinking along with M2!

A tad over a 2 years ago (4/13/2022) the commercial deposits high was hit at $18,158.3536 billion. Notice how BTFP is tapped as commercial deposits start decreasing in March of 2022?:

All this money pulled from commercial banks as M2 (U.S. money stock--currency and coins held by the non-bank public, checkable deposits, and travelers' checks, plus savings deposits, small time deposits under 100k, and shares in retail money market funds) is decreasing:

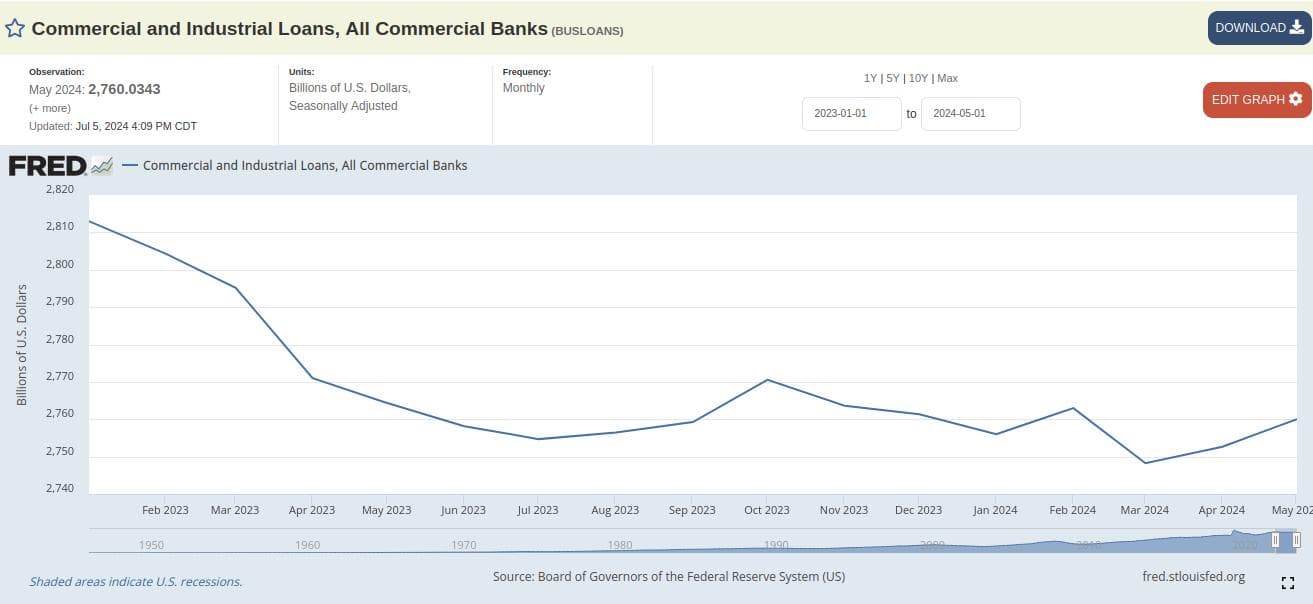

So how are they deploying cash? They sure as heck are not lending:

Commercial and Industrial (C&I) loans are loans made to businesses or corporations, not to individual consumers. These loans can be used for a variety of purposes, including capital expenditures (like buying equipment) and providing working capital for day-to-day operations. They are typically short-term loans with variable interest rates 1.

C&I loans are a key driver of economic growth because they provide businesses with the funds they need to expand, invest, and hire, which can stimulate economic activity. They are a major line of business for many banking firms as they provide credit for a wide array of business purposes 2.

As interest rates have risen, it has becomes more expensive for banks to borrow money. This increased cost can be passed on to businesses in the form of higher interest rates on commercial and industrial loans. This means that businesses would have to pay more to borrow money, which would make them less likely to take out loans for things like expansion or equipment upgrades--lining up with the recent downturn we can observe.

However, as we have seen, borrowing from the liquidity fairy is spiraling to make up for shrinking M2 and dwindling deposits!

The Fed has created an emergency backstop program so that banks won’t have to sell assets into the market if customers pull deposits in search of more attractive yields for their savings....

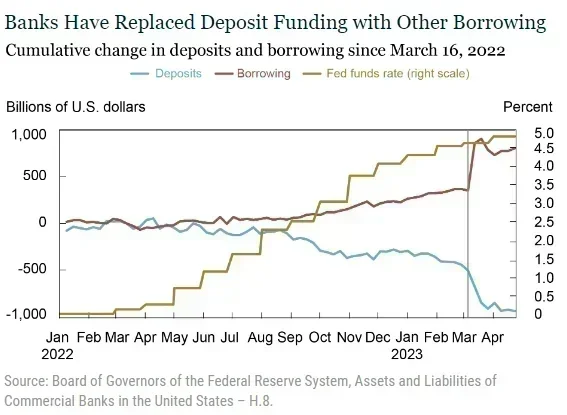

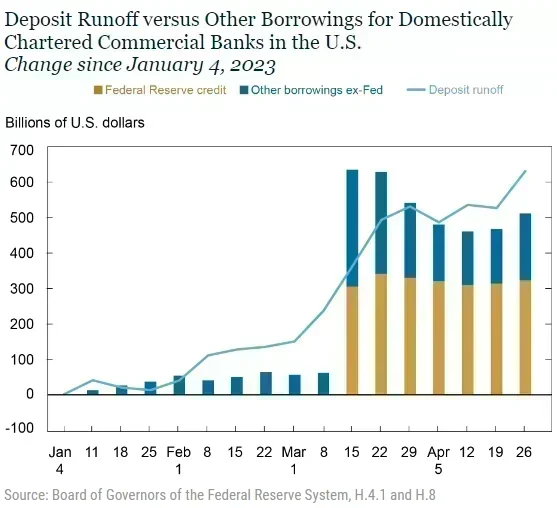

Over the few weeks prior to the FDIC receivership announcements on March 10 and 12, the banking sector lost another approximately $450 billion. Throughout, the banking sector has offset the reduction in deposit funding with an increase in other forms of borrowing which has increased by $800 billion since the start of the tightening.

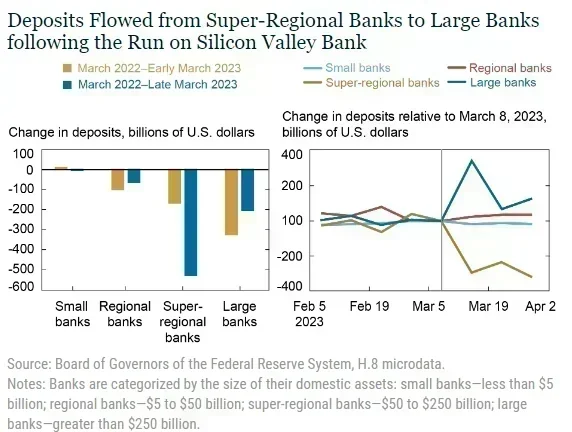

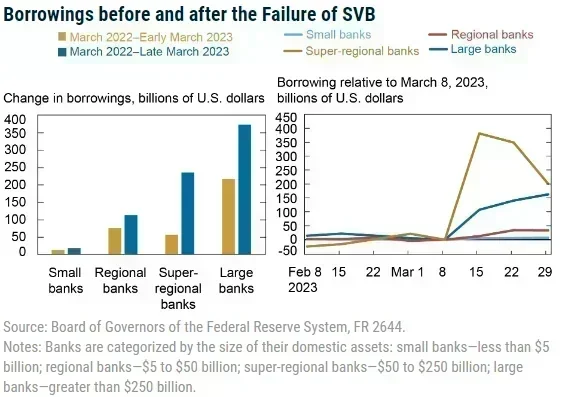

The right panel of the chart below summarizes the cumulative change in deposit funding by bank size category since the start of the tightening cycle through early March 2023 and then through the end of March. Until early March 2023, the decline in deposit funding lined up with bank size, consistent with the concentration of deposits in larger banks. Small banks lost no deposit funding prior to the events of late March. In terms of percentage decline, the outflows were roughly equal for regional, super-regional, and large banks at around 4 percent of total deposit funding:

The graph on the left demonstrates that following the SVB incident, there's a distinct shift in the pattern. This shift is primarily observed in the super-regional banks segment, which saw an exclusive increase in cash outflows. Conversely, other bank categories of different sizes mostly saw an increase in deposit inflows.

On the right, the graph indicates that the cash outflows in super-regional banks started immediately after SVB's collapse. This trend was countered by an increase in deposits at larger banks during the second week of March 2022.

Furthermore, for super-regional banks, deposit funding levels remained reduced throughout March. The significant inflows observed initially largely reverted by the month's end. It's important to note that banks with assets under $100 billion seemed to remain largely unaffected by these developments.

However, during the most acute phase of banking stress in mid-March, other borrowings exceeded reductions in deposit balances, suggesting significant and widespread demand for precautionary liquidity. A substantial amount of liquidity was provided by the private markets, likely via the FHLB system, but primary credit and the Bank Term Funding Program (both summarized as Federal Reserve credit) were equally important.

- Large banks saw the highest increase in borrowing, matching the pattern of significant deposit outflows before March 2023.

- In March 2023, both super-regional and large banks upped their borrowings, with super-regional banks, which experienced the most deposit outflows, showing the most significant increases.

- It's important to note that not all bank sizes experienced deposit outflows, yet all but the smallest banks raised their other borrowings.

- This trend indicates a system-wide demand for precautionary liquidity buffers, not limited to just the banks most impacted.

Wut Mean?

- Banks have been replacing deposit outflows with the borrowing we have covered above.

- 'Strong and resilient' indeed....

- It is starting to smell idiosyncratic all up in here:

To me, this is looking more and more like over-reliance on Central Bank Funding! Oh yeah...

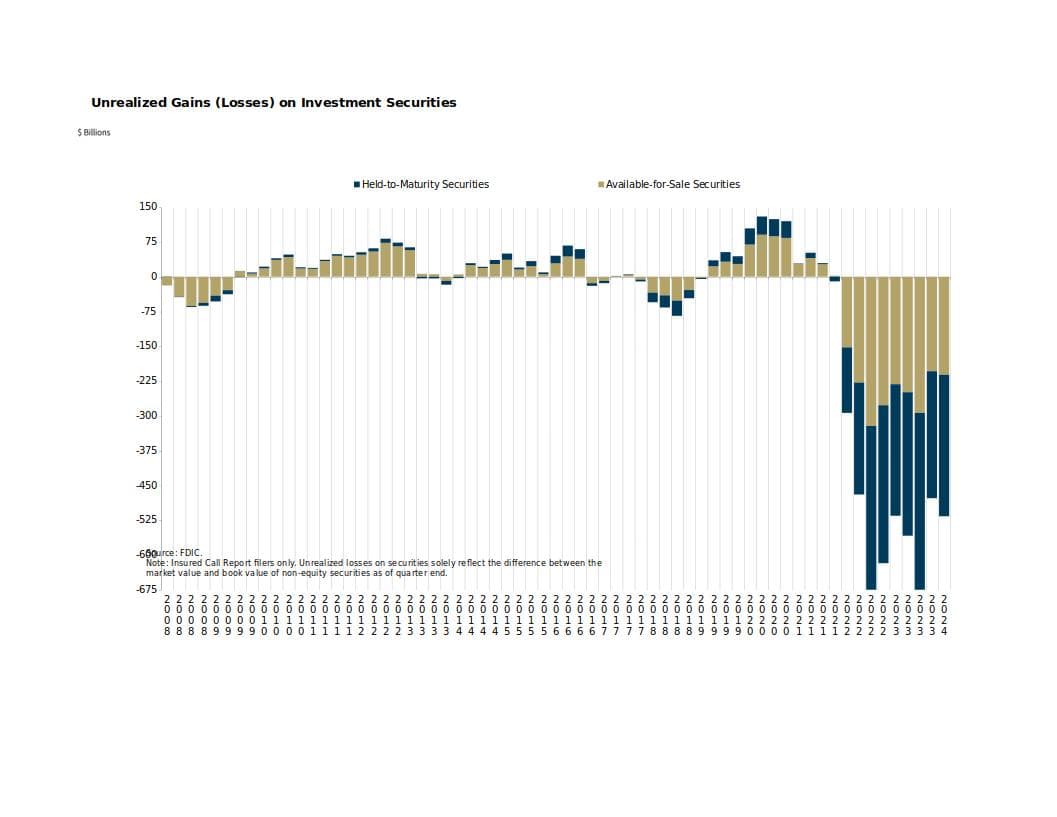

Fed & FDIC 🦵🥫 can't hide unrealized losses

the total unrealized losses as of now: $17.5T × 3.9 × 2.7% = $1.84 trillion $0.14 trillion more in unrealized losses $107.4 billion $40 billion ($0.04 trillion) on the bleeding edge of bankruptcy

Banks would be bankrupt already if it wasn't for BTFP.

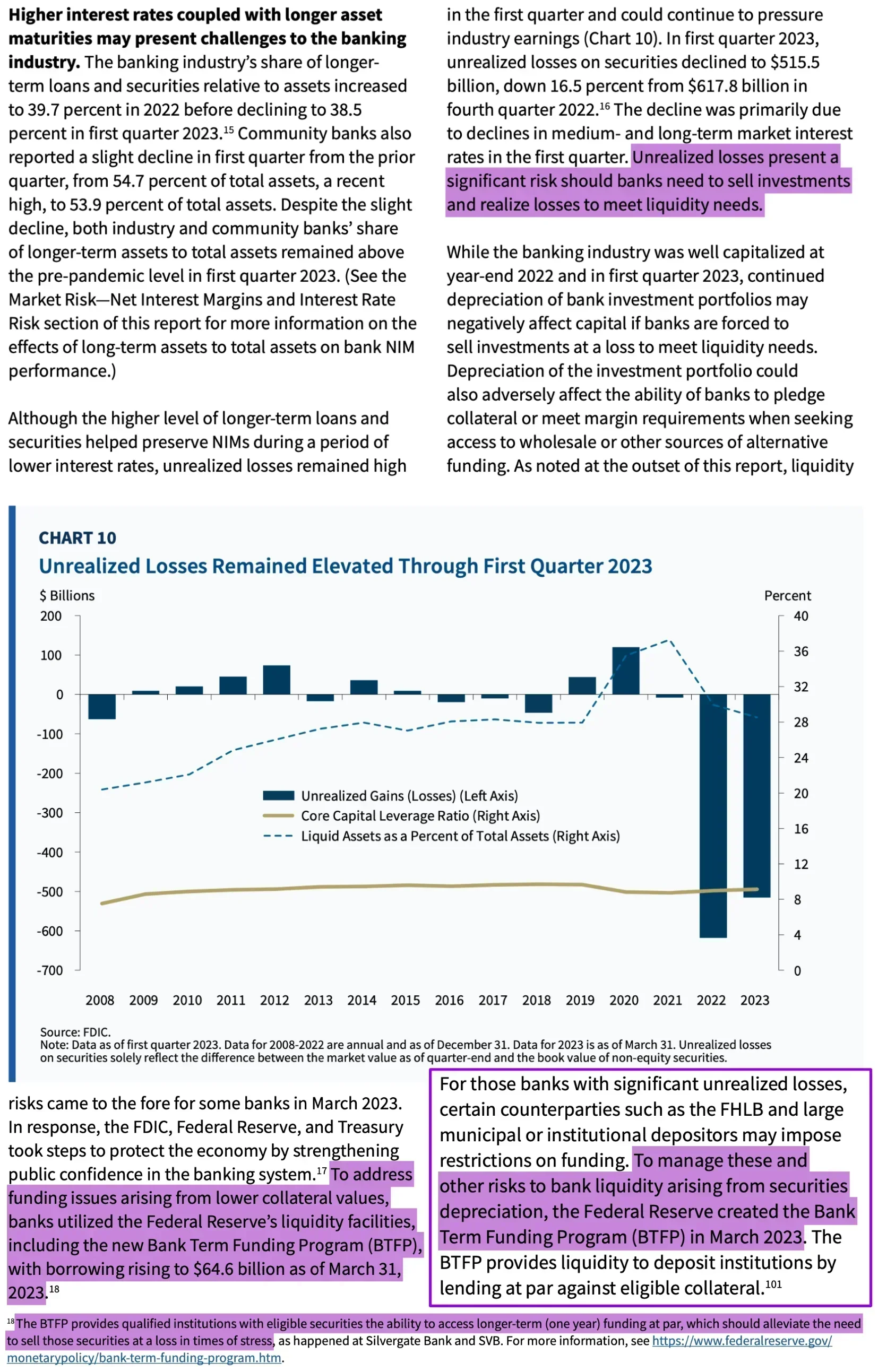

From the FDIC Quarterly Banking Profile:

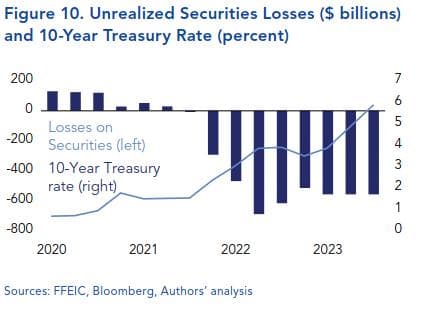

Unrealized Losses on Securities Increased From the Previous Quarter to $516.5 Billion

Unrealized losses on securities totaled $516.5 billion in the first quarter, an increase of $38.9 billion (8.2 percent) from fourth quarter 2023. Higher unrealized losses on residential mortgage-backed securities accounted for almost 95 percent of the total decrease. Mortgage rates increased in the first quarter, which placed downward pressure on the underlying values of such investments.

Vice Chair for Supervision Michael S. Barr:

Another interesting thought from r/Superstonk's u/TheUltimator5:

Office of Financial Research: "As of Q4 2023, 185 banks with $524 billion of assets had unrealized securities losses that exceeded their shareholders’ equity."

The 2023 bank failures revealed banks' vulnerability to unrealized securities losses and rapid uninsured deposit withdrawals. Despite this, many banks still hold significant unrealized securities losses and uninsured deposits at risk of major commercial real estate (CRE) loan losses. This analysis from the Office of Financial Research (OFR) identifies which banks are most susceptible to these losses.

Banks are heavily invested in CRE debt, with many having concentrations that have been problematic in the past. Without reducing their CRE exposure, banks face heightened risk, particularly if the office sector continues to underperform.

The uncertainty regarding banks' resilience to CRE loan losses could lead to a loss of confidence among investors and depositors. Following the 2023 bank failures, many shifted their funds to larger banks, a trend that could recur for today's vulnerable banks.

If future CRE loan losses match those of past downturns, numerous banks might see combined CRE and unrealized securities losses surpassing their shareholders' equity, even in a better interest rate environment....

"CRE Downturns and Bank Failures"

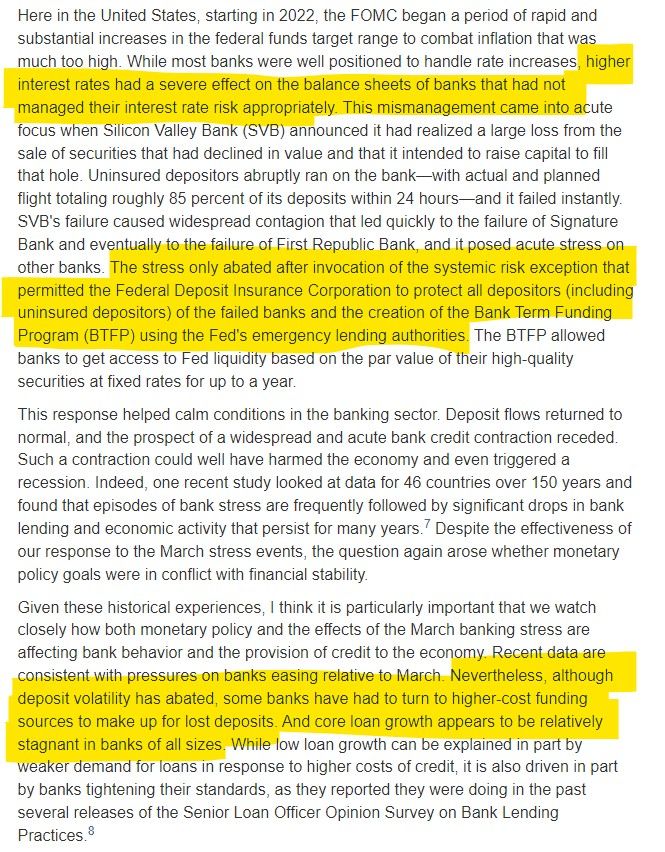

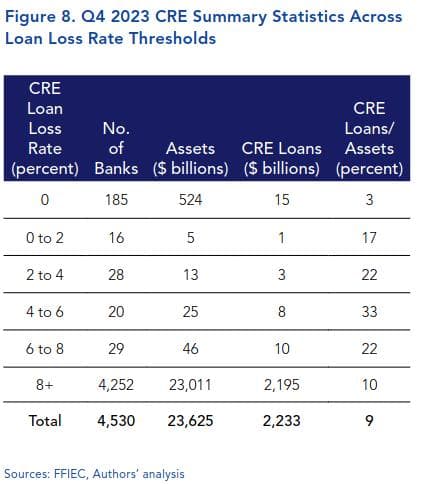

Since 1987, five downturns in CRE have coincided with recessions or high-interest rate periods. As of Q4 2023, banks are heavily invested in CRE debt, holding $2.2 trillion in CRE loans, including $406 billion in construction loans, making up 9% of their total assets.

Historically, CRE loan losses have been a major factor in bank failures, notably during the 2008-11 and 1987-90 periods. While multiple factors can lead to bank failures, CRE loan losses have frequently been the catalyst during these times.

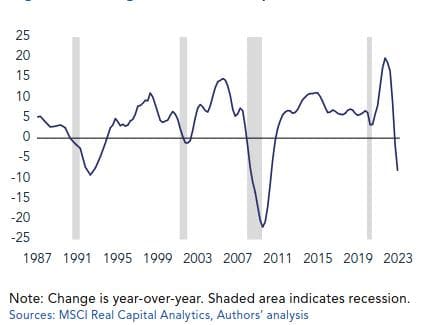

"The Office Sector Is Weighing Down CRE Performance"

CRE is experiencing a modest downturn due to higher interest rates and reduced liquidity. However, the analysis calls out that the office sector is significantly under-performing, primarily due to the widespread adoption of work-from-home (WFH)--companies are cutting back on office space as leases come up for renewal, leading to a gradual but steady increase in vacancies.

The sector's declining valuations and cash flows have resulted in higher delinquencies and defaults. The stock market performance of office Real Estate Investment Trusts (REITs) mirrors this trend, with office REIT prices dropping 52% since early 2020. In contrast, industrial REITs have seen a 33% increase, highlighting the varying impacts within the CRE market.

"How Many Banks Are Vulnerable to CRE Loan Losses?"

An analysis assessing bank vulnerability to commercial real estate (CRE) loan losses used data from the 2023 failures of Silicon Valley Bank (SVB), Signature Bank (SB), and First Republic Bank (FR-B). A bank is considered vulnerable if it has above-average CRE loan exposure, significant unrealized securities losses, and a high level of unsecured deposits.

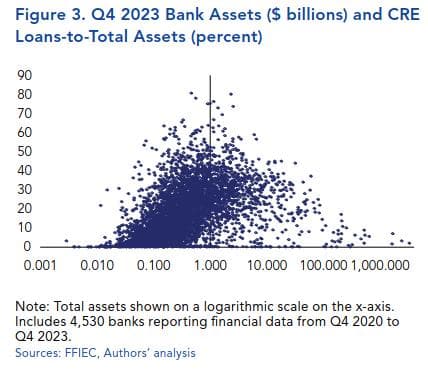

CRE Loan Exposure: Small banks (assets ≤ $1 billion) tend to have higher CRE loan concentrations.

- As of Q4 2023, 102 small banks with $109 billion in combined assets had a CRE loans-to-assets ratio of 50%.

- Conversely, larger banks with over $250 billion in assets had an average CRE-to-assets ratio of 4%.

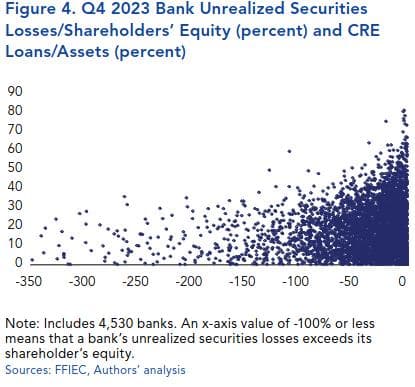

Significant Unrealized Securities Losses: High CRE loan concentrations alone do not necessarily indicate risk. However, many banks with high CRE concentrations also have substantial unrealized securities losses.

- As of Q4 2023, 185 banks with $524 billion in assets had unrealized securities losses exceeding their shareholders’ equity.

- Among these, 21 banks with $21 billion in assets had a CRE concentration of 25% or more.

- Additionally, 764 banks with $1.2 trillion in assets had unrealized losses equal to 75% of shareholders’ equity, including 120 banks with $130 billion in assets and a CRE concentration of 25% or more.

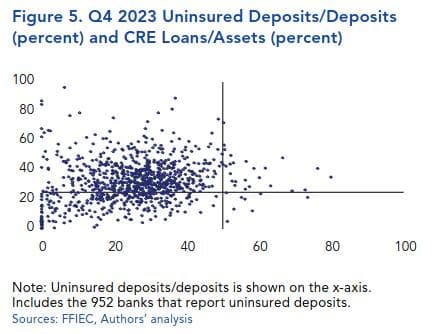

Deposits, essentially short-term loans from depositors, fund nearly 80% of banks’ assets. A lack of confidence can lead to deposit withdrawals, destabilizing banks. The 2023 failures of SVB, SB, and FR-B highlighted this risk, triggering significant official-sector intervention to prevent a wider banking crisis.

- As of Q4 2023, 81 banks had an uninsured deposits ratio of 50% or higher, exceeding FR-B’s 48% before its failure.

- Among these, 54 banks with $187 billion in assets also had a CRE concentration of 25% or more.

"Deterioration of the Credit Quality of CRE Loans"

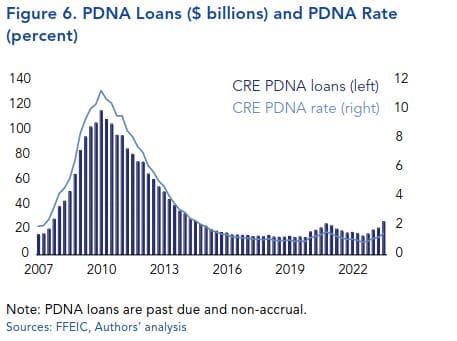

The credit quality of bank CRE loans has recently deteriorated, evidenced by a sharp rise in past due and non-accrual (PDNA) CRE loans.

- As of Q4 2023, PDNA CRE loans totaled $28.7 billion, marking a $12.0 billion or 72% increase since the beginning of the year.

- The PDNA rate rose to 1.28%, up from 0.77% a year ago, reaching its highest level since Q3 2015.

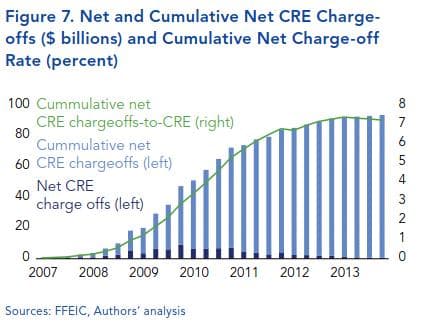

Currently, aggregate CRE net charge-offs are under $1 billion, but these typically lag behind the growth of PDNA loans. Historically, during a CRE downturn, loan losses can be substantial. For instance, the authors call out that during the 2007-2009 financial crisis, cumulative net CRE loan losses escalated to $93 billion, corresponding to a 7.3% CRE net charge-off rate, though these losses were realized over several years.

"Estimated CRE Loan Losses"

The authors state potential future losses from CRE loans remain uncertain, but historical net charge-off rates provide a reference. During the 2007-2009 financial crisis, CRE loan losses peaked at 7.3%. If banks faced a similar rate today, they would incur a $163 billion charge-off. Even at a 4% loss rate, banks would see an $89 billion impairment.

Using these estimates, vulnerable banks—those where CRE loan losses plus unrealized securities losses exceed shareholders' equity—were identified. As of Q4 2023, 185 banks with $524 billion in assets already had unrealized securities losses surpassing their equity. If CRE loan losses hit 4%, 229 banks with $542 billion in assets would be underwater. At an 8% loss rate, 278 banks with $614 billion in assets would be affected.

As of Q4 2023, 185 banks with $524 billion in assets already had unrealized securities losses surpassing their equity. If CRE loan losses hit 4%, 229 banks with $542 billion in assets would be underwater. At an 8% loss rate, 278 banks with $614 billion in assets would be affected.

These 278 banks are generally small, with assets of $1 billion or less, and are mainly located in the Midwest and South. The Midwest has 102 vulnerable banks with $50 billion in assets, while the South has 141 banks with $494 billion in assets. The Northeast and Pacific regions have fewer at-risk banks, with none in New England.

Many of the vulnerable banks have high CRE loan concentrations and large unrealized securities losses. Of the 37 banks reporting uninsured deposits, 18 have an uninsured deposits-to-total deposits ratio of 33% or higher, and seven exceed 50%.

Three states have the highest concentration of vulnerable banks: Texas (43 banks with $442 billion in assets), Alabama (20 banks with $9 billion in assets), and Minnesota (19 banks with $6 billion in assets). These states have 33 banks with significant CRE loan concentrations, and their loan performance is below average, with a Q4 2023 aggregate PDNA rate of 1.94%, compared to the overall bank average of 1.28%.

"The Effect of Changing Interest Rates on Unrealized Securities Losses"

Banks' securities portfolios, largely composed of long-term, fixed-rate debt securities, have suffered significant fair-value losses due to rising interest rates. By Q4 2023, banks faced $478 billion in unrealized securities losses. This shift began when the Federal Open Market Committee (FOMC) started raising rates in March 2022, pushing the federal funds rate target range from 0.25% to 5.50% by July 2023.

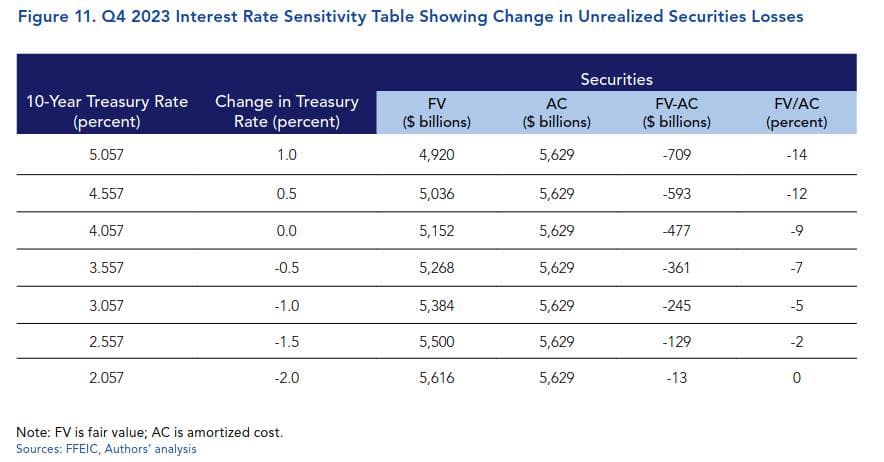

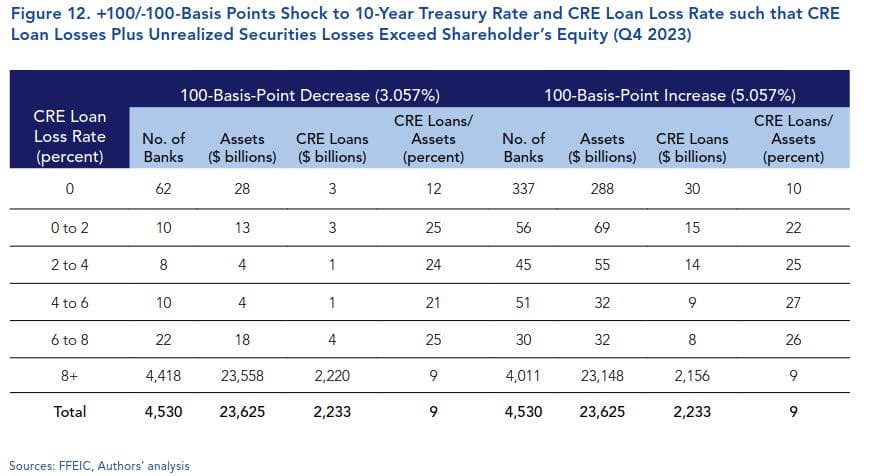

As of Q4 2023, every 50-basis-point change in the 10-year Treasury rate results in a $118 billion change in the aggregate fair value of banks' securities. A 100-basis-point decrease to 3.057% would reduce unrealized losses to $245 billion, while a 100-basis-point increase to 5.057% would raise losses to $709 billion.

Using different interest rate scenarios, the analysis projects the impact on banks' securities portfolios and their vulnerability to commercial real estate (CRE) loan losses. In a scenario with a 100-basis-point rate decrease and no CRE loan losses, 62 banks with $28 billion in assets would have unrealized securities losses exceeding their equity. If CRE loan losses reach 4%, 80 banks with $45 billion in assets would be impacted; at an 8% loss rate, 112 banks with $67 billion in assets would be affected.

Conversely, in a scenario with a 100-basis-point rate increase, 337 banks with $288 billion in assets would have unrealized securities losses surpassing their equity. At a 4% CRE loan loss rate, 438 banks with $412 billion in assets would be vulnerable; at an 8% loss rate, 519 banks with $477 billion in assets would face combined realized and unrealized losses exceeding their shareholders' equity.

The authors conclude that many banks are still grappling with conditions similar to those that led to the significant bank failures in 2023, including substantial unrealized securities losses and high levels of uninsured deposits. The added prospect of CRE loan losses heightens the risk, particularly for smaller banks with assets of $1 billion or less. Even if interest rates decrease this year, hundreds of banks with substantial total assets remain at risk unless they significantly reduce their CRE exposure or bolster their resilience.

S&P Global: Public US banks with high Commercial Real Estate (CRE) concentrations under SEC scrutiny.

S&P Global's Zoe Sagalow is reporting that the US Securities and Exchange Commission (SEC) is intensifying its scrutiny of public US banks with high concentrations of commercial real estate (CRE) holdings. This move comes as federal bank regulators, including the Federal Deposit Insurance Corp., the Office of the Comptroller of the Currency, and the Federal Reserve, increase their own examinations of banks' CRE portfolios for safety and soundness concerns.

Banks must now provide detailed disclosures about their CRE portfolios, including industry and geographic breakdowns, loan-to-value ratios, occupancy percentages, loan modifications, appraisal sources, and risk management practices. The SEC's involvement, typically outside its usual purview, indicates a significant shift in regulatory focus.

In April, Independent Bank Group Inc. and New York Community Bancorp Inc. received SEC letters requesting additional CRE details, following earlier letters to Western Alliance Bancorp and several community banks. This trend has been ongoing for at least a year, with the SEC sending numerous letters seeking granular CRE data, particularly breakdowns by industry.

Despite the SEC's lack of authority to demand changes in banks' lending behaviors, its increased focus aims could be to enhance transparency for investors. Experts speculate that the SEC's actions might be driven by concerns highlighted in the Financial Stability Oversight Council's latest report, which identified CRE as a potential vulnerability for banks.

Again, it is unclear why the SEC is probing CRE books, especially since the SEC does not have authority to demand banks' change their lending behavior like the Federal Deposit Insurance Corp., the Office of the Comptroller of the Currency and the Federal Reserve do.

It is also possible banking agencies asked the SEC to get involved.

Interestingly, this comes on the heals of today's Office Financial Research reporting that 764 banks with $1.2 trillion in assets had unrealized losses equal to 75% of shareholders’ equity, including 120 banks with $130 billion in assets and a CRE concentration of 25% or more.

If CRE loan losses hit 4%, 229 banks with $542 billion in assets would be underwater. At an 8% loss rate, 278 banks with $614 billion in assets would be affected.

During the 2007-2009 financial crisis, CRE loan losses peaked at 7.3%. If banks faced a similar rate today, they would incur a $163 billion charge-off. Even at a 4% loss rate, banks would see an $89 billion impairment.

TLDRS:

- As of June 30, 2024 the total outstanding amount of all advances under the BTFP was $106,336,593,000.

- The amount of interest paid to live another day? $7,380,456,000 (so far...).

- Borrowing from the liquidity fairy via BTFP continues to make up for a shrinking M2 and dwindling commercial deposits.

- How did all these banks pass those 'Stress tests' needing all this liquidity?!?!....

- "The updated guidance encourages depository institutions to incorporate the discount window as part of their contingency funding plans."

- The liquidity fairy is now ENCOURAGED?

- The FDIC noticed that some banks aren't correctly reporting the amount of deposits they have that aren't covered by federal insurance.

- Some banks mistakenly think that if a deposit is backed by assets (like collateral), it doesn't need to be reported as uninsured.

- This isn't right! The deposit's status doesn't change just because it has collateral.

- When banks incorrectly report uninsured deposits, it could create a perception in the market that these banks are more stable than they actually are.

- Banks that incorrectly report uninsured deposits might face liquidity challenges in extreme circumstances, where depositors simultaneously demand their funds.

- S&P Global's Zoe Sagalow is reporting the SEC is intensifying scrutiny of public US banks with high concentrations of commercial real estate (CRE) holdings.

- Experts speculate that the SEC's increased focus on CRE could be driven by concerns highlighted in the Financial Stability Oversight Council's latest report, which identified CRE as a potential vulnerability for banks.

- The Office of Financial Research reports that 764 banks with $1.2 trillion in assets have unrealized losses equal to 75% of shareholders' equity, and CRE loan losses of 4% could put 229 banks underwater, while an 8% loss rate could affect 278 banks, recalling the peak CRE loan losses of 7.3% during the 2007-2009 financial crisis.

- Even if interest rates decrease this year, hundreds of banks with substantial total assets remain at risk unless they significantly reduce their CRE exposure or bolster their resilience.

- Fed Chair Jerome Powell testified before the U.S. Senate Committee on Banking, Housing, and Urban Affairs, highlighting economic expansion despite moderating GDP growth in the first half of the year.

- "we do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent. Incoming data for the first quarter of this year did not support such greater confidence."

- On the consumer side, Consumer spending remains robust, with moderate growth in capital spending and residential investment.The labor market has stabilized with a 4.1% unemployment rate and an average of 222,000 payroll job gains per month in the first half of the year.Inflation has eased but is still above the Fed's 2% goal, with total and core personal consumption expenditures (PCE) prices rising 2.6% over the past 12 monthsLonger-term inflation expectations remain well anchored.

- A combination of slower wage growth, higher interest rates, and depleted savings indicate that the headwinds will continue against consumers and this will continue to play heavily on consumer spending moving forward.Reminder, consumer spending is a major factor in the U.S. economy and its GDP, it goes down, companies fail.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to hold elevated interest rates--causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.

As of June 30, 2024 the total outstanding amount of all advances under the BTFP was $106,336,593,000. The amount of interest paid to live another day? $7,380,456,000.

by u/Dismal-Jellyfish in Superstonk

As of June 30, 2024 the total outstanding amount of all advances under the BTFP was $106,336,593,000. The amount of interest paid to live another day? $7,380,456,000.https://t.co/75ZErF1uFY

— dismal-jellyfish (@DismalJellyfish) July 12, 2024