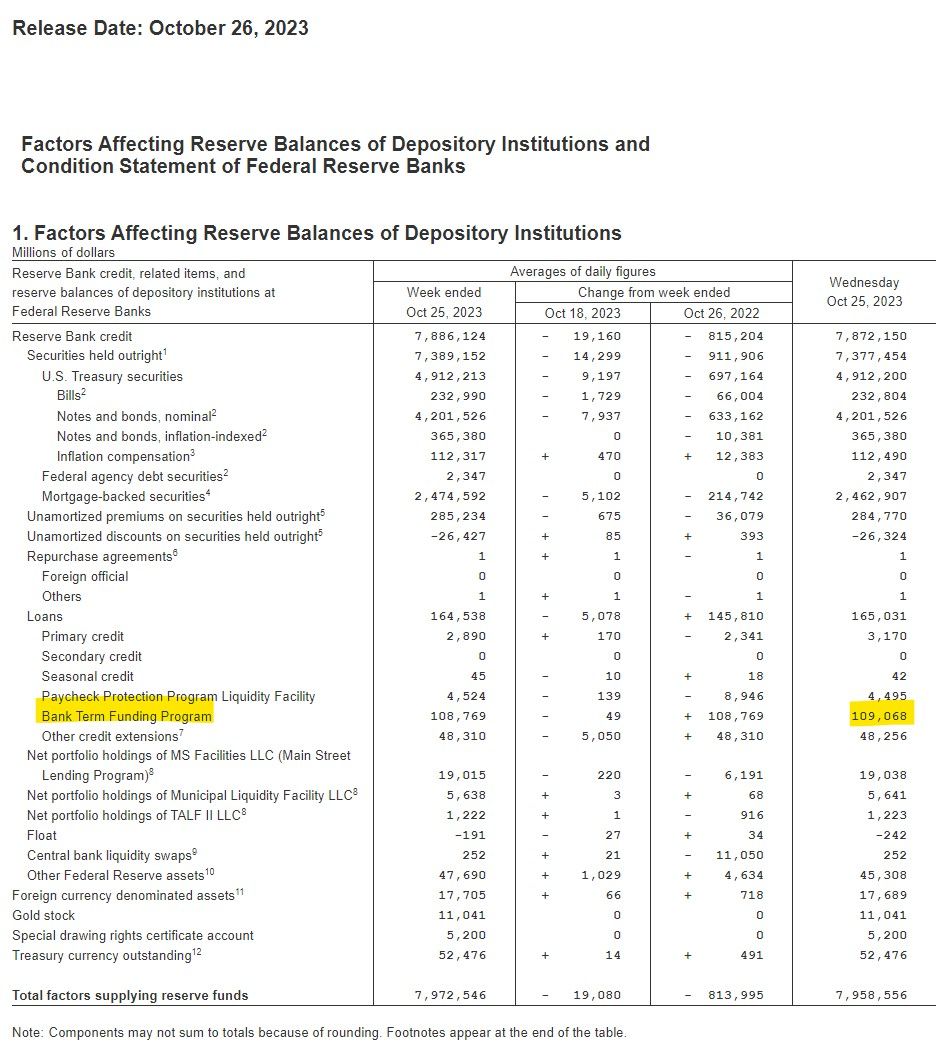

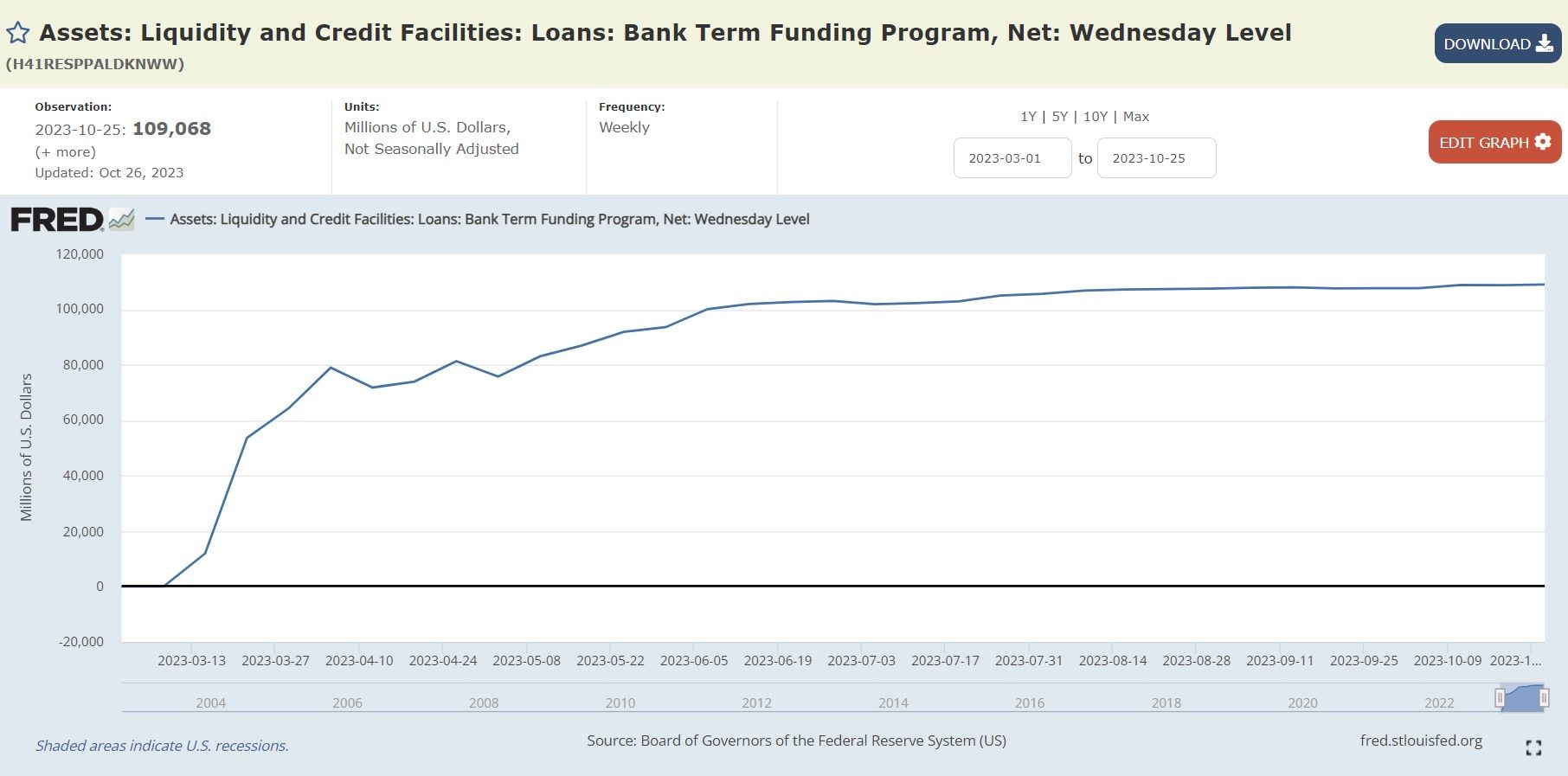

Bank Term Funding Program usage reported at $109.068B, above $100B for the 21st consecutive week! An over reliance on central bank funding that is growing faster than the rate of inflation, BTFP is a moral hazard!

Hello, happy Friday and beginning to the weekend!

Borrowing from the Bank Term Funding Program hit a NEW all time high this week ($109.068 billion)--the 21st consecutive week above $100 billion!

What we are reviewing:

- Bank Term Funding Program (BTFP)

- Discount Window/Primary Credit

- "Other Credit Extensions"

I hope to shed light on the recent uptick in borrowing due to an attempt to offset the shrink in M2 and dip in deposits.

Buckle up!

Bank Term Funding Program (BTFP):

Weekly readings from the Fed:

| Date amount observed | Bank Term Funding Program (BTFP)($ billion) | Up from 3/15, 1st week of program ($ billion) |

|---|---|---|

| 3/15 | $11.943 billion | $0 billion |

| 3/22 | $53.669 billion | $41.723 billion |

| 3/29 | $64.403 billion | $52.460 billion |

| 3/31 | $64.595 billion | $52.652 billion |

| 4/5 | $79.021 billion | $67.258 billion |

| 4/12 | $71.837 billion | $59.894 billion |

| 4/19 | $73.982 billion | $62.039 billion |

| 4/26 | $81.327 billion | $69.384 billion |

| 5/3 | $75.778 billion | $63.935 billion |

| 5/10 | $83.101 billion | $71.158 billion |

| 5/17 | $87.006 billion | $75.063 billion |

| 5/24 | $91.907 billion | $79.964 billion |

| 5/31 | $93.615 billion | $81.672 billion |

| 6/7 | $100.161 billion | $88.218 billion |

| 6/14 | $101.969 billion | $90.026 billion |

| 6/21 | $102.735 billion | $90.792 billion |

| 6/28 | $103.081 billion | $91.138 billion |

| 7/5 | $101.959 billion | $90.016 billion |

| 7/12 | $102.305 billion | $90.362 billion |

| 7/19 | $102.927 billion | $90.984 billion |

| 7/26 | $105.078 billion | $93.155 billion |

| 8/2 | $105.684 billion | $93.741 billion |

| 8/9 | $106.864 billion | $94.921 billion |

| 8/16 | $107.242 billion | $95.299 billion |

| 8/23 | $107.386 billion | $95.443 billion |

| 8/30 | $107.527 billion | $95.584 billion |

| 9/6 | $107.855 billion | $95.912 billion |

| 9/13 | $107.993 billion | $96.05 billion |

| 9/20 | $107.599 billion | $95.656 billion |

| 9/27 | $107.715 billion | $95.772 billion |

| 10/4 | $107.665 billion | $95.722 billion |

| 10/11 | $108.884 billion | $96.941 billion |

| 10/18 | $108.818 billion | $96.875 billion |

| 10/25 | $109.068 billion | $97.125 billion |

Monthly Reports to Congress:

| Date Reported | Total amount outstanding | Total pledged collateral | Interest paid to survive another day |

|---|---|---|---|

| 3/15 | $11,942,528,000 | $15,855,798,000 | $662,000 |

| 3/31 | $64,595,880,000 | $79,569,489,000 | $93,568,000 |

| 4/30 | $83,061,693,000 | $104,229,674,000 | $369,957,000 |

| 5/31 | $107,376,686,000 | $128,972,991,000 | $762,960,000 |

| 6/30 | $115,629,868,000 | $136,535,267,000 | $1,211,623,000 |

| 7/31 | $119,127,391,000 | $144,379,894,000 | $1,683,694,000 |

| 8/31 | $121,234,139,000 | $145,422,700,000 | $2,173,066,000 |

| 9/30 | $119,104,573,000 | $145,371,270,000 | $2,645,685,000 |

Over $500 million in interest from August to September to survive another day...

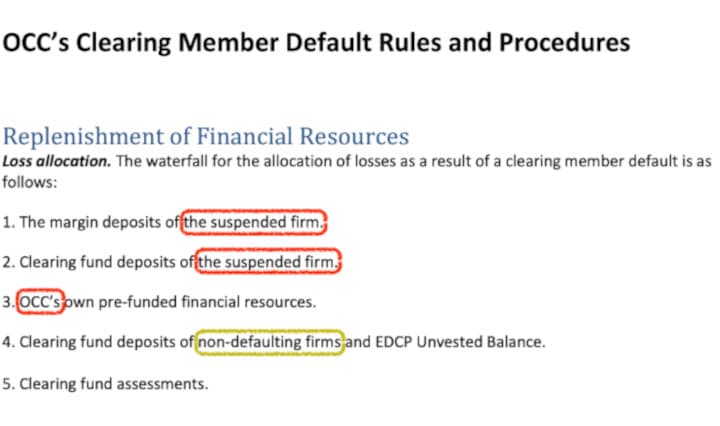

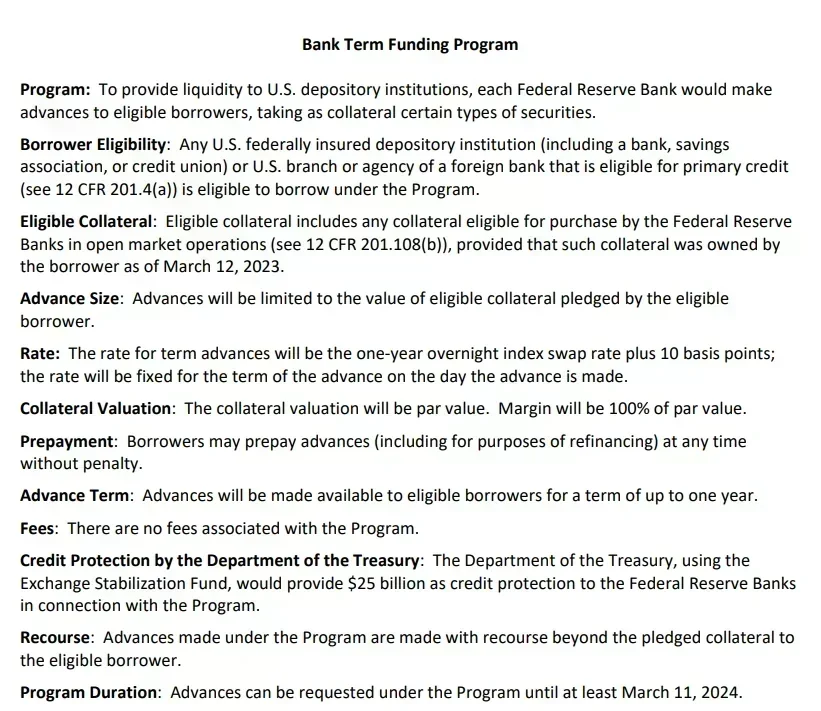

- Association, or credit union) or U.S. branch or agency of a foreign bank that is eligible for primary credit (see 12 CFR 201.4(a)) is eligible to borrow under the Program.

- Banks can borrow for up to one year, at a fixed rate for the term, pegged to the one-year overnight index swap rate plus 10 basis points.

- Banks have to post collateral (valued at par!).

- Any collateral has to be “owned by the borrower as of March 12, 2023."

- Eligible collateral includes any collateral eligible for purchase by the Federal Reserve Banks in open market operations.

Richard Ostrander (one of the architects of BTFP) spoke about it:

When the Federal Reserve established the BTFP, the lawyers of the New York Fed played an important role in facilitating its rapid implementation. I was responsible for coordinating among my team of attorneys at the New York Fed and the Board of Governors to ensure that our actions complied with applicable statutes and regulations.

Over the weekend of March 11 and 12, the Fed designed the BTFP to support the stability of the broader financial system by providing a source of financing for banks with Treasury, Agency and other eligible holdings whose market value had significantly diminished given interest rate increases.

There was not enough time to set up special purpose vehicles as the Fed had done for some of the pandemic programs. The only way to have the program up and running so quickly was to leverage our discount window facilities.As a result, we turned to Section 13(3) of the Federal Reserve Act, which authorizes specialized lending in unusual and exigent circumstances. The BTFP extends the maximum term of lending from the Section 10B limit of four months up to a special limit of one year. Additionally, unlike traditional discount window operations, the BTFP authorizes banks to borrow against eligible holdings up to their par value rather than their market value less a haircut

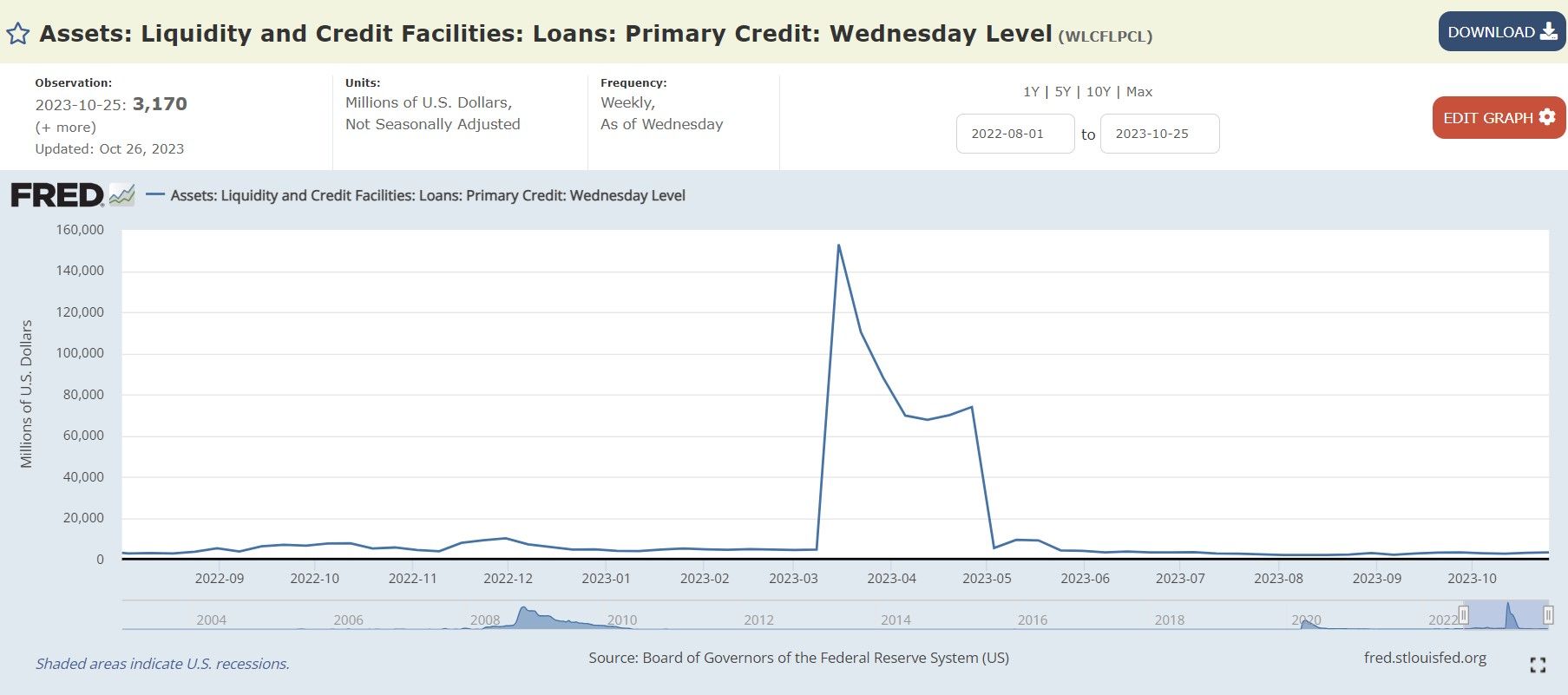

Discount Window/Primary Credit:

| Date | Discount Window | Down from 3/15 high |

|---|---|---|

| 3/15 | $152.853 billion | $0 billion |

| 3/22 | $110.248 billion | -$42.605 billion |

| 3/29 | $88.157 billion | -$64.696 billion |

| 4/5 | $69.705 billion | -$83.148 billion |

| 4/12 | $67.633 billion | -$85.22 billion |

| 4/19 | $69.925 billion | -$82.928 billion |

| 4/26 | $73.855 billion | -$78.998 billion |

| 5/3 | $.5345 billion | -$152.3185 billion |

| 5/10 | $.9323 billion | -$151.9207 billion |

| 5/17 | $.9048 billion | -$151.9482 billion |

| 5/24 | $.4211 billion | -$152.4319 billion |

| 5/31 | $.3971 billion | -$152.4559 billion |

| 6/7 | $.3167 billion | -$152.5363 billion |

| 6/14 | $.3618 billion | -$152.4912 billion |

| 6/21 | $.3208 billion | -$152.5322 billion |

| 6/28 | $.3209 billion | -$152.5321 billion |

| 7/5 | $.3356 billion | -$152.5174 billion |

| 7/12 | $.2682 billion | -$152.5848 billion |

| 7/19 | $.2633 billion | -$152.5897 billion |

| 7/26 | $.2249 billion | -$152.6281 billion |

| 8/2 | $.1898 billion | -$152.0632 billion |

| 8/9 | $.1911 billion | -$152.6619 billion |

| 8/16 | $.1966 billion | -$152.6564 billion |

| 8/23 | $.2190 billion | -$152.634 billion |

| 8/30 | $.2907billion | -$152.5623 billion |

| 9/6 | $.2051 billion | -$152.6479billion |

| 9/13 | $.2698 billion | -$152.5832 billion |

| 9/20 | $.3078 billion | -$152.5452 billion |

| 9/27 | $.3193 billion | -$152.5337billion |

| 10/4 | $.2773 billion | -$152.5757 billion |

| 10/11 | $.2580 billion | -$152.5950 billion |

| 10/18 | $.2962 billion | -$152.5568 billion |

| 10/25 | $.3170 billion | -$152.5360 billion |

Primary Credit allows banks to borrow against collateral at the current federal funds rate:

Overview:

Federal Reserve lending to depository institutions (the “discount window”) plays an important role in supporting the liquidity and stability of the banking system and the effective implementation of monetary policy.

By providing ready access to funding, the discount window helps depository institutions manage their liquidity risks efficiently and avoid actions that have negative consequences for their customers, such as withdrawing credit during times of market stress. Thus, the discount window supports the smooth flow of credit to households and businesses. Providing liquidity in this way is one of the original purposes of the Federal Reserve System and other central banks around the world.

The "Primary Credit" program is the principal safety valve for ensuring adequate liquidity in the banking system. Primary credit is priced relative to the FOMC’s target range for the federal funds rate and is normally granted on a “no-questions-asked,” minimally administered basis. There are no restrictions on borrowers’ use of primary credit.

Examples of common borrowing situations:

- Tight money markets or undue market volatility

- Preventing an overnight overdraft

- Meeting a need for funding, including a short-term liquidity demand that may arise from unexpected deposit withdrawals or a spike in loan demand

The introduction of the primary credit program in 2003 marked a fundamental shift - from administration to pricing - in the Federal Reserve's approach to discount window lending. Notably, eligible depository institutions may obtain primary credit without exhausting or even seeking funds from alternative sources. Minimal administration of and restrictions on the use of primary credit makes it a reliable funding source. Being prepared to borrow primary credit enhances an institution's liquidity.

Notice how use of the Discount Window has PLUMMETED as BTFP has come in to play?

| Date amount observed | Bank Term Funding Program (BTFP)($ billion) | Discount Window ($ billion) |

|---|---|---|

| 3/15 | $11.943 billion | $152.853 billion |

| 3/22 | $53.669 billion | $110.248 billion |

| 3/29 | $64.403 billion | $88.157 billion |

| 4/5 | $79.021 billion | $69.705 billion |

| 4/12 | $71.837 billion | $67.633 billion |

| 4/19 | $73.982 billion | $69.925 billion |

| 4/26 | $81.327 billion | $73.855 billion |

| 5/3 | $75.778 billion | $.5345 billion |

| 5/10 | $83.101 billion | $.9323 billion |

| 5/17 | $87.006 billion | $.9048 billion |

| 5/24 | $91.907 billion | $.4211 billion |

| 5/31 | $93.615 billion | $.3971 billion |

| 6/7 | $100.161 billion | $.3167 billion |

| 6/14 | $101.969 billion | $.3618 billion |

| 6/21 | $102.735 billion | $.3208 billion |

| 6/28 | $103.081 billion | $.3209 billion |

| 7/5 | $101.959 billion | $.3356 billion |

| 7/12 | $102.305 billion | $.2682 billion |

| 7/19 | $102.927 billion | $.2633 billion |

| 7/26 | $105.078 billion | $.2249 billion |

| 8/2 | $105.684 billion | $.1898 billion |

| 8/9 | $106.864 billion | $.1911 billion |

| 8/16 | $107.242 billion | $.1966 billion |

| 8/23 | $107.386 billion | $.2190 billion |

| 8/30 | $107.527 billion | $.2907billion |

| 9/6 | $107.855 billion | $.2051 billion |

| 9/13 | $107.993 billion | $.2698 billion |

| 9/20 | $107.599 billion | $.3078 billion |

| 9/27 | $107.715 billion | $.3193 billion |

| 10/4 | $107.665 billion | $.2773 billion |

| 10/11 | $108.884 billion | $.2580 billion |

| 10/18 | $108.818 billion | $.2962 billion |

| 10/25 | $109.068 billion | $.3170 billion |

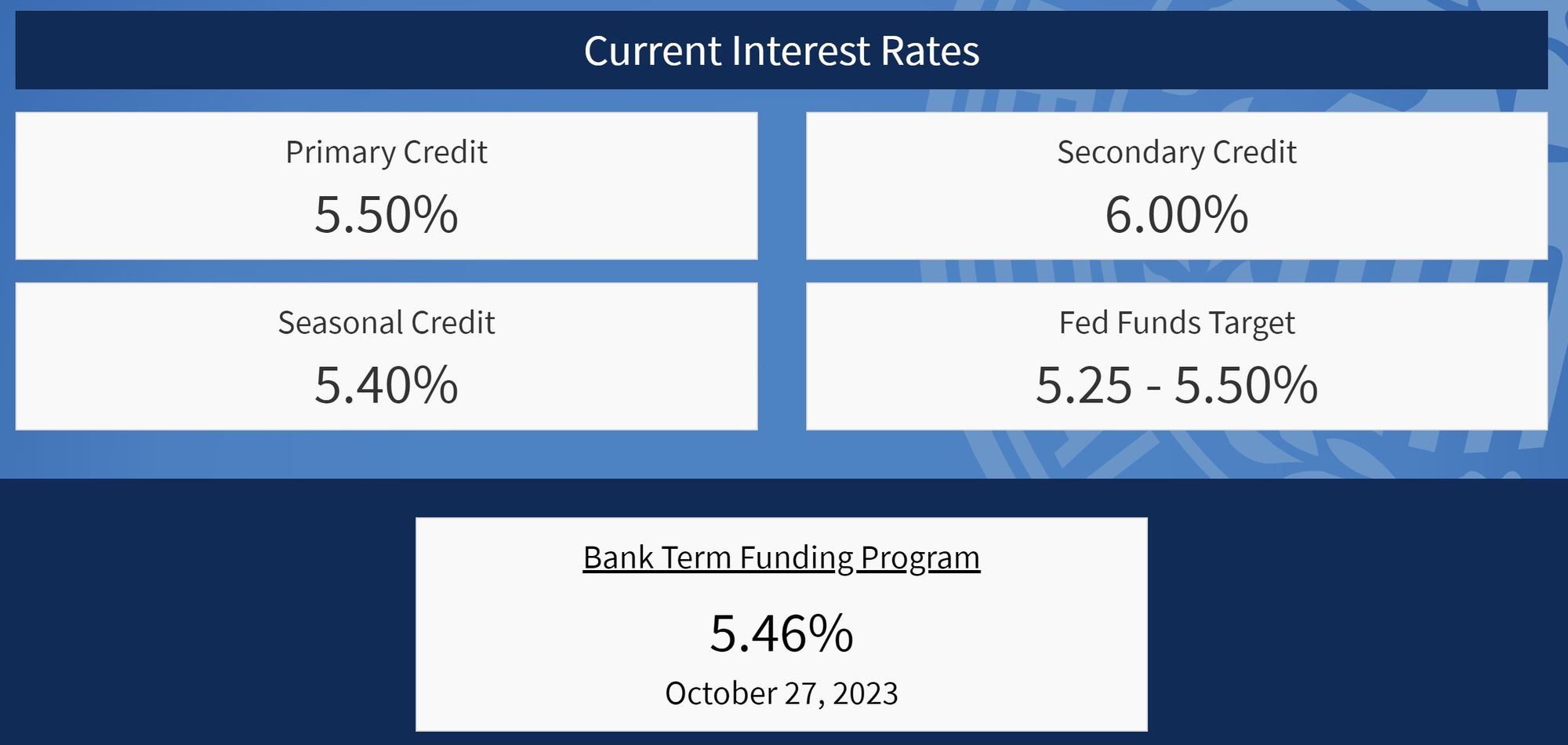

BTFP offers higher interest rates now but longer terms--to need over $100 billion in liquidity at near 5.5% interest must really be all about 'surviving another day'?

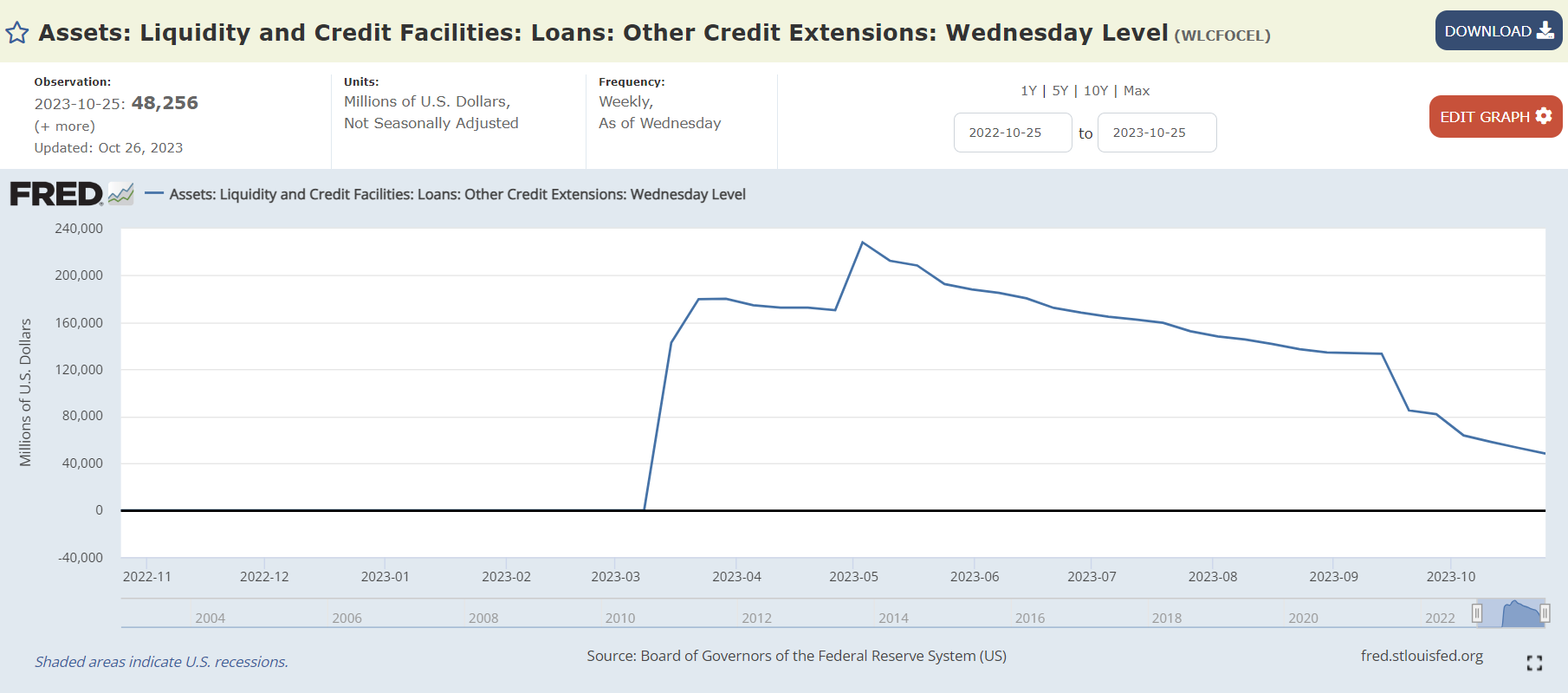

“Other credit extensions”:

| Date | Other Credit Extension |

|---|---|

| 3/15 | $142.8 billion |

| 3/22 | $179.8 billion |

| 3/29 | $180.1 billion |

| 4/5 | $174.6 billion |

| 4/12 | $172.6 billion |

| 4/19 | $172.6 billion |

| 4/26 | $170.3 billion |

| 5/3 | $228.2 billion |

| 5/10 | $212.5 billion |

| 5/17 | $208.5 billion |

| 5/24 | $192.6 billion |

| 5/31 | $188.092 billion |

| 6/7 | $185.162 billion |

| 6/14 | $180.468 billion |

| 6/21 | $172.342 billion |

| 6/28 | $168.293 billion |

| 7/5 | $164.775 billion |

| 7/12 | $162.438 billion |

| 7/19 | $159.640 billion |

| 7/26 | $152.455 billion |

| 8/2 | $148.072 billion |

| 8/9 | $145.407 billion |

| 8/16 | $141.636 billion |

| 8/23 | $137.171 billion |

| 8/30 | $134.369 billion |

| 9/6 | $133.796 billion |

| 9/13 | $133.369 billion |

| 9/20 | $85.005 billion |

| 9/27 | $81.883 billion |

| 10/4 | $63.702 billion |

| 10/11 | $58.257 billion |

| 10/18 | $53.156 billion |

| 10/25 | $48.256 billion |

"Other credit extensions" includes loans that were extended to depository institutions established by the Federal Deposit Insurance Corporation (FDIC). The Federal Reserve Banks' loans to these depository institutions are secured by collateral and the FDIC provides repayment guarantees.

How I understand this works:

- The FDIC created temporary banks to support the operations of the ones they have taken over.

- The FDIC did not have the money to operate these banks.

- The Fed is providing that in the form of a loan via "Other credit extensions".

- The FDIC is going to sell the taken over banks assets.

- Whatever the difference between the sale of the assets and the ultimate loan number is, will be the amount split up amongst all the remaining banks and applied as a special fee to make the Fed 'whole'.

- It can be argued the consumer will ultimately end up paying for this as banks look to pass this cost on in some way.

There has been an update on this piece back in May:

Whatever the difference between the sale of the assets and the ultimate loan number is, will be the amount split up amongst all the remaining banks and applied as a special fee to make the Fed 'whole'.

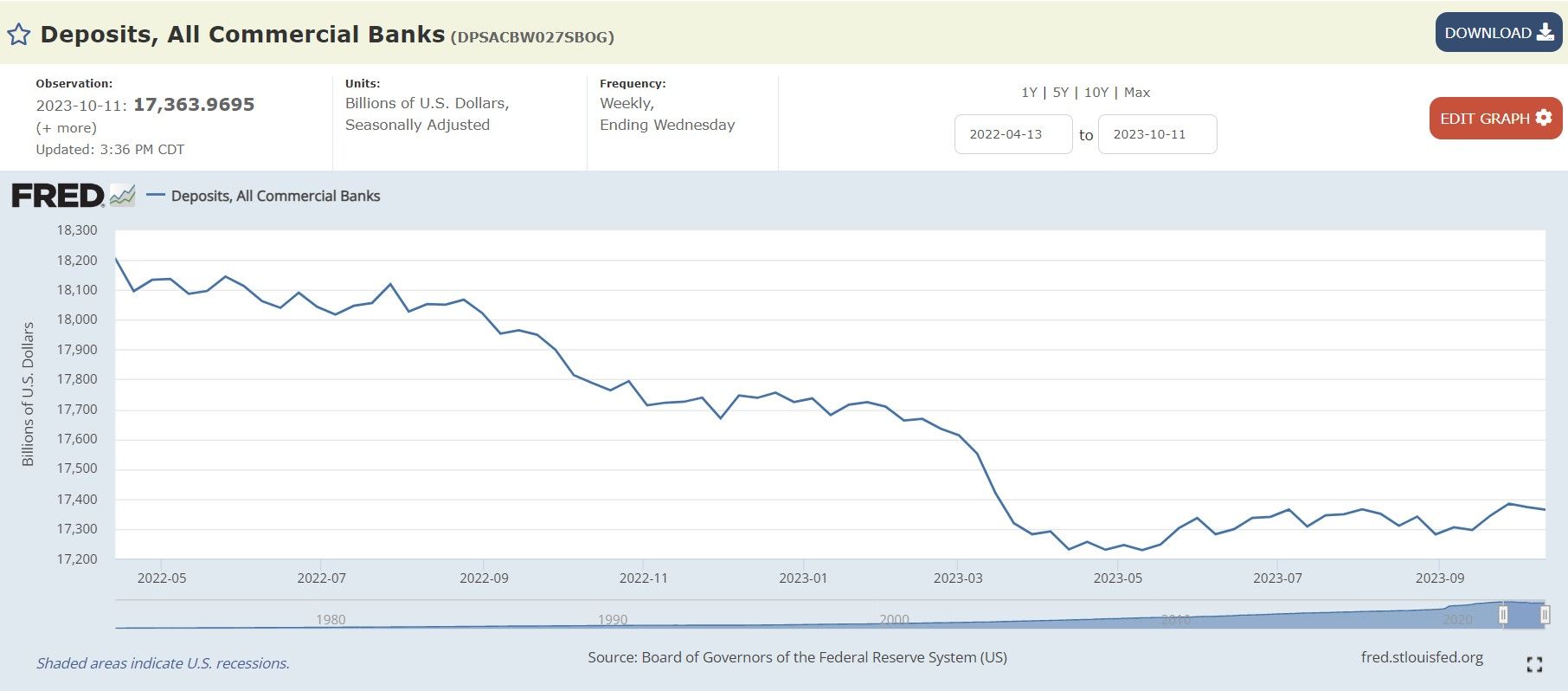

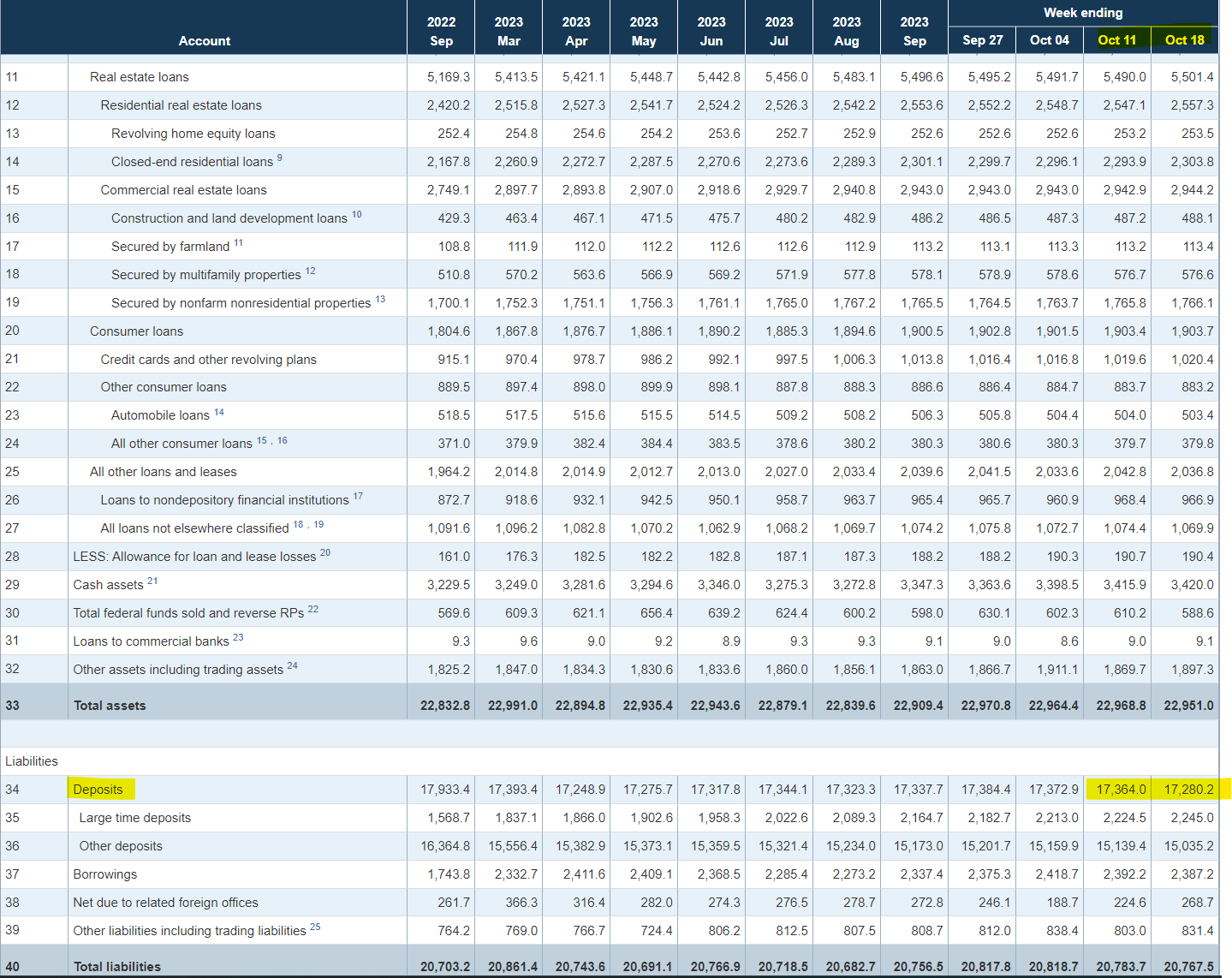

Why are the Banks borrowing so heavily? Commercial deposits have been shrinking along with M2!

A tad over a year ago (4/13/2022) the commercial deposits high was hit at $18,158.3536 billion.

| Date | Deposits, All Commercial Banks (billions) | Down from all time high (billions) |

|---|---|---|

| 4/13/2022 | $18,158 | 0 |

| 2/22/2023 (Run picks up speed) | $17,690 | -$468 billion |

| 3/1/2023 | $17,662 | -$496 billion |

| 3/8/2023 | $17,599 | -$559 billion |

| 3/15/2023 | $17,428 | -$730 billion |

| 3/22/2023 | $17,256 | -$902 billion |

| 3/29/2023 | $17,192 | -$966 billion |

| 4/5/2023 | $17,253 | -$905 billion |

| 4/12/2023 | $17,168 | -$990 billion |

| 4/19/2023 | $17,180 | -$978 billion |

| 4/26/2023 | $17,164 | -$994 billion |

| 5/3/2023 | $17,149 | -$1,009 billion |

| 5/10/2023 | $17,123 | -$1,035 billion |

| 5/17/2023 | $17,152 | -$1006 billion |

| 5/24/2023 | $17,238 | -$920 billion |

| 5/31/2023 | $17,282 | -$876 billion |

| 6/7/2023 | $17,203 | -$955 billion |

| 6/14/2023 | $17,297 | -$861 billion |

| 6/21/2023 | $17,343 | -$815 billion |

| 6/28/2023 | $17,342 | -$816 billion |

| 7/5/2023 | $17,367 | -$791 billion |

| 7/12/2023 | $17,289 | -$869 billion |

| 7/19/2023 | $17,335 | -$820 billion |

| 7/26/2023 | $17,338 | -$820 billion |

| 8/2/2023 | $17,355 | -$803 billion |

| 8/9/2023 | $17,344 | -$814 billion |

| 8/16/2023 | $17,295 | -$863 billion |

| 8/23/2023 | $17,339 | -$819 billion |

| 8/30/2023 | $17,269 | -$889 billion |

| 9/6/2023 | $17,305 | -$853 billion |

| 9/13/2023 | $17,296 | -$862 billion |

| 9/20/2023 | $17,344 | -$814 billion |

| 9/27/2023 | $17,384 | -$774 billion |

| 10/4/2023 | $17,372 | -$786 billion |

| 10/11/2023 | $17,364 | -$794 billion |

| 10/18/2023 | $17,280 | -$878 billion |

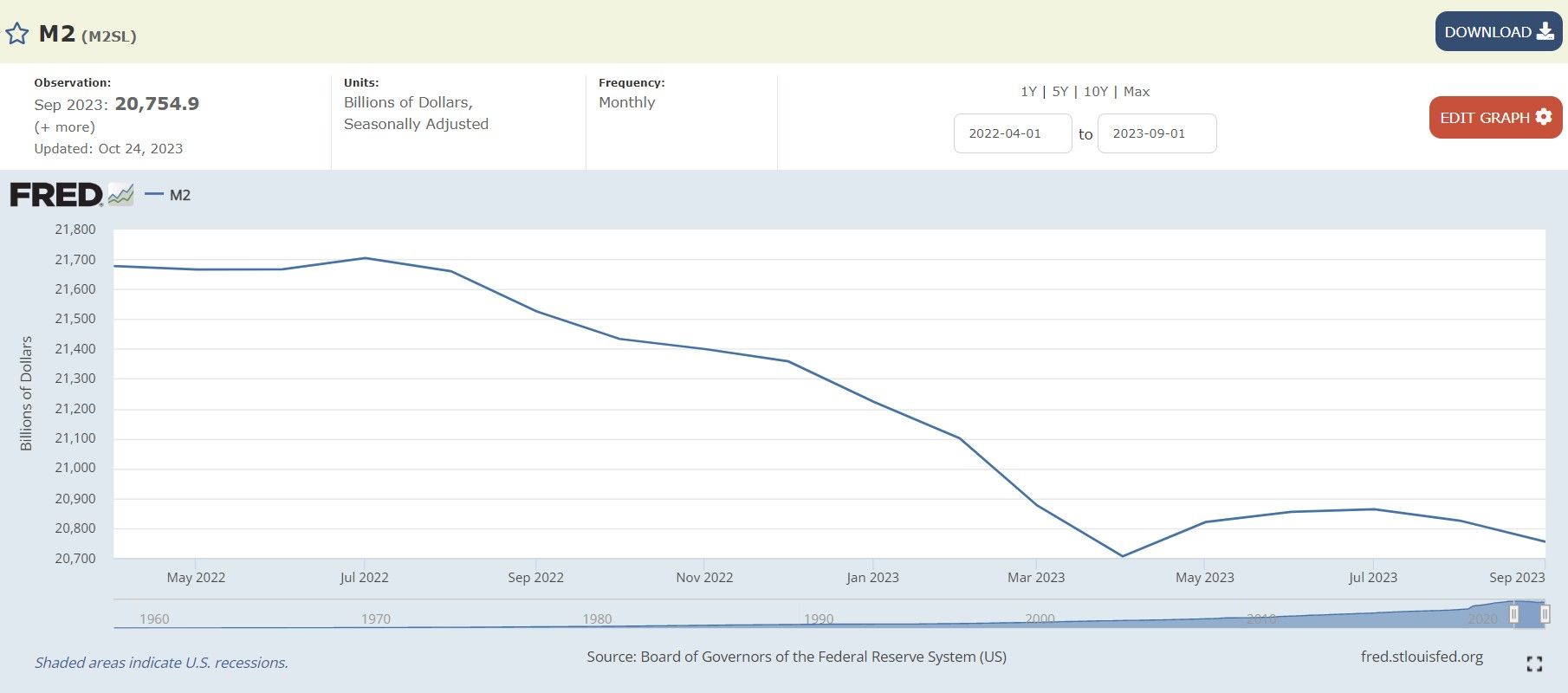

All this money pulled from commercial banks as M2 (U.S. money stock--currency and coins held by the non-bank public, checkable deposits, and travelers' checks, plus savings deposits, small time deposits under 100k, and shares in retail money market funds) is decreasing:

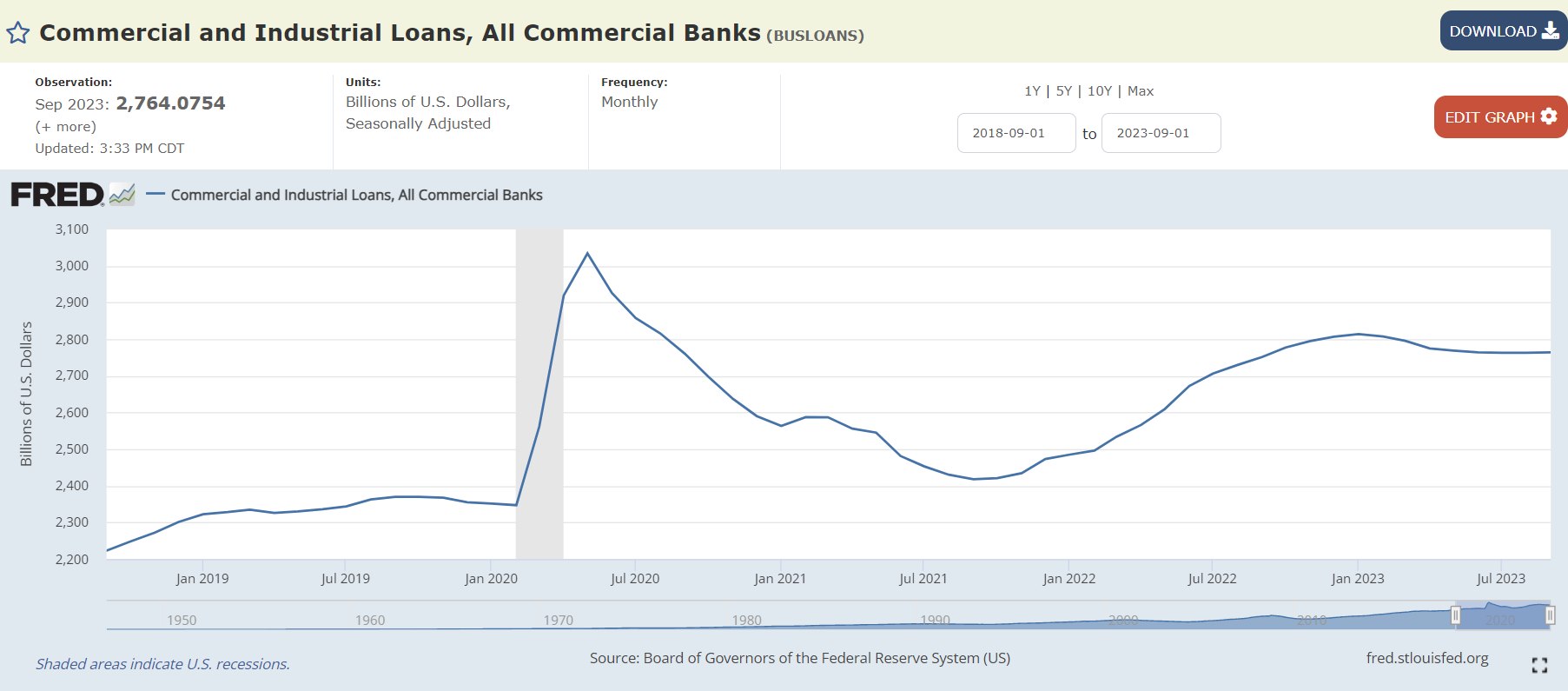

So how are they getting money? They sure as heck are not lending:

Commercial and Industrial (C&I) loans are loans made to businesses or corporations, not to individual consumers. These loans can be used for a variety of purposes, including capital expenditures (like buying equipment) and providing working capital for day-to-day operations. They are typically short-term loans with variable interest rates 1.

C&I loans are a key driver of economic growth because they provide businesses with the funds they need to expand, invest, and hire, which can stimulate economic activity. They are a major line of business for many banking firms as they provide credit for a wide array of business purposes 2.

As interest rates have risen, it has becomes more expensive for banks to borrow money. This increased cost can be passed on to businesses in the form of higher interest rates on commercial and industrial loans. This means that businesses would have to pay more to borrow money, which would make them less likely to take out loans for things like expansion or equipment upgrades--lining up with the recent downturn we can observe:

However, as we have seen, borrowing from the liquidity fairy is spiraling to make up for shrinking M2 and dwindling deposits!

The Fed has created an emergency backstop program so that banks won’t have to sell assets into the market if customers pull deposits in search of more attractive yields for their savings....

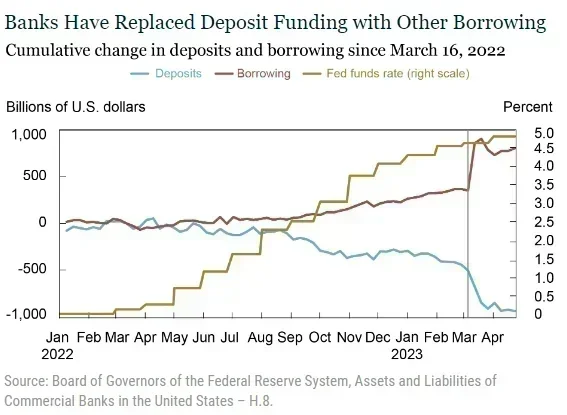

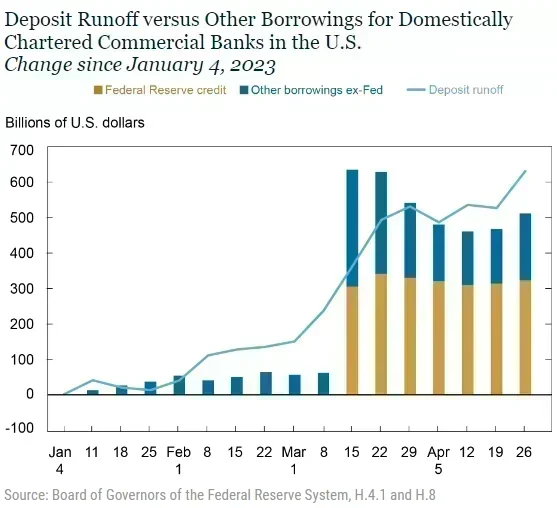

Over the few weeks prior to the FDIC receivership announcements on March 10 and 12, the banking sector lost another approximately $450 billion. Throughout, the banking sector has offset the reduction in deposit funding with an increase in other forms of borrowing which has increased by $800 billion since the start of the tightening.

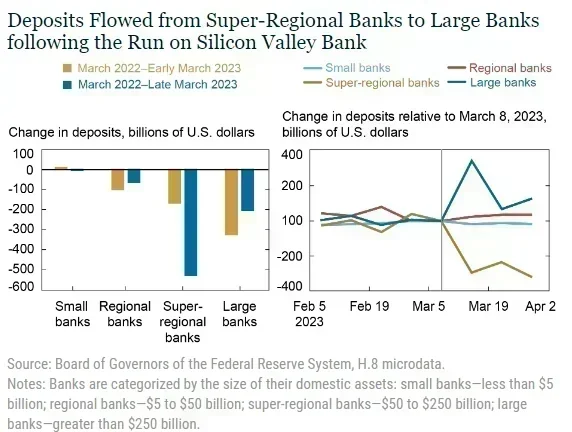

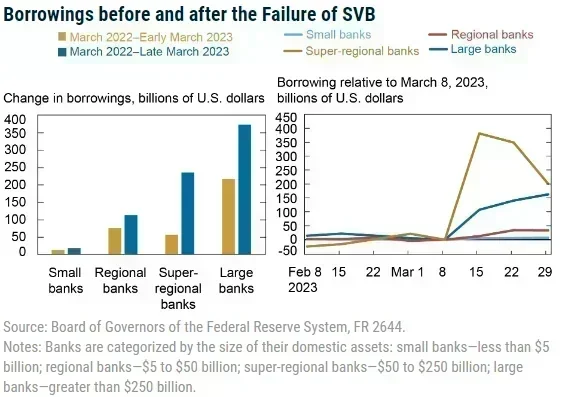

The right panel of the chart below summarizes the cumulative change in deposit funding by bank size category since the start of the tightening cycle through early March 2023 and then through the end of March. Until early March 2023, the decline in deposit funding lined up with bank size, consistent with the concentration of deposits in larger banks. Small banks lost no deposit funding prior to the events of late March. In terms of percentage decline, the outflows were roughly equal for regional, super-regional, and large banks at around 4 percent of total deposit funding:

The blue bar in the left panel above shows that the pattern changes following the run on SVB. The additional outflow is entirely concentrated in the segment of super-regional banks. In fact, most other size categories experience deposit inflows.

The right panel illustrates that outflows at super-regionals begin immediately after the failure of SVB and are mirrored by deposit inflows at large banks in the second week of March 2022.

Further, while deposit funding remains at a lower level throughout March for super-regional banks, the initially large inflows mostly reverse by the end of March. Notably, banks with less than $100 billion in assets were relatively unaffected.

However, during the most acute phase of banking stress in mid-March, other borrowings exceeded reductions in deposit balances, suggesting significant and widespread demand for precautionary liquidity. A substantial amount of liquidity was provided by the private markets, likely via the FHLB system, but primary credit and the Bank Term Funding Program (both summarized as Federal Reserve credit) were equally important.

- Large banks increased borrowing the most, which is in line with deposit outflows being strongest for larger banks before March 2023.

- During March 2023, both super-regional and large banks increase their borrowings, with most increases being centered in the super-regional banks that faced the largest deposit outflows.

- Note, however, that not all size categories face deposit outflows but that all except the small banks increase their other borrowings.

- This pattern suggests demand for precautionary liquidity buffers across the banking system, not just among the most affected institutions:

Wut Mean?

- Banks have been replacing deposit outflows with the borrowing we have covered above.

- 'Strong and resilient' indeed....

- It is starting to smell idiosyncratic all up in here:

To me, this is looking more and more like over-reliance on Central Bank Funding! Oh yeah...

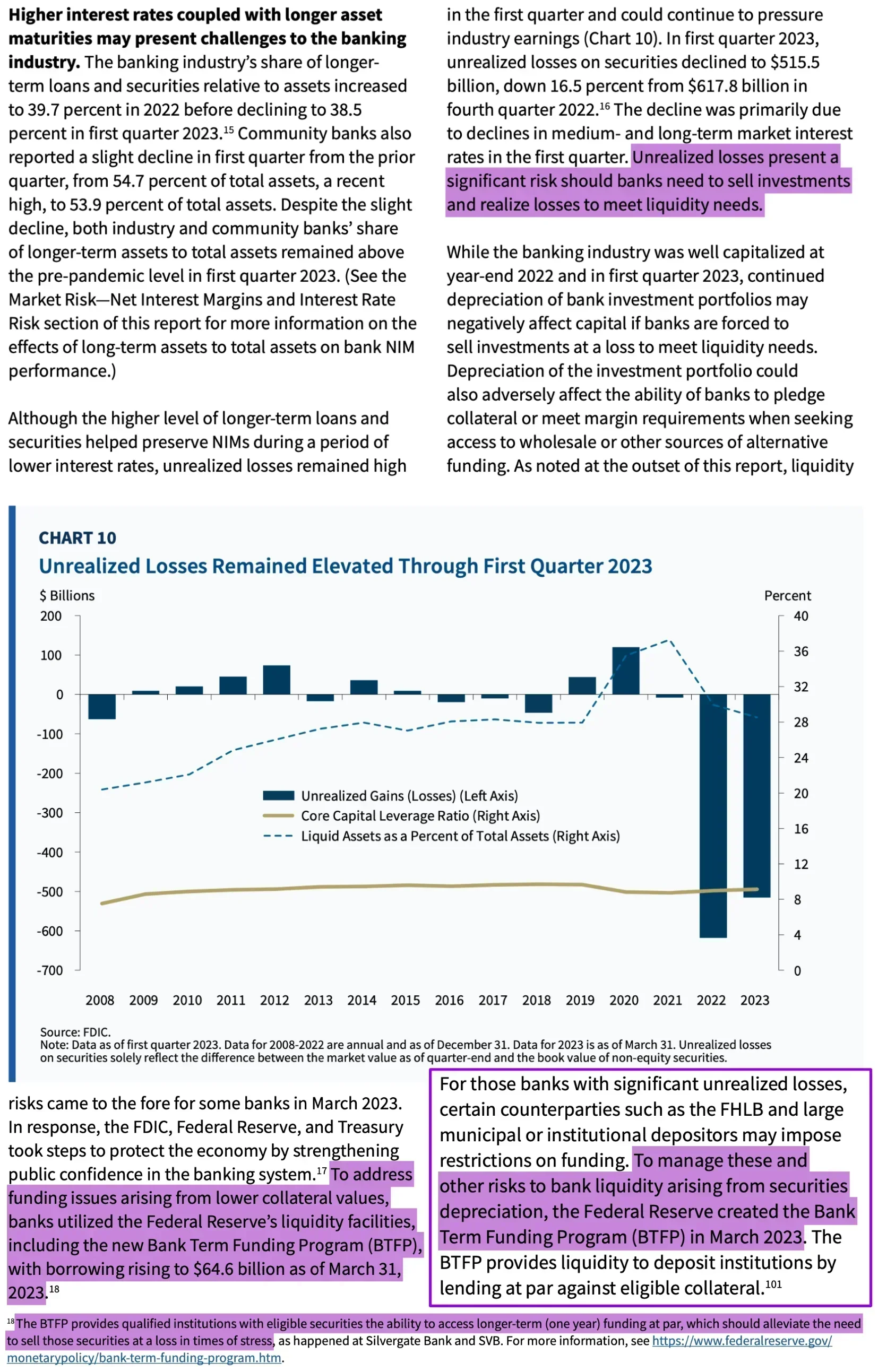

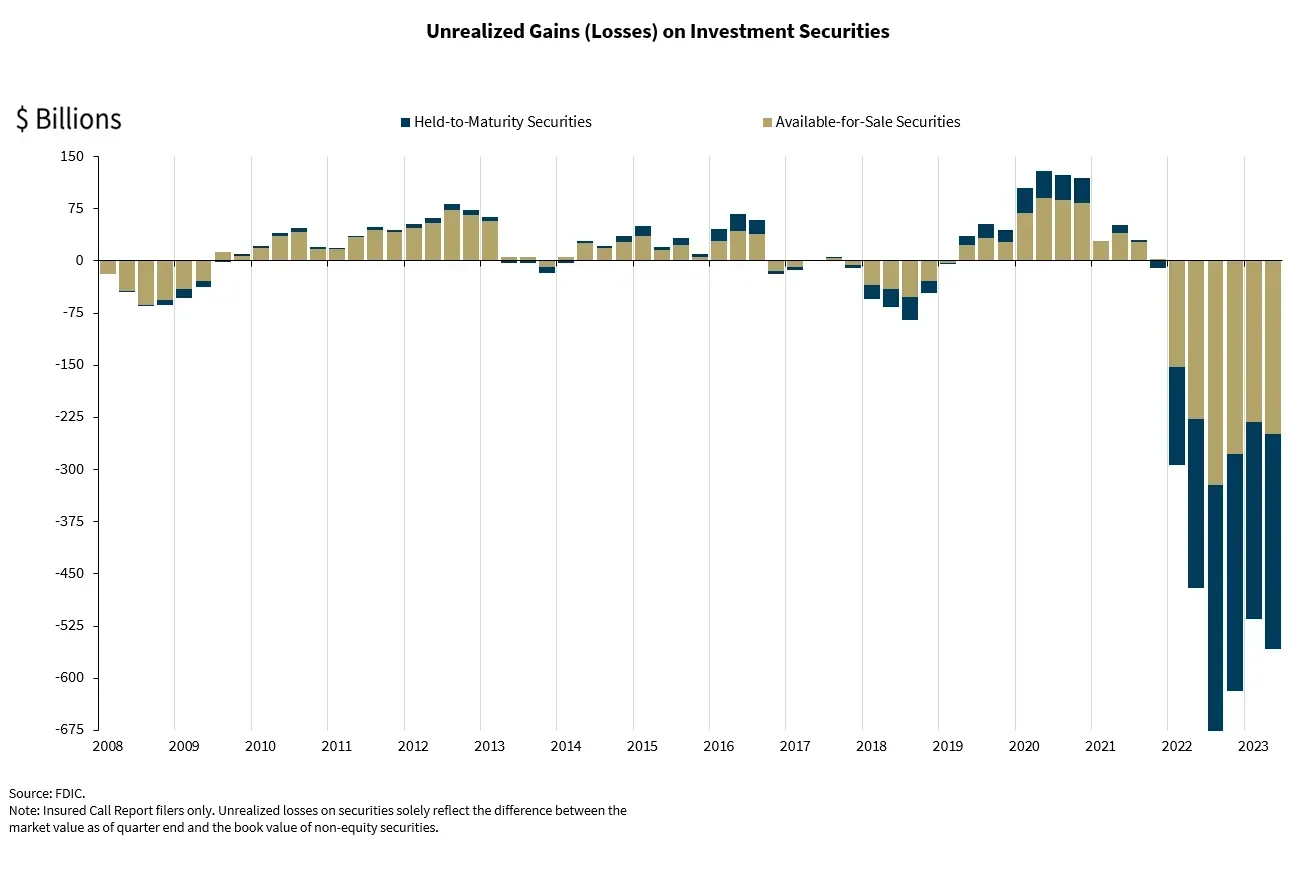

Fed & FDIC 🦵🥫 can't hide unrealized losses

the total unrealized losses as of now: $17.5T × 3.9 × 2.7% = $1.84 trillion $0.14 trillion more in unrealized losses $107.4 billion $40 billion ($0.04 trillion) on the bleeding edge of bankruptcy

Banks would be bankrupt already if it wasn't for BTFP.

From the FDIC THE OTHER DAY:

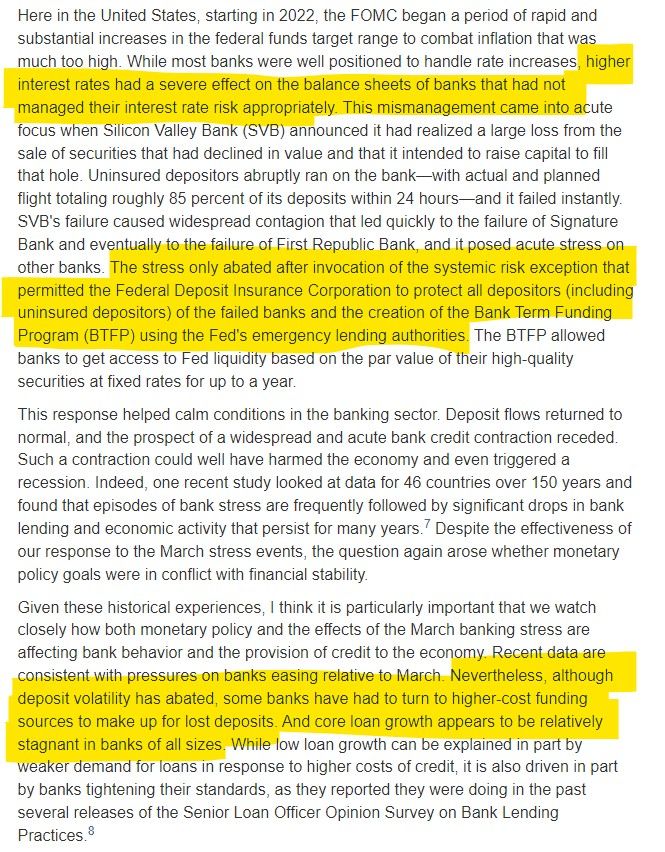

Vice Chair for Supervision Michael S. Barr:

It is also interesting that Barr also calls out banks turning to 'pay-day' loans to make up for lost deposits!

TLDRS:

- As of 10/25/23 total outstanding amount of all advances from the liquidity fairy under the Bank Term Funding Program was $109.068 billion.

- $84 billion withdrawn from commercial banks in the last week.

- Borrowing from the liquidity fairy via BTFP continues to make up for a shrinking M2 and dwindling commercial deposits.

- Notice how use of the Discount Window has PLUMMETED as BTFP has come in to play?

- BTFP offers higher interest rates but longer terms--to need over $100 billion in liquidity at near 5.5% interest must really be all about 'surviving another day'?

- How did all these banks pass those 'Stress tests' the other day needing all this liquidity?!?!....

- "The updated guidance encourages depository institutions to incorporate the discount window as part of their contingency funding plans."

- The liquidity fairy is now ENCOURAGED?

- The FDIC noticed that some banks aren't correctly reporting the amount of deposits they have that aren't covered by federal insurance. Some banks mistakenly think that if a deposit is backed by assets (like collateral), it doesn't need to be reported as uninsured.

- This isn't right! The deposit's status doesn't change just because it has collateral.

- When banks incorrectly report uninsured deposits, it could create a perception in the market that these banks are more stable than they actually are.

- Banks that incorrectly report uninsured deposits might face liquidity challenges in extreme circumstances, where depositors simultaneously demand their funds.

- Reminder, while banks have the liquidity fairy, 'we' get the promise of 2 more rate hikes this year, Atlanta Fed President Raphael Bostic yet again enrichens himself inappropriately from his position.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to raise interest rates--causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.