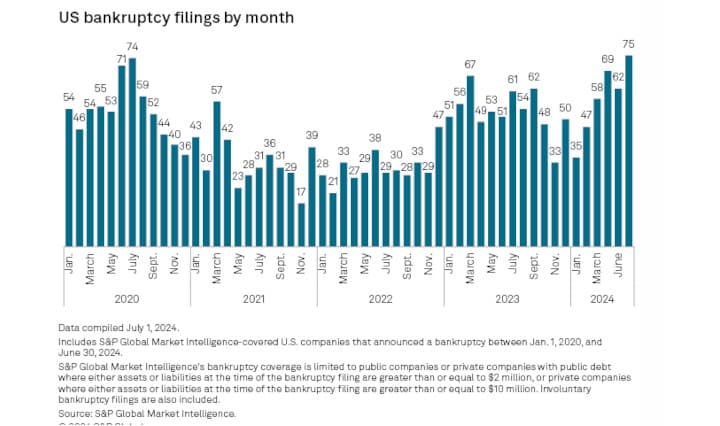

IMF: "Services price inflation is holding up progress on disinflation, which is complicating monetary policy normalization. Upside risks to inflation have thus increased, raising the prospect of higher-for-even-longer interest rates"

The International Monetary Fund said Tuesday in its World Economic Outlook Update that global growth remains on track with the April 2024 World Economic Outlook (WEO) forecast, projected at 3.2% in 2024 and 3.3% in 2025. However, persistent services price inflation is complicating disinflation efforts and in turn,