It's official: Federal Reserve Board announces the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11. The program is confirmed to expire but usage continues to rapidly pick up speed!

Source: https://www.federalreserve.gov/newsevents/pressreleases/monetary20240124a.htm

Today, the Fed announced that the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11 and that the program will continue to make loans until that time and is available as an additional source of liquidity for eligible institutions.

As the program ends, the interest rate applicable to new BTFP loans has been adjusted such that the rate on new loans extended from now through program expiration will be no lower than the interest rate on reserve balances in effect on the day the loan is made. This rate adjustment ensures that the BTFP continues to support the goals of the program in the current interest rate environment. This change is effective immediately. All other terms of the program are unchanged.

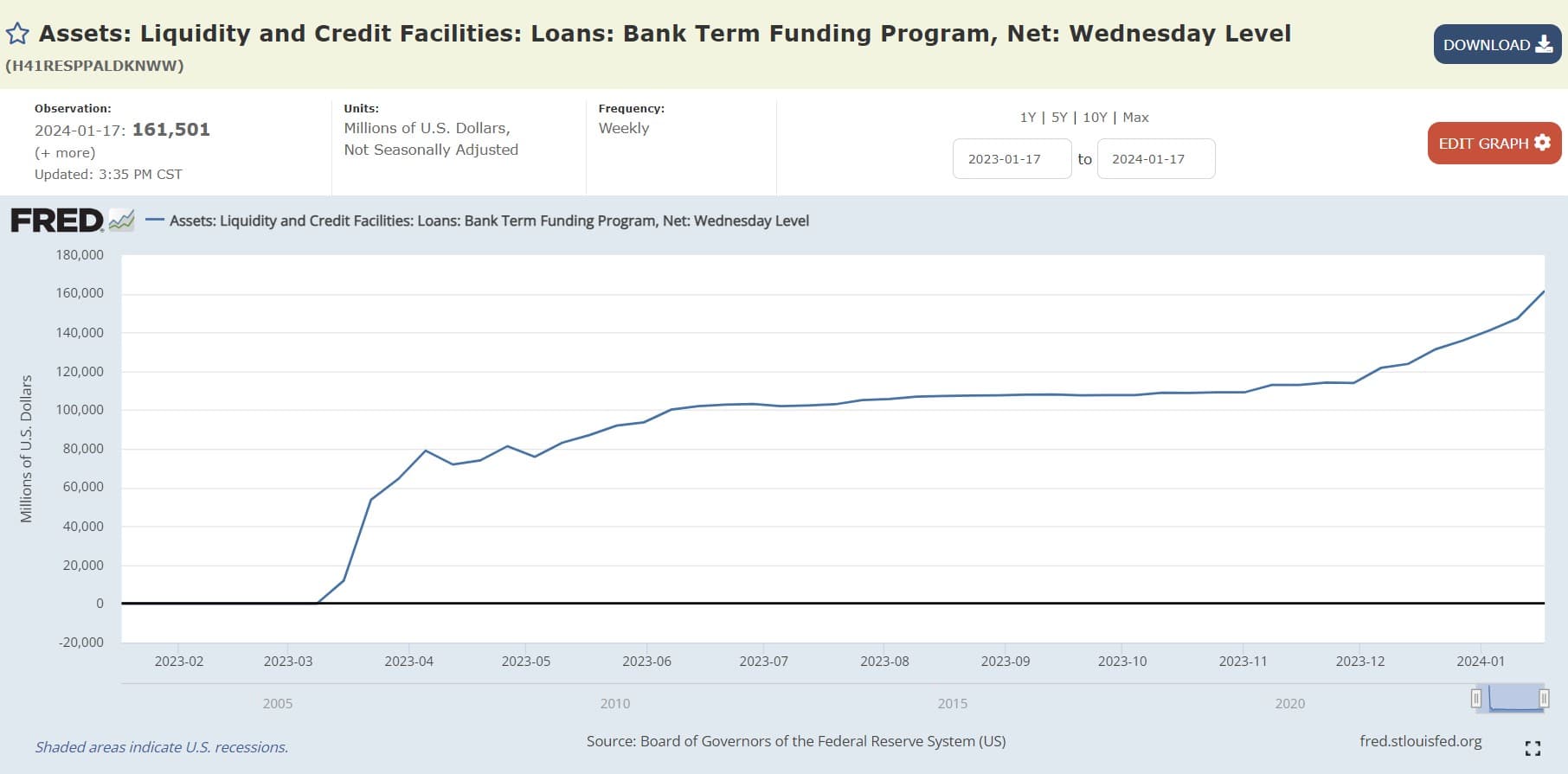

Bank Term Funding Program (BTFP) aka the liquidity fairy usage continues to explode--usage up 9.7% in a week and 30.5% since 12/13/23.

I have posted multiple times about BTFP but from December to January, its usage has EXPLODED.

These numbers are reported to the public via two ways: Reports to Congress and weekly via the Fed's balance sheet at a 'Wednesday level'.

Reports to Congress:

| Date | Amount outstanding | Pledged collateral | Interest paid |

|---|---|---|---|

| 3/15 | $11,942,528,000 | $15,855,798,000 | $662,000 |

| 3/31 | $64,595,880,000 | $79,569,489,000 | $93,568,000 |

| 4/30 | $83,061,693,000 | $104,229,674,000 | $369,957,000 |

| 5/31 | $107,376,686,000 | $128,972,991,000 | $762,960,000 |

| 6/30 | $115,629,868,000 | $136,535,267,000 | $1,211,623,000 |

| 7/31 | $119,127,391,000 | $144,379,894,000 | $1,683,694,000 |

| 8/31 | $121,234,139,000 | $145,422,700,000 | $2,173,066,000 |

| 9/30 | $119,104,573,000 | $145,371,270,000 | $2,645,685,000 |

| 10/31 | $120,605,902,000 | $146,215,465,000 | $3,132,539,000 |

| 11/30 | $114,041,296,000 | $150,128,533,000 | $3,622,263,000 |

Weekly readings from the Fed:

| Date amount observed | Bank Term Funding Program (BTFP)($ billion) | Up from 3/15, 1st week of program ($ billion) |

|---|---|---|

| 3/15 | $11.943 billion | $0 billion |

| 3/22 | $53.669 billion | $41.723 billion |

| 3/29 | $64.403 billion | $52.460 billion |

| 3/31 | $64.595 billion | $52.652 billion |

| 4/5 | $79.021 billion | $67.258 billion |

| 4/12 | $71.837 billion | $59.894 billion |

| 4/19 | $73.982 billion | $62.039 billion |

| 4/26 | $81.327 billion | $69.384 billion |

| 5/3 | $75.778 billion | $63.935 billion |

| 5/10 | $83.101 billion | $71.158 billion |

| 5/17 | $87.006 billion | $75.063 billion |

| 5/24 | $91.907 billion | $79.964 billion |

| 5/31 | $93.615 billion | $81.672 billion |

| 6/7 | $100.161 billion | $88.218 billion |

| 6/14 | $101.969 billion | $90.026 billion |

| 6/21 | $102.735 billion | $90.792 billion |

| 6/28 | $103.081 billion | $91.138 billion |

| 7/5 | $101.959 billion | $90.016 billion |

| 7/12 | $102.305 billion | $90.362 billion |

| 7/19 | $102.927 billion | $90.984 billion |

| 7/26 | $105.078 billion | $93.155 billion |

| 8/2 | $105.684 billion | $93.741 billion |

| 8/9 | $106.864 billion | $94.921 billion |

| 8/16 | $107.242 billion | $95.299 billion |

| 8/23 | $107.386 billion | $95.443 billion |

| 8/30 | $107.527 billion | $95.584 billion |

| 9/6 | $107.855 billion | $95.912 billion |

| 9/13 | $107.993 billion | $96.05 billion |

| 9/20 | $107.599 billion | $95.656 billion |

| 9/27 | $107.715 billion | $95.772 billion |

| 10/4 | $107.665 billion | $95.722 billion |

| 10/11 | $108.884 billion | $96.941 billion |

| 10/18 | $108.818 billion | $96.875 billion |

| 10/25 | $109.068 billion | $97.125 billion |

| 11/1 | $109.070 billion | $97.127 billion |

| 11/8 | $112.935 billion | $100.992 billion |

| 11/15 | $112.942 billion | $100.999 billion |

| 11/22 | $114.099 billion | $102.156 billion |

| 11/29 | $113.871 billion | $101.928 billion |

| 12/6 | $121.695 billion | $109.752 billion |

| 12/13 | $123.964 billion | $112.021 billion |

| 12/20 | $131.335 billion | $119.392 billion |

| 12/27 | $135.805 billion | $123.862 billion |

| 1/3 | $141.202 billion | $129.259 billion |

| 1/10 | $147.175 billion | $135.232 billion |

| 1/17 | $161.501 billion | $149.558 billion |

Over $3,622,263,000 in interest since march to survive another day and usage of the program is accelerating...

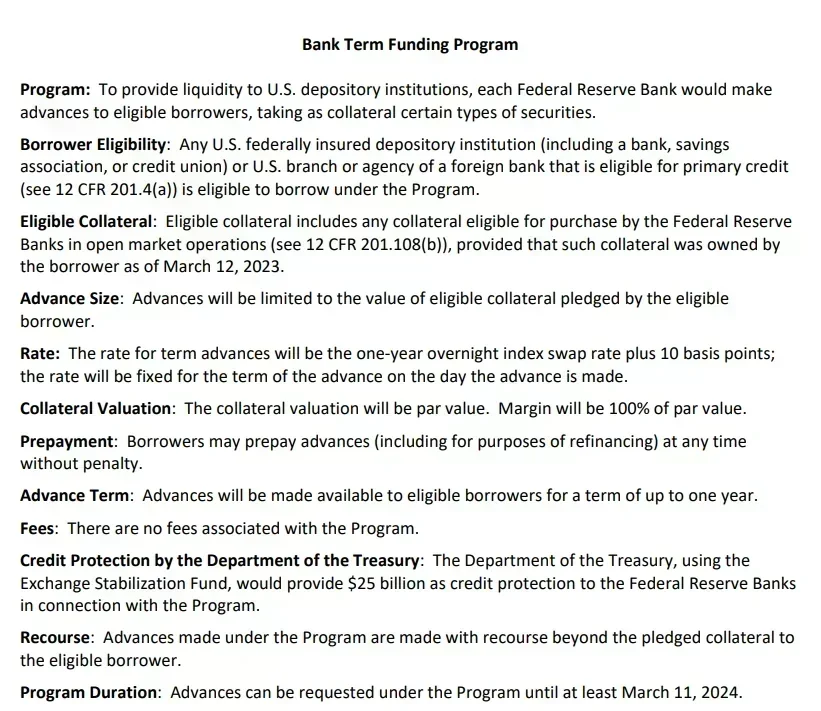

- Association, or credit union) or U.S. branch or agency of a foreign bank that is eligible for primary credit (see 12 CFR 201.4(a)) is eligible to borrow under the Program.

- Banks can borrow for up to one year, at a fixed rate for the term, pegged to the one-year overnight index swap rate plus 10 basis points.

- Banks have to post collateral (valued at par!).

- Any collateral has to be “owned by the borrower as of March 12, 2023."

- Eligible collateral includes any collateral eligible for purchase by the Federal Reserve Banks in open market operations.

Richard Ostrander (one of the architects of BTFP) spoke about implementing the program:

When the Federal Reserve established the BTFP, the lawyers of the New York Fed played an important role in facilitating its rapid implementation. I was responsible for coordinating among my team of attorneys at the New York Fed and the Board of Governors to ensure that our actions complied with applicable statutes and regulations.

Over the weekend of March 11 and 12, the Fed designed the BTFP to support the stability of the broader financial system by providing a source of financing for banks with Treasury, Agency and other eligible holdings whose market value had significantly diminished given interest rate increases.

There was not enough time to set up special purpose vehicles as the Fed had done for some of the pandemic programs. The only way to have the program up and running so quickly was to leverage our discount window facilities.

As a result, we turned to Section 13(3) of the Federal Reserve Act, which authorizes specialized lending in unusual and exigent circumstances. The BTFP extends the maximum term of lending from the Section 10B limit of four months up to a special limit of one year.

Additionally, unlike traditional discount window operations, the BTFP authorizes banks to borrow against eligible holdings up to their par value rather than their market value less a haircut

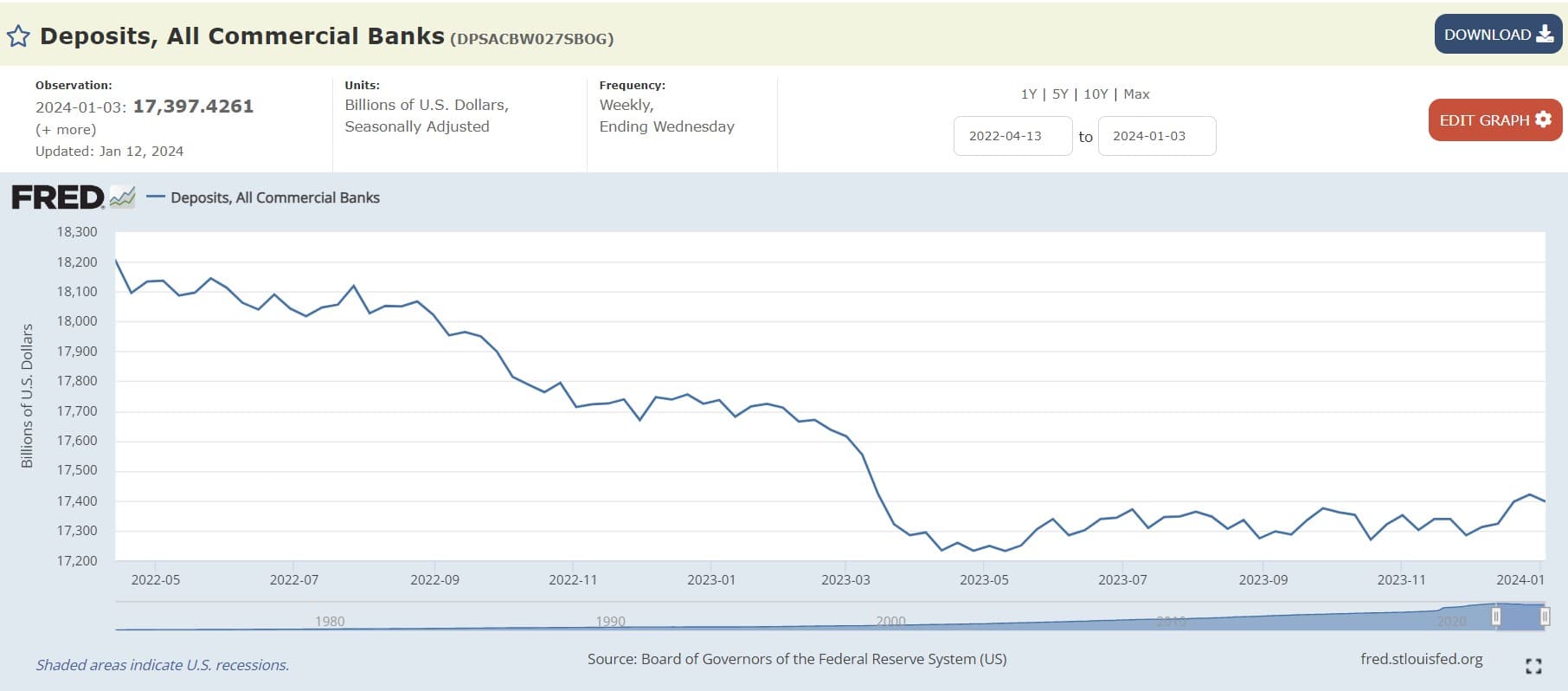

Why are the Banks borrowing from BTFP so heavily? Commercial deposits have been shrinking along with M2!

A tad over a year ago (4/13/2022) the commercial deposits high was hit at $18,158.3536 billion. Notice how BTFP is tapped as commercial deposits start decreasing in March of 2022?:

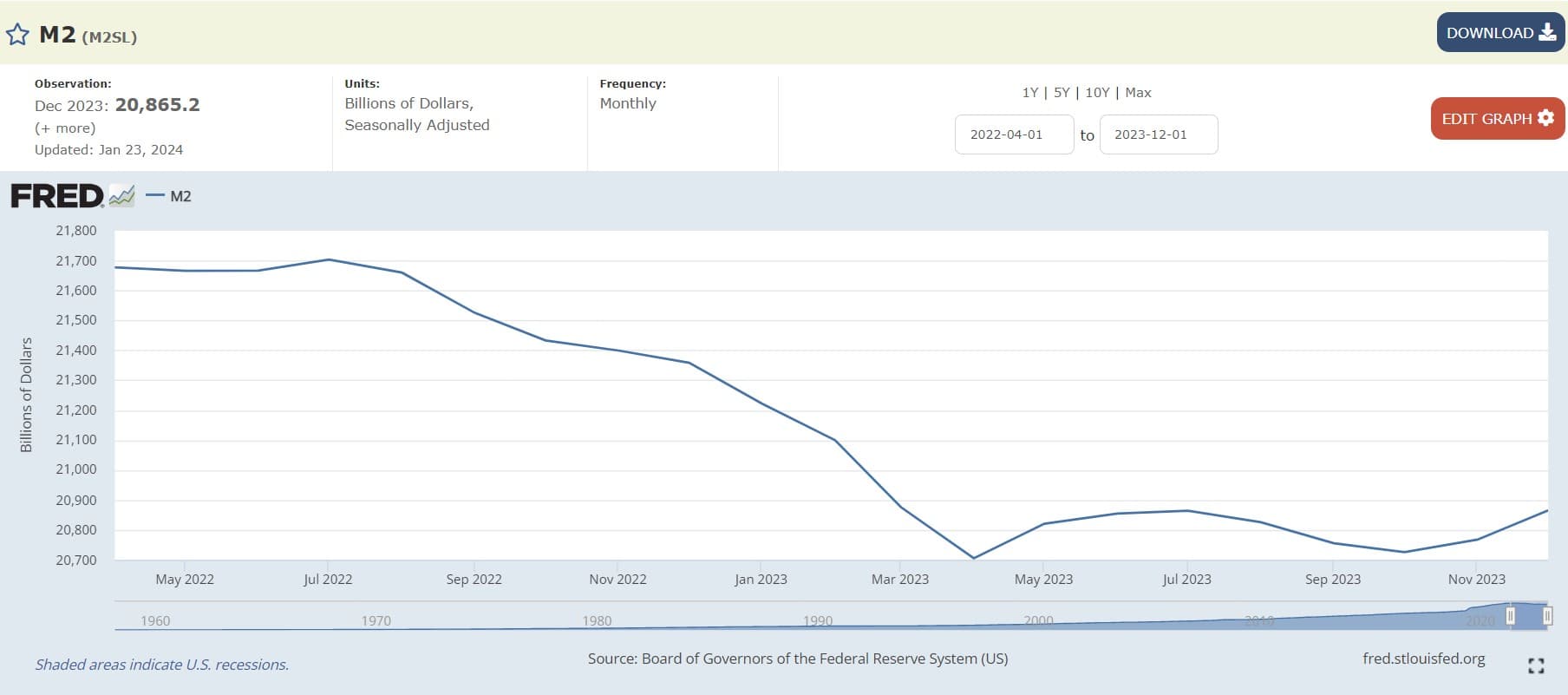

All this money pulled from commercial banks as M2 (U.S. money stock--currency and coins held by the non-bank public, checkable deposits, and travelers' checks, plus savings deposits, small time deposits under 100k, and shares in retail money market funds) is decreasing:

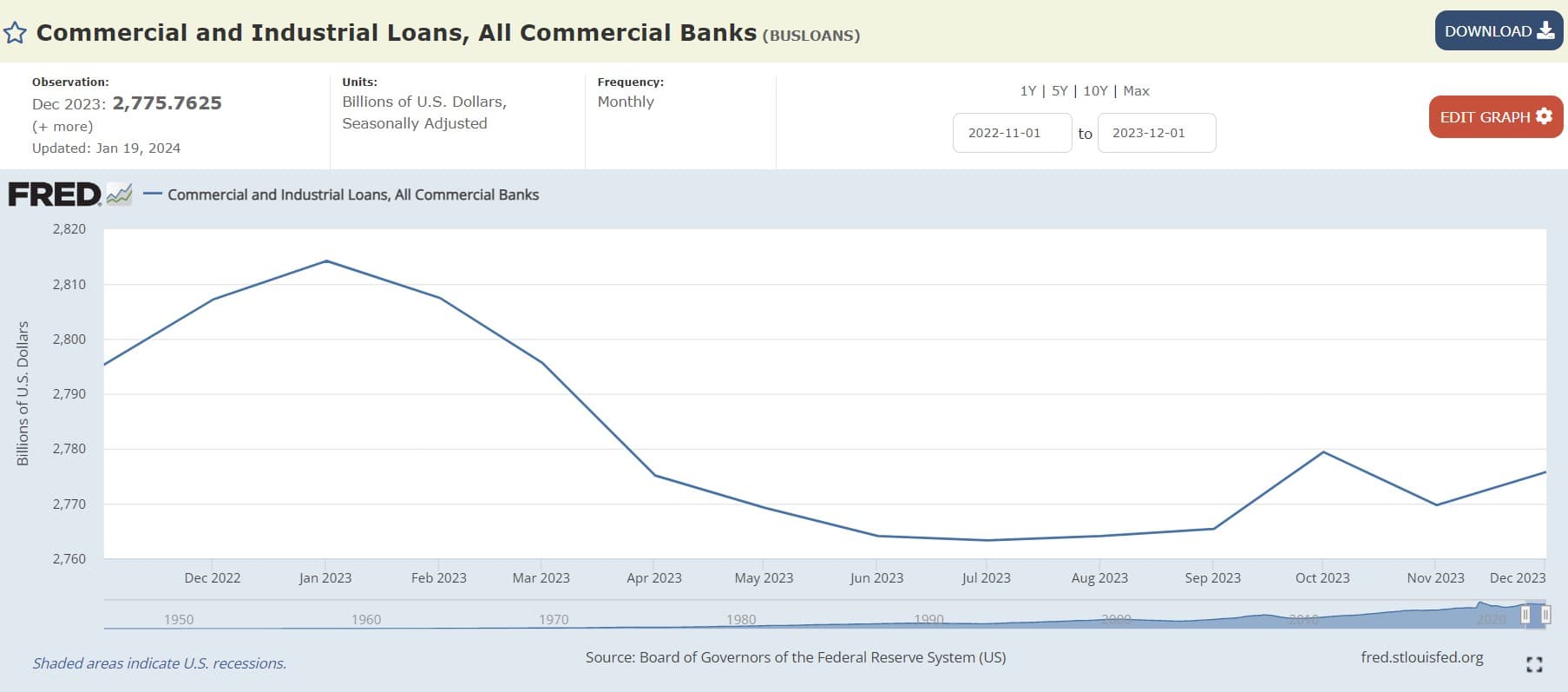

So how are they deploying cash? They sure as heck are not lending:

Commercial and Industrial (C&I) loans are loans made to businesses or corporations, not to individual consumers. These loans can be used for a variety of purposes, including capital expenditures (like buying equipment) and providing working capital for day-to-day operations. They are typically short-term loans with variable interest rates 1.

C&I loans are a key driver of economic growth because they provide businesses with the funds they need to expand, invest, and hire, which can stimulate economic activity. They are a major line of business for many banking firms as they provide credit for a wide array of business purposes 2.

As interest rates have risen, it has becomes more expensive for banks to borrow money. This increased cost can be passed on to businesses in the form of higher interest rates on commercial and industrial loans. This means that businesses would have to pay more to borrow money, which would make them less likely to take out loans for things like expansion or equipment upgrades--lining up with the recent downturn we can observe.

However, as we have seen, borrowing from the liquidity fairy is spiraling to make up for shrinking M2 and dwindling deposits!

The Fed has created an emergency backstop program so that banks won’t have to sell assets into the market if customers pull deposits in search of more attractive yields for their savings....

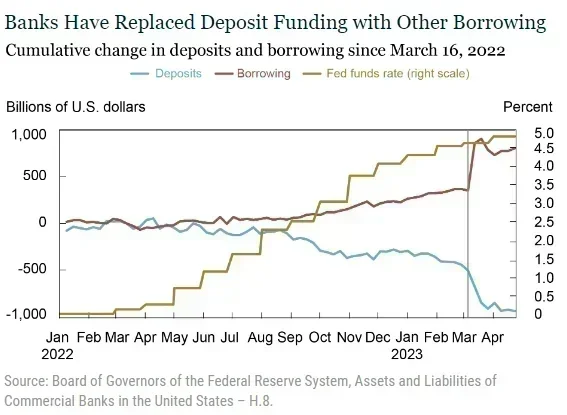

Over the few weeks prior to the FDIC receivership announcements on March 10 and 12, the banking sector lost another approximately $450 billion. Throughout, the banking sector has offset the reduction in deposit funding with an increase in other forms of borrowing which has increased by $800 billion since the start of the tightening.

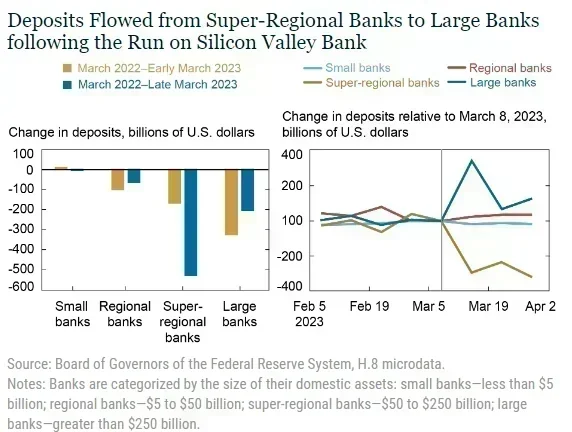

The right panel of the chart below summarizes the cumulative change in deposit funding by bank size category since the start of the tightening cycle through early March 2023 and then through the end of March. Until early March 2023, the decline in deposit funding lined up with bank size, consistent with the concentration of deposits in larger banks. Small banks lost no deposit funding prior to the events of late March. In terms of percentage decline, the outflows were roughly equal for regional, super-regional, and large banks at around 4 percent of total deposit funding:

The graph on the left demonstrates that following the SVB incident, there's a distinct shift in the pattern. This shift is primarily observed in the super-regional banks segment, which saw an exclusive increase in cash outflows. Conversely, other bank categories of different sizes mostly saw an increase in deposit inflows.

On the right, the graph indicates that the cash outflows in super-regional banks started immediately after SVB's collapse. This trend was countered by an increase in deposits at larger banks during the second week of March 2022.

Furthermore, for super-regional banks, deposit funding levels remained reduced throughout March. The significant inflows observed initially largely reverted by the month's end. It's important to note that banks with assets under $100 billion seemed to remain largely unaffected by these developments.

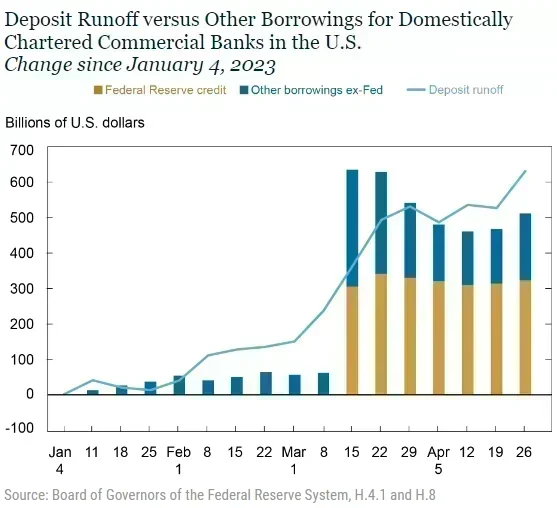

However, during the most acute phase of banking stress in mid-March, other borrowings exceeded reductions in deposit balances, suggesting significant and widespread demand for precautionary liquidity. A substantial amount of liquidity was provided by the private markets, likely via the FHLB system, but primary credit and the Bank Term Funding Program (both summarized as Federal Reserve credit) were equally important.

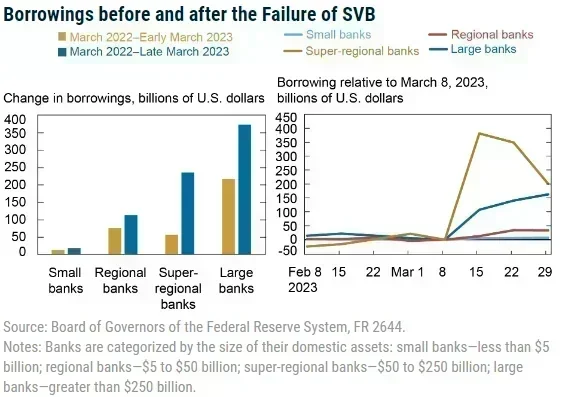

- Large banks saw the highest increase in borrowing, matching the pattern of significant deposit outflows before March 2023.

- In March 2023, both super-regional and large banks upped their borrowings, with super-regional banks, which experienced the most deposit outflows, showing the most significant increases.

- It's important to note that not all bank sizes experienced deposit outflows, yet all but the smallest banks raised their other borrowings.

- This trend indicates a system-wide demand for precautionary liquidity buffers, not limited to just the banks most impacted.

Wut Mean?

- Banks have been replacing deposit outflows with the borrowing we have covered above.

- 'Strong and resilient' indeed....

- It is starting to smell idiosyncratic all up in here:

To me, this is looking more and more like over-reliance on Central Bank Funding! Oh yeah...

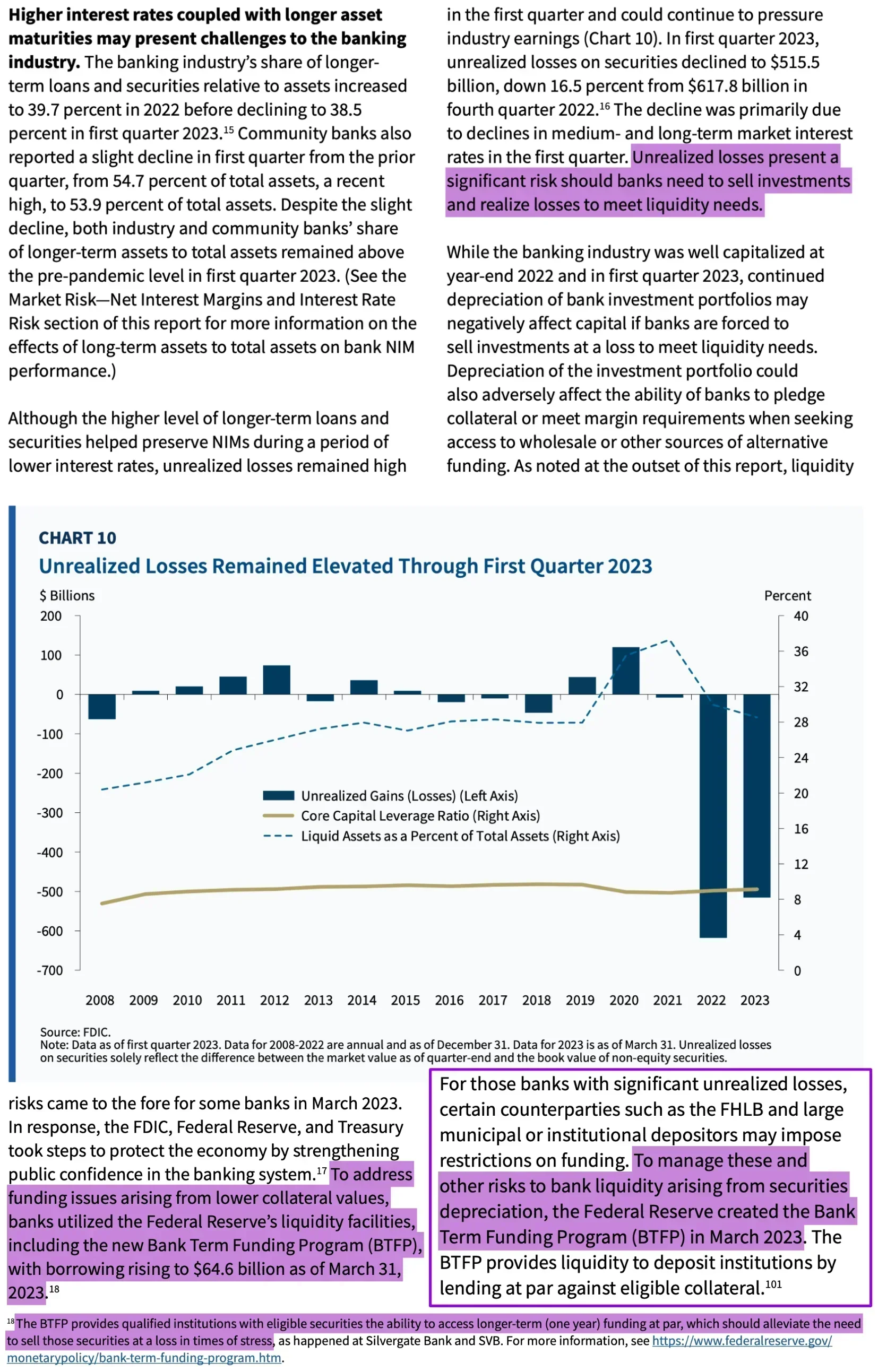

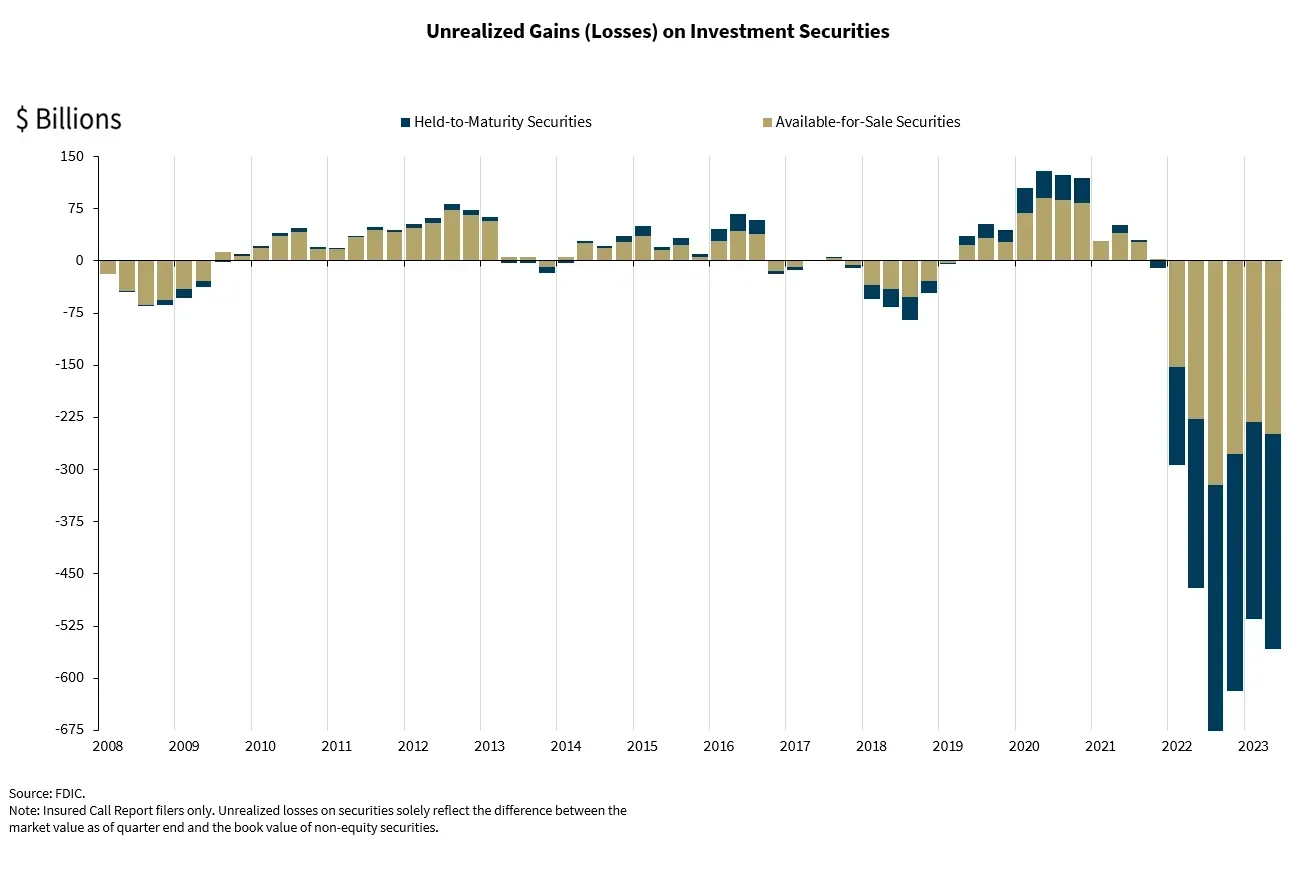

Fed & FDIC 🦵🥫 can't hide unrealized losses

the total unrealized losses as of now: $17.5T × 3.9 × 2.7% = $1.84 trillion $0.14 trillion more in unrealized losses $107.4 billion $40 billion ($0.04 trillion) on the bleeding edge of bankruptcy

Banks would be bankrupt already if it wasn't for BTFP.

From the FDIC in September:

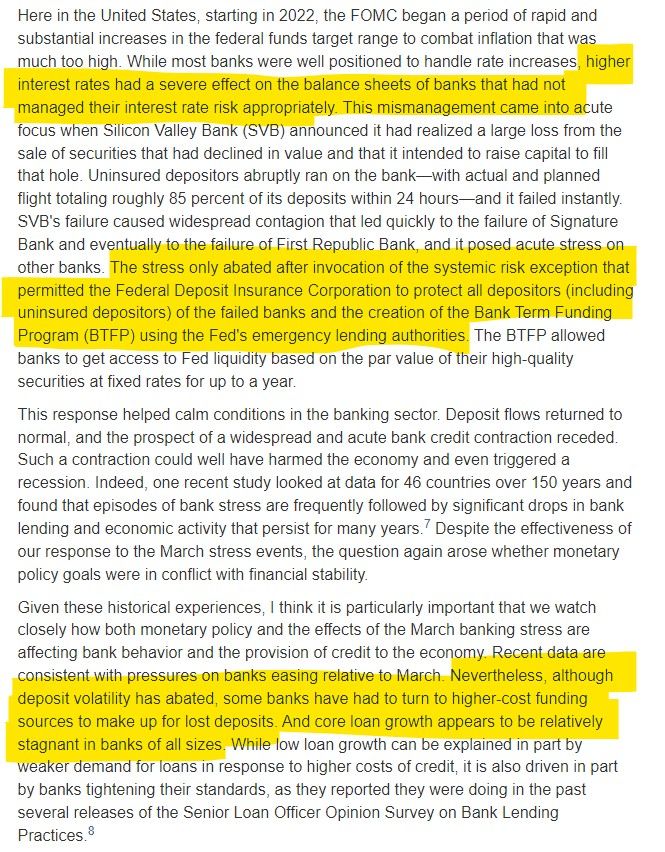

Vice Chair for Supervision Michael S. Barr:

Considering the Held-to-Maturity losses the banks are sitting on, The FDIC called those at $309.6 billion back in September. While I am sure this number has shifted since then, assuming BTFP usage is entirely held-to-maturity securities, as of 1/3, BTFP usage of $141.202 billion would represent BTFP usage at nearly 46% of held-to-maturity losses!

Another interesting thought from r/Superstonk's u/TheUltimator5:

The Fed's announcement lines up with Barr's comments a few weeks ago

The Bank Term Funding Program will expire on March 11 as it reaches its original one-year time limit, Fed Vice Chair for Supervision Michael Barr said at a panel appearance on Tuesday.

Banks may continue to borrow under the program until March 11 and refinance loans until 2025, Barr said.

Given that the program is due to expire in March and is still exploding in usage, how can it possible go away then?

Can we expect them to finagle a BTFP 2.0 before then? My understanding from the above is 1 year is the max the program can go and would require an act of Congress to extend. It will be very interesting to see how the Fed officials approach this all moving forward.

TLDRS:

- The Federal Reserve Board announces the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11

- This past week, total outstanding amount of all advances from the liquidity fairy under the Bank Term Funding Program was $161,501,000,000

- As of 10/31/23 total outstanding amount of all advances from the liquidity fairy under the Bank Term Funding Program was $120,605,902,000.

- Over $3,132,539,000 in interest to survive another day...(so far...)

- Borrowing from the liquidity fairy via BTFP continues to make up for a shrinking M2 and dwindling commercial deposits.

- How did all these banks pass those 'Stress tests' needing all this liquidity?!?!....

- "The updated guidance encourages depository institutions to incorporate the discount window as part of their contingency funding plans."

- The liquidity fairy is now ENCOURAGED?

- The FDIC noticed that some banks aren't correctly reporting the amount of deposits they have that aren't covered by federal insurance. Some banks mistakenly think that if a deposit is backed by assets (like collateral), it doesn't need to be reported as uninsured.

- This isn't right! The deposit's status doesn't change just because it has collateral.

- When banks incorrectly report uninsured deposits, it could create a perception in the market that these banks are more stable than they actually are.

- Banks that incorrectly report uninsured deposits might face liquidity challenges in extreme circumstances, where depositors simultaneously demand their funds.

- Reminder, while banks have the liquidity fairy, 'we' get left in the cold, and Atlanta Fed President Raphael Bostic yet again enrichens himself inappropriately from his position.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to raise interest rates--causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.