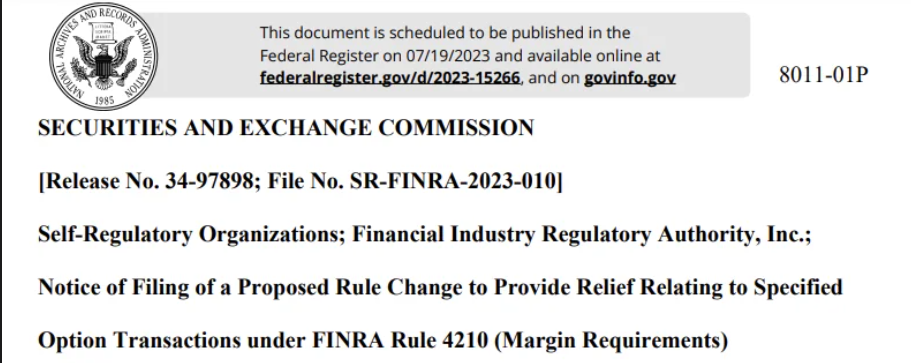

Notice of Filing of Proposed Rule Change to Amend and Restate the Cross-Margining Agreement between FICC and CME. Exhibit 3 (Updated Agreement) [REDACTED].

https://www.sec.gov/rules/sro/ficc/2023/34-97969.pdf

* On July 17, 2023, the Fixed Income Clearing Corporation (FICC) proposed a rule change (SR-FICC2023-010) to the Securities and Exchange Commission (SEC).

* This proposal involves an Amended and Restated Cross-Margining Agreement between FICC and the Chicago Mercantile Exchange Inc. (CME)