Notice of Filing of Proposed Rule Change to Amend and Restate the Cross-Margining Agreement between FICC and CME. Exhibit 3 (Updated Agreement) [REDACTED].

![r/Superstonk - FICC Alert & OPEN for comment! Notice of Filing of Proposed Rule Change to Amend and Restate the Cross-Margining Agreement between FICC and CME. Exhibit 3 (Updated Agreement) [REDACTED]. Exhibit 5 includes updated details for Suspension and Liquidation of a Cross--Margining …](https://preview.redd.it/wrzwx6ney0eb1.png?width=828&format=png&auto=webp&s=5933d4b9946a8fb405011d01fed595737f7e6b12)

https://www.sec.gov/rules/sro/ficc/2023/34-97969.pdf

- On July 17, 2023, the Fixed Income Clearing Corporation (FICC) proposed a rule change (SR-FICC2023-010) to the Securities and Exchange Commission (SEC).

- This proposal involves an Amended and Restated Cross-Margining Agreement between FICC and the Chicago Mercantile Exchange Inc. (CME).

- If approved, this Restated Agreement would replace the current Cross-Margining Agreement entirely and be incorporated into the FICC Government Securities Division Rulebook.

SR-FICC-2023-010Purpose:

![r/Superstonk - FICC Alert & OPEN for comment! Notice of Filing of Proposed Rule Change to Amend and Restate the Cross-Margining Agreement between FICC and CME. Exhibit 3 (Updated Agreement) [REDACTED]. Exhibit 5 includes updated details for Suspension and Liquidation of a Cross--Margining …](https://preview.redd.it/rn77w9wny0eb1.png?width=853&format=png&auto=webp&s=5890b4907b5b5e1066bf4920997284bc5f01530f)

Wut mean?:

Cross-margining arrangements between two clearing organizations, such as the FICC and the CME, are designed to recognize the offsetting value of positions maintained by a member for margin purposes.

- This can lead to margin reductions and capital efficiencies for common members.

FICC has proposed to replace the existing cross-margining agreement with a Restated Agreement, which aims to expand the scope and efficiency of the margin offsets available to clearing members, thus reducing their margin costs and allowing for more efficient capital usage.

- The agreement also aims to streamline the default management and loss sharing processes, making it clear that a joint liquidation would be the preferred method used by the Clearing Organizations in the event of a member default.

Key aspects of the proposed Restated Agreement include:

- Member Participation: Participation would continue to be voluntary, and the criteria for participation would remain the same as under the current agreement.

- Eligible Products: Additional CME products would become eligible under the proposed Restated Agreement, allowing for greater potential margin offsets.

- Calculation of Margin and Margin Reductions: The proposed Restated Agreement would simplify the overall margin calculation process by eliminating the need for application of offset classes of securities and conversion of CME Eligible Products into equivalent GSD Treasury security products. This should generate margin savings in excess of those under the existing agreement.

- Default Management: The proposed Restated Agreement would make clear that a joint liquidation is the preferred means of liquidation of cross-margining positions in the event of a member default. It would also provide for the possible exchange of variation margin during the course of a joint liquidation.

- FICC believes that the proposed expansion of the scope of CME Eligible Products available for cross-margining, the expansion of the scope and efficiency of the margin offsets that would be available to Cross-Margining Participants, and the improvement in the efficiency and effectiveness of the default management process would enhance the cross-margining arrangement between FICC and CME.

- "FICC believes that these enhancements would encourage greater utilization of centralized clearing, thereby facilitating systemic risk reduction."

Background:

![r/Superstonk - FICC Alert & OPEN for comment! Notice of Filing of Proposed Rule Change to Amend and Restate the Cross-Margining Agreement between FICC and CME. Exhibit 3 (Updated Agreement) [REDACTED]. Exhibit 5 includes updated details for Suspension and Liquidation of a Cross--Margining …](https://preview.redd.it/jm52xjnqy0eb1.png?width=821&format=png&auto=webp&s=ff1b0515289abfd44c79f9a832931c899bb3f9cb)

Wut mean?

- FICC has proposed to replace the existing cross-margining agreement with a Restated Agreement, which aims to expand the scope and efficiency of the margin offsets available to clearing members, thus reducing their margin costs and allowing for more efficient capital usage.

- The Restated Agreement also aims to streamline the default management and loss sharing processes, making it clear that a joint liquidation would be the preferred method used by the Clearing Organizations in the event of a member default.

Key aspects include:

- Member Participation: Participation would continue to be voluntary, and the criteria for participation would remain the same as under the existing agreement.

- Eligible Products: Additional CME products would become eligible under the proposed Restated Agreement, allowing for greater potential margin offsets.

- Calculation of Margin and Margin Reductions: The proposed Restated Agreement would simplify the overall margin calculation process by eliminating the need for application of offset classes of securities and conversion of CME Eligible Products into equivalent GSD Treasury security products.

- Default Management: The proposed Restated Agreement would make clear that a joint liquidation is the preferred means of liquidation of cross-margining positions in the event of a member default. It would also provide for the possible exchange of variation margin during the course of a joint liquidation.

Exhibit 3 (Updated Agreement) [REDACTED]Exhibit 5:

![r/Superstonk - FICC Alert & OPEN for comment! Notice of Filing of Proposed Rule Change to Amend and Restate the Cross-Margining Agreement between FICC and CME. Exhibit 3 (Updated Agreement) [REDACTED]. Exhibit 5 includes updated details for Suspension and Liquidation of a Cross--Margining …](https://preview.redd.it/8u5wvyc8z0eb1.png?width=887&format=png&auto=webp&s=b4d96ec273ec86ed882dd3da737fe06ba99e6d23)

Wut Mean?:

When a member of a clearing organization (think of it as a financial middleman) does something wrong or goes against the rules, they're called a "Defaulting Member". If this member is part of a group that shares risks called Cross-Margining Affiliates, the term “Defaulting Member” can refer to the entire group or just one of them, depending on the situation.

If a clearing organization decides to take action against this member because of their mistake, that organization is referred to as the “Liquidating CO”. They will immediately inform another related clearing organization about their decision.

Then, the second clearing organization has to make a choice:

- If it agrees to take similar action against the Defaulting Member, both organizations will follow a set of steps.

- If it doesn’t want to take similar action, it will ask the Defaulting Member to immediately pay an amount that's equal to the money saved at both clearing organizations. If this payment is done quickly and in full, the second organization will then pay the Liquidating CO. Once that's done, they have no further obligations related to this incident.

- However, if the second clearing organization doesn't get the full payment from the Defaulting Member in time, then they will stop representing this member. Both organizations will then follow the steps mentioned earlier.

In essence, this is a protocol about what happens when a member of a financial organization breaks the rules and how multiple organizations can respond and cooperate to address the situation.

![r/Superstonk - FICC Alert & OPEN for comment! Notice of Filing of Proposed Rule Change to Amend and Restate the Cross-Margining Agreement between FICC and CME. Exhibit 3 (Updated Agreement) [REDACTED]. Exhibit 5 includes updated details for Suspension and Liquidation of a Cross--Margining …](https://preview.redd.it/rd9gp24az0eb1.png?width=897&format=png&auto=webp&s=75341ad1fd129a4d8ac72b44208ca480299617bc)

Wut Mean?:

When a Defaulting Member causes problems, the clearing organizations (FICC or CME) follow these steps:

Step 1 (i): The two clearing organizations will first try to jointly manage, end, or shift the financial positions related to the Defaulting Member (called "Relevant Positions").

- If they can fix the issue in this way, they'll use the rules outlined in Section 7(c) to decide who bears any losses.

- However, the rules in Sections 7(d), 7(e), and 7(f) won't apply.

Step 2 (ii): If the organizations find it's not possible or wise to deal with the problem jointly:

- One organization (“X”) can offer to buy the problematic financial positions from the other organization (“Y”) at the last known price.

- If “Y” agrees to this buyout, then “Y” has no further duties to “X” concerning this particular issue.

- Also, in such a case, the rules mentioned in Sections 7(c), 7(d), 7(e), and 7(f) won't be used.

Step 3 (iii): If neither of the above solutions works:

- Each clearing organization will independently manage, end, or shift the financial positions of the Defaulting Member within their purview.

- In this scenario, the rules in Sections 7(d), 7(e), and 7(f) will be used to decide who bears any losses.

C

Step 1 (i): Each clearing organization figures out its gains (Net Gain) or losses (Net Loss). They do this by looking at the assets they have on hand (Collateral on Hand) and the costs they faced to end or shift the problematic financial positions (Liquidation Cost).

Step 2 (ii):

- They take the gains and losses from the previous step and combine them to get a total picture of how the Defaulting Member's issues affected them both.

- Any combined gain or loss from this joint action is then split between the two clearing organizations. The split is based on each organization's portion of the responsibility in the Cross-Margining Requirement (basically, a measure of how much each organization was involved in the shared risk).

![r/Superstonk - FICC Alert & OPEN for comment! Notice of Filing of Proposed Rule Change to Amend and Restate the Cross-Margining Agreement between FICC and CME. Exhibit 3 (Updated Agreement) [REDACTED]. Exhibit 5 includes updated details for Suspension and Liquidation of a Cross--Margining …](https://preview.redd.it/s0byu60cz0eb1.png?width=870&format=png&auto=webp&s=2c87c6124a2b5b07b6300beb83d0211b2e56be93)

Wut Mean?:

Step 3 (iii):

- If one clearing organization ends up in a worse position than what the previous allocation suggests (maybe they lost more than their fair share or didn't gain as much as they should have), then the other clearing organization has to compensate them.

- This compensation is the difference between what the "worse-off party" actually got (their individual gain or loss) and what they were supposed to get (their Allocated Net Gain or Loss).

Step 4 (iv):

- While figuring out the gains and losses in the above steps, neither clearing organization should count any money that was paid or received under some other specific sections (namely, Section 7(c)(v) and (vi)).

In simpler terms: When both organizations work together to solve the problems caused by a misbehaving member, they first calculate their own gains and losses. Then they combine these figures and split any overall gain or loss. If one organization feels it got a bad deal in this split, the other organization has to make up for it.

(v) dives into specifics about payments during the process of resolving the Defaulting Member's issues

The term "VM" likely refers to "Variation Margin," which is basically a type of payment made in the derivatives market to cover changes in the market value of positions.

(1):

If, during the process of settling the issues of a Defaulting Member on any business day, one clearing organization (“VM Payor”) has made gains in two specific ways (Cross-Margin VM Gain and Other VM Gain) and the other clearing organization (“VM Receiver”) has suffered a loss (Cross-Margin VM Loss):

- The VM Payor has to pay the VM Receiver.

- The payment amount is based on the loss of the VM Receiver, but it can't be more than what the VM Payor gained from the Cross-Margin VM Gain.

- However, the VM Payor doesn’t have to make the payment if they think that the whole liquidation process will cause them a net loss or if they believe the VM Receiver, due to legal constraints, can't make a specific payment mentioned in a section (Section 7(c)(vi)) that comes later.

(2):

If one clearing organization (let's call it "Org A") has a gain in one area but a loss in another, resulting in a net gain (referred to as "Aggregate VM Gain"), and a different clearing organization (let's call it "Org B") experiences a loss:

- Org A must compensate Org B for its loss.

- However, the amount Org A pays to Org B can't exceed Org A's net gain unless they both agree on a higher payment.

- Org A doesn't have to make the payment if:

- They believe they'll end up having an overall loss due to the defaulting member's liquidation.

- They think Org B might face legal issues that prevent it from making future payments described in another section.

In simpler words: If one organization makes a net profit and another incurs a loss during the liquidation process, the profitable one should compensate the other.

![r/Superstonk - FICC Alert & OPEN for comment! Notice of Filing of Proposed Rule Change to Amend and Restate the Cross-Margining Agreement between FICC and CME. Exhibit 3 (Updated Agreement) [REDACTED]. Exhibit 5 includes updated details for Suspension and Liquidation of a Cross--Margining …](https://preview.redd.it/5qqhbwfdz0eb1.png?width=920&format=png&auto=webp&s=048402872063dd7887e19029b449c37d398028b0)

Wut Mean?

(3):

- If one clearing organization (we'll call it "Org A") has both a gain and a loss that, when combined, results in an overall loss,

- And another clearing organization (we'll call it "Org B") has just a loss,

Then Org A doesn't have to compensate Org B for its loss, unless both organizations agree on a payment.

Put another way: If one organization ends up with a net loss and another has a loss, the one with the net loss isn't obligated to compensate the other, unless they both decide otherwise.

- (d) If both have profit or both have a deficit, nobody pays anything.

- (e) If one has a deficit and the other has enough profit to cover that deficit, the profitable one should pay to cover the deficit (unless legally stopped).

- (f) If one has a deficit and the other has a smaller profit, the profitable one should pay its entire profit to the other (again, unless there's a legal issue).

![r/Superstonk - FICC Alert & OPEN for comment! Notice of Filing of Proposed Rule Change to Amend and Restate the Cross-Margining Agreement between FICC and CME. Exhibit 3 (Updated Agreement) [REDACTED]. Exhibit 5 includes updated details for Suspension and Liquidation of a Cross--Margining …](https://preview.redd.it/dnvbbu9fz0eb1.png?width=852&format=png&auto=webp&s=fb9b0e61528212307661583d59f66deab0703aee)

This section outlines the communication and payment responsibilities of the two clearing organizations, FICC and CME, in the event of a Net Gain or Net Loss.

- Determination of Net Gain or Net Loss: Both FICC and CME need to calculate whether they have made a profit (Net Gain) or incurred a loss (Net Loss) as soon as they can.

- Notification:

- FICC will inform CME of its profit or loss, providing details about how it made those calculations if asked.

- Similarly, CME will do the same for FICC.

- Payment Obligations:

- If FICC owes CME (or vice versa) because of a guarantee, the owing organization must make that payment.

- Payment Deadline:

- Any required payment must be completed quickly and definitely within three business days after both organizations finalize their profit or loss calculations.

- Payment Method:

- All payments made under this section should be in "immediately available funds," meaning there shouldn't be any delay or hold in accessing the transferred money.

Basically, if one party owes the other due to the outcome of their financial activities, they must communicate their financial position and settle any debts promptly.

![r/Superstonk - FICC Alert & OPEN for comment! Notice of Filing of Proposed Rule Change to Amend and Restate the Cross-Margining Agreement between FICC and CME. Exhibit 3 (Updated Agreement) [REDACTED]. Exhibit 5 includes updated details for Suspension and Liquidation of a Cross--Margining …](https://preview.redd.it/6wbuftvmz0eb1.png?width=767&format=png&auto=webp&s=f7b8e4c4f3a33001f5e67f1e4f2d98c8f96366ca)

H: emphasizes the importance of accuracy and ensures that there's a procedure in place to rectify any payment discrepancies within a specific timeframe.

I:

- Obligation to Reimburse: If a Clearing Organization, acting as a Guarantor, needs to make a Guaranty payment on behalf of a Defaulting Member to the Beneficiary, the Defaulting Member becomes immediately obligated to reimburse the Guarantor for that payment. This obligation applies even if the Guarantor hasn't yet transferred the payment to the Beneficiary. This holds true even in the case of a pair of Cross-Margining Affiliates; both affiliates become jointly and severally liable.

- Subrogation Rights: The Guarantor inherits or is "subrogated" to all of the rights that the Beneficiary held against the Defaulting Member--the Guarantor steps into the shoes of the Beneficiary with respect to claims against the Defaulting Member.

- Notification: The Guarantor will inform the Defaulting Member (and both Cross-Margining Affiliates, if applicable) about their obligation to reimburse, termed as the "Reimbursement Obligation."The obligation becomes due as soon as the amount is determined.

- Adjustment: If the final amount of the Guaranty payment differs from the initially determined amount, the Reimbursement Obligation is adjusted accordingly. Payment differences are settled between the Guarantor and the Defaulting Member (or the relevant Cross-Margining Affiliate).

- Legal: further categorizes any payment obligations between the Guarantor, Beneficiary, and the Defaulting Member as being either "margin payments" or "settlement payments." It also identifies these transactions as being related to various contracts, like "swap agreements" or "commodity contracts," as defined in the Bankruptcy Code.

How to Comment:

- Submit Comments on SR-FICC-2023-010

https://www.sec.gov/cgi-bin/ruling-comments

TLDRS:

- On July 17, 2023, the Fixed Income Clearing Corporation (FICC) proposed a rule change to the Securities and Exchange Commission (SEC). This involves a new Cross-Margining Agreement between FICC and the Chicago Mercantile Exchange Inc. (CME), which would replace the current agreement and be incorporated into the FICC Government Securities Division Rulebook.

- Cross-margining arrangements allow for margin reductions and capital efficiencies for common members.

- The new agreement aims to expand the scope and efficiency of these margin offsets, reduce margin costs, and streamline default management and loss sharing processes.

Key points of the proposed agreement:

- Voluntary member participation with the same criteria as the existing agreement.

- Additional CME products would become eligible, allowing for potential margin offsets.

- Simplified margin calculation process, generating margin savings in excess of those under the existing agreement.

- Clear preference for joint liquidation in the event of a member default, with possible exchange of variation margin during the liquidation.

The proposal also expands the list of CME products eligible for cross-margining and adopts a new methodology for daily calculation of a Cross-Margining Participant’s Cross-Margin Requirements.

- This aims to expand the scope and efficiency of margin offsets, thus reducing margin costs and allowing for more efficient capital usage.

- In the event of a member default, the proposal outlines potential liquidation routes.

- The choice depends on portfolio exposure, resources, hedging cost, and approval through DTCC’s default management governance process.

Under the Existing Agreement, there is no express language requiring the Parties to attempt to conduct a joint liquidation.

- The proposed Agreement would make clear that a joint liquidation is the preferred means of liquidation of cross-margining positions in the event of a member default.

- Exhibit 3 (Updated Agreement) [REDACTED].

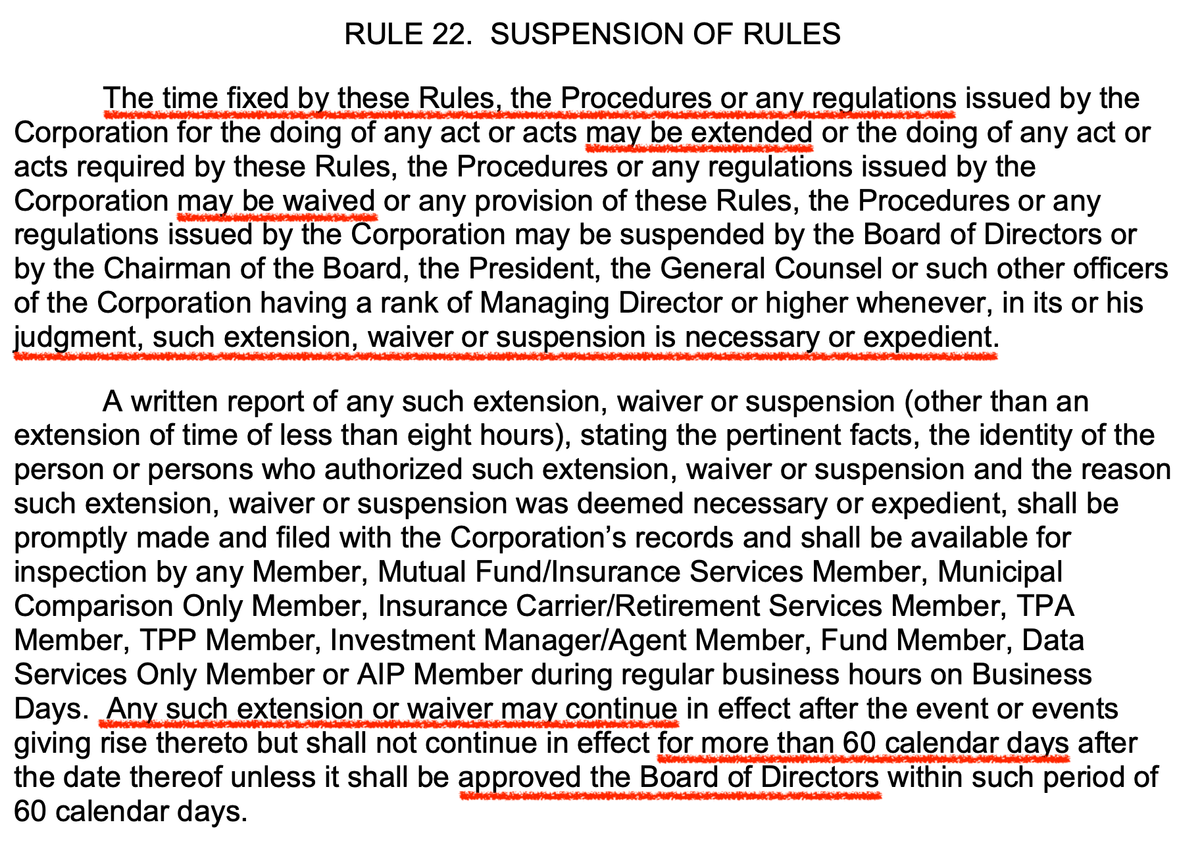

- Exhibit 5 includes updated details for Suspension and Liquidation of a Cross--Margining Participant.

Submit Comments on SR-FICC-2023-010

![r/Superstonk - FICC Alert & OPEN for comment! Notice of Filing of Proposed Rule Change to Amend and Restate the Cross-Margining Agreement between FICC and CME. Exhibit 3 (Updated Agreement) [REDACTED]. Exhibit 5 includes updated details for Suspension and Liquidation of a Cross--Margining …](https://preview.redd.it/vgxwofvm51eb1.png?width=610&format=png&auto=webp&s=3b8640a6d860f4a3ea34a8317a58cb9839fa762e)