Gary Gensler's Testimony to the Appropriations Committee About the 2024 Budget Request of $2.436B (Congress Funded at $2.364 billion). Staffing Surpassing 7-Year Levels, 35K+ Tips in 2022 (Double from 2016).

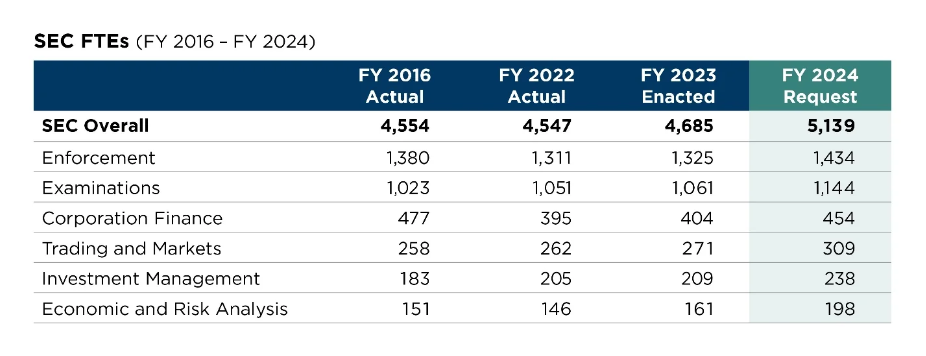

Full-time equivalents (FTEs) at the SEC and in individual Divisions. Overall SEC FTEs include all Offices and Divisions.

Budget Request

- FY 2024 request of $2.436 billion for SEC operations.

- The bulk of the increase would be to support currently authorized staffing levels given inflation.

- They've requested $39.6 million for needs supporting General Services Administration (GSA)-led real estate projects.

- Congress approved a bill las week that would fund the SEC at $2.364 billion, which would allow the SEC to continue operating at its current level.

- FY 2023 funding for the first time would bring the agency’s staffing back above where it was seven years ago.

- SEC oversee: credit rating agencies, the Public Company Accounting Oversight Board, the Financial Industry Regulatory Authority, the Municipal Securities Rulemaking Board, the Securities Investor Protection Corporation, and the Financial Accounting Standards Board.

In FY 23, the number of positions funded by Congress was 5,303, an increase of 400.

- The FY 2024 request seeks funding for an additional 170 positions, as well as full-year funding for those staff hired in FY 2023.

- The SEC’s funding is deficit-neutral; appropriations are offset by transaction fees.

Division of Enforcement:

- The SEC received over 35,000 tips, complaints, and referrals from whistleblowers and others in FY 2022, which is more than double the number received in FY 2016.

- During FY 2022, the Division decreased in size by 5 percent.

- Despite limited resources, the Division initiated over 750 enforcement actions in FY 2022, marking a 9 percent increase from the previous year. These actions led to orders totaling $6.4 billion in penalties and disgorgement.

- Rapid technological advancements in financial markets have resulted in misconduct, especially in the crypto sector. Addressing such issues demands new tools, expertise, and resources.

- The current year's staffing request aims to expand the team, bringing the Division's size to just 4 percent more than it was in FY 2016.

Division of Examinations:

- The Division of Examinations ensures firms adhere to legal compliance.

- In FY 2022, over 3,000 examinations were conducted on various registrants, including investment advisers, broker-dealers, and exchanges, to verify their legal commitments to customers.

The Division acts as the primary defense for the public using investment advisers. The number of registered investment advisers increased by 20 percent in the past five years, reaching around 15,000 from 12,500 in 2017.

- Concurrently, private funds advised by these advisers surged by 50 percent to about 50,000, straining the Division's resources.

The Division collaborates with self-regulatory organizations to inspect registered broker-dealers.

- Over the past five years, they jointly examined nearly half of these broker-dealers, even as daily equity market transactions doubled.

The FY 2024 proposal aims to expand the Division to 1,144 FTEs to address the past decade's market challenges.

- Most of this growth pertains to full-year funding for staff approved and recruited in FY 2023.

Programmatic DivisionsCorporation Finance:

- The Division of Corporation Finance supervises public company disclosures to aid informed investor decisions, emphasizing the importance of relevant, prompt, and correct information.

In the past three years, the number of companies under the Division's purview has risen by 18 percent to 7,836, mainly due to new public offerings.

- Merger activities have tripled since 2020 in the recent two fiscal years.

- However, the Division's staff remains about 17 percent less than in FY 2016.

- The current budget proposal aims to expand the team to 454 FTEs. Even with this growth, the Division would be 5 percent smaller than in FY 2016.

Investment Management:

- The Division of Investment Management supervises funds and advisers managing investments for numerous Americans.

- They oversee over 30,000 registered entities, including over 17,000 funds and 15,000 investment advisers.

- There's been notable growth in investment advisers and private funds. Specifically, assets managed by private funds, totaling around $25 trillion, have exceeded the U.S. commercial banking industry's $23 trillion.

In total, assets managed by registered investment companies, private funds, and separate accounts under the Division's supervision exceed $100 trillion.

- Due to this market expansion, funding for 238 FTEs has been requested.

Trading and Markets:

- The Division of Trading and Markets is responsible for ensuring markets are fair, orderly, and efficient. They play a crucial role in monitoring and supervising the markets, particularly during volatile periods.

They oversee a vast range of market participants, including over 3,500 broker-dealers, 24 national securities exchanges, 99 alternative trading systems, 50 security-based swap dealers, and seven active registered clearing agencies, among others.

- The Division has also seen a 67 percent increase in public inquiries since FY 2019, reaching around 20,000 in FY 2022.

- For FY 2024, a request for 309 FTEs has been made.

Economic Risk and Analysis:

- The Division of Economic and Risk Analysis aids the Commission in all its functions, from enforcement and examinations to market monitoring and rulemaking.

- In enforcement, the Division helps detect potential misconduct, evaluates unjust gains, and aids in reimbursing affected investors.

The Division's economists play a role in the entire rulemaking process. They conduct economic evaluations for proposed and adopted rules, weighing their costs, benefits, and impacts on efficiency, competition, and capital formation.

- The public is invited to comment on these analyses, and the agency actively seeks feedback, including on economic assessments.

- While FY 2023 staffing levels slightly surpassed those of 2016, a request for funding to support 198 FTEs in FY 2024.

Additional MattersTechnology:

- Data analysis in the Division of Enforcement has increased by 20 percent annually for the past three years. With the rise of cyber threats, the financial sector is on heightened alert.

Consequently, a request for $393 million has been made to address the Commission's data analysis, cybersecurity, and other IT requirements.

- This includes utilizing an extra $50 million from the SEC Reserve Fund for extended IT projects.

- For perspective, this expenditure is less than what some major market players spend on technology in a single month.

Real Estate:

- Budget includes allocation for offices and leases.

- SEC has offices in Washington, D.C., and 11 other locations.

- FY 2023 office costs constituted 5% of the budget.

Collaborated with GSA to optimize leasing space.

- Reduced 140,000 sq. ft. in the past nine years.

- Planning to reduce 30,000 sq. ft. in San Francisco and Fort Worth offices.

Intending to vacate one D.C. headquarters building by fiscal year-end.

- This move will save 210,000 sq. ft. and about $14 million annually.

- GSA secured a new lease for SEC's D.C. headquarters relocation.

- Separate FY24 request of $39.6 million for GSA's relocation efforts and Atlanta office lease.

TLDRS:

- SEC's asking for $2.436 billion for 2024 operations.

- Main reason? Covering costs due to inflation and supporting staff.

- Congress might fund the SEC with $2.364 billion...

- By 2023, SEC staffing will finally surpass levels from seven years ago.

- Fun fact: SEC's funding doesn't add to the deficit; it's covered by transaction fees.

- They got 35,000+ tips in 2022, double from 2016. Maybe some about GameStop shenanigans? 🤔

- They're eyeing misconduct in emerging areas, like crypto. But what about the stock market, right?

- Conducted 3,000+ checks in 2022 on various entities.

- They're requesting $393 million for IT needs, including cybersecurity. That's less than what some big players spend on tech in a month.