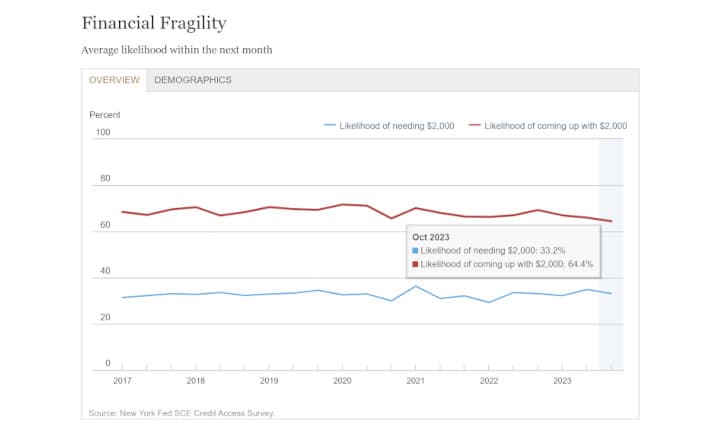

Survey of Consumer Expectations: U.S. households probability of being able to come up with $2,000 if an unexpected need arose within the next month falling to its lowest level since 2013.

Source: https://www.newyorkfed.org/microeconomics/sce/credit-access#/financial-fragility1

Wut Mean?:

Overall Decline in Consumer Credit Demand (2023):

* General weakening in most credit application rates.

* Credit card limit increase applications rose.

Rejection Rates Trends:

* Overall rise in rejection rates for credit applications.

* Decline in rejection rates for credit card limit