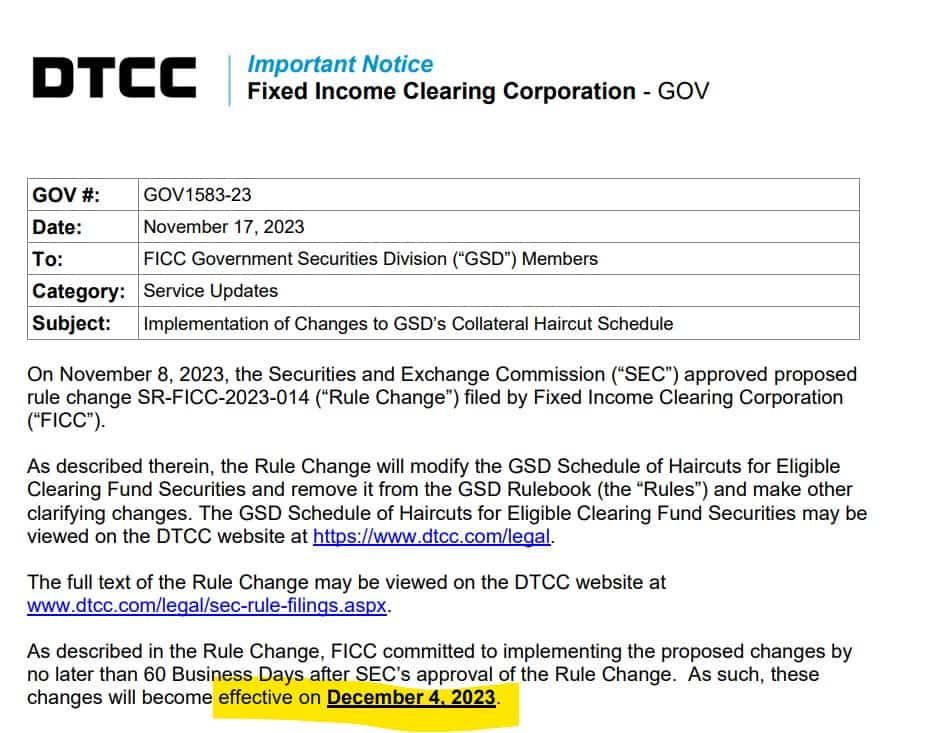

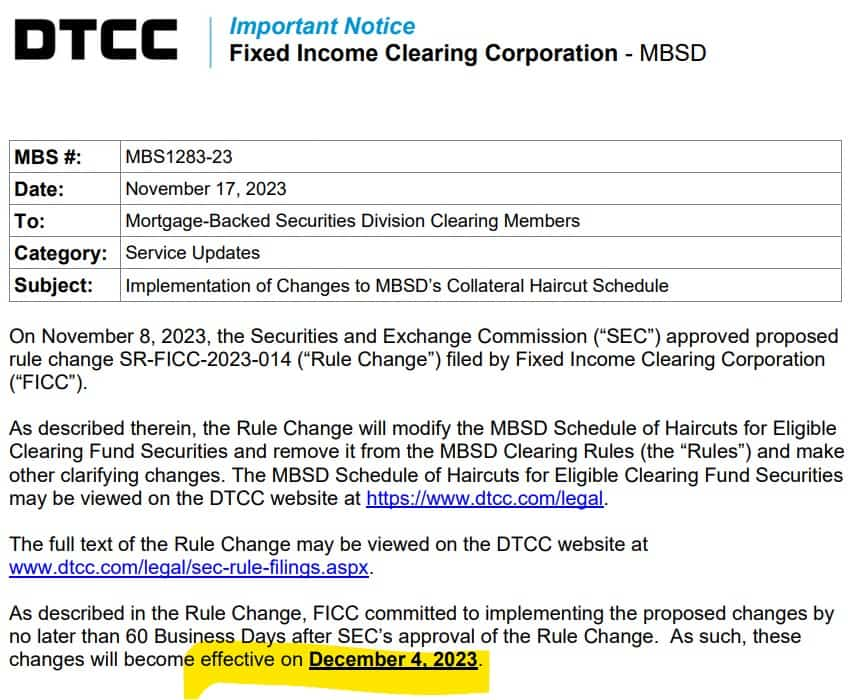

FICC & MBSD also have a new Haircut Schedule effective 12/4/23.

Background:

Wut Mean?:

FICC's Role:

- Acts as a central counterparty.

- Provides clearance and settlement services for U.S. government and mortgage-backed securities.

Margin Collection:

- Collects daily margin from members to manage credit exposure.

- GSD and MBSD Clearing Funds created from aggregated margins.

Purpose of Clearing Fund:

- Mitigates potential FICC losses from liquidating a member's portfolio in case of default.

- Reduces the risk of mutualizing losses among non-defaulting members.

Collateral for Required Fund Deposit:

- Members can use cash or Eligible Clearing Fund Securities (agency, mortgage-backed, Treasury securities).

- Securities valued minus a 'haircut' for price fluctuation protection.

Haircuts and Concentration Limits:

- Protect against collateral value erosion during liquidation.

- Limit concentration in specific asset types to reduce risk.

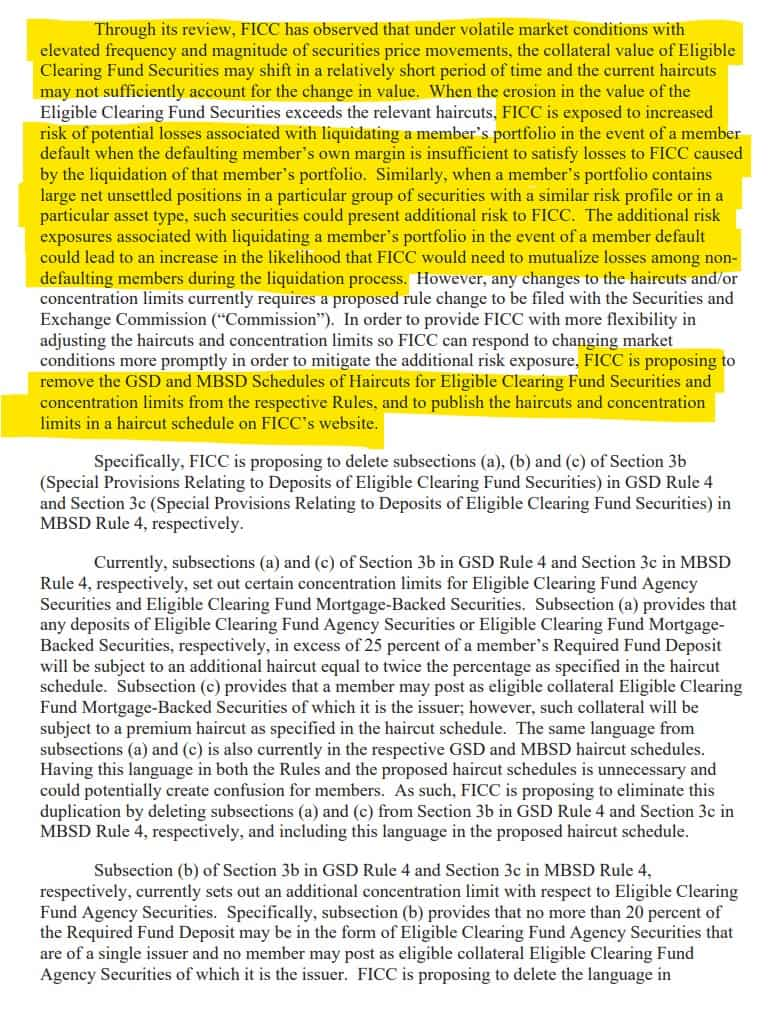

Challenges in Volatile Markets:

- Rapid collateral value shifts.

- Current haircuts may not sufficiently cover value changes...

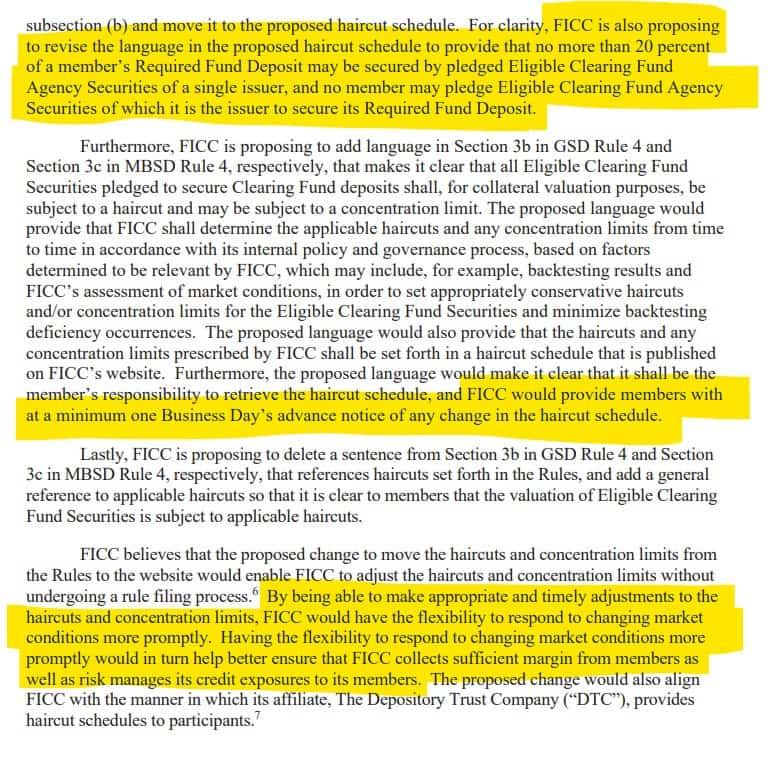

Proposed Changes by FICC:

- Posting haircuts and concentration limits on FICC’s website for flexibility.

- Meaning they can update collateral requirements in as little as a day vs. having to go through the rules process.

- Adjusting haircuts and concentration limits promptly in response to market conditions.

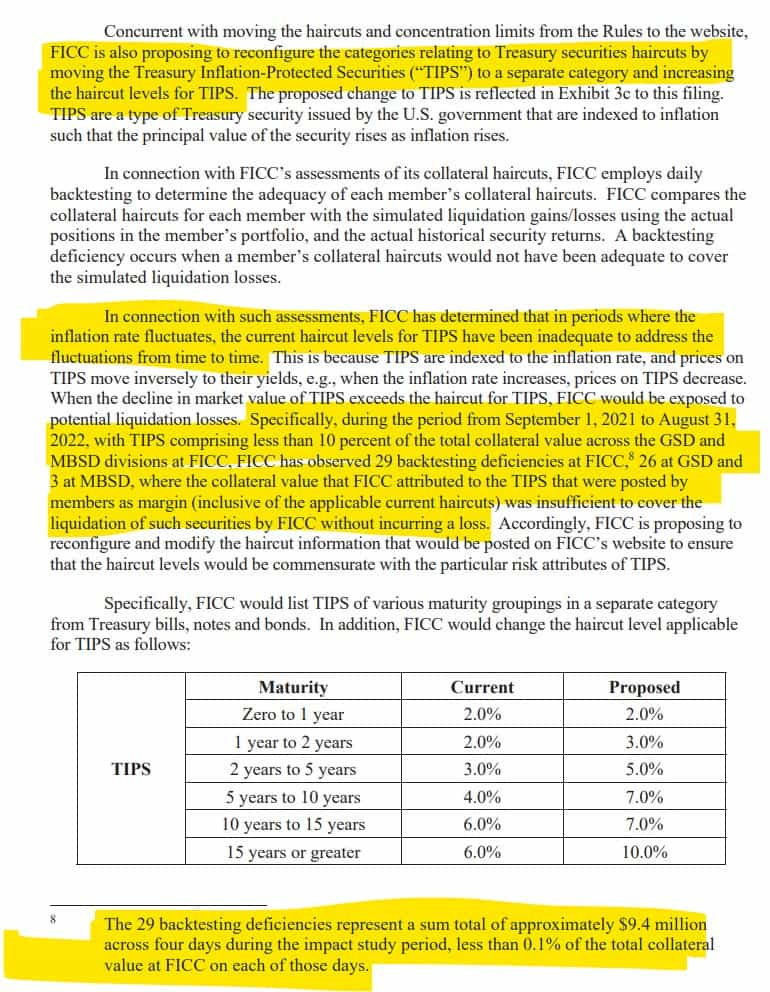

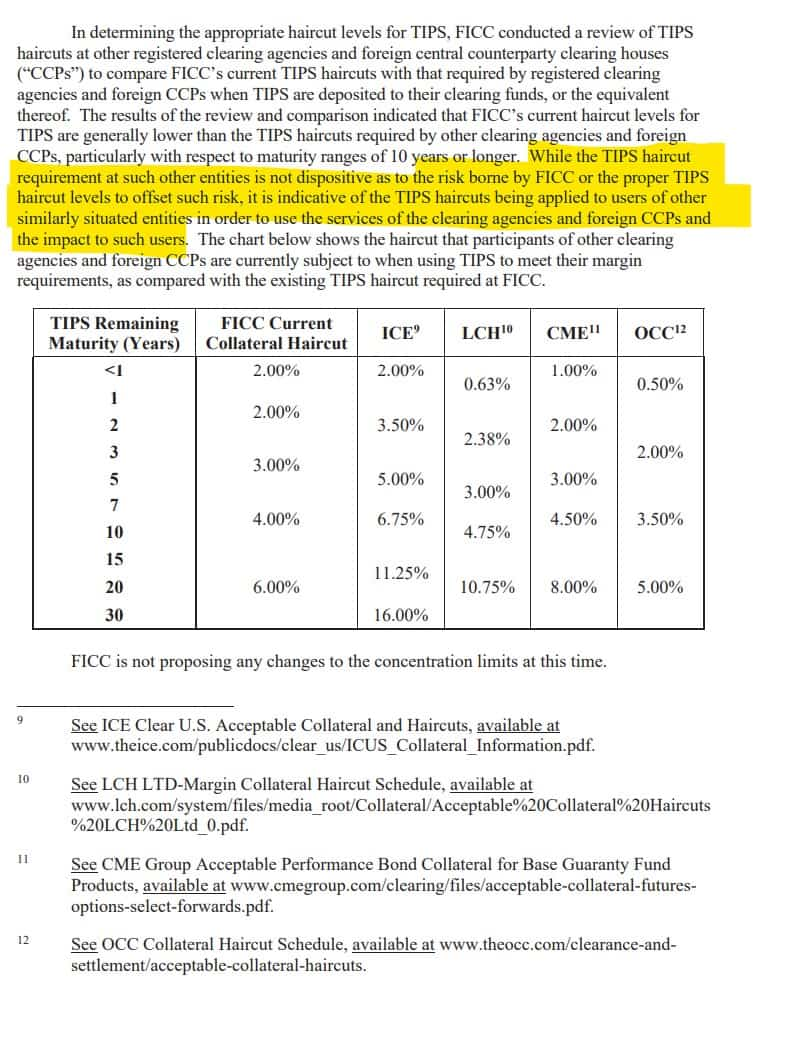

Treasury Securities Haircuts:

- Reconfiguration of categories to separate out Treasury Inflation-Protected Securities (TIPS).

- Increasing haircuts for TIPS.

- Reflects inadequacy of current levels during inflation rate fluctuations--the insidious power of inflation!

Impact Study:

Why is this interesting?

NSCC also has a New Haircut schedule taking effect 12/4/2023. Why? IDIOSYNCRATIC RISK!

TLDRS:

- FICC & MBSD also have a new Haircut Schedule effective 12/4/23.

- Changes Relating to NSCC's Schedule of Haircuts for Eligible Clearing Fund Securities approved 11/8/23 and will also be effective 12/4/23.

- NSCC's new VaR charge, which calls out haircuts, went into place October 2, 2023.

- Remember VaR tinkers with the mechanics that would have defaulted Robinhood, Instinet, & Others 1/28/21.

- The changes should lead to higher margin requirements for those with short positions in volatile stocks like GameStop. The higher the costs, the more pressure on short sellers to close their positions, especially if they face liquidity challenges.

- If short sellers can't meet their margin requirements, they'll be forced to buy back the shares to close their positions, leading to a surge in demand and subsequently, a rise in share price.

- As the stock price rises due to forced buybacks, other short sellers face further margin calls, creating a snowball effect where more short sellers are forced to buy back shares, pushing the price up even further until lift off...

- MOASS Prediction: anytime after 10/2. I used this example previously and I think it is apt to use again--calling out this is more akin to a tornado watch. Conditions are ripe for a storm, with the now implemented VaR getting 'teeth' in the form of revised haircuts soon™.

- How do I feel? The same--zen: buying, holding, drsing, and shopping at GameStop :)

- This prediction is not financial advice or advocating for a specific date in anyway, only an attempt to read tea leaves based on implementation dates and prior happenings.