OPEN for comment: Joint Industry Plan to Address Extraordinary Market Volatility for all exchange-traded products (“ETPs”) except for single stock ETPs--for example, those providing exposure to GameStop...

Purpose:

Appendix A to the Plan sets out the definitions of Tier 1 and Tier 2 NMS Stocks and the Percentage Parameters for each. Appendix A currently provides that Tier 1 includes all NMS Stocks included in the S&P 500 Index and the Russell 1000 Index, as well as “eligible” ETPs. Appendix A specifies:

To determine eligibility for an ETP to be included as a Tier 1 NMS Stock, all ETPs across multiple asset classes and issuers, including domestic equity, international equity, fixed income, currency, and commodities and futures will be identified. Leveraged ETPs will be excluded, and the list will be sorted by notional consolidated average daily volume (“CADV”). The period used to measure CADV will be from the first day of the previous fiscal half year up until one week before the beginning of the next fiscal half year. Daily volumes will be multiplied by closing prices and then averaged over the period. ETPs, including inverse ETPs, that trade over $2,000,000 CADV will be eligible to be included as a Tier 1 NMS Stock.

The eligible ETPs are then listed in Schedule 1 to Appendix A, and the list is reviewed and updated semi-annually. All ETPs that do not meet the “eligibility” definition are currently assigned to Tier 2.

For Tier 1 NMS Stocks, Appendix A defines the Percentage Parameters as: • 5% for Tier 1 NMS Stocks with a Reference Price more than $3.00; • 20% for Tier 1 NMS Stocks with a Reference Price equal to $0.75 and up to and including $3.00; and • The lesser of $0.15 or 75% for Tier 1 NMS Stocks with a Reference Prices less than $0.75.

For Tier 2 NMS Stocks, Appendix A defines the Percentage Parameters as: • 10% for Tier 2 NMS Stocks with a Reference Price of more than $3.00; • 20% for Tier 2 NMS Stocks with a Reference Price equal to $0.75 and up to and including $3.00; and • The lesser of $0.15 or 75% for Tier 2 NMS Stocks with a Reference Price less than $0.75.

Notice above, Tier 1 ONLY includes all NMS Stocks included in the S&P 500 Index and the Russell 1000 Index, as well as “eligible” ETPs?

This is changing:

![Tier 1 NMS Stocks shall include all NMS Stocks included in the S&P 500 Index and the Russell 1000 Index, and [the] all exchange-traded products (“ETP”), except for single stock ETPs, which will be assigned to the same Tier as their underlying stock, adjusted for any leverage factor.](https://dismal-jellyfish.com/content/images/2023/11/5--1--2.jpg)

Tier 1 NMS Stocks shall include all NMS Stocks included in the S&P 500 Index and the Russell 1000 Index, and [the] all exchange-traded products (“ETP”), except for single stock ETPs, which will be assigned to the same Tier as their underlying stock, adjusted for any leverage factor.

Study Data:

The Participants reviewed trading and quoting in all ETPs during the period from Q4 of 2019 through Q2 of 2021. This span included periods of greatly varying volatility and heterogeneous market conditions, including the sell-off during the onset of Covid-19 pandemic, the volatile period surrounding the 2020 U.S. presidential election, and the meme stock episode in early 2021.

Single stock ETF's for GameStop are here now...

Back to their Study Results:

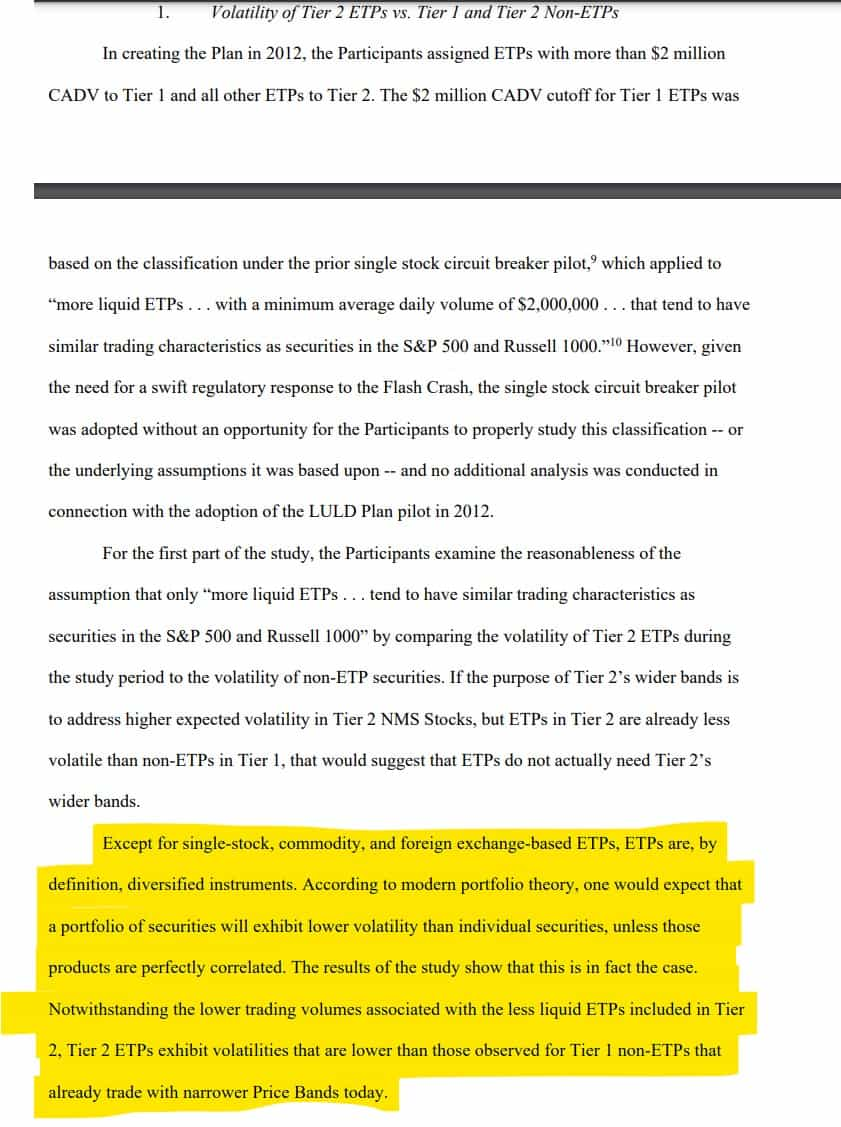

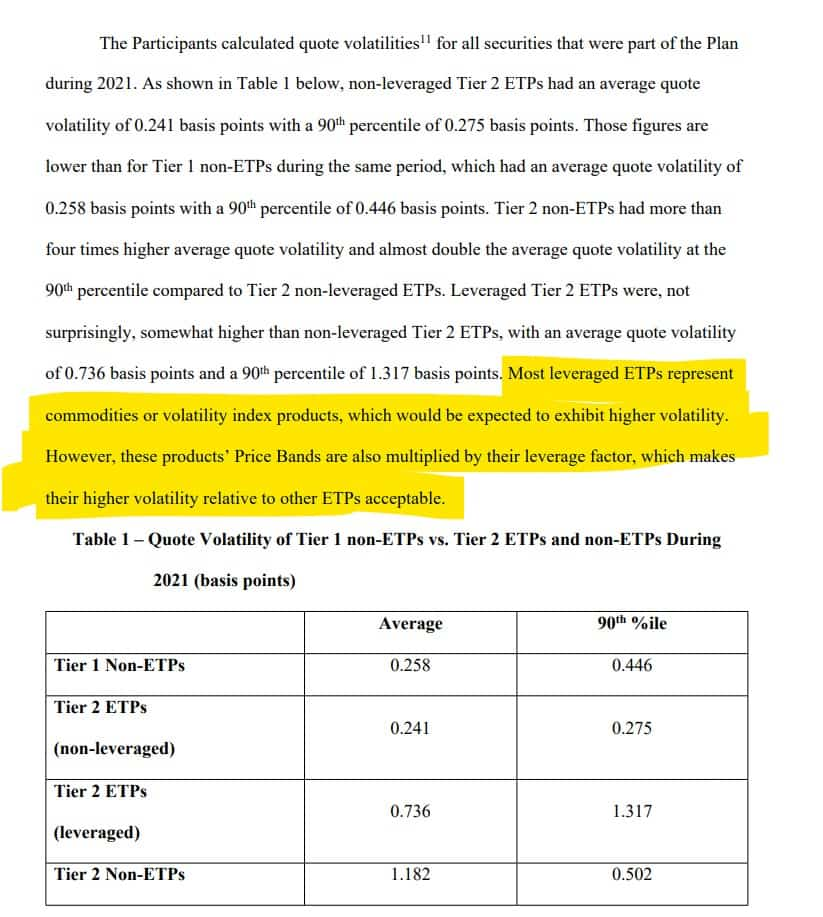

Overall, the comparison between Tier 1 non-ETPs and Tier 2 ETPs shows that quote volatility of Tier 2 ETPs operating under wider Price Bands is lower than Tier 1 non-ETPs, and that the incidence of Limit States and Trading Pauses for Tier 1 non-ETPs is substantially higher than that of Tier 2 ETPs. By contrast, Tier 2 non-ETPs are considerably more volatile than Tier 1 non-ETPs, which substantiates the wider Price Bands applied to these securities, as the higher number of Limit States and Trading Pauses in Tier 2 non-ETPs are occurring under 10% Price Bands. The Participants believe that these data indicate that the Price Bands are not well calibrated to the realized volatility for Tier 2 ETPs and should not be twice as wide as those for Tier 1 non-ETPs.

Analysis of ETP Trades Executing Past Theoretical Tier 1 Bands:

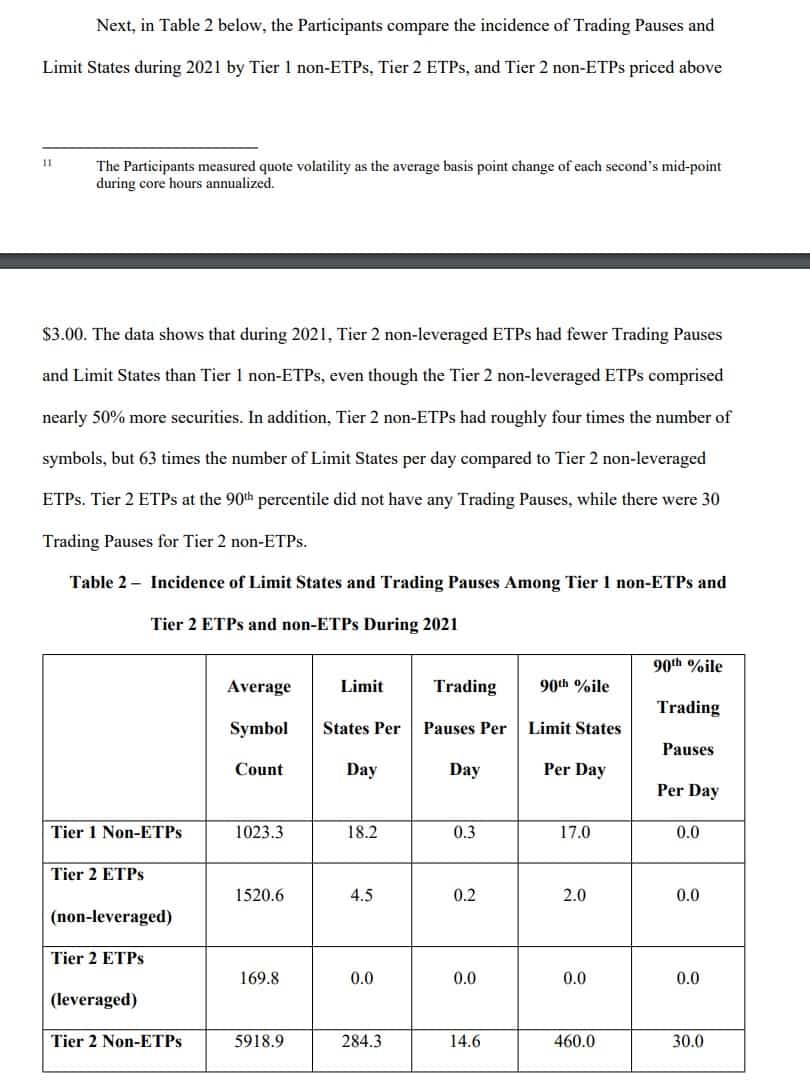

For the second part of the study, the Participants sought to identify the range of potential notional value that would have been impacted during the study period if trades in Tier 2 ETPs had been bounded by 5% Price Bands instead of 10% Price Bands. Specifically, the Participants calculated theoretical Tier 1 (i.e., 5%, adjusted for leverage factor) Price Bands for all Tier 2 ETPs in the study (“Theoretical Tier 1 Bands”). Once the theoretical narrower bands were calculated, the Participants identified 101,956 trades that occurred at prices between the Theoretical Tier 1 Bands and the actual Tier 2 bands.

The Participants believe that the notional value of trades impacted during the study period would be between these two numbers – at least $36.8 million on the lower end, with upper end at $711.1 million. This is because there would likely be more liquidity focused near the narrower Theoretical Tier 1 Bands, resulting in some of those trades executing at or near those revised bands, while other trades would have been prevented by the narrower Theoretical Tier 1 Bands. Given the lower liquidity typically available in Tier 2 ETPs, it is not likely that all of the market depth would shift to the narrower theoretical bands. However, because there could be significant additional volume executed at prices at or near the narrower bands, it is unlikely that the dollar value prevented could reach the upper bound of $711.1 million.

Daily Notional Value Prevented and Symbols Impacted by Theoretical Tier 1 Bands:

Price Movement After the Theoretical Blocked Trades:

Likely Impact on Trading Pauses:

In sum, for two of the three half-year changes the Participants studied, spreads improved and there was a neutral to positive effect on inside liquidity for ETPs shifting from Tier 2 to Tier 1. The opposite was true for Tier 2 ETPs that changed tier from the second half of 2020 to the first half of 2021. These results show that, on balance, market quality statistics improved for Tier 2 ETPs that moved to Tier 1.

As these data show, contrary to expectations, narrowing the Price Bands for ETPs that moved from Tier 2 into Tier 1 did not increase the incidence of Trading Pauses, Limit States, or the amount of time spent in Limit States. This is likely because market participants adjust their behavior and provide more liquidity to ETPs once their bands are tightened. The Participants acknowledge that the number of ETPs that move between Tiers, especially into Tier 1 after being in Tier 2, is relatively small and may not provide a significant enough population to offer strong support for that statistic. The Participants note, however, that Amendment 18 removed doublewide bands at the open for all stocks and at the close for Tier 2 stocks, market participants adjusted to the tighter bands without a large increase in LULD Trading Pauses.

Study Conclusions

- Tier 1 non-ETPs are far more likely than Tier 2 ETPs to enter into Limit States and Trading Pauses due to the underlying volatility of these securities. This finding suggests that the Price Band width for Tier 2 ETPs is poorly calibrated relative to their actual trading behavior.

- During the study period, the notional value of trades that would have been prevented if Tier 2 ETPs had used tighter Tier 1 bands would have been substantial for such thinly traded products, bounded on the lower end at $36.8 million and the upper end at $711.1 million.

- In the majority of cases where a trade would have been prevented by the narrower Theoretical Tier 1 Bands, prices reverted by the end of the following 5- and 10- minute periods, suggesting that having these thinly-traded ETPs in Tier 1 would protect investors from executing trades at inferior prices that may occur due to transitory gaps in liquidity rather than fundamental valuation changes.

- In most cases where ETPs have been reclassified from Tier 2 to Tier 1, market quality improved as evidenced by the lower quote volatility, tighter spreads, and increased liquidity for ETPs that moved from Tier 2 to Tier 1.

- Using tighter Tier 1 bands for all ETPs would provide greater investor protection from temporary liquidity gaps, which are facilitated by the wider price bands in Tier 2.

- The number of Limit States and Trading Pauses decreased when Tier 2 ETPs moved to Tier 1 and increased when Tier 1 ETPs moved to Tier 2.

From this evidence, the Participants conclude that moving Tier 2 ETPs to Tier 1 would improve market quality, more effectively dampen volatility, provide greater investor protection, and decrease the number of unnecessary Limit States and Trading Pauses. Accordingly, the Participants seek approval of this amendment because it enhances the public interest, the protection of investors, and the maintenance of fair and orderly markets, and would remove impediments to and perfect the mechanisms of a national market system in conformance with Rule 608.

Questions they would like comments on and how to comment:

- The Participants propose to amend Appendix A of the Plan by deleting the definition of ETPs “eligible” for Tier 1 and to specify that all ETPs, except for single stock ETPs, would be assigned to Tier 1. What are commenters’ views on whether the proposal is consistent with the Exchange Act?

- Because all leveraged ETPs (except Tier 2 single stock ETPs) would be assigned to Tier 1, the Participants also propose to add text into Section I of Appendix A describing how the Percentage Parameters would be set for leveraged ETPs. What are commenters’ views on whether this proposal regarding leveraged ETPs to the Plan is consistent with the Exchange Act?

- The proposal acknowledges that the ETPs studied covered several asset classes, including domestic equities, international equities, fixed income, currency, commodity, and digital currency ETPs. For example, the Participants’ analysis provides aggregate statistical information with respect to Tier 2 ETPs as a whole. In addition, the proposal states that, except for single-stock, commodity, and foreign exchange-based ETPs, ETPs are by definition diversified instruments. The proposed amendment to the Plan, which would assign all ETPs to Tier 1, only excludes single stock ETPs, but does not propose to exclude other ETPs based on other single reference assets, such as ETPs based on single commodities or single digital currency-related assets. Do commenters agree that the methodology and results of the analysis support the conclusions drawn by the Participants? Please explain. Does this aggregated approach to evaluating Tier 2 ETPs as a whole support the conclusions drawn by the Participants with respect to different segments of Tier 2 ETPs? For example, what are commenters’ views on whether the proposal’s study explains why such other ETPs based on a single asset (other than stocks) should be assigned to Tier 1?

- The proposal compares the quote volatility of Tier 2 ETPs to that of Tier 1 non-ETPs, where quote volatility is measured using the mid-point at each second. With this measure of volatility, the proposal concludes that Tier 2 ETPs have lower quote volatility than Tier 1 non-ETPs, suggesting that Tier 2 ETPs are not too volatile for the Tier 1 price bands. In addition, the proposal acknowledges that Tier 2 ETPs are often thinly traded, and we request comment on whether being thinly traded might bias the particular volatility measure used in the analysis due to infrequent updates of the mid-point. What are commenters’ views on whether the analysis has adequately captured Tier 2 ETP volatility in support of the conclusion that they are not too volatile for the Tier 1 price bands? If not, what measure of volatility would be more appropriate? Please explain.

- The Participants conclude that the proposal would protect investors from executing trades at inferior prices (Theoretical Blocked Trades). To support this conclusion, the Participants deduce from an analysis that if the proposal was in place from 2019- 2021, it would have prevented $45 million in trades during the pandemic-driven volatility in 2020. Do commenters agree that the analysis supports the conclusion that preventing Theoretical Blocked Trades would have protected investors during this volatile period? Please explain.

- The Participants’ analysis finds that trades in Tier 2 ETPs that executed outside the Tier 1 price bands (Theoretical Blocked Trades) are generally followed by midpoint prices within the Tier 1 bands. Based on this finding, the Participants conclude that prices revert after these Theoretical Blocked Trades, indicating that the Theoretical Blocked Trades executed during temporary liquidity gaps. Do commenters agree that the analysis measures price reversion and that the Theoretical Blocked Trades often executed during temporary liquidity gaps? If not, how do commenters suggest the analysis could examine the extent to which Theoretical Blocked Trades executed during temporary liquidity gaps? Please explain.

- The Participants state that Plan does not impose any burden on competition that is not necessary or appropriate in furtherance of the purposes of the Exchange Act. Do commenters believe that the Plan imposes any burden on competition that is not necessary or appropriate in furtherance of the purposes of the Exchange Act?

- Further, would the proposal have a positive, negative, or neutral impact on competition? Please explain. How would the proposal impact competition across ETP issuers or ETPs on similar baskets of securities currently in different tiers? Please explain. How would any impact on competition from the proposal benefit or harm the national market system or the various market participants? Please describe and explain how, if at all, aspects of the national market system or different market participants would be affected. Please support any response with data, if possible.

- More generally, to the extent possible please provide specific data, analyses, or studies for support regarding any impacts of the proposal on competition.

How to comment:

Electronic Comments:

- Use the Commission’s internet comment form available at SEC's website.

- Alternatively, send an email to [email protected]. Include "File Number 4-631" in the subject line.

Paper Comments:

- Send paper comments in triplicate to:

- Secretary, Securities and Exchange Commission

- 100 F Street NE, Washington, DC 20549-1090

General Guidelines:

- Reference "File Number 4-631" in the subject line of emails or on paper comments.

- Choose only one method of submission to help the Commission process and review comments efficiently.

- The Commission will post all comments on its website.

- Avoid including personal identifiable information in submissions, unless you want it publicly available.

- Obscene material or content subject to copyright protection might be redacted or withheld.

- All submissions should be sent on or before 21 days from publication in the Federal Register.

TLDRS:

- Joint Industry Plan to Address Extraordinary Market Volatility for all exchange-traded products (“ETPs”) except for single stock ETPs--for example, those providing exposure to GameStop.

- OPEN for comment!