To the people familiar with the matter complaining DFV updates are market manipulation, please revisit Gary Gensler's testimony from Thursday, May 6, 2021

To the people familiar with the matter complaining DeepFuckingValue/RoaringKitty/Kieth Gill updates are market manipulation, please revisit Gary Gensler's testimony from Thursday, May 6, 2021 at the house congressional hearing GAME STOPPED? WHO WINS AND LOSES WHEN SHORT SELLERS, SOCIAL MEDIA, AND RETAIL INVESTORS COLLIDE, PART III:

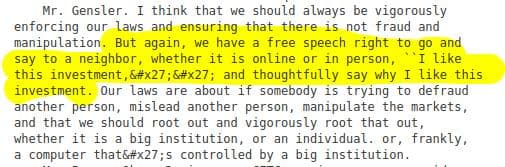

Specifically, the following from Gary's testimony:

"I think that we should always be vigorously enforcing our laws and ensuring that there is not fraud and manipulation. But again, we have a free speech right to go and say to a neighbor, whether it is online or in person, `I like this investment', and thoughtfully say why I like this investment. Our laws are about if somebody is trying to defraud another person, mislead another person, manipulate the markets, and that we should root out and vigorously root that out, whether it is a big institution, or an individual. or, frankly,a computer that's controlled by a big institution."

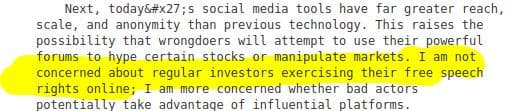

"I am not concerned about regular investors exercising their free speech rights online; I am more concerned whether bad actors potentially take advantage of influential platforms."

All DFV has done is proclaim a like for the stock and shown proof of his conviction via his position updates--not a push to defraud, mislead, or manipulate anyone. He is not a bad actor, he is someone that has gone long with a thesis he was willing to share.

Frankly, he provides more insight and transparency on the 'long side' then Wall Street does on the on the 'short side'.

- The National Association of Private Fund Managers (NAPFM), Alternative Investment Management Association (AIMA), and Managed Funds Association (MFA) filed a lawsuit asking the U.S. Court of Appeals for the Fifth Circuit to invalidate the two rules recently adopted by the Securities and Exchange Commission (SEC) requiring reporting and public disclosure of securities loans and short selling activity.

- They call out that both rules impose extensive new requirements for the reporting and public disclosure of information pertaining to short sales of securities, whether of the short-sale activity itself (as in the Short Position Reporting Rule) or of the loans of securities to facilitate that short-sale activity (as in the Securities Loan Reporting Rule).

- They complain the Short Position Reporting Rule and its detailed disclosures about short-sale activity can impose substantial harms on market participants (including by revealing confidential investment strategies and potentially facilitating retaliation or other manipulative activities).

- They also claim the rules are invalid and believe the Court should grant their petition and invalidate the rules.

What folks are saying on Short Position and Short Activity reporting by Institutional Investment Managers:

- Gary Gensler: "Today, I’m pleased that, based upon public comment, we’re adopting a rule fulfilling that Congressional mandate. Today’s adoption will promote greater transparency about short selling both to regulators and the public."

- Caroline Crenshaw: "This could help the SEC reconstruct market events & design responses to events that take place during times of volatility similar to the “meme” stock episode that might happen in the future."

- Mark Uyeda on 'NO' for (Rule 13f-2): "Public knowledge of their short positions would render them susceptible to a short squeeze & also reduce the incentives to engage in this beneficial activity."

- Hester Peirce Statement on SEC's Short Sale Disclosure: "Because a narrower rule leveraging existing reporting requirements could have brought more meaningful transparency at lower costs, I cannot support this recommendation."

What folks are saying on Transparency in the Securities Lending Market:

- Gary Gensler: "as relates to the reporting to regulators, the final rule will require lenders to report loan data to a registered national securities association—i.e., FINRA—by the end of each trading day."

- Hester Peirce: "While providing transparency regarding securities lending is a worthy & statutorily mandated objective, the approach we are voting on today is not the right way to achieve that objective. Accordingly, I cannot support this recommendation."

- Mark Uyeda "when these changes from the proposal are taken together, to what extent can the resulting information be used to estimate particular short selling positions & is that acceptable?"

TLDRS:

- To the people familiar with the matter complaining DeepFuckingValue/RoaringKitty/Kieth Gill updates are market manipulation please pound sand.

- The updates are an exercise of an individual's free speech and given ability to tell others what they like per the Chairmen of the SEC Gary Gensler in his testimony to congress:

- "I think that we should always be vigorously enforcing our laws and ensuring that there is not fraud and manipulation. But again, we have a free speech right to go and say to a neighbor, whether it is online or in person, `I like this investment', and thoughtfully say why I like this investment. Our laws are about if somebody is trying to defraud another person, mislead another person, manipulate the markets, and that we should root out and vigorously root that out, whether it is a big institution, or an individual. or, frankly,a computer that's controlled by a big institution."

- "I am not concerned about regular investors exercising their free speech rights online; I am more concerned whether bad actors potentially take advantage of influential platforms."

To the people familiar with the matter complaining DFV updates are market manipulation, please revisit Gary Gensler's testimony from Thursday, May 6, 2021: "we all have a free speech right to go and say to a neighbor, whether it’s online or in person, I like this investment”

by u/Dismal-Jellyfish in Superstonk

To the people familiar with the matter complaining DFV's updates are market manipulation, please revisit Gary Gensler's testimony: "we all have a free speech right to go and say to a neighbor, whether it’s online or in person, I like this investment”https://t.co/xhSYCL6NEG

— dismal-jellyfish (@DismalJellyfish) June 4, 2024