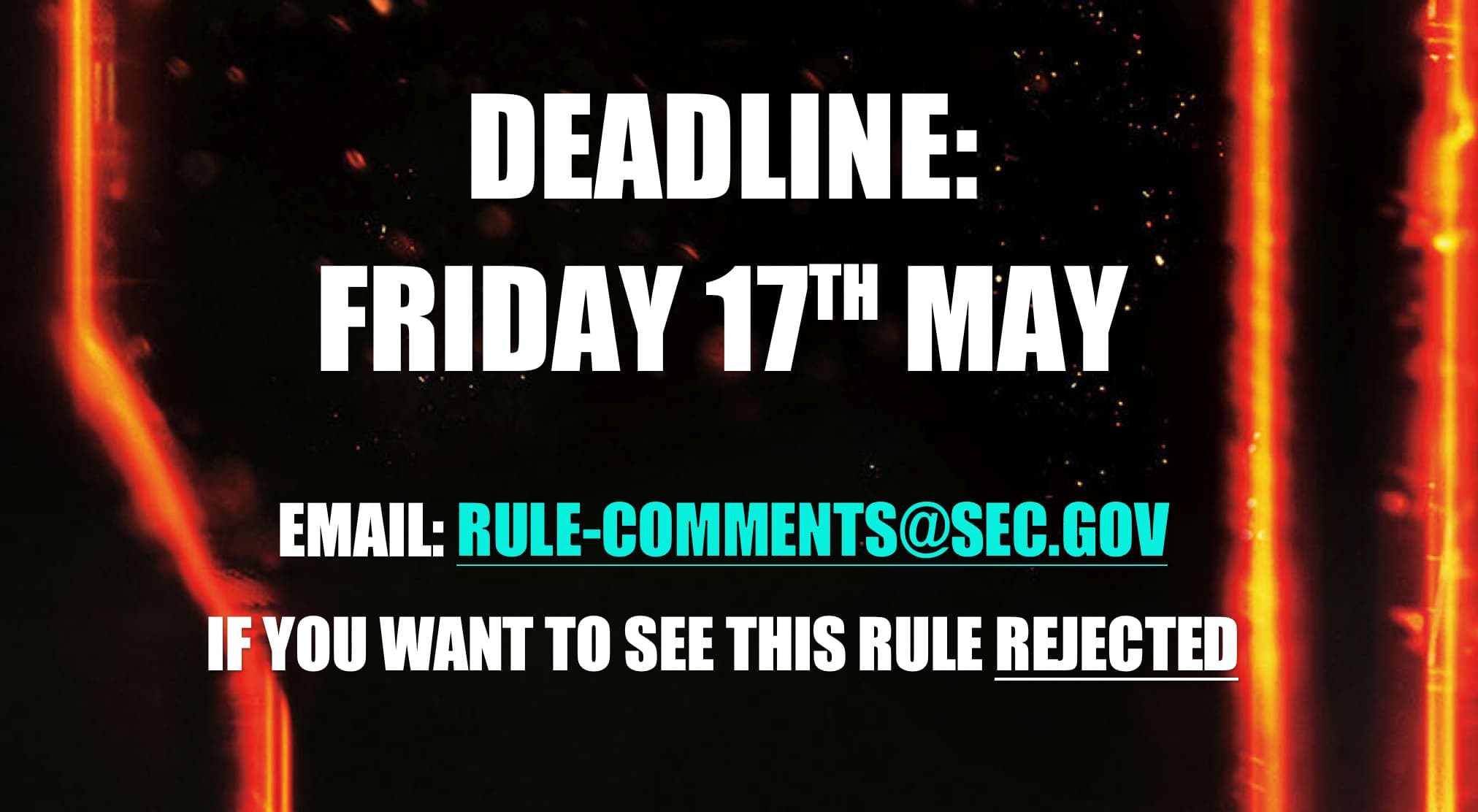

Time is ticking away, with only 2 days remaining to support the rejection of SR-OCC-2024-001: Have you sent your comment to the SEC yet?

Are you ready to join household investors in championing integrity in our financial markets? Step up and claim your place in history amongst the greats.

What a week it's been, but it's not over yet!

WE STILL HAVE TWO DAYS LEFT UNTIL THE SEC SUBMISSION DEADLINE 🔥

If shifting goal posts isn't for you - and you fancy holding Wall Street accountable should they be unable to facilitate their Margin requirements, why not consider sending the SEC an email to support their rejection of the SR-OCC-2024-001 rule.

The integrity of our financial markets are at stake here.

Future generations are depending on you. Let's not let them down.

Let's fight for Market Reform.

Subject: Comments on SR-OCC-2024-001 34-100009

Dear Members of the Securities and Exchange Commission,

I am writing to express my concerns regarding Rule SR-OCC-2024-001, which proposes adjustments to margin thresholds, specifically during periods of high volatility.

This proposed adjustment is concerning because it essentially shifts the goalposts when clearing members are unable to meet their financial obligations. The necessity for margin calls in the first place is to prevent clearing members from overextending themselves on their bets, ensuring that they have adequate collateral to cover potential losses.

By adjusting margin thresholds during periods of high volatility, there is a risk that clearing members may not be required to maintain sufficient collateral, increasing the likelihood of default and destabilising the financial system.

This proposed adjustment raises critical questions about the integrity of the options market and the role of the Options Clearing Corporation (OCC) in managing risk.

The basis of this letter is equally to express support and appreciation to the SEC in their rejection of this rule, with supporting encouragement for this decision and future outcome.

With due consideration to the reasons for the rejection as presented:

- Section 17A(b)(3)(F) of the Exchange Act, which requires, among other things, that the rules of a clearing agency are designed to promote the prompt and accurate clearance and settlement of securities transactions and derivative agreements, contracts, and transactions; and to assure the safeguarding of securities and funds which are in the custody or control of the clearing agency or for which it is responsible; [Refer to 15 U.S.C. 78q-1(b)(3)(F)]

- Rule 17Ad-22(e)(2) of the Exchange Act, which requires that a covered clearing agency provide for governance arrangements that, among other things, specify clear and direct lines of responsibility; and [Refer to 17 CFR § 240.17Ad-22(e)(2)]

- Rule 17Ad-22(e)(6) of the Exchange Act, which requires that a covered clearing agency establish, implement, maintain, and enforce written policies and procedures reasonably designed to cover, if the covered clearing agency provides central counterparty services, its credit exposures to its participants by establishing a risk-based margin system that, among other things, (1) considers, and produces margin levels commensurate with, the risks and particular attributes of each relevant product, portfolio, and market, and (2) calculates sufficient margin to cover its potential future exposure to participants in the interval between the last margin collection and the close out of positions following a participant default. [Refer to 17 CFR § 240.17Ad-22(e)(6)]

The OCC, as the central counterparty for options and futures contracts traded on U.S. exchanges, plays a crucial role in ensuring the integrity of the options market. Its primary responsibility is to guarantee the fulfillment of contracts and manage the risk associated with trading these financial instruments.

Margin calls serve a crucial purpose in the financial system by acting as a safeguard against excessive risk-taking. They ensure that clearing members have adequate collateral to cover potential losses, thereby preventing them from overextending themselves on their bets. However, by allowing for adjustments to margin thresholds during periods of high volatility, there is a risk of undermining this fundamental principle.

In the context of financial jargon, this proposal effectively allows clearing members to "kick the can down the road" when it comes to meeting their financial obligations. It's akin to "moving the goalposts" in a high-stakes game, where the rules are changed to accommodate those struggling to keep up.

Imagine a scenario where a hedge fund has taken substantial positions on a volatile stock. As the stock price experiences wild fluctuations, the hedge fund might find itself increasingly unable to meet its margin requirements. Under Rule SR-OCC-2024-001, the margin thresholds could be adjusted, effectively lowering the bar for maintaining adequate collateral. This not only incentivises risky behavior but also exacerbates systemic risk, as it increases the likelihood of default later down the line.

Furthermore, such adjustments lack transparency and introduce an element of arbitrariness into the margin calculation process. Without clear guidelines and objective criteria for determining margin thresholds, there is a risk of favoritism or manipulation, further eroding market integrity.

The use of "idiosyncratic volatility control settings" to adjust these margin thresholds during high volatility introduces a risk because it lacks transparency in the calculation and implementation process. Without clear guidelines on how these settings are determined, there is a potential for arbitrary or ad-hoc adjustments, allowing the Options Clearing Corporation (OCC) to alter the criteria whenever Clearing Members require assistance. This flexibility raises concerns about fairness, as it may create an environment where the rules can be changed based on individual circumstances, potentially favouring certain market participants or introducing an element of unpredictability.

The proposal's supporting evidence, particularly regarding said calculation of margin thresholds, is troublingly redacted. This lack of disclosure undermines the principles of transparency and accountability that are crucial in regulatory frameworks. As stakeholders, we require detailed information on how these adjustments will be made to ensure fair and equitable treatment of all market participants.

This lack of transparency undermines the integrity of financial markets by eroding trust among participants. Financial markets thrive on clear and consistent rules that are applied uniformly to ensure a level playing field. When rules can be adjusted opaquely, it creates uncertainty and diminishes confidence in the regulatory framework. Maintaining trust is essential for the effective functioning of financial markets, and transparency in rule-making and enforcement is a key factor in upholding the integrity of the overall financial system.

Moreover, the proposal grants unchecked authority to the Financial Risk Management (FRM) Officer to make unilateral decisions during periods of high market stress. This authority, while ostensibly intended to protect the interests of the OCC, raises questions about potential conflicts of interest. The FRM Officer is entrusted with safeguarding both the OCC's interests and those of at-risk Clearing Members, creating a potential conflict that needs addressing and changing.

In conclusion, Rule SR-OCC-2024-001 poses a significant threat to the stability and integrity of the financial system. It undermines the fundamental purpose of margin calls and introduces unnecessary risks that could have dire consequences for market participants.

In light of these concerns, I urge the Securities and Exchange Commission to carefully reconsider this proposal and prioritise the protection of investors and the stability of the financial markets by rejecting Proposed Rule SR-OCC-2024-001. Clear guidelines, transparency in calculations, and checks and balances on discretionary authority are essential for maintaining the integrity and stability of the financial markets.

Thank you for your attention to this matter. I trust that the SEC will carefully consider these concerns and take appropriate actions to address the potential risks associated with this rule.

Sincerely,

[APE]

📱 ☎️ Pastebin for mobile users: https://pastebin.com/RGZBBNjG

You can copy and paste the letter here, making it even easier to submit to the SEC via mobile.

In addition to the swiftly composed piece I've just shared, this is with the full caveat that my comment letter pails in comparison to the absolute powerhouse of a submission as has been drafted by WhatCanIMakeToday.

You can check it out here:

FULLY DETAILED LETTER TEMPLATE:

Because excellence deserves to be recognised.

Simians Smash SEC Rule Proposal To Reduce Margin Requirements To Prevent A Cascade of Clearing Member Failures! [COMMENT TEMPLATE INCLUDED]

📱 ☎️ Pastebin for mobile users: https://pastebin.com/dpXQ0gim

Go on, go make a difference out there. Submit your comment 💪

Seriously, please go give this a read.

This is a very comprehensive and well articulated deep dive into the issues as we have been discussing here, and if you need more assistance to help you shape your comments - this is a great resource to draw from. Please do give it every appreciation it deserves.

Thank you WhatCanIMakeToday 🙏

✅ 📢 🌏 How to Comment:

📱🖥️ ✉️ Email: [email protected]

- Include the file number: SR-OCC-2024-001 34-100009 - in the subject line of your email to the SEC.

- This is open to audiences worldwide.

- Commission's Internet Comment Form: Use the form available at SEC's rule comment page.

🤫 🫣 Valuing Your Privacy

Remember:

Avoid including personal identifiable information in your submissions unless you want it to be made publicly available.

- The SEC may redact or withhold content that is obscene.

✉️ 🔍 Don't want to use your personal email?

Why not sign up for https://proton.me/mail

From their website:

Proton Mail is an encrypted email service based in Switzerland that protects your privacy and data from trackers and scanners. You can create a free account, switch from any email provider, and enjoy features like password protection, aliases, and scheduling.

🖥️ 💡 Work Smarter, not Harder - with ChatGPT

AI Language Model designed to help you.

Consider inputting these writing guides into ChatGPT to help you compose your own comment.

Here's a prompt to help you get started:

Draft a formal letter expressing support for the SEC's decision to reject the OCC's proposed rule change. Emphasise the importance of transparency, risk mitigation, and investor protection in maintaining a fair financial market. Specifically, address concerns about the lack of transparency in the OCC's proposal, potential systemic risks from margin requirement adjustments during market volatility, and the conflict of interest in the FRM Officer's role. Maintain a respectful and professional tone, providing detailed reasons and supporting evidence for your support of the SEC's decision. Use the example letter as a reference for structuring arguments and aligning with the SEC's grounds for disapproval.

Work Smarter, not Harder.

ChatGPT is user friendly, check out what it looks like here: https://chatgpt.com

Please note:

🚨 ChatGPT remains an unreliable source for verified information and facts and will always require people to assess/review and cross-reference the generated responses.

You are the fact checker, not the AI.

📚👀 Want to learn more about this rule? Check out the following posts:

🔥 SR-OCC-2024-001 EXPLAINER POSTS:🔥

CREDIT: Dismal-Jellyfish.

Options Clearing Corporation is looking to adjust parameters for calculating margin requirements during periods when the products it clears & the markets it serves experience high volatility. OPEN for comment! here.

CREDIT: WhatCanIMakeToday

OCC Proposes Reducing Margin Requirements To Prevent A Cascade of Clearing Member Failures: here.

CREDIT: kibblepigeon

Dismantling Rule SR-OCC-2024-001 - The Exposed Threat of Margin Erosion and Risk Escalation: here.

🔥 FOLLOW UP SEC REJECTION AND TEMPLATE LETTER:🔥

CREDIT: WhatCanIMakeToday

Simians Smash SEC Rule Proposal To Reduce Margin Requirements To Prevent A Cascade of Clearing Member Failures! [COMMENT TEMPLATE INCLUDED]: here.

📚👀 SEC COMMENTS / REJECTION:📚👀

To access the submitted proposals: https://www.sec.gov/files/rules/sro/occ/2024/34-99393.pdf?ref=dismal-jellyfish.com

To access the submitted SEC comments: https://www.sec.gov/comments/sr-occ-2024-001/srocc2024001.htm

📚👀 Want to learn more about how to reject it? Check out the following posts:

These include helpful reading sources, a breakdown of what this rule means the materials needed to help you write your own comment!