REGULATORY KILL SHOT - Rule proposal: SR-OCC-2024-001 has been shut down by the SEC. Let's drive this win home.

The SEC's rejects OCC's bid to adjust margin thresholds for clearing members during high market volatility. Does this signal OCC's concern over risk of default?

Right folks, it seems our efforts in the regulatory space is paying off, and it's time for us to drive home the message to Wall Street that we mean business.

It's not about moving the goalposts when financial institutions have overextended themselves; rather, it's about fulfilling financial obligations when necessary. And we're here to work with the SEC to make this happen.

And given the spicy price action we've been seeing recently, perhaps Wall Street are starting to feel the heat 🌶️🔥

And who doesn't like to see some upward movement up in here:

CREDIT: https://www.reddit.com/r/Superstonk/comments/1co6s3g/dorito_update_breakout_confirmed_hedgie/ (our very own, most excellent badasstrader).

So why are we here today?

It seems that when an idiosyncratic, volatile stock like GME poses a risk to the financial markets, regulatory bodies such as the OCC focus their efforts on implementing safeguards to protect themselves and their clearinghouse members in case of default.

Why?

Because if clearing members default in times of extreme market volatility - it will bring the rest of the financial house down with them.

And we're certainly starting to get an idea just how tentative things are getting out there in the banking and finance industry:

Uh oh.

Looks a little shaky out there.

So it makes perfect sense that the powers that be might be looking to bring in rules that are going to take the heat off.

Cue:

So let's recap:

Rule SR-OCC-2024-001 can give the OCC the authority to adjust margin thresholds in moments of high market volatility.

Like say - during a Black Swan event.

A black swan event in finance is an unexpected and highly impactful occurrence that disrupts the markets, often leading to major losses and chaos.

Like, MOASS.

Mother Of All Short Squeezes 🚀

What does this mean?

Wall Street firms (including banks, brokerage houses, and other financial institutions - like hedgefunds):

Banks like: JPMorgan Chase, Goldman Sachs, Morgan Stanley, Citigroup, and Bank of America Merrill Lynch etc

Or Hedge funds like: Citadel, Point72, Melvin Capital, Citron Research, and D1 Capital Partners etc

Utilise the Options Clearing Corporation (OCC) to handle the clearing and settlement of option trades.

Now, imagine some hedgefunds decided to short GME.

If options contracts are used in the shorting process, the OCC plays a role in handling the clearing and settlement of these trades.

The OCC acts as the central counterparty, ensuring the completion of options trades and managing the associated risks.

Being that these hedgefunds have taken a position betting that the price of GameStop's stock will go down (or you know, might engineer this happening by means of cellar boxing), and to do this they would have needed to borrow lots of shares of GameStop in order to sell them, all part of a plan to drive the price down. Then, they'd hope to buy those shares back later at a lower price and make a profit.

But when you borrow those shares, you usually have to put up some money, or other securities as collateral first, just in case things go a little pear shaped.

Issue is - this creates a problem for short sellers if the securities used as collateral for the borrowed stock fall in value due to market downturns, and the value of the stock you've been betting against keeps stock going up...

Like GME for example - which keeps going up:

Whereas the value of market securities are quickly diminishing. And my goodness, the market aren't looking too healthy right now:

So when the value of these securities (used as collateral against the bet) drops below a certain threshold set by the broker or lender, short sellers will be issued a margin call where they'd be asked to put up even more money or other assets as further collateral to cover their bet.

A margin call is essentially a demand for investors to deposit more funds or securities into their trading account to cover potential losses. Like a safety net for the lender to ensure they're protected if things go south.

And that might be hard if you're a hedge fund running out of cash.

- A loss in $38 billion for the previous 12 months reported in October can't be an easy pill to swallow. Ouch!

And failure to comply with margin calls can lead to forced liquidation of positions by the brokerage to cover the outstanding margin debt.

And this signals a big problem for short hedge funds everywhere.

What does this all mean? Big picture time:

Have you ever played with dominoes?

The premise of the game mirrors real-life scenarios of firms defaulting, where the collapse of one firm triggers a chain reaction, similar to domino tiles toppling over and knocking down others in succession.

In the case of OCC Clearing Member defaults, this means that if, for instance, short sellers have borrowed heavy sums from the banks to fund their risky bets, those lenders (i.e the banks) are now also at risk of defaulting if they themselves can't cover the losses.

And in a scenario where MULTIPLE firms are, say, short on the same asset - like GME - hedge funds (and their lenders, aka the banks) might suddenly find themselves collectively in a very vulnerable position - especially should that very stock start moving quite rapidly upwards 🚀 which it might lead to a whole LOAD of defaults.

And in light of this, it seems the clearinghouse (OCC) has chosen to step in.

Why has the OCC brought in proposed rule: SR-OCC-2024-001?

The SR-OCC-2024-001 proposal aims to grant the OCC the authority to modify margin threshold parameters using undisclosed criteria to mitigate the risk of such defaults occurring.

As below:

Looks like the OCC is starting to get a little nervous about their clearing members' ability to meet their financial obligations.

OCC:

🤷♀️ 🤷♂️❔ Wait a minute, Kibble. If a clearing member defaults on their financial obligations, the OCC, as the central counterparty, has an obligation to the counterparties on the other side of those short sell transactions - right?

That's right.

🤷♀️ 🤷♂️❔ So if the OCC has a fiduciary duty to ensure that counterparties of short selling, such as the shareholders of GME, are protected in the event of defaults by clearing members involved in short selling transactions - an essential responsibility for upholding the integrity and stability of the options market - why would they be creating a rule to bail out Wall Street, essentially prolonging the inevitable if they lack the financial capacity to cover their bets?

Well, you see - if multiple clearing members default, the OCC will also incur losses from having to cover those defaults. Therefore, it's indeed in the OCC's interest to prevent clearing members from defaulting - because they'll lose money too.

Trading's a tough game, ain't it?

OCC:

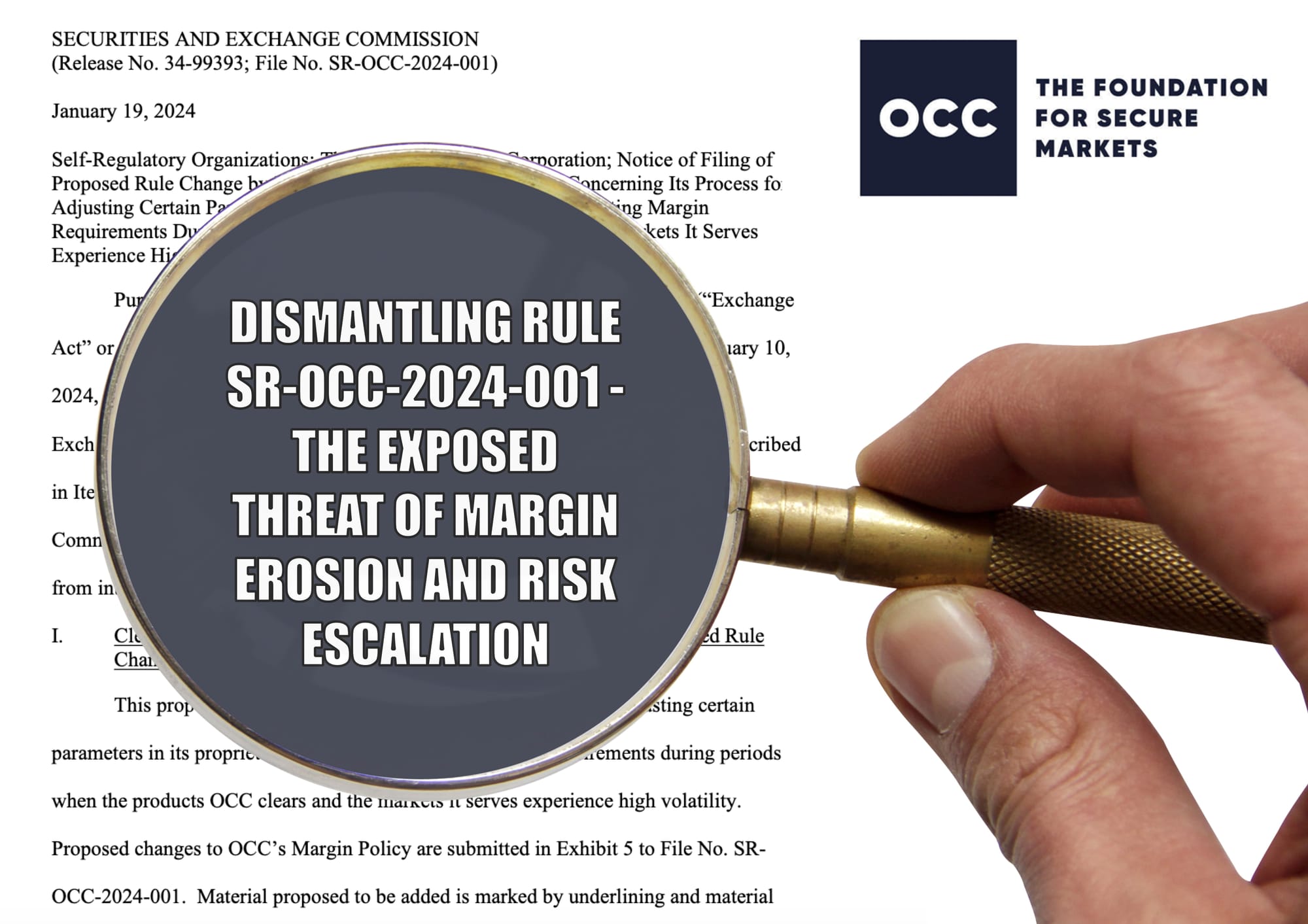

There's a lot to breakdown in the proposal itself: https://www.sec.gov/files/rules/sro/occ/2024/34-99393.pdf?ref=dismal-jellyfish.com

But the headlines are:

🚩 OCC seek to change the "idiosyncratic volatility control settings" anytime a Clearing Member needs help.

🚩We don't know HOW these margin thresholds are calculated, and everything in the proposal's supporting evidence as related to this is REDACTED.

🚩The OCC want to give significant authority to role of the Financial Risk Management (FRM) for approving idiosyncratic control settings.

🚩BUT this introduces significant risk and it poses a conflict as they are required to safeguard both OCC's interests and at-risk Clearing Members.

Kinda important.

And being that this proposed rule favours Clearing Members at the expense of market fairness and investor protection, this was flagged to the SEC.

By none other than the mighty household investors.

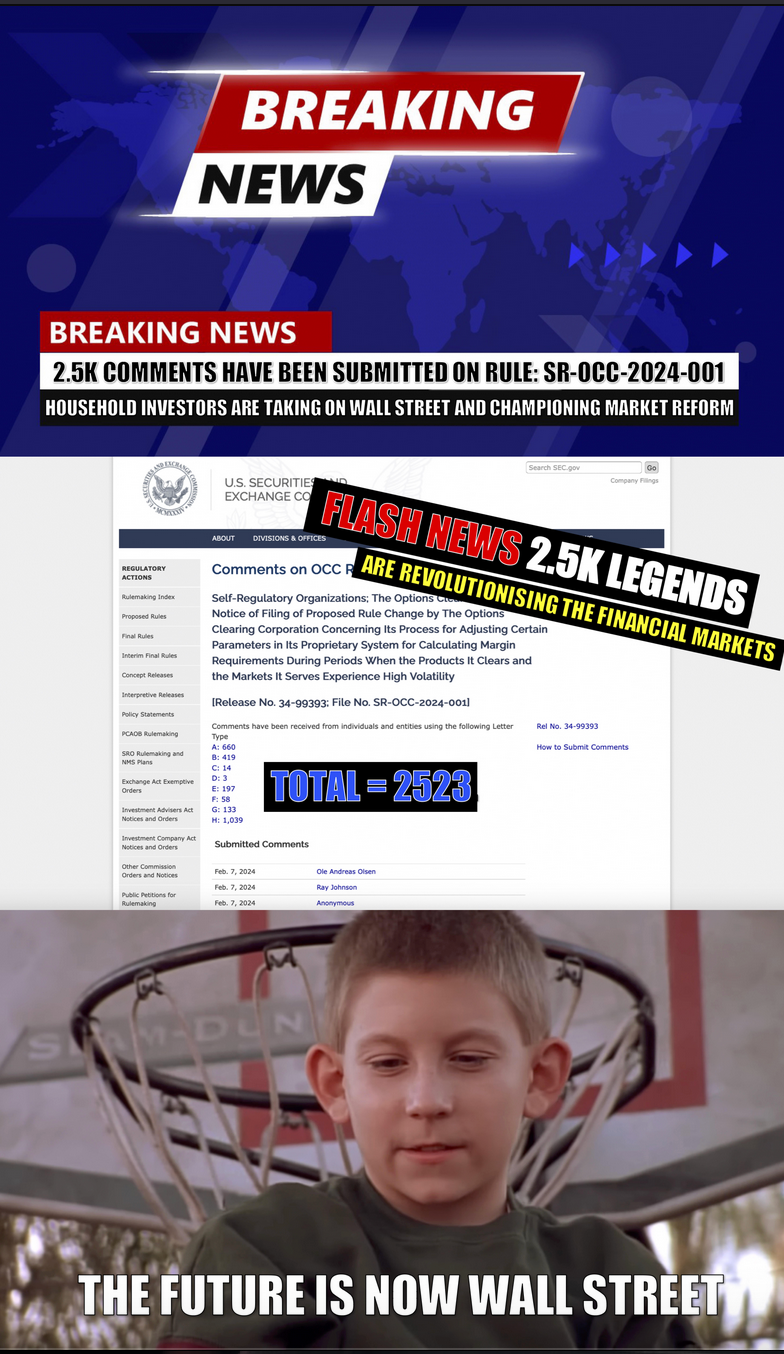

In March, 2o24 - over 2.5k+ investors worldwide came together to address the risks posed within the OCC's rule proposal.

Household investors submitted their comments to the SEC - flagging issues with an over reliance on idiosyncratic control settings to handle adjustments in OCC's operations when the markets face high volatility, as decided by a FRM Officer, who is also responsible for protecting the OCC's interests, creating a conflict of interest in the role.

And it was incredible.

Posts like this littered the internet as communities came together to spread the word and questions were addressed:

Questions included:

🤷♀️ 🤷♂️ Why should the OCC adjust margin thresholds with "idiosyncratic volatility control settings" during high volatility when Clearing Members need help?

🤷♀️ 🤷♂️ If the SR-OCC-2024-001 rule is to ascertain parameters in the OCC's proprietary system for calculating margin requirements during high volatility - why are we not provided with the specific details on how these parameters will be calculated?

🤷♀️ 🤷♂️ Why entrust the OCC's FRM Officer with unchecked authority to make unilateral decisions regarding during periods of high market stress? Particularly when their role is to safeguard the OCC's interests?

FRM:

Also FRM:

And many more. You can check out some of the discussion points in this post here:

And it worked.

The SEC took notice.

And in recognition of the flaws - coupled with calls for increased margin requirements, external auditing, and changes to loss allocation procedures to mitigate systemic risks and the promotion of market resilience as put forward, the proposal was swiftly served up on a hot steamy plate of rejection.

If you're still with me here, bravo - and if you're just skimming through - take note of the following, because it's new.

The SEC has highlighted specific reasons for why this rule is BS (i.e., grounds for why this rule proposal should be disapproved) in a conveniently bulleted list [SR-OCC-2024-001 34-100009 (pgs 4-5); Federal Register]

- Section 17A(b)(3)(F) of the Exchange Act, which requires, among other things, that the rules of a clearing agency are designed to promote the prompt and accurate clearance and settlement of securities transactions and derivative agreements, contracts, and transactions; and to assure the safeguarding of securities and funds which are in the custody or control of the clearing agency or for which it is responsible; [Refer to 15 U.S.C. 78q-1(b)(3)(F)]

- Rule 17Ad-22(e)(2) of the Exchange Act, which requires that a covered clearing agency provide for governance arrangements that, among other things, specify clear and direct lines of responsibility; and [Refer to 17 CFR § 240.17Ad-22(e)(2)]

- Rule 17Ad-22(e)(6) of the Exchange Act, which requires that a covered clearing agency establish, implement, maintain, and enforce written policies and procedures reasonably designed to cover, if the covered clearing agency provides central counterparty services, its credit exposures to its participants by establishing a risk-based margin system that, among other things, (1) considers, and produces margin levels commensurate with, the risks and particular attributes of each relevant product, portfolio, and market, and (2) calculates sufficient margin to cover its potential future exposure to participants in the interval between the last margin collection and the close out of positions following a participant default. [Refer to 17 CFR § 240.17Ad-22(e)(6)]

🥇🙏 - With thanks to WCIMT for the sourcing of this. You can check out the original post here.

And now we have the opportunity to support the SEC in their rejection of this rule.

Do you want to join thousands of other investors worldwide in the fight for fair markets, equal opportunities and financial liberation?

To mark your name in the history books and forever immortalise yourself as a champion of progress, integrity, and change?

You wanna see MOASS happen?

Sure you do!

So why not take a few minutes out of your day to do something life changing? Not just for you, but for all future generations too.

"But Kibble, I'm too tired. I work so much and I have no mental headspace to try and tackle something like this. It's all too much. I'm overwhelmed."

I hear you friend, I hear you.

But remember - if we want financial liberation, we must fight for it. This is about our freedom.

Wall Street relies on our apathy - our being too tired or too overwhelmed to do anything to stop the current broken status quo. But stop it we must.

Don't listen to Ken, listen to the voices of tomorrow's generation - who will thank you for investing in their future, as will be shared with your own.

So if you're short on time, tired or this feels a little too overwhelming (finance lingo can be hard to dissect, I get it) - consider that there are options available to you beyond the need to write a long letter from scratch.

Like Good ol' Letter Templates!

Brilliant they are - you can read, edit, amend and send.

Like this one here, couresty of WhatCanIMakeToday:

WhatCanIMakeToday:

https://www.reddit.com/r/Superstonk/comments/1ciqum4/simians_smash_sec_rule_proposal_to_reduce_margin/

📱📞☎️ Pastebin version (ready to copy, paste and edit for mobile users): https://pastebin.com/dpXQ0gim

⏰ ⏳I will also be creating a second letter template resource soon. In the meanwhile, please feel inspired to share your comment templates too.

The greatest thing about these letter templates is that they are a helpful tool designed to help you find your voice. We may all sound different, but the words we say matter just the same.

Here, you can copy, edit, and send these templates directly to the SEC via email.

And remember, you don't need to write the longest letter to make your point hit home. You can support the rejection in fewer words - as your contributions are uniquely your own.

Find the words that help you express yourself best, and embrace the many tools and resources out there to assist you.

Speaking of which, have you heard about:

🖥️ 💡 ChatGPT

- AI Language Model.

- "I'm a program designed to understand and generate human-like text based on the input I receive." - ChatGPT, 2024.

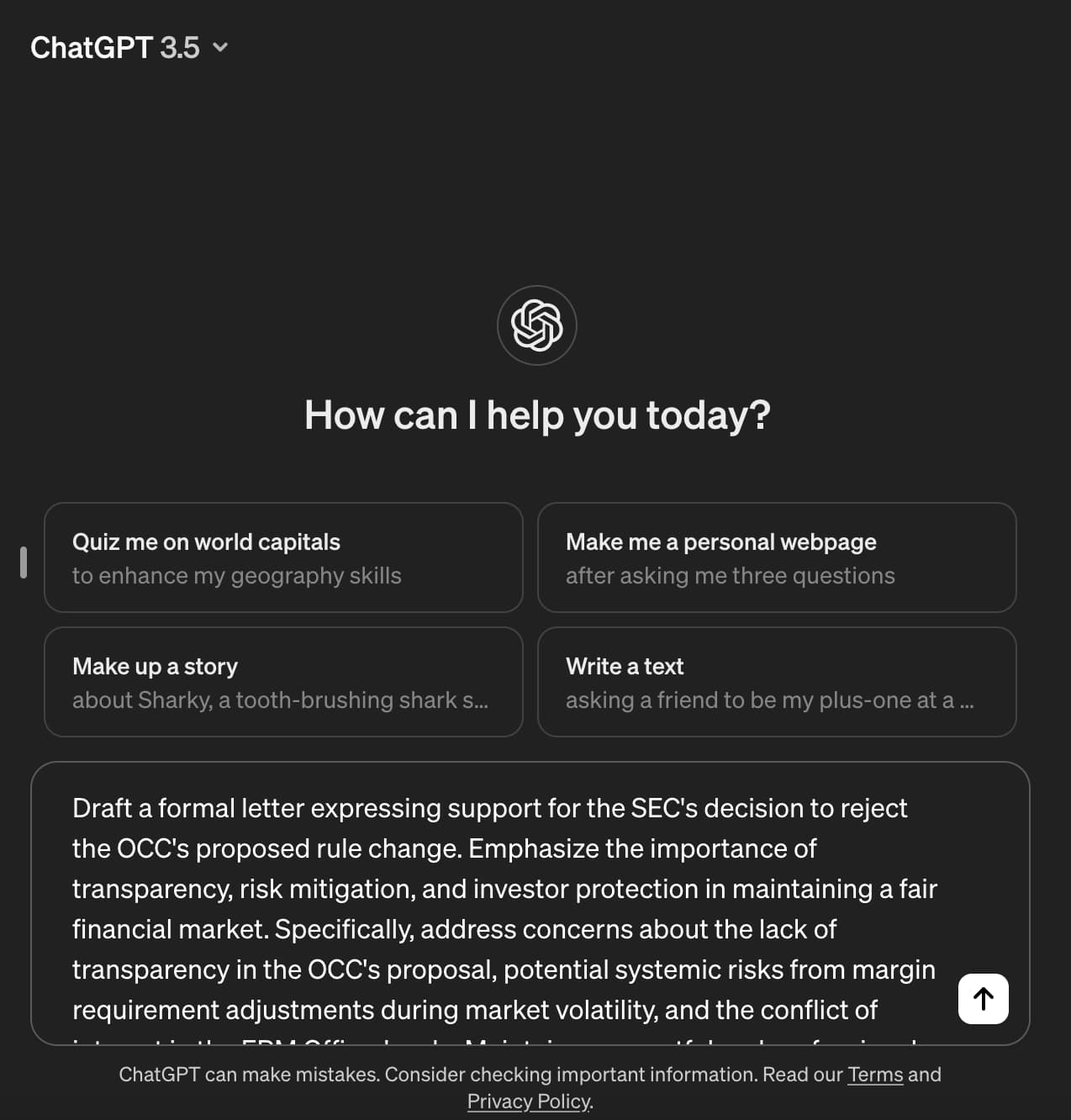

Consider inputting these writing guides into ChatGPT to help you compose your own comment.

Here's a prompt to help you get started:

Draft a formal letter expressing support for the SEC's decision to reject the OCC's proposed rule change. Emphasize the importance of transparency, risk mitigation, and investor protection in maintaining a fair financial market. Specifically, address concerns about the lack of transparency in the OCC's proposal, potential systemic risks from margin requirement adjustments during market volatility, and the conflict of interest in the FRM Officer's role.

Maintain a respectful and professional tone, providing detailed reasons and supporting evidence for your support of the SEC's decision. Use the example letter as a reference for structuring arguments and aligning with the SEC's grounds for disapproval.

Work Smarter, not Harder.

ChatGPT is user friendly, check out what it looks like here: https://chatgpt.com

Please note:

🚨 ChatGPT remains an unreliable source for verified information and facts and will always require people to assess/review and cross-reference the generated responses.

You are the fact checker, not the AI.

__________________________________________________

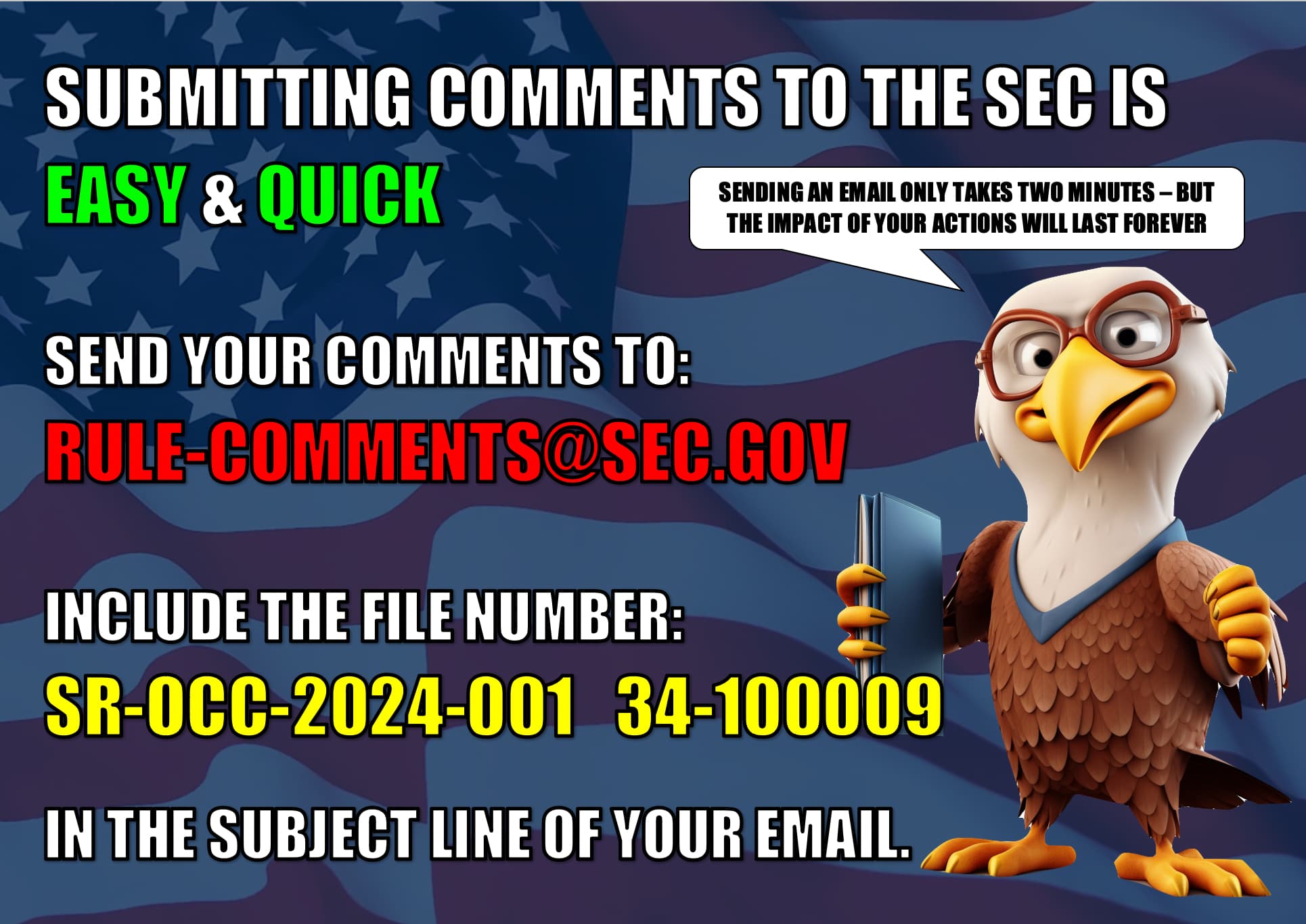

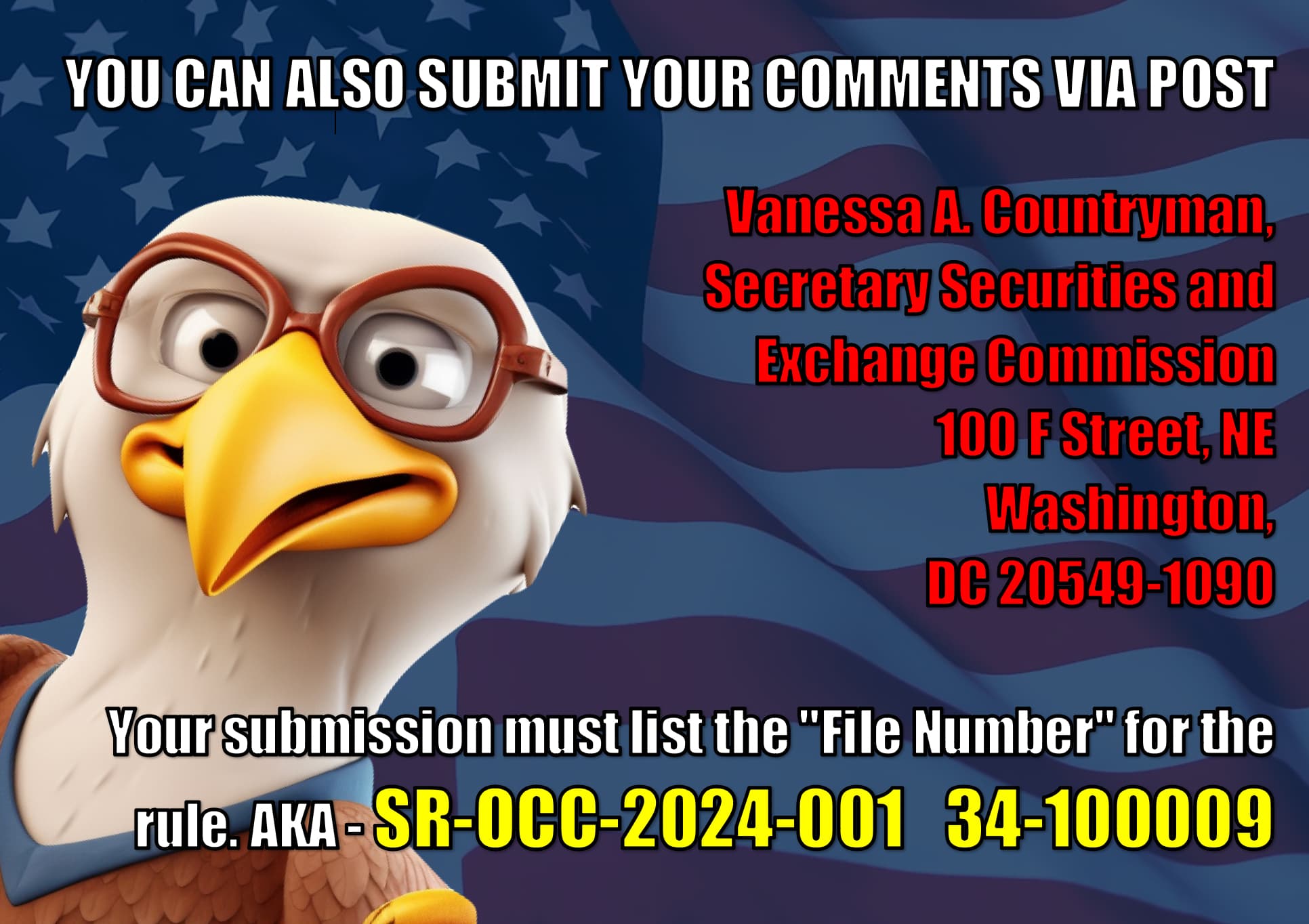

✅ 📢 🌏 How to Comment:

- Commission's Internet Comment Form: Use the form available at SEC's rule comment page.

📱🖥️ ✉️

Email: [email protected]

- Include the file number: SR-OCC-2024-001 34-100009 - in the subject line of your email to the SEC.

- This is open to audiences worldwide.

REMEMBER:

- Choose only one submission method to help the Commission process and review your comments more efficiently.

- The Commission will post all comments on its website.

- You can access these at SEC's rule comment page.

- Avoid including personal identifiable information in your submissions unless you want it to be made publicly available.

- The SEC may redact or withhold content that is obscene.

With credit and appreciation to Dismal-Jellyfish.

It's only takes two minutes to change the world.

So what are you waiting for?

Remember to be kind in your engagements.

The SEC need our support, and we're here to help them. Let's tackle corruption and greed in the financial markets the right way.

Let's break this down.

The OCC proposed a rule change (SR-OCC-2024-001) that would allow them to reduce margin call requirements by adjusting margin thresholds using [REDACTED] parameters during periods of high market volatility.

AKA - putting the breaks on MOASS if a clearing member, like Citadel for example, can't meet margin call and defaults, bringing down the house down with them.

And incredibly, after thousands (and thousands) of household investors around the world submitted their comments to oppose this rule change proposal, the SEC listened and is now going to throw it out.

Incredible, huh?

Damn right.

And now we have the chance to stand with the SEC and ensure this rule proposal is decisively rejected.

Because accountability isn't about shifting the goalposts to remove the risk of clearing member default when financial institutions can't meet their margin call obligations.

So are you in?

That's the spirit.

And remember - this is important.

Without this proposed rule as a safeguard in place, Wall Street faces mounting pressure. And if household investors strip the OCC of its ability to continually adjust Margin Call thresholds, this could become a serious catalyst for whatever spicy market action we're going to see next.

Tick tock.

So now to ride this home, showing Wall Street exactly how much we can accomplish when we work together.

📚👀 Want to learn more about this rule? Check out the following posts:

🔥 SR-OCC-2024-001 EXPLAINER POSTS:🔥

CREDIT: Dismal-Jellyfish.

Options Clearing Corporation is looking to adjust parameters for calculating margin requirements during periods when the products it clears & the markets it serves experience high volatility. OPEN for comment! https://dismal-jellyfish.com/occ-revamps-idiosyncratic-margin-requirements-volatility-controls/

CREDIT: WhatCanIMakeToday

OCC Proposes Reducing Margin Requirements To Prevent A Cascade of Clearing Member Failures: https://www.reddit.com/r/Superstonk/comments/1ae0toi/occ_proposes_reducing_margin_requirements_to/

CREDIT: kibblepigeon

Dismantling Rule SR-OCC-2024-001 - The Exposed Threat of Margin Erosion and Risk Escalation: https://www.reddit.com/r/Superstonk/comments/1ak549e/dismantling_rule_srocc2024001_the_exposed_threat/

🔥 FOLLOW UP SEC REJECTION AND TEMPLATE LETTER:🔥

CREDIT: WhatCanIMakeToday

Simians Smash SEC Rule Proposal To Reduce Margin Requirements To Prevent A Cascade of Clearing Member Failures! [COMMENT TEMPLATE INCLUDED]: https://www.reddit.com/r/Superstonk/comments/1ciqum4/simians_smash_sec_rule_proposal_to_reduce_margin/

📚👀 SEC RULE / COMMENTS / REJECTION:📚👀

To access the submitted proposals: https://www.sec.gov/files/rules/sro/occ/2024/34-99393.pdf?ref=dismal-jellyfish.com

To access the submitted SEC comments: https://www.sec.gov/comments/sr-occ-2024-001/srocc2024001.htm

To access the SEC rejection details: [SR-OCC-2024-001 34-100009 (pgs 4-5); Federal Register]

It's never been easier to change the world. Get involved, it's our Call of Duty.

Game on.