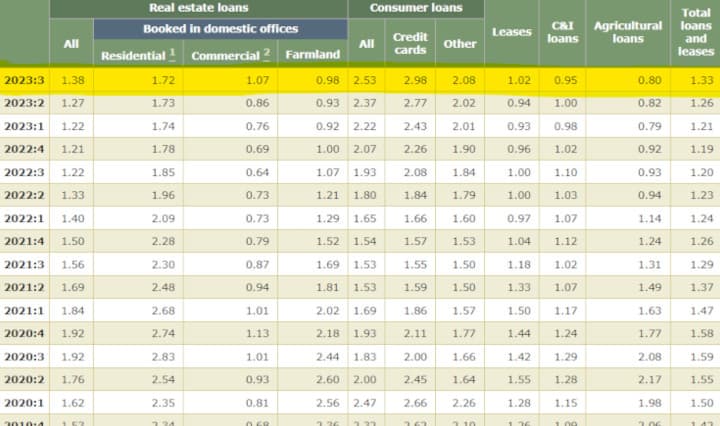

Delinquency Rates on Loans and Leases at Commercial Banks are spiking!

Source: https://www.federalreserve.gov/releases/chargeoff/delallsa.htm

Credit Cards:

All Consumer Loans:

Delinquency Rate on All Loans, All Commercial Banks:

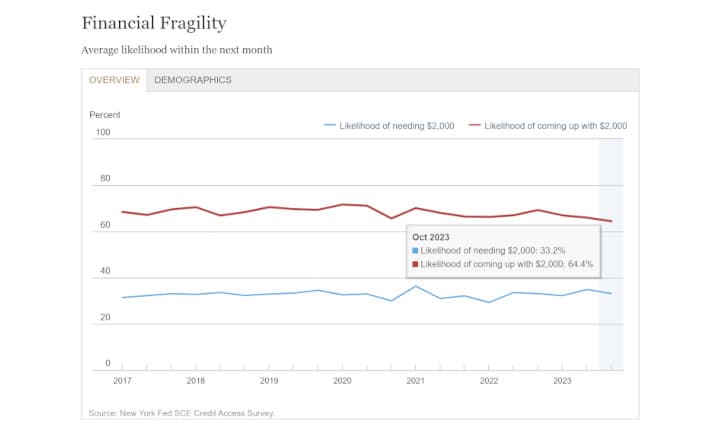

On the consumer side, this lines up with the Survey of Consumer Expectations: U.S. households probability of being able to come up with $2,000 if an