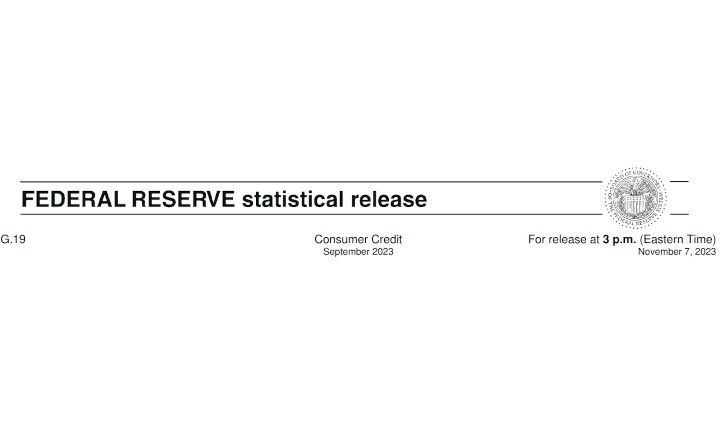

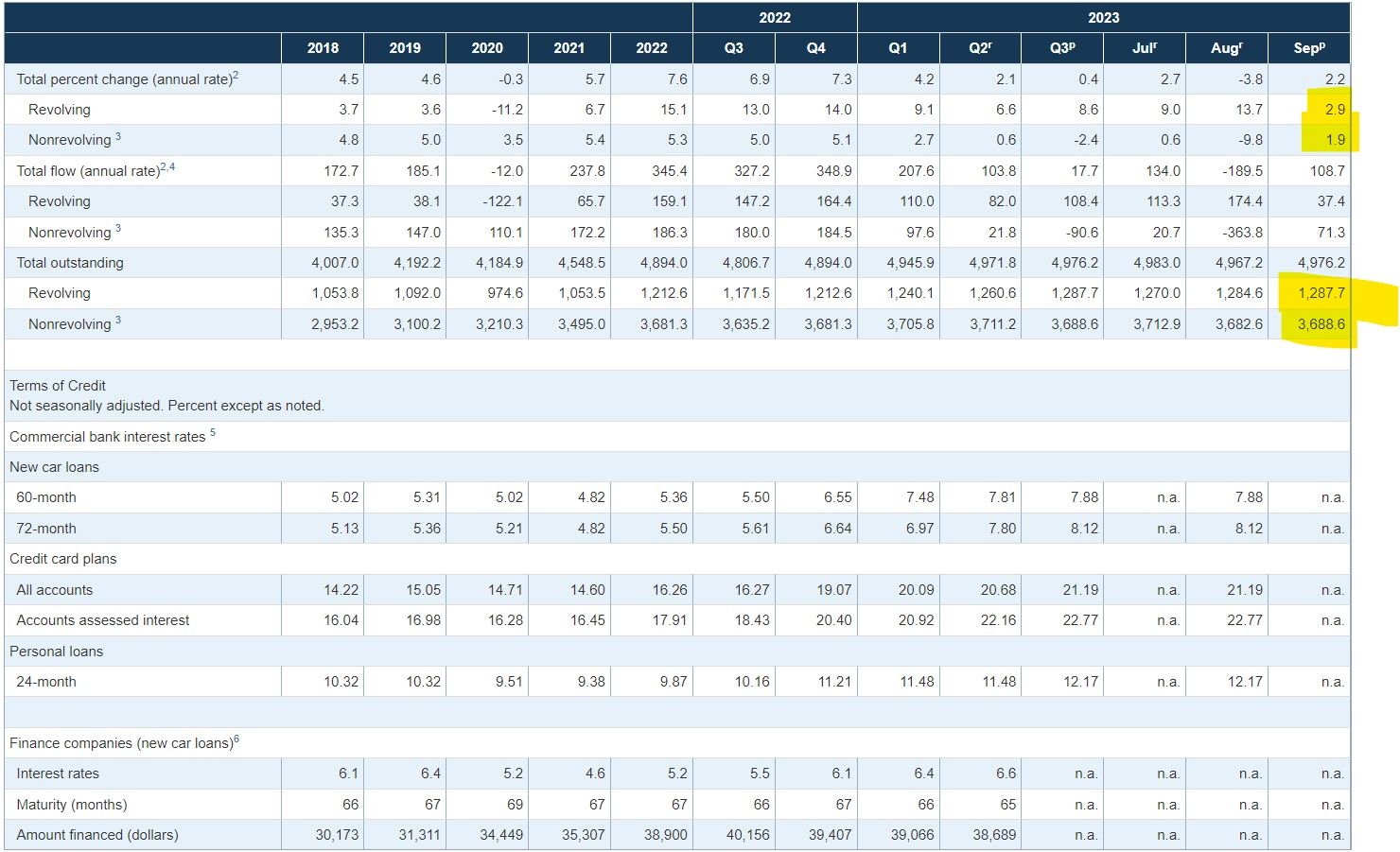

U.S. Revolving credit (credit cards) grew From August to September by $3.1 billion and increased at an annual rate of 8.6%.

Consumer credit increased at a seasonally adjusted annual rate of 0.4% during the third quarter. Revolving credit increased at an annual rate of 8.6%, while nonrevolving credit decreased at an annual rate of 2.4%. In September, consumer credit increased at an annual rate of 2.2 percent.

Consumer spending is a major factor in the U.S. economy and its GDP (total value of goods and services produced in a country over a specific period). When consumers spend more, businesses sell more goods and services, which can lead to increased production, more hiring, and overall economic growth.

While taking on debt allows consumers to spend beyond their immediate earnings (for instance, buying a house with a mortgage or purchasing goods with a credit card), there's a limit to how much debt is sustainable.

However, as we have previously covered, expectations for future credit availability deteriorated in August, with the share of respondents expecting it will be harder to obtain credit in the year ahead increasing.

Additionally, the Fed's Beige Book August 2023 shows "Some Districts highlighted reports suggesting consumers may have exhausted their savings and are relying more on borrowing to support spending."

So growth could slow if folks continue pile up too much debt and are then forced to cut back on this spending but boy are they still piling it on!

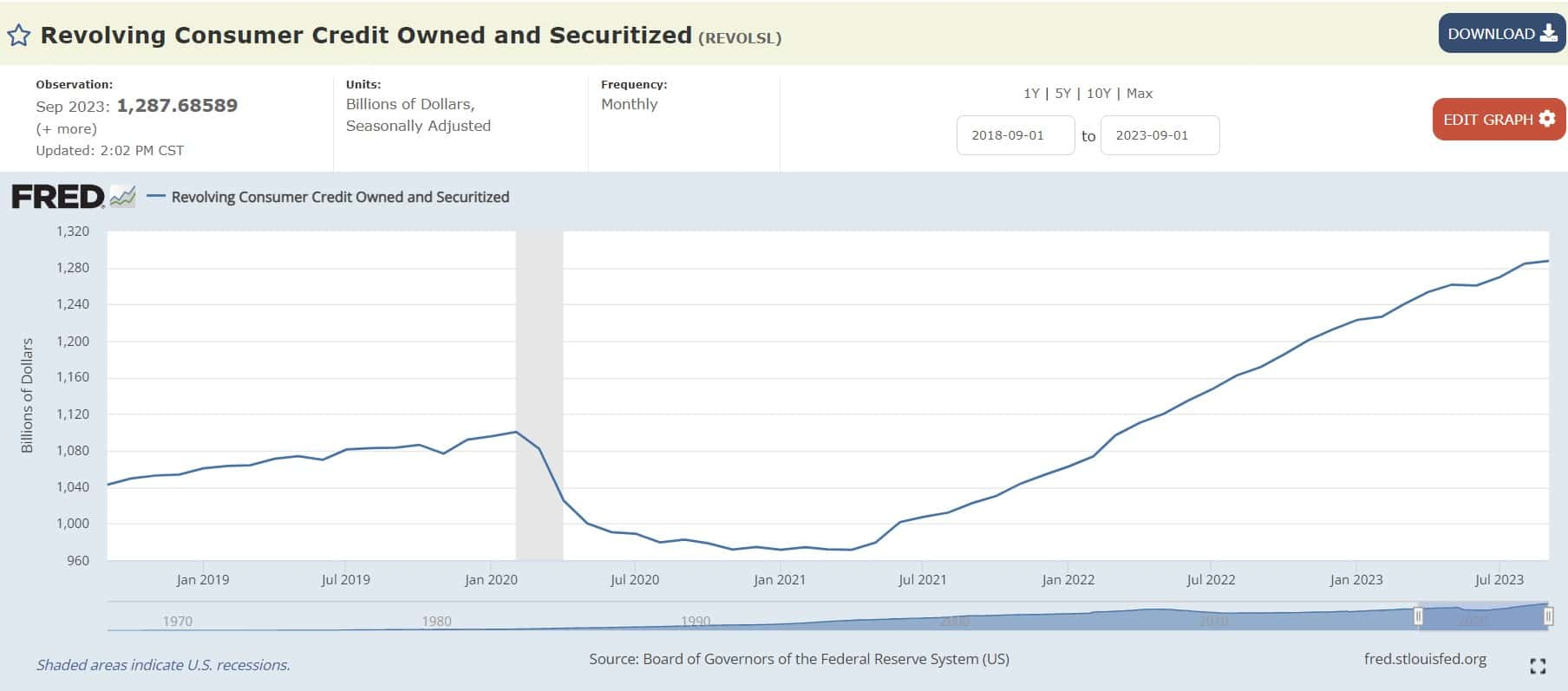

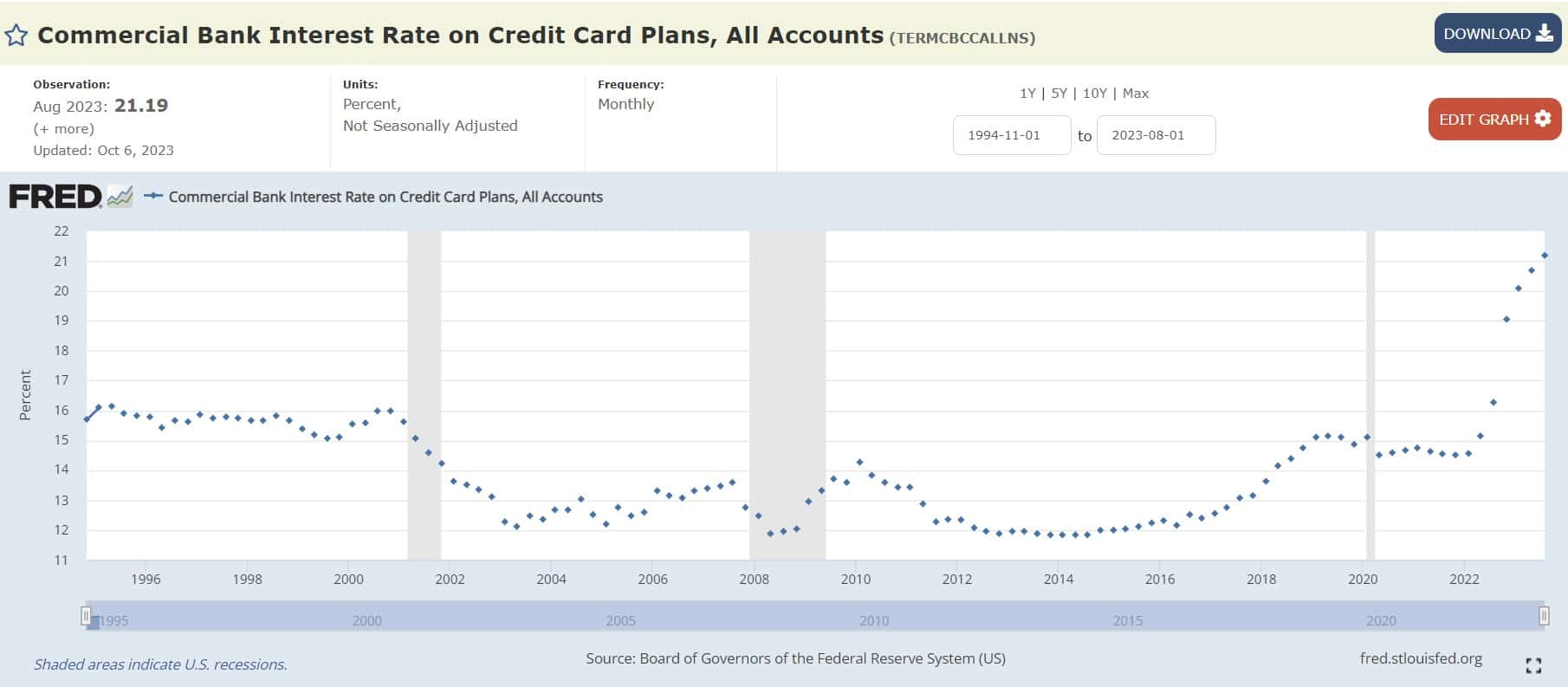

It just keeps climbing over $1 trillion all at killer interest:

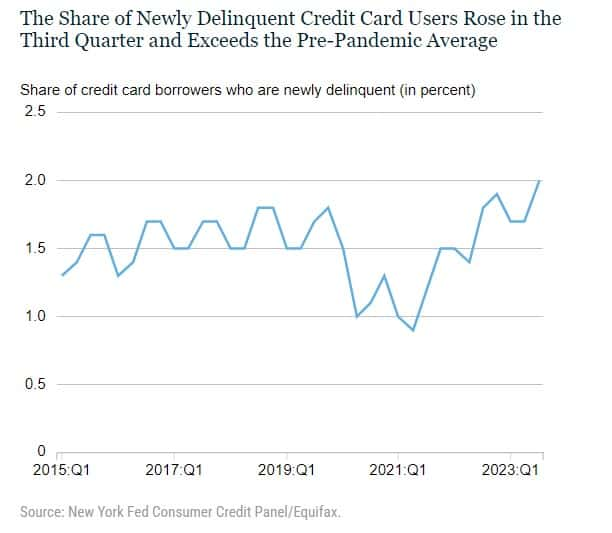

Delinquencies are on the rise as well!

This morning, the New York Fed’s Center for Microeconomic Data released the 2023:Q3 Quarterly Report on Household Debt and Credit. After only moderate growth in the second quarter, total household debt balances grew $228 billion in the third quarter across all types, especially credit cards and student loans. Credit card balances grew $48 billion this quarter and marked the eighth quarter of consecutive year-over year increases. The $154 billion nominal year-over-year increase in credit card balances marks the largest such increase since the beginning of our time series in 1999.

Notice how the delinquency rates are starting to creep up?

Individuals face the greatest challenges in repaying their debts when they're unemployed. If unemployment rates stay low and job opportunities persist, it seems most borrowers can generally keep up with their loan and minimum credit card payments, even with depleted savings.

A concern is that while payrolls grew faster, gains in wages are slowing. Year-over-year gains in average hourly earnings slowed to 4.1% in October from 4.3% in September and starting to grow closer to prepandemic levels.

A combination of slower wage growth, higher interest rates, and depleted savings indicate that the headwinds are mounting against consumers and this will likely play heavily on spending moving forward.

TLDRS:

- U.S. Revolving credit (credit cards) grew From August to September by $3.1 billion and increased at an annual rate of 8.6%.

- A combination of slower wage growth, higher interest rates, and depleted savings indicate that the headwinds are mounting against consumers and this will play heavily on spending moving forward.

- Consumer spending is a major factor in the U.S. economy and its GDP...

- I believe inflation is the match that has been lit that will light the fuse of our rocket.