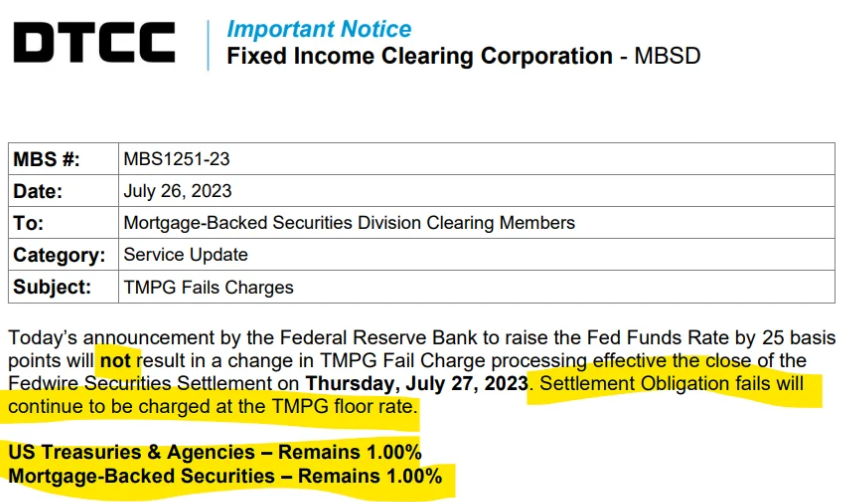

The Fed's decision to raise Fed Funds Rate by 25 basis points will not result in a change in TMPG Fail Charge. Settlement Obligation fails (FTDs in Treasury & Government bonds) & will continue to be charged at the TMPG fail charge floor rate.

https://www.dtcc.com/-/media/Files/pdf/2023/7/26/MBS1251-23.pdf

https://www.dtcc.com/-/media/Files/pdf/2023/7/26/GOV1517-23.pdf

https://twitter.com/susannetrimbath/status/1521955876386394113

Dr. T dropping knowledge. They charge 3% MINUS fed funds target rate (minimum 1%)

Treasury Market Practices Group (TMPG), you can read more here (warning is a pdf to New York fed): https://www.newyorkfed.org/medialibrary/microsites/tmpg/files/04_01_2013_Fails_charges_FAQ.pdf

https://www.newyorkfed.org/medialibrary/microsites/tmpg/files/04_01_2013_Fails_charges_FAQ.pdf

https://www.dtcc.com/charts/daily-total-us-treasury-trade-fails

What do these charts show?

They show the value of U.S. Treasury securities that were not delivered to fulfill a trade contract. “Failures-to-deliver” occur when either sellers fail to deliver or buyers fail to receive securities in time to settle a trade. Settlement of a trade is the point at which the seller is required to deliver the securities agreed upon in the trade and the buyer has to deliver the funds to pay for the securities.

Do the charts show the value of failed U.S. Treasury securities deliveries for more than just the previous day?

Yes. You can chart rates for the previous day, week, month or the previous 12 months.

What's the data source?

DTCC's Fixed Income Clearing Corporation, which serves as the clearing house for markets that trade in U.S. government securities.

Are there consequences for a failure to deliver?

Yes. Not only does the original trade fail, but the party that bought the securities may have already pledged them in a subsequent trade, and now that trade too will involve a failure-to-deliver, thus creating a cascading effect.

Are there penalties for a fail?

To encourage prompt delivery of securities, Fixed Income Clearing Corporation (FICC) follows the recommendation of the Treasury Market Practices Group, which is made up of executives from the securities industry. Based on the group’s recommendation, FICC now collects interest at an annual rate of 3% on the settlement value of the trade (minus the Target Fed funds rate in effect the day before the settlement day).

Wut mean?:

They (DTCC) should be charging more to begin with.

It is 3% - the Fed Funds rate.

Back when Fed Funds was effectively 0, that meant the fails charge was 3% (simple math here).

Let’s assume that a firm fails on a $50 million position on which it is owed $50.1 million. If the Target Fed funds rate the previous day was 0%, then the fails charge will be 3% per year and it will be applied to the $50.1 million total value of the trade. This will result in an FTD charge of $4,175 for that day.

HOWEVER, with the Fed Funds rate all jacked up, these charges are now 'way cheaper', sine the Fed Funds rate is so high (and they don't do negative numbers, it is now capped at 1%).

So, for a firm that fails on a $50 million position on which it is owed $50.1 million. With the Target Fed funds rate 5.5%, then the fails charge will be the floor 1% per year and it will be applied to the $50.1 million total value of the trade. This will result in a charge for the FTD is now $1,391.67 for that day.

Bigger picture, $27.330 billion in Treasuries failed 7/26. That means that charge for the day was $759,166.67 per day @ 1% vs. $2,277,500 per day @ 3%.

Hope this explanation helps more than confuses? Please let me know if you have questions, happy to try and help!

TLDRS:

- Yesterday's Fed FOMC decision to raise Fed Funds Rate by 25 basis points will not result in a change in TMPG Fail Charge.

- Settlement Obligation fails (FTDs in Treasury & Government bonds) will continue to be charged at the TMPG fail charge floor rate.

- The Fed's actions ENABLE lower FTD costs for the DTCC.

- There is a 1% floor on the fine for FTDs in Treasury and Government bonds set by the TMPG that DTCC follows. Does not apply to stocks, though, where fees & margin calls follow a different process.

- They (the Fed) help make it easier to pay less on FTDs in treasuries while paying more in overnight RRP (5.3% up to $160 billion per counterparty now!), boo!