The Daily Stonk: A Recap (6/2/24-6/8/24)

Welcome, Welcome, Welcome to this edition of the 'Daily Stonk' I'm your host Dismal-Jellyfish here with a quick recap of the week.

Before going any further, I am sure you may me wondering why the post to begin with? Great question! With the rate events seemingly picking up, and the velocity of posts on r/Superstonk certainly picking up, it makes it harder for anyone not terminal online and connected to 'all the platforms' to keep up with events of the week surrounding GameStop.

This post format(and any future like it) is meant to help with trying to put information you may have missed from across Reddit, Twitter, YouTube, and other mediums into one central place so you can review at your own convenience.

With that, let's get to it as it has been a BUSY week!

Superstonk is currently the most active sub on all of Reddit 🦍 $GME pic.twitter.com/yXemCJHwwk

— ₿en Wehrman 🦍⚡️🥩 (@benwehrman) June 6, 2024

Sunday June 2, 2024:

Our week kicked off with a digital explosion of the best kind as Roaring Kitty, yes, that not cat, reappeared on Twitter to drop a reverse Uno card. I mean, if you’re going to make a folks listen up, why not do it with a card that says, “I’m not done yet, suckers!”

This sent all of r/Superstonk into a delightful frenzy. You could practically hear the collective gasp of excitement, confusion, mild hysteria, and fruit worried it's in danger from puckered anuses echoing across the sub.

But wait, there's more!

Roaring Kitty’s alter ego, Deep Fucking Value, decided to join the party by posting his first GME YOLO Update in three years to r/Superstonk. The madman increased his position from 800,000 to 5,000,000 million shares with 120,000 call options for 12 million more shares. Oh yeah, he has nearly $30 million in cash as well!

For anyone doubting the YOLO updates from 2021 were his last, u/BENshakalakahits them with the Borat “NOT!”

Sunday saw the sub lose its collective mind, and rightfully so after all of this time. The highly upvoted post from u/biernini captured the realization that DFV chose to post his YOLO update on Superstonk and not anywhere else on Reddit, as if every member was being rewarded for their unwavering belief in just liking the stock. It was like Christmas, just with more memes and less eggnog.

For example, u/no-ideawhat-im-doing had everyone laughing and regretting with their meme for not buying more GME at $20 per share.

— Roaring Kitty (@TheRoaringKitty) June 3, 2024

Reddit Discussion: https://www.reddit.com/r/Superstonk/comments/1d6r84q/roaring_kitty_theroaringkitty_on_x/

GME YOLO update – June 2 2024

by u/DeepFuckingValue in Superstonk

"Final Update"

DFV chose to post his YOLO on Superstonk! We did it!

by u/biernini in Superstonk

Monday June 3, 2024:

| Date | Open | High | Low | Close | Volume | CTB High | CTB Low | Shares Available High | Shares Available Low |

| 06/03/24 | $40.19 | $40.50 | $26.40 | $28.00 | 165808300 | 20.4472% | 14.0996% | 2,100,000 @ 14.0996% | 100 @ 20.3343% |

The day began with the German market showing off like a peacock. The price opened then soared to $36.90 within zero minutes. It closed in Germanyat $36.60 after peaking at $40.31 and dipping to $27.93, with an eye-popping volume of 696,195. In terms of volume and price movement, this was bonkers. Normally, the German market seems as exciting as watching paint dry, but Monday, it was like watching F1 cars flying around.

Enter u/buttfarm69: he dropped a emotional post that took the sub on a feels trips, making everyone feel grateful for sticking with the stonk through thick and thin. It iss powerful stuff, like the ending of a really good Pixar movie, but with more butts being farmed.

Meanwhile, in the land of corporate media, there was mass hysteria! Bloomberg slapped a breaking news banner on the screen, announcing that GameStop soared over 83% in pre-market because Keith Gill’s YOLO post revealed a $116 million 'bet'.

CNBC was having a collective meltdown, pondering the fate of those poor souls who sold the calls. “I don’t even know if they can cover,” they cried in posted clips to the sub, as if that’s Keith Gill’s problem.

Spoiler Alert: it’s not.

Maybe don’t sell calls you can’t cover?

u/jolly-program-6996 chimed in with a tweet from Demo Capital, basically saying, “Thank God help the GME short sellers if they don’t exit before Roaring Kitty posts his position.” The sentiment is unmistakably clear: if you’re shorting GME right now, you might want to rethink your life choices.

In a move that surprised exactly no one, Andrew Left of Citron Research decided to short GameStop, AGAIN.

This guy must love losing money?

In May, he announced a short position and later covered it, only to re-short today.

Monday also brought out the 'glitches', because why not? Berkshire shares (among others) dropped over 99% due to a glitch, with some orders actually going through. The errors were blamed on the Consolidated Tape Association, but seeing Berkshire’s share price plunge from almost $700,000 to $185 was like watching someone trip over nothing—hilarious yet concerning.

Kind of like a reverse of what is about to happen with GameStop?

And in news from out of left field, PleasrDAO confirmed rumors that they might give special access to GME holders. There’s no official partnership between GameStop and PleasrDAO as of yet, but the idea of GME shareholders getting access to the Wu-Tang album is pretty exciting. It’s like a weird crossover episode you didn’t know you needed.

The biggest stir of the day? DFV dropped another GME YOLO update on Superstonk. Despite being up to a total value of $289,276,400.56 (yes, that’s real), he didn’t sell a single share or contract. Corporate media, of course, started bashing him, speculating about MaRkEt MaNiPuLaTiOn.

Spoiler Alert: it’s not.

Maybe don’t sell calls you don't have the shares for to someone who literally has “Deep Fucking Value” as a moniker?

Lastly, u/Doom_Douche is onto who go DFV to post in Superstonk and the answer will shock you!

Diamantenhände 💎👐 German market is open 🇩🇪

by u/Parsnip in Superstonk

My name is ButtFarm69 & I have some STRONG WORDS for this community of Apes...

by u/ButtFarm69 in Superstonk

CNBC is BIG MAD: “What about the people who sold those calls?… i mean, they’re wiped out. I don’t even know if they can cover.”

by u/Ozoning in Superstonk

Just going to leave this here

by u/Jolly-Program-6996 in Superstonk

HOLY SHIT AGAIN

by u/gauruv1 in Superstonk

Mods don't delete pls. - BRK.A: 27 Shares went through for 185$ each

by u/Few_Understanding552 in Superstonk

2103 is coming really fucking soon and the rumors are true - we are giving special access to $GME holders

— ✨ Pleasr (@PleasrDAO) June 3, 2024

💿👉 https://t.co/iSgvsd1lMm pic.twitter.com/XEsBzpfHGC

Reddit Post: https://www.reddit.com/r/Superstonk/comments/1d7j5f5/so_its_true/

GME YOLO update – June 3 2024

by u/DeepFuckingValue in Superstonk

We found the user that convinced DFV to post his YOLO update on our sub!

by u/Doom_Douche in Superstonk

Tuesday June 4, 2024:

| Date | Open | High | Low | Close | Volume | CTB High | CTB Low | Shares Available High | Shares Available Low |

| 06/04/24 | $26.26 | $28.01 | $25.20 | $26.50 | 51662100 | 14.0996% | 5.9944% | 1,900,000 @ 14.0996% | 550,000 @ 5.9944% |

Let’s start with some hot-off-the-presses data: FINRA revealed that Monday’s short interest volume shot up a staggering 553% from the previous week. Yes, you heard that right, 553%. The last time we saw short volume this high was Tuesday, January 19th, 2021. We all remember what happened nine days later...

Switching gears, Citron Research is back again and tried to throw their hat back into the ring with a tweet, attempting to downplay Roaring Kitty’s significance in the market. They suggested that while Kitty’s actions might not be illegal, he is overstating his importance. Citron went on to lament that the market dynamics and structure of GME have changed since January 2021 and claimed that back then, GME had 100% short interest and a potential turnaround story, whereas now, it’s a failed business model with low short interest.

Buttfarm69 did not take this lying down. Oh no, they tore Citron a new... let’s call it a new 'exit strategy...'

Here’s a taste of their glorious retort:

“FOR THE RECORD, have you ever thought, even for a tiny microsecond, that MAYBE, just maybe, YOUR SHORT THESIS and your SHORT associates overstate YOUR importance in the market and that YOU overlooked the market dynamics and structure of $GME?

Because the only thing that has changed since 2021 IS HOW I AM WAY MORE PISSED OFF THAN I WAS THREE AND A HALF YEARS AGO AND NOW I’M GONNA HODL TIL ALL YOU SHORT ROACHES, RATS, LEECHES, and VULTURES ALL DROWN UNDER THE WEIGHT OF THE WORST FINANCIAL BET YOU’LL EVER MAKE IN YOUR DUMB SHORT LIFE.

I think we can all agree that Buttfarm69 sets a standard for passionate, rhetoric. It’s like Shakespeare, but with more expletives and a clearer stance on short selling.

Adding to the mix, Larry Cheng tweeted some sage advice: “Beware of the confidently voiced, loudly stated, declaratively positioned, moderately informed statement that is probably incorrect.” Wise words, Larry. Especially in these times, where everyone and their dog with a short position has a hot take about GME on CNBC.

Yesterday, according to Finra, the short interest volume went up 553% from the week prior. The last time we saw short volume this high was Tuesday Jan 19th, 2021. We all know what happened 9 days later... 👀

by u/welp007 in Superstonk

FOR THE RECORD, have you ever thought, even for a tiny microsecond, that MAYBE, just maybe, YOUR SHORT THESIS and your SHORT associates overstate YOUR importance in the market and that YOU overlooked the market dynamics and structure of $GME?

— ButtFarm69.eth (@ButtFarm69) June 4, 2024

Because the only thing that has…

Reddit Post: https://www.reddit.com/r/Superstonk/comments/1d7vflz/buttfarm69_answer_to_citron_research_im_gonna/

Beware of the confidently voiced, loudly stated, declaratively positioned, moderately informed statement that is probably incorrect.

— Larry Cheng (@larryvc) June 5, 2024

Reddit Discussion: https://www.reddit.com/r/Superstonk/comments/1d8ektm/larry_cheng_on_x/

Wednesday June 5, 2024:

| Date | Open | High | Low | Close | Volume | CTB High | CTB Low | Shares Available High | Shares Available Low |

| 06/05/24 | $26.30 | $31.84 | $26.11 | $31.57 | 73156400 | 8.8801% | 6.2036% | 2,100,000 @ 8.8801% | 1,600,000 @ 6.2036% |

The day started with a heartwarming shoutout to our favorite ‘today’s the day’ starfish poster, u/Pharago. This stalwart of positivity was celebrated by u/cosmoshistorian for posting that cheerful starfish every market morning and bringing a smile to start the day.

u/TheTangoFox chimed in, highlighting the staples of this sub: the starfish, the daily tweets at the DTCC, the RRP numbers, and of course, the endless sideways trading. It’s these traditions that make r/Superstonk the unique, slightly insane, community that it is.

We know what we’re about, and we embrace it. It’s the little things that remind us why we HODL.

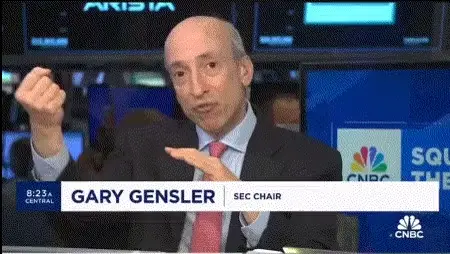

Switching gears, Gary Gensler made an appearance on CNBC. When Jim Cramer tried to go off the rails, Gary pushed back like a pro. “Again, it’s not hypothetical. You are describing real things that are happening in the public domain that people are interested in.” More on Gary further down.

u/ISayBullish brought the hype with a detailed GameStop Bull Thesis, reminding everyone why we’re all in this together. The key points:

- GameStop is profitable.

- GameStop has around $2 billion in cash.

- Long-term debt is limited to a low-interest, unsecured term loan from the French government.

- Gaming is the biggest and most resilient entertainment industry, with virtually unlimited growth potential.

- CEO Ryan Cohen takes no salary and buys shares with his own money.

- Over 190,000 record holders have their shares in their names with Computershare.

- GameStop Pro Memberships offer 5% off all digital games and currencies.

- CandyCon, a GameStop brand, makes customizable controllers for PC and Switch.

- GameStop has partnered with ModRetro for exclusive products.

- GameStop buys and sells graded collectible cards.

- Financial institutions betting against GameStop, like Melvin Capital and Credit Suisse, no longer exist.

- Mainstream media, funded by these institutions, falsely portray GameStop.

- Jim Cramer, who is notoriously wrong, claims GameStop is the worst company in America.

And of course, the cherry on top: “I didn’t hear no bell.”

u/CanIMarginThat delivered some juicy due diligence, alleging that market makers sold DFV those $20 calls without hedging properly. They claim they initially hedged the first two blocks but then decided that drawing more attention to the stock wasn’t in their best interest. So, they stopped hedging altogether. Risky business, indeed.

u/mastermind pointed out a trend: $40 is the new $20. Call buyers are flooding into June 21st, suggesting we might see some explosive moves soon. Get your popcorn ready!

Finally, u/MamaFen shared a quote from Cramer that left everyone thinking: “I’ve never seen anything like this: a group of buyers with no sensitivity to price. These people don’t have unlimited firepower, but they’ve got enough firepower to engineer a short squeeze any time a bunch of professionals decide to bet against this thing.” Wise words from the man who usually gets it wrong.

Can we take a moment to appreciate our lad Pharago? I think it’s absolutely epic how this has been posted every market morning for years. Brings a smile to my face🌟

by u/cosmoshistorian in Superstonk

Gary Gensler on GME

by u/ydnar in Superstonk

The GameStop Bull Thesis

by u/ISayBullish in Superstonk

What the what? While we were ooking like monkeys watching Gary Gensler explain to cokerat that DFV buying options is not illegal- The fucking SEC was losing a battle in court to hedge-fucks!

by u/NootHawg in Superstonk

They never hedged

by u/CanIMarginThat in Superstonk

40 Is the New 20 - Call buyers keep flooding into June 21. This is nuts.

by u/metametamind in Superstonk

Just Gonna Leave This Here.

by u/MamaFen in Superstonk

Thursday June 6, 2024:

| Date | Open | High | Low | Close | Volume | CTB High | CTB Low | Shares Available High | Shares Available Low |

| 06/05/24 | $26.30 | $31.84 | $26.11 | $31.57 | 73156400 | 9.0641% | 2.6613% | 2,700,000 @ 9.0641% | 1,700,000 @ 2.6613% |

I'll start with a Twitter exchange that had everyone talking. Larry Cheng responded to a tweet praising Elon Musk for his commitment to no salary, bonus, or stock compensation for ten years unless he created tremendous value for Tesla shareholders. Larry’s response? “I can think of one,” hinting at Ryan Cohen and GameStop...

Dave Laure chimed in on Twitter with a sentiment we all share: “I mean come on now – how do you not think that $GME is the absolute most fascinating thing happening in markets right now?” Dave, r/Superstonk couldn’t agree more!

u/XURIN posted a timely clip of Roaring Kitty being asked about the best-case scenario price target for GameStop.

The day saw more trading halts, with the first halt at the very nice price of $42.069 if you rounded. It’s almost like the universe is winking...

u/Unfair_Usual722 pointed out some intriguing activity on Roaring Kitty’s YouTube channel, sparking speculation and excitement across the sub of new content.

Then, u/Mjbishop327 was the first to post the big news: Roaring Kitty scheduled a live stream for June 7, 2024, at 10 am.

Not long after, u/captlejack noted how quickly corporate media jumped on the news, with headlines proclaiming, “GameStop shares jump 30% as Roaring Kitty schedules live stream.” It’s like they’ve finally caught on to the fact that the man moves markets with a tweet and a smile.

And then, the bombshell: u/DeepFuckingValue dropped a GME YOLO update for June 6, 2024. Hold onto your butts, his positions include $232,750,000 in shares, $324,300,000 in calls, and $29,409,005 in cash, totaling a mind-blowing $586,459,005.

u/Calvaaa pointed out that even Benzinga had no words for this one, simply providing a link to the Superstonk YOLO post. Sometimes, the numbers speak for themselves.

I can think of one other. https://t.co/D2RMybYudH

— Larry Cheng (@larryvc) June 6, 2024

I mean come on now - how do you not think that $GME is the absolute most fascinating thing happening in markets right now?

— Dave Lauer (@dlauer) June 6, 2024

Reddit Post: https://www.reddit.com/r/Superstonk/comments/1d9oi3c/can_you_feel_it_enter_fomo/

Roaring Kitty is asked "best case scenario" price target for GameStop | October 6, 2020

by u/XURiN- in Superstonk

HALT!!

by u/Mikeymike34 in Superstonk

Credit: u/Mikeymike34

Roaring Kitty (DFV): YouTube Channel activity 👀

by u/Unfair_Usual722 in Superstonk

Roaring Kitty Live Stream - June 7, 2024 @10am

by u/Mjbishop327 in Superstonk

Ohmmmmm Guys!!!!

by u/minesskiier in Superstonk

The fucks are fast.

by u/captjejack in Superstonk

GME YOLO update – June 6 2024

by u/DeepFuckingValue in Superstonk

Holy shit. Benzinga had no words and just straight up linked DVF reddit post..

by u/Calvaaa in Superstonk

Friday June 7, 2024:

TODAY'S THE DAAAAAAAY (BUY & DRS & HODL & VOTE & ENJOY THE WEEKEND!!! & GOOD MORNING ALL YALL!!!)💎🙌🚀🌕

by u/Pharago in Superstonk

u/Phargo

GAMESTOP TO OFFER UP TO 75 MILLION SHARES ATM

by u/Infenix13 in Superstonk

GameStop Discloses First Quarter 2024 Results

by u/Fieryhotsauce in Superstonk

Roaring Kitty Live Stream - June 7, 2024 (Youtube Stream Link)

by u/Doom_Douche in Superstonk

462k People Await DFV!

by u/tallfeel in Superstonk

u/tallfeel

WTF is happening with GameStop? Start Here

by u/Doom_Douche in Superstonk

u/Doom_Douche

The Finest Investor of Our Generation!

by u/Brave-Or-Stupid in Superstonk

u/Brave-Or-Stupid

CNBC getting owned by DFV

by u/ydnar in Superstonk

u/ydnar

THAT’S MY QUANT 🎷🐓♋️

by u/FunkyChicken69 in Superstonk

u/FunkyChicken69

On @CNBC - @CitronResearch 's Andrew Left just said he cannot discuss a probe into him and other short sellers for trying to manipulate $GME 👀

— DOMO Capital Management, LLC (@DOMOCAPITAL) June 7, 2024

To the people 'familiar with the matter', discussing whether DeepFuckingValue's YOLO update posts amount to market manipulation, please pound sand and revisit Gary Gensler's statement 6/7/24 and previous testimony to Congress:

- https://www.reddit.com/r/Superstonk/comments/1d9l1rg/sec_chair_gary_gensler_investors_today_can_get/

- https://www.congress.gov/event/117th-congress/house-event/112590/text

- "Investors today can get information from more sources than ever before. They can share advice peer-to-peer via new social media platforms, as well as Reddit communities and YouTube channels."

- “We should always be vigorously enforcing our laws and ensuring that there’s not fraud and manipulation, but again, we all have a free speech right to go and say to a neighbor, whether it’s online or in person, I like this investment,”

- “Our laws are about if somebody’s trying to defraud another person, mislead another person, manipulate the markets,”

- "I am not concerned about regular investors exercising their free speech rights online; I am more concerned whether bad actors potentially take advantage of influential platforms."

Adding, DFV's YouTube disclaimer calls all of this out as well:

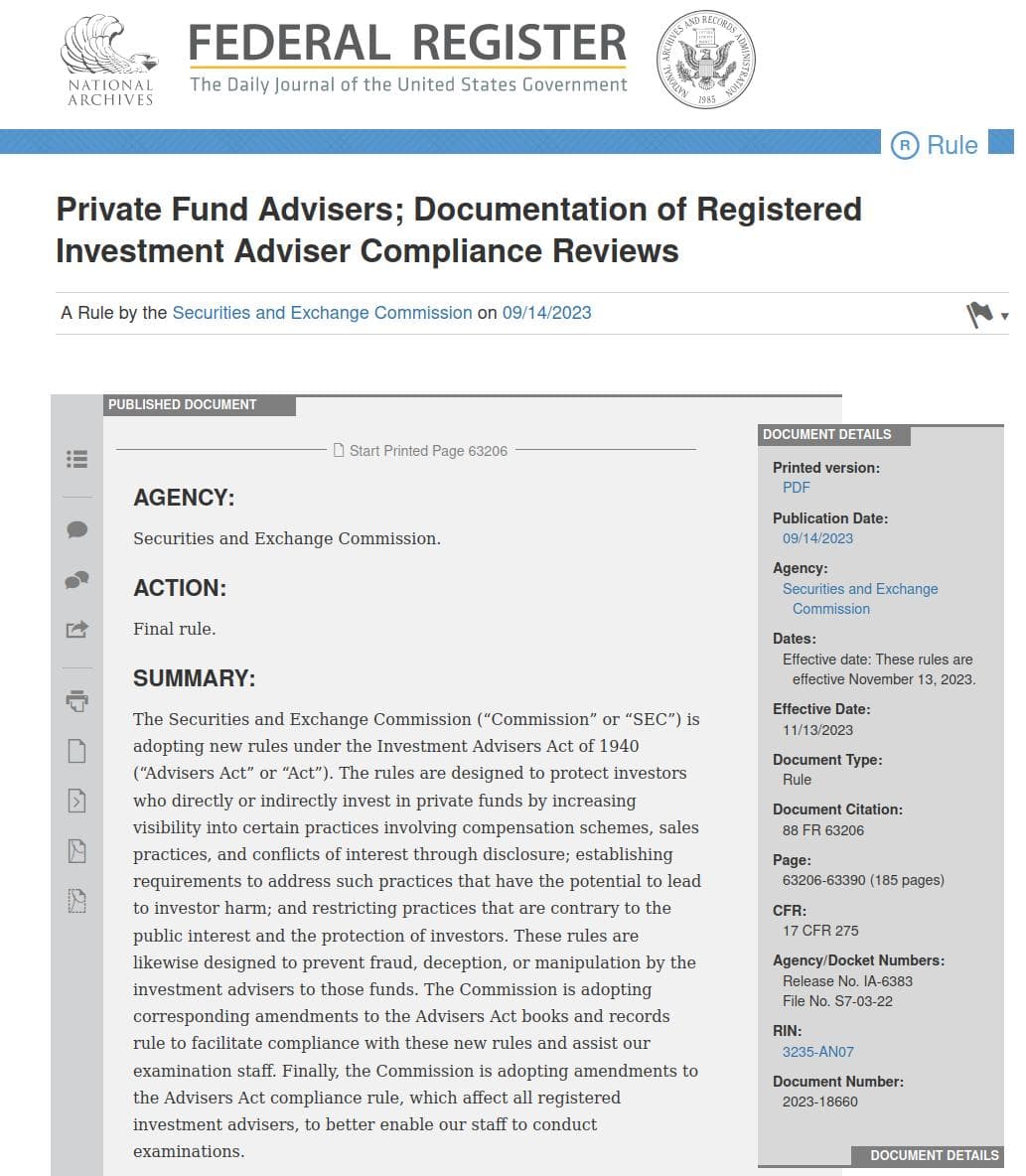

Wall Street is BIG MAD about new SEC Rules:

Uh... guys. Are they going to fuck with us again?

by u/drwtsn1 in Superstonk

The US House of Appropriations Committee is trying to kill the CAT 🔥

by u/welp007 in Superstonk

Managed Funds Association (MFA) on court vacating the SEC's Private Fund Adviser Rule restricting activity contrary to the public interest and the protection of investors: "Unfortunately, this is just one instance of SEC overreach as it looks to push through the most aggressive agenda in decades."

by u/Dismal-Jellyfish in Superstonk

MFA President and CEO Bryan Corbett issued the following statement after the Fifth Circuit Court of Appeals vacated the Private Fund Adviser Rule:

"Unfortunately, this is just one instance of SEC overreach as it looks to push through the most aggressive agenda in decades"

In September 2023, six private equity and hedge fund trade groups sued the SEC, arguing the agency overstepped its statutory authority when adopting sweeping new expenses and fees rules last week.

- "The rules exceed the Commission's statutory authority, were adopted without compliance with notice-and-comment requirements, and are otherwise arbitrary, capricious, an abuse of discretion, and contrary to law, all in violation of the Administrative Procedure Act," the associations wrote in the lawsuit.

- They asked the court to vacate the rules.

- Today MFA is celebrating that they won since the court vacated the rules.

What were they so upset about?:

- "The final rules would have restricted certain other private fund adviser activity that is contrary to the public interest and the protection of investors."

- Would require private fund advisers registered with the Commission to provide investors with quarterly statements detailing certain information regarding fund fees, expenses, and performance.

- Would require a private fund adviser registered with the Commission to obtain and distribute to investors an annual financial statement audit of each private fund it advises and, in connection with an adviser-led secondary transaction, a fairness opinion or valuation opinion.

- Prohibit all private fund advisers from providing investors with preferential treatment regarding redemptions and information if such treatment would have a material, negative effect on other investors.

The Securities and Exchange Commission today adopted new rules and rule amendments to enhance the regulation of private fund advisers and update the existing compliance rule that applies to all investment advisers. The new rules and amendments are designed to protect private fund investors by increasing transparency, competition, and efficiency in the private funds market.“Private funds and their advisers play an important role in nearly every sector of the capital markets,” said SEC Chair Gary Gensler. “By enhancing advisers’ transparency and integrity, we will help promote greater competition and thereby efficiency. Consistent with our mission and Congressional mandate, we advance today’s rules on behalf of all investors — big or small, institutional or retail, sophisticated or not.”To enhance transparency, the final rules will require private fund advisers registered with the Commission to provide investors with quarterly statements detailing certain information regarding fund fees, expenses, and performance. In addition, the final rules will require a private fund adviser registered with the Commission to obtain and distribute to investors an annual financial statement audit of each private fund it advises and, in connection with an adviser-led secondary transaction, a fairness opinion or valuation opinion.To better protect investors, the final rules will prohibit all private fund advisers from providing investors with preferential treatment regarding redemptions and information if such treatment would have a material, negative effect on other investors. In all other cases of preferential treatment, the Commission adopted a disclosure-based exception to the proposed prohibition, including a requirement to provide certain specified disclosure regarding preferential terms to all current and prospective investors.In addition, the final rules will restrict certain other private fund adviser activity that is contrary to the public interest and the protection of investors. Advisers generally will not be prohibited from engaging in certain restricted activities, so long as they provide appropriate specified disclosure and, in some cases, obtain investor consent. The final rules, however, will not permit an adviser to charge or allocate to the private fund certain investigation costs where there is a sanction for a violation of the Investment Advisers Act of 1940 or its rules.To avoid requiring advisers and investors to renegotiate governing agreements for existing funds, the Commission adopted legacy status provisions applicable to certain of the restricted activities and preferential treatment provisions. Such legacy status will apply to those governing agreements entered into in writing prior to the compliance date and with respect to funds that have commenced operations as of the compliance date.

Today, the Commission is considering final rules related to private fund advisers. I am pleased to support this adoption because, by enhancing advisers’ transparency and integrity, we will help promote greater competition and thereby efficiency in this important part of the markets.Private funds and their advisers play a significant role for investors and issuers. They play an important role in nearly every sector of the capital markets. On one side are the funds’ investors, such as retirement plans or endowments. Standing behind those entities are millions of investors like municipal workers, teachers, firefighters, professors, students, and more. On the other side are issuers raising capital from private funds, ranging from startups to late-stage companies.After the 2008 financial crisis, Congress understood the important role that private funds and advisers play. In the Dodd-Frank Act of 2010, Congress effectively required most private fund advisers to register with the Securities and Exchange Commission. Congress also gave the Commission specific new authorities under the Investment Advisers Act of 1940 to prohibit or restrict advisers’ sales practices, conflicts, and compensation schemes.[1] This built upon our existing authorities to regulate advisers with respect to their books and records as well as with respect to fraudulent, deceptive, or manipulative practices, among others.[2]In addition, Congress mandated in 1996 that, in our rulemaking, the Commission must consider efficiency, competition, and capital formation in addition to investor protection and the public interest.Importantly, Congress did not cabin either of these provisions—the Dodd-Frank reforms or the 1996 requirements to consider efficiency, competition, and capital formation—only to retail investors. Thus, consistent with our mission and Congressional mandate, we advance today’s rules on behalf of all investors—big or small, institutional or retail, sophisticated or not.First, the rules will increasetransparencyand comparability in funds’ quarterly statements to investors. This will apply to advisers’ fees (such as management fees, performance fees, and portfolio investment fees), expenses, and performance metrics.Second, the rules will bring greater transparency to investors regarding preferential treatment, often arranged through side letters. Under the rules, advisers will be able to continue to offer side letters to fund investors, but only if the material economic terms of those agreements are disclosed in advance and all other terms subsequently are disclosed to all investors in that fund. With regard to preferential treatment for redemptions and portfolio holdings information, if such preferential treatment would have a material negative effect on other investors, advisers will be able to offer such terms if also offered to all investors in that fund.Third, the rules will prohibit an adviser from charging to the fund fees and expenses related to investigations that result in a court or government authority sanctioning the adviser for violating the Advisers Act. Such activity is contrary to public interest and investor protection. Further, the rule will restrict a limited number of other named activities (such as an adviser borrowing from a fund they advise) by prohibiting them unless the adviser provides disclosure, and, in some cases, receives investor consent.Fourth, the rules will require advisers to obtain a fairness or valuation opinion when the adviser directs a fund to sell assets to another fund that the adviser also advises. This will help address potential conflicts of interest that may emerge when an adviser may profit at the expense of one fund’s investors because the adviser is advising funds on both sides of a transaction.Fifth, to benefit market integrity, the rules will require an annual audit of private funds conducted consistent with audits under the existing Advisers Act custody rule.Finally, today’s adoption includes amendments regarding books and records to help ensure compliance for all advisers.In finalizing today’s rule, we benefitted from public feedback on our proposal.First, for example, as detailed in the release, the final rule was revised from the proposal to allow for more flexibility to offer preferential treatment through side letters so long as they’re disclosed and in some cases the preferential treatment is offered to all investors. Second, the prohibition on reimbursement for examination costs was revised to be permitted as long as it’s disclosed. Third, certain activities that would have been prohibited under the proposal are now being permitted in the adopting release so long as the adviser gets consent from investors in that fund. For example, reimbursement for investigation costs would be allowed other than those that result in sanctions for violations of the Advisers Act. Fourth, in addressing comments on our proposal, the adopting release no longer prohibits advisers from seeking indemnification for negligence.[3]Further, in response to commenters, the final release includes a legacy provision with regard to preferential treatment and restricted activities. This legacy provision provides that advisers would not need to renegotiate limited partnership agreements even if such agreements otherwise would have been covered by the preferential treatment and restricted activity provisions.Lastly, the annual audit requirement can be satisfied using requirements consistent with the current custody rule, rather than through a new set of requirements as proposed. Given this, earlier today, the Commission reopened for public comment our February 2023 safeguarding proposal.Today’s final rules will promote private fund advisers’ efficiency, competition, integrity, and transparency. That benefits investors, issuers, and the markets alike.

SEC Commissioner Mark T. Uyeda: "Today, the Commission seeks to impose rules for private funds – which are generally available only for sophisticated investors – that are far more burdensome and restrictive than those products for retail investors." "I am unable to supporthttps://dismal-jellyfish.com/gensler-comment-in-sec-adoption-rule-10c-1a/

"Unfortunately, this is just one instance of SEC overreach as it looks to push through the most aggressive agenda in decades"

Heck, Wall Street and their trade groups are so mad they are suing about it!

- The National Association of Private Fund Managers (NAPFM), Alternative Investment Management Association (AIMA), and Managed Funds Association (MFA) filed a lawsuit asking the U.S. Court of Appeals for the Fifth Circuit to invalidate the two rules recently adopted by the Securities and Exchange Commission (SEC) requiring reporting and public disclosure of securities loans and short selling activity.

- They call out that both rules impose extensive new requirements for the reporting and public disclosure of information pertaining to short sales of securities, whether of the short-sale activity itself (as in the Short Position Reporting Rule) or of the loans of securities to facilitate that short-sale activity (as in the Securities Loan Reporting Rule).

- They complain the Short Position Reporting Rule and its detailed disclosures about short-sale activity can impose substantial harms on market participants (including by revealing confidential investment strategies and potentially facilitating retaliation or other manipulative activities).

- They also claim the rules are invalid and believe the Court should grant their petition and invalidate the rules.

What folks are saying on Short Position and Short Activity reporting by Institutional Investment Managers:

- Gary Gensler: "Today, I’m pleased that, based upon public comment, we’re adopting a rule fulfilling that Congressional mandate. Today’s adoption will promote greater transparency about short selling both to regulators and the public."

- Caroline Crenshaw: "This could help the SEC reconstruct market events & design responses to events that take place during times of volatility similar to the “meme” stock episode that might happen in the future."

- Mark Uyeda on 'NO' for (Rule 13f-2): "Public knowledge of their short positions would render them susceptible to a short squeeze & also reduce the incentives to engage in this beneficial activity."

- Hester Peirce Statement on SEC's Short Sale Disclosure: "Because a narrower rule leveraging existing reporting requirements could have brought more meaningful transparency at lower costs, I cannot support this recommendation."

What folks are saying on Transparency in the Securities Lending Market:

- Gary Gensler: "as relates to the reporting to regulators, the final rule will require lenders to report loan data to a registered national securities association—i.e., FINRA—by the end of each trading day."

- Hester Peirce: "While providing transparency regarding securities lending is a worthy & statutorily mandated objective, the approach we are voting on today is not the right way to achieve that objective. Accordingly, I cannot support this recommendation."

- Mark Uyeda "when these changes from the proposal are taken together, to what extent can the resulting information be used to estimate particular short selling positions & is that acceptable?

Banks are in Trouble:

The sensational data points from last week's FDIC Quarterly Banking Profile began to pop up.

The Quarterly Banking Profile is a quarterly publication that provides the earliest comprehensive summary of financial results for all FDIC-insured institutions.

Reports from 4,568 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) report aggregate net income of $64.2 billion in first quarter 2024, an increase of $28.4 billion (79.5 percent) from the prior quarter.

A large decline in noninterest expense because of several substantial, non-recurring items recognized by large banks in the prior quarter, as well as higher noninterest income and lower provision expenses this quarter, contributed to the quarterly increase.

For the reporting period, FDIC-Insured Institutions Reported Net Income of $64.2 Billion

- Net Income Increased From the Prior Quarter, Driven By Lower Noninterest Expense, Provision Expenses, and Higher Noninterest Income

- Community Bank Net Income Increased Quarter Over Quarter

- The Net Interest Margin Fell For the Second Consecutive Quarter

- Asset Quality Metrics Remained Generally Favorable With the Exception of Material Deterioration in Credit Card and Commercial Real Estate Portfolios

- Loan Balances Declined Modestly From the Prior Quarter, but Increased From a Year Ago

- Domestic Deposits Increased For the Second Straight Quarter

- The Deposit Insurance Fund Reserve Ratio Increased Two Basis Points to 1.17 Percent

- The number of banks on the FDIC’s “Problem Bank List” increased from 52 to 63. 5 Total assets held by problem banks rose $15.8 billion to $82.1 billion.

- Problem banks represent 1.4 percent of total banks, which is within the normal range for non-crisis periods of 1 to 2 percent of all banks.

- The noncurrent rate for non-owner occupied CRE loans of 1.59 percent is now at its highest level since fourth quarter 2013, driven by office portfolios at the largest banks.

- The credit card net charge-off rate was 4.70 percent in the first quarter, up 55 basis points quarter over quarter and the highest rate since third quarter 2011.

- Unrealized losses on securities totaled $516.5 billion in the first quarter, an increase of $38.9 billion (8.2 percent) from fourth quarter 2023.

After the jab from the FDIC report, the largest banks are being 'jabbed' via 2024 stress test as the Federal Reserve Board announced that the results from its annual bank stress tests will be released on Wednesday, June 26, at 4:30 p.m. EDT.

This year, 32 banks with $100 billion or more in total assets are subject to the Board's stress tests. The scenario includes a severe global recession with heightened stress in commercial and residential real estate markets. Separately, the exploratory analysis includes four separate hypothetical elements, including two funding stresses applied to all banks tested and two market shocks applied to only the largest and most complex banks.

2024 Scenario

In the 2024 stress test scenario, the U.S. unemployment rate rises nearly 6-1/2 percentage points, to a peak of 10 percent. The increase in the unemployment rate is accompanied by severe market volatility, a widening of corporate bond spreads, and a collapse in asset prices, including a 36 percent decline in house prices and a 40 percent decline in commercial real estate prices. Large banks with substantial trading or custodial operations are also required to incorporate a counterparty default scenario component to estimate and report potential losses and capital effects associated with the unexpected default of the firm's largest counterparty.

In addition, banks with large trading operations will be tested against a global market shock component that primarily stresses their trading and related positions. The global market shock component is a set of hypothetical stresses to a large set of risk factors reflecting market distress and heightened uncertainty.

The table below shows the components of the annual stress test that apply to each bank, based on data as of the third quarter of 2023.

This year's exploratory analysis includes four separate hypothetical elements that will assess the resilience of the banking system to a wider range of risks. Two of the hypothetical elements include funding stresses that cause a rapid repricing of a large proportion of deposits at large banks. Each element has a different set of interest rate and economic conditions, including a moderate recession with increasing inflation and rising interest rates, and a severe global recession with high and persistent inflation and rising interest rates.

The other two elements of the exploratory analysis include two sets of market shocks that will be applied only to the largest and most complex banks. These shocks hypothesize the failure of five large hedge funds, with each under a different set of financial market conditions. Those conditions include expectations of reduced global economic activity with a negative outlook for long-term inflation, and expectations of severe recessions in the United States and other countries.

The exploratory analysis is distinct from the stress test and will explore additional hypothetical risks to the broader banking system, rather than focusing on firm-specific results. The Board will publish aggregate results alongside the annual stress test results in June 2024.

2024 Stress Test Banks:

| Bank | Subject to global market shock | Subject to counterparty default |

|---|

| Ally Financial Inc. | ||

|---|---|---|

| American Express Company | ||

| Bank of America Corporation | X | X |

| The Bank of New York Mellon Corporation | X | |

| Barclays US LLC | X | X |

| BMO Financial Corp. | ||

| Capital One Financial Corporation | ||

| The Charles Schwab Corporation | ||

| Citigroup Inc. | X | X |

| Citizens Financial Group, Inc. | ||

| Credit Suisse Holdings (USA), Inc. | X | X |

| DB USA Corporation | X | X |

| Discover Financial Services | ||

| Fifth Third Bancorp | ||

| The Goldman Sachs Group, Inc. | X | X |

| HSBC North America Holdings Inc. | ||

| Huntington Bancshares Incorporated | ||

| JPMorgan Chase & Co. | X | X |

| Keycorp | ||

| M&T Bank Corporation | ||

| Morgan Stanley | X | X |

| Northern Trust Corporation | ||

| The PNC Financial Services Group, Inc. | ||

| RBC US Group Holdings LLC | ||

| Regions Financial Corporation | ||

| Santander Holdings USA, Inc. | ||

| State Street Corporation | X | |

| TD Group US Holdings LLC | ||

| Truist Financial Corporation | ||

| UBS Americas Holding LLC | ||

| U.S. Bancorp | ||

| Wells Fargo & Company | X | X |

Computershare Update:

Update: New DRS/DSPP FAQs available https://t.co/1TBfWE4mpW

— Computershare (@Computershare) June 6, 2024

Ban Bets:

FINE I'LL DO IT MYSELF. PROOF OR BAN BET

by u/sSilicore in Superstonk

u/sSilicore

Comment

by u/gmorgan99 from discussion

in Superstonk

u/solididude

Ban bet

by u/mateofeo1 in Superstonk

u/Mateofeo1

A Bet, With a Side of Proof or Ban

by u/CalebTGordan in Superstonk

u/CalebTGordan

If we hit $69.69 today I'll get GME tattooed across my balls or ban me

by u/DJSourNipples in Superstonk

u/DJSourNipples

Screw it, if DFV exercises, this is going in my ass

by u/My_50_lb_Testes in Superstonk

u/My_50_lb_Testes

Looking Ahead to the Weekend:

Happy Birthday Week My Friend 🥳

by u/Novel_Gold1185 in Superstonk

And there you have it, folks. Another week of financial fireworks, epic memes, and community in the r/Superstonk universe. From starfish shoutouts and Gary Gensler Cramer takedowns to Larry Cheng's praise for Ryan Cohen and Roaring Kitty's game-changing updates, we're living it all.

The dedication, passion, and sheer tenacity of this community continue to shine through every post, tweet, and market move.

Until next time!

Additional Information:

Welcome r/ALL - Looking to catch up on the GME Saga? Start here!!!

by u/Doom_Douche in Superstonk

When you wish upon a star - a complete guide to Computershare

by u/Doom_Douche in Superstonk

DFV YOLO Updates:

GME YOLO update – June 2 2024

by u/DeepFuckingValue in Superstonk

GME YOLO update – June 3 2024

by u/DeepFuckingValue in Superstonk

GME YOLO update – June 6 2024

by u/DeepFuckingValue in Superstonk

The Daily Stonk: A Recap (6/2/24-6/8/24)

by u/Dismal-Jellyfish in Superstonk

The Daily Stonk: A Recap (6/2/24-6/8/24)https://t.co/6HfGbD8aqd

— dismal-jellyfish (@DismalJellyfish) June 7, 2024