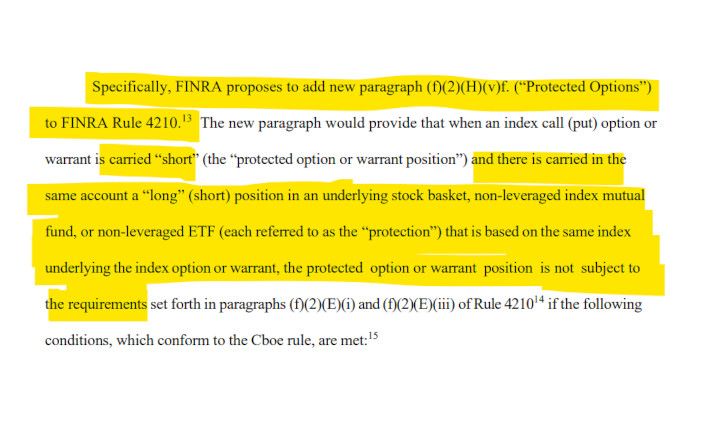

Open for comment: FINRA proposes to add new paragraph (“Protected Options”) to FINRA Rule 4210 (Margin Requirements). Appears to exempt if a long call offsets a short put?

Below is the text of the proposed rule change. Proposed new language is underlined; proposed deletions are in brackets:

Wut Mean? (I think):

My understanding is there are 2 options plays that require margin, sold puts and sold calls.

A sold put means that you need to have margin for