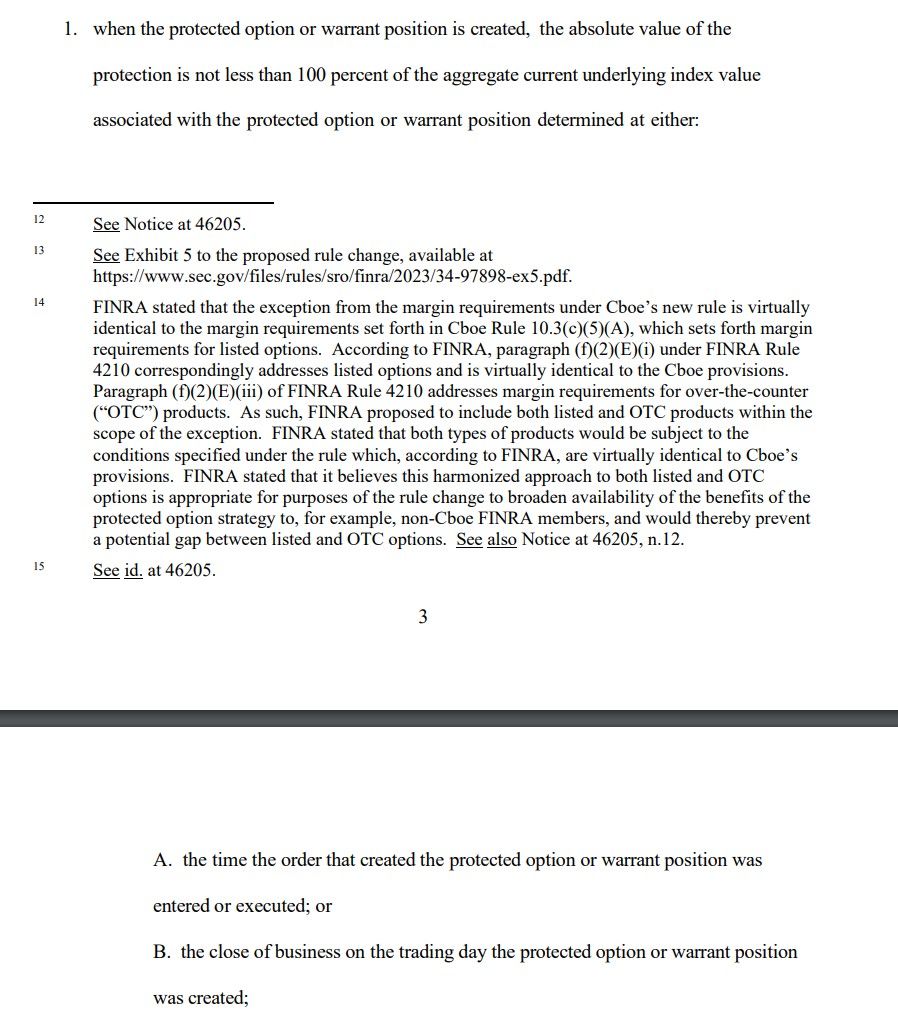

Open for comment: FINRA proposes to add new paragraph (“Protected Options”) to FINRA Rule 4210 (Margin Requirements). Appears to exempt if a long call offsets a short put?

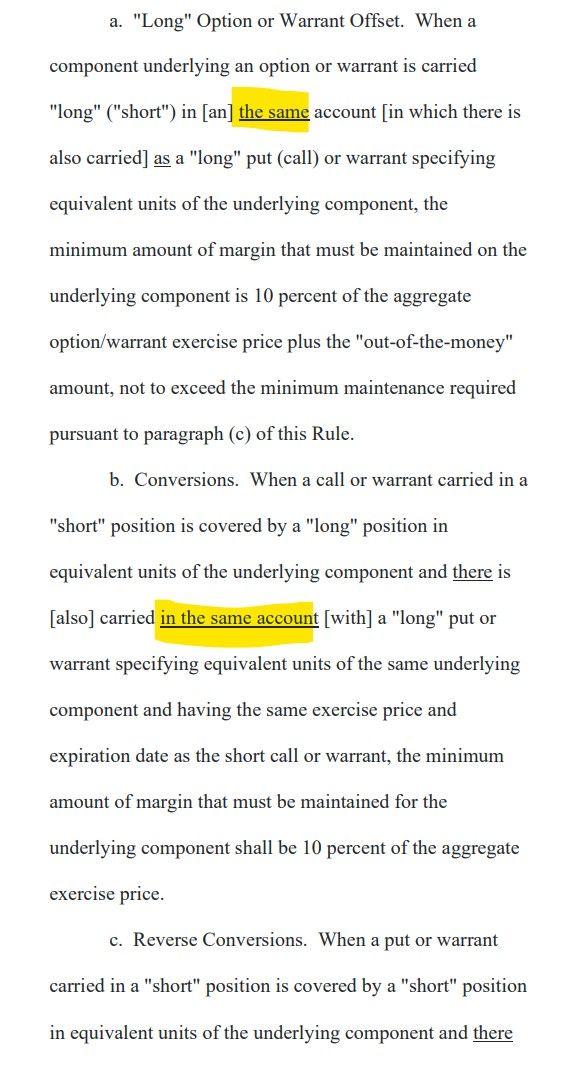

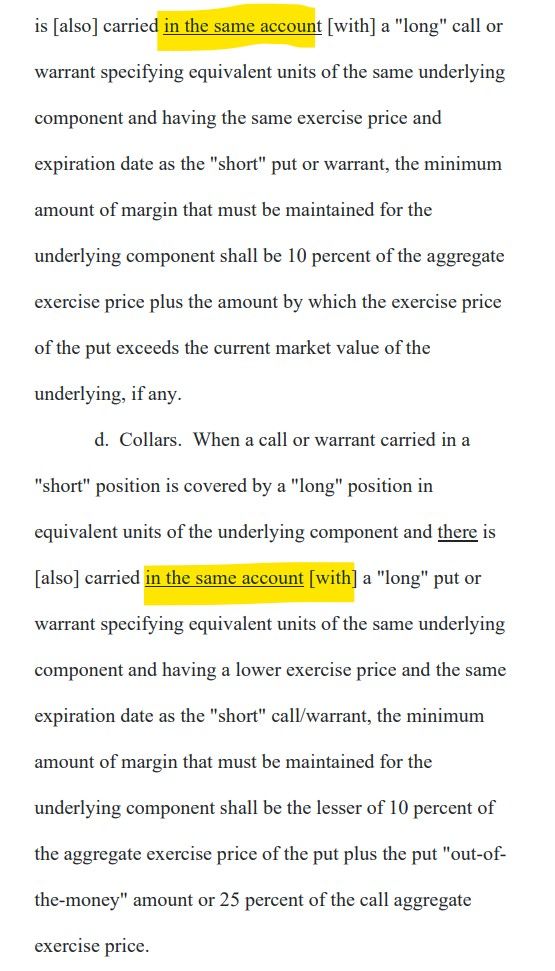

Below is the text of the proposed rule change. Proposed new language is underlined; proposed deletions are in brackets:

Wut Mean? (I think):

My understanding is there are 2 options plays that require margin, sold puts and sold calls.

A sold put means that you need to have margin for buying the shares if assigned or enough cash/collateral to buy back the option if it goes sideways.

This rule appears to exempts you if you have an long call to offset the delta of a short put?

Hoping others can weigh in though as the verbiage does appear contradictory. I do believe it is worth commenting even if to call out that clearer understanding is required.

How to comment:

- Use the Commission’s internet comment form to Submit a Comment on SR-FINRA-2023-010

- or Send an email to [email protected]. Please include file number SR-FINRA-2023- 010 on the subject line.

- All submissions should refer to file number SR-FINRA-2023-010.

- This file number should be included on the subject line if email is used.

- To help the Commission process and review your comments more efficiently, please use only one method.

- Do not include personal identifiable information in submissions; you should submit only information that you wish to make available publicly.

Interested persons are invited to submit written data, views, and arguments regarding whether the proposed rule change should be approved or disapproved by [insert date 21 days after the date of publication in the Federal Register]. Any person who wishes to file a rebuttal to any other person’s submission must file that rebuttal by [insert date 35 days after the date of publication in the Federal Register]

It was published in the federal register 10/4: https://www.federalregister.gov/documents/2023/10/04/2023-21956/self-regulatory-organizations-financial-industry-regulatory-authority-inc-order-instituting

Comments due by 10/25!

In particular, the Commission seeks comment on the following questions and asks commenters to submit data where appropriate to support their views:

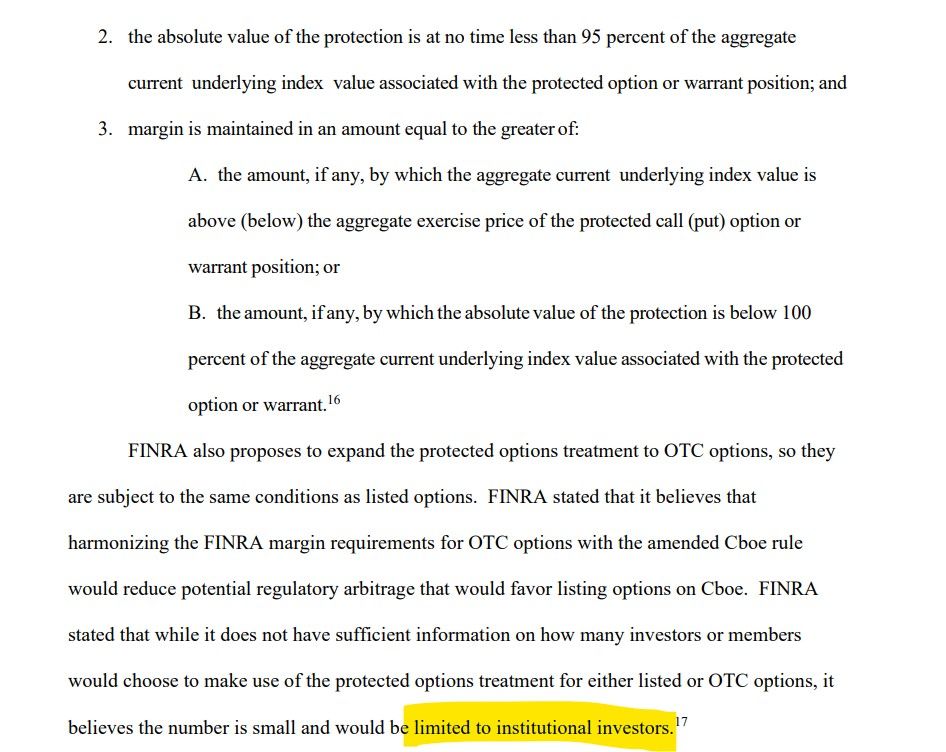

- What are commenters’ views on FINRA’s proposal to expand the protected options treatment to OTC options so they are subject to the same conditions as listed options? Would the expansion of the protected options treatment to OTC options help to reduce potential regulatory arbitrage that may favor listing options on certain exchanges?

- What are commenters’ views on the types of market participants that would utilize the protected options treatment for either listed or OTC options? For example, would use of the protected options treatment for either listed or OTC options be generally limited to institutional investors? Please explain why or why not.

Previous posts on this topic:

EDIT 10/6:

An interesting comment from u/taimpeng:

I think you missed a key detail here: "traders would have the opportunity to offset short option positions or warrants with positions in underlying assets like stock baskets, non-leveraged index mutual funds or non-leveraged exchange-traded funds (ETFs) linked to the same index [as the sold options]." (<- quote pulled from a Yahoo Finance article discussing the proposed change, but it agrees with my reading of it), reducing margin requirements as long the value of their offsetting position stays covering >95% of the protected position's value (i.e., the offsetting position can even be a dirty/imperfect hedge as long as it stays within 5%). Note how the other offsets ("long options", "conversions", "reverse conversions", "collars") mentioned in the rule all specify that the hedge is "specifying equivalent units", meaning they have to be exact hedges, while this proposed rule instead specifies it must be based on the same index and stay within 5% of what a perfect hedge would.

Also, note that no GME ETFs have >3.5% weighting of $GME right now https://www.etf.com/stock/GME (similar for most small/mid caps and their ETFs), so it should be easy for them to create a basket of stocks from any $GME ETF such that the basket excludes $GME but otherwise stays within 5% of the index's value. ETF APs and MMs can then sell ETF calls, and hedge by buying delta against the 95%+ of non-$GME ETF components as a basket of stocks to hold for their short position's "protection" (which should also help drive up their prices relative to $GME). This leaves them effectively short $GME without having to deal with the full margin reqs that would come from their unhedged shorts.

As far as I can tell, it's basically letting ETF MMs work in just little bit of pair/dispersion trading (< 5%) into their hedging when performing their traditional market function... you know, as a treat.

TLDRS:

- FINRA proposes to add new paragraph (“Protected Options”) to FINRA Rule 4210 (Margin Requirements).

- Appears to exempt if a long call offsets a short put?

- Since CBOE did this already they claim the need to 'catch up'

- Open for Comment!

- Comments due by 10/25