U.S. Census Bureau: Seasonally adjusted, retail sales up 1.0% in July from June, the biggest month-to-month increase since January 2023. More cold water on corporate media's 'easing inflation' and September rate cut story.

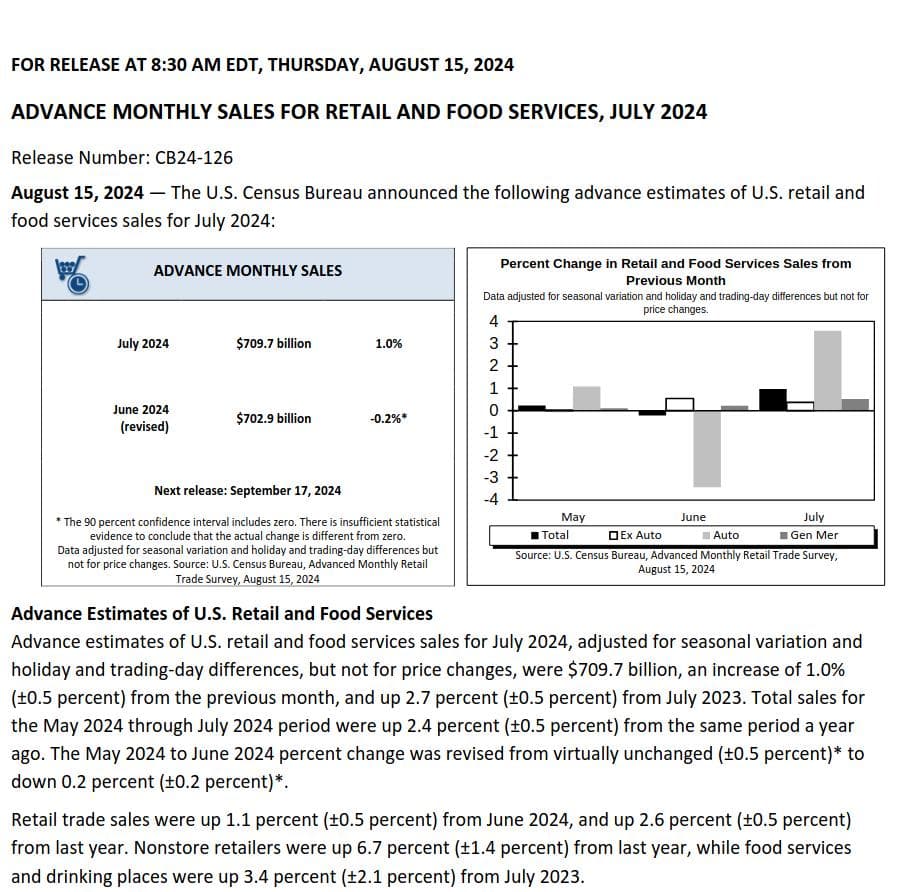

Pouring gasoline on the inflation conflagration, U.S. retail and food services sales jumped by 1.0% in July 2024 from June, according to the U.S. Census Bureau's latest advance estimates. This marks the biggest month-to-month increase since January 2023. Regardless of the narrative put forth by corporate media, inflation is not easing nor anywhere near tamed.

These figures are part of the Census Bureau's Advance Monthly Retail Trade and Food Services Survey, which provides early insights into consumer spending, a critical component of the U.S. Gross Domestic Product (GDP). The survey, based on responses from a sample of approximately 4,800 firms, plays a vital role in understanding the health of the U.S. economy.

The report highlights significant gains across many sectors, with retail trade sales rising by 1.1% from June 2024 and 2.6% year-over-year. Notice how spending is still over the Fed's 2.0% goal for inflation?

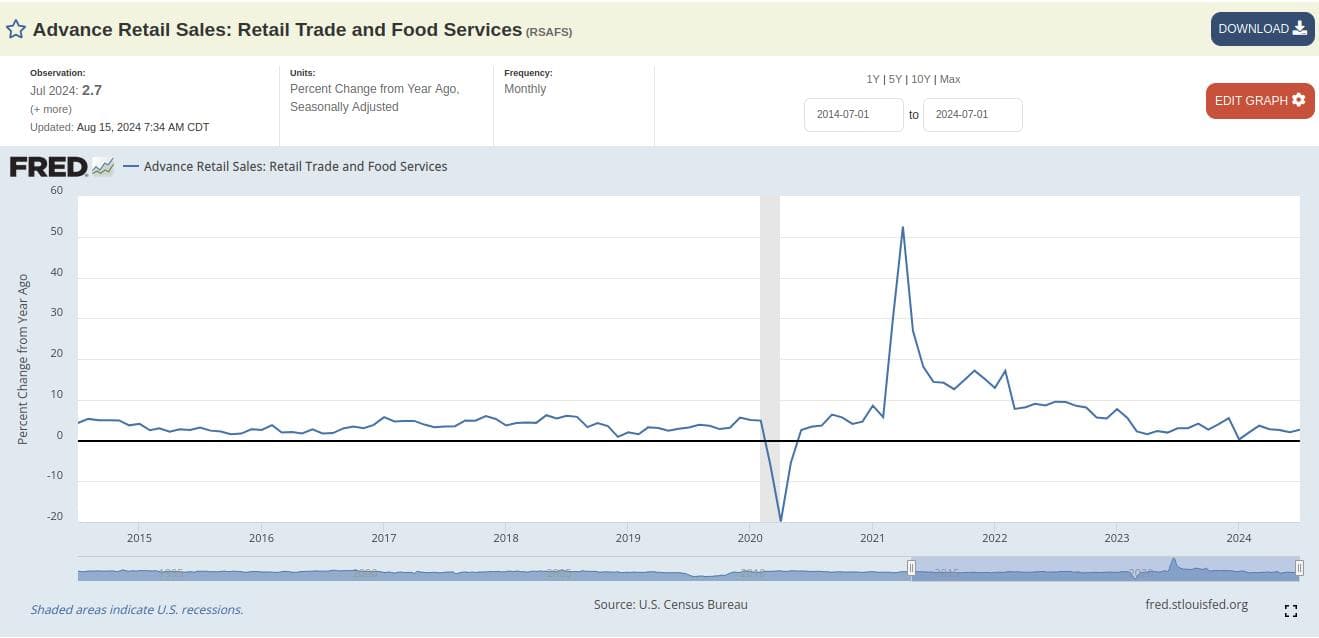

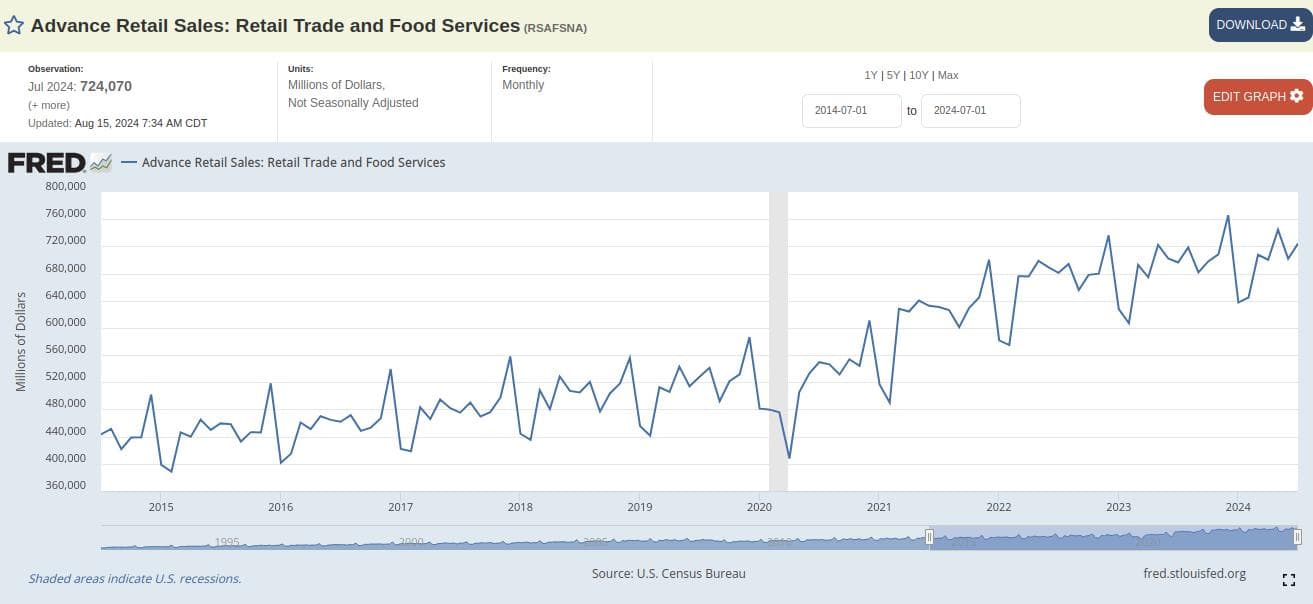

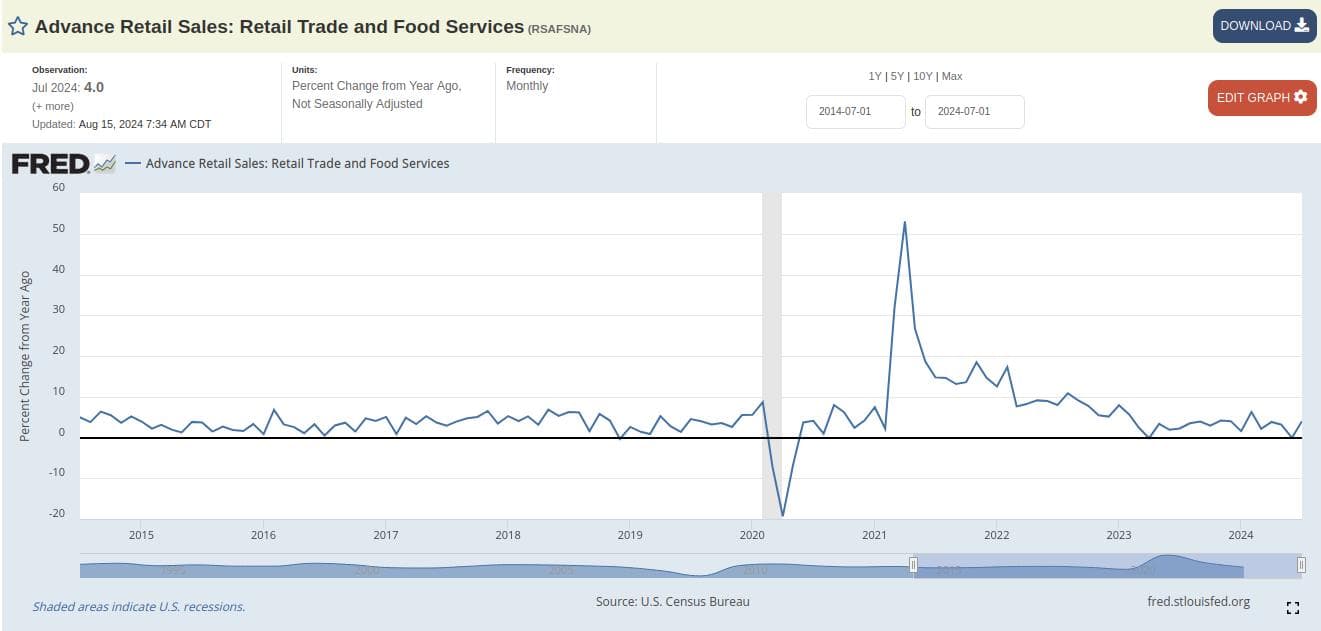

Seasonally adjusted, July's sales totaled $709.7 billion, up 2.7% compared to July 2023. Not seasonally adjusted, retail sales totaled $724 billion (up 4.0%):

I am sure some are asking, why the breakdown of seasonably adjusted and not seasonably adjusted? Seasonally adjusted data provides a clearer view of underlying trends in the data without the noise caused by predictable seasonal effects. This makes it easier to identify long-term trends or cycles in the data.

Not seasonally adjusted data shows the real numbers, including all seasonal influences. This is useful for when you want to to see the raw, real-world numbers, such as in cases where the seasonal effect itself is of interest (e.g., how much the holiday season boosts retail sales each year--think back to school this time of year).

Wut Mean?:

Seasonally adjusted sales ($724 billion) higher than not seasonally adjusted sales ($709.7 billion) suggests that July typically experiences higher-than-average retail activity due to seasonal factors like summer vacations, back-to-school shopping, etc.

Remember though. seasonally adjusted growth of 2.7% reflects the underlying economic conditions and growth in retail sales, excluding the typical seasonal surge. While in contrast, the 4.0% increase in not adjusted sales indicates that the season itself contributed to a more substantial overall increase in sales.

E-commerce was the biggest gainer:

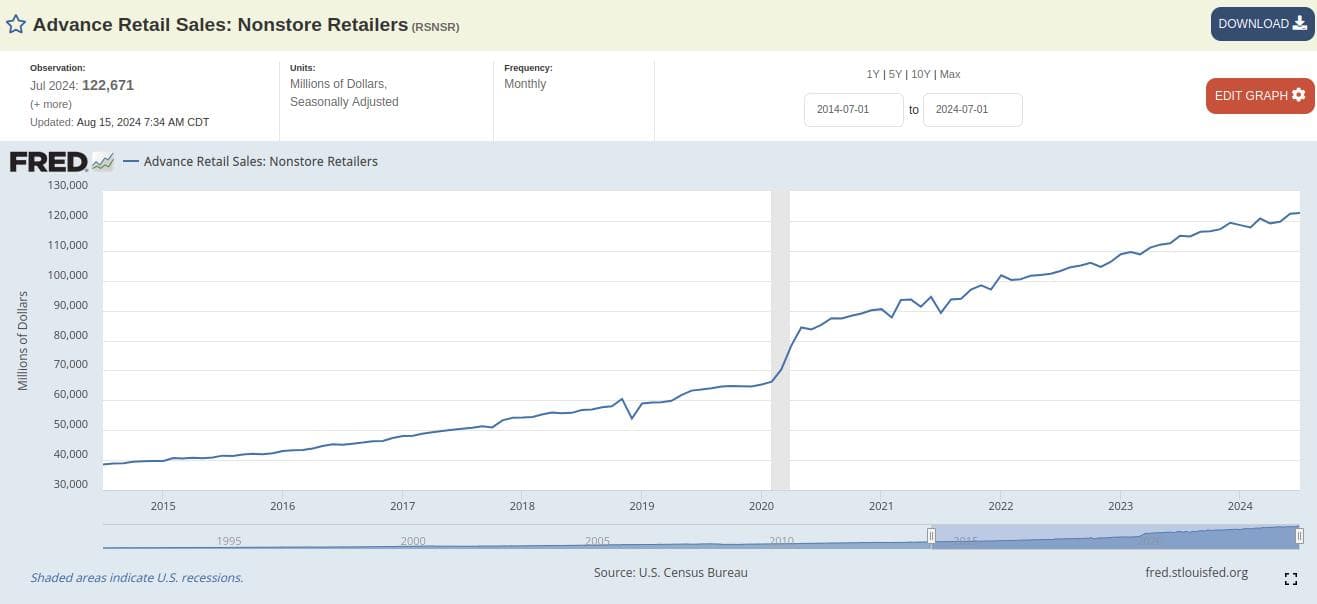

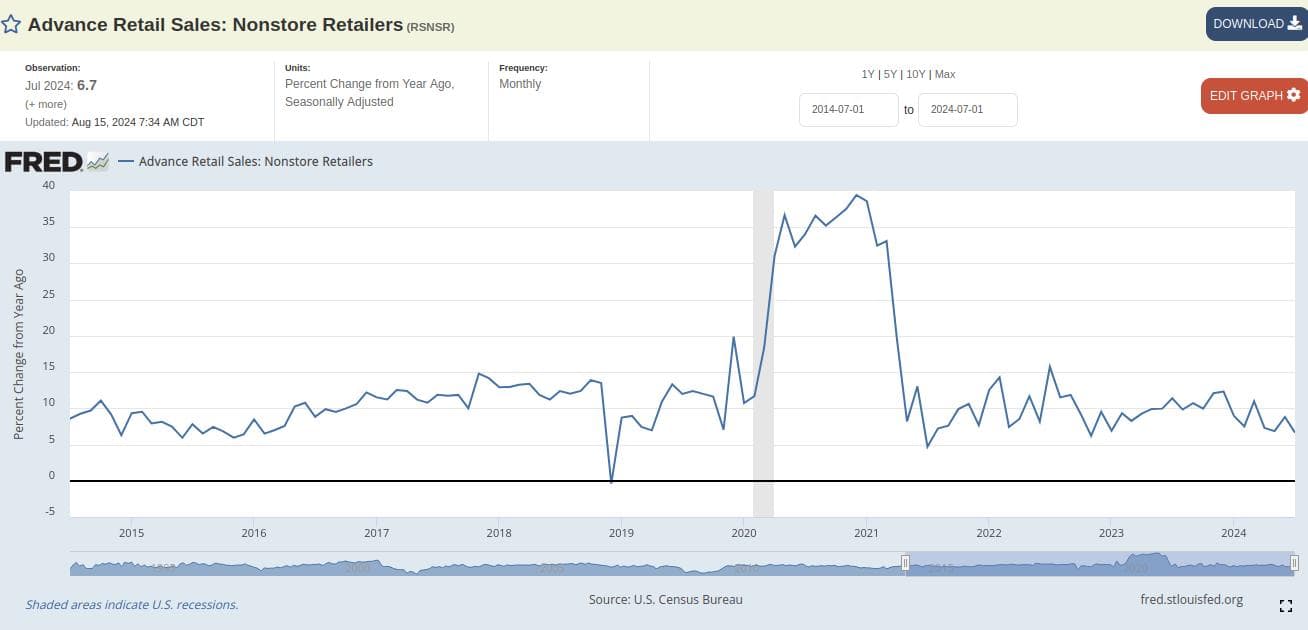

Notably, the biggest jump was in nonstore retailers (AKA e-commerce), which saw a seasonally adjusted 6.7% year-over-year increase to $122 billion or a little more than 17% of total sales ($122 billlion/$709 billion), meaning online is getting closer to capturing $1 out of every $5 spent by retail–more evidence that GameStop has made the right call revamping its e-commerce capacity--go go PSA grading cards on top of a revamped app and website!

Spending at Auto dealers rebounded:

At $133.58 billion, spending on new and used vehicles is the largest category of retail sales at ~19% ($133.58 billion/$709 billion) and was up .4% from June. A big reason for such strong numbers is folks are actually able to purchase vehicles again after the hack that hit the auto-dealers earlier this summer.

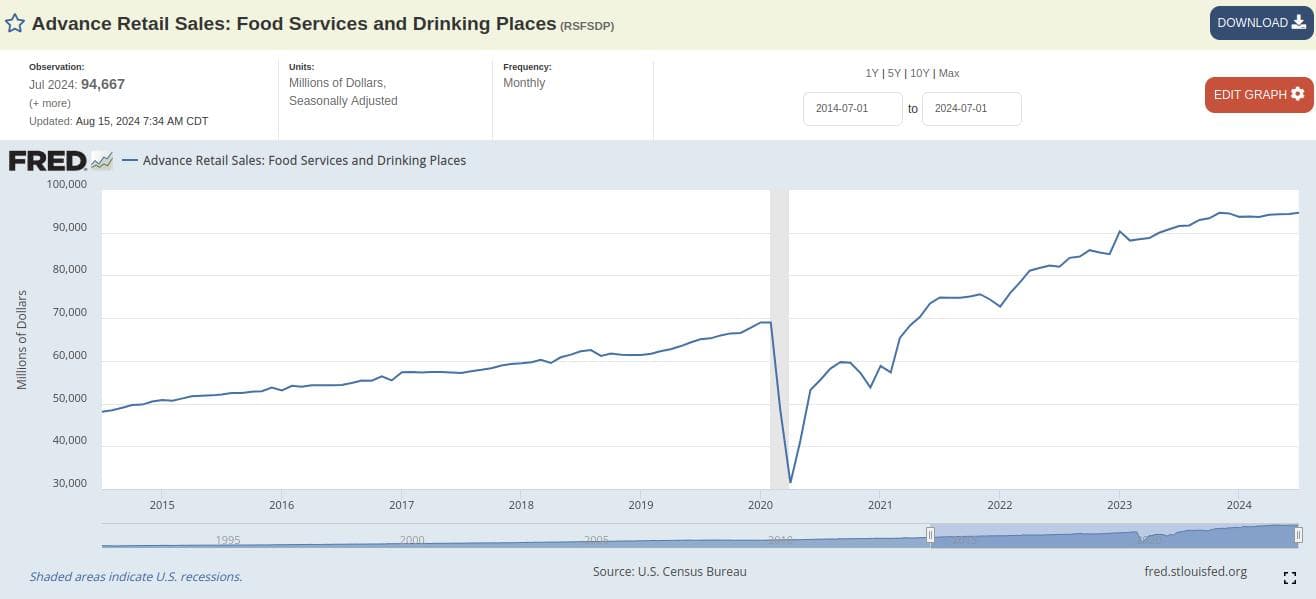

Food Services and drinking places:

Food services and drinking places is the third biggest category of sales at 13%, came in at $94.667 billion, up .3% from June and up 4.1% May 2023-Jul 2023, which includes places like restaurants, bars, food halls, etc. As we can see, while not growing 'bigly' folks are still going out for food and drinks.

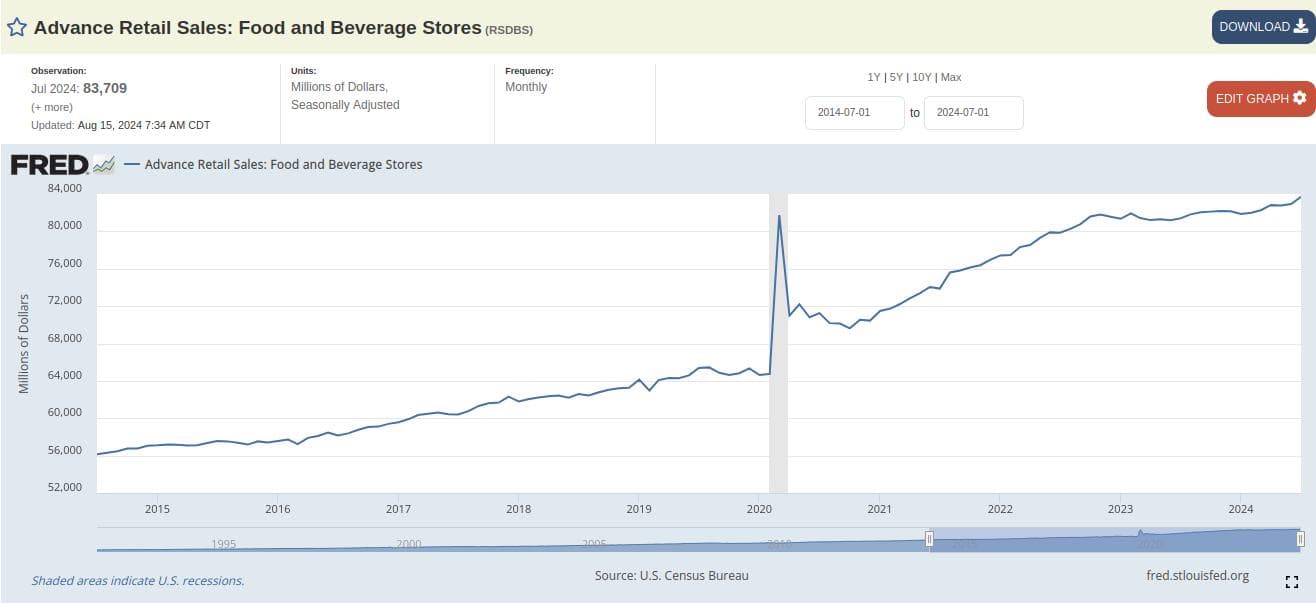

Food and Beverage Stores:

At nearly 12% of retails sales, purchases of food and beverage from grocery stores has hit a new all time seasonably adjusted high at $83.709 billion--up .4% from June and 2.3% May 2023-Jul 2023.

Gas Stations:

At about 8% of total sales, this one really grinds my gears! Gas station sales track closely to the price of gasoline sales. So, back in 2022 when prices were going through the roof on gas, total spending at gas stations was waaay up.

However, while corporate media will celebrate how far down this spending has come from 2022's high, even this new 'celebrated level' is at October 2021's level--still above the 'normal' spending level back in January of 2020 ($43 billion). Again, the media will celebrate this decrease but it is still $10 billion more per month than before inflation popped off and is looks primed to keep climbing. And while gasoline is a non-durable good, you can bet it increasing in price will work its way into the durable goods it does power and lead to higher durable good prices (further knee-capping what was holding CPI down).

These sales viewed through the lens of yesterday's CPI report shows inflation is not easing:

he Consumer Price Index (CPI) and Core CPI both picked up pace in July on a month-to-month basis. Remember, inflation in core services make up over 60% of the total CPI, jumped from what now looks like a previous anomaly (+0.31% up from +0.13% in June.).

Meanwhile, food prices saw a slight increase; energy prices stabilized (aka stopped going down...); and the huge decline in durable goods prices decelerated, according to the Bureau of Labor Statistics July inflation report today.

The drop in durable goods is what carried this report and has corporate media celebrating 'easing inflation'.

However, inflation is proving just how 'transitory' it really is as it gears up for what appears to be another another leg up.

Month-to-moth:

- Core Services CPI: +0.31% up from +0.13% in June.

- Durable goods CPI: -0.30% less than June's decrease.

- Core CPI: +0.17% biggest jump since April.

- Overall CPI: +0.15% largest increase since April.

Year-to-year:

Core services CPI (green line in the chart below) jumped 4.9% year-over-year in July. Notice how since the end of 2023 it has held steady around 5%? At more than 60% of total CPI, it is still almost 300% higher than the Fed's 2% goal!

Durable goods CPI (purple line in the chart below) durable goods CPI fell by 4.1% year-over-year.

Core CPI (red line in the chart below and excludes food and energy), was upby 3.2% year-over-year.

Overall CPI (blue line in the chart below) was up 2.9% year-over-year, a slow deceleration from June. Since mid 2023, overall CPI has hovered at 3%. With the Fed stating they need to see sustained progress towards their 2% goal, how can they think about cutting rates in September when they have made 0 progress in a year getting CPI off of 3%?

TLDRS:

- U.S. retail and food services sales increased by 1.0% in July 2024 from June, the largest monthly rise since January 2023.

- Despite corporate media narratives of cooling inflation and rate cuts in September, inflation remains a significant concern and is not easing.

- Seasonally adjusted July sales totaled $709.7 billion, up 2.7% compared to July 2023.

- Not seasonally adjusted, July retail sales were $724 billion, up 4.0% from the previous year.

- E-commerce experienced the largest gain, with nonstore retailers (e-commerce) seeing a 6.7% year-over-year increase.

- E-commerce sales reached $122 billion, making up a little more than 17% of total retail sales ($709 billion).

- Online sales are approaching capturing $1 out of every $5 spent by retail!

- This growth supports GameStop's decision to revamp its e-commerce capabilities!

- Recall, year-over-year, core services CPI increased by 4.9%, maintaining levels around 5% since late 2023, which is still well above the Federal Reserve's 2% target.

- With overall CPI hovering around 3% since mid-2023 and minimal progress toward the Fed's 2% goal, questions arise about the potential for interest rate cuts in September.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to hold or even increasing interest rates--causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.

U.S. Census Bureau: Seasonally adjusted, retail sales up 1.0% in July from June, the biggest month-to-month increase since January 2023. Even more cold water on corporate media's 'easing inflation' and 'September rate cut' narratives.

by u/Dismal-Jellyfish in Superstonk

U.S. Census Bureau: Seasonally adjusted, retail sales up 1.0% in July from June, the biggest month-to-month increase since January 2023. Even more cold water on corporate media's 'easing inflation' and 'September rate cut' narratives.https://t.co/WprWjUXPZR

— dismal-jellyfish (@DismalJellyfish) August 16, 2024