While corporate media celebrates 'inflation easing', month-to-month CPI and Core CPI accelerated. Inflation is not easing!

The Consumer Price Index (CPI) and Core CPI both picked up pace in July on a month-to-month basis. Remember, inflation in core services make up over 60% of the total CPI, jumped from what now looks like a previous anomaly (+0.31% up from +0.13% in June.).

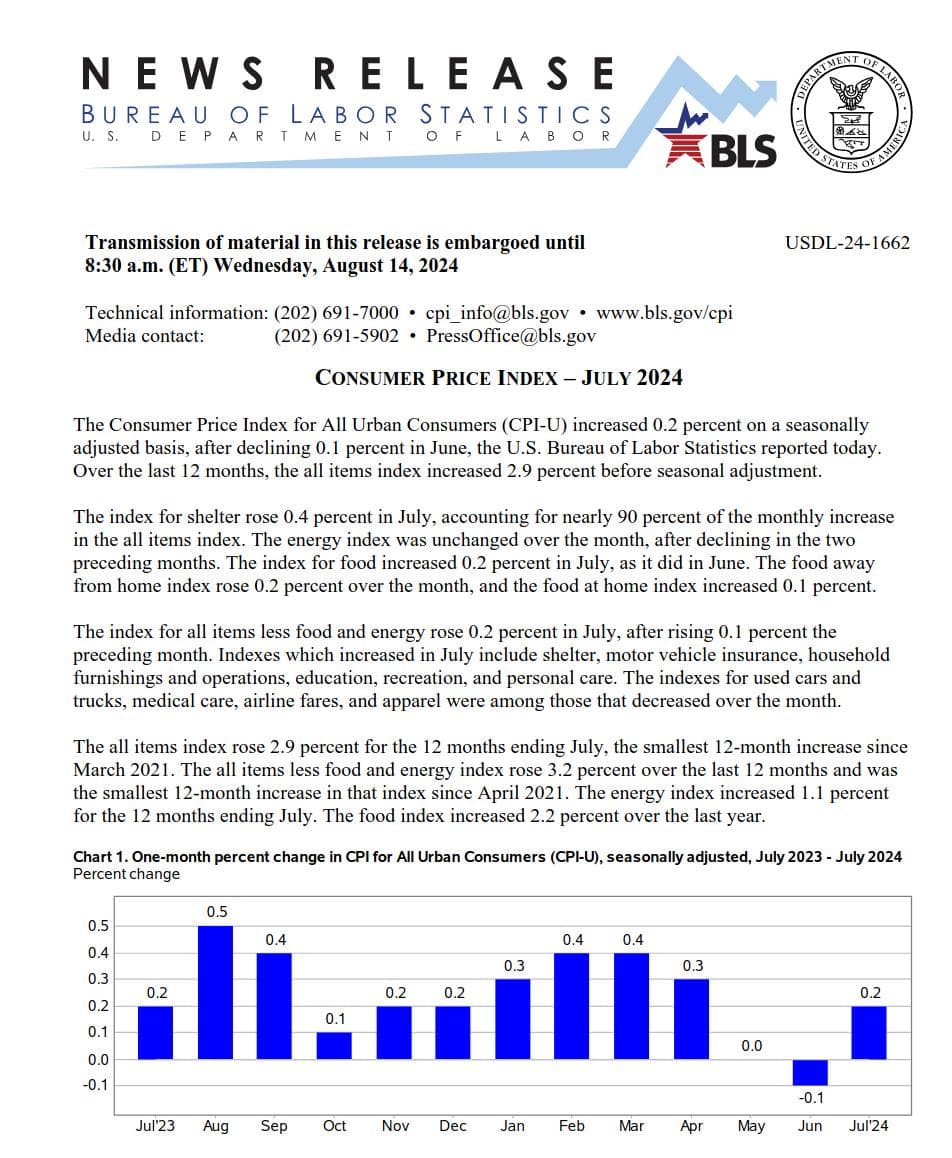

Meanwhile, food prices saw a slight increase; energy prices stabilized (aka stopped going down...); and the huge decline in durable goods prices decelerated, according to the Bureau of Labor Statistics July inflation report today.

The drop in durable goods is what carried this report and has corporate media celebrating 'easing inflation'.

However, inflation is proving just how 'transitory' it really is as it gears up for what appears to be another another leg up.

Month-to-moth:

- Core Services CPI: +0.31% up from +0.13% in June.

- Durable goods CPI: -0.30% less than June's decrease.

- Core CPI: +0.17% biggest jump since April.

- Overall CPI: +0.15% largest increase since April.

Year-to-year:

Core services CPI (green line in the chart below) jumped 4.9% year-over-year in July. Notice how since the end of 2023 it has held steady around 5%? At more than 60% of total CPI, it is still almost 300% higher than the Fed's 2% goal!

Durable goods CPI (purple line in the chart below) durable goods CPI fell by 4.1% year-over-year.

Core CPI (red line in the chart below and excludes food and energy), was upby 3.2% year-over-year.

Overall CPI (blue line in the chart below) was up 2.9% year-over-year, a slow deceleration from June. Since mid 2023, overall CPI has hovered at 3%. With the Fed stating they need to see sustained progress towards their 2% goal, how can they think about cutting rates in September when they have made 0 progress in a year getting CPI off of 3%?

TLDRS:

- Despite claims of "easing inflation," both the Consumer Price Index (CPI) and Core CPI increased on a month-to-month basis in July, signaling that inflation is not slowing down.

- Core services inflation, which represents over 60% of the total CPI, saw a significant rise, from +0.13% in June to +0.31% in July, while food prices slightly increased and energy prices stabilized.

- The decline in durable goods prices decelerated, contributing to a narrative of easing inflation, but the overall data suggests inflation remains persistent.

- Year-over-year, core services CPI increased by 4.9%, maintaining levels around 5% since late 2023, which is still well above the Federal Reserve's 2% target.

- With overall CPI hovering around 3% since mid-2023 and minimal progress toward the Fed's 2% goal, questions arise about the potential for interest rate cuts in September.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to hold or even increasing interest rates--causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.

While corporate media celebrates 'inflation easing', month-to-month CPI and Core CPI accelerated in July. Inflation is not easing!

by u/Dismal-Jellyfish in Superstonk

While corporate media celebrates 'inflation easing', month-to-month CPI and Core CPI accelerated in July. Inflation is not easing!https://t.co/ZrhoIZIfiF

— dismal-jellyfish (@DismalJellyfish) August 15, 2024