Reserve Bank of Australia Statement on Monetary Policy: "forecasts for both headline and underlying inflation over the year ahead have been revised higher" "The inflation forecasts out to 2025 have also been revised higher."

There are both upside and downside risks to the outlook for inflation. Domestic demand pressures on inflation could be more persistent than anticipated – for example, if growth in consumer spending or investment were stronger than forecast – and cost pressures on inflation could be accentuated by supply-side shocks from the conflicts abroad or the El Niño weather pattern. With inflation remaining high and forecast to decline more gradually than anticipated three months ago, inflation expectations might drift higher, which could further delay the return of inflation to the target range. Conversely, domestic demand pressures on inflation could ease faster than expected, particularly if some of the downside risks to consumption growth were to be realised, and global disinflationary pressures could be greater than assumed, particularly if downside risks to the outlook for global economic activity were to materialise.

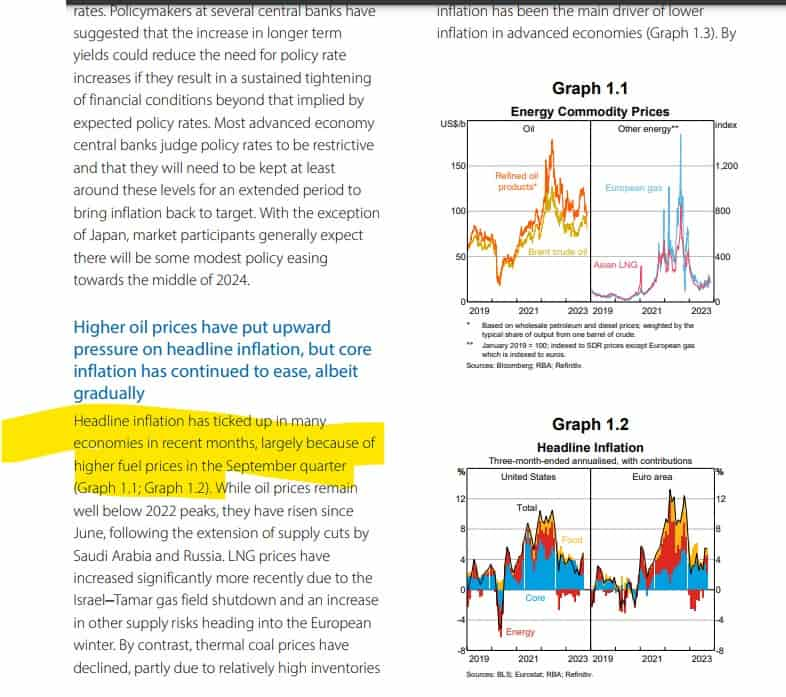

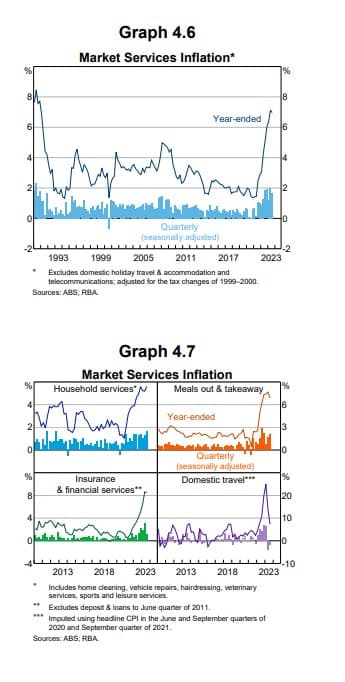

Persistently high inflation remains the major concern for central banks in advanced economies. Headline inflation has edged higher over recent months because of increases in fuel prices. Core inflation has continued to decline in year-ended terms, but progress has been gradual because core services inflation has been declining only slowly as demand for services has been relatively strong and labour markets have remained tight. The risk that inflation takes even longer to return to target has increased.

The weight of recent information suggests that the risk of inflation remaining higher for longer has increased. The updated forecasts have inflation in Australia higher in the near term and taking a bit longer to return to the top of the Bank’s target range. The forecasts assume a path for the cash rate that is in line with financial market pricing and market economist expectations, and therefore incorporate some increase in the cash rate. In addition, there is potential for further upside surprises to inflation, both because domestic inflationary pressures are persisting and because of external factors, such as potential global energy market disruptions and the prospect of higher food price inflation related to El Niño.

While it has been reassuring that medium-term inflation expectations have remained anchored to date, some measures have recently been edging up. These could rise further if upside risks to the forecasts were to materialise. Rising inflation expectations would add to inflationary pressures, especially if productivity growth remains subdued. This would require a prolonged period of below-trend growth, and lower employment, to reverse. It is important to avoid this given the significant costs involved, namely even higher interest rates and a larger rise in unemployment

High inflation remains the key challenge facing most central banks. After earlier declines, headline inflation rates have edged up again in many economies in recent months, driven mainly by higher fuel prices. Core inflation has eased further in year-ended terms, but progress has been gradual, largely because strength in core services inflation has been persistent.

"The outlook for global economic activity is uncertain, with risks tilted to the downside"

TLDRS:

Reserve Bank of Australia Statement on Monetary Policy:

- "forecasts for both headline and underlying inflation over the year ahead have been revised higher"

- "The inflation forecasts out to 2025 have also been revised higher."

- Reminder, while banks have the liquidity fairy, 'we' get the promise of more rate hikes this year, Atlanta Fed President Raphael Bostic yet again enrichens himself inappropriately from his position.

- To fix one end of their mandate (price stability) from the inflation problem they created, the US Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to raise interest rates--causing further stress to businesses and households.

- This places other central banks like the RBA in a bind.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.