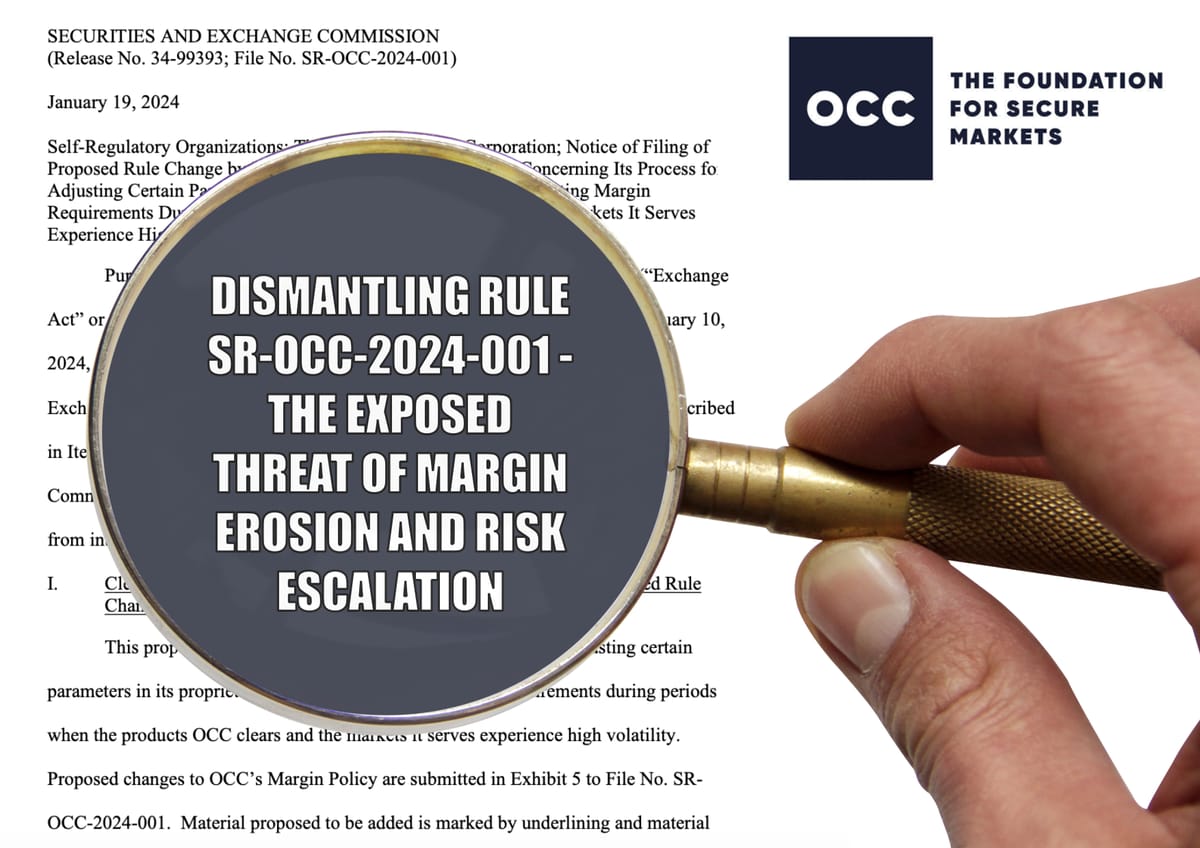

Dismantling Rule SR-OCC-2024-001 - The Exposed Threat of Margin Erosion and Risk Escalation

The OCC's recurrent use of idiosyncratic choices, adjusting margin requirements amid persistent market volatility, urgently raises concerns about systemic risks.