NFT Future Beckons Advocacy Action / UK Economic Secretary Fails to Champion Public Representation / CFTC Proposes Customer Fund Protection

NFT Future Beckons Advocacy Action / UK Economic Secretary Fails to Champion Public Representation / CFTC Proposes Customer Fund Protection

2024 has begun 💥 - and with it - a new year full of endless possibility and things to learn as we continue in our efforts to take back the markets and our freedom.

As there's always so many things deserving of our attention - it's hard to dedicate ourselves to everything all at once, so let's check out in brief what's been going on out there and what we can do to help out.

Breakdown Table of Contents as below:

- GSMP Update

- NFT Future/Advocacy

- UK CSD Responses/Contact

- CFTC Proposal/Comments

- Be Your Own Change (BYOC)

So we've had some pretty big news drop recently in regards to the GameStop NFT Marketplace - which you can check out here: https://nft.gamestop.com/

A close up for those in the back:

Disappointing - right?

Well fret not, as the saying goes; "Where there's a will, there's a way."

Although it seems there are a few more avenues to navigate here, updates like this can also be wonderful to highlight what steps we need to take next to help put things back on track - because MOASS isn't just going to be a victory as belonging to Gamestop alone, but each and everyone one of us here.

But it's understandable to feel a little disheartened by this news - Gamestop are trying to change things for the better - we all know that, and that's one of the reasons why we hold - and it's particularly confusing when faced with obstacles when we think about all the exceptional possibilities that NFTs bring.

I mean - there are any number of ways in which NFTs could change the world as we know it.

Here are just some examples as below:

As a result of this news - it highlights how important it is that we get involved regulatory matters that surround issues with the NFT Marketplace and do our part to help not only our company, but aid the future success of our investments - and so that starts with shifting our focus to what we can do in the regulatory space to help make that happen.

This is particularly important when linked with the subject of GME - as NFTs can also track and verify the authenticity and origin of physical goods through the supply chain.

AKA - Reduces the risk of counterfeiting. Like say, in the case of stocks.

Harnessing the potential of Non-Fungible Tokens (NFTs) to track and verify the authenticity of physical goods, especially in the context of stocks, offers a transformative solution for addressing issues like abusive naked short selling in financial markets.

By leveraging blockchain's inherent features of transparency, immutability, and decentralised governance, this system ensures the authenticity and origin of shares. NFTs authenticate ownership, preventing counterfeit shares and providing a clear transaction history. Smart contracts enforce regulatory compliance, and real-time settlement reduces windows for manipulative practices. This innovative application of technology not only enhances market integrity but also streamlines processes, offering a more secure and accountable financial ecosystem. Advocating for this shift towards blockchain-based share representation becomes crucial for fostering a fair, transparent, and resilient financial landscape.

Losing the the ability to use NFTs would be detrimental in the fight against corruption, rehypothecation, and illegal short sales in the crypto world. A robust crypto alternative is crucial for transparency and fairness. Public ledgers and smart contracts ensure everyone operates on a level playing field, preventing the creation of assets out of thin air, as seen in Bitcoin and Ethereum. This safeguards against rehypothecation, and proper regulation can help prevent unethical short-selling practices, making the financial system more secure and ethical.

Now more than ever - it's an important time to get involved with more regulatory matters to make sure that we can pave the way for GameStop to assist in rebuilding the structure of our financial markets.

Taking as example the advocacy work as already being done by Coinbase:

You can check out more here: https://www.coinbase.com/public-policy/advocacy/standwithcrypto - with much appreciation to Dismal-Jellyfish for the information as shared as above 🙏

But we'll explore this in a separate post later on.

In the interim, finding motivation and inspiration becomes crucial as we strive to defend, protect, and advocate for a world where Gamestop and the burgeoning NFT era can flourish.

Let's initiate efforts now to tackle regulatory uncertainties head-on, working collaboratively to pave the way for the future we want to see exist.

Taking a proactive stance will not only address challenges but also contribute to creating an environment conducive to the success of innovations we passionately support

We have the power to pave the way in how we want the future to look and the time to do it is now.

Let's get involved today!

You may have seen the work we have been doing to discuss the various antics as going on in the UK at the moment, particularity surrounding the UK Government's recent attempt to digitise the ways in which UK asset owners hold their shares.

Unfortunately, the Taskforce overseeing this are advocating for a model that would mandate the removal of ownership of shares as they are transferred into a Central Securities Depository (CSD).

This isn't good.

In light of this, investors have been regularly engaging with both their MPs and the Taskforce, striving to be a part of the ongoing discussions as it is paramount to ensure that the democratic voice of the public is well-represented in these crucial conversations.

And in brilliant news (!!) we've seen an abundance of UK shareholders reaching out to their MPs to gain further clarification on these ongoing matters, which we have explored in these posts here & here.

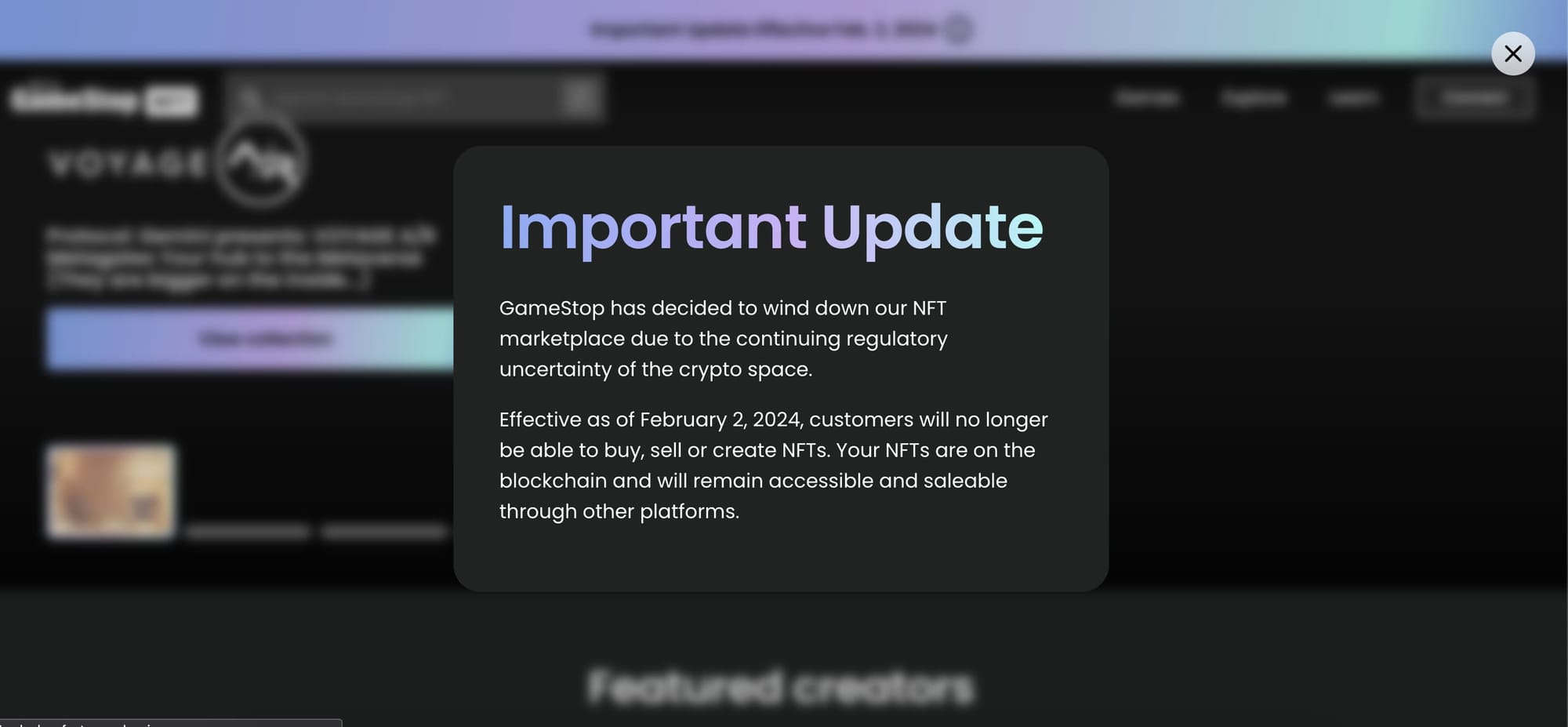

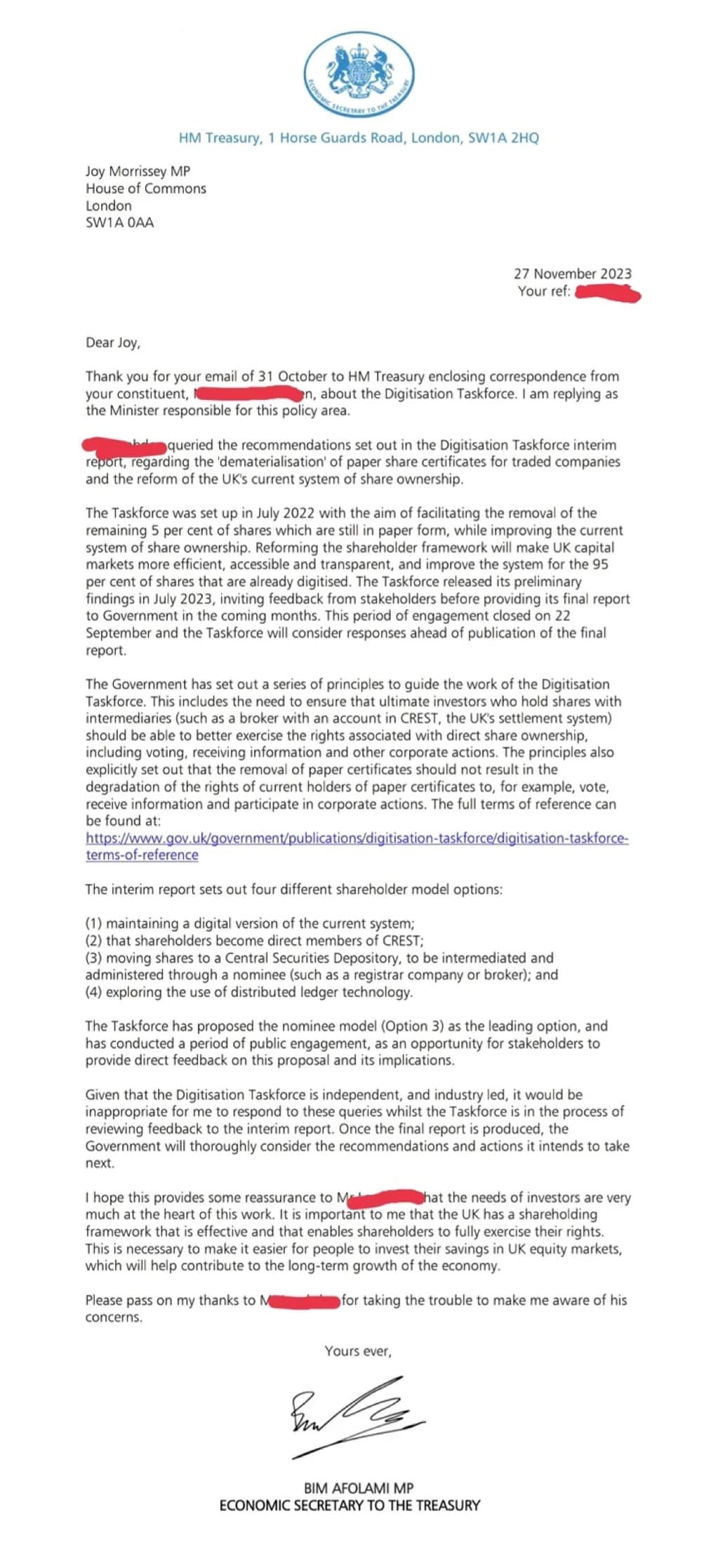

Which has resulted in responses from the UK Economic Secretary himself, Bim Afolami:

If you want to check out more about his work independent of his role as Economic Secretary and why his name has been hitting the headlines, you can check out more in this post here.

Let's check out some of the responses we've seen posted since the start of the new year.

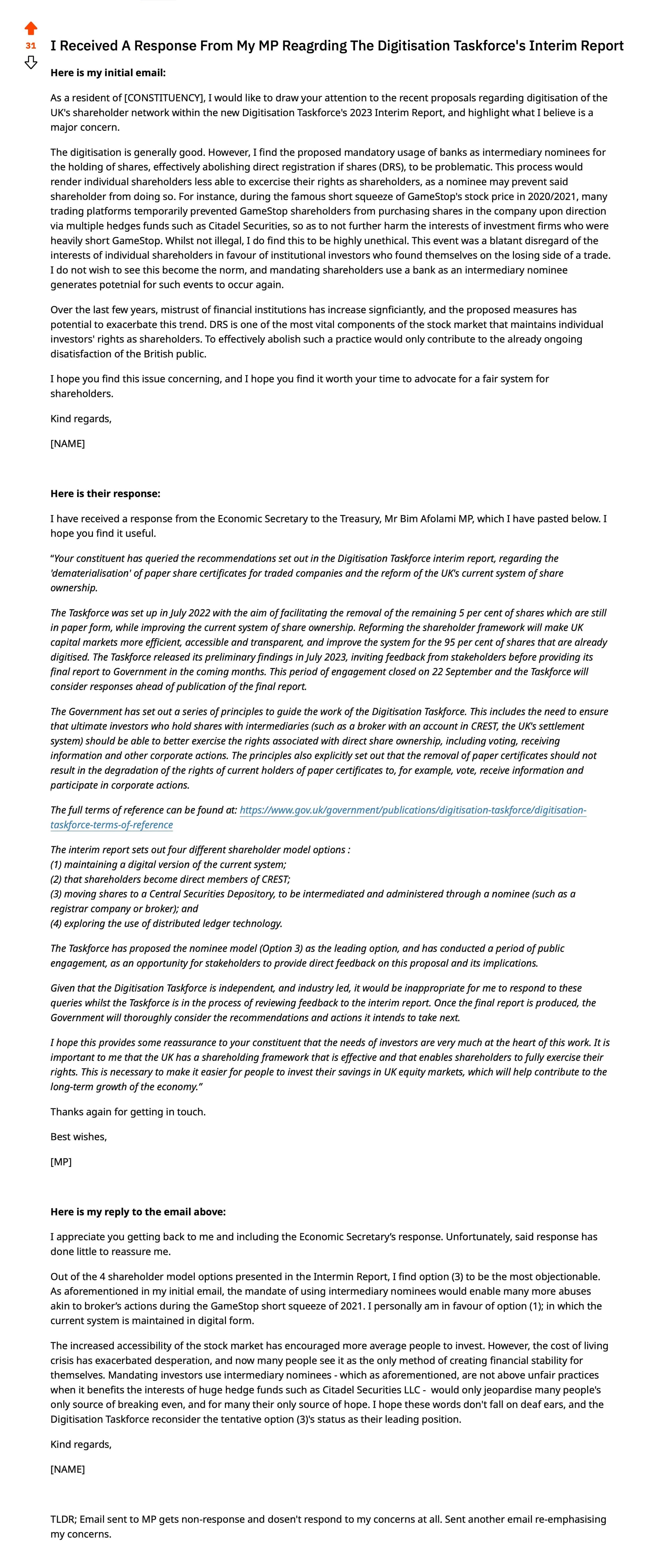

Please find the original post here.

Unfortunately, in response to the aforementioned concerns, Bim Afolami, the Economic Security representative, claims that due to the Taskforce operating independently from the HM Treasury, it would be "inappropriate' for him to respond."

Which simply isn't true.

The core issue at hand is our request for inclusion in the ongoing discussions within the Taskforce. As affected stakeholders, we want to ensure that the findings presented in the finalised report accurately mirror the needs and desires of the stakeholders impacted by these proposals.

Given that the UK Digitisation Taskforce was initiated by the UK Chancellor, it is considered appropriate for government bodies, such as the Economic Secretary, to engage with said Taskforce if it becomes apparent that it is failing to consult and involve those it seeks to represent.

Encouraging citizens to sit and wait for the Government's decisions based on a finalised report, risks sidelining the active representation and input of the very individuals they are meant to serve.

And in fostering a transparent and participatory approach, the Taskforce not only upholds democratic principles but also reinforces the legitimacy and credibility of the proposed changes, ensuring they align with the genuine needs and aspirations of the community.

So why isn't our input allocated the value that it deserves?

It's all very disappointing, isn't it?

It poses the question: Why is the UK Public's needs and wants being relegated to a secondary status, subservient to what the government deems as the appropriate course of action?

But alas, we persist in our efforts to push for engagement so that the benefit of our insight can influence the final report, as its objective is stated to:

'... drive forward the full digitisation of the UK shareholding framework by eliminating the use of paper share certificates, and in general seeking to improve the UK’s intermediated system of share ownership.' pg. 2

However, achieving this transformative goal necessitates direct input from those who will be directly impacted. Our ongoing advocacy aims to ensure that the stakeholders' perspectives are integral in shaping the conclusive recommendations for the future of the UK shareholding framework.

Like here -

Please find the original post here.

Yet again - we're being told to sit tight and do nothing and let the Government to take charge.

Why are we being denied active representation and inclusion?

The Government exists to serve us, and we aim to remind them of this.

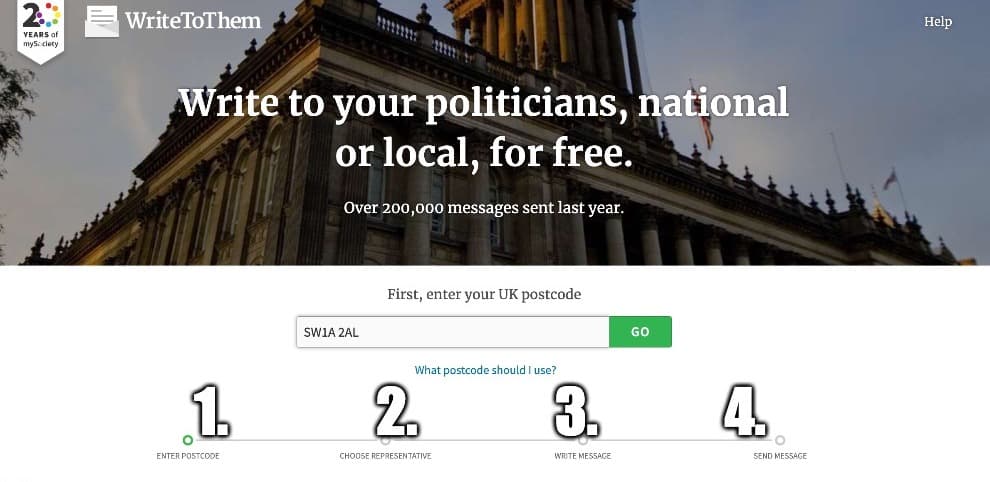

Here's a easy way to contribute.

If you are a UK resident - you can click on the link below to locate your local MP Representative.

https://www.writetothem.com/

Follow the instructions - it's just four easy steps:

- Enter Postcode

- Choose Representative

- Write Message

- Send

And that's it.

Taking these quick and easy steps is important to protect the well-being of YOUR shares. Let's work together to safeguard DRS, ensuring your that your assets are securely held in your legal name.

And what's better? You can call them directly too.

☎ RING

☎ RING

☎ HELLO? ADVOCACY FOR SHAREHOLDER RIGHTS CALLING!

If you prefer to speak to someone directly, well good news - it's super easy to do, just follow this link:

https://members.parliament.uk/FindYourMP

Here's a talking template as below:

Feel free to amend/change/update in any way that best suits your needs and preferences.

☎ Hello [MP's Name],

☎ I'm [Your Name], a resident in your constituency.

☎ Especially concerning is the impact on shareholder empowerment with the proposed opt-in system. Holding shares in our legal names is crucial for autonomy. Directly registered shares (DRS) on the primary register are vital, and their sanctity should not be threatened.

☎ As investors, we seek an inclusive and transparent decision-making process. We want to be actively consulted and engaged in the report, which is currently lacking.

☎ I'm calling to formally request your support in advocating for these concerns and our continued involvement within the taskforce. We want the final report to truly reflect our needs and wants. Your support can contribute to a fair outcome for investors in our community. I appreciate your attention to this matter.

☎ Thank you for your time, and I look forward to hearing your thoughts on this matter.

Remember to be kind when you call - we're trying to positively influence the process, not make enemies 🙏

If you would like letter templates or further talking points to help you - why not check out this post here which has all the detail you need to get you started.

Power to the shareholders! 🚀

This is something everyone can get involved with. 🌎

There is always lots going on in the world of rules and regulation - and so we turn our attention and focus to what's happening in the US Financial Markets -

CFTC Protection of Clearing Member Funds Held by Derivatives Clearing Organizations

Courtesy of the most excellent Dismal-Jellyfish, check out the below:

I appreciate that it's a lot to read, and if you're anything like me, simplicity helps. So, here's a breakdown to make it more pleasantly digestible:

The Key Points:

The Commodity Futures Trading Commission (CFTC) is suggesting some new rules to make sure that if a company that handles financial transactions (called a Derivatives Clearing Organization or DCO) goes bankrupt, the money of the people who use its services (clearing members) is properly protected.

Keeping Money Safe:

- The proposed rules say that the money belonging to the people who use the DCO's services should be kept separate from the DCO's own money. This separation is meant to ensure that even if the DCO faces financial problems, the customers' money remains safe.

International Transactions:

- The rules also suggest allowing the DCO to keep money in foreign banks under certain conditions, expanding where they can store the money.

Checking and Balancing:

- The DCO would have to regularly check if they owe any money to their customers and ensure that they have enough money to cover it.

Extra Protection for Clearing Members:

- The rules want to provide additional safeguards for a type of money called "proprietary funds," which belongs to the companies that use the DCO's services. This extra protection is to make sure these funds are kept safe in case the DCO goes bankrupt.

Preventing Misuse:

- The rules explicitly state that the DCO or the bank holding the money can't use this special type of money for anything other than what it's intended for.

Documenting and Checking:

- The DCO has to get a letter from the bank confirming that the special funds belong to the companies using the DCO's services. Regular checks are also required to ensure the right amount of this special money is always available.

Bankruptcy Protection:

- In case the DCO goes bankrupt, the rules make sure that the money owed to the companies using its services gets repaid first before other debts are settled.

The government is suggesting new rules to make sure that if a company handling financial transactions faces financial issues, the money belonging to the people using its services is kept safe.

The rules include keeping customers' money separate, allowing the company to store money abroad, and implementing checks to ensure proper handling.

Extra protections are proposed for certain funds, preventing their misuse. In case the company goes bankrupt, the rules prioritise repaying money owed to customers before other debts.

If you're someone involved in financial transactions or you use the services of a company that handles these transactions (like a brokerage or a bank), these rules are meant to protect your money in case the company faces financial difficulties.

The CFTC is asking for public opinions (comments) on these rules. If you have thoughts on how these rules could be better or if you're concerned about something, sharing your opinion can help shape the final rules in a way that's fair and sensible.

Extra protection is always a good thing - so let's do our part to make it happen.

- CFTC Comments Portal: Visit https://comments.cftc.gov, find the link for this specific rulemaking under “Submit Comments,” and follow the instructions provided on the Public Comment Form.

- Mail: Address your comments to Christopher Kirkpatrick, Secretary of the Commission, Commodity Futures Trading Commission, at Three Lafayette Centre, 1155 21st Street, NW, Washington, DC 20581.

- Hand Delivery/Courier: Deliver your comments to the same address as for mail submissions, following the same guidelines.

- Choose Only One Method: Submit your comments through only one of the above methods. Submissions via the CFTC Comments Portal are particularly encouraged.

- Language Requirement: Comments should be in English. If submitted in another language, they must be accompanied by an English translation.

- Public Posting: Comments will be posted as received on https://comments.cftc.gov.

- Only submit information you are comfortable making public.

- Moderation and Accessibility: The Commission reserves the right to review, prescreen, filter, redact, refuse or remove any submission deemed inappropriate for publication, such as those containing obscene language.

- However, all submissions, even those redacted or removed, that contain comments on the merits of the rulemaking will be retained in the public comment file.

- They will be considered as required under the Administrative Procedure Act and other applicable laws, and may be accessible under the FOIA.

If you want to read more about this topic and indeed lots of other important and equally interesting developments out there in the financial markets, please do check out this wonderful post here:

https://dismal-jellyfish.com/catching-up-from-being-away/

Change starts with us.

While many of us may be stretched thin with responsibilities and work, driving change requires us to take the lead. Instead of asking what our company can do for us, let's consider what we can do for our company. Together, we can safeguard our investments by advocating for equality in our financial markets.

Let's be the catalysts for positive change.

Be Breathtaking. Get involved.

That's all folks.

Be excellent to each other.