New York Fed President John Williams: "I personally don’t think it was the case that the pace of rate increases was really behind the issues at the two banks back in March". Counterargument that it is the Fed's fault detailed inside.

Sources:

New York Fed President John Williams. He is also vice-chairman of the rate-setting Federal Open Market Committee

Comments from a moderated discussion organized by the Economics Review at New York University:

- “I personally don’t think it was the case that the pace of rate increases was really behind the issues at the two banks back in March,”

- “I think it’s well understood there were some pretty idiosyncratic specific issues with those institutions.”

- “You’ve seen that in the past where credit conditions may tighten somewhat,” Williams said, noting that this could affect spending and employment. “We don’t really know whether this will happen this time. We haven’t seen any clear signs yet of credit conditions tightening and we don’t know how big those effects will be.”

- “In the end, I don’t worry too much especially about market expectations well off into the future, because it could be that there’s different views of how the economy may perform,” he said. “At the end of the day we need to make the decisions we think are the right ones to achieve our goals of maximum employment and price stability.”

- "I don't really worry about” the divergence, Williams said. "I think part of it is because there is an expectation among many market participants and economists that the economy's going to slow even more than I expect."

- Williams also reiterated that he believes inflation, now at around 5%, will come down slowly over time and will ease to 3.75% this year and will likely ebb to the 2% target by 2025. Williams said that he also sees a gradual rise over time in unemployment from the current low 3.5% to between 4% and 4.5%.

Counterargument:I believe Williams is wrong and have worked to show the counterpoint (the Fed is responsible) by reviewing the Fed's guidance and actions taken since SVB failed.

https://www.federalreserve.gov/faqs/what-is-forward-guidance-how-is-it-used-in-the-federal-reserve-monetary-policy.htm

'When central banks provide forward guidance, individuals and businesses will use this information in making decisions about spending and investments.'

Why does this matter?

People make financial decisions based on this guidance from the Fed. Every quarter, the Fed publishes rate forecasts for the future. Back in December 2020 their median estimate for 2023 the federal funds rate was 0.1%:

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20201216.pdf

FOMC Dot Plot

The FOMC (Federal Open Market Committee) dot plot, alternatively called the Fed’s dot plot, is a chart that summarizes the FOMC’s outlook for the federal funds rate. It is published quarterly and watched closely by investors and economists for indications on the future trajectory of the federal funds rate.

In these dot plots, we can see guidance was low through 2021

What is the Federal Funds rate today?

That's right, Inflation has it at 5.00%, only off by a factor of ALMOST 50X!!! Any bank(s) that followed this guidance have been CRUSHED.Fed Gov. Michelle Bowman on this 'phenomena':

My general point is that inflation is much too high, and the outlook for inflation remains significantly uncertain. This uncertainty makes it very challenging to provide precise guidance on the path for the federal funds rate.

It is important to note that the degree of specificity contained in the Committee's forward guidance comes with tradeoffs. Explicit forward guidance hasn't always been viewed as a helpful addition to the monetary policy toolkit, particularly before the 2008 financial crisis. Before that time, while there was some acknowledgement that forward guidance could meaningfully affect financial conditions, there was a great deal of concern about the "costs and risks" of providing this type of guidance

I will focus here on two features of our current environment that I see as especially relevant for assessing the role of explicit forward guidance as a monetary policy tool in the current conduct of monetary policy. The first is that with inflation unacceptably high and the resulting urgent need to remove monetary policy accommodation, the federal funds rate is no longer near zero. The Committee can now indicate its intended stance of monetary policy through changes to the target range for the federal funds rate—its stated primary tool of monetary policy—rather than relying on more unconventional monetary policy tools, such as forward guidance and balance sheet policy, to serve as the main indicators of the stance of monetary policy. The second is that the outlook for inflation and economic activity is especially uncertain, with significant two-sided risks. Gone are the days when the risks to the outlook were skewed to the downside, especially with respect to inflation. And two-sided risks to economic activity are also widely recognized by the public, with press reports of an overheating labor market often featured alongside discussions of high or rising recession risks.

In our current environment, I view the benefits of providing explicit forward guidance as lower than they were in the years immediately after the 2008 crisis. Given that the federal funds rate is now well above zero, the FOMC can communicate changes in the stance of monetary policy through changes in the target range for the federal funds rate and not rely on explicit forward guidance as it did when the federal funds rate was at the effective lower bound.

The Committee's experience in the second half of last year illustrates this point. Looking back, one might reasonably argue that during that time the Committee's explicit forward guidance for both the federal funds rate and asset purchases contributed to a situation where the stance of monetary policy remained too accommodative for too long—even as inflation was rising and showing signs of becoming more broad-based than previously thought. The facts on the ground were changing quickly and significantly, but the communication of our policy stance was not keeping pace, which meant that our policy stance was not keeping pace.

Of course, the fact that some of the data that were directly relevant to our decision-making did not accurately reflect the economic conditions prevailing at the time—and which were subsequently revised—likely also led to a delay in the removal of monetary policy accommodation in 2021.

Remember, the same people forecasting these rates are SETTING these rates and they themselves called out this 'led to a delay in the removal of monetary policy accommodation in 2021'.

What does all this buying going underwater look like though? They said rates would stay low and folks kept buying all the bonds. However, by rapidly raising the federal funds rate over the course of the year form near 0 to 5.00%, many portfolios have become upside down:

$+600 BILLION in unrealized losses!!!

About 'Held-to-Maturity' Securities:

https://www.eidebailly.com/insights/articles/2022/4/rising-rates-and-considerations-for-held-to-maturity-classification

https://www.eidebailly.com/insights/articles/2022/4/rising-rates-and-considerations-for-held-to-maturity-classification

https://www.eidebailly.com/insights/articles/2022/4/rising-rates-and-considerations-for-held-to-maturity-classification

This caught the attention of the FDIC:

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/fdic-worried-about-growing-unrealized-losses-in-us-banks-bond-portfolios-73330606

FDIC Chairman Martin Gruenberg begins finger pointing at the Fed in speech 3/6/23 (https://www.reddit.com/r/Superstonk/comments/11o9793/fdic_alert_fdic_chairman_martin_gruenberg_begins/):

'unrealized losses weaken a bank’s future ability to meet unexpected liquidity needs' 'especially when interest rates change to the extent they have over the past year'

https://www.fdic.gov/news/speeches/2023/spmar0623.html

https://www.fdic.gov/news/speeches/2023/spmar0623.html

4 days later SVB first to blow:

What has happened since SVB has failed:

From the Joint Statement by Treasury, Federal Reserve, and FDIC:

After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

The Fed will pay for this:

the Federal Reserve on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all depositors.

Sometime in the future, FDIC charges the banks for the losses and gives it back to the Fed?:

“Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.”

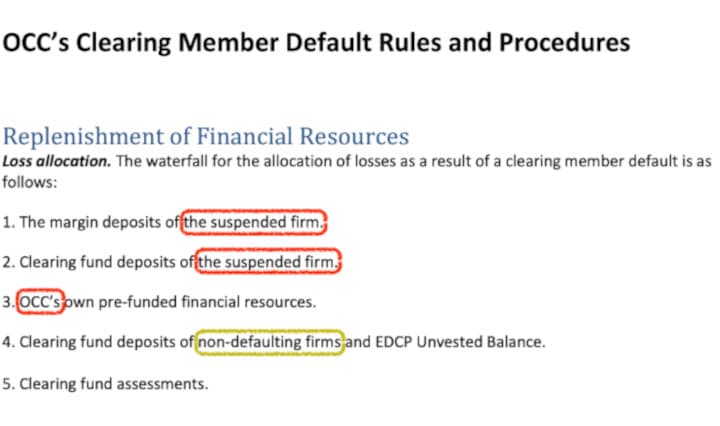

Order of events (I think based on the statements linked) for failed banks:

- Fed gives money to FDIC as they need it

- THE FDIC makes deposits available (like they have done today for SVB)

- FDIC sells the assets of the shutdown bank (will take time)

- The FDIC's loss is the difference between cost of bailout to the depositors and the proceeds of the sales from step 3

- The FDIC charges other banks a “special assessment on banks, as required by law" to cover any differences in step 4

- The FDIC pays back the Fed?

For other banks, Bank Term Funding Program (BTFP) AKA the Fed making sure collateral never loses value:

The Fed is making available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. The Federal Reserve is prepared to address any liquidity pressures that may arise.

- Offering loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral.

- These assets will be valued at par.

The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution's need to quickly sell those securities in times of stress.

With approval of the Treasury Secretary, the Department of the Treasury will make available up to $25 billion from the Exchange Stabilization Fund as a backstop for the BTFP. The Federal Reserve does not anticipate that it will be necessary to draw on these backstop funds.

Banks no longer have to book a loss and sell assets they are underwater on to cover deposit outflows but instead can borrow from the Fed against their underwater assets at par value (NOT CURRENT MARKET).

TLDRS:New York Fed President John Williams doesn't believe the Fed's rate hikes led to issues with SVB and Signature bank.I believe Williams is wrong and have worked to show the counterpoint (the Fed is responsible) by reviewing the Fed's guidance and actions taken since SVB failed.

The same people forecasting the Federal funds rates are SETTING the rates and they rug pulled everyone with their actions vs guidance and had to rapidly raise interest rates (and set the process off of breaking everything) because of inflation. I believe inflation is the match that has been lit that will light the fuse of our rocket.