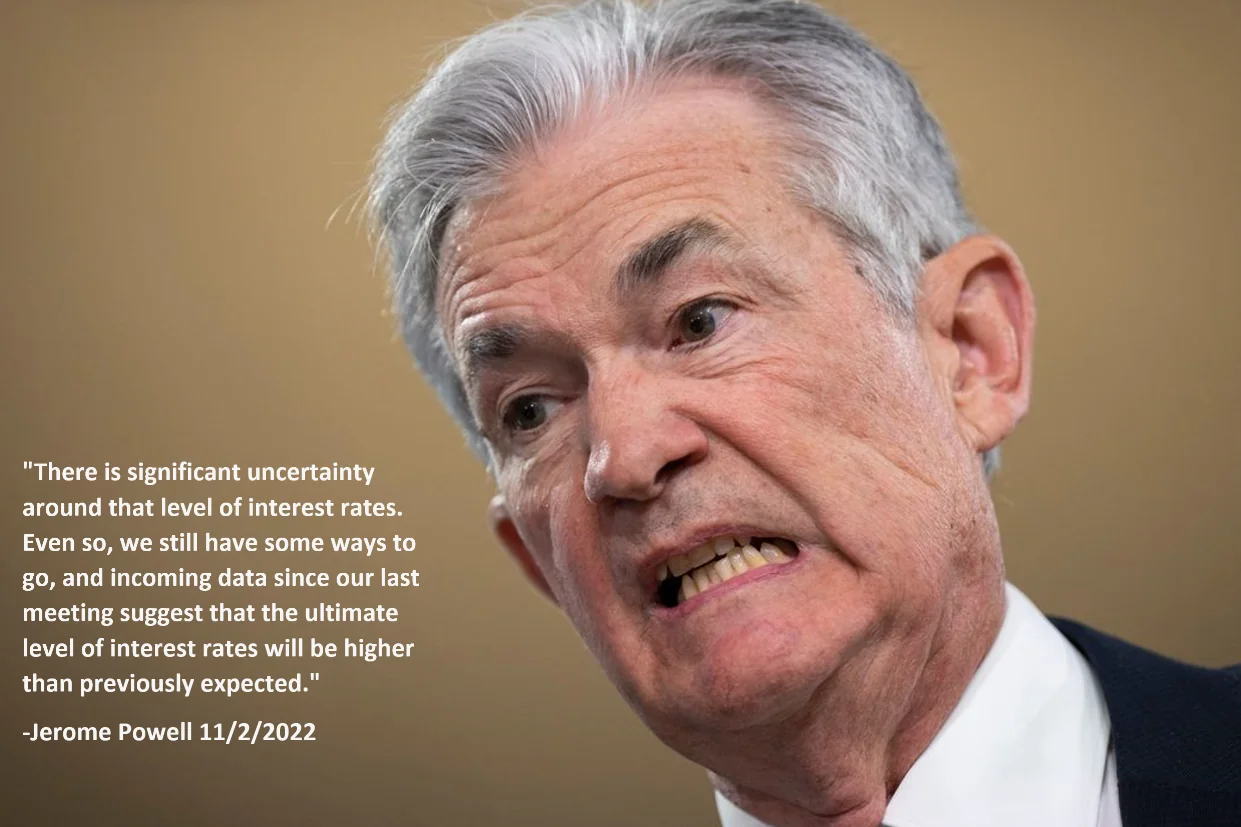

Inflation Alert! Revisiting data that made JPow say: There is significant uncertainty around that level of interest rates.

Revisiting data that made JPow say: "There is significant uncertainty around that level of interest rates. Even so, we still have some ways to go, and incoming data since our last meeting suggest that the ultimate level of interest rates will be higher than previously expected."

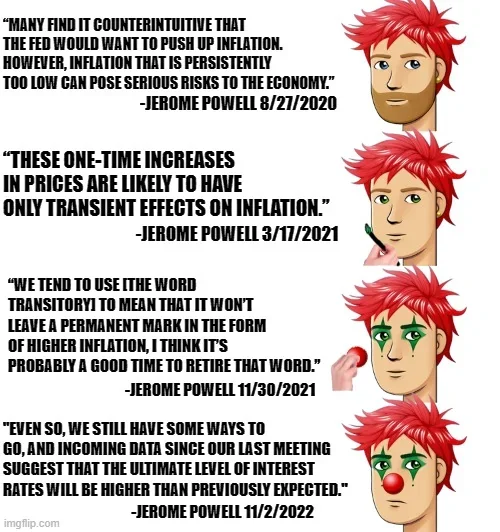

Before diving into the data and JPow's quote that 'ties' it all together, I would like to level set with some context:

- The Federal Reserve has been given a dual mandate by congress—pursuing the economic goals of maximum employment and price stability.

- The Fed and JPow in the past have stated 'price stability' is inflation at the rate of 2 percent, as measured by the annual change in the Price Index for Personal Consumption Expenditures (PCE).

- The Fed views maximum employment as the highest level of employment that the economy can sustain over time. The Fed does not have a numerical target for the level of employment; rather, the Fed analyzes economic conditions.

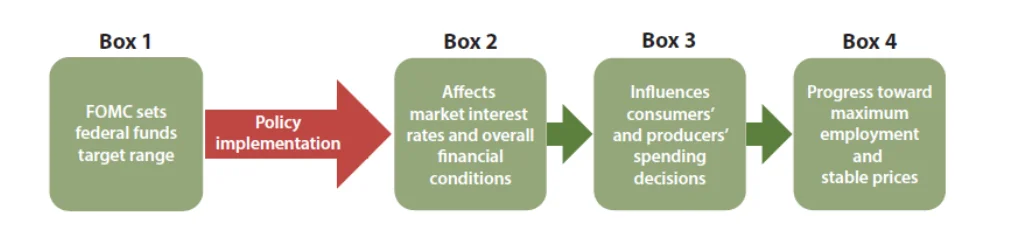

- The federal funds rate ( the rate that banks pay for overnight borrowing in the federal funds market ) is the Fed’s policy rate, which means it is the rate the Fed chooses to target to achieve its policy goals–the dual mandate.

- Changes in the federal funds rate influence other interest rates that in turn influence borrowing costs for households and businesses as well as broader financial conditions.

- The Federal Open Market Committee (FOMC) sets the target range for the federal funds rate with the upper and lower limits on the range

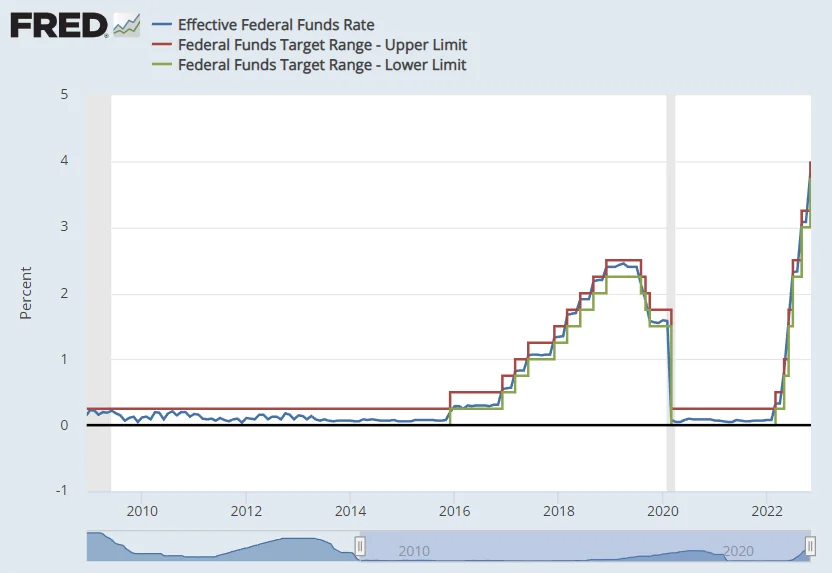

- To fight inflation, FOMC has been raising the federal funds rate.

- However, when interest rates go up, it becomes more expensive to borrow, so businesses are generally unwilling to add more workers and may have to reduce headcount to account for increased costs.

- This generally places downward pressure on employment and wages

- Rates have been going up:

All of which brings us back to JPow's quote, so what incoming data has him concerned?

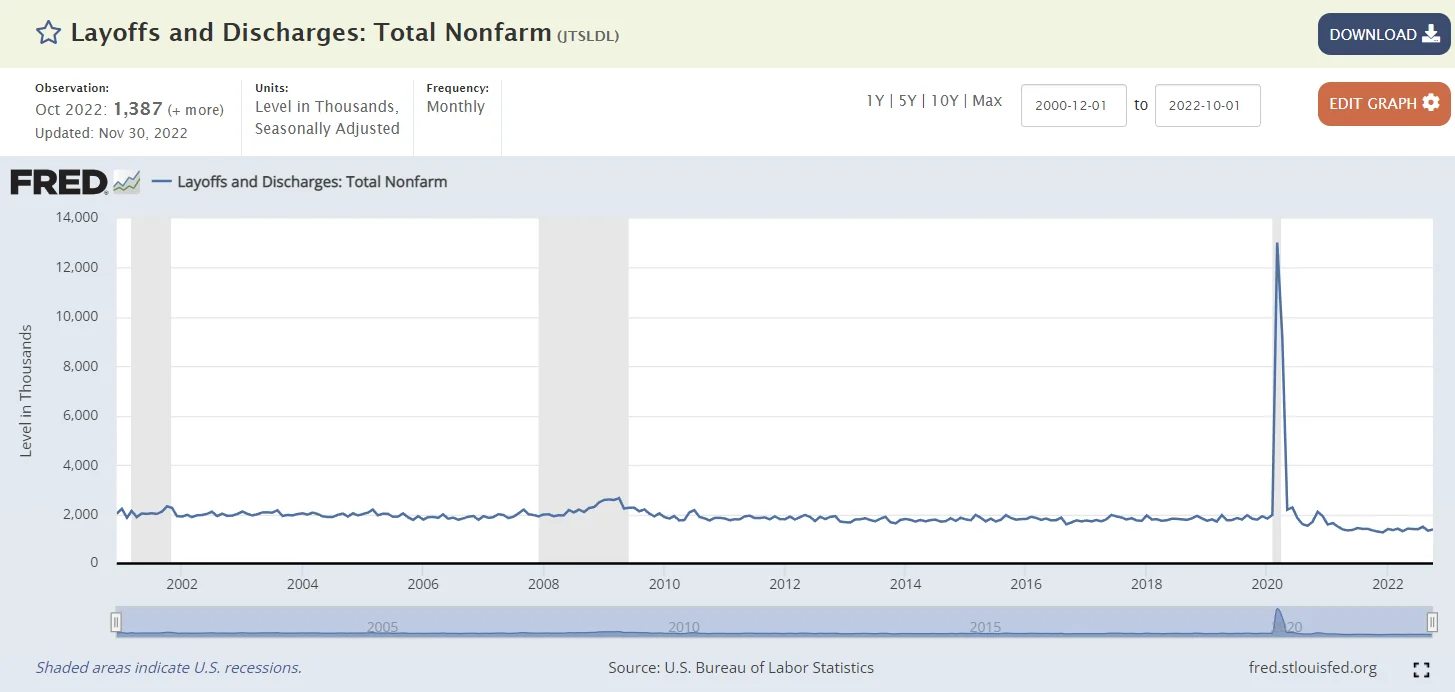

1. Employment is strong

ADP employment report (level change):

In his speech yesterday, JPow called the labor market out as too tight:

In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all.

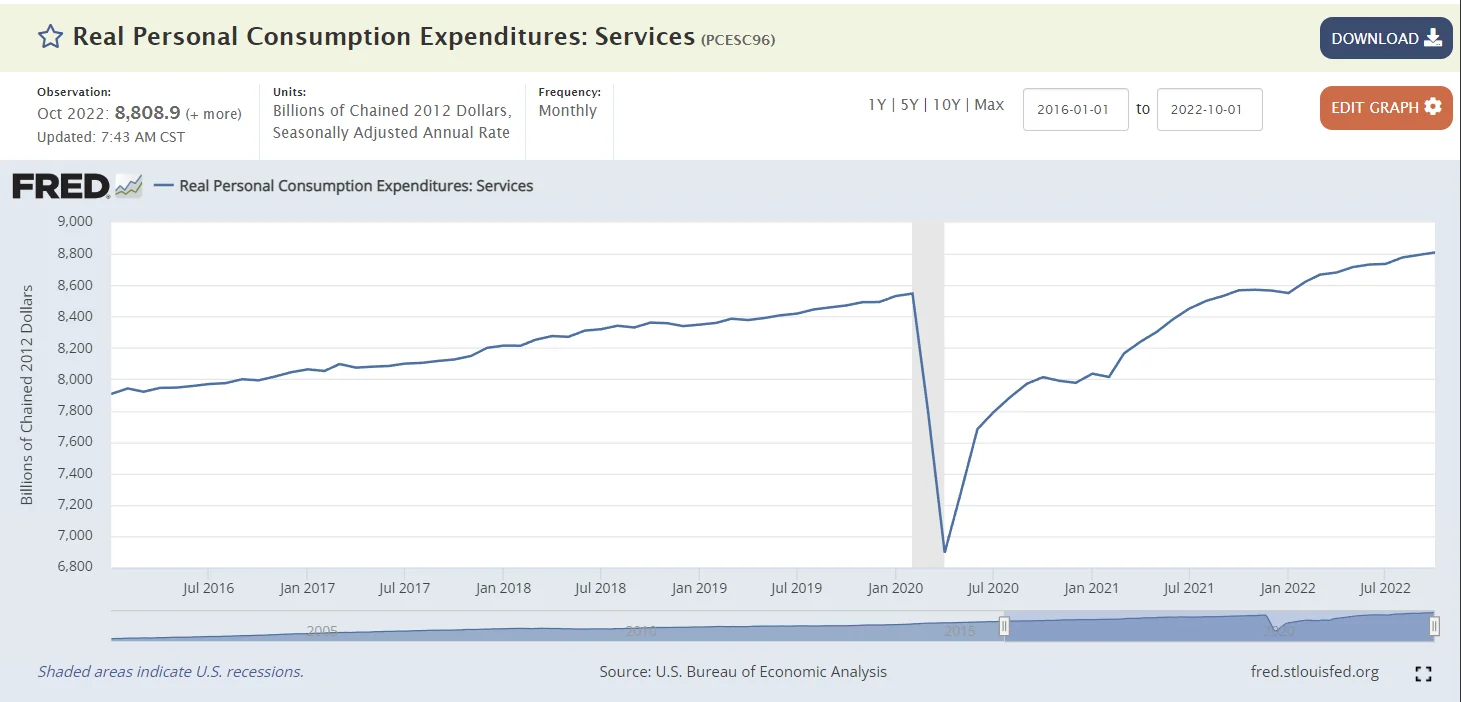

Finally, we come to core services other than housing. This spending category covers a wide range of services from health care and education to haircuts and hospitality. This is the largest of our three categories, constituting more than half of the core PCE index. Thus, this may be the most important category for understanding the future evolution of core inflation. Because wages make up the largest cost in delivering these services, the labor market holds the key to understanding inflation in this category.

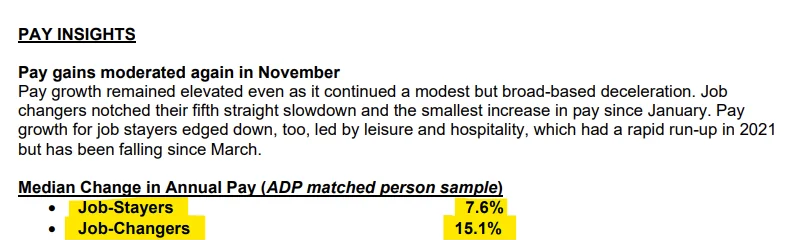

In the labor market, demand for workers far exceeds the supply of available workers, and nominal wages have been growing at a pace well above what would be consistent with 2 percent inflation over time. Thus, another condition we are looking for is the restoration of balance between supply and demand in the labor market.

Currently, the unemployment rate is at 3.7 percent, near 50-year lows, and job openings exceed available workers by about 4 million—that is about 1.7 job openings for every person looking for work (figure 5). So far, we have seen only tentative signs of moderation of labor demand.

Wage growth, too, shows only tentative signs of returning to balance. Some measures of wage growth have ticked down recently. But the declines are very modest so far relative to earlier increases and still leave wage growth well above levels consistent with 2 percent inflation over time.

Finally, the labor market, which is especially important for inflation in core services ex housing, shows only tentative signs of rebalancing, and wage growth remains well above levels that would be consistent with 2 percent inflation over time. Despite some promising developments, we have a long way to go in restoring price stability.

Reviewing employment data released yesterday:

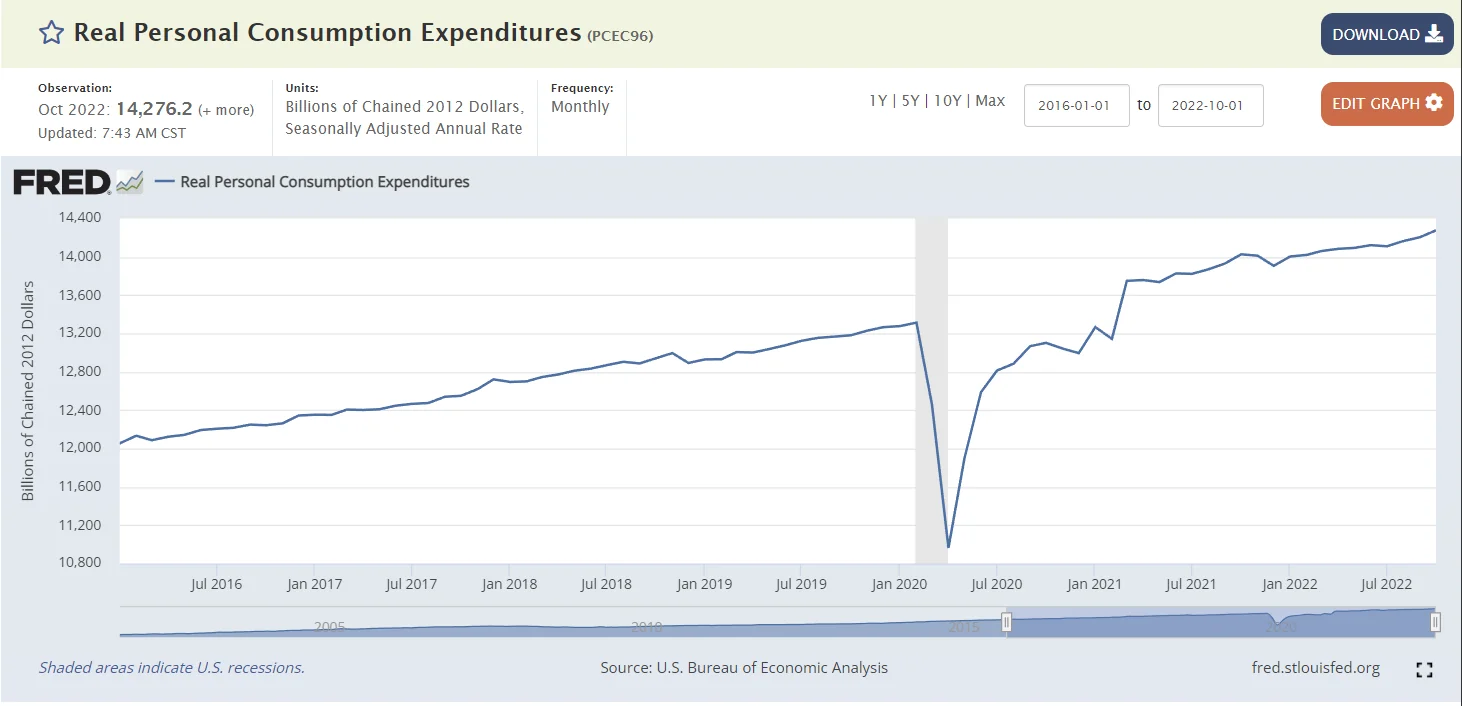

2. Spending is outpacing inflation

Consumer spending on goods and services, adjusted for inflation, was up 0.5% in October from September, seasonally adjusted, the biggest month-to-month increase in a year.

Furthermore, spending on services was up .2% (2.8% from last year). This is a biggie as services account for OVER 60% of total consumer spending!

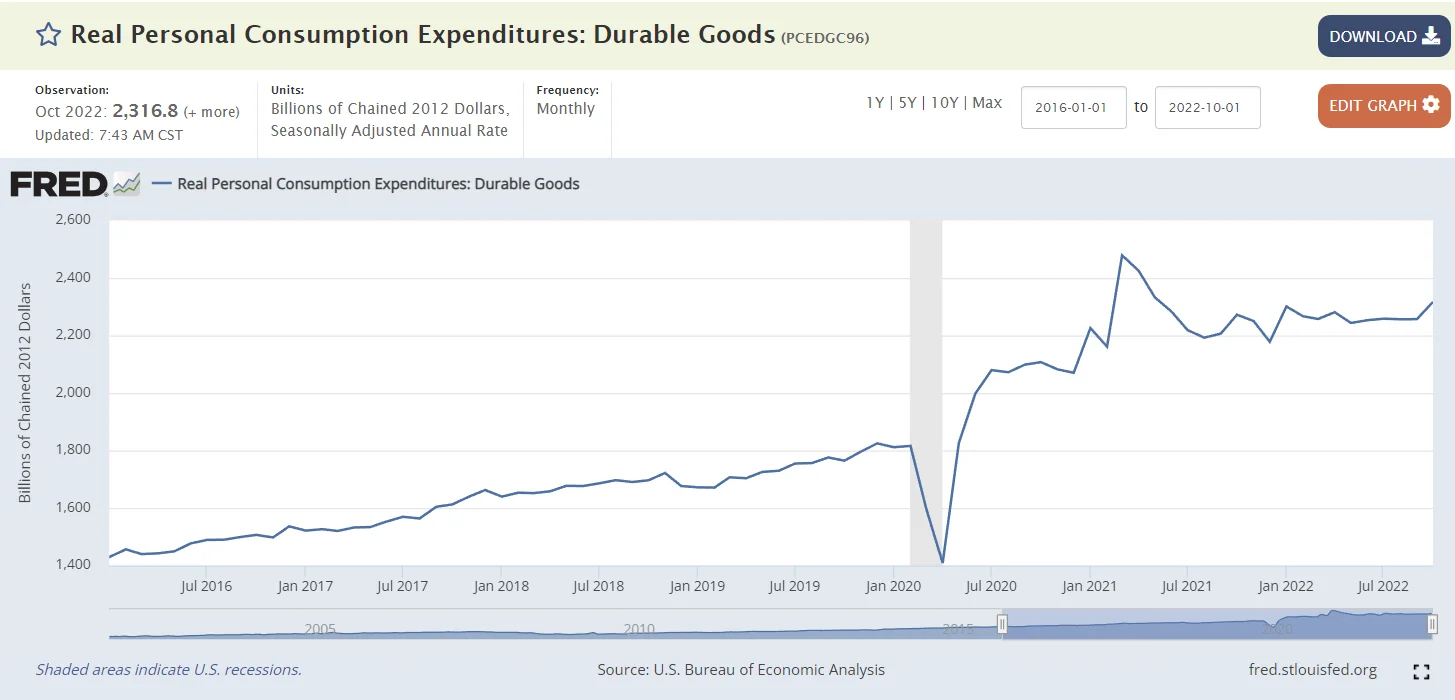

When it comes to 'things' people are still buying all sorts of durable goods--up 2.7% for the month and 2% for the year. In terms of inflation-adjusted “chained 2012 dollars , only the stimulus check 'fueled' run in 2021 is higher!

Nondurable goods (gas, food,etc) also continues to increase:

As we can see from above, the labor market by most major metrics is primed to continue feeding into inflation (and further upsetting price stability--wage-price spiral anyone?).Speaking of price stability, consider this calendar year so far:

| Month | CPI Percent Change from Year Ago | PCE Reading Percent Change from Year Ago |

|---|---|---|

| January | 7.5% | 6.1% |

| February | 7.9% | 6.4% |

| March | 8.5% | 6.8% |

| April | 8.3% | 6.4% |

| May | 8.6% | 6.5% |

| June | 9.1% | 7.0% |

| July | 8.5% | 6.4% |

| August | 8.3% | 6.2% |

| September | 8.2% | 6.3% |

| October | 7.7% | 6.0% |

| YTD reading | 8.26% | 6.41% |

With 2 readings left in the year, even if CPI inflation comes in at 0 for the rest of the year, 2022 CPI inflation would be at 6.88%, 45% greater than the CBO's 4.7% estimate for CY2022.

With 2 readings left in the year, even if PCE inflation comes in at 0 for the rest of the year, 2022 PCE inflation would be at 5.34%. This is 167% greater than the committee's stated 2% PCE goal.

TL:DRS

JPow recently stated 'incoming data since our last meeting suggest that the ultimate level of interest rates will be higher than previously expected.' This is a review of some of employment and spending data and how the Fed will sacrifice from the labor market (by continuing to raise rates) in the name of price stability.

To fix one end of the mandate (price stability) from the problem they created, the Fed is sacrificing employment (their other end of the mandate) to bolster price stability.