Inflation Alert! Inflation in the Producer Pipeline is over 20% according to the Bureau of Labor Statistics. This will get passed on to consumers!!! One more time for JPow, inflation is not transitory!

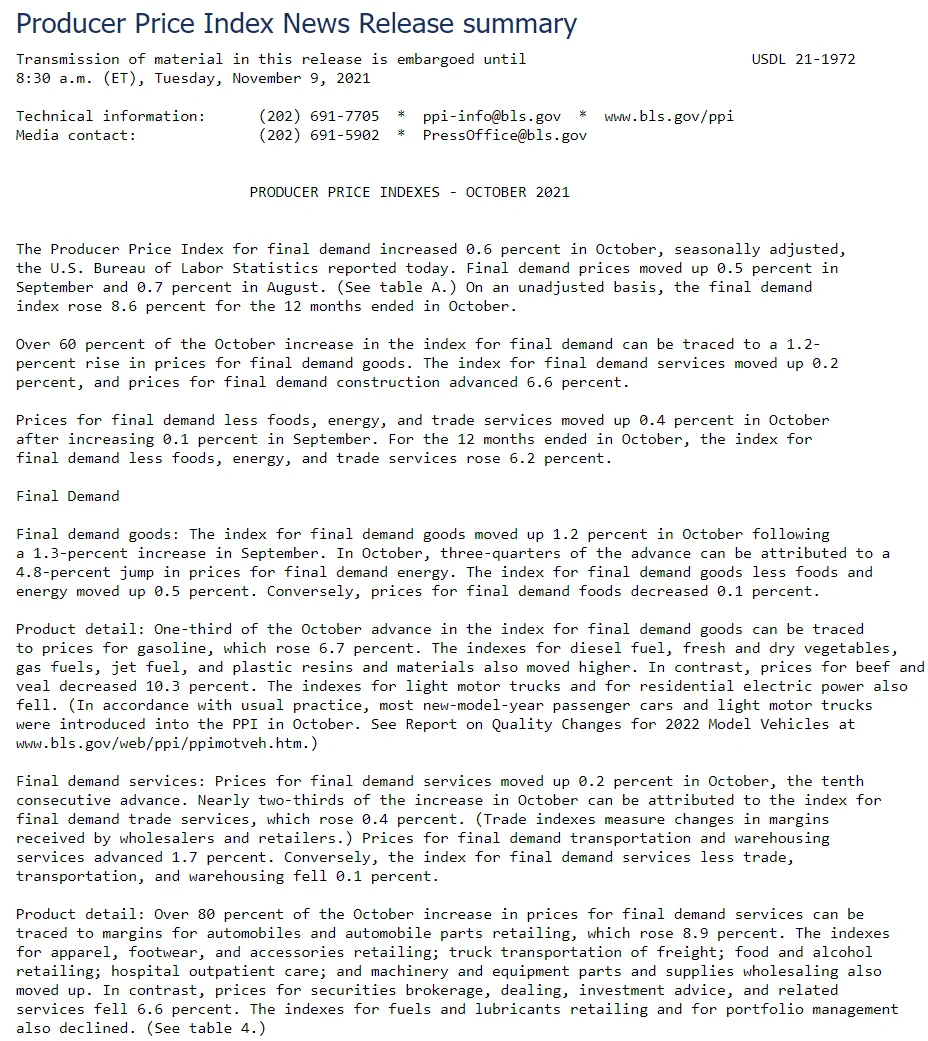

Yesterday the Bureau of Labor Statistics released the Producer Price Index for October.

This report categorizes demand into 4 stages based on how things are produced. From Stage 1 industries that are some distance up the production flow and create inputs for State 2 industries (inputs for to be produced widgets). Stage 3 industries and Stage 4 industries primarily create the inputs for Final Demand industries, which create the inputs for consumer-facing industries (tracked by the CPI).

Retracing the pricing pipeline of production:

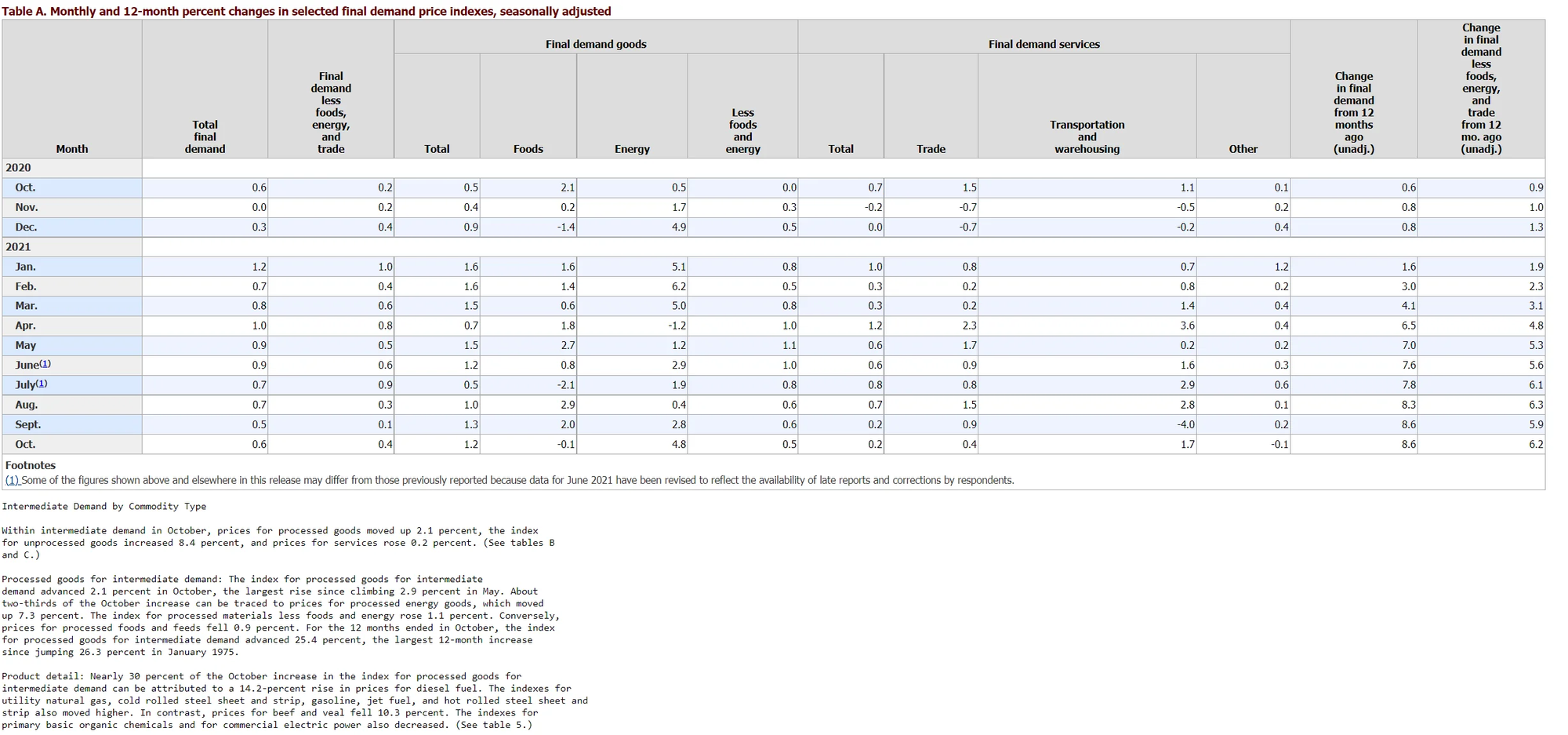

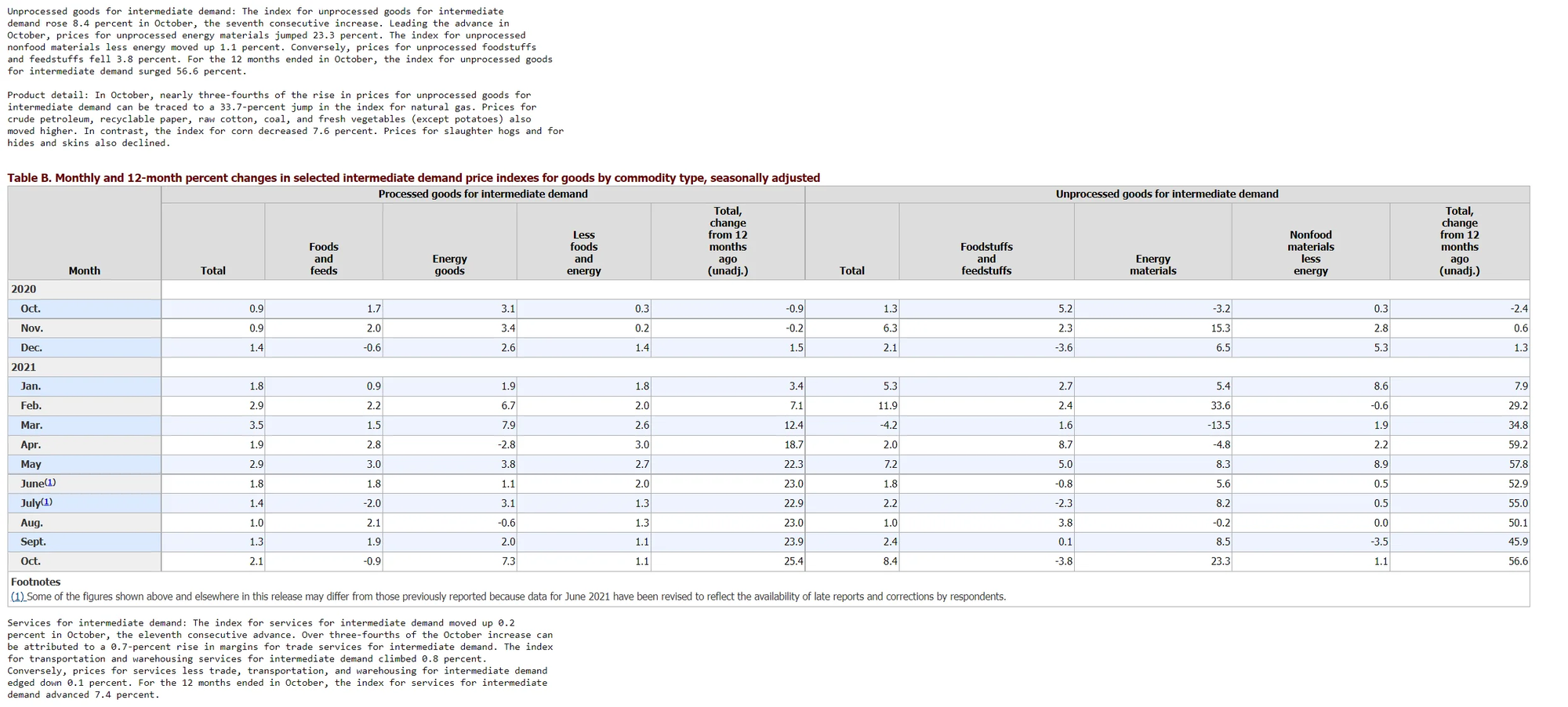

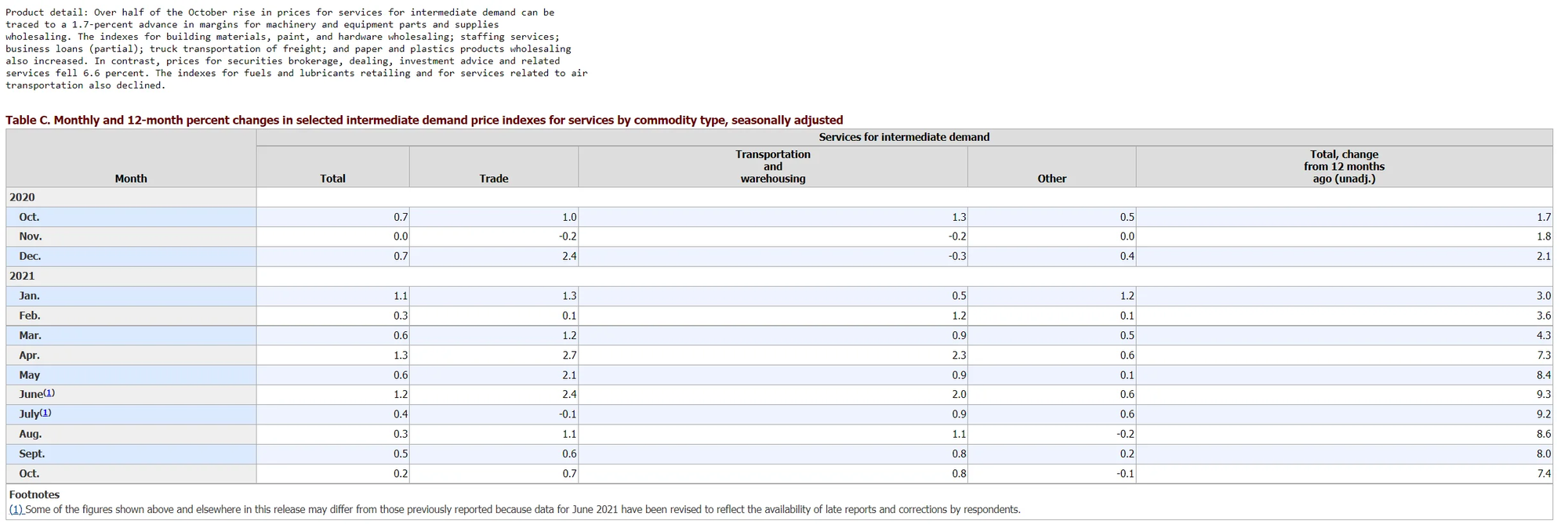

- Intermediate Demand, Stage 4, the input cost for final demand: +0.7% in October from September, goods +1.2% and services +0.1% month to month. Year-over-year +11.8%.

- Intermediate Demand, Stage 3: +0.9% in October from September, with goods +1.1% and services +0.6%. Year-over-year +20.2%

- Intermediate Demand, Stage 2: exploded by 4.7% in October from September, with goods jumping 9.8% month to month and services up 0.1%. Year-over-year +27.8%, the highest in the data!

- Intermediate Demand, Stage 1, furthest up the production pipeline: +1.0% for the month, with goods +2.1% and services -0.2%. Year-over-year: +20.4%

As we can see the production pipeline is up over 20% in all but one instance and this will continue to make its way to Stage 4, and ultimately onto the consumer!

All of this while The Fed will still continue to plow away with $120 billion in assets purchases each month only just getting ready to start tapering:

$40 billion a month in mortgage-backed securities. This will continue to depress mortgage rates and only continues to add gasoline to the inflation fire.

$80 billion in Treasury securities a month (with policy rates near 0%): represses short-term and long-term interest rates in general, and inflates asset prices and consumer prices, which further DESTROYS the purchasing power of the dollar.

While the rest of the world's banks are acting, the Fed still claims this inflation is “transitory"...

TL:DR - The Dollar losing purchasing power + Inflation = Permanent Loss of purchasing power. Unless one of the many other catalysts triggers the MOASS, I believe inflation is the match that has been lit that will light the fuse of the rocket.

Additionally, in the data reviewed above, the production pipeline is up over 20% in all but one instance and this will continue to make its way to Stage 4, and ultimately onto the consumer!

Buckle Up.