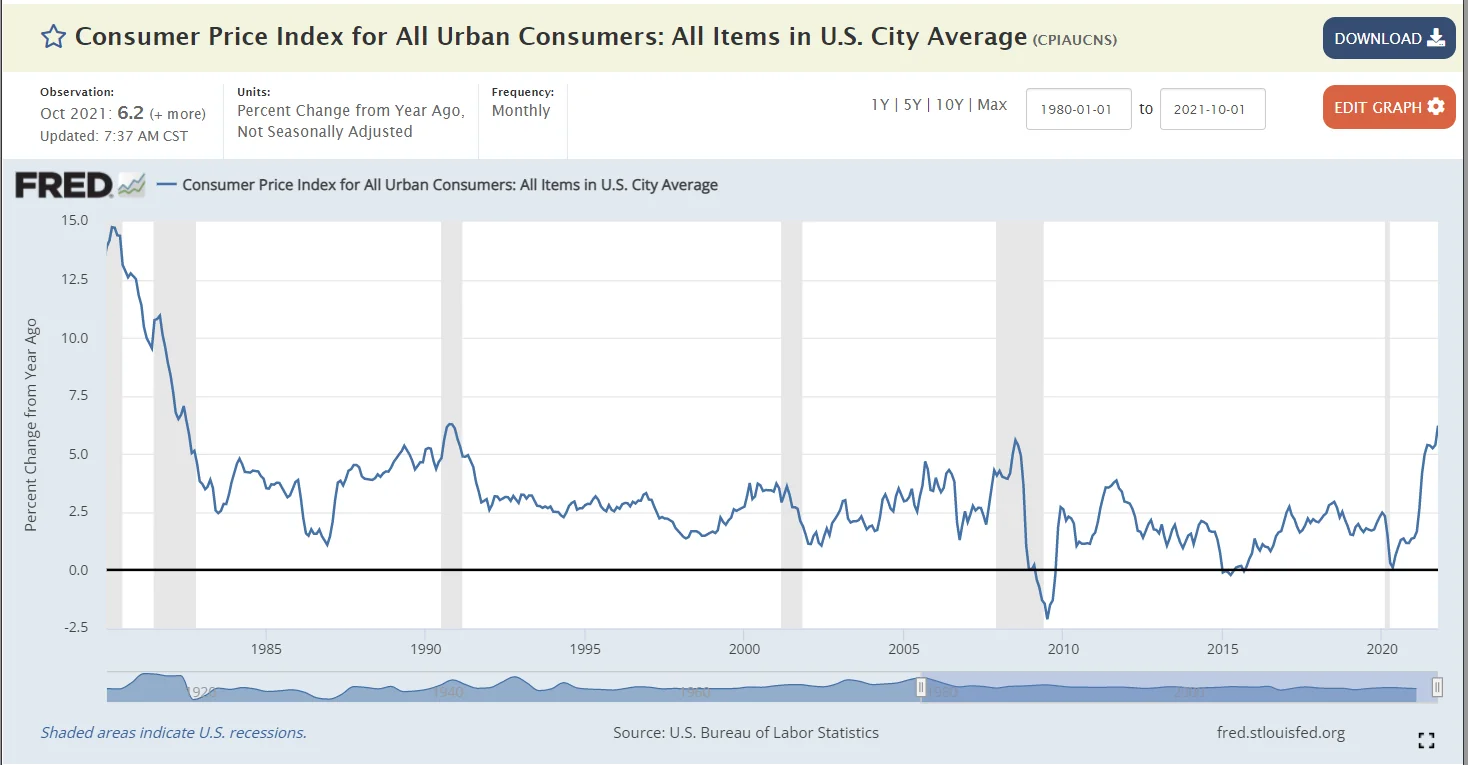

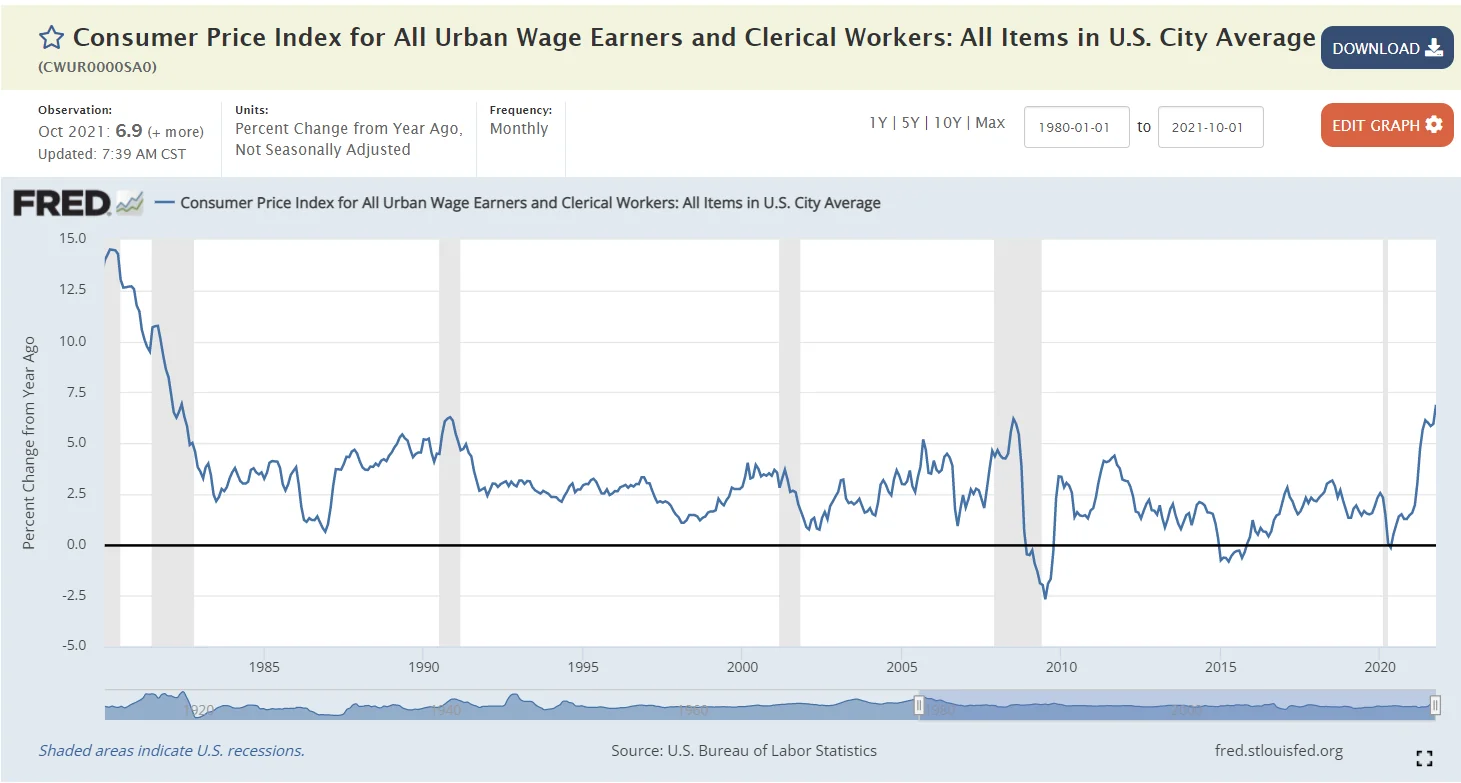

Inflation Alert! Come take a dive with me and let's break down October's +6.2% inflation, for Urban Wage-earners +6.9% (NOT NICE) data released today by the Bureau of Labor Statistics.

Barring another MOASS trigger, I still believe inflation is a lit match that will light the MOASS fuse.

Good evening r/Superstonk, jellyfish with you to dive into today's inflation numbers further with you that the Bureau of Labor Statistics today released the October CPI index that hit the front of r/Superstonk.

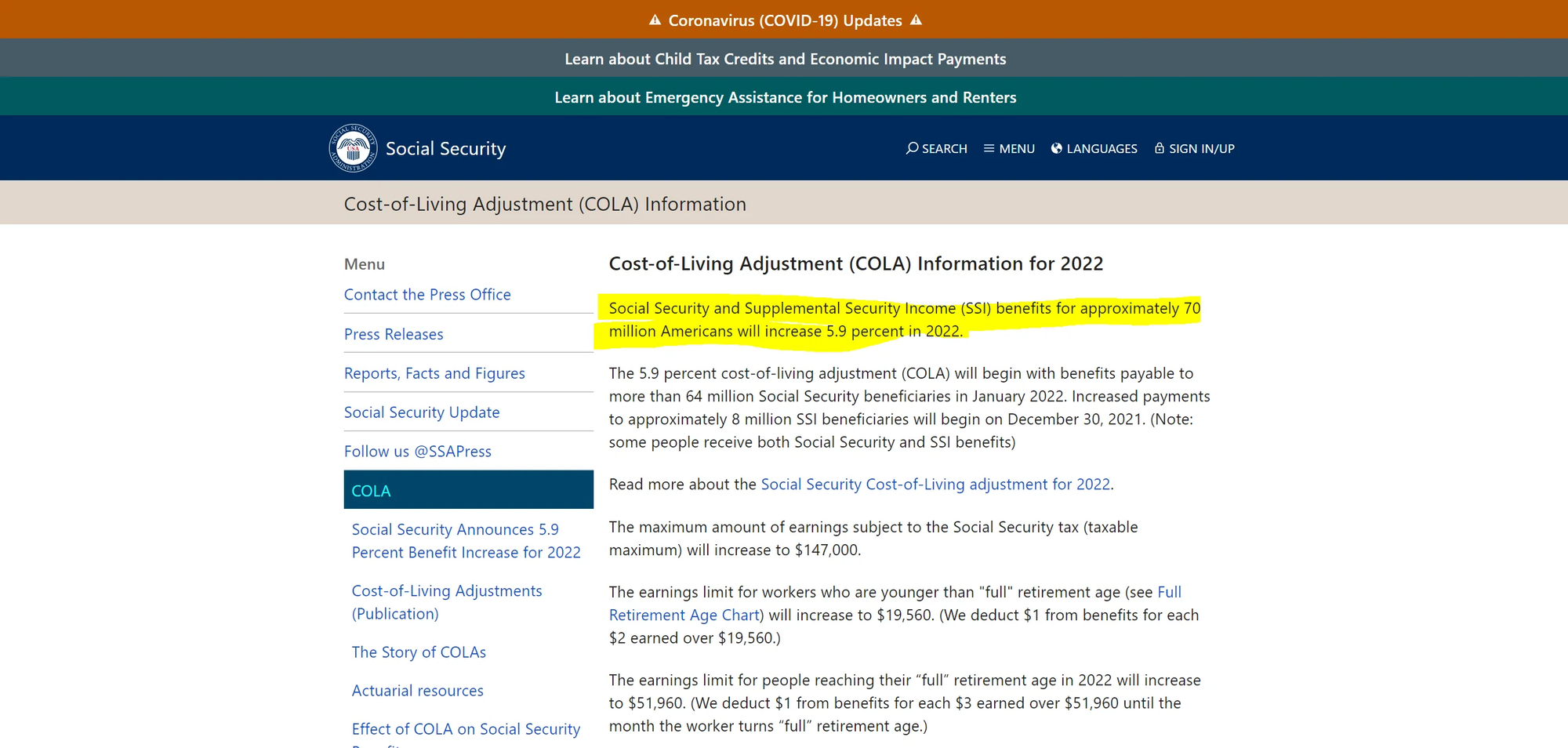

Yes, retires are in for a BIG bump (2022 Cost of Living Adjustment is 5.9%):

However, as we covered this morning, inflation within the production pipeline is over 20%. This will continue to be passed down to consumers and eat away at this Cost of Living Adjustment, especially when we consider the following figures:

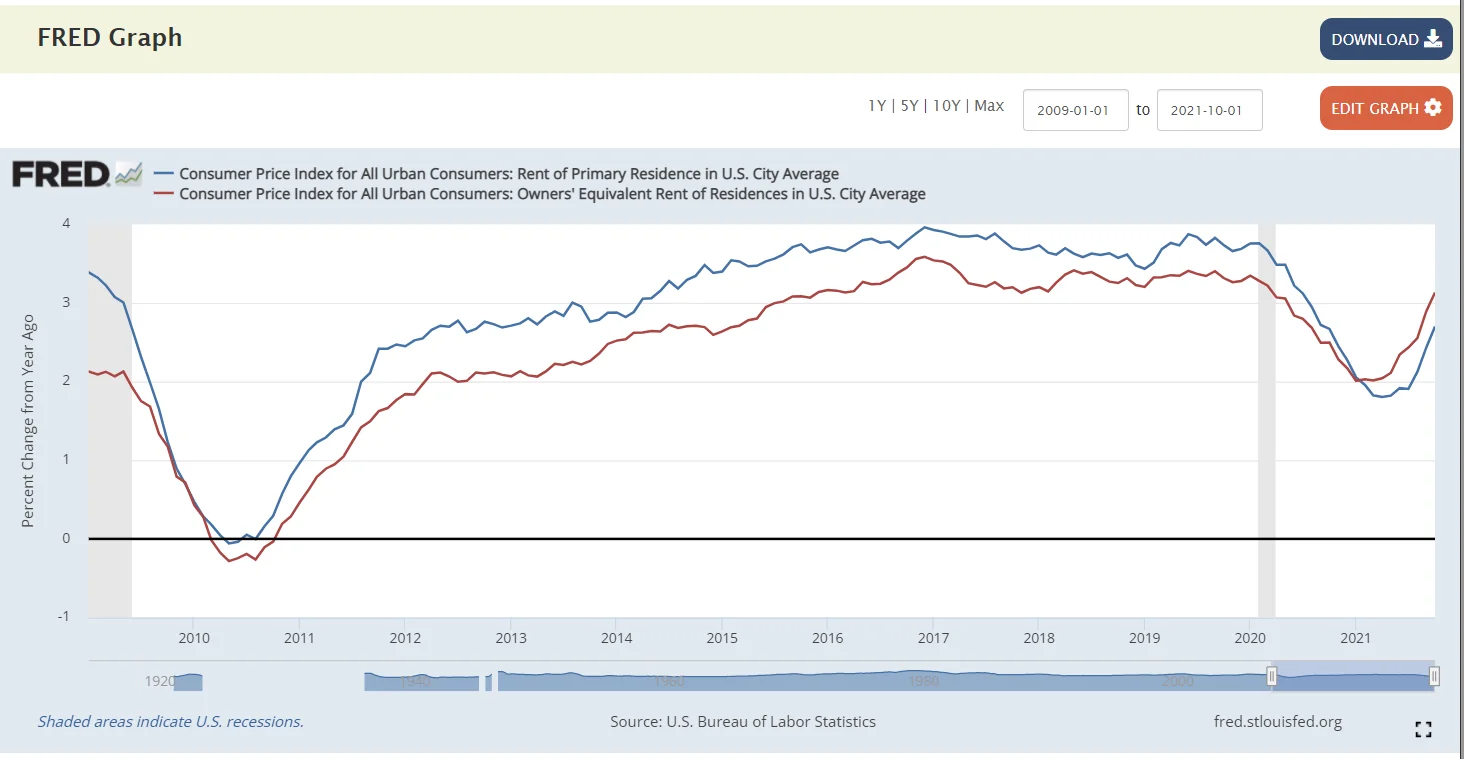

Rent is nearly 1/3 of CPI and continuing to rise!

'Rent of primary residence' (7.6% in the overall CPI), rose by 0.4% in October from September, and by 2.7% year-over-year.

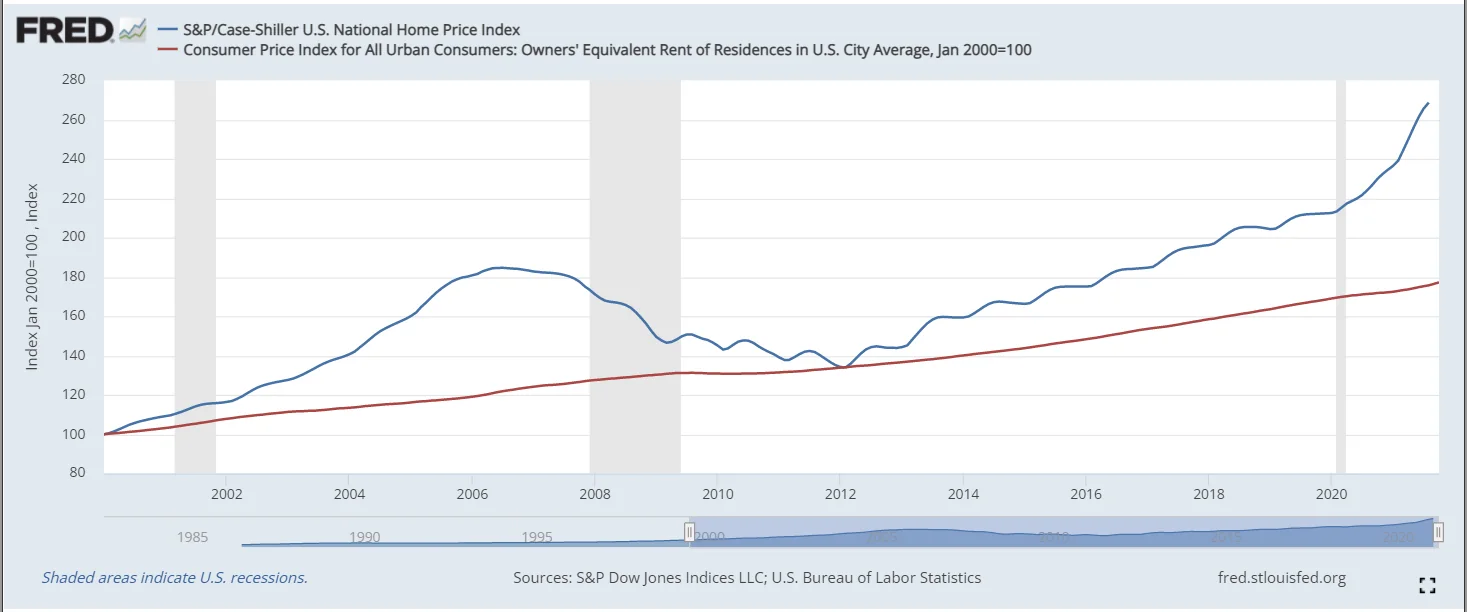

'Owner’s equivalent rent of residences' (23.6% in the overall CPI) and is IMHO a purposely used flawed tool to track the costs of owning a home since it is based on surveys that ask current homeowners what they think their home might rent for. They can make up any number and this is what they choose to go with. Nonetheless, it is up 3.1% year over year.

However, actual home prices have spiked by 20%, according to the Case-Shiller Home Price Index. Remember, this tracks price changes of the same home over time--making it a measure of house price inflation (blue line below). Notice how “Owner’s equivalent of rent” (red line)is steadily on the rise as well!?

Food Costs

Remember that COLA we talked about above? Food alone has eaten into that.

Energy Costs

All the major energy component indexes increased sharply over the last 12 months...

Vehicles

If you can find a new vehicle, get ready to pay through the roof:

All of this while The Fed will still continue to plow away with $120 billion in assets purchases each month only just getting ready to start tapering:

$40 billion a month in mortgage-backed securities. This will continue to depress mortgage rates and only continues to add gasoline to the inflation fire.

$80 billion in Treasury securities a month (with policy rates near 0%): represses short-term and long-term interest rates in general, and inflates asset prices and consumer prices, which further DESTROYS the purchasing power of the dollar.

TL:DR - The Dollar losing purchasing power + Inflation = Permanent Loss of purchasing power. Unless one of the many other catalysts triggers the MOASS, I believe inflation is the match that has been lit that will light the fuse of the rocket.

Additionally, in the data reviewed above and with inflation in the production pipeline up over 20% in all but one instance--more inflation is coming for the consumer!

Buckle Up.