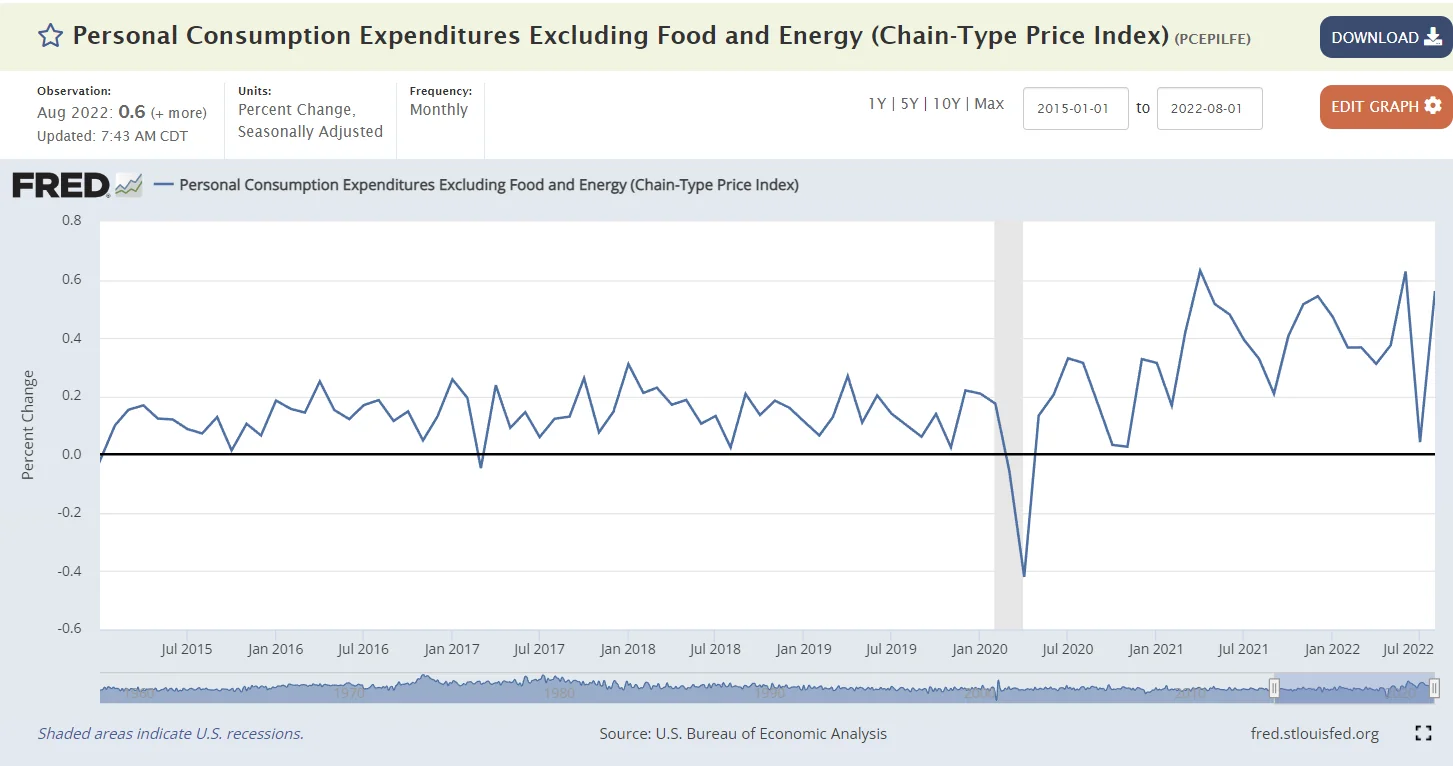

Inflation Alert! According to the Bureau of Economic Analysis “Core PCE” (the metric the Fed uses for its monetary policy) rose .6% in August. What mean? Inflation is not slowing down and is back on the upswing.

Good evening and happy Friday r/Superstonk! As the title states, the Bureau of Economic Analysis reported today 'core PCE' (the metric the Fed uses for its monetary policy decisions) continues to rise (.6%) after a 'transitory' July when inflation 'was being tamed'--funny how that transitory word keeps coming back, huh?

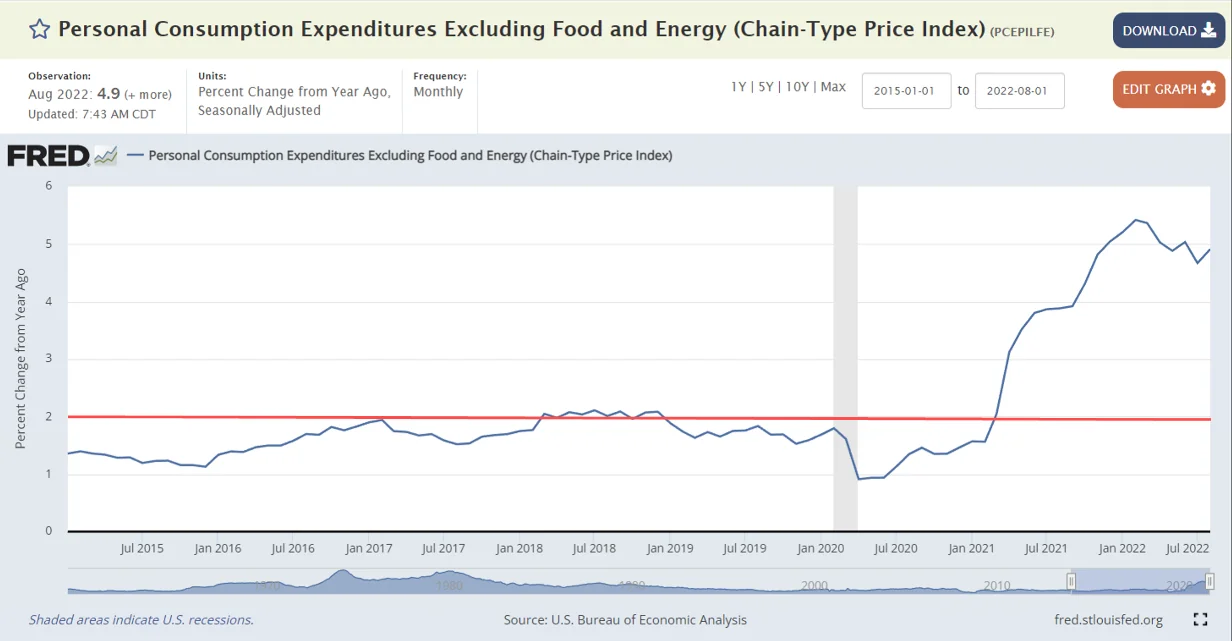

Compared to this time last year, 'core PCE' is up 4.9%.

Unless the Fed gets serious about rates (paired with actual Quantitative Tightening), inflation is going to continue to keep running higher.

Interesting enough, an emergency meeting has been set for Monday. The topic? Review and determination by the Board of Governors of the advance and discount rates to be charged by the Federal Reserve Banks.

How Changes in Interest Rates Affect Inflation

When the Federal Reserve responds to elevated inflation risks by raising its benchmark federal funds rate it effectively increases the level of risk-free reserves in the financial system, limiting the money supply available for purchases of riskier assets.

Conversely, when a central bank reduces its target interest rate it effectively increases the money supply available to purchase risk assets.

By increasing borrowing costs, rising interest rates discourage consumer and business spending, especially on commonly financed big-ticket items like housing and capital equipment. Rising interest rates also tend to weigh on asset prices, reversing the wealth effect for individuals and making banks more cautious in lending decisions.

The Fed uses the discount rate to control the supply of available funds, which in turn influences inflation and overall interest rates, with the more money available, the more likely inflation will occur.

Raising the rate makes it more expensive to borrow from the Fed. That lowers the supply of available money, which increases the short-term interest rates. Lowering the rate has the opposite effect, bringing short-term interest rates down.

I would like to end this post with a comment from another post (talking about the British Pension funds that needed bailing out):

The gorilla in the room is that those pension funds were robbed of their income for more than a decade by the artificial suppression of long term rates brought about by central bank's (like the Fed and BoE) Quantitative Easing.

These funds were encouraged, perhaps even forced, to engage in riskier and riskier derivatives to replace that lost income.

The costs of all this Quantitative Easing and interest rate suppression is immense as currently out of control inflation is showing us (and appears to be just getting started).