Inflation Alert! A deep dive into the Bureau of Labor Statistics Consumer Price Index Summary for January and the continued destruction of the $USD's purchasing power.

Hello and happy Friday r/Superstonk, I hope everyone's day is off to a great start! Let's get into this!

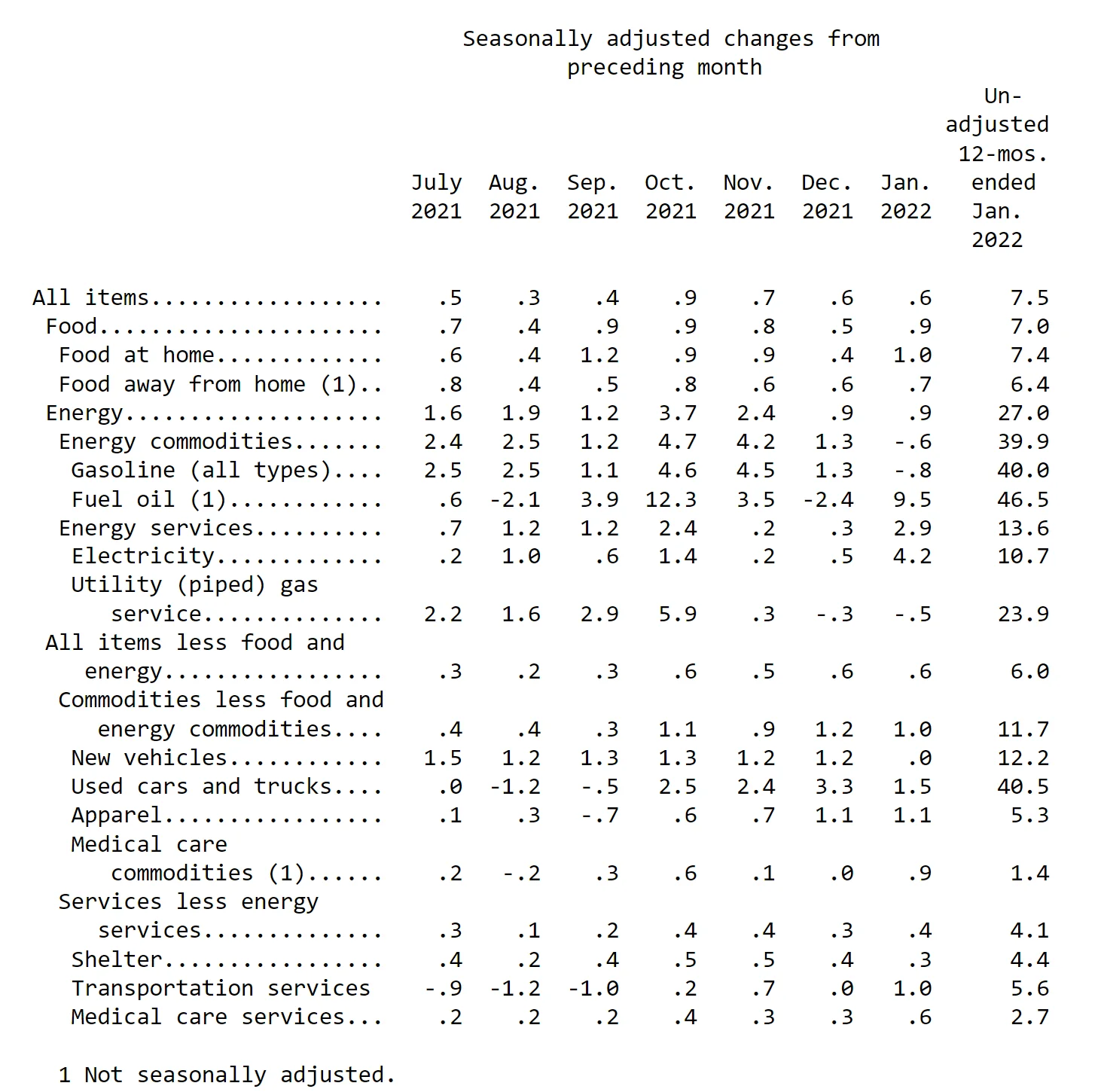

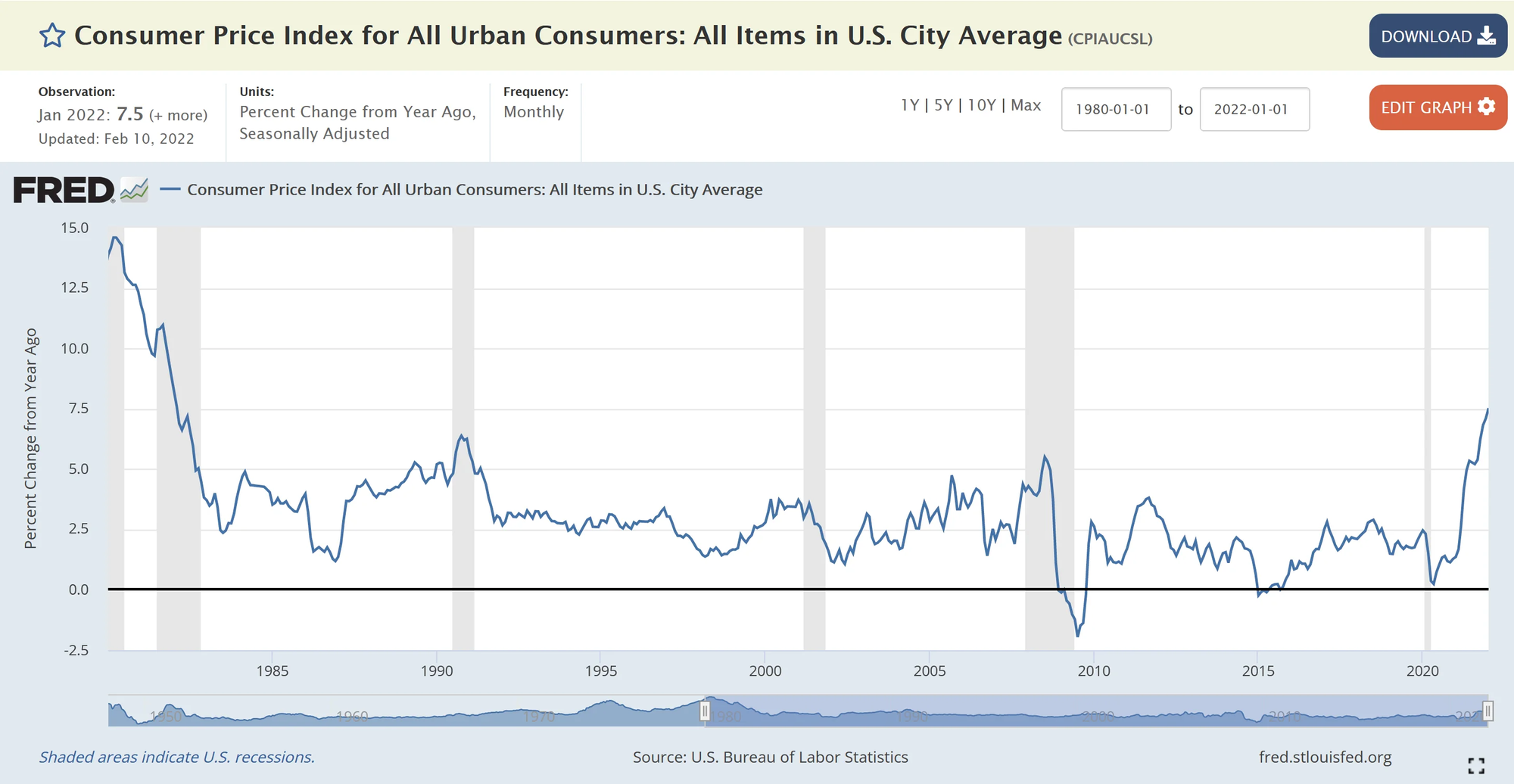

As many are already aware, the Bureau of Labor Statistics released its Consumer Price Index Summary for January, showing that the Consumer Price Index for All Urban Consumers (CPI-U) increased 7.5% (not seasonally adjusted) over the previous 12 months--the biggest number since February 1982:

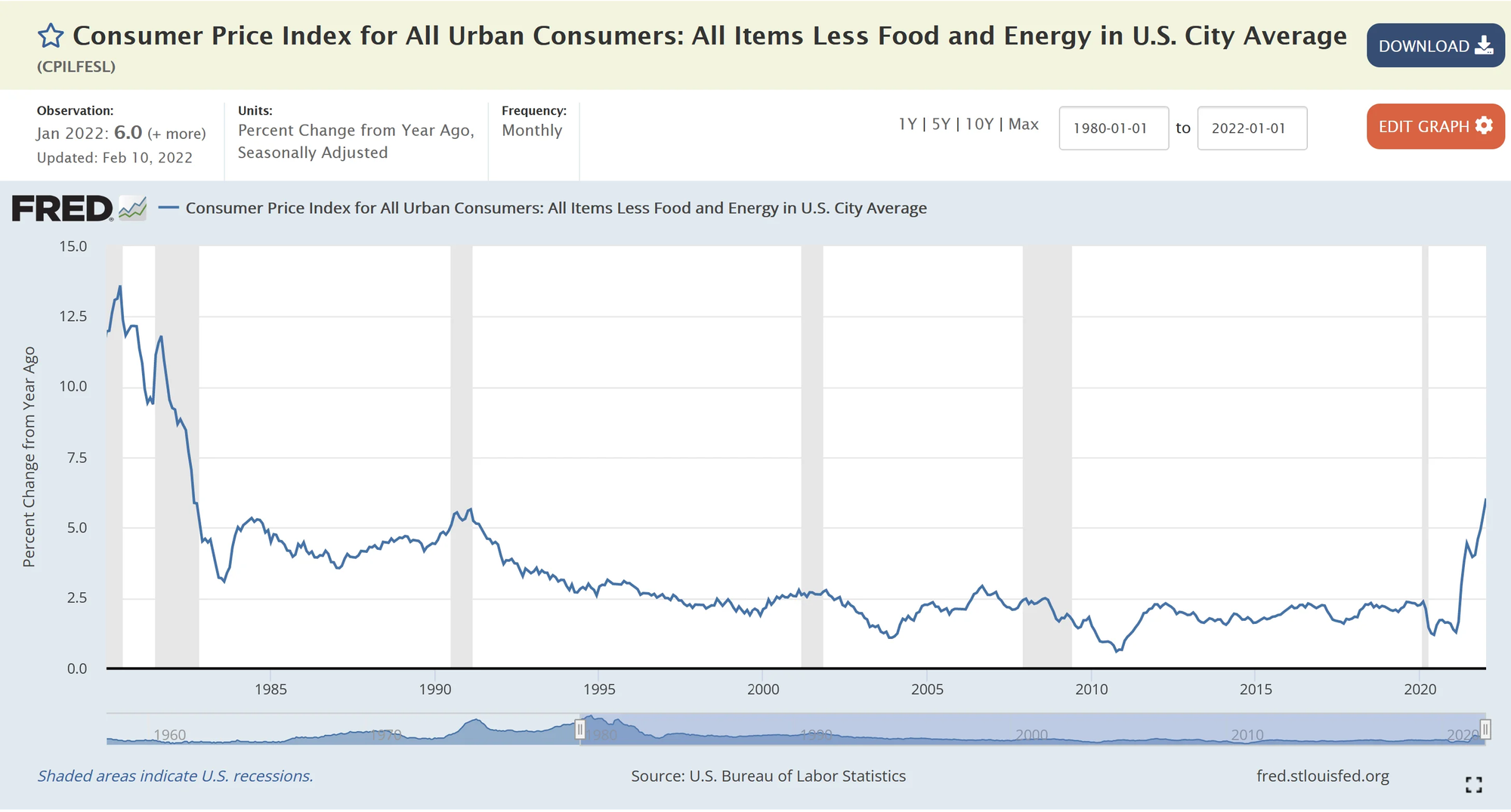

Remember though, JPow and The Fed uses 'core' CPI-U for their decision-making purposes, which was up 6% for the year (highest since 1982). The cynic can view using this measure as 'hiding' how bad things really are, while JPow would snapback volatile items like food and energy (you know, what we all need to survive...) skew measurements. Whatever side of the line you fall on, this 'softball metric' is RAGING just like CPI:

I would like to take a second here to level set how our situation now is different than in 1982 (as I am sure many of you notice CPI and 'core' CPI were on the downtrend back then and might wonder why that cannot happen this time--at least yet).

First, Paul Volcker (chair of the Fed back then) was not deliberately asleep at the wheel like JPow is now. Interest rates (the 'bazooka' in the Fed's toolbox) were in double digits (15% percent in 1981), with Volker stating at the time (even with unemployment on the rise because of rate hikes):

"We have set our course to restrain growth in money and credit. We mean to stick with it”

This is in STARK contrast to his eventual successor, JPow who is still pouring gasoline on the fire by still buying assets (he is slowing a bit), but this is still REPRESSING interest rate close to 0.

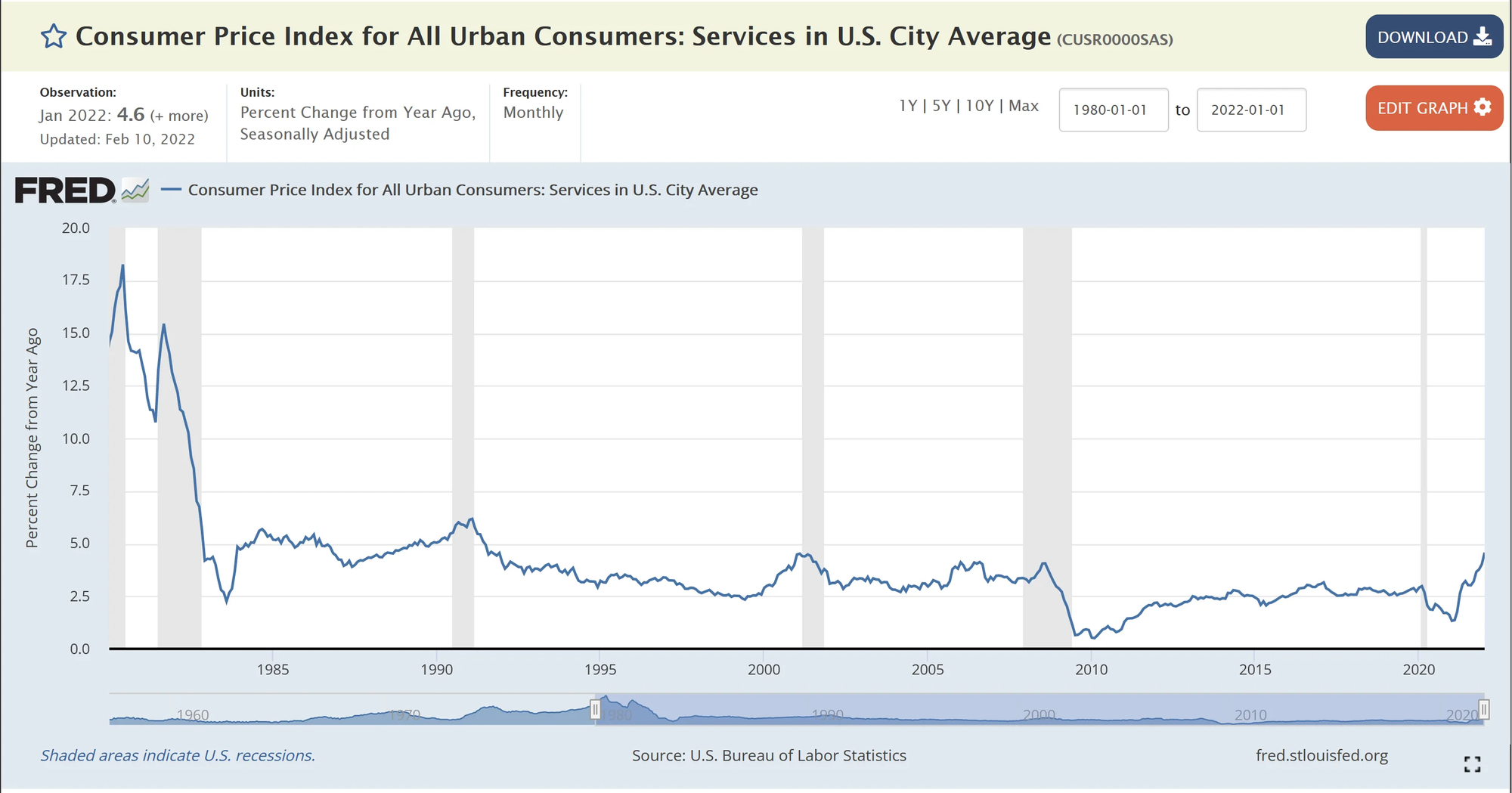

JPow is out of excuses as well (supply chains, chip shortage, labor shortages, it's only in the vehicle market, trust me bro it's transitory..). Inflation is EVERYWHERE in the economy now--as it has 'trickled down' to every part of the economy:

Services

Housing

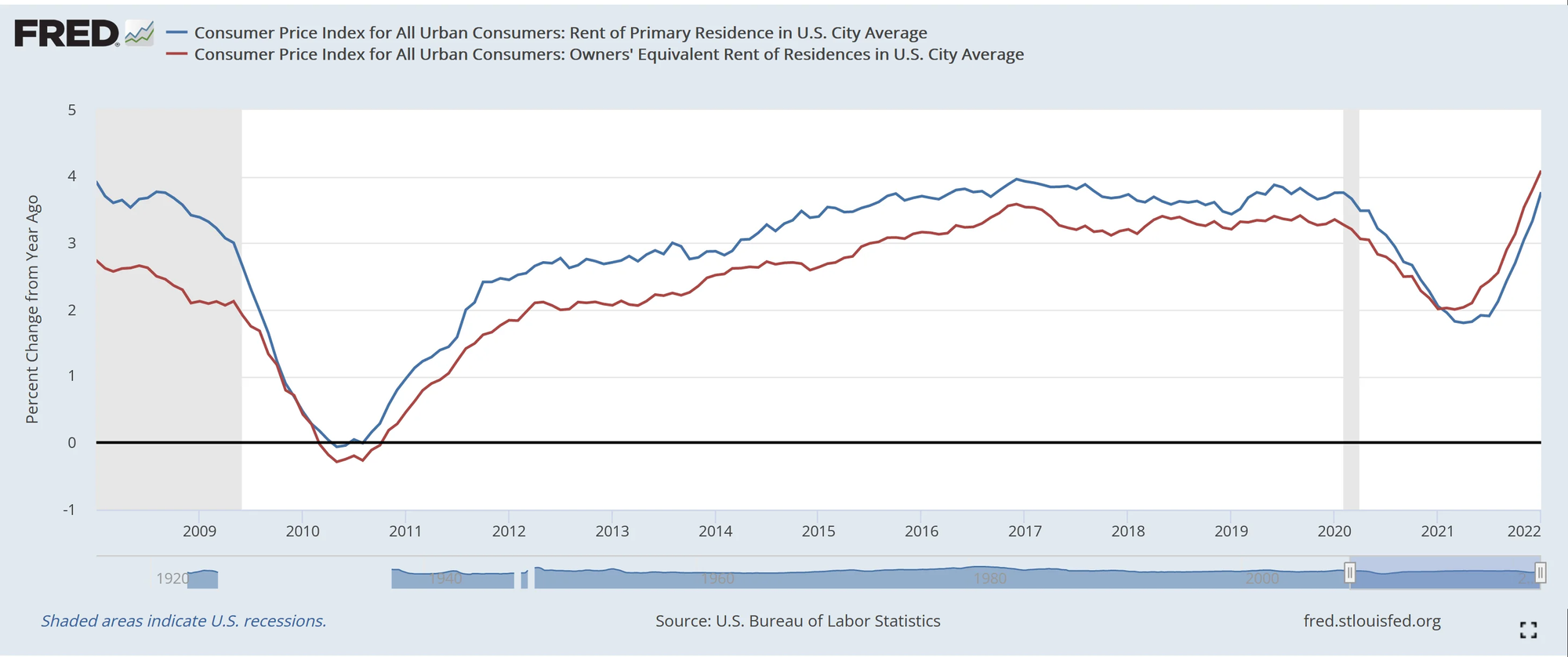

“Rent of primary residence” (weighted as 7.4% of CPI): was up 3.8% compared to a year ago.

"Owner’s equivalent rent of residences" (discussed further in the linked post and weighted as 24.3% of CPI): was up 4.1%

Rents are spiking tremendously and now making their way into CPI. According to data from Zumper's National Rent Report, the median asking rent for1 bedroom apartments increased by 10% or more in 56 of the 100 largest cities in the US, compared to the year before.

In 34 of the 100 largest cities, 1 bedroom rents jumped by 15% or more. In 20 of the cities, rents were up by 20% or more, with 11 cities witnessing spikes of 25% or more. Many of the largest year-over-year jumps are in medium-size cities, where people aren't making 'city' incomes and wages are lower, to begin with--further increasing pain.

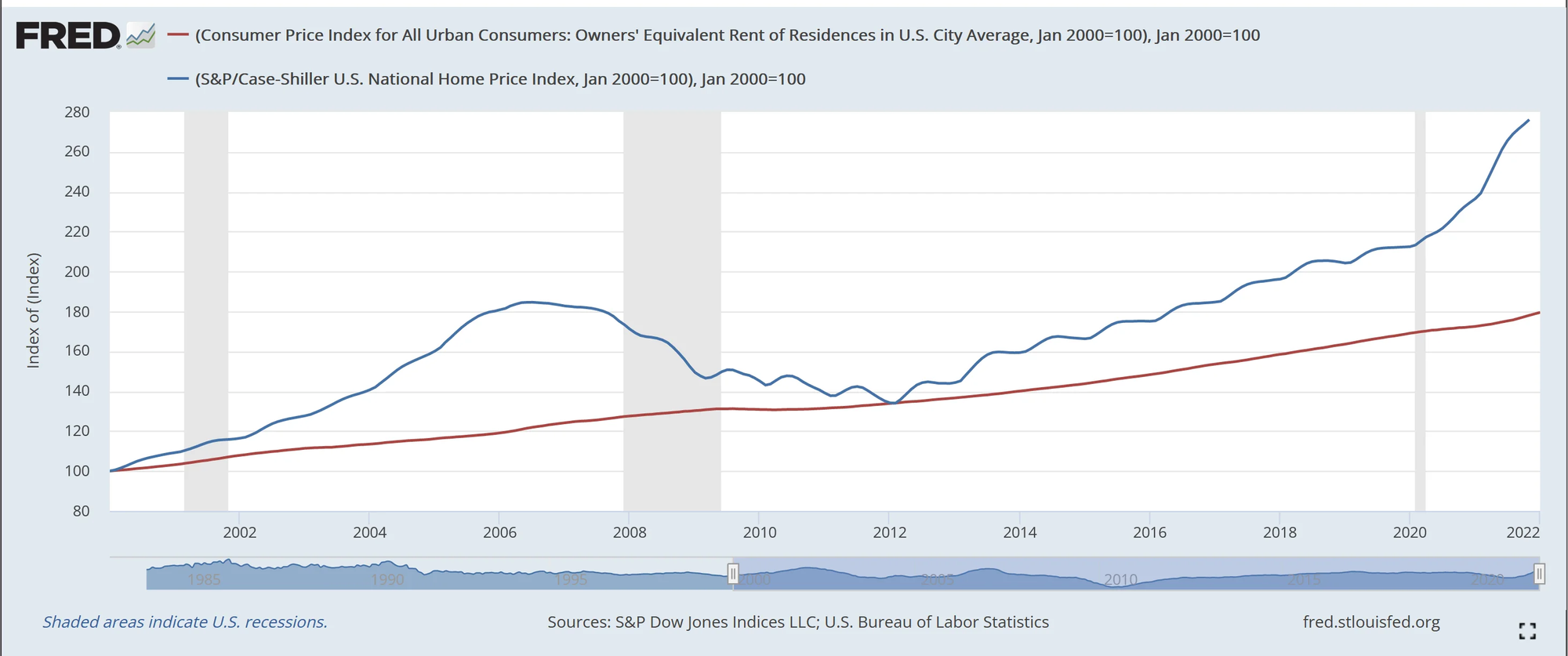

Additionally, according to the Case-Shiller Home Price Index (background here), the actual costs of purchasing a house have jumped by 19% from the year prior

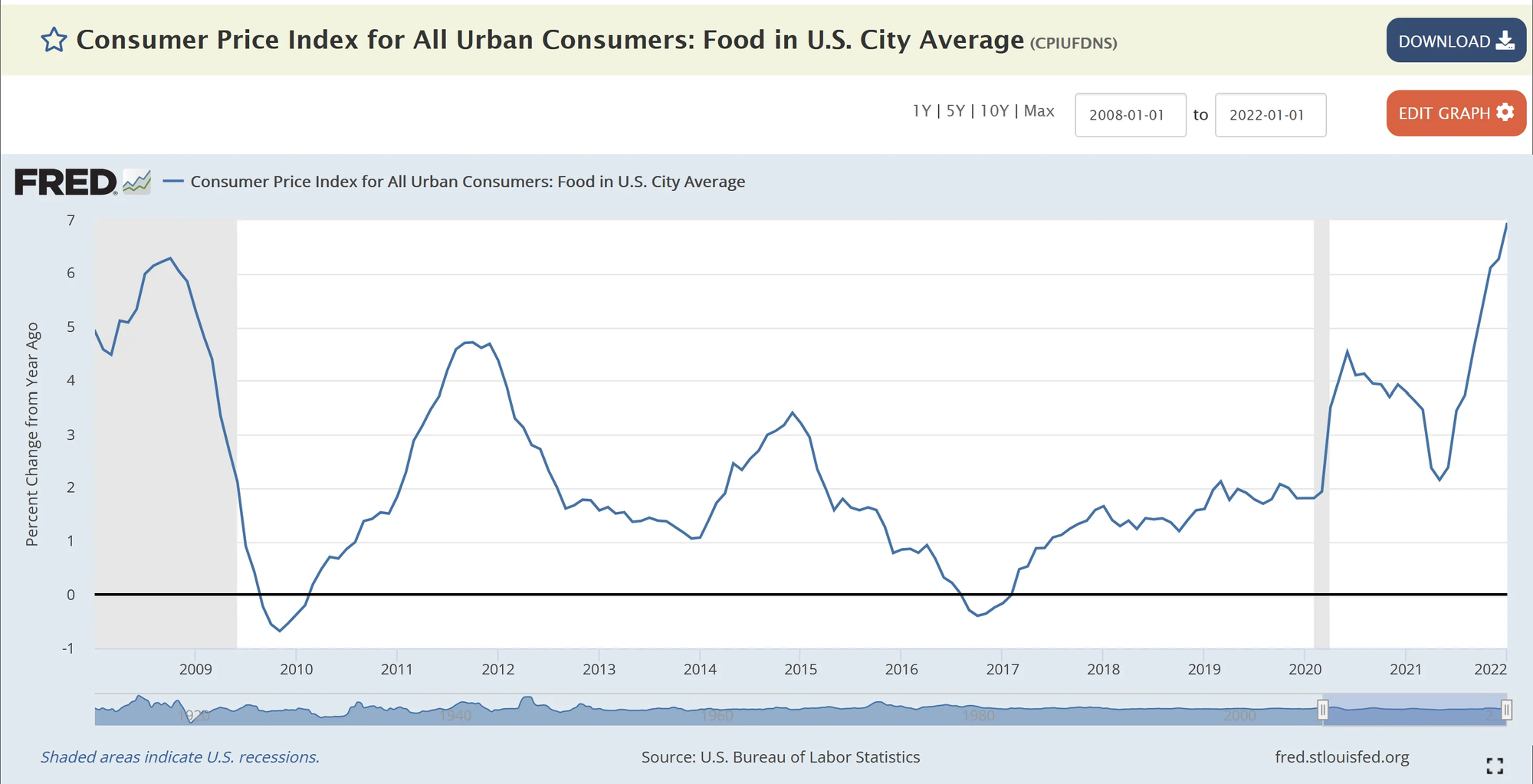

Food

Food costs make up 13.4% of CPI and are up 7% over the last year:

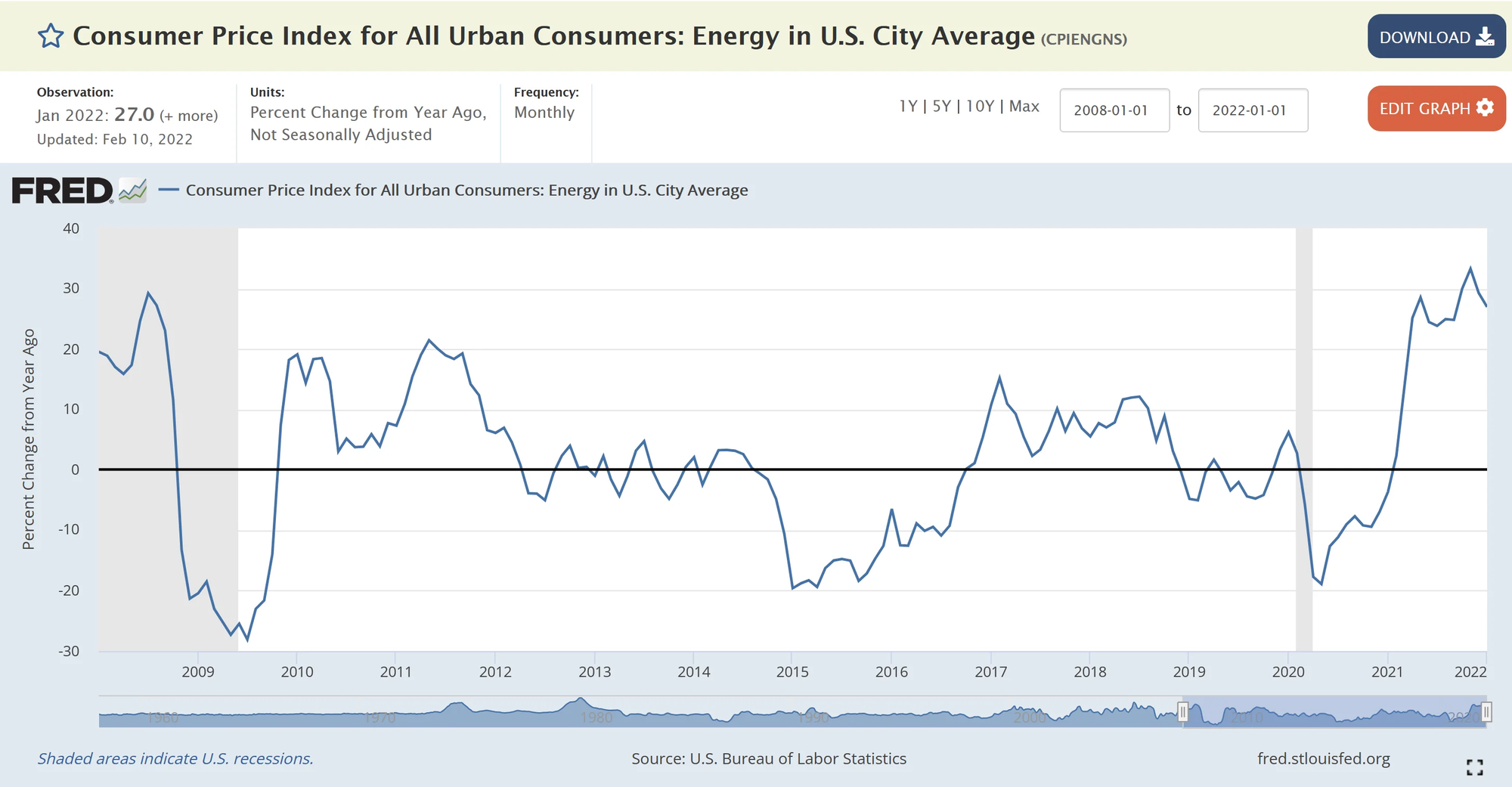

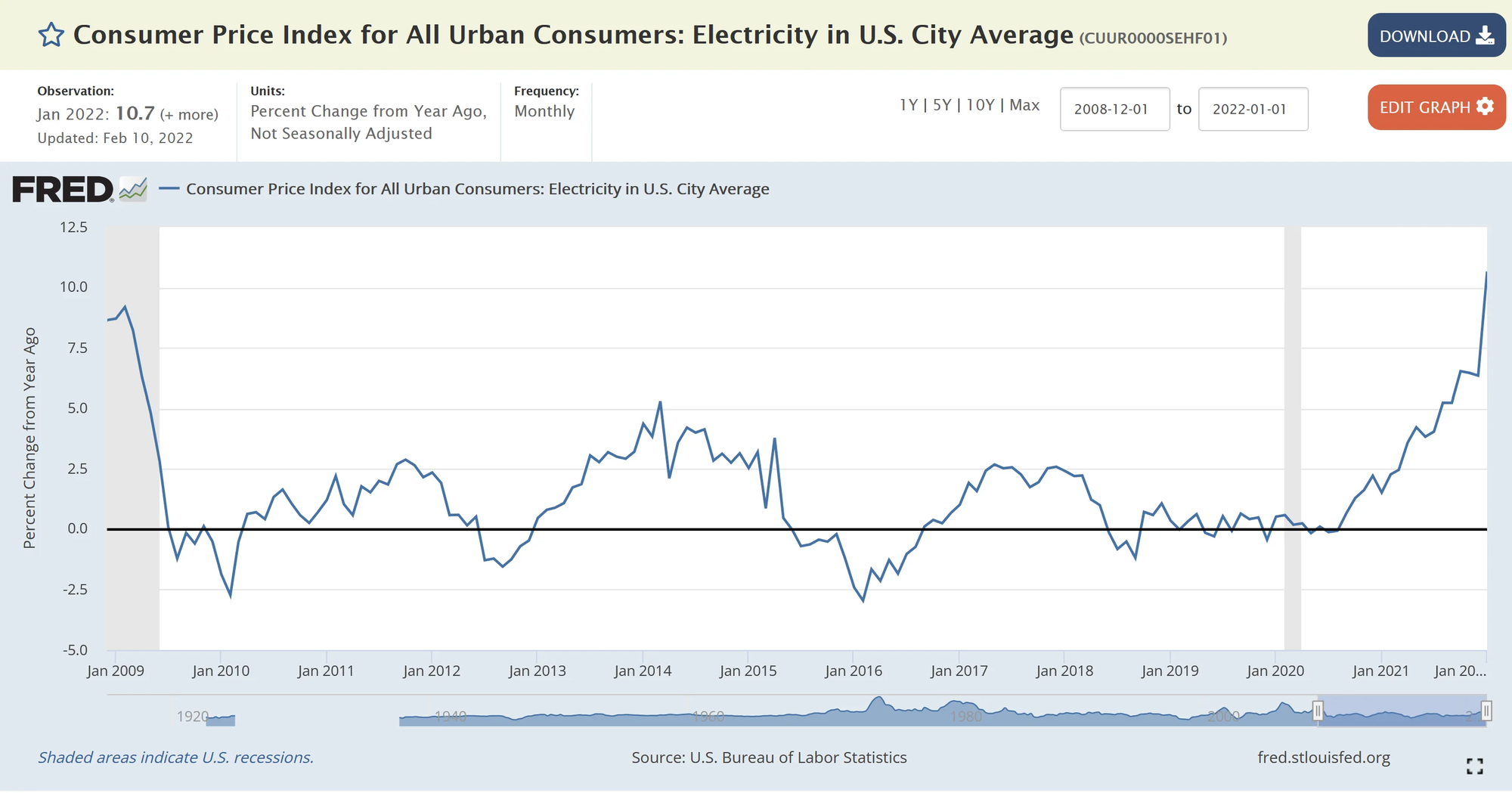

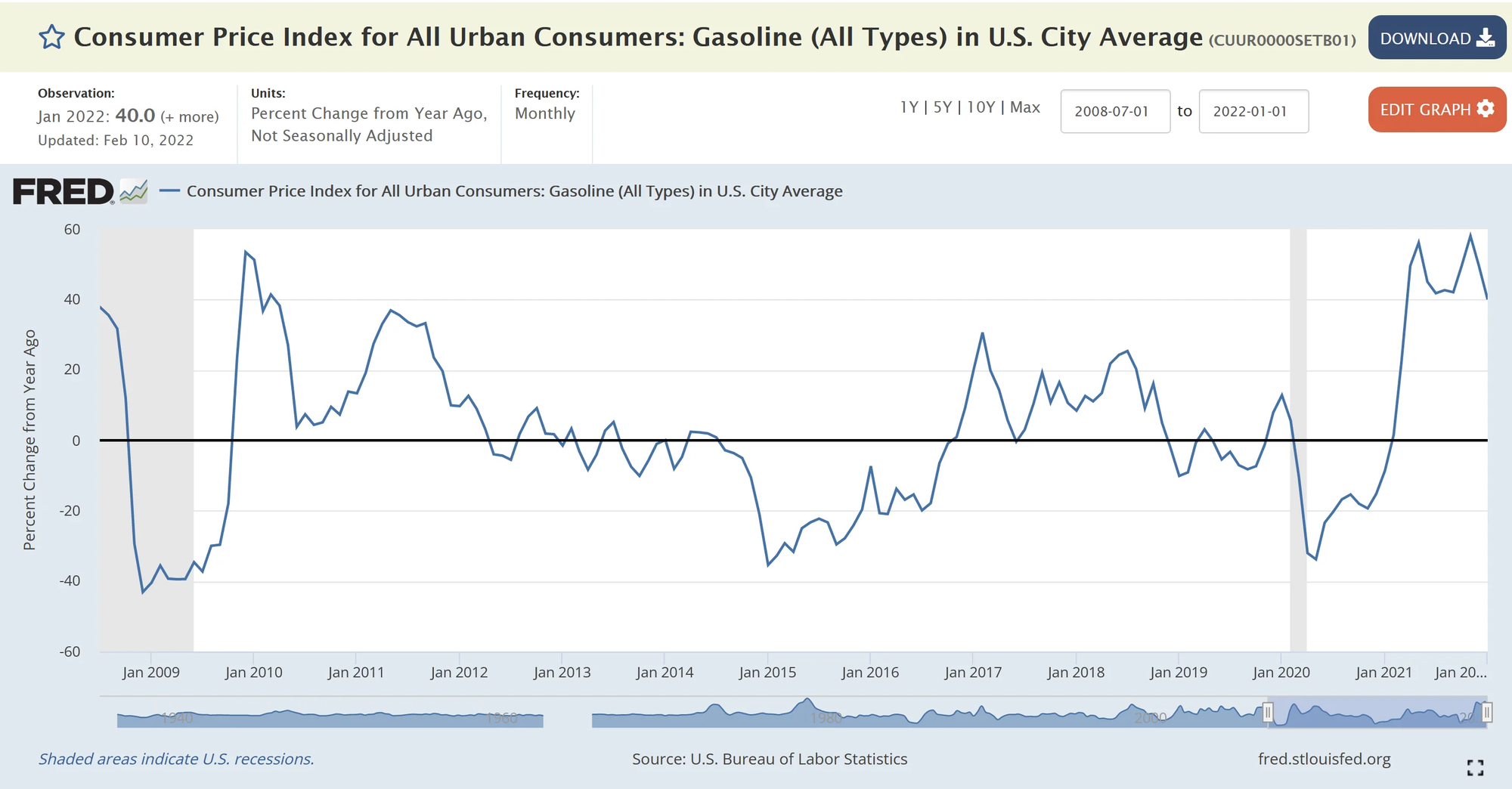

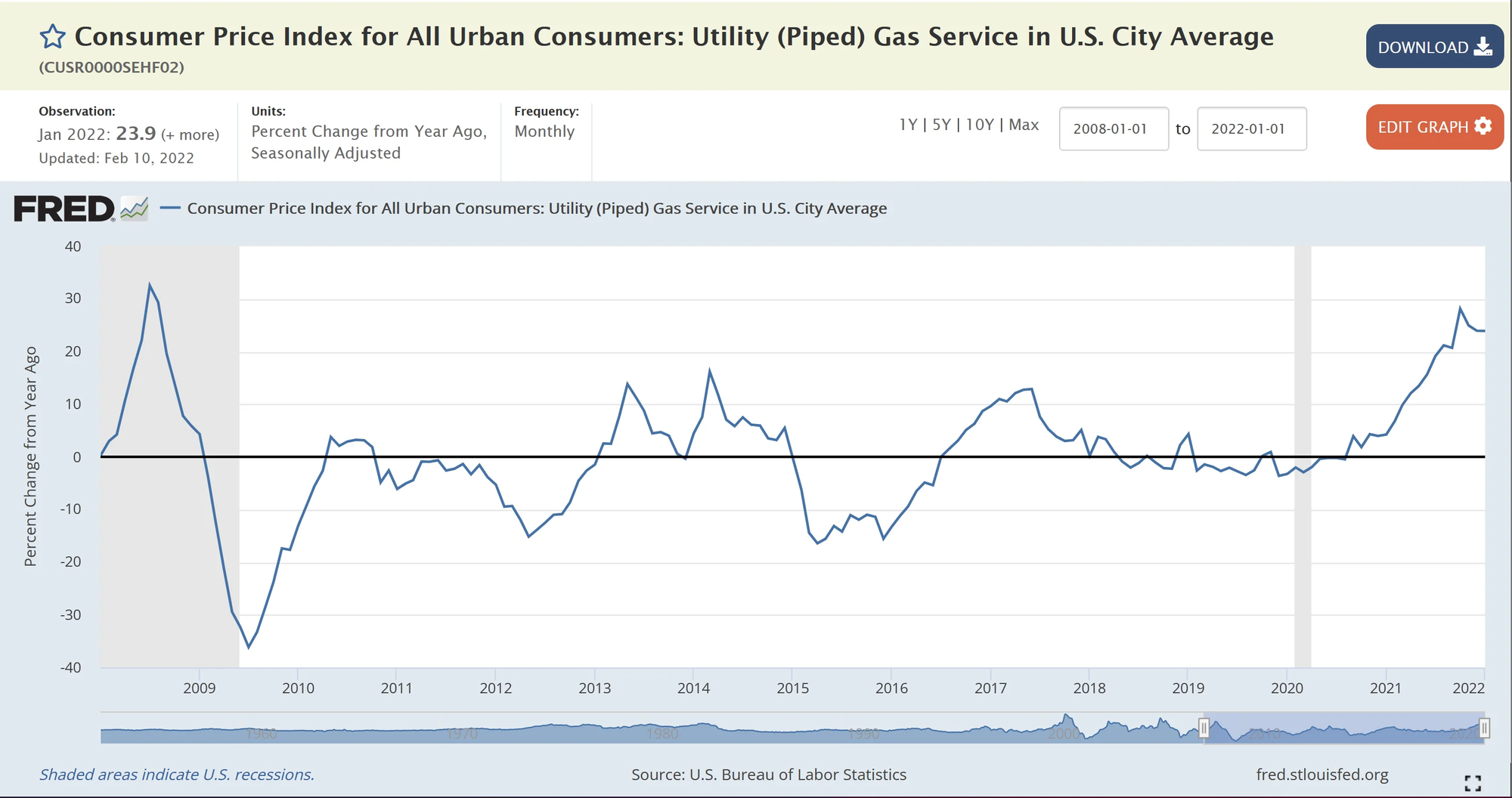

Energy

Energy makes up 7.5% of overall CPI and was up 27% vs. last year:

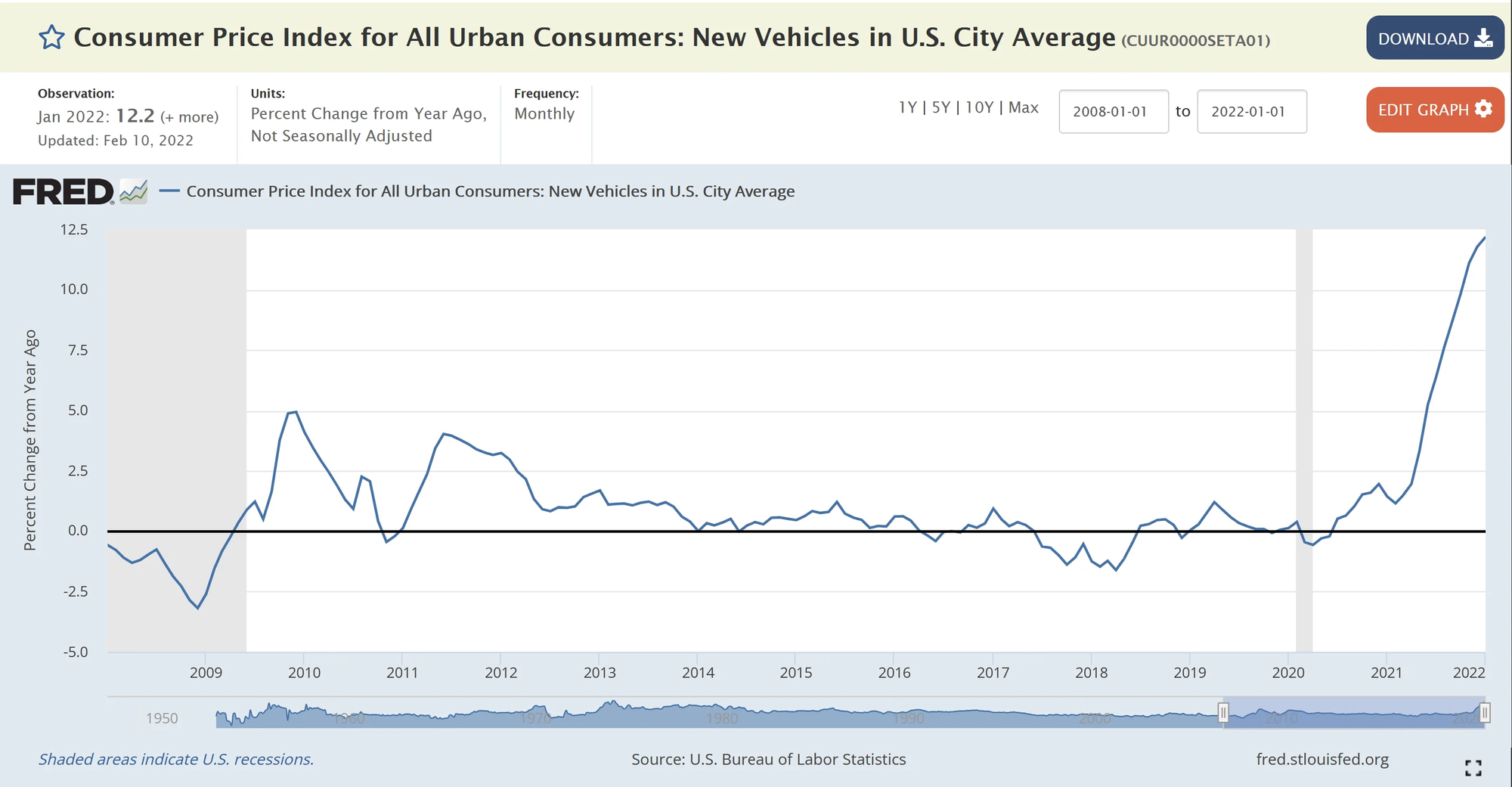

Vehicles

New cars and trucks make up 4.1% of the CPI calculation and have jumped 12.2% from last year:

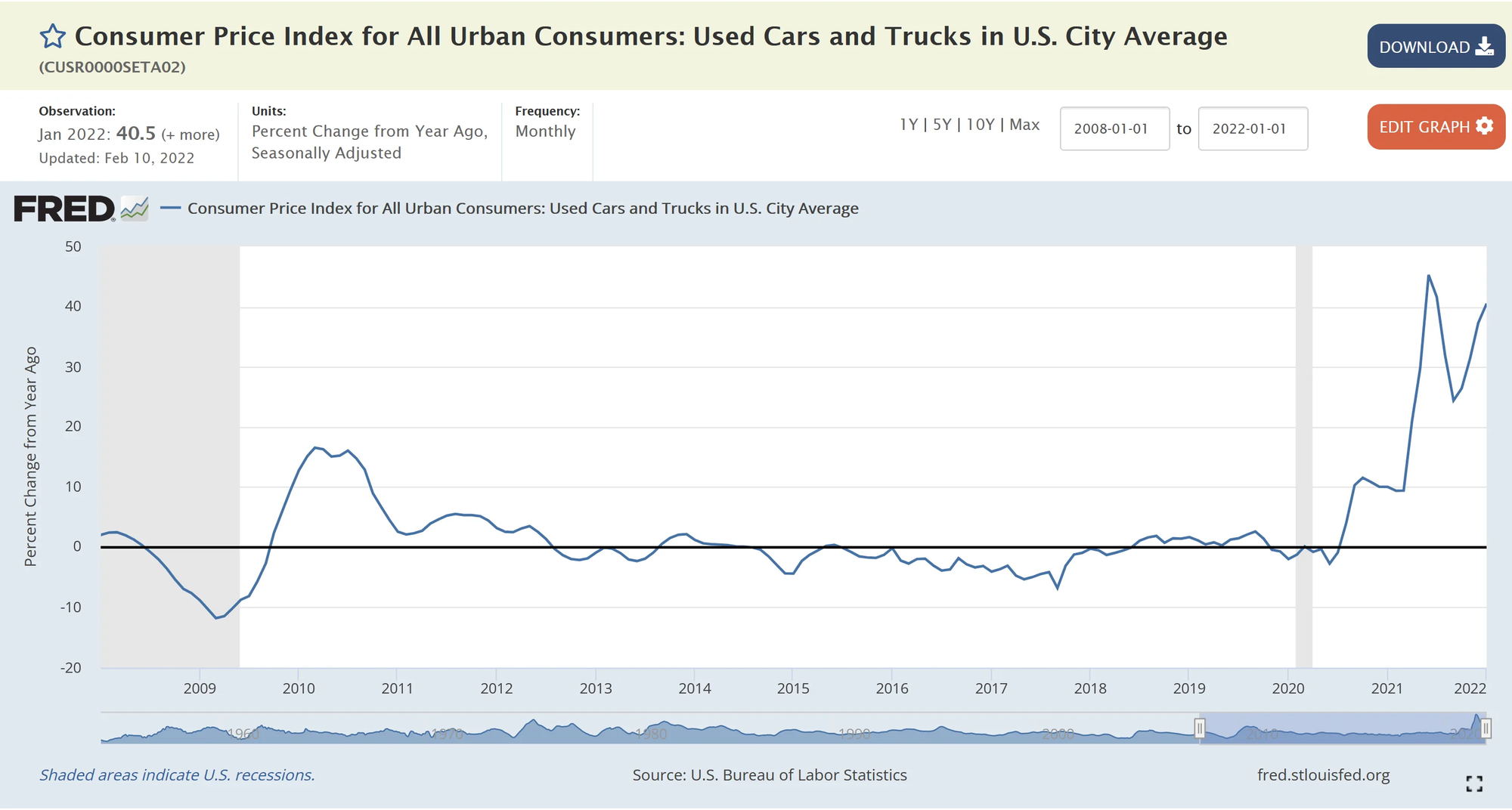

Used vehicles make up 4.1% of the CPI calculation and have jumped 40.5% year-over-year:

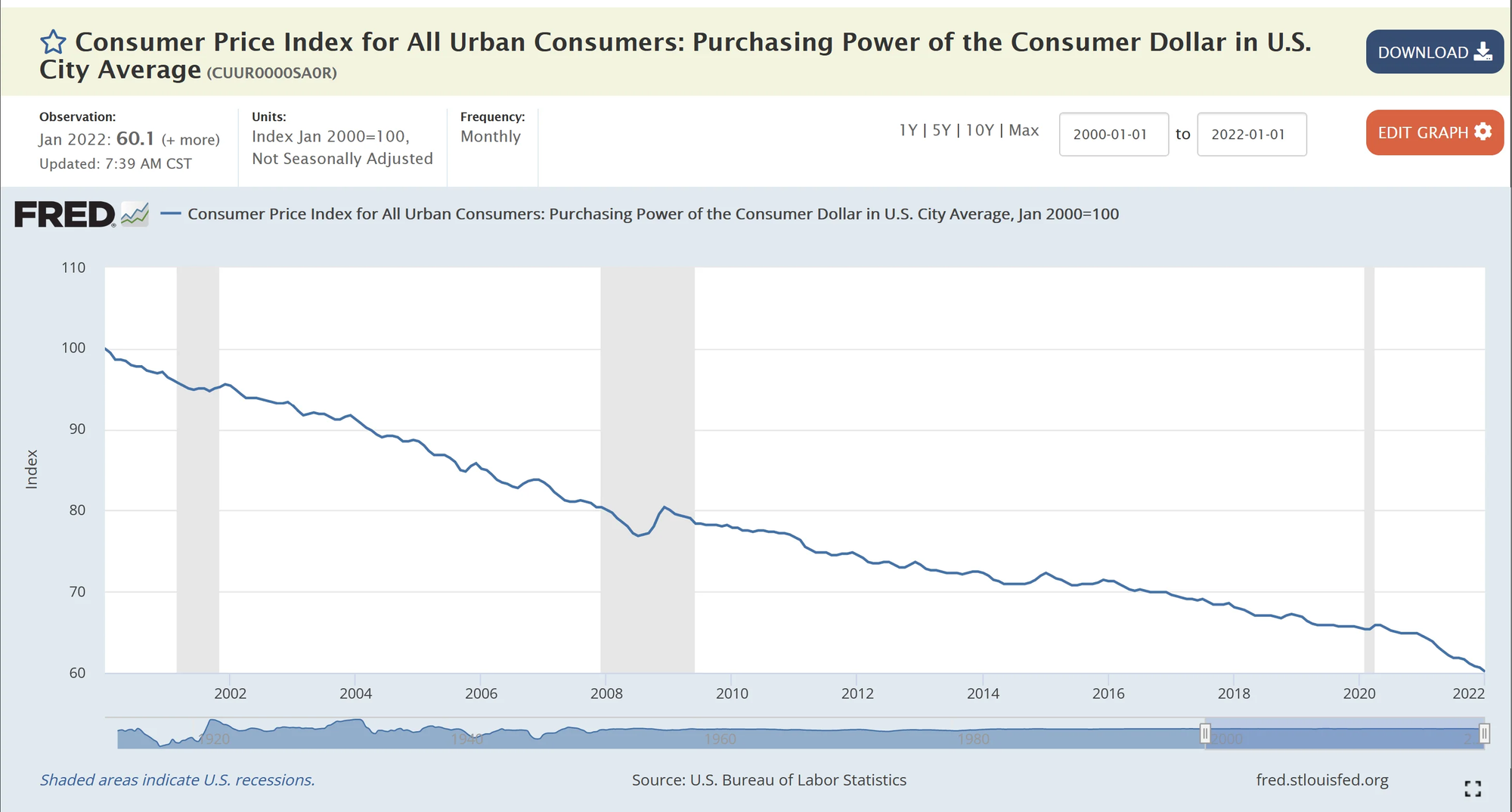

Inflation's biggest impact to you and I: Loss of the purchasing power

Loss of purchasing power is the truly insidious part of all this inflation. As inflation continues to rage, the purchasing power of folk's wages and salaries drops by that much as well!

Let me say this again, the purchasing power of $100 in January 2000 has dropped to $60.10. Stated another way, if you put $100 USD in the bank in 2000 and did not touch it until today, the purchasing power of your 'savings' has taken a 40% hit--all because JPow refuses to stop the brrr.