SEC Chair Gary Gensler: "Investors today can get information from more sources than ever before. They can share advice peer-to-peer via new social media platforms, as well as Reddit communities and YouTube channels."

SEC Chair Gary Gensler emphasizes the value of diverse information sources for investors, including peer-to-peer advice via social media platforms like Reddit and YouTube, which bring new voices and research into the investment field.

Prepared Remarks before the Investor Advisory Committee

Good morning. I am pleased to speak with the Investor Advisory Committee. As is customary, I’d like to note that my views are my own as Chair of the Securities and Exchange Commission, and I am not speaking on behalf of my fellow Commissioners or the staff.

This Investment Advisory Committee is meeting on the 90th anniversary of the agency’s founding. How appropriate, given the words of our third Chair, William O. Douglas: “We are the investors’ advocate.”[1]

I understand that your panel discussions today will focus on how technology is changing investment advice, as well as artificial intelligence in the financial sector. The Committee also will discuss potential recommendations to enhance both financial literacy and protections for self-directed investors.

Investors today can get information from more sources than ever before. They can share advice peer-to-peer via new social media platforms, as well as Reddit communities and YouTube channels. This has brought new voices and new research into the field, providing information to everyday investors.

At the same time, however, it's important to remember that market participants still need to comply with our time-tested laws. Those who promote the offer and sale of securities cannot mislead or defraud the public. Further, if you take money to promote a security, you must disclose that you have received consideration for the promotion, as well as the amount of such consideration.[2]

While today marks the 90th anniversary of the 1934 Securities and Exchange Act, a year before Congress enacted the Securities Act of 1933, which included important provisions protecting the public against fraud and touting of securities. Interesting to me, fraud and touting were included in the same section 17.

At the time, investors would assume that the information they were following on newspapers and tipsheets were independent and unbiased—when in fact, it was bought and paid for.[3]

With section 17, Congress drew an important distinction between the sale and offering of securities and other products in the market. The focus is just as applicable today, with celebrities and finfluencers using social media to endorse financial products and share advice. Just as importantly, I’d like to remind the everyday investors tuning in: A celebrity’s endorsement doesn’t necessarily mean that an investment product is right for you—or even, frankly, that it’s legitimate.

I also encourage investors to recognize various conflicts of interest that could impact your decision-making. Please check out our educational resources and tools to help you in your journey at SEC.gov and Investor.gov.

Regarding artificial intelligence, it’s already transforming much of finance—from call centers and claims processing to making predictions about markets, loans, or credit.

When it comes to robo-advising and brokerage apps, companies can use this technology to make predictions about our behaviors in response to targeted messages, pricing, and products. It’s important to recognize, however, that an AI model’s optimization function may incorporate conflicts of interest between the platform and its customers.

When brokers or advisers act on those conflicts and place their interests ahead of their investors’ interests, those investors may suffer financial harm.

Given that firms are automating human decision making, these challenges hold significant weight in the $110 trillion capital markets we oversee. That's why we proposed a rule regarding potential conflicts in the use of predictive data analytics.[4] Having received robust comments from the public and this Committee, I've asked staff to continue to consider best next steps.

Further, bad actors are finding new ways to exploit AI and deceive the public. Make no mistake: fraud is fraud. The SEC is focused on identifying and prosecuting any form of fraud that might threaten investors, capital formation, or the markets more broadly.

Lastly, as someone who researched the application of AI at MIT, I’ll be the first to say how exciting the field is. I’ll remind everyone that investment advisers and broker dealers might want to tap into your excitement by suggesting they're using this new technology to help you get a better return. Under the securities laws, firms should have a reasonable basis for those claims—and they should communicate full and truthful disclosure about the associated risks.

Investment advisers or broker-dealers also should not mislead the public by saying they are using an AI model when they are not, nor say they are using an AI model in a particular way but not do so. Such AI washing, whether it’s by companies raising money or financial intermediaries, such as investment advisers and broker-dealers, may violate the securities laws.

I understand you're also discussing recommendations to the SEC on financial literacy and protections for self-directed investors. I look forward to the Committee’s thoughts on these matters.

Thank you.

"Investors today can get information from more sources than ever before. They can share advice peer-to-peer via new social media platforms, as well as Reddit communities and YouTube channels. This has brought new voices and new research into the field, providing information to everyday investors."

Key Takeaways:

- "Investors today can get information from more sources than ever before. They can share advice peer-to-peer via new social media platforms, as well as Reddit communities and YouTube channels. This has brought new voices and new research into the field, providing information to everyday investors."

- "Those who promote the offer and sale of securities cannot mislead or defraud the public."

- "A celebrity’s endorsement doesn’t necessarily mean that an investment product is right for you—or even, frankly, that it’s legitimate."

Keith Gill, known online as DeepFuckingValue on Reddit and Roaring Kitty on Twitter, is primarily engaged in sharing his like of the stock aka 'advice' on platforms like Reddit, YouTube, and Twitter. His transparency about his own positions is the furthest thing from defrauding the reader as his strategies have drawn significant attention to GameStop, encouraging a broader audience to explore and understand the broader market. Gill’s approach is rooted in openness, where he clearly delineates his own investments and research without explicitly promoting the offer or sale of securities. This transparency provides valuable insight to everyday investors and helps to demystify the otherwise opaque world of stock trading.

SEC Chairman Gary Gensler has acknowledged the evolving landscape of investment information, noting, "Investors today can get information from more sources than ever before. They can share advice peer-to-peer via new social media platforms, as well as Reddit communities and YouTube channels. This has brought new voices and new research into the field, providing information to everyday investors." Gill exemplifies this trend, using his platforms to share his analysis and perspectives, thereby contributing to a more informed and engaged investor community.

Importantly, Gill's activities align with regulatory expectations. While Gensler cautions that "those who promote the offer and sale of securities cannot mislead or defraud the public," he also emphasizes that a celebrity endorsement does not inherently validate an investment. Gill's method does not involve endorsements but rather a transparent sharing of his own journey and insights. This distinction is crucial, as it highlights that his contributions are educational and informational, not promotional or deceptive. As such, Gill’s influence has helped break open access to investment knowledge, empowering individuals to make more informed decisions based on comprehensive, peer-shared research.

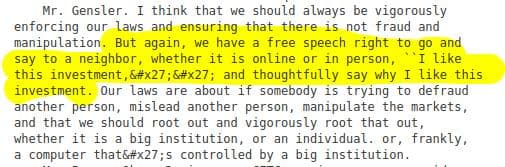

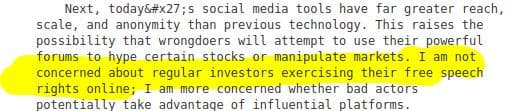

These thoughts align with Gensler's past comments:

Specifically, the following from Gary's testimony:

"I think that we should always be vigorously enforcing our laws and ensuring that there is not fraud and manipulation. But again, we have a free speech right to go and say to a neighbor, whether it is online or in person, `I like this investment', and thoughtfully say why I like this investment. Our laws are about if somebody is trying to defraud another person, mislead another person, manipulate the markets, and that we should root out and vigorously root that out, whether it is a big institution, or an individual. or, frankly,a computer that's controlled by a big institution."

"I am not concerned about regular investors exercising their free speech rights online; I am more concerned whether bad actors potentially take advantage of influential platforms."

To the people familiar with the matter complaining Keith Gill's updates are market manipulation on the long side, why is Wall Street so bent out of shape about new disclosures on the short side?

Heck, Wall Street and their trade groups are so mad they are suing about it!

- The National Association of Private Fund Managers (NAPFM), Alternative Investment Management Association (AIMA), and Managed Funds Association (MFA) filed a lawsuit asking the U.S. Court of Appeals for the Fifth Circuit to invalidate the two rules recently adopted by the Securities and Exchange Commission (SEC) requiring reporting and public disclosure of securities loans and short selling activity.

- They call out that both rules impose extensive new requirements for the reporting and public disclosure of information pertaining to short sales of securities, whether of the short-sale activity itself (as in the Short Position Reporting Rule) or of the loans of securities to facilitate that short-sale activity (as in the Securities Loan Reporting Rule).

- They complain the Short Position Reporting Rule and its detailed disclosures about short-sale activity can impose substantial harms on market participants (including by revealing confidential investment strategies and potentially facilitating retaliation or other manipulative activities).

- They also claim the rules are invalid and believe the Court should grant their petition and invalidate the rules.

What folks are saying on Short Position and Short Activity reporting by Institutional Investment Managers:

- Gary Gensler: "Today, I’m pleased that, based upon public comment, we’re adopting a rule fulfilling that Congressional mandate. Today’s adoption will promote greater transparency about short selling both to regulators and the public."

- Caroline Crenshaw: "This could help the SEC reconstruct market events & design responses to events that take place during times of volatility similar to the “meme” stock episode that might happen in the future."

- Mark Uyeda on 'NO' for (Rule 13f-2): "Public knowledge of their short positions would render them susceptible to a short squeeze & also reduce the incentives to engage in this beneficial activity."

- Hester Peirce Statement on SEC's Short Sale Disclosure: "Because a narrower rule leveraging existing reporting requirements could have brought more meaningful transparency at lower costs, I cannot support this recommendation."

What folks are saying on Transparency in the Securities Lending Market:

- Gary Gensler: "as relates to the reporting to regulators, the final rule will require lenders to report loan data to a registered national securities association—i.e., FINRA—by the end of each trading day."

- Hester Peirce: "While providing transparency regarding securities lending is a worthy & statutorily mandated objective, the approach we are voting on today is not the right way to achieve that objective. Accordingly, I cannot support this recommendation."

- Mark Uyeda "when these changes from the proposal are taken together, to what extent can the resulting information be used to estimate particular short selling positions & is that acceptable?"

TLDRS:

- SEC Chair Gary Gensler emphasizes the value of diverse information sources for investors, including peer-to-peer advice via social media platforms like Reddit and YouTube, which bring new voices and research into the investment field.

- He stresses that those promoting the offer and sale of securities must not mislead or defraud the public, highlighting the importance of transparency and honesty in investment advice.

- Gensler points out that a celebrity endorsement doesn't necessarily validate an investment product or guarantee its legitimacy, reminding investors to exercise caution.

- Gensler acknowledges the significance of free speech in sharing investment advice online, emphasizing the need to root out fraud and manipulation while supporting the rights of regular investors to discuss their investment preferences openly.

- Gensler's comments seemingly further support Keith Gill (known online as DeepFuckingValue on Reddit and Roaring Kitty on Twitter) is not committing market manipulation when he shares his investment positions and strategies transparently on platforms like Reddit, YouTube, and Twitter, even though it draws significant attention to GameStop and encourages broader market understanding--all without promoting the sale of securities.

- Gill’s openness about his thesis provides valuable insights for everyday household investors, while contributing to a more informed and engaged investor community that emphasizes education over promotional content.

SEC Chair Gary Gensler: "Investors today can get information from more sources than ever before. They can share advice peer-to-peer via new social media platforms, as well as Reddit communities and YouTube channels."

by u/Dismal-Jellyfish in Superstonk

SEC Chair Gary Gensler: "Investors today can get information from more sources than ever before. They can share advice peer-to-peer via new social media platforms, as well as Reddit communities and YouTube channels."https://t.co/R3QfYB5eHM

— dismal-jellyfish (@DismalJellyfish) June 6, 2024