A breakdown: forecasts suggest $1 in every $4 dollars to be spent online this holiday season, with expectations of 9.4% annual growth in online sales, all while RCEO drives a pivot from brick-and-mortar to technology driven!

Highlights:

- Peak retail season, which is the months of November and December combined, is expected to generate 2.8% more in holiday retail sales than in 2022, adjusted for an expected 0.5% increase in retail prices, according to a recent S&P Global Market Intelligence analysis.

- Companies will also have to adapt to consumers' holiday shopping preferences, including the growing online marketplace.

- Market Intelligence forecasts suggest one in every four dollars will be spent online this holiday season, with expectations of 9.4% annual growth in online sales.

- When asked about changes to their holiday shopping plans this year, over two-thirds of consumers said they were curtailing their spending compared to the previous year.

- Meanwhile, the apes at r/Superstonk are slapping some rocket boosters onto Santa’s Sleigh this Holiday Season and helping GameStop deliver toys to Toys for Tots and bringing smiles to a lot of families all while Best Buy's CEO complains about Taylor Swift, 'Barbenheimer', & 'funflation' hurting sales, GameStop has Apes holding down the balance sheet in an economy facing headwinds and rallying around 'Oppencohen'!

Speaking of Oppencohen, he called out the need to transform in his letter to the board back in 2020:

This point of efficiency was further driven home back in September:

Subject: Survival

I will be straight to the point.

It is not sustainable for GameStop to operate a money losing business. The mission is to operate hyper efficiently and profitably. Our expense structure must allow us to endure any adverse scenario. Whether it’s a difficult economy or revenue deceleration from shrinking software, we must be profitable. Our job is to make sure GameStop is here for decades to come. Extreme frugality is required. Every expense at the company must be scrutinized under a microscope and all waste eliminated. The company has no use for delegators and money wasters. I expect everyone to treat company money like their own and lead by example.

Prospering in retail means survival. If we survive, we stay in the game. Survival is avoiding the deadly sins that often lead retailers to self-destruct. This is usually a result of the following - buying bad inventory, using leverage, and running expenses too high. By avoiding these self-inflicted mistakes and focusing on the basics, GameStop can be here for a long time.

I expect everyone to roll up their sleeves and work hard. I’m not getting paid, so I’m either going down with the ship or turning the company around. I much prefer the latter.

It won’t be easy. Best of luck to us all.

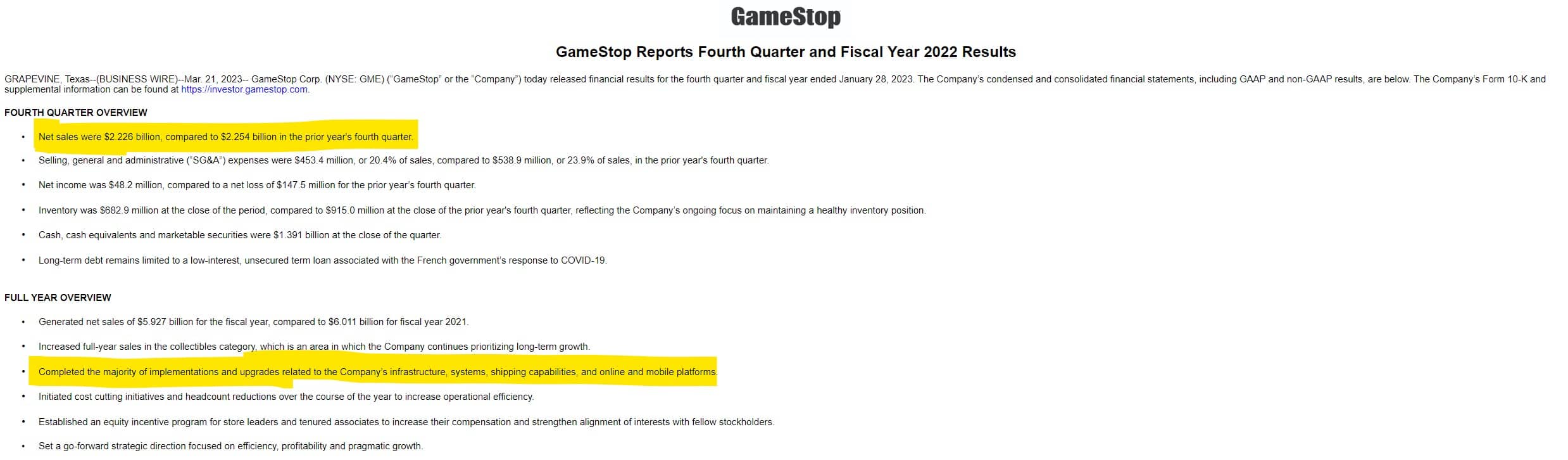

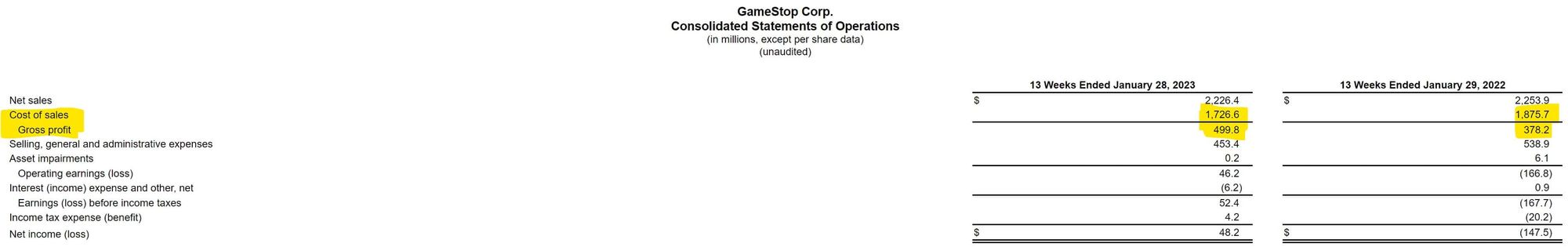

Last 4th quarter:

Meanwhile, the Wall Street Journal previously reported that e-commerce sales accounted for only about 10% of GameStop's overall sales.

Let's do some 'fuzzy' maths!

- Peak retail season, which is the months of November and December combined, is expected to generate 2.8% more in holiday retail sales than in 2022 (gross sales).

- One in every four dollars will be spent online this holiday season, with expectations of 9.4% annual growth in online sales.

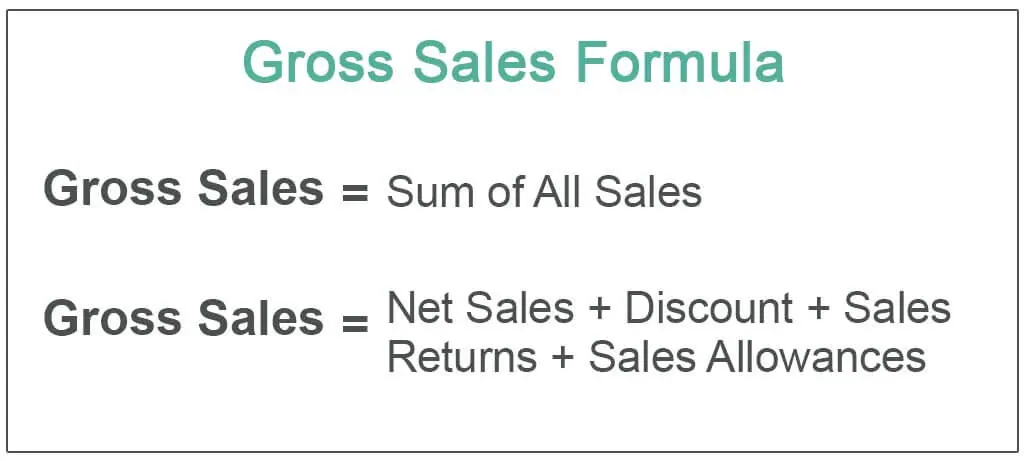

Looking at the consolidated statement further, I do not see any deductions for returns, allowances, or discounts. Therefore, gross sales equals net sales, or put another way:

Gross Sales = Gross Profit + Cost of Sales

13 Weeks Ended January 28, 2023

| Cost of sales (in millions) | $1,726.6 |

|---|---|

| Gross profit (in millions) | $499.8 |

| Gross Sales (in millions) | $2,226.4 |

In most business scenarios, it is my understanding that there are usually some deductions from gross sales, leading to net sales being lower, but in this particular instance, the lack of such deductions resulted in both figures being the same.

Back to the numbers, on $2.226 billion in sales, that would put 2022 Q4 online sales at $222,260,000 and brick-and-mortar sales $2,000,340,000 according to the Wall Street Journal's 90/10 breakdown.

Recall, Market Intelligence calls for 9.4% annual growth in online sales for retailers, which would see GameStop bring in $243,152,440 via online sales + $2,056,349,520 from 2.8% increase via brick-and-mortar sales, for a total of $2,299,501,960.

To put $2,299,501,960 in perspective, again this is fuzzy maths, a 2.8% increase on $2.226 billion (without any online sales) is $2,288,328,000.

$2,299,501,960 > $2,288,328,000 and would be a 3.3% jump in sales from 2022 Q4's $2.226 billion.

I am not sure how that splits across all 4 quarters, so have left it all in Q4.

For instance, it could be even spread across all 4 quarters at 2.35%, which would knock our numbers lower.

$222,260,000 at 2.35% growth = $227,483,110 in online sales

$2,000,340,000 at 2.8% growth = $2,056,349,520

$2,056,349,520 + $227,483,110 = $2,283,832,630

$2,283,832,630 > $2,226,000,000 by 2.6%

Gross sales do not state the level of profitability of GameStop but there is a high chance that an increase in gross sales (especially from online sales) increases the level of profits.

It looks like this fourth quarter the upgrades to the GameStop's infrastructure are beginning to payoff in a big way if industry wide projections hold steady and this is before Apes have there say with Toys for Tots and holding down the balance sheet.

Bullish!

TLDRS:

- Peak retail season, which is the months of November and December combined, is expected to generate 2.8% more in holiday retail sales than in 2022.

- Market Intelligence forecasts suggest one in every four dollars will be spent online this holiday season, with expectations of 9.4% annual growth in online sales.

- Net sales in Q4 2022 were $2.226 billion.

- The Wall Street Journal previously reported that e-commerce sales accounted for only about 10% of GameStop's overall sales.

- Market Intelligence calls for 9.4% annual growth in online sales for retailers, which would see GameStop bring in $243,152,440 via online sales + $2,056,349,520 from 2.8% increase via brick-and-mortar sales, for a total of $2,299,501,960.

- $2,299,501,960 would be a 3.3% jump in sales from 2022's Q4 $2.226 billion.

- Just in time for the apes at r/Superstonk are slapping some rocket boosters onto Santa’s Sleigh this Holiday Season and helping GameStop deliver toys to Toys for Tots and bringing smiles to a lot of families all while Best Buy's CEO complains about Taylor Swift, 'Barbenheimer', & 'funflation' hurting sales, GameStop has Apes holding down the balance sheet in an economy facing headwinds and rallying around 'Oppencohen'!

- Bullish!