Dropping Like a Stone: ON RRP Take-up in the Second Half of 2023. Liberty Street Economics interpret the recent drop in ON RRP take-up through the lens of the channels identified in the recent staff report driving its initial increase.

Source: Gara Afonso, Marco Cipriani, and Gabriele La Spada, “Dropping Like a Stone: ON RRP Take-up in the Second Half of 2023,” Federal Reserve Bank of New York Liberty Street Economics, December 19, 2023, https://libertystreeteconomics.newyorkfed.org/2023/12/dropping-like-a-stone-on-rrp-take-up-in-the-second-half-of-2023/.

Background: Liberty Street has a paper Treasury Bill Supply and ON RRP Investment based on the Staff Report Banks’ Balance-Sheet Costs, Monetary Policy, and the ON RRP.

Dropping Like a Stone: ON RRP Take-up in the Second Half of 2023:

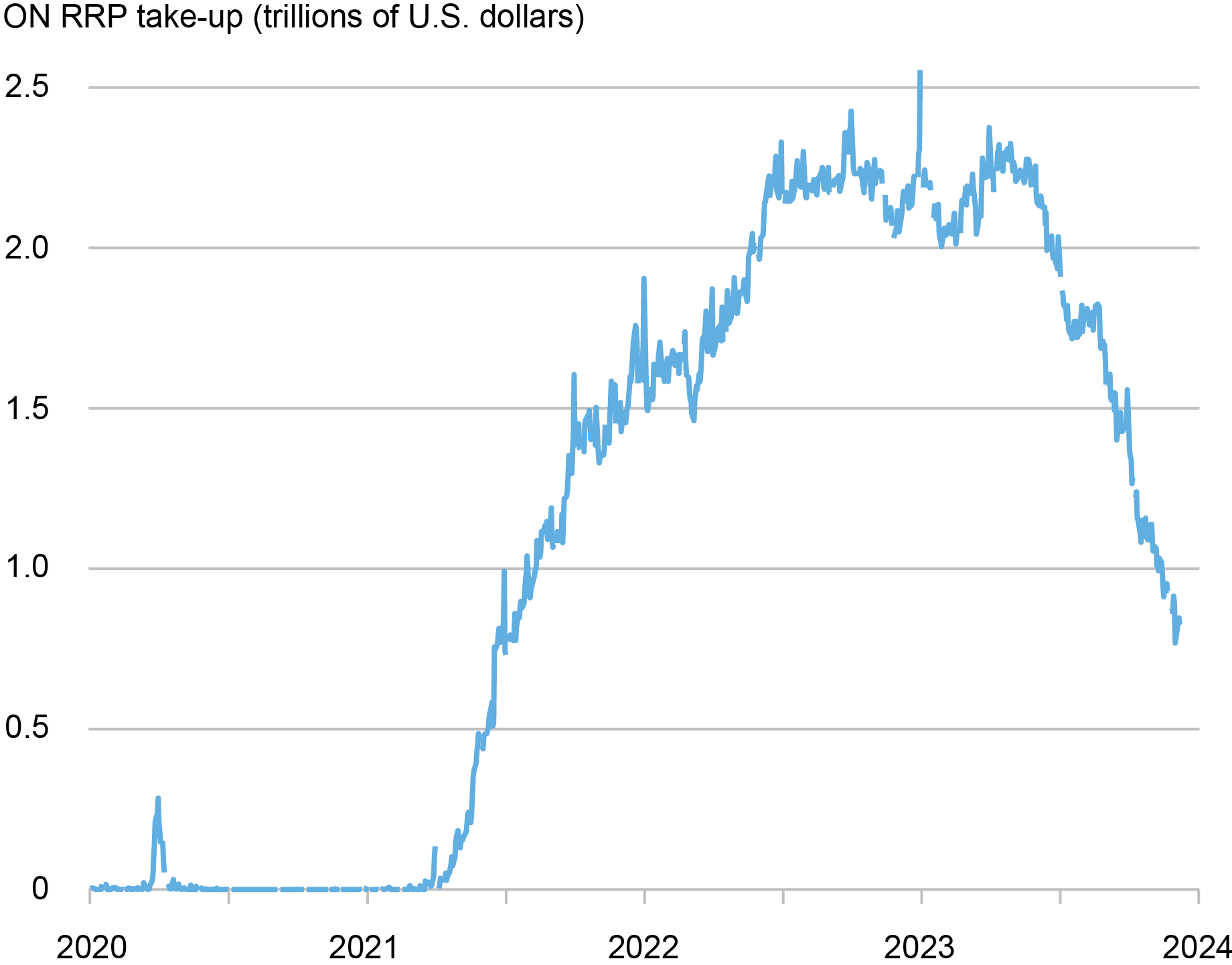

Take-up at the Overnight Reverse Repo Facility (ON RRP) has halved over the past six months, declining by more than $1 trillion since June 2023. This steady decrease follows a rapid increase from close to zero in early 2021 to $2.2 trillion in December 2022, and a period of relatively stable balances during the first half of 2023. In this post, we interpret the recent drop in ON RRP take-up through the lens of the channels that we identify in our recent Staff Report as driving its initial increase.

Banks’ Balance-Sheet Costs:

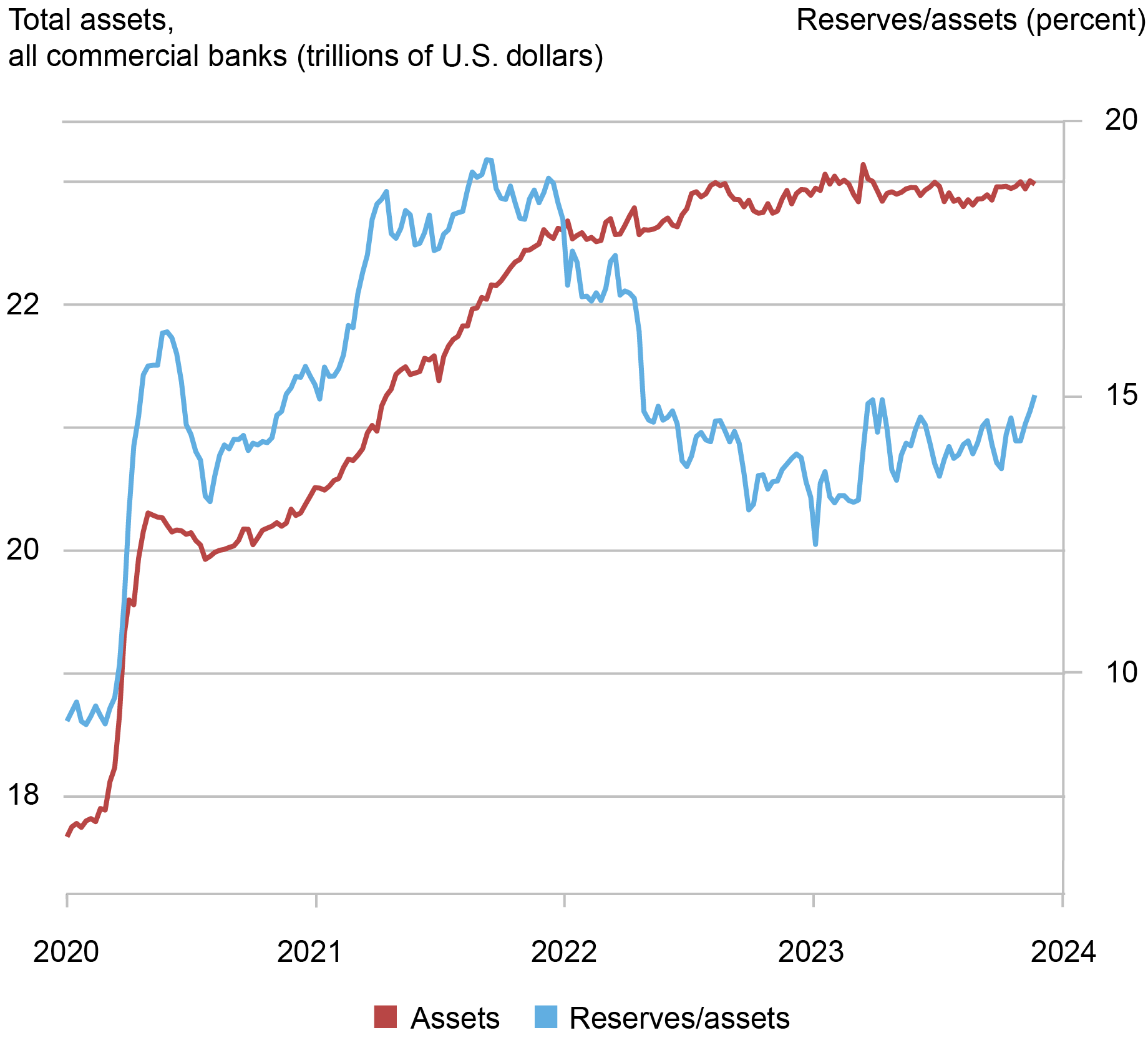

As the Federal Reserve expanded its balance sheet in response to the COVID-19 pandemic, it increased the supply of reserves to the banking system and, as a result, banks’ balance sheets also grew. Reserves increased from $1.6 trillion—or 9 percent of banks assets—in January 2020 to $3.2 trillion—or 16 percent of bank assets—over the following three months, reaching a historical maximum of 19 percent of banks’ assets in September 2021. As the chart below shows, bank assets also grew from $18 trillion in January of 2020 to $20 trillion in April 2020, and continued to increase to $23 trillion in May 2023.

As banks’ balance sheets expand, regulatory ratios—such as the supplementary leverage ratio (SLR)—are likely to become tighter for some institutions. Banks react to increased balance-sheet costs by pushing some of their deposits toward the money market fund (MMF) industry—for instance, by lowering the rate paid on bank deposits—and reducing their demand for short-term debt. As we explain in our paper, both effects are likely to have boosted ON RRP take-up during March 2021 – May 2023, as most MMFs are eligible to invest in the ON RRP and do so especially when alternative investment options, such as banks’ wholesale short-term debt—including repos by dealers affiliated with a bank holding company—dwindle.

Likely, these effects have subsided relative to 2022. Indeed, since June 2023, bank assets have hovered around $23 trillion, slightly below their March 2023 peak. Moreover, reserves have been around 14 percent of bank assets since June 2023, below the average of 16 percent observed between March 2020 and May 2023. Since the SLR treats all assets in the same way regardless of their riskiness, large banks’ balance-sheet expansions are particularly costly if they are used to finance safe assets with low returns. Therefore, though bank assets have remained relatively stable, the recent decline in the ratio of reserves to bank assets has likely reduced banks’ overall balance-sheet costs.

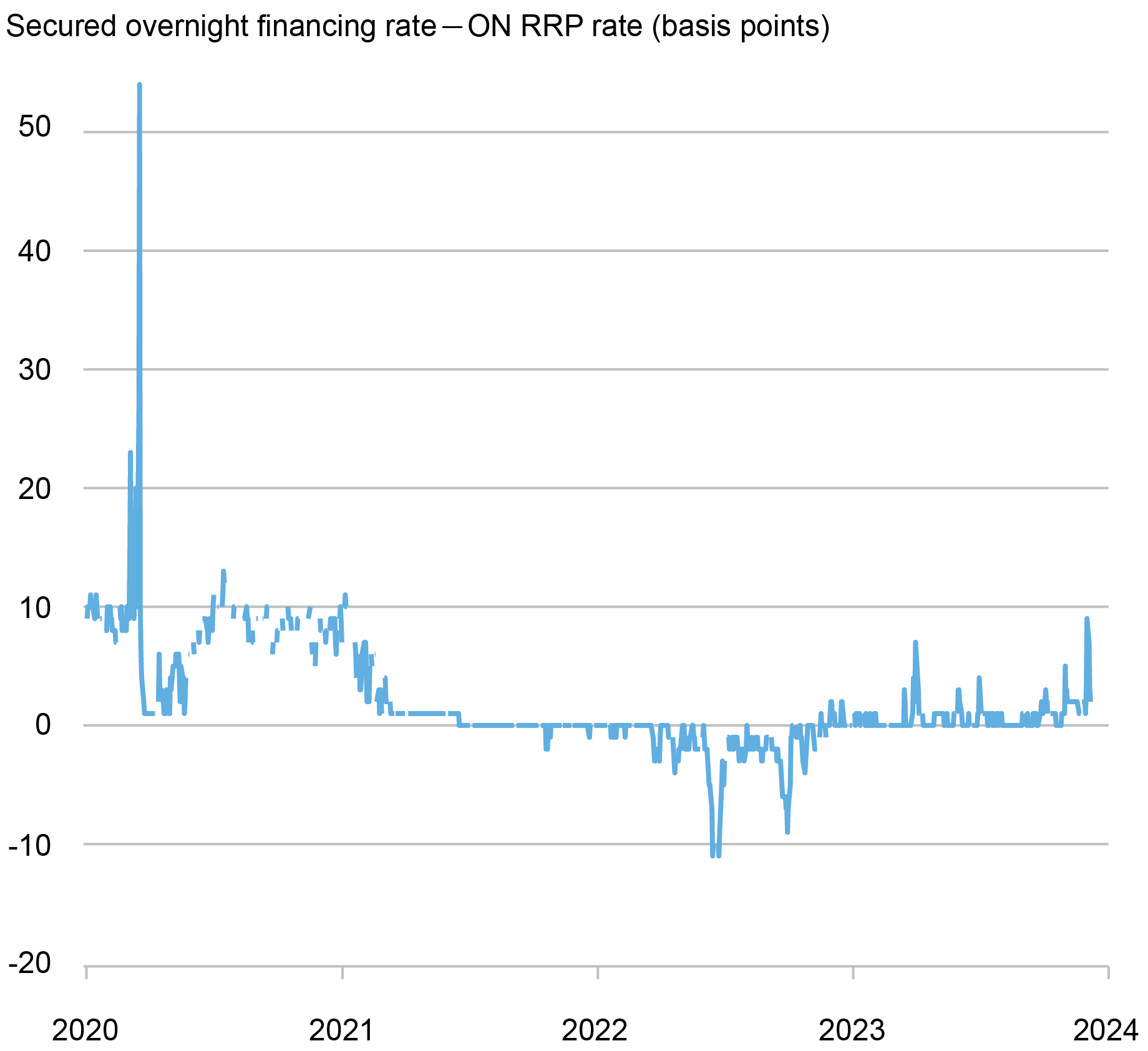

Consistent with a decrease in banks’ balance-sheet costs (and an increase in the supply of bank debt), the interest rates at which banks and broker dealers borrow via overnight Treasury-backed repos have increased since the fourth quarter of 2022 and are now a few basis points above the ON RRP rate (see chart below). This positive rate differential pushes MMFs away from investing at the ON RRP facility and into private repos.

The SOFR-ON RRP Spread Has Been Positive…:

Monetary Policy:

Monetary policy can affect ON RRP take-up by MMFs in two ways. First, the interest-rate pass-through of MMF shares is higher than that of bank deposits; as a result, the size of the MMF industry comoves with the monetary policy cycle as investors switch from bank deposits to MMF shares when the policy rate increases. Though the assets of the MMF industry are at an all-time high, the pace of the increase has somewhat decreased recently, consistent with a slower pace of monetary policy tightening; moreover, the share of MMF assets managed by government funds—the ones most likely to invest in the ON RRP—has decreased since June 2022 by 7 percentage points.

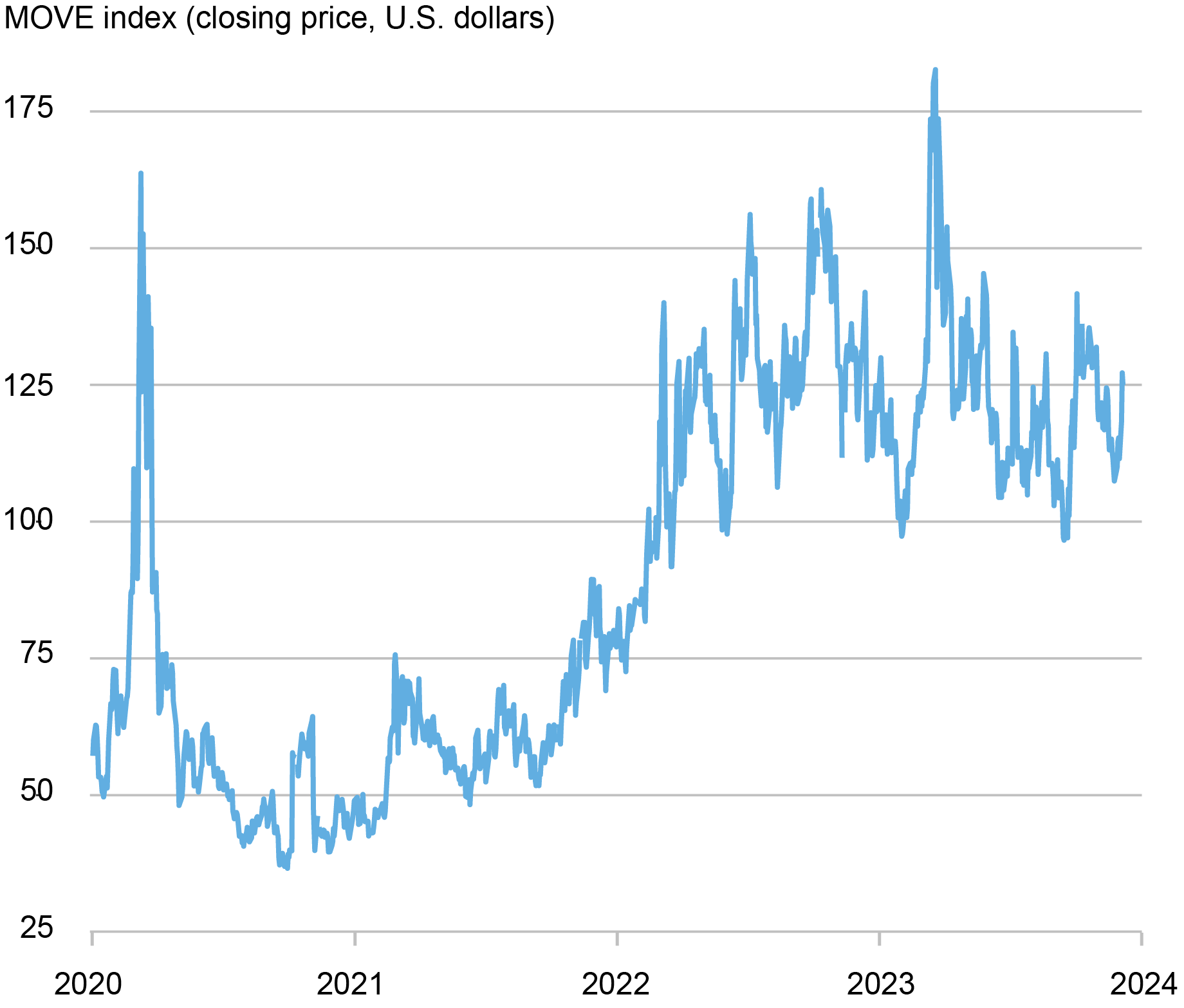

Second, monetary policy can affect MMFs’ take-up at the ON RRP also through its effect on interest-rate uncertainty. Higher uncertainty leads MMFs to rebalance their portfolios toward investments with shorter duration; the ON RRP is one such investment as it is overnight. Indeed, interest rate uncertainty—as measured by the MOVE index—had increased substantially during the latest tightening cycle, raising from 57.3 in May 2021 to 136 in May 2023. Recently, however, the increase has been partially reversed. Indeed, the average level of the MOVE was 125.6 in the first half of 2023 but declined to 117.3 in the second half of the year.

…while Interest-Rate Uncertainty Has Been Decreasing:

The Supply of T-bills:

A third driver of ON RRP take-up is the supply of T-bills. The Federal Government has expanded the supply of T-bills dramatically in 2023: T-bills outstanding increased from $3.7 trillion at the end of 2022 to $5.3 trillion at the end of September 2023, with a $1.3 trillion increase since June. As the supply of T-bills grows, the investment options of MMFs—and especially of government funds, which represent 83 percent of the industry and can only invest in short-term government debt and repos backed by government debt—expand and, as a result, their investment in the ON RRP dwindles. In our staff report, we estimate that a $100 billion increase in the amount of T-bill issuance reduces the proportion of ON RRP investment in a government-MMF portfolio by 2.3 percentage points, relative to that in a prime-MMF portfolio; since average monthly T-bill issuance went from $1.12 trillion in the period from 2022:Q1-2023:Q1 to $1.53 trillion in 2023:Q2-2023:Q3, this effect on portfolio rebalancing amounts to an additional decrease in ON RRP investment of roughly $350 billion.

Summing It Up:

The increase in ON RRP take-up between 2021 and May 2023 was driven by a series of factors: a rise in banks’ balance-sheet costs due to the expansion of the supply of reserves in response to the COVID-19 pandemic, the rapid hikes in policy rates aimed at fighting inflation and the resulting increase in interest-rate uncertainty, and the decrease in the T-bill supply of 2021-22 resulting from the normalization of public debt after the COVID-19 crisis.

These factors have reversed: the Federal Reserve restarted running off its balance sheet after the temporary expansion during the banking turmoil of March 2023; the growth of the banking system waned while the ratio of reserves to asset decreased; the pace of interest-rate hikes slowed down; and the T-bill supply increased again. If these dynamics persist in the months ahead, ON RRP take-up may continue to decrease. Such a steady decline would be consistent with that observed in early 2018, when investment at the ON RRP gradually disappeared as the Federal Reserve continued to normalize the size of its balance sheet and reserves in the banking system became less abundant.

Additional information:

The reason ON RRP has been dropping recently is called out in the most recent FOMC minutes:

On the liabilities side of the balance sheet, usage of the overnight reverse repurchase agreement (ON RRP) facility declined further, as money market mutual funds continued to absorb new Treasury bill issuance and appeared to increase investment in the private market for repurchase agreements (repos) as well.

- October 31–November 1, 2023 FOMC Minutes

- Between January 2021 and June 2022, money market funds (MMFs) significantly increased their investments in the Federal Reserve's Overnight Reverse Repurchase (ON RRP) facility by $2 trillion, while their lending in the private repo market decreased by almost $500 billion.

- MMFs, the largest providers of cash to the repo market and main investors in the ON RRP facility, continued lending in private repo markets at rates below the ON RRP rate.

- Despite their shift towards ON RRP, private repo borrowing remained steady as dealers sought liquidity from other sources, like affiliates, to compensate for reduced funding from MMFs.

- The ON RRP facility aims to set a floor on overnight lending rates for MMFs, affecting private repo market rates and quantities.

- MMFs have demonstrated flexibility in lending rates, occasionally accepting rates below the ON RRP rate for reasons like maintaining dealer relationships and managing late-day flows.

- MMFs' private-repo counterparties, primarily dealers, responded to reduced funding from MMFs by increasing funding sourced from their affiliates.

This shift suggests a growing importance of affiliate relationships in maintaining liquidity amidst changes in MMF lending behavior. - The repo market, vital for short-term lending against collateral, has seen FICC's sponsored GC service grow in volume, providing benefits like netting to dealers.

- MMFs are significant participants in this market, typically through tri-party repo or bilateral centrally cleared repo.

- The Federal Reserve's ON RRP facility, heavily utilized by MMFs, helps support the Fed's target range for the federal funds rate by setting a floor under overnight rates.

- However, the facility's control over repo rates is not absolute, as evidenced by MMFs' willingness to accept lower rates.

- The interactions between the ON RRP facility and the private repo market continues to play a significant role in setting overnight interest rates.

TLDRS:

- The authors call out the increase in Overnight Reverse Repurchase (ON RRP) take-up from 2021 to May 2023 was influenced by several factors, including higher balance-sheet costs for banks due to the expansion of reserve supply following the pandemic.

- Other contributing factors were the rapid increases in policy rates to combat inflation, which led to greater interest-rate uncertainty, and a reduction in the supply of Treasury bills (T-bills) during 2021-22 as part of the normalization of public debt pandemic.

- Recent trends show a reversal of these factors: the Federal Reserve has begun reducing its balance sheet size, which had temporarily expanded during the banking turmoil of March 2023.

- The growth of the banking system has slowed, and the ratio of reserves to assets has decreased.

- The pace of interest-rate hikes has slowed down.

- There has been an increase in the T-bill supply again.

- If these trends continue, the take-up of ON RRP is likely to continue decreasing.

- This potential decline in ON RRP take-up could mirror the trend observed in early 2018 when investments in ON RRP gradually reduced as the Federal Reserve continued to normalize its balance sheet and reserves in the banking system became less abundant.