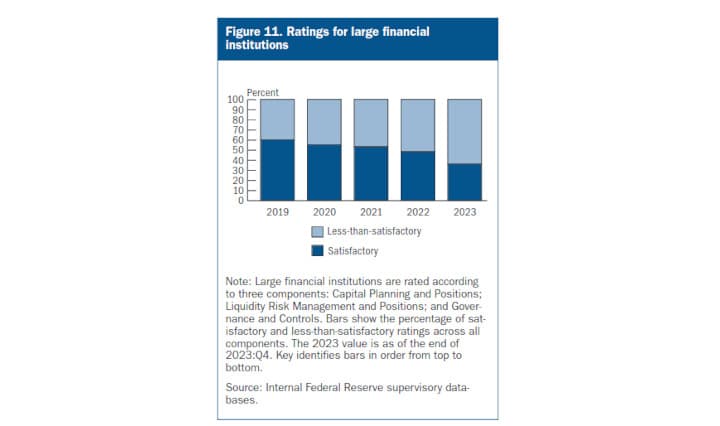

Fed supervisors summarize assessments of large financial institutions using LFI rating system--in 2023, only 1/3 of large financial institutions had satisfactory ratings.

The Federal Reserve Board publishes its semiannual Supervision and Regulation Report to inform the public of current banking conditions as well as provide transparency about its supervisory and regulatory policies and actions.

This report focuses on developments in three areas:

- Banking System Conditions provides an overview of the financial condition of the

banking sector. - Regulatory Developments outlines the Federal Reserve’s recent regulatory policy work.

- Supervisory Developments highlights the Federal Reserve’s current supervisory programs and priorities.

Interesting Notes:

- Since the banking stresses of March 2023, the amount of collateral pre-positioned at the discount window has increased significantly and is now nearly $3 trillion.

- Over 5,000 banks and credit unions are signed up to use the discount window, of which nearly 3,000 have collateral pledged.

- Credit card balances increased to a historic high at the end of 2023, despite tightened lending standards and fewer credit line increases at large banks.

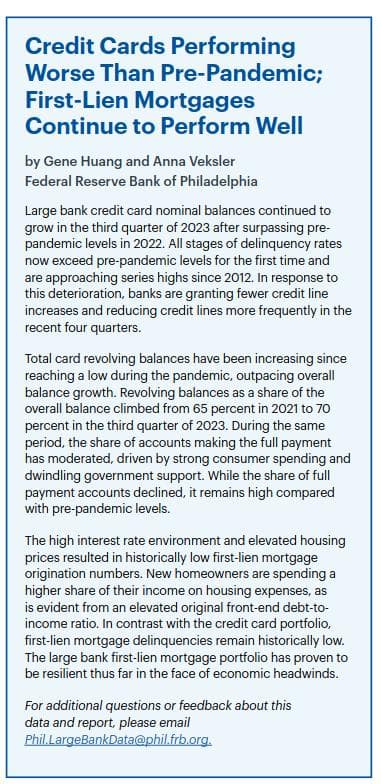

Large bank credit card nominal balances continued to grow in the third quarter of 2023 after surpassing pre-pandemic levels in 2022. All stages of delinquency rates now exceed pre-pandemic levels for the first time and are approaching series highs since 2012. In response to this deterioration, banks are granting fewer credit line increases and reducing credit lines more frequently in the recent four quarters.

Total card revolving balances have been increasing since reaching a low during the pandemic, outpacing overall balance growth. Revolving balances as a share of the overall balance climbed from 65 p ercent in 2021 to 70 percent in the third quarter of 2023. During the same period, the share of accounts making the full payment has moderated, driven by strong consumer spending and dwindling government support. While the share of full payment accounts declined, it remains high compared with pre-pandemic levels.

The high interest rate environment and elevated housing prices resulted in historically low first-lien mortgage origination numbers. New homeowners are spending a higher share of their income on housing expenses, as is evident from an elevated original front-end debt-to- income ratio. In contrast with the credit card portfolio, first-lien mortgage delinquencies remain historically low. The large bank first-lien mortgage portfolio has proven to be resilient thus far in the face of economic headwinds.

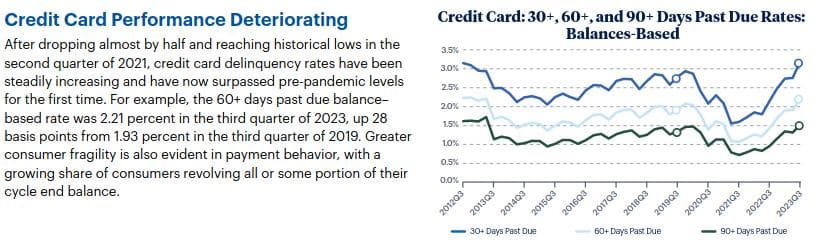

After dropping almost by half and reaching historical lows in the second quarter of 2021, credit card delinquency rates have been steadily increasing and have now surpassed pre-pandemic levels for the first time. For example, the 60+ days past due balance–based rate was 2.21 percent in the third quarter of 2023, up 28 basis points from 1.93 percent in the third quarter of 2019. Greater consumer fragility is also evident in payment behavior, with a growing share of consumers revolving all or some portion of their cycle end balance.

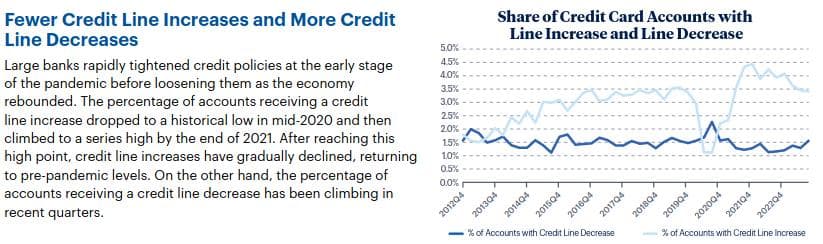

Large banks rapidly tightened credit policies at the early stage of the pandemic before loosening them as the economy rebounded. The percentage of accounts receiving a credit line increase dropped to a historical low in mid-2020 and then climbed to a series high by the end of 2021. After reaching this high point, credit line increases have gradually declined, returning to pre-pandemic levels. On the other hand, the percentage of accounts receiving a credit line decrease has been climbing in recent quarters.

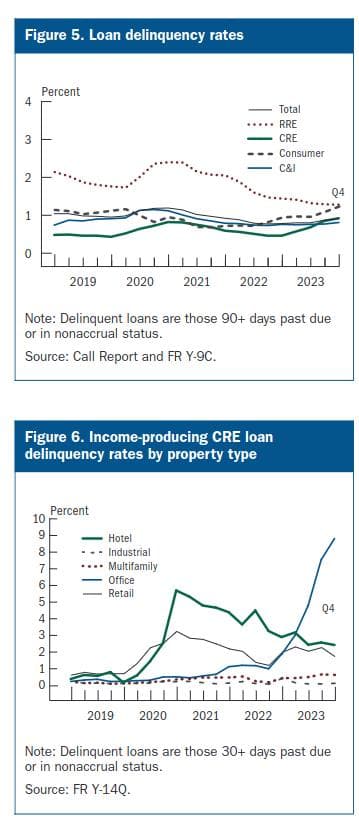

The rise in CRE delinquencies was largely due to loans secured by nonowner-occupied non-farm nonresidential properties in banks with at least $100 billion in total assets. Nonowner-occupied nonfarm nonresidential properties include hotels, offices, retail stores, warehouse facilities, and other types of business property used as collateral.

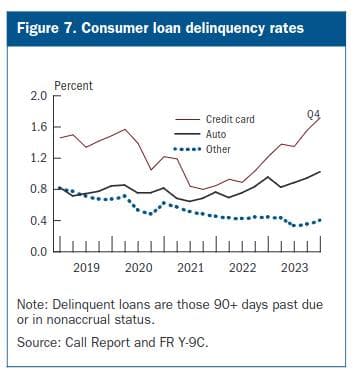

The delinquency rate for consumer loans was driven higher in 2023 by the credit card and auto loan sectors. The credit card loan delinquency rate reached 1.7 percent at year-end 2023, its highest level in the last five years. In addition, the share of borrowers carrying forward all or some portion of their credit card balance to the next billing cycle has increased. The delinquency rate for auto loans increased in 2023 and now exceeds pre-pandemic levels.

Auto loans originated prior to the pandemic by banks with total assets over $100 billion have performed worse than newer loans, partially reflecting a tightening of lending standards for the newer loans.

"The credit card loan delinquency rate reached 1.7 percent at year-end 2023, its highest level in the last five years. In addition, the share of borrowers carrying forward all or some portion of their credit card balance to the next billing cycle has increased. The delinquency rate for auto loans increased in 2023 and now exceeds pre-pandemic levels."

Why is this interesting? Remember this from the other day?:

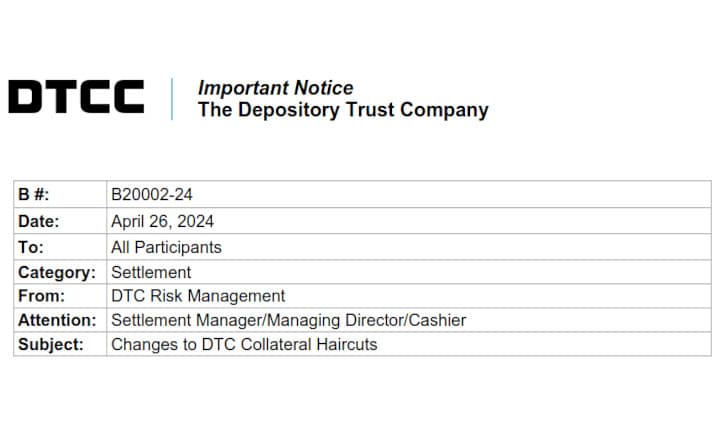

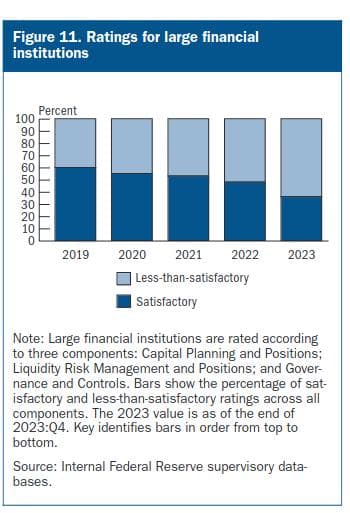

Collateral valuation for corporate notes or bonds rated B1 to B3, will be updated to use a haircut value of 70%, up from 50%.

What could this mean for GameStop?

The new collateral requirements could lead to margin calls for some market participants as the increase in the haircut for corporate bonds rated between B1 and B3 from 50% to 70% means that the value of these bonds as collateral significantly decreases.

For example, if a participant has pledged such bonds to secure a swap, the effective value of their collateral drops. What was previously enough collateral might no longer suffice under the new haircut rules.

If the decrease in the collateral value causes the total collateral held by a participant to fall below the required margin level for their positions, the participant would face a margin call.

As we have learned, anyone facing margin calls need to quickly liquidate other assets or find additional acceptable collateral to meet the margin requirements or face their position blowing up.

If hedge funds or other financial institutions are using corporate bonds (especially those now subject to a higher haircut) or crypto-related investments as collateral for borrowing shares of GameStop to short sell, the new rules could significantly impact their operations.

Again, the increased haircut on B1 to B3 rated bonds means these institutions would need to provide more collateral to maintain the same level of borrowing...

If they are unable to meet these new requirements, they'll face closing their short positions and forced buy back of GameStop shares to return to their lenders...

TL:DR – I believe inflation is the match that has been lit that will light the fuse of our rocket.

Back to the Supervision and Regulation Report--Trends in Supervisory Ratings and Findings...

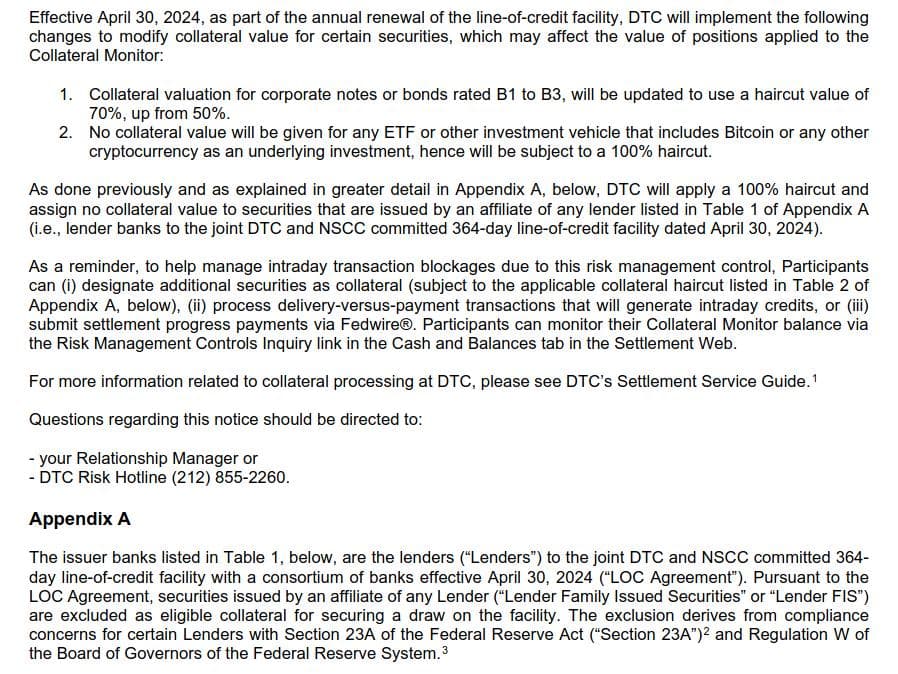

- "Federal Reserve supervisors summarize their assessments of large financial institutions using the LFI rating system."

- "The LFI rating system evaluates whether a firm possesses sufficient financial and operational strength and resilience to maintain safe-and-sound operations and comply with laws and regulations"

- "only about one-third of the large financial institutions had satisfactory ratings across all three LFI rating components"

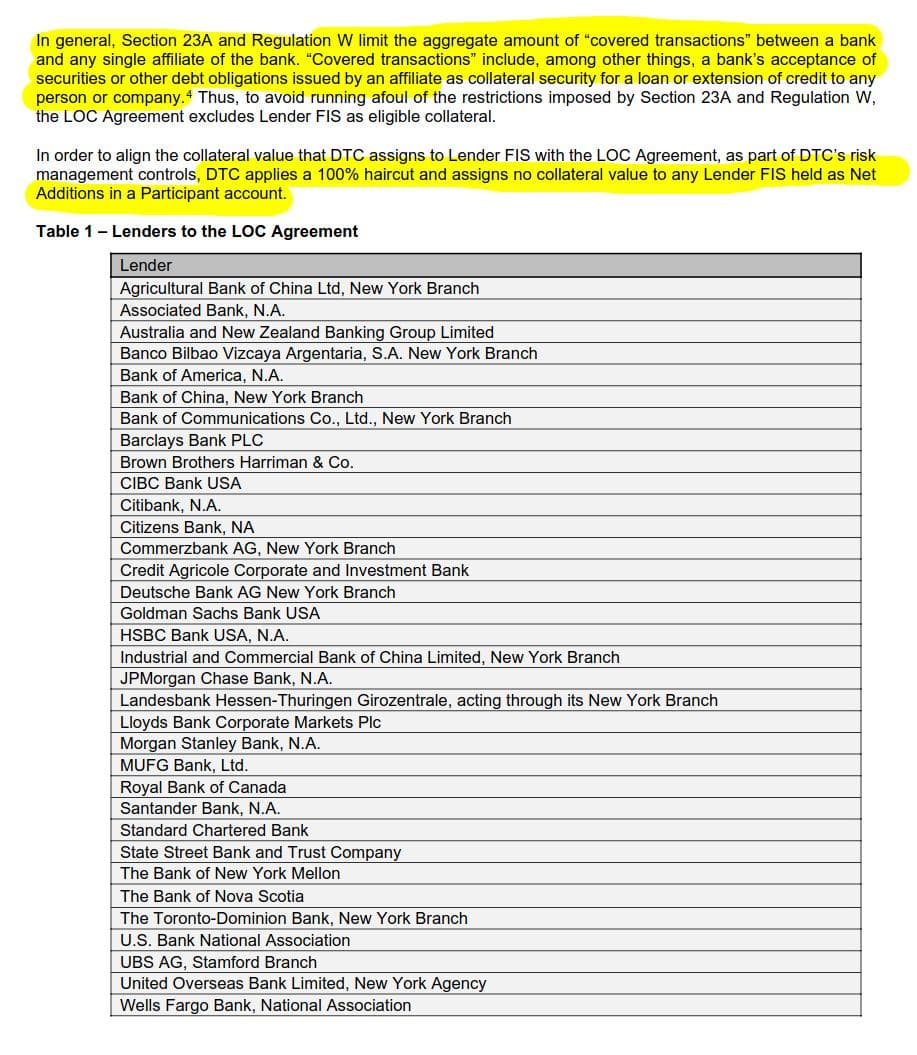

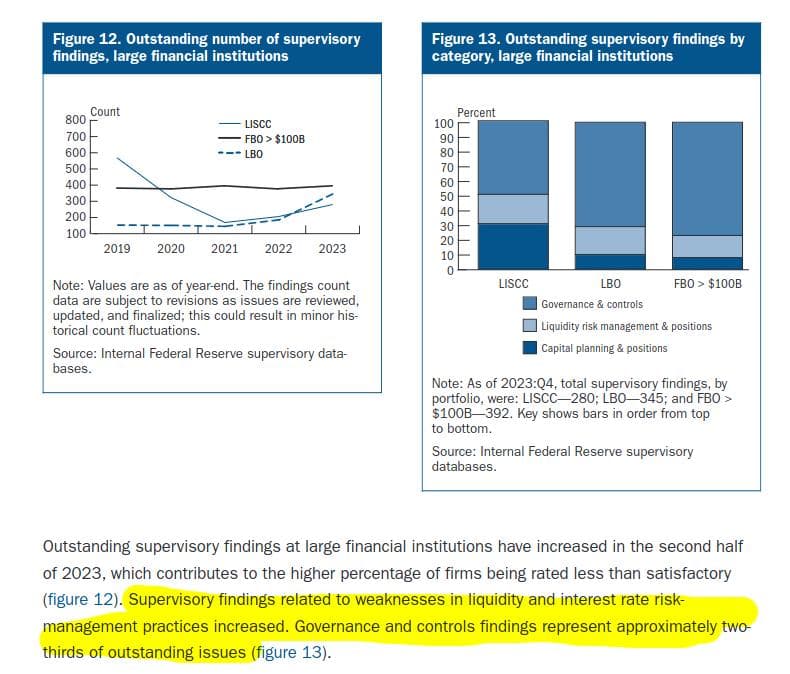

"Supervisory findings related to weaknesses in liquidity and interest rate risk-management practices increased. Governance and controls findings represent approximately two-thirds of outstanding issues."

TLDRS:

The Federal Reserve Board's Supervision and Regulation Report covers:

- Banking System Conditions: Overview of financial health.

- Regulatory Developments: Recent policy work.

- Supervisory Developments: Current programs and priorities.

Key Points:

- Collateral at the discount window is nearly $3 trillion post-March 2023.

- Over 5,000 banks and credit unions use the discount window.

- Credit card balances hit a historic high in 2023.

- Delinquency rates for credit cards and auto loans increased in 2023.

- Delinquency rates for credit cards are highest in the last 5 years.

- Federal Reserve supervisors use the LFI rating system to assess large financial institutions.

- The LFI rating evaluates a firm's financial and operational strength, resilience, and compliance with laws and regulations.

- Only about one-third of large financial institutions received satisfactory ratings across all LFI components.