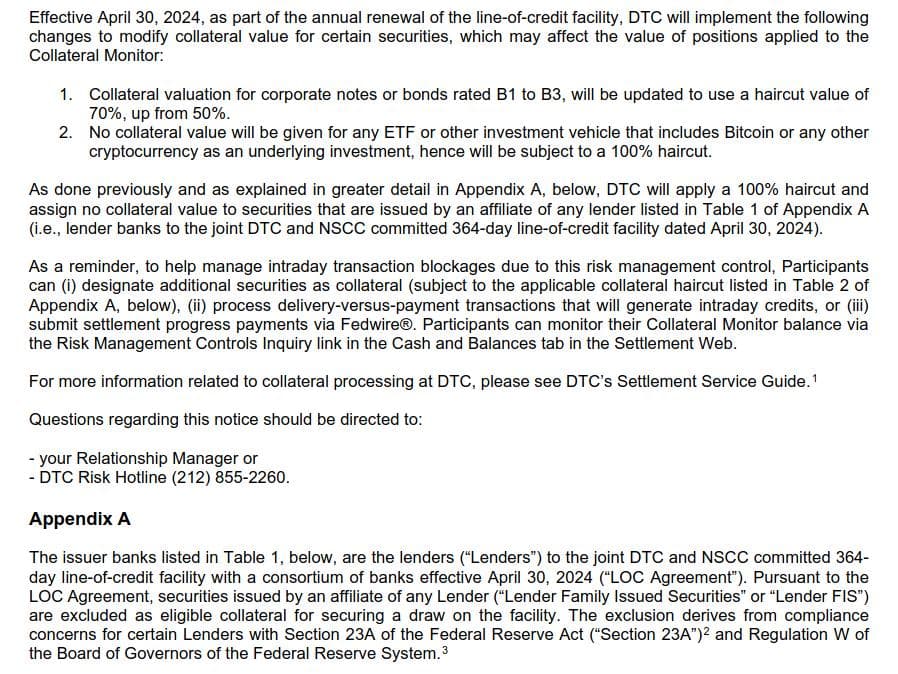

On April 30, 2024, as part of the annual renewal of the line-of-credit facility, DTC will implement changes to modify collateral value for certain securities, which may affect the value of positions applied to the Collateral Monitor.

- Collateral valuation for corporate notes or bonds rated B1 to B3, will be updated to use a haircut value of 70%, up from 50%.

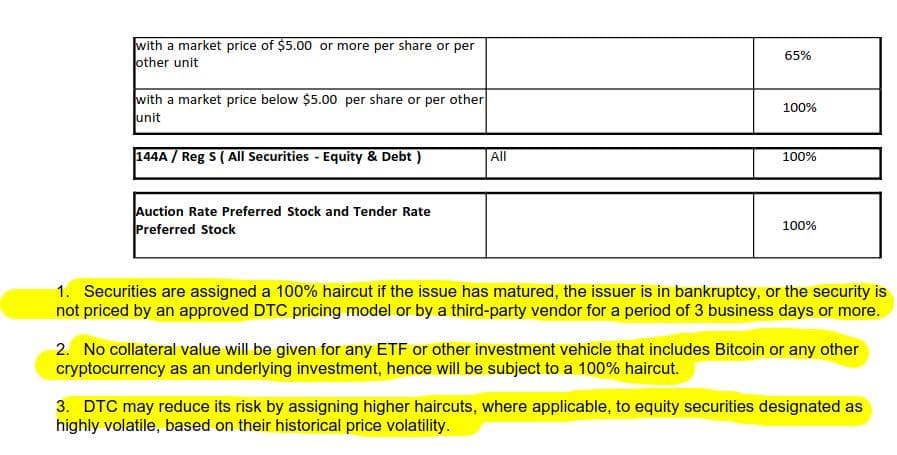

- No collateral value will be given for any ETF or other investment vehicle that includes Bitcoin or any other cryptocurrency as an underlying investment, hence will be subject to a 100% haircut.

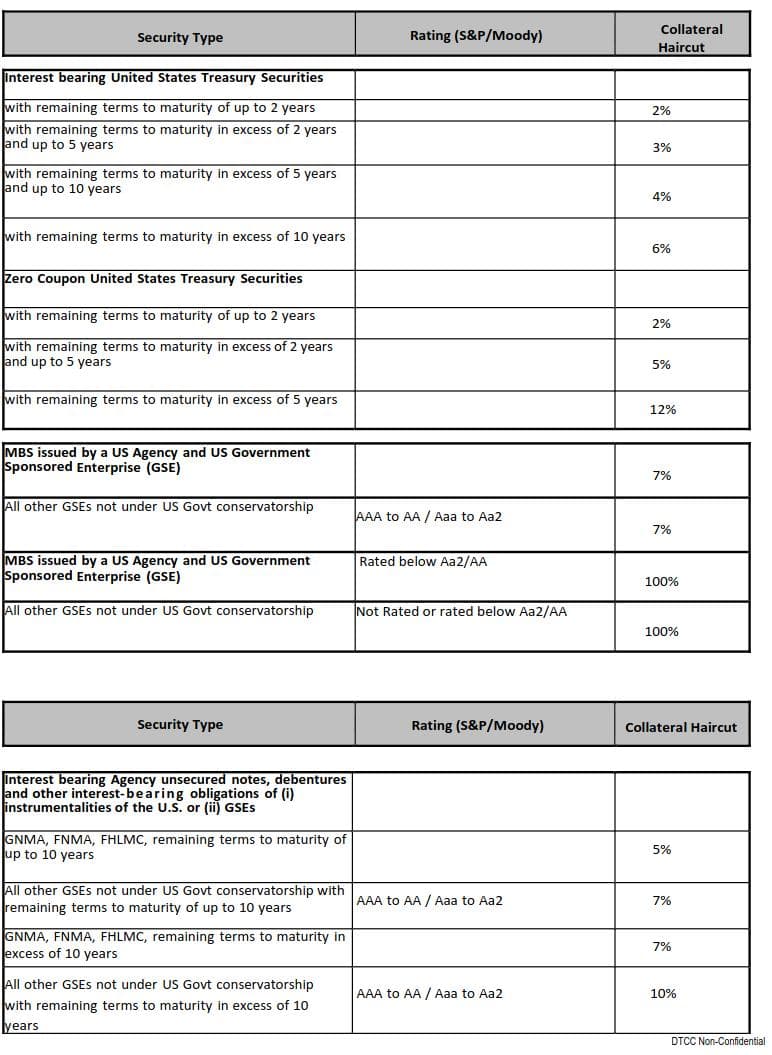

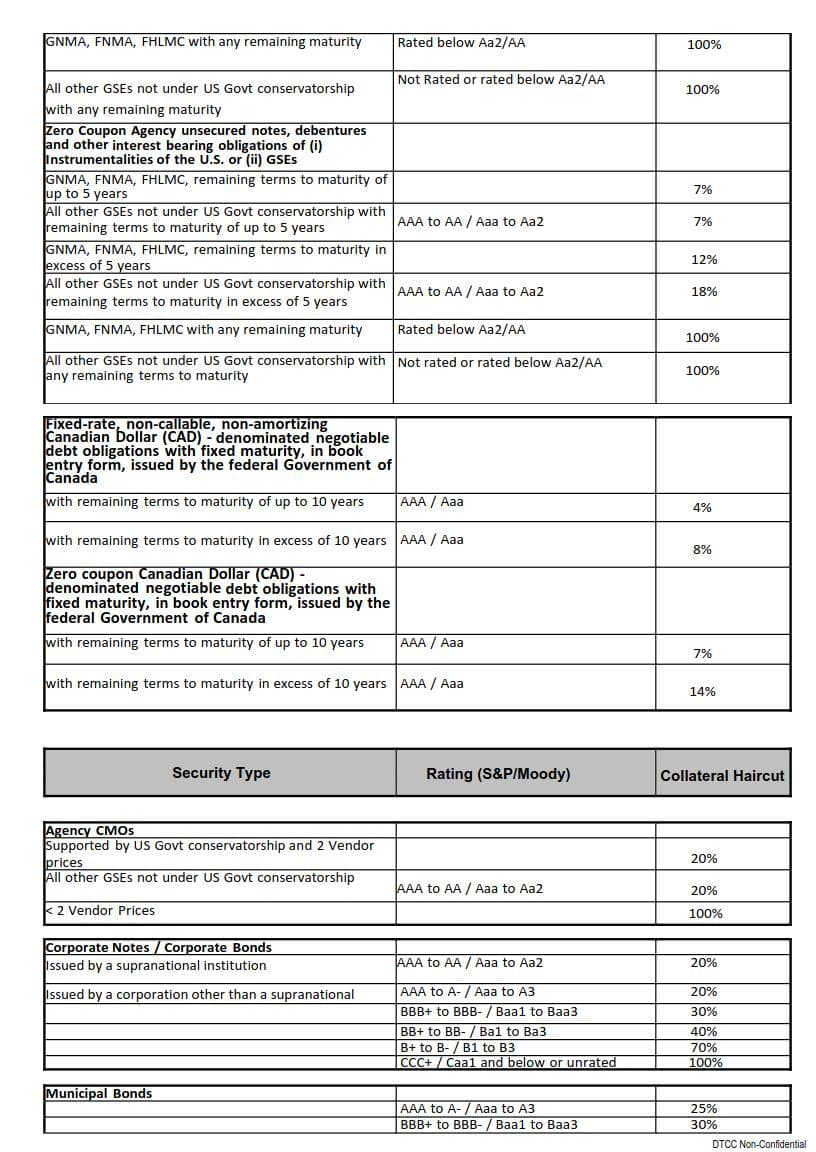

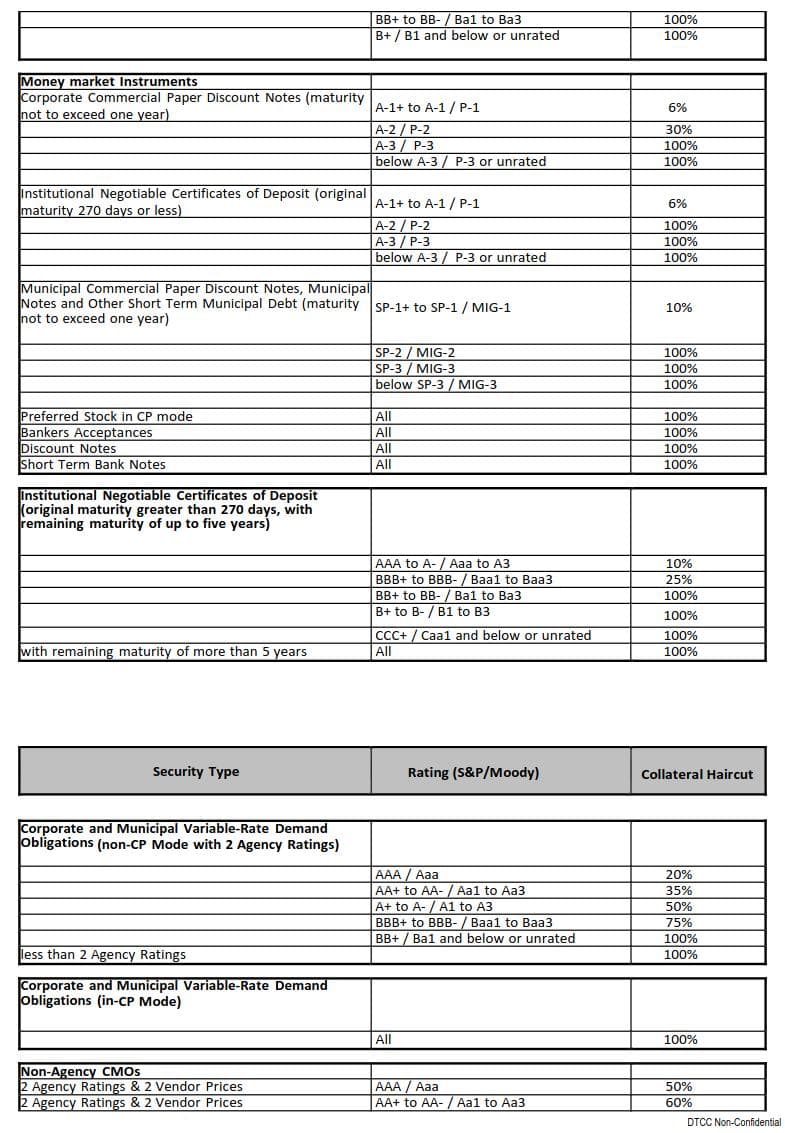

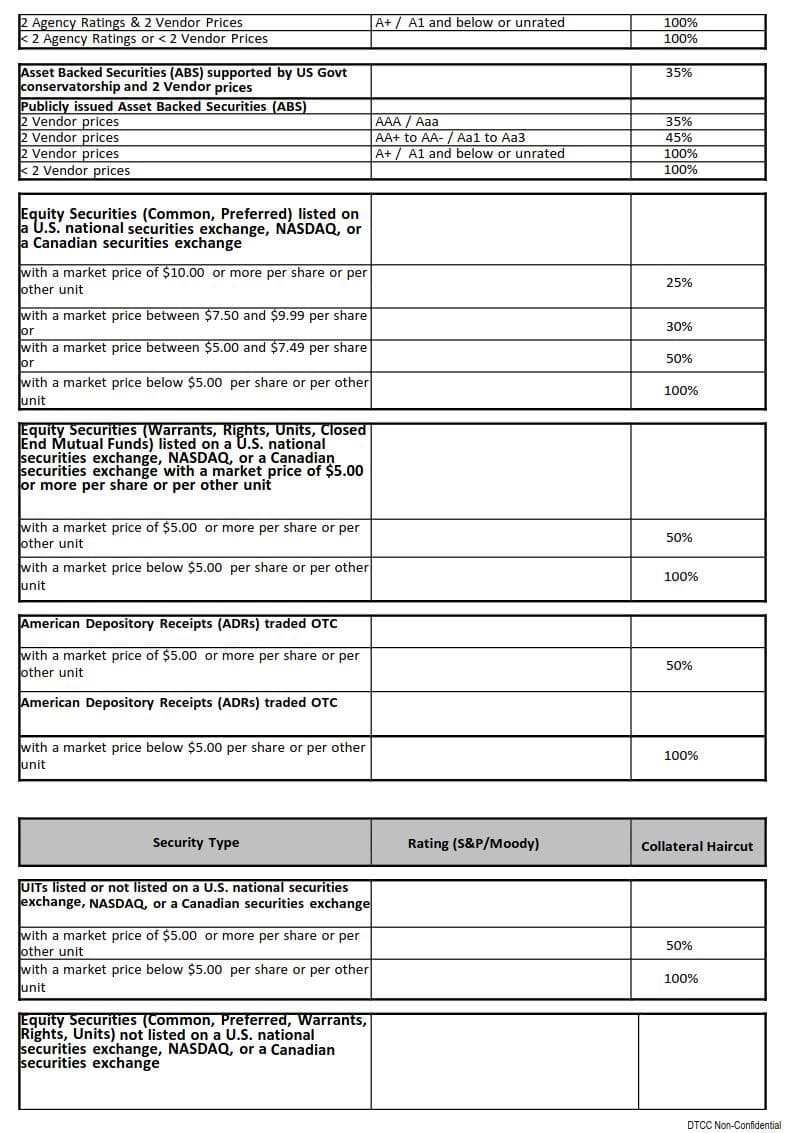

Eligible Collateral (All categories)

Wut Mean?:

- The collateral value assigned to corporate notes or bonds with a credit rating between B1 and B3 will be reduced. Previously, these bonds were subject to a 50% "haircut" (meaning only 50% of their market value was considered as collateral). Starting April 30, the haircut will increase to 70%.

- This means that only 30% of the market value of these bonds will now be considered as collateral.

- Any Exchange-Traded Fund (ETF) or other investment vehicle that includes cryptocurrencies as an underlying investment will be assigned a 100% haircut.

- This means these assets will have no collateral value at all.

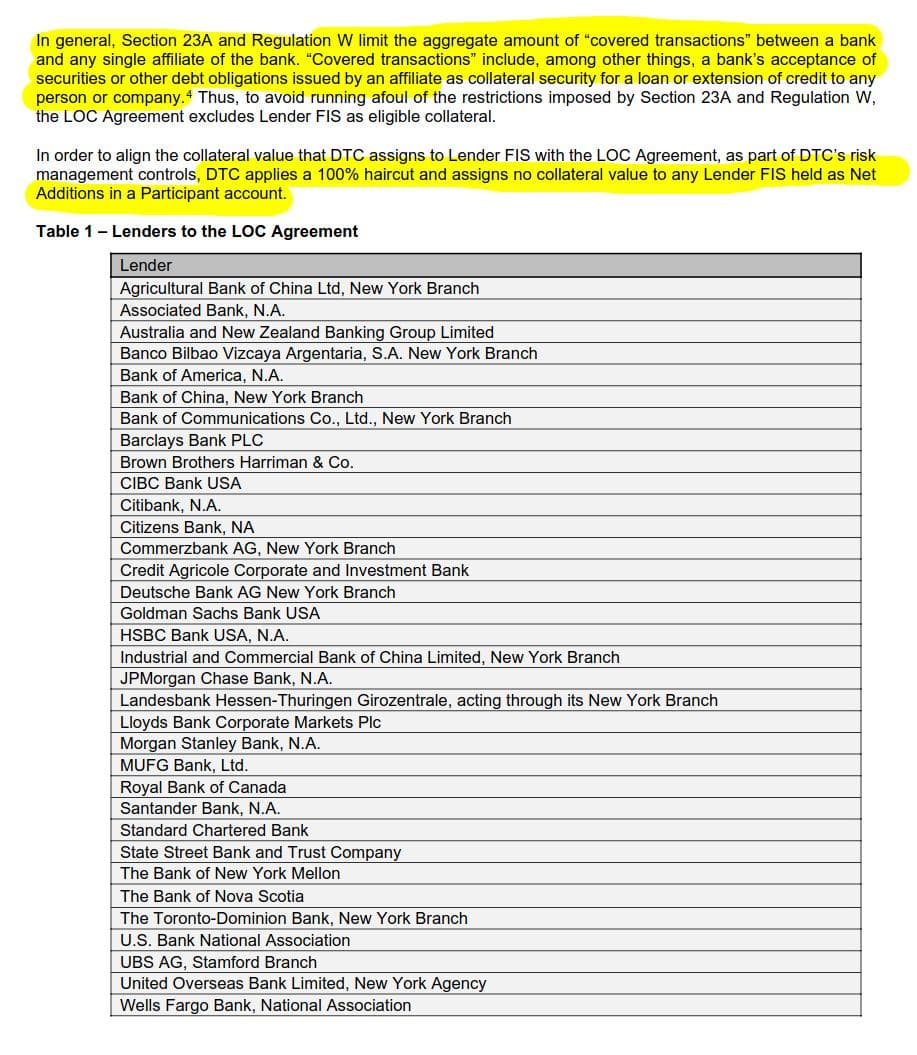

- Securities issued by affiliates of any lender listed in an appendix will also be assigned a 100% haircut, making them ineligible as collateral.

What could this mean for GameStop?

The new collateral requirements could lead to margin calls for some market participants as the increase in the haircut for corporate bonds rated between B1 and B3 from 50% to 70% means that the value of these bonds as collateral significantly decreases.

For example, if a participant has pledged such bonds to secure a swap, the effective value of their collateral drops. What was previously enough collateral might no longer suffice under the new haircut rules.

If the decrease in the collateral value causes the total collateral held by a participant to fall below the required margin level for their positions, the participant would face a margin call.

For those who have used ETFs or other investment vehicles that include cryptocurrencies as collateral, the new rule assigning a 100% haircut effectively renders these assets valueless for collateral purposes. If these assets formed a significant part of a participant’s collateral pool, the new rule could suddenly erase a substantial portion of their collateral value, triggering a margin call.

As we have learned, anyone facing margin calls need to quickly liquidate other assets or find additional acceptable collateral to meet the margin requirements or face their position blowing up.

If hedge funds or other financial institutions are using corporate bonds (especially those now subject to a higher haircut) or crypto-related investments as collateral for borrowing shares of GameStop to short sell, the new rules could significantly impact their operations.

Again, the increased haircut on B1 to B3 rated bonds means these institutions would need to provide more collateral to maintain the same level of borrowing...

If they are unable to meet these new requirements, they'll face closing their short positions and forced buy back of GameStop shares to return to their lenders...

TLDRS

- On April 30, 2024 DTC will implement changes to modify collateral value for certain securities, which may affect the value of positions applied to the Collateral Monitor.

- The increase in the haircut for corporate bonds rated B1 to B3 from 50% to 70% significantly decreases the value of these bonds as collateral.

- The assignment of a 100% haircut to ETFs and investment vehicles that include cryptocurrencies as an underlying asset renders these investments valueless for collateral purposes.

- This reduction may lead to margin calls for participants using these instruments to secure short positions against GameStop.