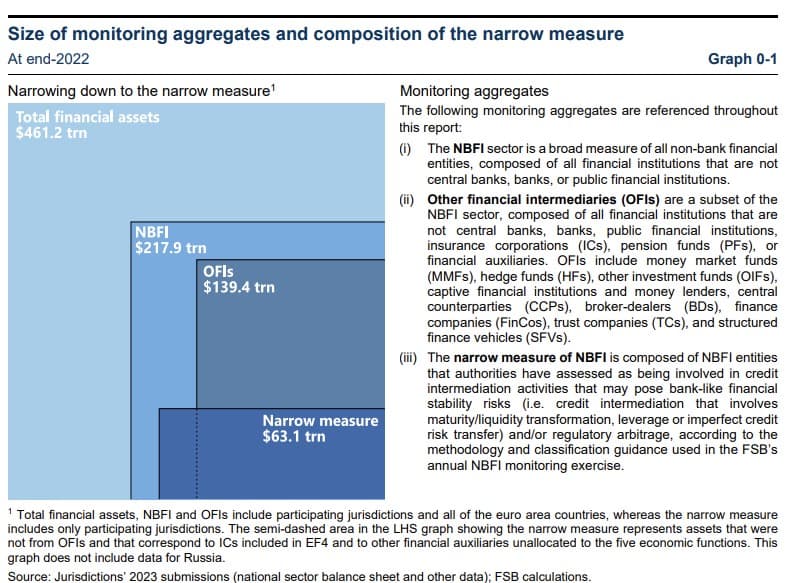

FSB Global monitoring report on non-bank financial intermediation 2023: Total financial assets of NBFI's declined 5.5% in 2022 compared to 2021, to $217.9 trillion, mainly reflecting valuation losses in mark-to-market asset portfolios.

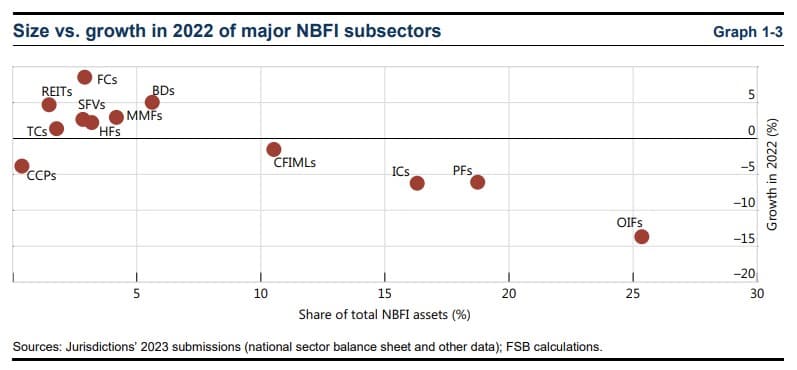

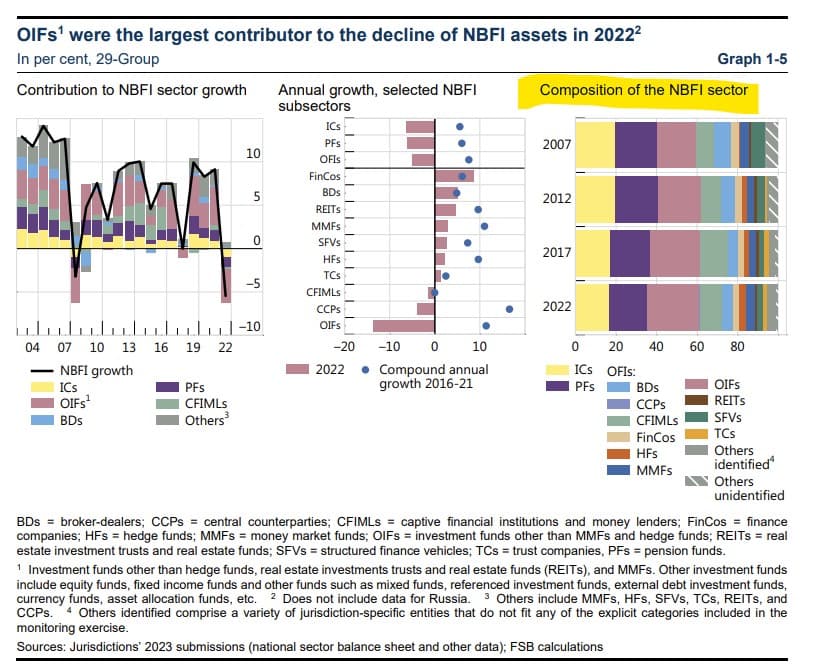

Since 2017 investment funds have driven changes in NBFI asset levels, and this continued to be the case in 2022, as investment funds led the decline in NBFI assets. More broadly, there was a negative contribution to asset levels from sectors with large mark-to-market portfolios:

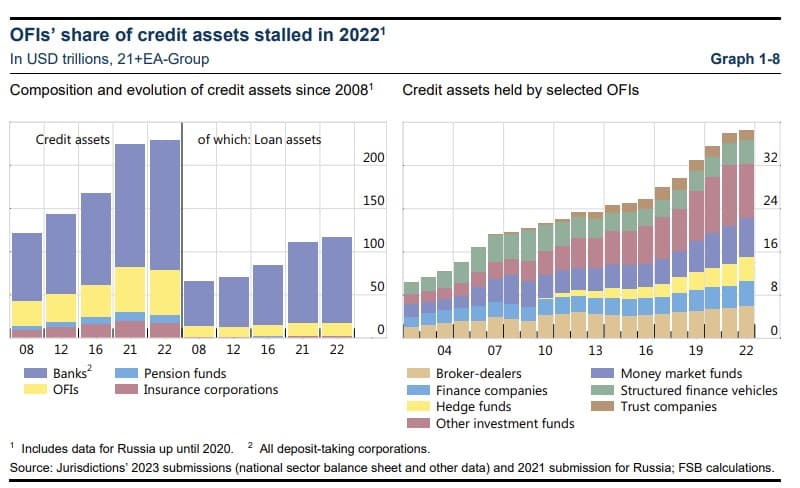

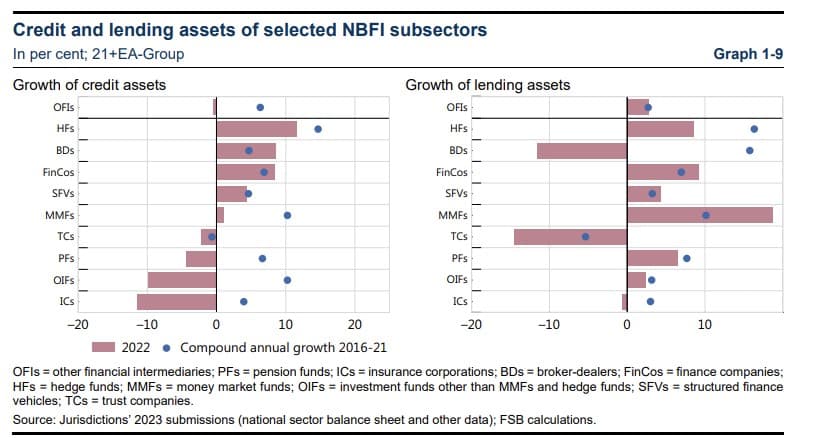

Among OFIs, credit assets of insurance corporations and other investment funds decreased by the largest amount from 2021 (-11.5% and -9.9% respectively). Other investment funds continued to represent the largest share among the OFIs (26.3%), followed by MMFs (18.8%) and broker-dealers (15.7%),The Netherlands experienced the greatest fall in OIF credit assets (-24.1%, see above), followed by Ireland (-16.0%), Germany (-15.0%), and the United States (-14.9%). The United States accounted for 57.4% of the OIF credit assets decline, given its size. Hedge Funds have grown in this category as well:

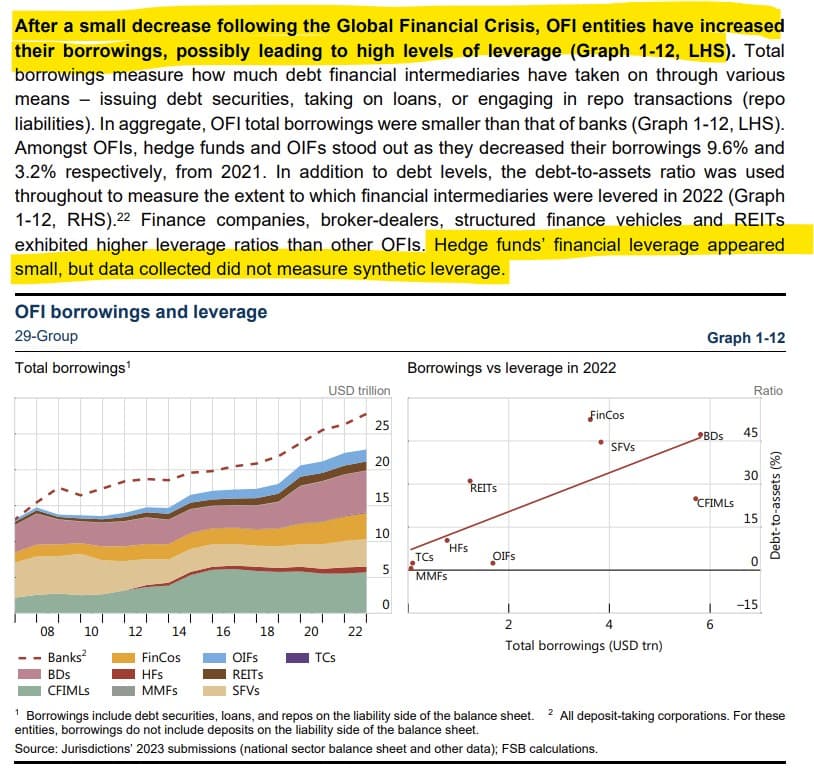

After a small decrease following the Global Financial Crisis, OFI entities have increased their borrowings, possibly leading to high levels of leverage:

Hedge funds’ financial leverage appeared small, but data collected did not measure synthetic leverage.

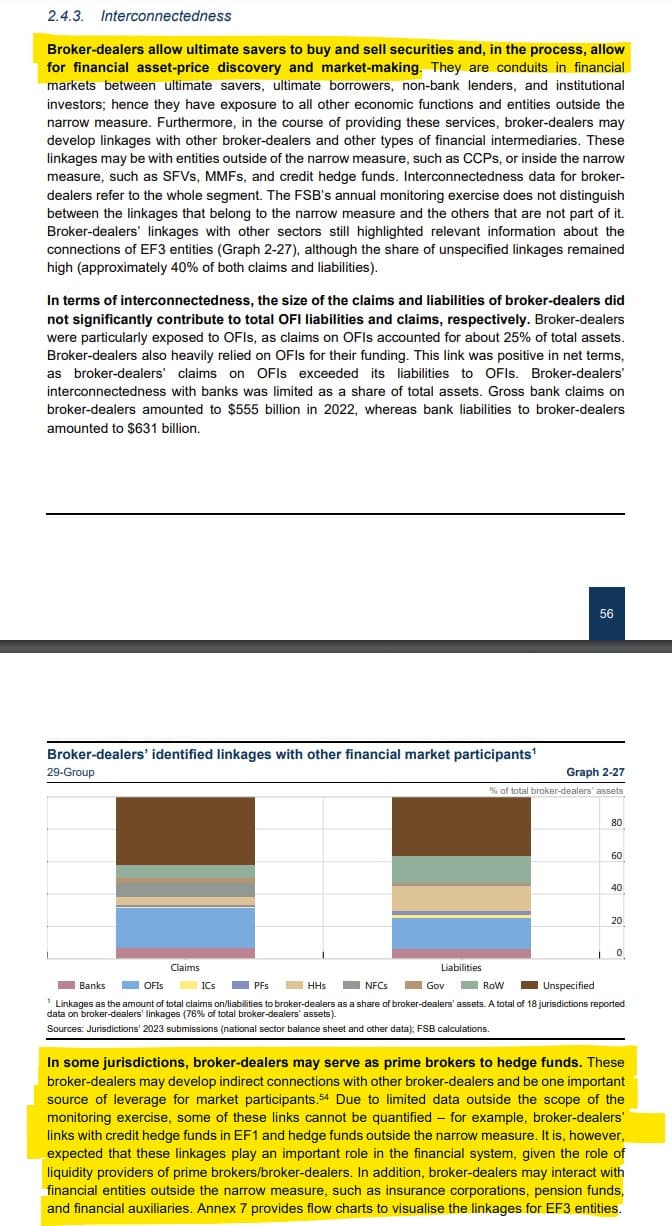

In some jurisdictions, broker-dealers may serve as prime brokers to hedge funds. These broker-dealers may develop indirect connections with other broker-dealers and be one important source of leverage for market participants. Due to limited data outside the scope of the monitoring exercise, some of these links cannot be quantified – for example, broker-dealers’ links with credit hedge funds in EF1 and hedge funds outside the narrow measure. It is, however, expected that these linkages play an important role in the financial system, given the role of liquidity providers of prime brokers/broker-dealers. In addition, broker-dealers may interact with financial entities outside the narrow measure, such as insurance corporations, pension funds, and financial auxiliaries.

EF4’s impact and importance may be significantly understated because of the difficulty of adequately capturing off-balance-sheet exposures and the lack of vulnerability metrics. The analysis in this section relies on credit insurers’ balance sheets, which are often modest. Balance sheets may not reflect the nominal value of credit exposure when entities offer credit protection using derivatives contracts. Only four jurisdictions included off-balance-sheet assets in EF4. Because of the small size of EF4 assets as a proportion of total financial assets in reporting jurisdictions, reporting of vulnerability metrics data for EF4 is particularly sparse and therefore these are not published.

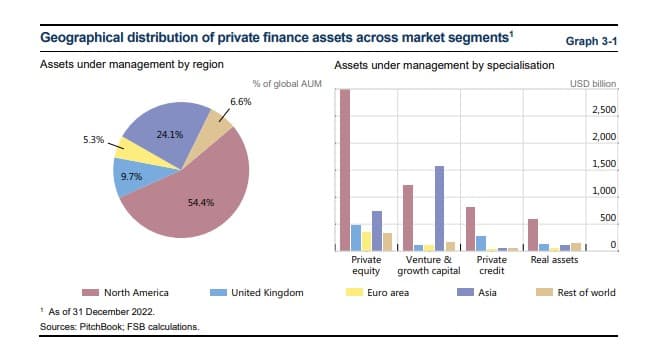

Private finance often engages in leveraged strategies and is a significant sponsor of leveraged debt issuance at the portfolio company level.

Private Finance:

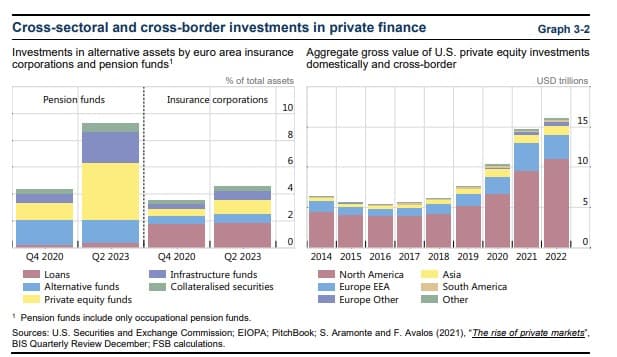

The lack of transparency in the private fund industry reinforces the need for enhanced data and better monitoring of risks in this segment, including from an interconnectedness perspective.

Cross-border linkages in private finance are significant but difficult to assess, due to insufficient data on the size of cross-border holdings.

Other Data:

- Treasury Securities as an asset hit a recorded all time high at $1409.94 billion. Remember:

- BOE Rings Alarm Bells On Hedge Funds' Risky Trade: Net short position in Treasury futures jumped to $800 billion

- Hedge Funds Catapulted Treasury Shorts to Record at Wrong Time: Investors boost net short UST futures bets to most since 2006

- SEC Chair Gary Gensler: "Many hedge funds are receiving the vast majority of their repo financing in the non-centrally cleared market, where haircuts or initial margin requirements are not necessarily applied."

- Gary Gensler: "in the last few years, many hedge funds are receiving repo financing in the non-centrally cleared bilateral market, where haircuts or initial margin requirements are not necessarily applied."

- Gary Gensler: "We must build upon the work of the Hedge Fund Working Group. That means looking at large, interconnected, highly-levered hedge funds, associated repo markets for financing, the prevalence of low to 0 haircuts in such funding..."

- Fed's Barr: "their highly leveraged positions in Treasury markets are facilitated by very low, or even zero, haircuts on their repo financing; & that demand for this leverage is highly concentrated among a handful of large hedge funds"

- Office of Financial Research Alert! OFR finds Hedge Fund Activities Can Influence the U.S. Treasury Yield Curve.

- Total debt securities hit a new all time series high at $3,474.17 billion.

- Leveraged loans hit a new all time series high at $365.61 billion.

- Other loans hit a new all time series high at $167.7 billion.

- Total liabilities hit a new all time high at $4,956.51 billion (+7.7% from Q1!).

- Total security repurchase agreements hit a new all time high at $1736.16 billion.

- Security repurchase agreements with domestic institutions hit a new all time high at $868.01 billion.

- Security repurchase agreements with foreign institutions hit a new all time high at $868.15 billion.

- Total loans; liability hit a new all time high at $2,658.98 billion.

- Loans, total secured borrowing via prime brokerage; liability hit a new all time high at $2,029.08 billion.

- U.S. Senators Sherrod Brown and Jack Reed expressed concern over the rapid growth of the private credit market, which has expanded from $1.6 trillion to a projected $3.5 trillion in the next five years, urging financial regulators to assess its potential risks to the banking system.

- The Senators highlighted that private credit funds operate with minimal oversight and transparency, leading to uncertainties about their size, risk level, loan terms, lenders' funding structures, and borrowers' financial health.

- They noted that private credit has become significantly interconnected with the traditional banking system, with banks engaging in lending to private credit funds, arranging private credit deals, and transferring risk through complex financial instruments.

- The Senators expressed worry that private credit fund managers are increasingly investing in riskier deals as the sector grows, posing potential threats to the financial system's stability.

- They are urging regulators to use their full authority to thoroughly assess risks posed by the private credit industry to ensure the safety and soundness of the banking system.

- They have requested that regulators describe the steps their agencies are taking to monitor risks in the private credit sector by December 20, 2023, to address these growing concerns.

- I wonder how many of these 'exotic financial instruments' have been used against GME?

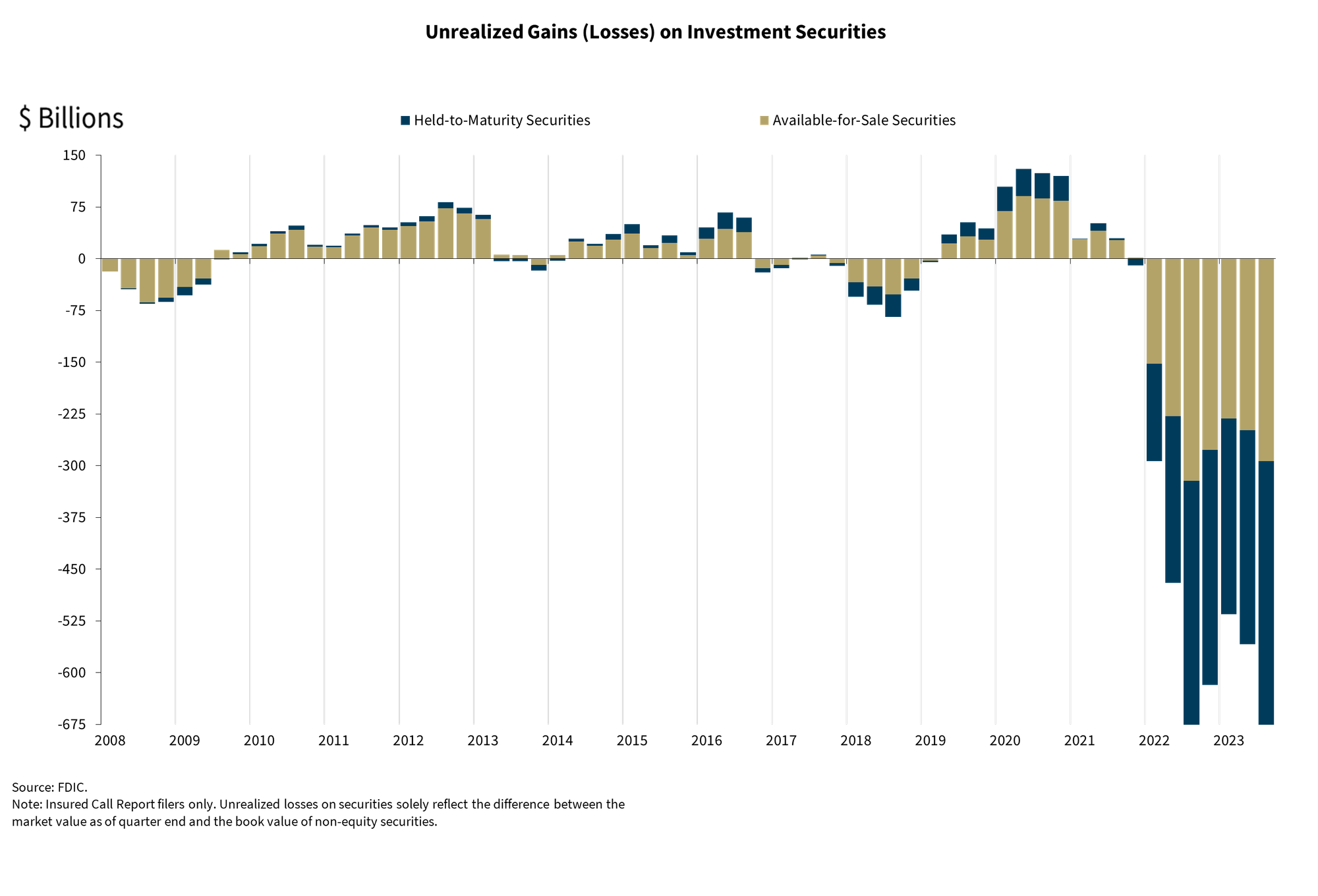

- FDIC-Insured Institutions Q3 2023: Unrealized losses on securities totaled $683.9 billion in the third quarter, up $125.5 billion (22.5 percent) from the Q2 2023.

- Unrealized losses on held-to-maturity securities totaled $390.5 billion.

- Net Income Decreased From the Prior Quarter, Driven By Lower Noninterest Income and Higher Realized Losses on Securities

- The Net Interest Margin Increased From the Prior Quarter to 3.30 Percent

- Community Banks Reported Lower Net Income From the Prior Quarter

- Loan Balances Increased From Last Quarter and One Year Ago

- Total Deposits Declined For a Sixth Consecutive Quarter

- First and second quarter income benefitted from non-recurring gains from the accounting treatment for the acquisition of the three large bank failures this spring.

- Excluding these one-time gains, net income would have been roughly flat for the past four quarters.

- Multifunction crypto-asset intermediaries (MCIs) generate revenue mainly through proprietary trading and investments, including in cryptocurrencies they issue themselves.

- MCIs often operate from offshore financial centers and are characterized by private ownership and a lack of transparency in their corporate structure, financials, and product descriptions, sometimes intentionally obscuring their activities and associated risks.

- Control of MCIs typically resides with a single individual or a small group, centralizing decision-making authority.

- These intermediaries are subject to vulnerabilities common in traditional finance, such as leverage and liquidity mismatch, which may be exacerbated by their involvement in proprietary trading, market making, and crypto-asset lending/borrowing.

- MCIs' key role in the crypto-ecosystem and their links with traditional financial institutions, including through stablecoins, create unique vulnerabilities and potential for significant spillovers to crypto markets and the broader economy, although current risks to financial stability are considered limited the report calls out lack of information makes it impossible to tell for sure what it going on.

- The report says the quiet part out loud: "Where regulatory requirements are not complied with or absent, fund management practices prohibited in traditional finance may be present in the crypto-asset space"

- M1 includes the most liquid forms of money, such as cash and checking deposits.

- A decrease in M1 suggests a reduction in the most readily available money in the economy.

- M2 includes all of M1 plus "near-money" (savings deposits, money market mutual funds, and other time deposits).

- A decrease in M2 indicates a decline in not only the liquid money supply (M1) but also in slightly less liquid financial assets.

- The drop in currency in circulation shows less cash is being held by the public.

New York Fed economists conclusion: "the evolution of banks and nonbanks is highly intertwined."

- The evolution of banks and nonbanks is closely linked, particularly since the 1990s.

- In the 1990s, financial 'innovation' and regulatory changes boosted asset securitization.

- This shifted financial intermediation from a traditional bank-centric model (taking deposits, issuing loans, and holding them to maturity) to a new model where loans were packaged into securities and sold to investors.

- With this shift, nonbank activities like specialty lending, market making, asset management, and insurance gained prominence, which supported the securitization process.

- After the Global Financial Crisis (GFC), the number of NBFI subsidiaries decreased notably.

- This coincided with the largest BHCs becoming subject to "living wills" under the Dodd-Frank Act.

- Despite these changes, the connection between banks and NBFIs may not have disappeared but could have transformed into a different form, continuing the trend of banks adapting to regulatory boundaries.

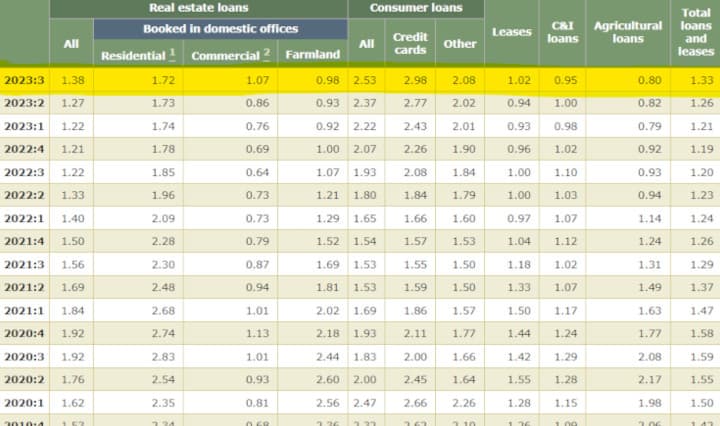

Delinquency Rates on Loans and Leases at Commercial Banks are spiking!

TLDRS:

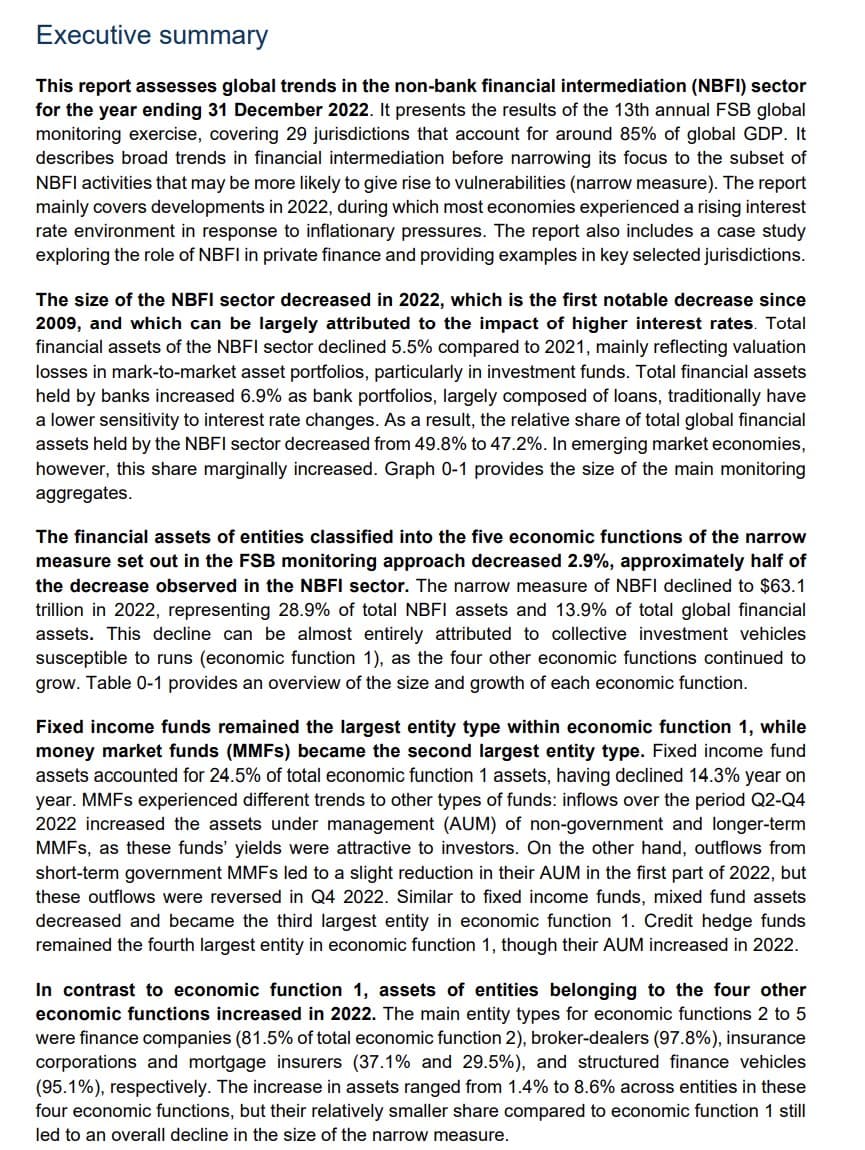

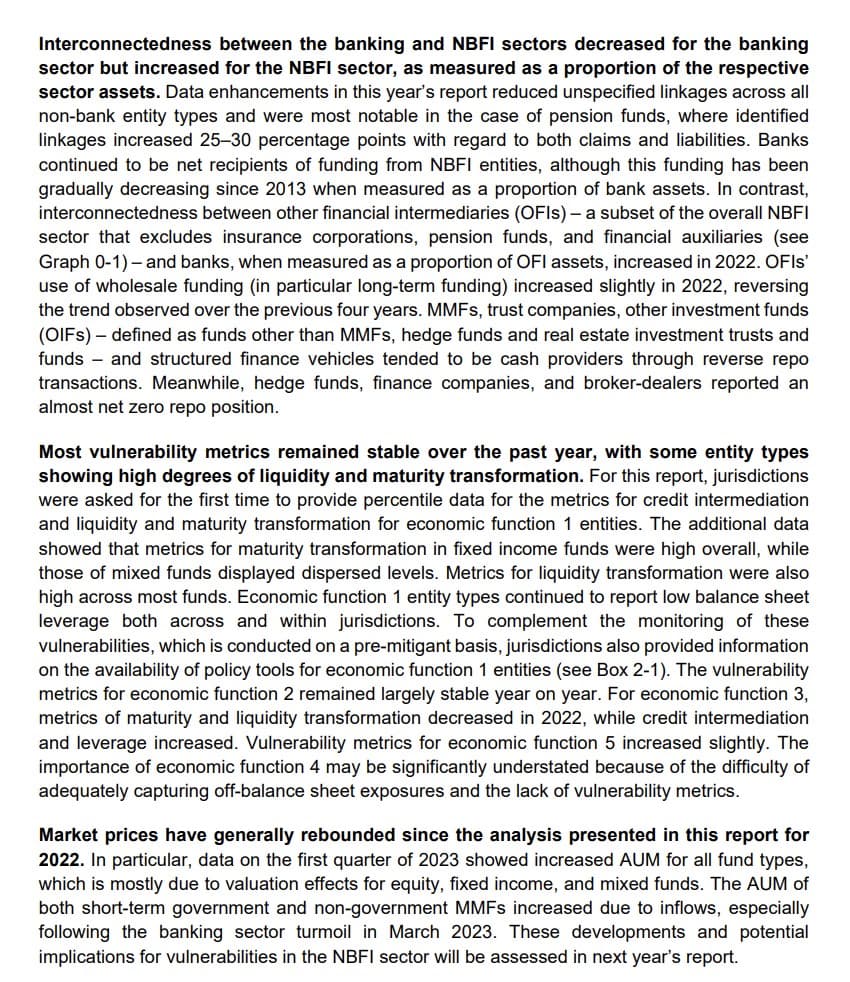

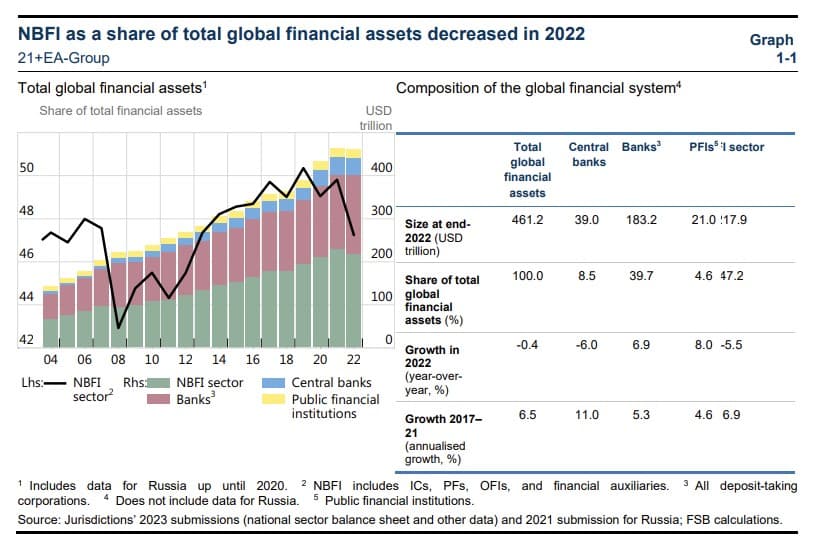

- Annual monitoring exercise saw a decrease in the size of the non-bank financial intermediation (NBFI) sector in 2022 – the first notable decrease since 2009 – largely due to the impact of higher interest rates on asset valuations.

- The total financial assets of the sector declined 5.5% compared to 2021 to $217.9 trillion, mainly reflecting valuation losses in mark-to-market asset portfolios, particularly in investment funds.

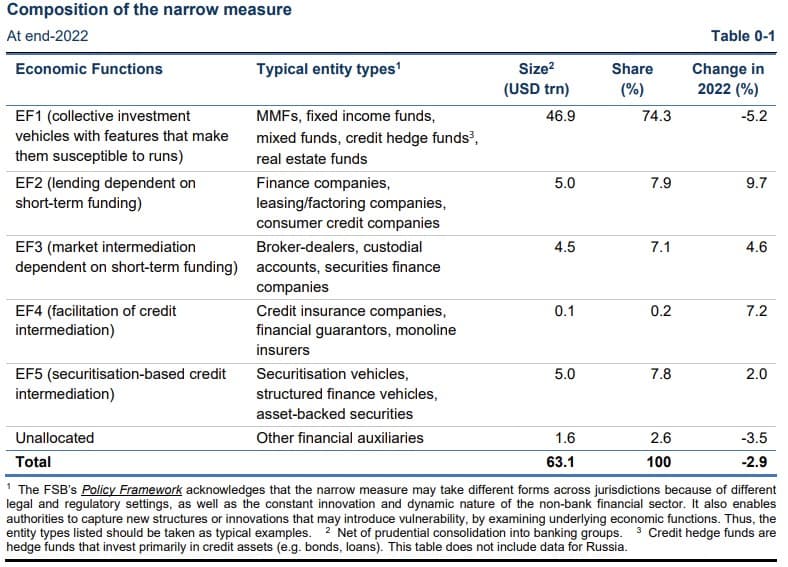

- The narrow measure of the NBFI sector – comprising entities that authorities have assessed as being involved in credit intermediation activities that may pose bank-like financial stability risks – decreased 2.9% to $63.1 trillion in 2022, representing 28.9% of total NBFI assets.

- This decline can be almost entirely attributed to collective investment vehicles susceptible to runs, such as fixed income, mixed, and credit hedge funds. Money market funds were the only investment fund type to grow in 2022.

- Banks continued to be net recipients of funding from NBFI entities, although this funding has been gradually decreasing as a proportion of bank assets since 2013.

- Most vulnerability metrics of NBFI entities – measuring credit intermediation, maturity transformation, liquidity transformation, and leverage – remained stable.

- Metrics for maturity transformation in fixed income funds were high overall, while metrics for liquidity transformation were also high across most funds.

- MMFs, fixed income funds, mixed funds, credit hedge funds, real estate funds got whacked -5.2% in 2022.

- There was a negative contribution to asset levels from sectors with large mark-to-market portfolios.

- Hedge funds’ financial leverage appeared small, but data collected did not measure synthetic leverage.

- In some jurisdictions, broker-dealers may serve as prime brokers to hedge funds.

- These broker-dealers may develop indirect connections with other broker-dealers and be one important source of leverage for market participants.

- Due to limited data outside the scope of the monitoring exercise, some of these links cannot be quantified – for example, broker-dealers’ links with credit hedge funds in EF1 and hedge funds outside the narrow measure.

- It is, however, expected that these linkages play an important role in the financial system, given the role of liquidity providers of prime brokers/broker-dealers.

- In addition, broker-dealers may interact with financial entities outside the narrow measure, such as insurance corporations, pension funds, and financial auxiliaries.

- EF4’s impact and importance may be significantly understated because of the difficulty of adequately capturing off-balance-sheet exposures and the lack of vulnerability metrics.

- The analysis in this section relies on credit insurers’ balance sheets, which are often modest.

- Balance sheets may not reflect the nominal value of credit exposure when entities offer credit protection using derivatives contracts.

- Only four jurisdictions included off-balance-sheet assets in EF4.

- Because of the small size of EF4 assets as a proportion of total financial assets in reporting jurisdictions, reporting of vulnerability metrics data for EF4 is particularly sparse and therefore these are not published.

- Private finance often engages in leveraged strategies and is a significant sponsor of leveraged debt issuance at the portfolio company level.

- The lack of transparency in the private fund industry reinforces the need for enhanced data and better monitoring of risks in this segment, including from an interconnectedness perspective.

- Cross-border linkages in private finance are significant but difficult to assess, due to insufficient data on the size of cross-border holdings.