The Fed's Enhanced Financial Accounts (EFAs) on Hedge Funds: Hedge Fund liabilities hit a new all time high in 2023:Q2.

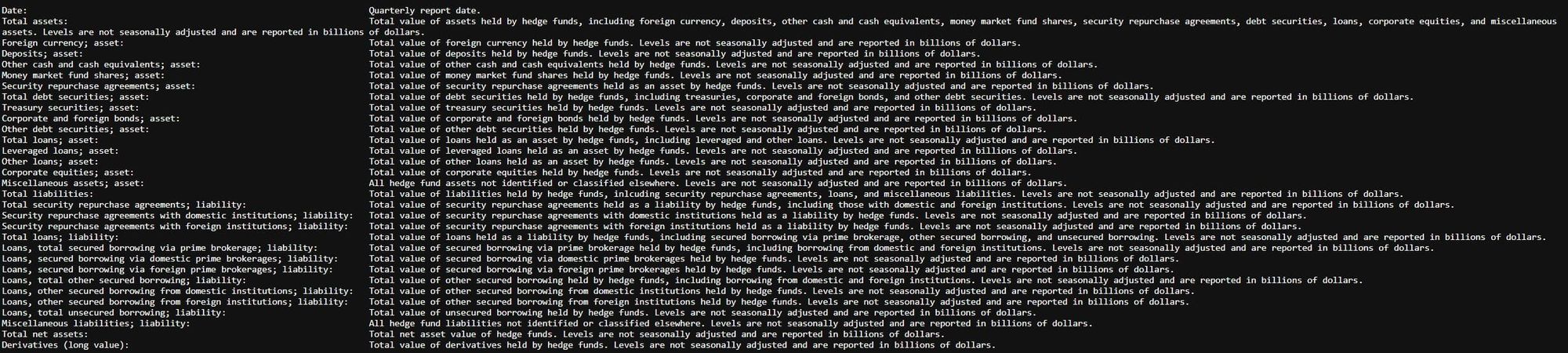

- This table shows the aggregate assets and liabilities of hedge funds that file Form PF with the Securities and Exchange Commission.

- Unlike table B.101.f in the regular Financial Accounts publication, which reports assets and liabilities of domestic hedge funds only, this table presents data on all hedge funds that file Form PF, both domestic and foreign.

- The first part of the table reports the long position for the respective asset categories, with derivative exposure being excluded.

- The second part of the table reports the liability items, which detail the source of borrowing. A memo item reports total long derivative exposure.

| Date | Total assets | Foreign currency; asset | Deposits; asset | Other cash and cash equivalents; asset | Money market fund shares; asset | Security repurchase agreements; asset | Total debt securities; asset | Treasury securities; asset | Corporate and foreign bonds; asset | Other debt securities; asset | Total loans; asset | Leveraged loans; asset | Other loans; asset | Corporate equities; asset | Miscellaneous assets; asset | Total liabilities | Total security repurchase agreements; liability | Security repurchase agreements with domestic institutions; liability | Security repurchase agreements with foreign institutions; liability | Total loans; liability | Loans, total secured borrowing via prime brokerage; liability | Loans, secured borrowing via domestic prime brokerages ; liability | Loans, secured borrowing via foreign prime brokerages; liability | Loans, total other secured borrowing; liability | Loans, other secured borrowing from domestic institutions; liability | Loans, other secured borrowing from foreign institutions; liability | Loans, total unsecured borrowing; liability | Miscellaneous liabilities; liability | Total net assets | Derivatives (long value) |

| 2012:Q4 | 4254.22 | 51.97 | 116.9 | 309.04 | 74.9 | 347.61 | 1708.78 | 654.49 | 993.65 | 60.64 | 133.35 | 108.84 | 24.5 | 1148.48 | 363.19 | 1834.19 | 602.76 | 294.72 | 308.04 | 976.64 | 764.23 | 599.9 | 164.34 | 209.83 | 139.66 | 70.18 | 2.58 | 254.78 | 2420.03 | 8311.76 |

| 2013:Q1 | 4729.57 | 75.49 | 105.4 | 294.93 | 76.49 | 412.56 | 1942.94 | 755.22 | 1135.35 | 52.37 | 136.65 | 110.5 | 26.15 | 1292.39 | 392.73 | 2137.6 | 657.58 | 306.58 | 350.99 | 1153.52 | 906.42 | 715.64 | 190.78 | 243.46 | 126.91 | 116.56 | 3.64 | 326.5 | 2591.97 | 5900.76 |

| 2013:Q2 | 4851.63 | 71.39 | 116.99 | 320.31 | 77.14 | 543.69 | 1884.14 | 664.32 | 1134.43 | 85.39 | 140.48 | 107.03 | 33.45 | 1332.26 | 365.23 | 2217.88 | 779.15 | 404.36 | 374.79 | 1205.52 | 948.27 | 714.11 | 234.16 | 251.49 | 118.5 | 132.99 | 5.76 | 233.21 | 2633.75 | 4844.51 |

| 2013:Q3 | 4998.9 | 70.3 | 125.02 | 336.5 | 85.55 | 508.26 | 1901.87 | 673.41 | 1171.91 | 56.56 | 143.17 | 108.38 | 34.79 | 1424.21 | 404.02 | 2248.64 | 668.15 | 327.45 | 340.7 | 1252.65 | 958.63 | 759.94 | 198.69 | 286.63 | 142.36 | 144.27 | 7.39 | 327.84 | 2750.26 | 4930.88 |

| 2013:Q4 | 5351.05 | 70.85 | 134.01 | 381.27 | 126.79 | 474.71 | 1930.15 | 657.51 | 1229.22 | 43.42 | 149.23 | 102.68 | 46.55 | 1618.21 | 465.82 | 2294.94 | 579.54 | 290.07 | 289.47 | 1392.8 | 1083.19 | 862.97 | 220.22 | 301.88 | 144.85 | 157.04 | 7.73 | 322.6 | 3056.11 | 5253.12 |

| 2014:Q1 | 5544.42 | 82.19 | 146.01 | 386.11 | 128.38 | 566.71 | 1987.79 | 679 | 1261.15 | 47.65 | 154.05 | 110.86 | 43.19 | 1661.02 | 432.17 | 2437.48 | 558.01 | 257.69 | 300.32 | 1461.47 | 1139.93 | 910.72 | 229.21 | 310.31 | 124.12 | 186.19 | 11.24 | 418 | 3106.94 | 5260.63 |

| 2014:Q2 | 5778.15 | 78.68 | 154.67 | 398.53 | 139.37 | 572.34 | 2046.01 | 623.27 | 1360.17 | 62.57 | 161.68 | 113.64 | 48.04 | 1775.19 | 451.68 | 2511.18 | 605.29 | 275.4 | 329.89 | 1433.12 | 1123.5 | 876.48 | 247.02 | 296.67 | 106.49 | 190.18 | 12.94 | 472.77 | 3266.97 | 5166.33 |

| 2014:Q3 | 5883.62 | 86.13 | 153.11 | 421.41 | 132.19 | 617.16 | 2131.29 | 710.54 | 1351.63 | 69.11 | 160.51 | 113.41 | 47.1 | 1742.82 | 439 | 2641.73 | 635.54 | 293.52 | 342.02 | 1441.53 | 1114.58 | 847.2 | 267.38 | 314.08 | 121.19 | 192.89 | 12.87 | 564.66 | 3241.88 | 5305.47 |

| 2014:Q4 | 5925.22 | 77.59 | 161.87 | 426.46 | 166.37 | 553.59 | 2058.62 | 659.94 | 1334.33 | 64.35 | 168.14 | 116.34 | 51.81 | 1809.85 | 502.72 | 2564.85 | 614.55 | 302.28 | 312.27 | 1486.4 | 1168.91 | 896.95 | 271.97 | 307.43 | 122.59 | 184.85 | 10.05 | 463.9 | 3360.36 | 4654.88 |

| 2015:Q1 | 6350.43 | 91.42 | 162.73 | 398.79 | 159.67 | 583.07 | 2337.87 | 754.92 | 1516.57 | 66.39 | 167.34 | 116.63 | 50.71 | 1887.13 | 562.41 | 2814.97 | 728.29 | 375.16 | 353.13 | 1527.28 | 1217.2 | 959.31 | 257.88 | 301.08 | 104.45 | 196.63 | 9 | 559.4 | 3535.46 | 5087.53 |

| 2015:Q2 | 6277.1 | 71.11 | 150.12 | 392.14 | 163.62 | 555.92 | 2243.31 | 727.8 | 1452.3 | 63.2 | 169.72 | 118.96 | 50.76 | 1974.95 | 556.2 | 2725.15 | 713.89 | 375.88 | 338.02 | 1554.87 | 1263.15 | 980.11 | 283.04 | 279.78 | 130.41 | 149.37 | 11.94 | 456.38 | 3551.95 | 4668.83 |

| 2015:Q3 | 6191.98 | 68.33 | 170.8 | 394.34 | 162.35 | 566 | 2268.08 | 743.58 | 1458.71 | 65.79 | 164.77 | 110.28 | 54.5 | 1800.15 | 597.16 | 2744.57 | 794.55 | 418.25 | 376.3 | 1470.24 | 1181.88 | 915.65 | 266.23 | 275.69 | 125.74 | 149.95 | 12.67 | 479.78 | 3447.41 | 4934.26 |

| 2015:Q4 | 6037.1 | 62 | 179.52 | 397.97 | 178.31 | 519.42 | 2133.7 | 701.37 | 1371.95 | 60.38 | 164.3 | 108.7 | 55.61 | 1830.64 | 571.23 | 2592.98 | 673.07 | 358.14 | 314.93 | 1468.26 | 1161.42 | 893.64 | 267.78 | 295.21 | 138.36 | 156.85 | 11.63 | 451.65 | 3444.12 | 4607.14 |

| 2016:Q1 | 6063.07 | 75.49 | 184.03 | 417.65 | 163.11 | 550.11 | 2228.16 | 754.83 | 1410.53 | 62.8 | 169.06 | 109.05 | 60.01 | 1726.54 | 548.92 | 2703.13 | 783.41 | 413.82 | 369.59 | 1431.35 | 1117.15 | 859.15 | 257.99 | 302.45 | 149.97 | 152.47 | 11.75 | 488.37 | 3359.94 | 5060.3 |

| 2016:Q2 | 6241.18 | 86.93 | 193.71 | 416.13 | 181.42 | 561.88 | 2401.83 | 868.14 | 1451.78 | 81.91 | 173.09 | 112.86 | 60.23 | 1695.33 | 530.87 | 2838.07 | 794.74 | 412.3 | 382.43 | 1450.79 | 1132.82 | 845.21 | 287.61 | 306.84 | 150.52 | 156.32 | 11.14 | 592.54 | 3403.12 | 5232.76 |

| 2016:Q3 | 6399.52 | 86.4 | 175.25 | 385.57 | 177.06 | 615.05 | 2366.65 | 870.68 | 1436.1 | 59.86 | 186.48 | 120.69 | 65.79 | 1821.18 | 585.88 | 2932.54 | 839.24 | 454.07 | 385.17 | 1571.97 | 1251.56 | 955.62 | 295.94 | 307.53 | 153.07 | 154.46 | 12.89 | 521.33 | 3466.98 | 5415.58 |

| 2016:Q4 | 6409.75 | 86.5 | 160.47 | 370.89 | 189.46 | 690.74 | 2265.77 | 797.48 | 1415.76 | 52.54 | 191.79 | 123.29 | 68.5 | 1824.79 | 629.32 | 2908.51 | 772.28 | 406.66 | 365.62 | 1611.6 | 1260.23 | 956.93 | 303.3 | 337.18 | 166.42 | 170.77 | 14.18 | 524.63 | 3501.24 | 5137.43 |

| 2017:Q1 | 6697.45 | 92.85 | 166.77 | 369.45 | 166.07 | 796.3 | 2365.72 | 810.56 | 1498.32 | 56.84 | 193.77 | 124.16 | 69.61 | 1962.41 | 584.11 | 3111.79 | 829.93 | 416.59 | 413.34 | 1728.44 | 1360.75 | 1033.86 | 326.9 | 351.24 | 161.21 | 190.02 | 16.46 | 553.41 | 3585.66 | 5620.49 |

| 2017:Q2 | 6823.72 | 94.87 | 169.4 | 371.9 | 173.19 | 829.59 | 2307.48 | 757.62 | 1482.97 | 66.89 | 213.4 | 145.01 | 68.39 | 2017.64 | 646.25 | 3175.92 | 879.79 | 445.01 | 434.78 | 1804.35 | 1425.45 | 1061.63 | 363.82 | 365.83 | 171.42 | 194.4 | 13.08 | 491.77 | 3647.8 | 5459.67 |

| 2017:Q3 | 7075.97 | 131.16 | 182.01 | 362.75 | 186.75 | 850.96 | 2387.17 | 778.01 | 1544.82 | 64.34 | 211.87 | 137.38 | 74.49 | 2130.55 | 632.75 | 3329.76 | 796.67 | 390.93 | 405.74 | 1940.41 | 1544.41 | 1152.22 | 392.18 | 381.73 | 176.55 | 205.18 | 14.27 | 592.68 | 3746.21 | 6013.04 |

| 2017:Q4 | 7177.63 | 105.78 | 161.84 | 358.91 | 195.63 | 822.45 | 2368.83 | 778.11 | 1526.55 | 64.18 | 220.86 | 142.62 | 78.25 | 2273.14 | 670.19 | 3296.33 | 762.95 | 377.33 | 385.62 | 1982.3 | 1569.19 | 1180.71 | 388.48 | 396.29 | 182.35 | 213.94 | 16.81 | 551.09 | 3881.3 | 6587.96 |

| 2018:Q1 | 7357.27 | 130.56 | 157.23 | 367.04 | 186.32 | 919.25 | 2476.53 | 748.26 | 1667.25 | 61.01 | 236.6 | 149.87 | 86.73 | 2256.9 | 626.85 | 3425.32 | 860.21 | 413.19 | 447.02 | 2053.04 | 1601.24 | 1211.66 | 389.58 | 435 | 195.67 | 239.34 | 16.79 | 512.07 | 3931.95 | 9668.54 |

| 2018:Q2 | 7590.1 | 127.64 | 148.34 | 383.77 | 183.29 | 878.57 | 2648.6 | 892.3 | 1685.53 | 70.77 | 247.36 | 149.93 | 97.43 | 2305.13 | 667.4 | 3612.22 | 987.87 | 530.78 | 457.08 | 2166.83 | 1717.03 | 1311.81 | 405.21 | 433.24 | 201.77 | 231.47 | 16.56 | 457.52 | 3977.88 | 8131.63 |

| 2018:Q3 | 7732.51 | 117.6 | 166.24 | 380.91 | 193.03 | 905.24 | 2725.16 | 958.96 | 1689.49 | 76.71 | 257.14 | 155.13 | 102.01 | 2330.08 | 657.11 | 3734.72 | 958.05 | 521.28 | 436.77 | 2229.86 | 1793.77 | 1349.55 | 444.23 | 421.18 | 208.14 | 213.04 | 14.91 | 546.81 | 3997.79 | 6539.58 |

| 2018:Q4 | 7487.33 | 114.04 | 167.23 | 376.76 | 223.67 | 925.26 | 2790.3 | 1078.62 | 1631.33 | 80.35 | 265.68 | 159.57 | 106.11 | 1979.44 | 644.96 | 3732.07 | 1208.02 | 689.66 | 518.36 | 1899.05 | 1454.03 | 1103.42 | 350.6 | 431.05 | 208.03 | 223.02 | 13.97 | 625 | 3755.26 | 6297.7 |

| 2019:Q1 | 7864.09 | 124.9 | 168.29 | 426.82 | 184.83 | 976.42 | 2955.63 | 1206.47 | 1680.01 | 69.15 | 289.06 | 172.95 | 116.11 | 2200.95 | 537.18 | 3951.55 | 1357.05 | 764.55 | 592.51 | 2055.28 | 1595.8 | 1221.71 | 374.09 | 444.66 | 223.96 | 220.7 | 14.82 | 539.22 | 3912.54 | 7381.33 |

| 2019:Q2 | 8100.68 | 124.68 | 164.23 | 434.17 | 183.95 | 867.77 | 3146.99 | 1364.23 | 1715.78 | 66.99 | 296.54 | 180.93 | 115.61 | 2262.74 | 619.61 | 4112.08 | 1429.06 | 803.19 | 625.86 | 2100.64 | 1609.25 | 1255.51 | 353.74 | 473.52 | 234.31 | 239.21 | 17.88 | 582.38 | 3988.6 | 7484.9 |

| 2019:Q3 | 7958.43 | 131.83 | 156.36 | 444.55 | 190.97 | 797.95 | 3068.11 | 1303.95 | 1697.46 | 66.69 | 293.09 | 187.08 | 106.01 | 2168.55 | 707.03 | 3976.09 | 1467.03 | 832.63 | 634.4 | 1973.45 | 1515.52 | 1199.48 | 316.05 | 439.81 | 208.8 | 231.02 | 18.12 | 535.61 | 3982.34 | 7525.74 |

| 2019:Q4 | 8113.09 | 129.28 | 151.84 | 452.97 | 205.22 | 837.1 | 3008.97 | 1226.57 | 1718.94 | 63.46 | 315.39 | 199.01 | 116.38 | 2378.44 | 633.87 | 4015.67 | 1440.39 | 798.94 | 641.45 | 2099.78 | 1584.59 | 1245.72 | 338.88 | 494.74 | 241.69 | 253.06 | 20.45 | 475.5 | 4097.42 | 7337.23 |

| 2020:Q1 | 7628.47 | 118.36 | 189.92 | 461.32 | 251.32 | 902.31 | 2960.11 | 1208.01 | 1690.18 | 61.92 | 308.33 | 201.88 | 106.45 | 1787.47 | 649.34 | 3913.47 | 1520.92 | 808.16 | 712.76 | 1716.69 | 1204.6 | 975.03 | 229.57 | 488.4 | 250.39 | 238.01 | 23.69 | 675.86 | 3715 | 6798.38 |

| 2020:Q2 | 7682.04 | 134.47 | 162.54 | 392.09 | 221.31 | 827.93 | 2819.79 | 988.99 | 1770.78 | 60.01 | 329.63 | 211.2 | 118.43 | 2141.37 | 652.93 | 3644.13 | 1273.67 | 672.49 | 601.18 | 1910.14 | 1443.83 | 1176.38 | 267.46 | 451.38 | 219.98 | 231.4 | 14.93 | 460.31 | 4037.91 | 6190.88 |

| 2020:Q3 | 8118.11 | 106.15 | 164.11 | 365.66 | 200.64 | 936.16 | 2981.24 | 1030.23 | 1889.13 | 61.89 | 359.53 | 233.28 | 126.25 | 2351.95 | 652.66 | 3861.23 | 1437.53 | 703.93 | 733.6 | 2060.42 | 1564.46 | 1282.62 | 281.85 | 481.4 | 210.9 | 270.5 | 14.56 | 363.28 | 4256.88 | 7643.64 |

| 2020:Q4 | 8465.89 | 122.96 | 162.29 | 384.13 | 201.47 | 874.81 | 2878.84 | 913.46 | 1903.87 | 61.51 | 356.2 | 234.78 | 121.42 | 2757.51 | 727.68 | 3965.76 | 1302.01 | 655.28 | 646.73 | 2244.66 | 1792.32 | 1475.44 | 316.88 | 436.6 | 213.1 | 223.49 | 15.74 | 419.09 | 4500.13 | 7653.64 |

| 2021:Q1 | 8557.82 | 130.87 | 168.94 | 430.53 | 205.06 | 1006.22 | 2629.75 | 813.52 | 1761.41 | 54.82 | 389.34 | 258.91 | 130.43 | 2898.36 | 698.75 | 3938.54 | 1151.13 | 576.73 | 574.4 | 2426.77 | 1889.83 | 1546.33 | 343.49 | 519.39 | 264.59 | 254.8 | 17.56 | 360.63 | 4619.28 | 8560.49 |

| 2021:Q2 | 9225.03 | 138.53 | 184.52 | 507.72 | 200.78 | 1122.86 | 2801.85 | 871.89 | 1879.07 | 50.88 | 399.86 | 266.19 | 133.67 | 3164.71 | 704.18 | 4284.45 | 1191.76 | 567.54 | 624.22 | 2724.53 | 2123.99 | 1774.41 | 349.57 | 581.73 | 293.65 | 288.08 | 18.81 | 368.16 | 4940.58 | 8881.29 |

| 2021:Q3 | 9620.19 | 167.25 | 206.53 | 456.39 | 209.66 | 1227.41 | 3044 | 965.06 | 2016.48 | 62.46 | 420.67 | 279.91 | 140.75 | 3070.36 | 817.92 | 4585.36 | 1284.31 | 599.57 | 684.75 | 2723.02 | 2102.74 | 1727.9 | 374.84 | 584.72 | 306.39 | 278.32 | 35.56 | 578.03 | 5034.83 | 8892.06 |

| 2021:Q4 | 9680.92 | 157.93 | 189.4 | 484.16 | 241.81 | 1251.54 | 2918.79 | 951.56 | 1908.57 | 58.66 | 445.17 | 296.66 | 148.51 | 3190.79 | 801.32 | 4575.54 | 1229.56 | 589.05 | 640.52 | 2879.63 | 2147.39 | 1766.88 | 380.51 | 678.89 | 358.4 | 320.49 | 53.35 | 466.35 | 5105.39 | 8542.39 |

| 2022:Q1 | 9976.45 | 172.36 | 187.35 | 698.28 | 240.55 | 1296.7 | 3078.5 | 1068.88 | 1955.54 | 54.08 | 472.06 | 319.32 | 152.74 | 3030.84 | 799.82 | 4566.97 | 1168.14 | 490.83 | 677.31 | 2713.23 | 2024.86 | 1697.72 | 327.14 | 645.24 | 328.92 | 316.32 | 43.13 | 685.6 | 5409.48 | 9217.74 |

| 2022:Q2 | 9285.91 | 186.16 | 176.33 | 483.12 | 266.88 | 1228.62 | 3027.81 | 1134.36 | 1838.61 | 54.84 | 480.42 | 320.28 | 160.14 | 2541.77 | 894.79 | 4508.06 | 1233.32 | 537.43 | 695.89 | 2504.39 | 1830.87 | 1546.22 | 284.65 | 636.41 | 353.15 | 283.26 | 37.11 | 770.35 | 4777.85 | 7906.11 |

| 2022:Q3 | 9083.2 | 162.17 | 165.9 | 478.06 | 256.81 | 1160.75 | 3072.42 | 1086.99 | 1931.62 | 53.82 | 481.7 | 323.34 | 158.36 | 2446.42 | 858.96 | 4379.28 | 1233.52 | 550.28 | 683.24 | 2415.91 | 1759.92 | 1489.51 | 270.41 | 616.12 | 394.73 | 221.39 | 39.87 | 729.86 | 4703.92 | 7934.79 |

| 2022:Q4 | 9119.4 | 172.88 | 179.02 | 485.22 | 247.9 | 1101.16 | 3080.05 | 1094.35 | 1925.35 | 60.35 | 495.3 | 335.23 | 160.07 | 2521.81 | 836.07 | 4438.28 | 1243.6 | 590.64 | 652.96 | 2435.87 | 1758.66 | 1439.85 | 318.81 | 634.37 | 484.46 | 149.91 | 42.84 | 758.81 | 4681.12 | 7752.95 |

| 2023:Q1 | 9400.75 | 159.12 | 228.79 | 469.32 | 218.94 | 1185.84 | 3161.29 | 1198.27 | 1910.51 | 52.5 | 515.76 | 353.93 | 161.83 | 2606.71 | 854.99 | 4601.47 | 1528.28 | 745.66 | 782.61 | 2552.23 | 1895.31 | 1533.1 | 362.21 | 614.52 | 453.22 | 161.31 | 42.4 | 520.97 | 4799.28 | 8288.42 |

| 2023:Q2 | 9797.31 | 185.46 | 200.33 | 481.64 | 200.49 | 1162.41 | 3474.17 | 1409.94 | 1995.44 | 68.79 | 533.32 | 365.61 | 167.7 | 2702.22 | 857.27 | 4956.51 | 1736.16 | 868.01 | 868.15 | 2658.98 | 2029.08 | 1639 | 390.08 | 588.58 | 438.38 | 150.2 | 41.32 | 561.38 | 4840.8 | 9073.25 |

Source: https://www.federalreserve.gov/releases/efa/all_hedge_funds_balance_sheet.csv

Hedge funds are private funds that pool investors’ money and invest in a wide range of assets. Private funds are excluded from the definition of investment company under the Investment Company Act of 1940 by section 3(c)(1) or 3(c)(7) of that Act, and are therefore not subject to some regulations intended to protect investors. As a result, hedge funds are not included in the mutual fund sectors of the Financial Accounts. Hedge funds typically require a high minimum investment and are only open to accredited investors, such as wealthy individuals and institutional investors, for example, pension funds and insurance companies. Hedge funds typically have more flexible investment strategies than mutual funds and often employ leverage. Hedge funds hold a wide variety of asset types which can include derivatives, currencies, and real estate, in addition to equities and fixed income instruments. Investors in hedge funds can face limitations on redemptions of shares, which differs from the daily redemption requirements of mutual funds.

Hedge funds must file Form PF if they have investment advisors that are registered or are required to register with the Securities and Exchange Commission (SEC), manage one or more private funds, and have at least $150 million in private fund assets under management. Smaller hedge funds file Form PF annually while qualifying hedge funds - those with at least $500 million in assets under management - must file quarterly and report more detail on their assets and liabilities. Commodity pools that elect to file Form PF as hedge funds are included.

Different methodological choices and revisions to Form PF filings can lead to small differences between the hedge funds’ aggregate balance sheet presented here and the SEC’s private fund statistics. The technical Q&A of the Financial Accounts provides more detail on how the hedge fund balance sheet is estimated. The methodology used to estimate the split of the gross asset value on different instruments includes information from Question 26 and 30 of Form PF.

The hedge funds sector has not been fully incorporated in the regular Financial Accounts publication. Hedge funds domiciled abroad are included in the rest of the world sector. In contrast, the assets of domestic hedge funds are usually assigned to the household sector, which is a residual holder on many instruments.

About the Enhanced Financial Accounts (EFAs):

The Enhanced Financial Accounts initiative is a long-term effort to augment the Financial Accounts of the United States with a richer and more detailed picture of financial intermediation and interconnections. As part of this initiative, we are providing supplementary information that offers finer detail, additional types of activities, higher-frequency data, and more-disaggregated data, even if such data are not available for all sectors or easily incorporated into the existing structure of the Financial Accounts. Many of the EFA projects are accompanied by FEDS Notes that provide additional information or context. Like all Financial Accounts data, EFA data are updated regularly and subject to revision.

Highlights:

- Treasury Securities as an asset hit a recorded all time high at $1409.94 billion. Remember:

- BOE Rings Alarm Bells On Hedge Funds' Risky Trade: Net short position in Treasury futures jumped to $800 billion

- Hedge Funds Catapulted Treasury Shorts to Record at Wrong Time: Investors boost net short UST futures bets to most since 2006

- SEC Chair Gary Gensler: "Many hedge funds are receiving the vast majority of their repo financing in the non-centrally cleared market, where haircuts or initial margin requirements are not necessarily applied."

- Gary Gensler: "in the last few years, many hedge funds are receiving repo financing in the non-centrally cleared bilateral market, where haircuts or initial margin requirements are not necessarily applied."

- Gary Gensler: "We must build upon the work of the Hedge Fund Working Group. That means looking at large, interconnected, highly-levered hedge funds, associated repo markets for financing, the prevalence of low to 0 haircuts in such funding..."

- Fed's Barr: "their highly leveraged positions in Treasury markets are facilitated by very low, or even zero, haircuts on their repo financing; & that demand for this leverage is highly concentrated among a handful of large hedge funds"

- Office of Financial Research Alert! OFR finds Hedge Fund Activities Can Influence the U.S. Treasury Yield Curve.

- Total debt securities hit a new all time series high at $3,474.17 billion.

- Leveraged loans hit a new all time series high at $365.61 billion.

- Other loans hit a new all time series high at $167.7 billion.

- Total liabilities hit a new all time high at $4,956.51 billion (+7.7% from Q1!).

- Total security repurchase agreements hit a new all time high at $1736.16 billion.

- Security repurchase agreements with domestic institutions hit a new all time high at $868.01 billion.

- Security repurchase agreements with foreign institutions hit a new all time high at $868.15 billion.

- Total loans; liability hit a new all time high at $2,658.98 billion.

- Loans, total secured borrowing via prime brokerage; liability hit a new all time high at $2,029.08 billion.

TLDRS:

The Fed's Enhanced Financial Accounts (EFAs) on Hedge Funds:

- Total liabilities hit a new all time high at $4,956.51 billion (+7.7% from Q1!).

- Treasury Securities as an asset hit a recorded all time high at $1409.94 billion.

- Total debt securities hit a new all time series high at $3,474.17 billion.

- Leveraged loans hit a new all time series high at $365.61 billion.

- Other loans hit a new all time series high at $167.7 billion.

- Total security repurchase agreements hit a new all time high at $1736.16 billion.

- Security repurchase agreements with domestic institutions hit a new all time high at $868.01 billion.

- Security repurchase agreements with foreign institutions hit a new all time high at $868.15 billion.

- Total loans; liability hit a new all time high at $2,658.98 billion.

- Loans, total secured borrowing via prime brokerage; liability hit a new all time high at $2,029.08 billion.