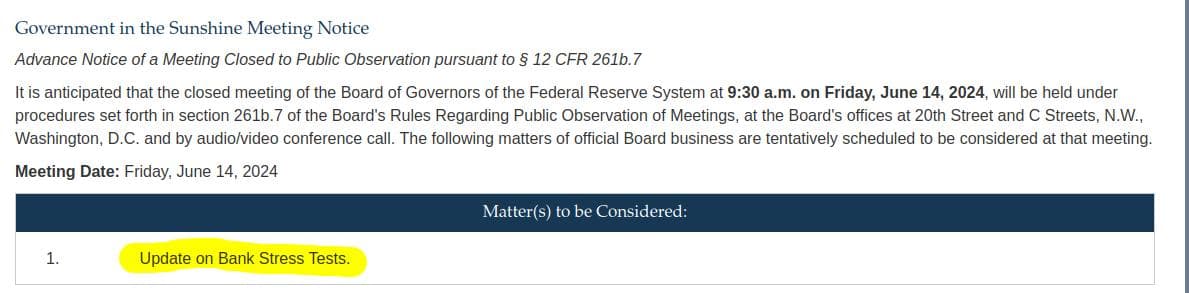

Federal Reserve Alert! The Fed to hold a CLOSED meeting at 9:30 a.m. on Friday, June 14, 2024 for an update on Bank Stress Tests.

Last week, the Fed announced that results from its annual bank stress tests will be released on Wednesday, June 26, at 4:30 p.m. EDT. This year, 32 banks with $100 billion or more in total assets are subject to the stress tests.

Additionally, aggregate results from the Board's first exploratory analysis, which will not affect bank capital requirements, will be released simultaneously.

Stress tests are one supervisory tool used to measure whether banks have adequate capital to absorb losses so that they can lend to households and businesses even in a severe recession. They evaluate banks' resilience by estimating losses, net revenue, and capital levels—which provide a cushion against losses—under a hypothetical recession scenario.

This year, 32 banks with $100 billion or more in total assets are subject to the Board's stress tests. The scenario includes a severe global recession with heightened stress in commercial and residential real estate markets. Separately, the exploratory analysis includes four separate hypothetical elements, including two funding stresses applied to all banks tested and two market shocks applied to only the largest and most complex banks.

2024 Scenario

In the 2024 stress test scenario, the U.S. unemployment rate rises nearly 6-1/2 percentage points, to a peak of 10 percent. The increase in the unemployment rate is accompanied by severe market volatility, a widening of corporate bond spreads, and a collapse in asset prices, including a 36 percent decline in house prices and a 40 percent decline in commercial real estate prices. Large banks with substantial trading or custodial operations are also required to incorporate a counterparty default scenario component to estimate and report potential losses and capital effects associated with the unexpected default of the firm's largest counterparty.

In addition, banks with large trading operations will be tested against a global market shock component that primarily stresses their trading and related positions. The global market shock component is a set of hypothetical stresses to a large set of risk factors reflecting market distress and heightened uncertainty.

The table below shows the components of the annual stress test that apply to each bank, based on data as of the third quarter of 2023.

This year's exploratory analysis includes four separate hypothetical elements that will assess the resilience of the banking system to a wider range of risks. Two of the hypothetical elements include funding stresses that cause a rapid repricing of a large proportion of deposits at large banks. Each element has a different set of interest rate and economic conditions, including a moderate recession with increasing inflation and rising interest rates, and a severe global recession with high and persistent inflation and rising interest rates.

The other two elements of the exploratory analysis include two sets of market shocks that will be applied only to the largest and most complex banks. These shocks hypothesize the failure of five large hedge funds, with each under a different set of financial market conditions. Those conditions include expectations of reduced global economic activity with a negative outlook for long-term inflation, and expectations of severe recessions in the United States and other countries.

The exploratory analysis is distinct from the stress test and will explore additional hypothetical risks to the broader banking system, rather than focusing on firm-specific results. The Board will publish aggregate results alongside the annual stress test results in June 2024.

2024 Stress Test Banks:

| Bank | Subject to global market shock | Subject to counterparty default |

|---|

| Ally Financial Inc. | ||

|---|---|---|

| American Express Company | ||

| Bank of America Corporation | X | X |

| The Bank of New York Mellon Corporation | X | |

| Barclays US LLC | X | X |

| BMO Financial Corp. | ||

| Capital One Financial Corporation | ||

| The Charles Schwab Corporation | ||

| Citigroup Inc. | X | X |

| Citizens Financial Group, Inc. | ||

| Credit Suisse Holdings (USA), Inc. | X | X |

| DB USA Corporation | X | X |

| Discover Financial Services | ||

| Fifth Third Bancorp | ||

| The Goldman Sachs Group, Inc. | X | X |

| HSBC North America Holdings Inc. | ||

| Huntington Bancshares Incorporated | ||

| JPMorgan Chase & Co. | X | X |

| Keycorp | ||

| M&T Bank Corporation | ||

| Morgan Stanley | X | X |

| Northern Trust Corporation | ||

| The PNC Financial Services Group, Inc. | ||

| RBC US Group Holdings LLC | ||

| Regions Financial Corporation | ||

| Santander Holdings USA, Inc. | ||

| State Street Corporation | X | |

| TD Group US Holdings LLC | ||

| Truist Financial Corporation | ||

| UBS Americas Holding LLC | ||

| U.S. Bancorp | ||

| Wells Fargo & Company | X | X |

This stress test meeting takes place in the backdrop of the most recent FDIC Quarterly Banking Profile:

The Quarterly Banking Profile is a quarterly publication that provides the earliest comprehensive summary of financial results for all FDIC-insured institutions.

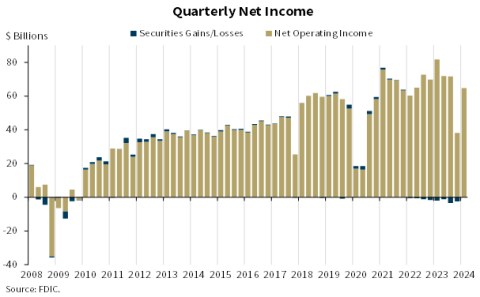

Reports from 4,568 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) report aggregate net income of $64.2 billion in first quarter 2024, an increase of $28.4 billion (79.5 percent) from the prior quarter.

Highlights from the First Quarter 2024 Quarterly Banking Profile

- FDIC-Insured Institutions Reported Net Income of $64.2 Billion

- Net Income Increased From the Prior Quarter, Driven By Lower Noninterest Expense, Provision Expenses, and Higher Noninterest Income

- Community Bank Net Income Increased Quarter Over Quarter

- The Net Interest Margin Fell For the Second Consecutive Quarter

- Asset Quality Metrics Remained Generally Favorable With the Exception of Material Deterioration in Credit Card and Commercial Real Estate Portfolios

- Loan Balances Declined Modestly From the Prior Quarter, but Increased From a Year Ago

- Domestic Deposits Increased For the Second Straight Quarter

- The Deposit Insurance Fund Reserve Ratio Increased Two Basis Points to 1.17 Percent

- The number of banks on the FDIC’s “Problem Bank List” increased from 52 to 63. 5 Total assets held by problem banks rose $15.8 billion to $82.1 billion.

- Problem banks represent 1.4 percent of total banks, which is within the normal range for non-crisis periods of 1 to 2 percent of all banks.

- The noncurrent rate for non-owner occupied CRE loans of 1.59 percent is now at its highest level since fourth quarter 2013, driven by office portfolios at the largest banks.

- The credit card net charge-off rate was 4.70 percent in the first quarter, up 55 basis points quarter over quarter and the highest rate since third quarter 2011.

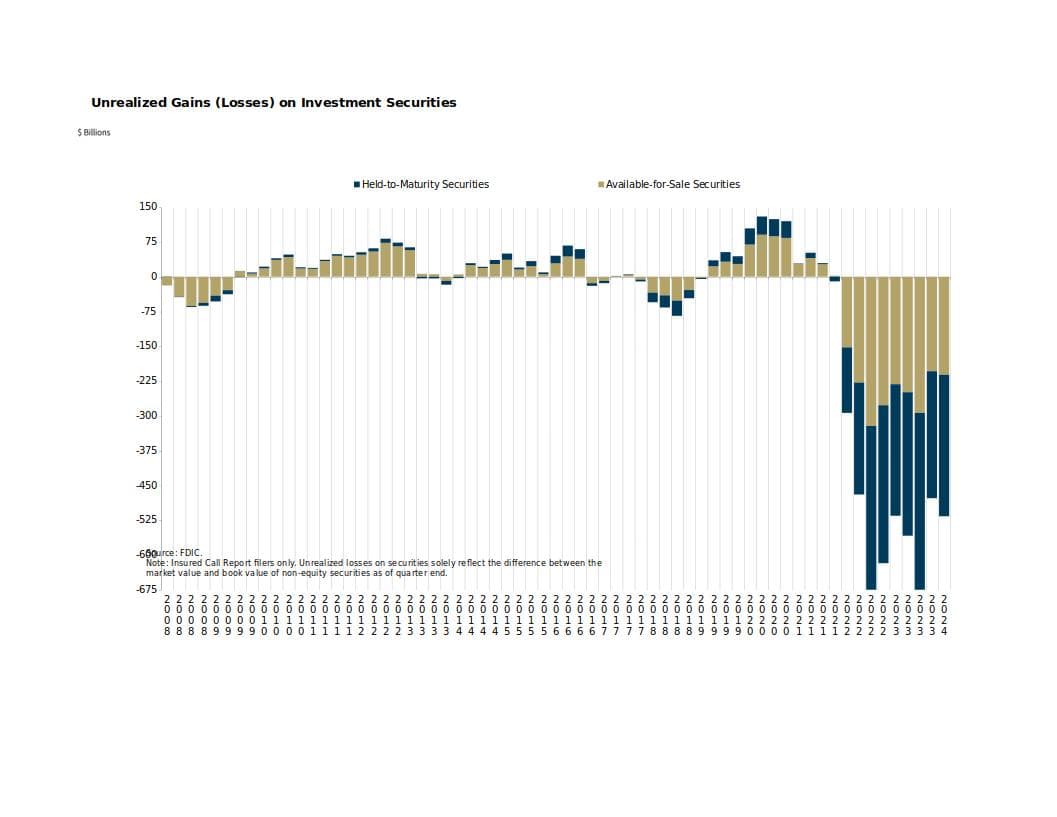

- Unrealized losses on securities totaled $516.5 billion in the first quarter, an increase of $38.9 billion (8.2 percent) from fourth quarter 2023.

The Industry’s Net Income Increased From the Prior Quarter, Driven By Lower Noninterest Expense, Provision Expenses, and Higher Noninterest Income:

First quarter net income for the 4,568 FDIC-insured commercial banks and savings institutions increased by $28.4 billion (79.5 percent) from the prior quarter to $64.2 billion. A large decline in noninterest expense (down $22.5 billion, or 13.3 percent) was the primary cause of the increase in net income. A decline in the expense related to the special assessment accounted for more than half of the decline in noninterest expense. Higher noninterest income (up $10.3 billion, or 15.2 percent) and lower provision expenses (down $4.3 billion, or 17.3 percent) also contributed to the quarterly increase.

The banking industry reported an aggregate return-on-assets ratio (ROA) of 1.08 percent in first quarter 2024, up from 0.61 percent in fourth quarter 2023 but down from 1.36 percent in first quarter 2023.

Community Bank Net Income Increased Quarter Over Quarter:

Quarterly net income for the 4,128 community banks insured by the FDIC was $6.3 billion in the first quarter, an increase of $363.2 million (6.1 percent) from fourth quarter 2023. Lower realized losses on the sale of securities and lower noninterest and provision expenses more than offset lower noninterest and net interest income. The community bank pretax ROA increased six basis points from one quarter ago to 1.13 percent.

The Net Interest Margin Fell For the Second Consecutive Quarter:

The industry’s net interest margin (NIM) declined ten basis points to 3.17 percent in the first quarter. NIM declined as funding costs continued to increase while the yield on earning assets declined during the quarter. The industry’s first-quarter NIM was seven basis points below the pre-pandemic average NIM.1 The community bank NIM of 3.23 percent also declined quarter over quarter; it is down 12 basis points from the prior quarter and 41 basis points from its pre-pandemic average.

Asset Quality Metrics Remained Generally Favorable With the Exception of Material Deterioration in Credit Card and Commercial Real Estate (CRE) Portfolios:

Loans that were 90 days or more past due or in nonaccrual status increased to 0.91 percent of total loans, up five basis points from the prior quarter and 16 basis points from the year-ago quarter. The quarterly increase was led by commercial and industrial loans and non-owner-occupied CRE loans. The noncurrent rate for non-owner occupied CRE loans of 1.59 percent is now at its highest level since fourth quarter 2013, driven by office portfolios at the largest banks. Despite the recent increases, the industry’s total noncurrent ratio remains 37 basis points below the pre-pandemic average of 1.28 percent.

The industry’s net charge-off rate of 0.65 percent was unchanged from the prior quarter but was 24 basis points higher than a year ago. This ratio remains 17 basis points above the pre-pandemic average. The credit card net charge-off rate was 4.70 percent in the first quarter, up 55 basis points quarter over quarter and the highest rate since third quarter 2011.

Loan Balances Declined Modestly From the Prior Quarter, but Increased From a Year Ago:

Total loan and lease balances declined $34.8 billion (0.3 percent) from the previous quarter. The decline was driven by lower credit card loans (down $35.7 billion, or 3.2 percent) and auto loans (down $7.6 billion, or 1.4 percent), primarily at large banks.

Total loan and lease balances increased by $205.2 billion (1.7 percent) from the prior year. This increase was led by credit card loans (up $98.3 billion, or 10.0 percent), 1-4 family residential loans (up $59.7 billion, or 2.4 percent), and nonfarm, nonresidential commercial real estate loans (up $42.6 billion, or 2.4 percent). Almost 85 percent of banks reported annual loan growth.

Community banks reported a 0.9 percent increase in loan and lease balances from the previous quarter and a 7.1 percent increase from the prior year. Growth in nonfarm, nonresidential CRE loans and 1-4 family residential mortgage loans drove both the quarterly and annual increases in loan and lease balances.

Domestic Deposits Increased For the Second Consecutive Quarter:

Domestic deposits increased $190.7 billion (1.1 percent) from fourth quarter 2023, marking a second consecutive quarterly increase. Growth in transaction accounts led the increase (up $247.2 billion, or 4.0 percent), offsetting a decline in savings deposit balances (down $125.5 billion, or 1.5 percent). Estimated insured deposits increased $114.9 billion (1.1 percent), while estimated uninsured domestic deposits increased $63.3 billion (0.9 percent) during the quarter, the first reported quarterly increase since fourth quarter 2021. After seven consecutive quarters of growth, brokered deposits declined $10.2 billion (0.8 percent) from the prior quarter.

The Deposit Insurance Fund Reserve Ratio Increased Two Basis Points to 1.17 Percent:

In the first quarter, the Deposit Insurance Fund (DIF) balance increased by $3.5 billion to $125.3 billion, primarily driven by assessment revenue. The reserve ratio increased two basis points during the quarter to 1.17 percent.

The Total Number of Insured Institutions Declined:

The total number of FDIC-insured institutions declined by 19 during the quarter to 4,568. One bank opened, four banks did not file a Call Report, and 16 institutions merged with other banks during the quarter.

Unrealized Losses on Securities Increased From the Previous Quarter to $516.5 Billion

Unrealized losses on securities totaled $516.5 billion in the first quarter, an increase of $38.9 billion (8.2 percent) from fourth quarter 2023. Higher unrealized losses on residential mortgage-backed securities accounted for almost 95 percent of the total decrease. Mortgage rates increased in the first quarter, which placed downward pressure on the underlying values of such investments.

The Number of Problem Banks Increased

The number of banks on the FDIC’s “Problem Bank List” increased from 52 to 63. 5 Total assets held by problem banks rose $15.8 billion to $82.1 billion. Problem banks represent 1.4 percent of total banks, which is within the normal range for non-crisis periods of 1 to 2 percent of all banks.

The recent FDIC Quarterly Profile indicates troubling signs for banks, particularly in the commercial real estate sector, just ahead of the Federal Reserve's upcoming stress tests. The FDIC's report highlights that while net income for FDIC-insured institutions rose to $64.2 billion (largely due to lower noninterest and provision expenses, and higher noninterest income)--the underlying asset quality metrics reveal significant vulnerabilities.

Notably, there has been material deterioration in credit card and commercial real estate (CRE) portfolios, with noncurrent rates for non-owner occupied CRE loans reaching their highest levels since 2013. This deterioration is predominantly driven by office portfolios at the largest banks, signaling potential systemic risks--uh, hello stress test scenario?

The stress tests, scheduled for release on June 26, will assess the resilience of 32 banks with assets exceeding $100 billion, under a severe hypothetical global recession scenario with heightened stress in both commercial and residential real estate markets. Now this last minute closed door meeting about stress tests?

Given the FDIC's most recent findings, these stress tests are particularly worrisome.The rising number of banks on the FDIC’s "Problem Bank List," now totaling 63, and the significant increase in assets held by these problem banks to $82.1 billion, amplify concerns about the stability of the banking sector. Moreover, the net charge-off rate for credit cards has spiked to 4.70 percent, the highest since 2011, indicating increasing strain on consumer finances that could spill over into broader economic distress.

These developments come at a time when the noncurrent rate for non-owner occupied CRE loans is at its highest in over a decade, suggesting that the commercial real estate market could be a significant source of vulnerability for banks--as the stress test should probe.

The FDIC's quarterly report serves as a sobering reminder of the fragility within key asset classes and the potential risks to financial stability--hello Unrealized Losses on Securities Increasing to $516.5 Billion.

As we all brace for the results, it appears the officials at the Fed are scrambling to get their ducks in a row before they are released?

TLDRS:

- The Fed to hold a CLOSED meeting at 9:30 a.m. on Friday, June 14, 2024 for an update on Bank Stress Tests.

- The Federal Reserve Board will release the results of its annual bank stress tests on June 26, assessing 32 banks with assets of $100 billion or more under a severe recession scenario.

- Results from its annual bank stress tests will be released on Wednesday, June 26, at 4:30 p.m. EDT.

- The stress tests will evaluate banks' ability to absorb losses and maintain capital levels to continue lending during economic downturns, focusing on commercial and residential real estate markets.

- The 2024 stress test scenario includes a significant rise in unemployment, severe market volatility, widening corporate bond spreads, and a sharp decline in asset prices, particularly a 36% drop in house prices and a 40% drop in commercial real estate prices.

- Additionally, the exploratory analysis will test banks against hypothetical funding stresses and market shocks, including scenarios involving the failure of large hedge funds and global economic distress.

- The FDIC's recent Quarterly Profile indicates deteriorating asset quality in commercial real estate and credit card portfolios, with noncurrent CRE loans at their highest levels since 2013, signaling potential systemic risks.

- The number of problem banks has increased to 63, with assets held by these banks rising to $82.1 billion, highlighting concerns about the stability of the banking sector and the potential impact of the upcoming stress test results on regulatory and market perceptions.

Federal Reserve Alert! The Fed to hold a CLOSED meeting at 9:30 a.m. on Friday, June 14, 2024 for an update on Bank Stress Tests. Recall, these results supposed to be released to the public 6/26/24.

by u/Dismal-Jellyfish in Superstonk

Federal Reserve Alert! The Fed to hold a CLOSED meeting at 9:30 a.m. on Friday, June 14, 2024 for an update on Bank Stress Tests. Recall, these results are supposed to be released to the public 6/26/24.https://t.co/vWwFoYweTJ

— dismal-jellyfish (@DismalJellyfish) June 13, 2024