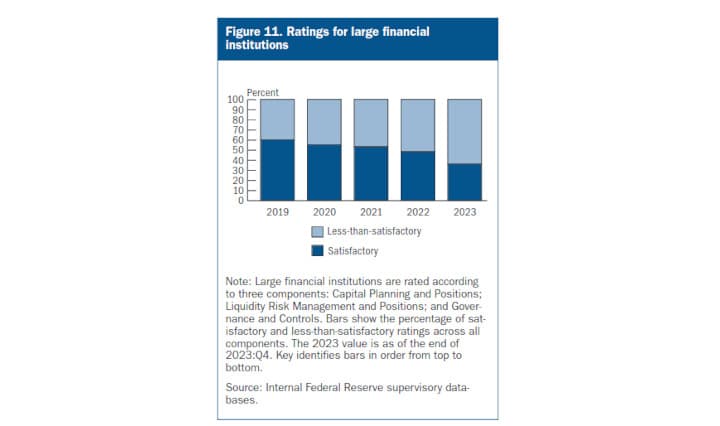

Fed supervisors summarize assessments of large financial institutions using LFI rating system--in 2023, only 1/3 of large financial institutions had satisfactory ratings.

The Federal Reserve Board publishes its semiannual Supervision and Regulation Report to inform the public of current banking conditions as well as provide transparency about its supervisory and regulatory policies and actions.

This report focuses on developments in three areas:

1. Banking System Conditions provides an overview of the financial