See all these comments? YOU have made this happen! Hundreds of apes across the world have been emailing the HM Treasury - and together, we're making WAVES to protect DRS. Comment Deadline 9/25

Hello and Happy Weekend! I am excited to team up with u/kibblepigeon to help with presenting everything around the UK's HM Treasury deadline coming up THIS Monday (9/25) in one place. Buckle up, this is a big post!

Get Involved: Regulation and Reform.

_____________________________________

Shaping the Future of Shareholder Rights

Are you a shareholder, investor, or simply curious about the future of securities trading and shareholder rights?

There's a critical report on the horizon that you should know about:

The UK Government have a Digitisation Taskforce, chaired by Sir Douglas Flint, that was launched by the Chancellor on 19 July 2022 to drive forward the modernisation of the UK’s shareholding framework.

You can read more about the UK’s proposal here: https://www.gov.uk/government/publications/digitisation-taskforce

The report, prepared by HM Treasury, lays out proposals for the digitisation of the securities framework, and it has far-reaching implications for the financial landscape.

What's in the Report?

The report delves into four key models, from digitisation of the current structures to Distributed Ledger Technology (DLT), all aimed at enhancing the efficiency and transparency of securities trading. With the objective of modernising the current system, these proposals hold the potential for positive change.

However, they also spark vital discussions about safeguarding shareholder rights, ensuring transparency, and understanding the evolving role of intermediaries in the financial landscape.

Why Should You Get Involved?

Your involvement matters because these changes could impact your rights as a shareholder and the way you manage your investments. Here's why you should pay attention:

🚨 FOR UK SHAREHOLDERS:

🚨 Your Legal Ownership Under Threat:

Hidden within the UK's proposed securities trading system improvements lies a significant peril: the potential loss of your legal ownership rights. Your assets could be moved into an intermediary account, where the legal title of your shares will be handed over to a state-managed nominee should this proposal go ahead. This isn't a mere suggestion; it's a concrete plan supported by the possibility of changing primary legislation. They aim to alter the very laws that govern your ownership rights, allowing for the legal transfer of your assets to a state-managed nominee.

Case in point:

🚨 A Threat to Your Fundamental Rights:

They also want to establish a "baseline service" level for intermediaries to offer "access" to shareholder rights—rights that should be yours by default as an asset holder. This means that exercising your fundamental rights could come with associated charges, creating an "opt-in" service while companies like Computershare offer similar services for free. Shareholders could find themselves exploited for increased government revenue if these proposals are accepted.

⚠️Critical Questions Emerge:

This proposal raises a multitude of disconcerting questions for UK shareholders.

· Who stands to gain from this alteration?

· How will the shift in legal ownership impact your shareholder rights?

· What safeguards are in place to prevent potential misuse of this power?

· And why is the government advocating for this change when more cost-effective and shareholder-friendly options are available?

The threat to your legal ownership is not theoretical—it's a tangible risk, and comprehending its implications is paramount to safeguarding your financial security.

🌎 FOR INTERNATIONAL SHAREHOLDERS:

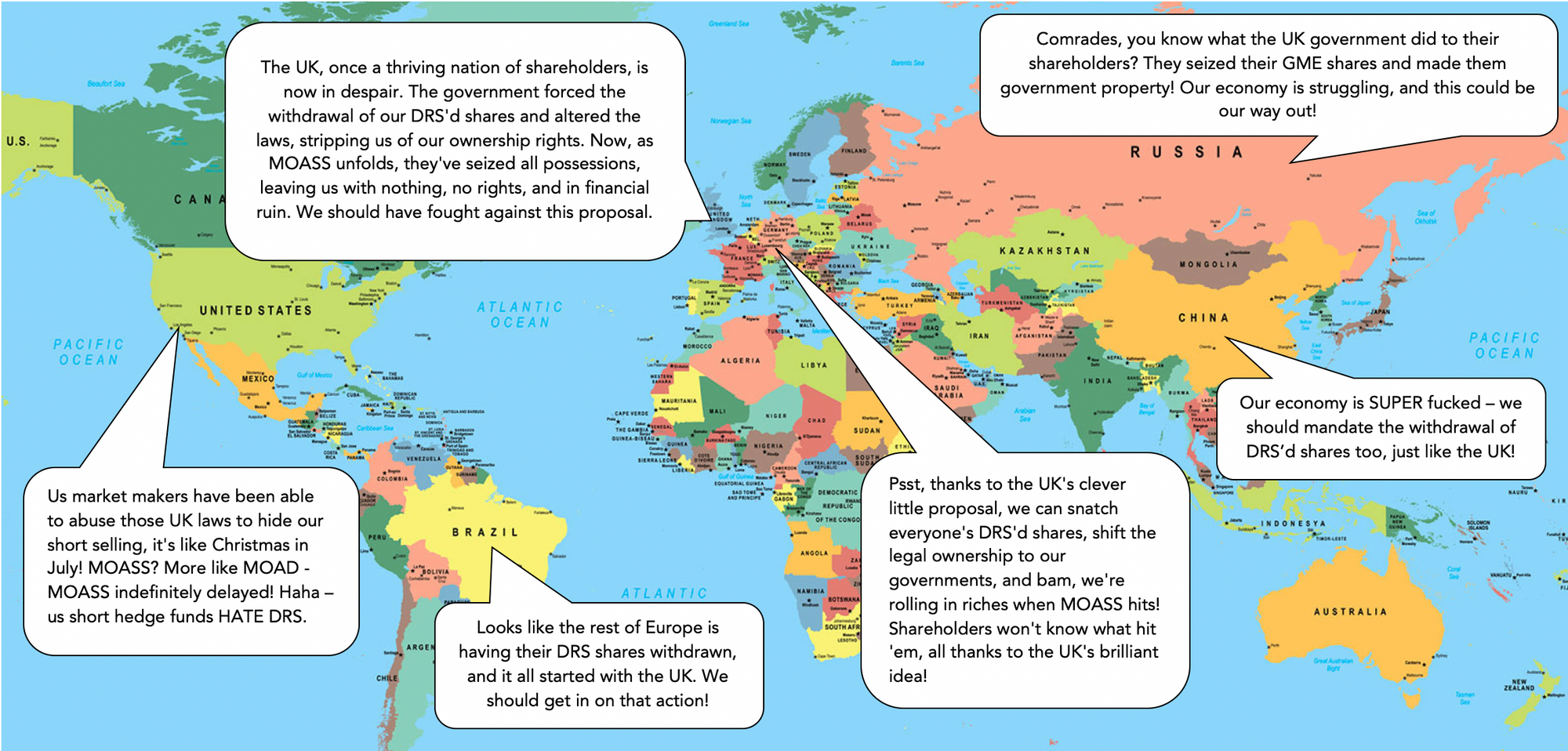

The UK's digitization proposal isn't just a matter confined to its borders; it carries grave implications for shareholders worldwide. If this proposal becomes law, it grants the UK government the legal right to seize shareholder assets, fundamentally altering ownership rights. This isn't a stand-alone event; it's a dire warning for shareholder rights on a global scale.

⚠️ 🌎 Global Precedent and Widespread Impact:

The UK's move sets a dangerous global precedent, opening the door for governments worldwide to follow suit. By compelling shareholders to surrender their legal ownership rights, this proposal jeopardizes shareholder and property rights everywhere.

⚠️ 🌎 Shareholder Vulnerability:

The actions taken by the UK government may embolden other nations to infringe upon shareholder rights. This could lead to the forced transfer of ownership, trade restrictions, and interference in corporate governance, leaving shareholders vulnerable to government overreach.

⚠️ 🌎 Investor Confidence Hit:

Such actions erode investor confidence not only in the UK but also in international financial markets. Investors seek stable and predictable environments to protect their assets and investments, and this proposal disrupts that stability.

⚠️ 🌎 Legal and Ethical Dilemmas:

The mandatory transfer of ownership raises significant legal and ethical concerns, challenging property and possession rights protected by international conventions such as the European Convention on Human Rights. Upholding these principles is crucial to safeguard individual freedoms and the rule of law worldwide.

The UK's digitisation plan isn't just a local policy change; it's a global harbinger of danger. It's time to recognise that this threat knows no borders, and it's incumbent upon stakeholders worldwide to pay attention and take action to protect shareholder rights everywhere.

📢 Your Voice Matters

The risk of losing control over your assets and being charged for basic rights is real. Your voice and participation can make a difference in safeguarding your shareholder rights and ensuring a transparent and equitable financial future.

Get involved, ask questions, and demand clarity on these proposals. It's your financial security on the line.

To do this - you can check out some of the email templates below to help inspire your response to this proposal:

The Shareholder Feedback Template:

Copy & paste template: https://pastebin.com/SuvJ9vcB & site link here.

Dave Lauer & We The Investors:

Copy & paste template: https://pastebin.com/bCN1WPS8 & site link here & post here.

Investor Letters: Bella Crema & Kibble:

Copy & paste template: https://pastebin.com/G5FQLQHw - Bella

Copy & paste template: https://pastebin.com/ZVr1M1zu - Kibble

And send to:

Get Your Questions Answered

To ensure that your concerns are heard and addressed, it's crucial to get involved. Engage with HM Treasury, ask questions, and seek clarity on the proposals. Your participation can help shape the future of shareholder rights and the financial system.

Stay tuned for our list of essential questions to ask HM Treasury and join the conversation, as well as some tips and tricks for writing your own letters below.

Your voice matters in safeguarding shareholder rights and ensuring a transparent and equitable financial future.

POWER TO THE SHAREHOLDERS

_____________________________________

Subject: Protecting Shareholder Rights and the Sanctity of Direct Registration.

Dear Mr. Douglas Flint,

I am writing to you as an advocate for the protection of shareholder rights and the sanctity of direct registration within our securities framework. The decisions made today will shape the future of our financial system and profoundly impact the lives of countless investors, both small and large.

Let me begin by acknowledging the efforts as put forth in the proposal for the dematerialisation of share certificates. The pursuit of innovation in our securities market is commendable, and I am heartened to see that we are exploring new avenues to enhance transparency and efficiency, particularly as demonstrated in proposed share model four, Distributed Ledger Technology using Blockchain.

It's vital that we preserve shareholders' rights, prioritising them above government self-interest, and protect individuals' choices in asset holdings. Securities held under shareholders' own legal name in the company's direct registrar should be joyously revered and promoted as an industry standard.

The proposal of transferring legal ownership of our assets into a Central Securities Depository (CSD) managed by the state raises grave concerns and inherently contradicts the fundamental premise of Article 1 of Protocol 1 to the ECHR, which states:

"Every natural or legal person is entitled to the peaceful enjoyment of his possessions."

What peace is there to have when our assets' security is under threat while in the care of the UK government?

I will address these risks as below.

The Core Concern:

The core of the concern lies the proposition that shareholders should be compelled to transfer their Direct Registration System (DRS) held shares to a Central Securities Depository (CSD), administered through a nominee, specifically CREST, under the management of UK Government institutions — a recommendation put forth by HM Treasury.

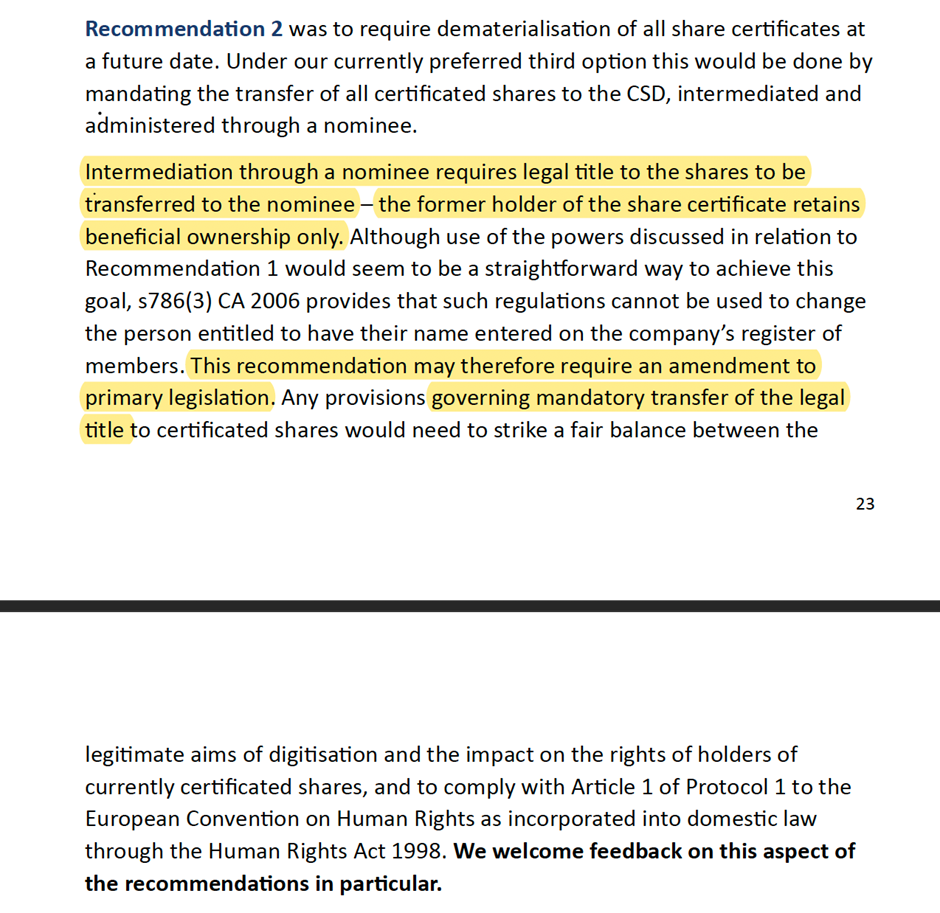

To facilitate this transition, the proposal briefly hints at the need for amendments to the primary legislation to enable the transfer of legal title (and ownership) to nominee:

“Intermediation through a nominee requires legal title to the shares to be transferred to the nominee … This recommendation may therefore require an amendment to primary legislation. …. governing mandatory transfer of the legal title” (pg. 23).

The proposed alteration in the primary law is a significant endeavour that demands careful consideration. It raises critical concerns related to shareholder rights and the potential long-term repercussions for investors. Despite its relatively brief mention in the report, it's essential to acknowledge that this proposed change could have far-reaching implications, touching on the core of our financial security and ownership

As a result, the Digitisation Taskforce Interim Report conspicuously lacks comprehensive and transparent disclosure, or, at the very least, elaboration. It appears to sidestep essential discussions surrounding the pressing and deeply concerning fact that shareholder rights will be put at significant risk due to the government's mandated push to transfer the legal ownership of personal assets to the state.

The desire to change primary legislation to achieve this goal this warrants thorough public scrutiny and critical assessment. For note, the absence of such scrutiny within the report, as well as evidence of discussion as had via any public channels, gives the distinct impression of intentional deception.

_______________________

The Separation of Ownership:

One of the fundamental principles of our current system is that shareholders holding DRS'd shares maintain both legal and beneficial ownership of their investments. This arrangement respects shareholders' economic rights and legal standing while ensuring their voices are heard in corporate matters.

However, the proposal seems to envision a future in which legal ownership resides with a nominee, creating a separation between the legal and beneficial owners. This separation is a cause for significant concern.

It is my understanding that when shareholders use a nominee to hold their shares, the law recognises the nominee as the official owner of the shares. In the UK, for example, the Companies Act 2006 outlines the rules for nominee arrangements.

In a nominee arrangement, there is a separation between the registered shareholder (the nominee) and the beneficial owner (the individual shareholder). The nominee's name is recorded on the company's official shareholder register, making them the legal owner of the shares for legal and administrative purposes.

The beneficial owner (i.e., the shareholder) still retains economic rights in the shares in principle, such as receiving dividends and having voting rights. However, their name will not appear on the company's official register.

This legal distinction can impact a shareholder's legal standing and participation in certain corporate actions or legal proceedings.

By compelling shareholders to forfeit their legal title to their shares under this mandated proposal, owners of securities are left with no enforceable form of ownership that would be recognised under legal jurisdiction.

This raises questions about why shareholders would support the move of their assets into a government-mandated CSD when they already have the fundamental rights afforded to them in the direct registrar, i.e., the primary register.

_______________________

Preserving Shareholder Rights vs. Proposed CSD Obstructions:

Whilst this proposal alludes to the consideration of shareholder rights:

“There should be no distinction in access to rights between shareholders who are directly registered and those who hold their shares through intermediaries." (pg. 20)

This extract inherently reflects the ambiguous and non-committal language as exercised in this report. There is a noticeable absence of definitively stated terms that would ensure the security and durability of shareholder rights, and this is a continued theme.

The use of the word "should" in statements like "investors should be able to effectively and efficiently exercise their rights" implies a recommendation or suggestion rather than a binding commitment. In financial and regulatory documents, the use of such language can leave room for interpretation of the intended meaning, and subsequent abuse.

To fortify the proposal and safeguard shareholder rights, it is imperative that specific mechanisms be put in place to guarantee unimpeded access to these rights. These mechanisms should be firmly entrenched as the foundational framework of the proposed model. Ambiguities in the proposal, if left unaddressed, could empower intermediaries or nominees to exert control over shareholders' access to their rights over time, leading to potential limitations on shareholder participation in critical corporate decisions.

This issue extends beyond theoretical concerns; history has shown that where ambiguity exists, it can be exploited to the detriment of shareholders.

Consider the Enron scandal of 2001, where shareholders were misled by complex financial statements that concealed massive debt and inflated profits. Enron's use of special purpose entities (SPEs) allowed the company to keep debt off its balance sheet, presenting a rosy financial picture that attracted investors. However, when the truth came to light, Enron filed for bankruptcy, resulting in massive losses for shareholders who had believed in the company's financial health.

Similarly, the Subprime Mortgage Crisis of 2008 demonstrated how ambiguity in financial products could lead to widespread investor losses. Financial institutions bundled complex mortgage-backed securities (MBS) and collateralized debt obligations (CDOs), obscuring the risks associated with these investments. Many investors, including pension funds and individual shareholders, purchased these products without a clear understanding of the underlying risks. When the housing market collapsed, these securities plummeted in value, causing significant losses for investors.

The WorldCom accounting scandal of 2002 further illustrates how unclear financial reporting can harm shareholders. WorldCom engaged in accounting fraud, inflating its assets by capitalizing ordinary expenses. This misleading financial reporting masked the company's true financial health, leading shareholders to believe that the company was profitable and stable. When the fraud was exposed, WorldCom filed for bankruptcy, and shareholders suffered substantial financial losses.

These historical examples underline the critical importance of clarity, transparency, and precise regulations in financial systems. When shareholder rights and financial systems lack clear safeguards, they become susceptible to exploitation, leading to devastating consequences for investors.

The proposed framework for transferring legal ownership of assets into a Central Securities Depository (CSD) managed by the state must therefore address these risks comprehensively to ensure the protection of shareholders' interests.

Furthermore, should shares be transitioned to a nominee structure, the controlling entity may unilaterally change the terms and conditions in which they are managed at any time, which could include:

- Limiting Voting Rights: Introducing new rules that curtail shareholders' ability to vote on important company decisions.

- Dividend Restrictions: Imposing restrictions on dividend access, impacting shareholders' income from their investments.

- Ownership Dilution: Allowing for the dilution of ownership, potentially reducing existing shareholders' ownership percentage.

- Data Access Restrictions: Restricting shareholders' access to information related to their investments, making informed decisions difficult.

- Confiscation of Assets: In extreme cases, a controlling entity might attempt to seize assets held within the nominee structure, essentially confiscating shareholders' investments.

How does the recommended CSD model address the issue of backtracking on promises?

_______________________

The proposal equally outlines intentions to implement a “baseline service” for intermediaries to provide “access” to services, such as an “ability” to vote. However, this approach raises questions about how it aligns with the best interest of shareholders, and why these services aren't automatically provided as they are within the direct registrar.

Page 20 of the report states:

“However, as we noted above, we do not believe that it is necessary to mandate an obligation on every intermediary to offer access to UBOs [Ultimate Beneficial Owner] for the expression of their rightsas long as they are transparent that this is their service proposition. However, the rights foregone should not be exercisable by any other party without the express consent of the UBO.

Where shareholders opt to be served through a service proposition which facilitates the expression of their rights, we believe a baseline service level should offer the following:

· Ability to vote

· Confirmation that voting instructions have been received and acted on as instructed

· A two-way communication channel between the issuer and the UBO

· Opportunity to participate in secondary capital offerings

· Ability to receive shareholder notices and documentation digitally

· An easy facility to keep shareholder details up to date so that the issuer does not lose track of shareholder contact and bank details.” (pg. 20).

One might wonder how this "opt-in" approach could genuinely enhance shareholder services, as it seems contradictory by nature.

Requiring shareholders to actively opt into services that are fundamental to their ownership, the proposal places an additional burden on shareholders, making it more challenging for them to exercise their rights effectively.

As such, this approach could inadvertently diminish the convenience and accessibility of these rights, which should be easily accessible to all shareholders by default. Could you elaborate on how it was determined that this would improve the shareholder’s experience? With note to any associated charges as would be expected from shareholders to accommodate this.

The report goes on to states it does not see it as necessary to require every intermediary to offer access to Ultimate Beneficial Owners (UBOs) for the expression of their rights, while simultaneously mandating the transfer of the legal rights of every shareholder's security asset to a nominee. This raises questions and highlights a significant discrepancy in the proposal's priorities. This model appears to prioritise ownership structure changes over ensuring UBOs have full access to their rights and this discrepancy could affect shareholder empowerment and transparency in corporate governance.

As such, how does HM Treasury plan to address this concern and ensure that shareholder rights are not relegated to a secondary status?

_______________________

Risk of Asset Confiscation within a Mandated CSD Model:

While it may seem far-fetched, the proposal does in fact open the door to the very real possibility of asset confiscation.

In the proposal, there's a mention of the HM Treasury's commitment to comply with Article 1 of Protocol 1 to the European Convention on Human Rights as incorporated into domestic law through the Human Rights Act 1998.

However, the Article 1 of Protocol 1 to the ECHR states:

"Every natural or legal person is entitled to the peaceful enjoyment of his possessions. No one shall be deprived of his possessions except in the public interest and subject to the conditions provided for by law and by the general principles of international law."

In practical terms, this means that under extreme scenarios, a powerful entity, such as the UK Government, could potentially seize assets held within the nominee structure, essentially taking away shareholders' investments. This risk becomes particularly significant if it's argued that such confiscation serves the "public interest”.

The question arises: who would have the authority to define what falls under the umbrella of the public interest? If this determination is made by the very entities responsible for managing these assets, it inherently introduces a conflict of interest.

In such a situation, the potential for abuse and overreach becomes apparent, as decisions that impact shareholders' investments and rights could be justified under the guise of protecting “public interest”, such as in a case of a global crash, and assets are seized to bail out those as responsible.

Without the adequate checks and balances to ensure fairness and transparency. This underscores the imperative need for independent oversight and clear regulations to prevent any abuse of power.

Yet, the proposal doesn't outline clear measures to safeguard shareholders from this risk. It's crucial that these terms and conditions are precisely defined and communicated to shareholders, who entrust their assets under these recommendations. Transparency and clear protections are paramount.

What steps will the HM Treasury take to eliminate this concern?

_______________________

Examining Cost Factors and Related Motive:

The proposal frequently mentions associated charges for shareholder services within this new model.

To illustrate, Computershare, a notable direct registrar, allows asset owners to exercise their shareholder rights through their platform without incurring any additional fees.

This leads to a crucial question: Considering that established and respected institutions like Computershare can provide cost-effective services for Direct Registration System (DRS'd) assets, what incentive do shareholders have to surrender their legal ownership of their stock in favour of transferring them to the proposed model, which introduces the imposition of additional costs?

In a financial landscape where costs are incessantly on the rise, imposing potential financial burdens on individual shareholders appears both inequitable and unjust. It is imperative to gain a comprehensive understanding of the rationality in this decision and why it isn't more thoroughly acknowledged within the proposal as a cautionary note to those who may be impacted.

Furthermore, when we consider that Option One, of the four proposed digitised models, is presented as a “lower cost option” (pg.14) compared to the other alternatives, it raises questions why a financially more burdensome alternative (Option Three) is favoured over a cost-effective solution, especially when other models were rejected for costing too much (Option Two).

This decision gives rise to concerns that the HM Treasury may be seeking to exploit shareholders for personal financial gain, and it prompts the need for further investigation into whether the HM Treasury's advocacy for the transfer of CSD-mandated shares is orchestrated as a means to generate revenue and income for the government. In such a scenario, it becomes necessary to evaluate whether this proposal is one that aligns with the needs and best interests of the shareholders, or if it is, in fact, being promoted as a new business venture, mandating customers in the transfer of their assets whilst charging shareholders to exercise their basic rights through the utilisation of their services.

Given the restrictive budgetary constraints hindering the selective choice of workable digitised solutions as outlined in this proposal, it's challenging to dispute the likelihood of the latter scenario.

_____________________

The Advantages of the Direct Registrar Over the CSD Model:

Let's take Computershare as our base example of a reputable, respected and leading direct registrar.

The current Computershare model offers shareholders a spectrum of ownership options, exemplifying the principle of choice in modern finance. Under this model, shareholders have the freedom to select their preferred method of holding shares, be it through traditional physical paper share certificates or modern digital accounts.

This flexibility empowers shareholders, allowing them to tailor their investment management to their individual preferences and needs. Whether one opts for a tangible certificate or a digital account registered in their own name, they retain direct control over their shares. This translates into tangible benefits, such as the ability to exercise rights like voting more directly and without unnecessary intermediaries.

Furthermore, the Computershare model is forward-thinking, already incorporating a range of digital solutions that facilitate shareholder-company interactions. Shareholders can engage in essential activities like voting online or receiving electronic communications, making the system more efficient and environmentally friendly. Notably, these services are provided without incurring additional charges, preserving shareholder interests.

However, the proposed CSD model represents a departure from these advantages. By consolidating all shares into a central digital repository, it concentrates control over a significant portion of the share ownership system. This centralisation potentially exposes the system to undue influence and manipulation by powerful entities, including the government or large financial institutions.

Shareholders, despite maintaining "beneficial" ownership of their shares, face a diminishing degree of control. This relinquishment of control could curtail their ability to exercise crucial shareholder rights, such as voting or selling shares, as the entity managing the CSD assumes a more prominent role.

Perhaps the most critical concern pertains to privacy. With all shareholder data coalescing into a single repository, questions naturally arise regarding how this information is accessed and safeguarded. Without stringent measures in place, the risk of personal information misuse or data breaches becomes a pressing issue. The potential consequences are dire, with shareholders' sensitive data susceptible to unauthorised access, potentially leading to privacy breaches, identity theft, or financial losses.

This leads to the fundamental question: why would shareholders willingly embrace the CSD model when it clearly offers significantly fewer benefits than the existing direct registrar system?

The advantages of choice, direct control, existing digital solutions, and cost-effectiveness embodied by the current model stand in stark contrast to the potential drawbacks of centralised control, reduced shareholder agency, and privacy concerns inherent in the CSD proposal.

_______________________

Data Privacy and Security Concerns Within the Nominee:

Digitisation implies that sensitive shareholder data will be stored electronically. The crucial concern here is how the government plans to ensure the security and privacy of this data, protecting it from potential cyberattacks or unauthorised access that could jeopardise shareholders' personal information.

One significant risk is the government's control over shareholder data. If data privacy isn't heavily prioritised, there's a real danger of government officials or employees accessing shareholders' personal and financial information without consent. For affluent shareholders, this could mean unauthorised individuals gaining insights into their investment portfolios, financial transactions, and personal details, including home addresses and contact information.

Consider a scenario where a government insider with access to shareholder data decides to leak sensitive information about affluent shareholders to the public or unauthorised parties. This exposure could lead to harassment or unsolicited solicitations, potentially compromising their financial standing or worse yet, safety.

Another critical issue is the vulnerability to identity theft if adequate data security measures are not put in place. Cybercriminals who gain access to shareholder databases can steal personal information, such as bank account details, and investment records and for affluent shareholders, this could result in their identities being used for financial fraud, opening fraudulent accounts, or making unauthorised transactions.

The examples of previous cybersecurity incidents in the UK, such as the Parliament Email Hacking in 2017, the NHS WannaCry Ransomware Attack in 2017, and the Foreign Office Cyberattack in 2021, serve as stark reminders of the government's historical vulnerabilities in safeguarding sensitive information. These incidents raise questions about the government's ability to effectively manage data security, especially when considering the proposed shift to a Central Securities Depository (CSD) model.

In contrast, examining a direct registrar like Computershare reveals distinct advantages in terms of data security. Computershare specialises in shareholder services, prioritising secure record-keeping and data management. Their dedicated protocols and infrastructure are designed to fortify data security, employing encryption techniques and access controls to thwart unauthorised access. Furthermore, professional shareholder service providers often maintain cybersecurity teams, ensuring proactive monitoring and defence against cyber threats. These comprehensive measures not only protect sensitive shareholder information but also ensure compliance with data protection regulations and industry standards.

Thus, the argument here underscores the inherent risks associated with the CSD model proposed by HM Treasury and highlights the superior data privacy and security capabilities offered by direct registrars. And raises the fundamental question:

Why would shareholders opt for the CSD model when the services it provides are significantly inferior?

_______________________

Governmental Influence on Shareholdings:

Within the proposed centralised CSD model, how is objectivity guaranteed in the management of shareholder assets? Considerations as listed below:

- Control Over Nominee Structure: If the government gains significant control over the nominee structure holding shares, they could potentially manipulate the entities managing these nominees. They might install nominees who are loyal to government interests rather than protecting shareholder rights. The impact of such a scenario could be significant, with shareholders losing their say in crucial corporate decisions such as board elections or company strategy - as the government-appointed nominees might prioritise the government's interests over the shareholder’s financial well-being.

2. Blocking Access to Information: In a corrupt scenario, the government could restrict or censor access to information about shares, leading to ill-informed investment decisions. As such, shareholders could miss out on critical data related to a stock’s financial health or market trends, which are essential for protecting their investments.

3. Timing Disparities in Trading: If intermediaries control the nominee structure, it might result in information asymmetry, where certain shareholders have more timely access to critical information. This situation could grant financial institutions an unfair advantage in crafting investment strategies. For example, if the nominee structure controlled by financial institutions provides advanced notice of corporate announcements to institutional investors but delays this information for retail investors, institutions could profit while disadvantaging retail investors. Delays in information reaching retail investors could lead to slower reactions to market events, potentially causing them to miss out on vital trading opportunities or face increased risks.

4. Interference with Voting Rights: Government interference could extend to voting rights. For example, the government might pressure or incentivise the nominees to vote in favour of decisions that align with the government's interests but might not be in the best interest of shareholders. Decisions such as mergers, acquisitions, or leadership changes, could be influenced by the government, potentially harming shareholder investments.

5. Asset Seizure: In an extreme case, a corrupt government might attempt to seize assets held within the nominee structure, including shareholders' shares, without due process or valid reasons

These concerns underscore the critical need for robust safeguards, clear regulations, and ongoing oversight to ensure that the digitisation of shareholdings and the use of nominee structures do not compromise the rights and interests of retail shareholders.

How does the HM Treasury intend to address these risks? And empower shareholders in these ongoing discussions surrounding accountability to prevent issues of conflict, transparency obstruction, or rampant abuse within these centralized models?

_______________________

Acknowledgement: The Other Proposed Models:

[1] Digital Upgrade of Current System:

Model One presents a cost-effective solution for digitising the current system while preserving shareholders' choice to maintain their shares within the direct registrar. This aligns with the interests of shareholders whilst fulfilling government objectives, serving their needs respectively. The report’s dismissal of this model, however, raises concerns. It states:

"However, it retains one aspect of the current system that many of those consulted wished to see removed – a second register of shareholdings, with consequential friction as shares move between the two registers."

It's challenging to believe that informed shareholders would wish to remove the "second" ledger (which in this context, is the direct registrar, aka company ledger) in light of the fact that a nominee arrangement results in a separation between the registered shareholder (the nominee) and the beneficial owner (the individual shareholder) - and their subsequent rights.

As it remains unclear who was consulted for the purposes of this report and how this data was acquired - could you please provide details about who was approached for their input on this matter? With supporting evidence that they were informed of the implications and risks when questioned.

The rejection of this model is also attributed to the "friction" that occurs during share transfers between the two registers. This is surprising because the main aim of this proposal is the digitisation of the share handling process, which should enable seamless automation of transfers, similar to BACS payments, thereby eliminating any friction.

One might also consider the option of eliminating the nominee structure entirely and advocating for DRS as an industry standard to remove any issue of “friction”. This approach would not only reduce the government's expenditure on establishing and upholding a new digitised system, but would liberate shareholders everywhere with more rights as connected with the direct registrar.

That is - unless there are specific reasons for the government's reluctance to relinquish control over shares already held within the nominee, and any benefits that may afford them. If applicable, it is expected that the HM Treasury disclose said benefits to ensure there is transparency and objectivity in the government's recommendations.

Incidentally, misleading terminology is used within the proposal, specifically when referring to the issuer's register (aka the company's ledger) as the secondary registrar. Can you please provide an explanation as to why the nominee, also known as the sub-register, is not referred to as such? The direct register is the primary register.

[2] Direct Membership for Certificated Shareholders:

The dismissal of the second model proposal to enhance the ability of certificated shareholders to become direct members of CREST arouses curiosities. This alternative would have allowed individual shareholders to retain their positions directly on the issuer's share register, similar to their status as certificated shareholders. However, the requirement for shareholders to seek sponsors to manage their CREST accounts has been cited as a deterrent due to high associated costs. Additionally, the dwindling number of direct CREST members and the lack of interest in pursuing this route have been noted.

This rejection raises queries about the rationale behind dismissing an option that could have provided shareholders with a valuable choice as the ability to maintain direct registration offers a balanced solution that respects shareholders' preferences. The claim of a lack of meaningful support raises an eyebrow, as it contradicts the idea that choice and flexibility should be valued in such matters.

Attributing financial constraints within the government's budget as reason for the dismissal of this model encourages speculation. While budget limitations are understandable, it's essential to weigh the potential benefits, increased shareholder agency, and the long-term health of the financial system against short-term financial constraints. Prioritising cost savings over shareholder empowerment and system resilience could have unintended consequences. Therefore, it is crucial for stakeholders to revisit this decision with a focus on achieving a more balanced outcome.

The report also raises questions as to why the UK Treasury lacks the financial resources to invest in its own systems, particularly in light of the proposal's objectives. Could you elaborate as to why this is?

One might suggest a more straightforward solution: eliminating the need for an intermediary nominee altogether, and empowering shareholders by registering their assets on the primary ledger (aka, the company ledger). This would remove the cost barrier, reduce workload for UK financial institutions and allow shareholders to take control of registering and managing their assets. Furthermore, the report recognises the advantageous nature of DRS, and its subsequent value, as stated here:

“The advantage of [Option Two] would be that the individual shareholder would remain directly on the issuer’s share register in their own name, as they were as certificated shareholders.” (pg. 14)

So why wasn’t DRS propositioned as the seemingly preferable digitisation solution alongside the other four suggested models?

[4] Distributed Ledger Technology (DLT):

To ensure commendation is issued where due, the inclusion of Option 4 in the Digitisation Taskforce's report, which explores the adoption of Distributed Ledger Technology (DLT) in the securities framework, demonstrates a forward-thinking approach and a commitment to innovation and transparency within the securities market.

This option presents several potential benefits, including enhanced transparency, streamlined processes, improved security, and increased accessibility. These advantages align with the interests of many shareholders who seek a more efficient and secure system.

Embracing technologies like DLT can indeed lead to a more equitable and robust securities ecosystem, primarily because it operates without a central authority or control. This inherently reduces the risk of third-party interference with individuals' assets, which is a considerable advantage.

However, it's perplexing that such a promising option, with its benefits of enhanced transparency, streamlined processes, improved security, and increased accessibility, was swiftly dismissed. The Taskforce stated that its primary goal was to propose practical steps for the immediate improvement of the existing system. While expediency is essential, it's crucial to question why decisions that can have a profound and lasting impact on the securities market are being rushed.

It is recognised that the Taskforce cites challenges faced by similar DLT projects in other countries, such as Australia, related to scale, complexity, and transition, which led to project cancellations. But the leading reason for the dismissal of this model appears to be attributed to cost and time - stating the belief that transitioning to DLT would be a:

"… lengthy process extending beyond the envisioned timeline for implementing recommendations of this report" (pg.16).

The self-imposed time constraints and urgency raises concerns about the nature of the decision-making process. Shouldn't it be more prudent to take the necessary time to assess and choose the correct model, especially when it concerns the long-term implementation and security of shareholders' assets? Paper certification has been a reliable method for an extended period, and transitioning to a new system should be carefully considered, rather than hurried. Is there a reason why this is being rushed through?

Despite these challenges, it's important to acknowledge that the benefits of transparency, efficiency, and accessibility associated with DLT make it a promising option for the future of securities trading.

Interestingly, shareholders could still have the option to hold their securities in a direct registrar while using Distributed Ledger Technology (DLT) for other aspects of share trading and management. DLT can be seamlessly integrated into various parts of the securities market infrastructure without necessarily requiring shares to be held by a nominee or in a centralized system. This flexibility allows for the adoption of DLT's benefits while maintaining direct ownership of shares in a registrar, like Computershare.

_______________________

Uncovering the Hidden Threat: Short Selling in Nominee Share Systems:

The report’s objectives indicate a focus on improving transparency and communication in the intermediation chain, suggesting that the centralised system as proposed will make it easier to track and monitor share ownership, reducing the risk of hidden interests or unrecorded transactions.

What this proposal fails to do, however, is to provide any detailed, concrete strategies or plans on how this will be achieved in practice. It outlines broad principles and objectives, such as improving transparency and communication, streamlining the system, and offering shareholder choice, but specific implementation details and mechanisms are not laid out in the interim report which makes it difficult to trust these unsubstantiated claims.

One challenge to the assertion of enhanced transparency within the recommended nominee structure is the risk of concealing short selling activities. In an intermediary account, when an investor borrows shares as held in the nominee and sells them, hoping to buy them back at a lower price later, the total number of shares within said nominee can be obscured - making it difficult to distinguish between borrowed shares and those held by other investors. In contrast, when shares are held on a direct register, the transparency of ownership makes it much easier to track and identify all shareholders, reducing the likelihood of such concealment.

Moreover, the influence of short sellers within the nominee structure poses a notable risk. Short sellers, known for their financial clout, could wield undue influence within this structure. For instance, if individuals affiliated with short sellers occupy key decision-making roles within the nominee structure, they may exploit their positions to the detriment of retail investors during critical moments, such as a short squeeze, by impeding share transfers or favouring resolutions that benefit short sellers.

The potential implications of these concerns underscore the critical need for robust regulatory oversight and transparency safeguards to protect retail shareholders from any form of manipulation or disadvantage, particularly during high-stakes events. It is also imperative that mechanisms for dispute resolution and ensuring equitable treatment of all shareholders are established to preserve trust in the integrity of our financial system.

Holding shares directly with a registrar like Computershare, however, offers enhanced transparency and mitigates the risks associated with tracking shares and detecting naked short selling. This approach ensures clear ownership records, transparent transactions, and physical or electronic ownership certificates for shareholders. Additionally, it reduces the risk of counterfeit shares through stringent verification processes and regulatory oversight. The timeliness of ownership record updates further ensures accuracy in reflecting the total number of outstanding shares.

In contrast, a nominee structure, as proposed in the digitisation plan, introduces complexities in tracking ownership, monitoring for manipulative practices, and preserving the transparency that direct ownership provides.

And so poses the question: Why would shareholders willingly expose themselves to such risks, and what concrete measures does the HM Treasury plan to implement to effectively combat the problem of abusive short selling within this framework?

_______________________

As we progress along this path of innovation and reform, let us do so with a steadfast commitment to safeguarding shareholder rights, particularly as they are held within the direct registrar.

I eagerly anticipate your thorough consideration of these points in your forthcoming discussions.

Please ensure that shareholders are informed of how to stay updated on these important matters, and how we can continue to contribute our insights in these ongoing discussions.

Sincerely.

[INVESTOR]

⭐️ Helping you to write your letters:

ChatGPT - https://chat.openai.com/chat is a AI language model that is designed to help make things easier for you.

Simply copy and paste the templates as offered in this post, pop it into the AI and use a prompt to help you curate your own world-changing submissions.

And here's a prompt to help you get started:

"Write a formal letter using this extracted copy & pasted text to express concerns about the proposed advocation for the mandatory removal of DRS'd shares into a Central Securities Depository (CSD), as managed by the state and its potential negative impact on [Stakeholders/Industry/Community]. Provide detailed reasons and supporting evidence for your opposition, maintaining a respectful and professional tone throughout."

REMINDER:

ChatGPT is a writing tool that could be used to help create a basis for your comment/email. This remains an unreliable source for verified information and facts and will always require people to asses/compare/research and cross-reference the generated responses.

⚠️You are the fact checker, not the AI platform. ⚠️

⭐️ Don't want to use your personal email address? ⭐️

Why don't you create yourself a new secure email address that protects your privacy with encryption?

Keep your conversations private: https://proton.me/mail- It’s free, safe and easy to use.

Introducing Questions for HM Treasury

Are you curious about the recent proposals for the modernisation and digitisation of the securities framework for the UK? Do you want to ensure that shareholder rights and interests are at the forefront of these changes?

We've compiled a list of essential questions for HM Treasury, to shed light on critical aspects of the proposed reforms.

These questions touch upon various models presented in the report, from digitisation to Distributed Ledger Technology (DLT), and seek to address concerns related to shareholder rights, transparency, and the potential impacts on the financial landscape.

If you're interested in gaining a deeper understanding of the motivations and implications behind these proposed changes, these questions can serve as a valuable starting point for your inquiries.

You can read more about the UK’s proposal here: https://www.gov.uk/government/publications/digitisation-taskforce

Ownership Structure and Separation:

· How does the proposed transition to a government-mandated Central Securities Depository (CSD) affect the legal and beneficial ownership of shares? Can you provide clarity on how shareholders' rights will be maintained in the context of this separation?

Legal Standing and Rights:

· In the nominee structure, where the nominee is recognised as the legal owner, what legal standing will beneficial owners (individual shareholders) have, especially in corporate actions or legal proceedings?

· Given that shareholders already possess fundamental rights within the direct registrar, what is the compelling reason for them to support the move to a government-mandated CSD structure?

Ambiguity and Binding Commitments:

· How does the HM Treasury plan to address the ambiguity in the language used in the proposal, particularly phrases like "should" and "investors should be able to effectively and efficiently exercise their rights"?

· Can you provide specific mechanisms and commitments that will guarantee unimpeded access to shareholder rights and ensure that these mechanisms are an integral part of the proposed model?

Historical Precedents and Regulatory Clarity:

· The text references historical financial scandals like Enron, the Subprime Mortgage Crisis, and the WorldCom accounting scandal. How does the proposed framework intend to learn from these examples and ensure that clarity, transparency, and precise regulations are in place to protect shareholders from similar risks?

Control Over Nominee Structure:

· If shares are transitioned into a nominee structure, what safeguards will be in place to prevent the controlling entity from unilaterally changing terms and conditions, including limiting voting rights, imposing dividend restrictions, or diluting ownership?

Backtracking on Promises:

· How does the recommended CSD model address the concern of potential backtracking on promises by the controlling entity regarding the management of shares within the nominee structure?

· Can you provide assurances that changes to the terms and conditions of nominee arrangements will be transparent, fair, and in the best interests of shareholders?

Opt-In Approach to Shareholder Services:

· Why does the proposal advocate for an "opt-in" approach for essential shareholder services, such as voting and communication with issuers, rather than providing them automatically, as in the direct registrar?

· How does the HM Treasury justify placing an additional burden on shareholders to actively opt into services that are fundamental to their ownership rights?

Priority of Ownership Structure vs. Shareholder Rights:

· The proposal mandates transferring legal ownership of all shareholders' security assets to a nominee but does not require intermediaries to offer access to Ultimate Beneficial Owners (UBOs) for the expression of their rights. How does the HM Treasury justify this discrepancy in priorities?

· What steps will be taken to ensure that UBOs have full access to their rights and that shareholder rights are not relegated to a secondary status in the proposed model?

Risk of Asset Confiscation and Public Interest:

· The proposal mentions compliance with Article 1 of Protocol 1 to the European Convention on Human Rights, which allows for asset seizure in the "public interest." Who will have the authority to define what constitutes the "public interest," and how will this be safeguarded against potential conflicts of interest?

· Can you outline the specific measures and safeguards that will be implemented to prevent any abuse of power and ensure fairness and transparency in the event of asset confiscation?

Cost Factors and Motive:

· Given that established entities like Computershare offer cost-effective services for Direct Registration System (DRS'd) assets without additional fees, what rationale is behind introducing potential financial burdens on shareholders in the proposed model?

· Why is a financially more burdensome alternative (Option Three) favoured over a cost-effective solution (Option One), especially when cost considerations influenced other aspects of the proposal?

· Can the HM Treasury provide a transparent breakdown of the associated charges for shareholder services within the new model and explain how these charges align with the best interests of shareholders?

Government Revenue vs. Shareholder Interests:

· Is there any evidence to suggest that the HM Treasury's advocacy for the transfer of CSD-mandated shares is motivated by a desire to generate revenue for the government?

· How does the proposal ensure that shareholder interests are not compromised or exploited for government financial gain?

· Can you clarify the budgetary constraints that influenced the choice of digitized solutions and whether they align with the needs and best interests of shareholders?

Data Privacy and Security Concerns Within the CSD Model:

· How will the government ensure the security and privacy of sensitive shareholder data within the CSD model?

· What measures are in place to prevent government officials or employees from accessing shareholders' personal and financial information without consent?

· How can the government safeguard against scenarios where sensitive information about affluent shareholders is leaked or misused?

· What protections are in place to prevent identity theft in case of data breaches?

· How will data breaches be prevented from leading to direct financial losses for shareholders?

· Given historical cybersecurity incidents involving the government, how can shareholders trust the government's ability to manage data security within a CSD model?

· Why would shareholders opt for the CSD model when it offers inferior data privacy and security compared to direct registrars like Computershare?

Digital Upgrade of Current System (Model One):

· Who were the stakeholders consulted for input on the dismissal of Model One, and can you provide evidence of their informed opinions regarding the implications and risks?

· Can you explain why the proposal refers to the issuer's register as the "secondary registrar" and why the nominee (sub-register) is not explicitly labelled as such?

· How does the proposal address the "friction" during share transfers between registers, especially given the primary aim of digitisation is to streamline processes and eliminate friction?

Direct Membership for Certificated Shareholders (Model Two):

· What led to the rejection of Model Two, which would have allowed certificated shareholders to become direct members of CREST?

· How were the costs associated with shareholder sponsorship considered in the decision to dismiss this model?

· Can you clarify why the UK Treasury lacks the financial resources to invest in its own systems, especially given the proposal's objectives to modernize and digitize the securities framework?

· Why wasn't Direct Registration System (DRS) proposed as a digitisation solution, given its advantages and alignment with shareholder interests?

Distributed Ledger Technology (DLT) (Model Four):

· Why was the promising option of DLT quickly dismissed, and why is there a rush to make decisions that could have a profound and lasting impact on the securities market?

· Can you elaborate on how the challenges faced by DLT projects in other countries might be addressed to ensure a smooth transition if DLT were adopted?

· Can you explain why the proposal did not explore the possibility of integrating DLT into the existing system, allowing shareholders to maintain direct ownership while benefiting from DLT's advantages in other aspects of share trading and management?

Assessing Transparency and Accountability in the Proposed CSD Nominee Structures:

· How will the proposal prevent government interference, manipulation, or undue influence over shareholder assets within nominee structures?

· What safeguards will be in place to ensure that intermediaries or nominees do not limit or control shareholders' access to their rights within the nominee structure?

· How does the proposal intend to reduce the risks associated with potential government interference in shareholder rights and manipulation?

· How can the proposal ensure transparency in tracking shares and detecting naked short selling within the nominee structure?

Uncovering the Hidden Threat: Short Selling in Nominee Share Systems:

· How does the proposal plan to address transparency concerns related to short selling activities within nominee structures?

· What measures will be in place to prevent undue influence of short sellers within the nominee structure?

· How can the proposal ensure equitable treatment of all shareholders during high-stakes events like a short squeeze?

· Given the potential implications on transparency and shareholder rights, why would shareholders agree to the proposed shift from direct registrars to a nominee structure?

Feel free to use them as a guide when engaging with HM Treasury or exploring these topics further. Your involvement can help shape the future of shareholder rights and the financial system.

Send your questions and emails to: [email protected]& CC' in Computershare: [email protected]

⚠️ Deadline: Monday, 25th September

Dave Lauer & We The Investors:

We The Investors have also created a letter template for shareholders and investors to send to the HM Treasury.

About We The Investors

We The Investors is a passionate and independent collective of individual investors, united and supported by industry leaders, on a mission to reshape the very foundations of our financial markets. Their vision is anchored in the principles of Transparency, Simplicity, Fairness, Choice, Control, Best Execution, and Enhanced Settlement & Clearing.

Summary Overview of WTI's Response

In their insightful response, WTI passionately endorses the transition away from paper-based systems in favour of a digitised approach, aligning with the Task Force's vision of leveraging technological advancements to enhance transparency and efficiency in financial markets.

WTI's support is particularly robust for Model Four, a revolutionary proposal that envisions a seismic shift in securities holding and settlement, harnessing the power of Distributed Ledger Technology (DLT).

However, their response also raises significant concerns about the proposal to transfer legal ownership of securities to a Central Securities Depository (CSD) managed by the UK government. WTI presents a compelling argument against centralising the nominee system for trading, settlement, and recordkeeping of UK shares.

Key Points of Contention Raised by WTI

· Maintaining Transparency: WTI contends that the existing system of directly registering shares on a company's stock ledger, known as the Direct Registration System (DRS), is transparent, efficient, and a global best practice. They argue against changing this system solely to dematerialize share certificates.

· Ownership Rights: WTI emphasises that once a directly registered shareholder becomes a "beneficial owner," there is no compelling reason to require them to forfeit their legal title to shares, especially when technology allows for direct registration within a digitised framework.

· Increased Costs: WTI raises concerns that a system of intermediation replacing the DRS would elevate trading, voting, and recordkeeping costs, ultimately affecting shareholders.

· Privacy and Cybersecurity Risks: They highlight privacy and cybersecurity risks associated with a government-operated nominee system, emphasizing the need for extensive safeguards in handling shareholder data.

· Challenges in Tracking and Settling Transactions: WTI warns of new challenges in tracking and settling share transactions, potentially permitting trading abuses and hindering the detection of certain activities.

Summary

We The Investors urges the Task Force to proceed with digitisation efforts while retaining the direct registration of shares on the stock ledgers of UK public companies. Existing technology can facilitate the digitization of shares while preserving transparency and efficiency without the need for a costly and cumbersome government-managed nominee system.

Read We The Investors' full response to the UK Digitisation Task Force for an in-depth exploration of their perspectives and recommendations here:

We The Investors' UK Digitization Task Force Recommendation Letter:

https://advocacy.urvin.finance/advocacy/we-the-investors-uk-digitization-task-force-recommendations

For more details please check out their reddit post here:

https://www.reddit.com/r/Superstonk/comments/16pbosy/we_the_investors_letter_to_uk_digitisation/

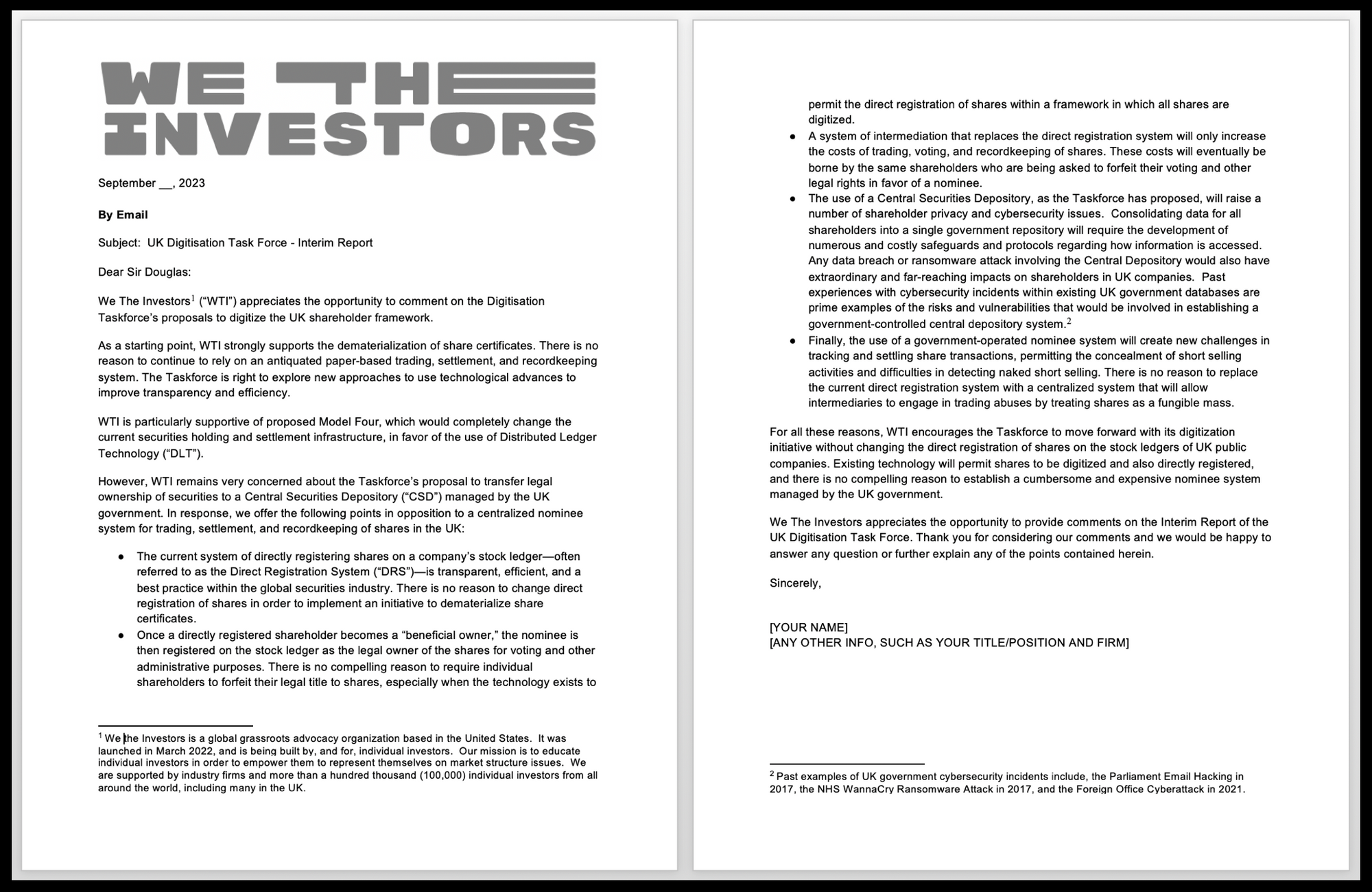

WTI Comment Letter Template:

September __, 2023

By Email

Subject: UK Digitisation Task Force - Interim Report

Dear Sir Douglas:

We The Investors[1] (“WTI”) appreciates the opportunity to comment on the Digitisation Taskforce’s proposals to digitize the UK shareholder framework.

As a starting point, WTI strongly supports the dematerialization of share certificates. There is no reason to continue to rely on an antiquated paper-based trading, settlement, and recordkeeping system. The Taskforce is right to explore new approaches to use technological advances to improve transparency and efficiency.

WTI is particularly supportive of proposed Model Four, which would completely change the current securities holding and settlement infrastructure, in favor of the use of Distributed Ledger Technology (“DLT”).

However, WTI remains very concerned about the Taskforce’s proposal to transfer legal ownership of securities to a Central Securities Depository (“CSD”) managed by the UK government. In response, we offer the following points in opposition to a centralized nominee system for trading, settlement, and recordkeeping of shares in the UK:

● The current system of directly registering shares on a company’s stock ledger—often referred to as the Direct Registration System (“DRS”)—is transparent, efficient, and a best practice within the global securities industry. There is no reason to change direct registration of shares in order to implement an initiative to dematerialize share certificates.

● Once a directly registered shareholder becomes a “beneficial owner,” the nominee is then registered on the stock ledger as the legal owner of the shares for voting and other administrative purposes. There is no compelling reason to require individual shareholders to forfeit their legal title to shares, especially when the technology exists to permit the direct registration of shares within a framework in which all shares are digitized.

● A system of intermediation that replaces the direct registration system will only increase the costs of trading, voting, and recordkeeping of shares. These costs will eventually be borne by the same shareholders who are being asked to forfeit their voting and other legal rights in favor of a nominee.

● The use of a Central Securities Depository, as the Taskforce has proposed, will raise a number of shareholder privacy and cybersecurity issues. Consolidating data for all shareholders into a single government repository will require the development of numerous and costly safeguards and protocols regarding how information is accessed. Any data breach or ransomware attack involving the Central Depository would also have extraordinary and far-reaching impacts on shareholders in UK companies. Past experiences with cybersecurity incidents within existing UK government databases are prime examples of the risks and vulnerabilities that would be involved in establishing a government-controlled central depository system.[2]

● Finally, the use of a government-operated nominee system will create new challenges in tracking and settling share transactions, permitting the concealment of short selling activities and difficulties in detecting naked short selling. There is no reason to replace the current direct registration system with a centralized system that will allow intermediaries to engage in trading abuses by treating shares as a fungible mass.

For all these reasons, WTI encourages the Taskforce to move forward with its digitization initiative without changing the direct registration of shares on the stock ledgers of UK public companies. Existing technology will permit shares to be digitized and also directly registered, and there is no compelling reason to establish a cumbersome and expensive nominee system managed by the UK government.

We The Investors appreciates the opportunity to provide comments on the Interim Report of the UK Digitisation Task Force. Thank you for considering our comments and we would be happy to answer any question or further explain any of the points contained herein.

Sincerely,

[YOUR NAME]

[ANY OTHER INFO, SUCH AS YOUR TITLE/POSITION AND FIRM]

[1] We The Investors is a global grassroots advocacy organization based in the United States. It was launched in March 2022, and is being built by, and for, individual investors. Our mission is to educate individual investors in order to empower them to represent themselves on market structure issues. We are supported by industry firms and more than a hundred thousand (100,000) individual investors from all around the world, including many in the UK.

[2] Past examples of UK government cybersecurity incidents include, the Parliament Email Hacking in 2017, the NHS WannaCry Ransomware Attack in 2017, and the Foreign Office Cyberattack in 2021.

TLDRS:

- Stand up for DRS

- Consider submitting your comment before Monday's (9/25) deadline!