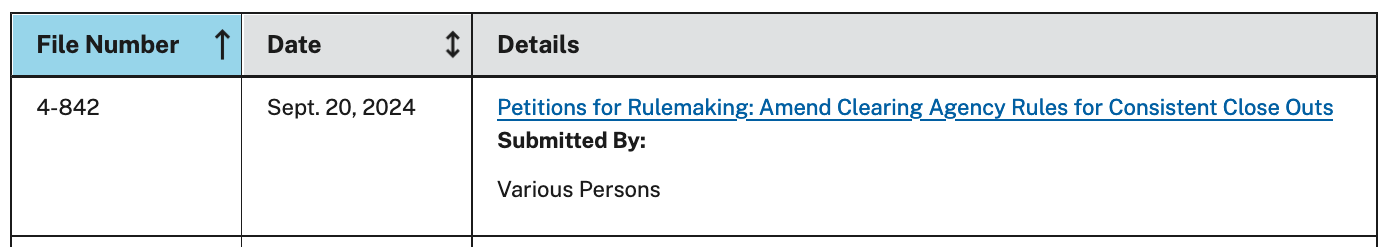

Short & Sweet - Easy Petition Templates for NSCC Rule Change. With Updates!

Set to expose Wall Street's regulatory loopholes, household investors are petitioning the SEC for much needed rule changes. It's time to level out the playing field.

For those of you out of the loop - we're getting rid of Wall Street's loophole of a rule, that allows them to throw out rules. Why? Because it's time for them to close their short positions.

And we're doing this by petitioning the SEC for a rule change.

This is the NSCC rule we're looking to fix:

And in heroic style, household investors around the world have already made quite the splash.

I mean check just out this for starters:

Pretty awesome, right?

This list was last updated on the 6th September, so there are quite a few submissions missing but you can keep tabs [here].

And with our last count at approx. 150 submissions:

Well, we gotta say it's an impressive start.

Seriously guys, bravo. When faced with a choice to create positive change or do nothing, you chose to act as heroes do. You chose to make a difference.

Not to mention, boy howdy - the comments have just been pouring in:

It's quite the sight to behold.

But...

This is Superstonk, home of the legends. And we're here to make history - so it's time to explore the ways we can make this process even easier for you so we can pump those numbers up.

Because truly, if we want change - getting involved with market reform (and submitting this email) is the way to get it done.

And it couldn't be any easier.

Now in the famous words of dear ol' Kevin here:

For all those who like to say more with less, here's a short template version just for you.

Inspired and including extracts by the masterful original as provided to us by WCIMT: [here] ← it really is the best version to send.

⭐️⭐️⭐️

KEY:

strikethrough text= removed rule- highlighted text = proposed changes

EMAIL: [email protected]

SUBJECT: Petition for Rulemaking: Amend Clearing Agency Rules for Consistent Close Outs

Dear Ms. Countryman,

I am writing as a retail investor to submit a petition for rulemaking under Rule 192 of the Securities and Exchange Commission’s (“SEC”) Rules of Practice, requesting amendments to the National Securities Clearing Corporation (“NSCC”) Rules & Procedures. Specifically, I propose revisions to Rules 4, 18, and 22 to address several critical issues related to settlement of guaranteed transactions, central counterparty (CCP) resilience, and overall financial market stability.

It has come to the attention of retail investors that NSCC Rules and Procedures do not codify strict procedures for closing out positions (e.g., in the event of a Member default). Per NSCC’s Disclosure Framework for Covered Clearing Agencies and Financial Market Infrastructures, “[a]s a cash market CCP, if a Member defaults, NSCC will need to complete settlement of guaranteed transactions on the failing Member’s behalf” [4 “Liquidity risk management framework”]. However, NSCC Rule 18 SEC. 6(a) contains a provision that “if, in the opinion of the Corporation, the close out of a position in a specific security would create a disorderly market in that security, then the completion of such close-out shall be in the discretion of the Corporation”.

The existing framework inadvertently incentivises Members to build up large positions that could become disorderly if closed out, thus becoming de facto “Too Big To Fail.” This misalignment of incentives can lead to systemic risks and a potential bailout scenario where losses are socialised.

As such, members may exploit the discretion afforded by the NSCC to perpetuate market distortions, such as through naked short positions. This can create artificial inflation of supply and disrupt market stability, with the CCPs bearing the risk and cost of unwinding such positions.

The costs associated with closing out disorderly positions should not solely fall on CCPs and the general public. Financial market participants responsible for creating these positions should bear the costs. The current rules fail to ensure that those responsible for creating risky positions are held accountable for the associated costs.

To address these issues, I propose the following changes to the NSCC Rules:

NSCC Rule 4 Proposed Change

SEC. 4. Loss Allocation Waterfall, Off-the-Market Transactions.

Each Member [, including its executives,] shall be obligated to the Corporation for the entire amount of any loss or liability incurred by the Corporation arising out of or relating to any Defaulting Member Event with respect to such Member. [To the extent that such loss or liability is not satisfied by the Member, all executives of the Member (past or present) shall be obligated to the Corporation for an amount equivalent to the preceding 5 years of compensation from the Member.] To the extent that such loss or liability is not satisfied pursuant to Section 3 of this Rule 4, the Corporation shall apply a Corporate Contribution thereto and charge the remaining amount of such loss or liability ratably to other Members, as further provided below.

NSCC Rule 18 Proposed Change

SEC. 6. (a) Promptly after the Corporation has given notice that it has ceased to act for the Member, and in a manner consistent with the provisions of Section 3, the Net Close Out Position with respect to each CNS Security shall be closed out (whether it be by buying in, selling out or otherwise liquidating the position) by the Corporation--; provided however, if, in the opinion of the Corporation, the close out of a position in a specific security would create a disorderly market in that security, then the completion of such close-out shall be in the discretion of the Corporation--.

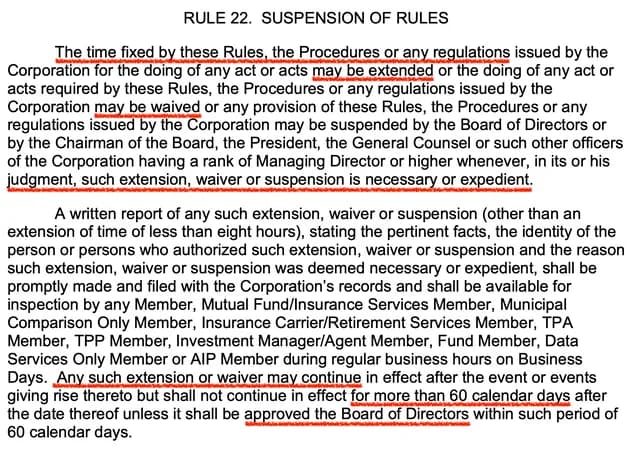

NSCC Rule 22 Proposed Change (Option A – Public Notice)

RULE 22. SUSPENSION OF RULES

The time fixed by these Rules, the Procedures or any regulations issued by the Corporation for the doing of any act or acts may be extended or the doing of any act or acts required by these Rules, the Procedures or any regulations issued by the Corporation may be waived or any provision of these Rules, the Procedures or any regulations issued by the Corporation may be suspended by the Board of Directors or by the Chairman of the Board, the President, the General Counsel or such other officers of the Corporation having a rank of Managing Director or higher whenever, in its or his judgment, such extension, waiver or suspension is necessary or expedient.

A written report of any such extension, waiver or suspension (other than an extension of time of less than eight hours), stating the pertinent facts, the identity of the person or persons who authorized such extension, waiver or suspension and the reason such extension, waiver or suspension was deemed necessary or expedient, shall be promptly made [and published on the Corporation’s website for access by the general public within 1 business day] and filed with the Corporation’s records and shall be available for inspection by any [person,] Member, Mutual Fund/Insurance Services Member, Municipal Comparison Only Member, Insurance Carrier/Retirement Services Member, TPA Member, TPP Member, Investment Manager/Agent Member, Fund Member, Data Services Only Member or AIP Member during regular business hours on Business Days. Any such extension or waiver may continue in effect after the event or events giving rise thereto but shall not continue in effect for more than 60 calendar days after the date thereof unless it shall be approved [by] the Board of Directors within such period of 60 calendar days [with a written report made and published as described by this paragraph].

NSCC Rule 22 Proposed Change (Option B – No Exceptions)

RULE 22. SUSPENSION OF RULES [NO EXCEPTIONS]

The time fixed by these Rules, the Procedures or any regulations issued by the Corporation for the doing of any act or acts may be extended or the doing of any act or acts required by these Rules, the Procedures or any regulations issued by the Corporation may be waived or any provision of these Rules, the Procedures or any regulations issued by the Corporation may be suspended by the Board of Directors or by the Chairman of the Board, the President, the General Counsel or such other officers of the Corporation having a rank of Managing Director or higher whenever, in its or his judgment, such extension, waiver or suspension is necessary or expedient. A written report of any such extension, waiver or suspension (other than an extension of time of less than eight hours), stating the pertinent facts, the identity of the person or persons who authorized such extension, waiver or suspension and the reason such extension, waiver or suspension was deemed necessary or expedient, shall be promptly made and filed with the Corporation’s records and shall be available for inspection by any Member, Mutual Fund/Insurance Services Member, Municipal Comparison Only Member, Insurance Carrier/Retirement Services Member, TPA Member, TPP Member, Investment Manager/Agent Member, Fund Member, Data Services Only Member or AIP Member during regular business hours on Business Days. Any such extension or waiver may continue in effect after the event or events giving rise thereto but shall not continue in effect for more than 60 calendar days after the date thereof unless it shall be approved the Board of Directors within such period of 60 calendar days.

[The time fixed by these Rules, the Procedures or any regulations issued by the Corporation for the doing of any act or acts may not be extended. The doing of any act or acts required by these Rules, the Procedures or any regulations issued by the Corporation may not be waived and any provision of these Rules, the Procedures or any regulations issued by the Corporation may not be suspended.

A written report of any deviation from these Rules, Procedures or any regulations issued by the Corporation (including extension, waiver or suspension), stating the pertinent facts, the identity of the person or persons who authorized such extension, waiver or suspension and the reason such extension, waiver or suspension was deemed necessary or expedient, shall be promptly made and published on the Corporation’s website for access by the general public within 1 business day and filed with the Corporation’s records and shall be available for inspection by any person, Member, Mutual Fund/Insurance Services Member, Municipal Comparison Only Member, Insurance Carrier/Retirement Services Member, TPA Member, TPP Member, Investment Manager/Agent Member, Fund Member, Data Services Only Member or AIP Member during regular business hours on Business Days.

Final Remarks

These proposed changes aim to create a fairer, more transparent, and resilient financial system. By implementing stricter rules and holding responsible parties accountable, we can better manage risks, prevent market distortions, and ensure that losses are absorbed by those who create the risks.

Thank you for considering this petition. I respectfully request prompt action on these proposed amendments to safeguard the interests of all market participants.

Sincerely,

A Concerned Retail Investor

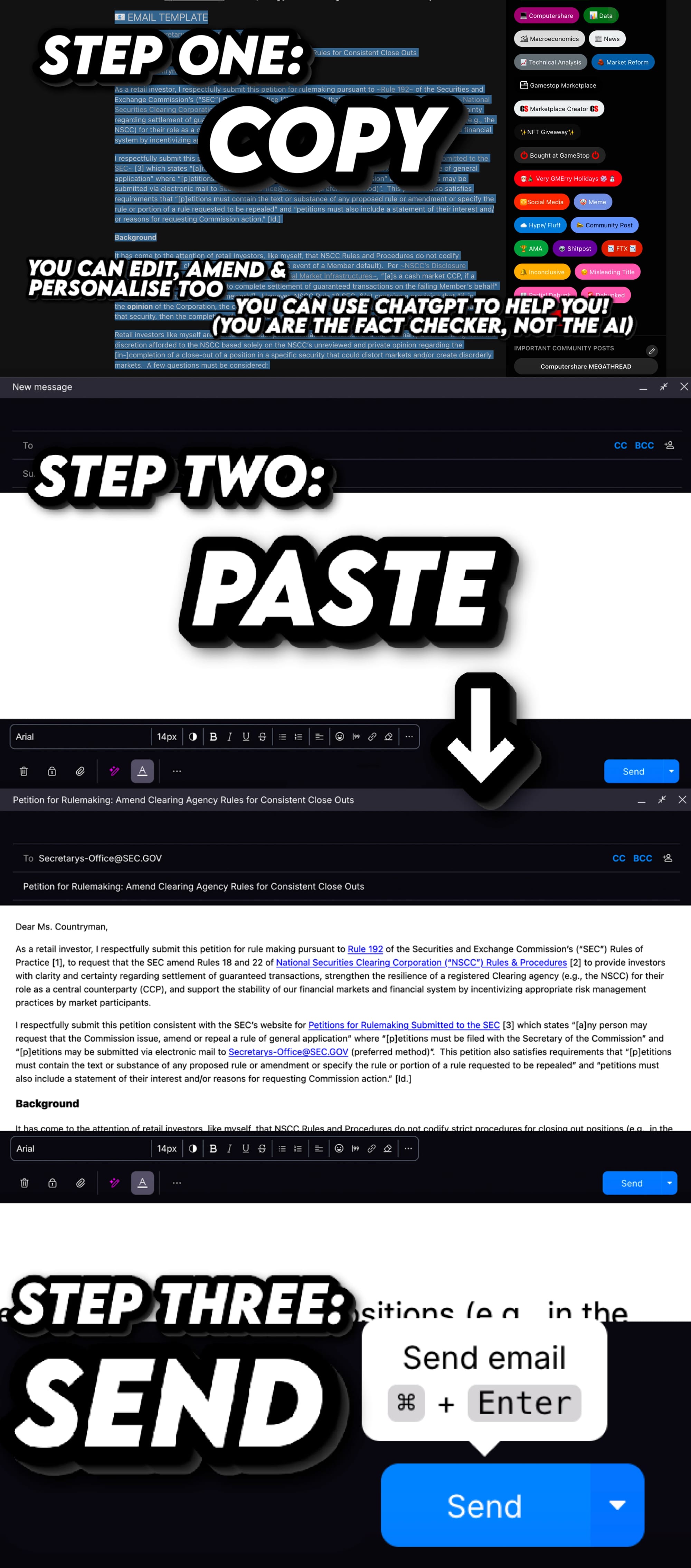

This post has already gone on long enough, so let's quickly recap the steps needed to get involved - and begin your legacy as heroes.

First up, here's where you're sending your petition:

EMAIL: [email protected]

SUBJECT: Petition for Rulemaking: Amend Clearing Agency Rules for Consistent Close Outs

↑↑↑↑↑

And here's how to send it:

And then that's it.

No really, that's it.

A few short minutes and you're done.

🌎💃 OPEN TO INTERNATIONAL AUDIENCES🕺 🌎

- ✅ - Do you hold GME (or indeed, any stock on the NYSE)?

- ✅ - Do you live on the planet earth?

- ✅ - Do you wanna be a living legend?

💻 💡DON'T WANT TO USE YOUR PERSONAL EMAIL?

Why not sign up for https://proton.me/mail instead - for a more secure and private way of engaging.

Proton Mail is an encrypted email service based in Switzerland that protects your privacy and data from trackers and scanners. You can create a free account, switch from any email provider, and enjoy features like password protection, aliases, and scheduling.

📚👀 WANNA READ MORE ABOUT THE NSCC RULE?

And check out WCIMT's latest post: [here]

If you're reading this, and you want to see real change - it starts with you. Take back control of your lives and see that you have the power to make it happen.

It really does take just a few moments to submit your petition, and the resources are all here to make things easy for you.

Don't miss out on this opportunity.

You are the catalyst, you always have been - and your legendary story continues here. Make this moment count.

You've got this 💪