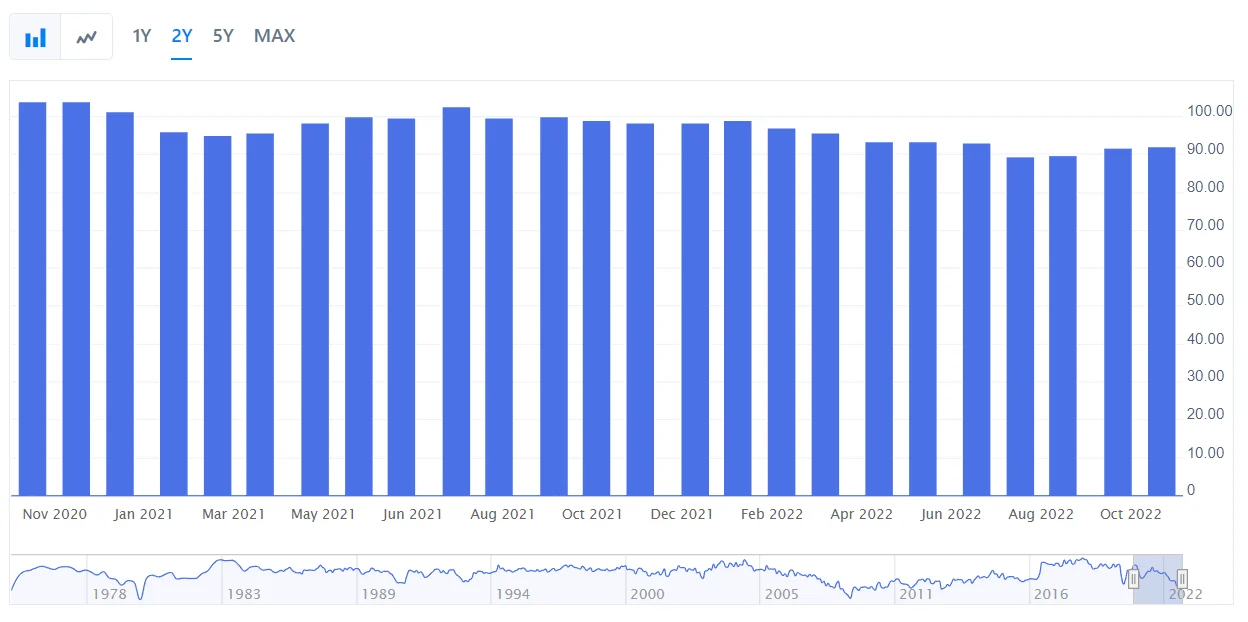

U.S. NFIB Small Business Optimism Alert! The Small Business Optimism Index rose 0.3 points in September to 92.1, making the ninth consecutive month below the 48-year average of 98.

U.S. NFIB Small Business Optimism Alert! The Small Business Optimism Index rose 0.3 points in September to 92.1, making the ninth consecutive month below the 48-year average of 98. Thirty percent of owners reported that inflation was their single most important problem in operating their business.

Overview

The National Federation of Independent Business (NFIB) Small Business Optimism Index is a composite of ten seasonally adjusted components. It comprises survey results from amongst the organization's members.

In providing an indication of the health of small businesses in the U.S., it is important to watch as roughly 50% of the nation's private workforce work for small businesses. A reading that is stronger than forecast is generally supportive (bullish) for the USD, while a weaker than forecast reading is generally negative (bearish) for the USD.

NFIB Chief Economist Bill Dunkelberg:

“Inflation and worker shortages continue to be the hardest challenges facing small business owners,”

“Even with these challenges, owners are still seeking opportunities to grow their business in the current period.”

Key findings include:

- Owners expecting better business conditions over the next six months decreased two points from September to a net negative 44%.

- Forty-six percent of owners reported job openings that were hard to fill, down three points from August and remaining historically high.

- The net percent of owners raising average selling prices decreased two points to a net 51% (seasonally adjusted).

- The net percent of owners who expect real sales to be higher increased nine points from August to a net negative 10%.

- The NFIB Uncertainty Index decreased two points to 72.

Other points of note:

The net percent of owners reporting inventory increases improved four points to a net negative 2%, Sixteen percent of owners reported increases in stocks and 17% reported reductions as solid sales reduced inventories at many firms.

Thirty-two percent of owners reported that supply chain disruptions have had a significant impact on their business. Thirty-four percent report a moderate impact and 22% report a mild impact. Only 10% of owners report no impact from recent supply chain disruptions.

A net 45% of owners reported raising compensation, down one point from August. A net 23% of owners plan to raise compensation in the next three months, down three points from August but historically still very high. Ten percent of owners cited labor costs as their top business problem and 22% said that labor quality was their top business problem.

More about this report:

The NFIB Research Center has collected Small Business Economic Trends data with quarterly surveys since the 4th quarter of 1973 and monthly surveys since 1986. Survey respondents are randomly drawn from NFIB’s membership. The report is released on the second Tuesday of each month. This survey was conducted in September 2022.