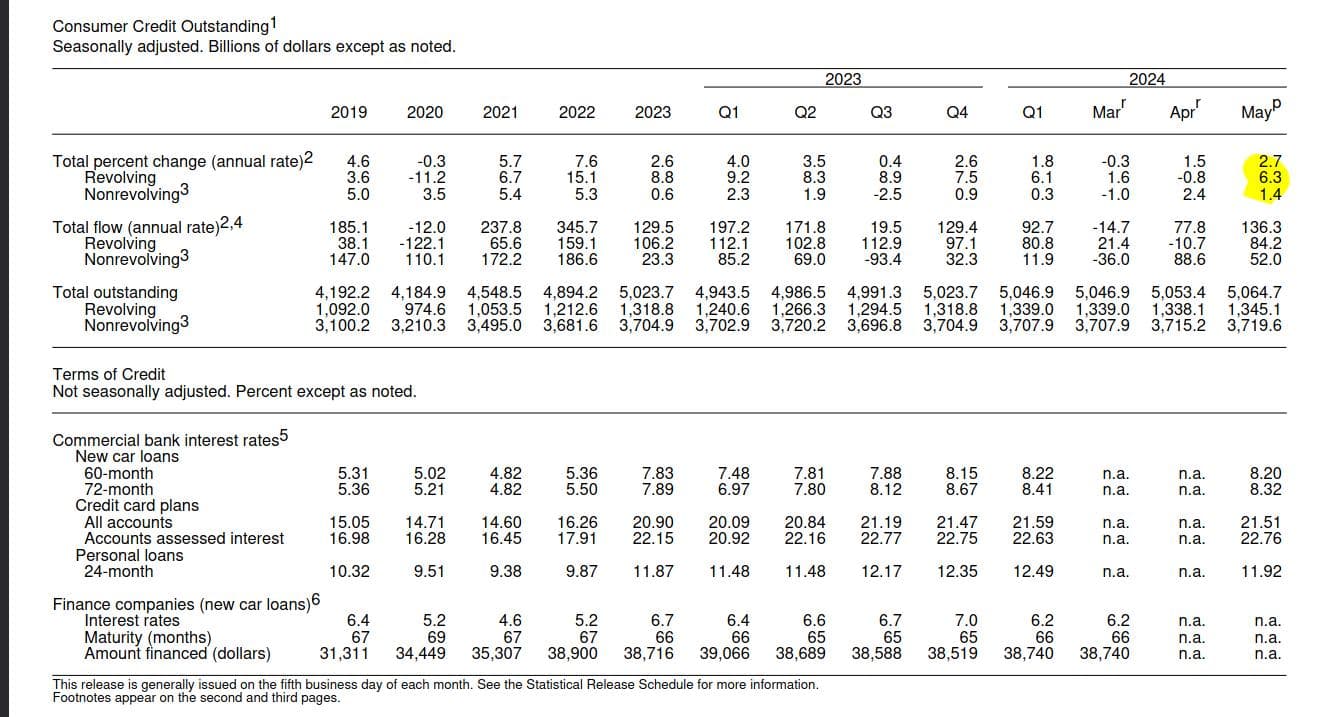

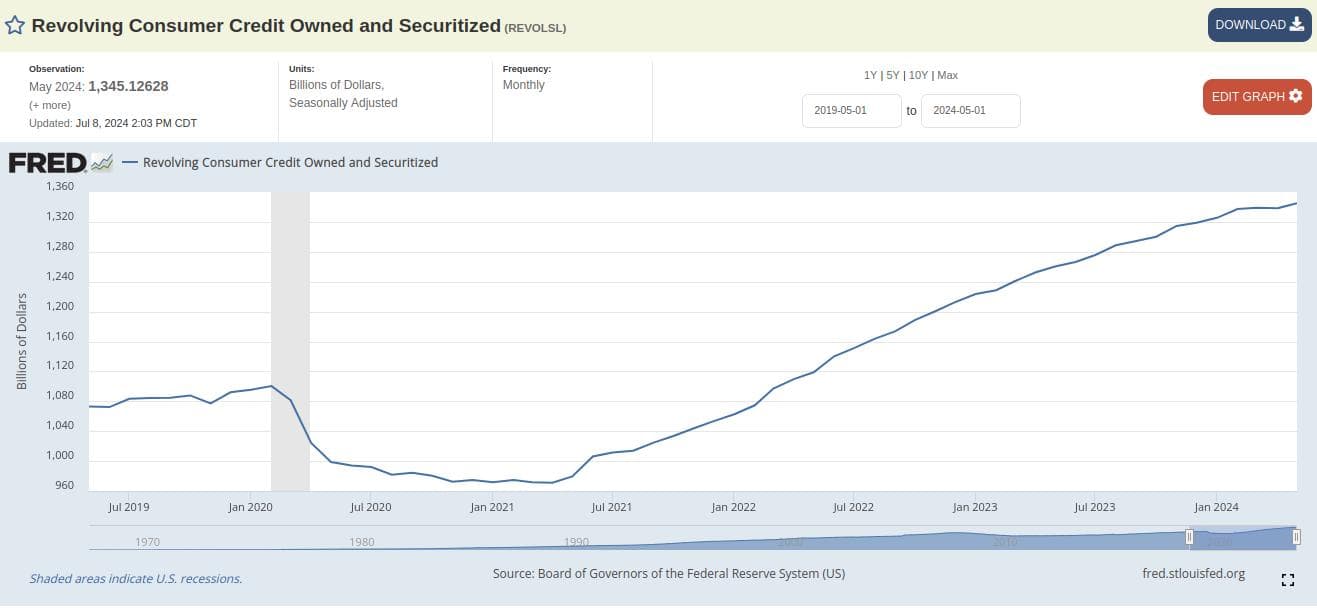

U.S. Revolving credit (credit cards) grew by $7.02 billion (+6.3%) in May to $1.345 trillion, up from $1.338 trillion recorded in April. Consumer Credit and Credit Card use continues to outpace the Fed's 2% inflation goal!

In May, consumer credit increased at a seasonally adjusted annual rate of 2.7 percent to $5.064 trillion.

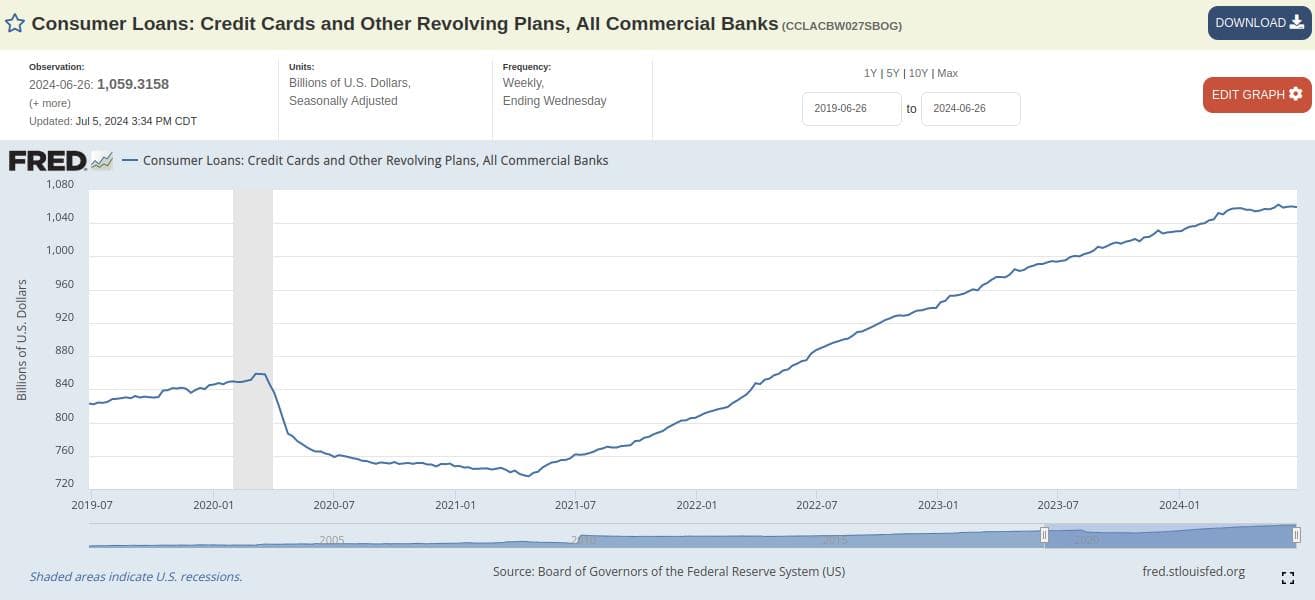

Revolving credit increased at an annual rate of 6.3 percent to $1.345 trillion, while nonrevolving credit increased at an annual rate of 1.4 percent to $3.718 trillion.

Consumer spending is a major factor in the U.S. economy and its GDP (total value of goods and services produced in a country over a specific period). When consumers spend more, businesses sell more goods and services, which can lead to increased production, more hiring, and overall economic growth.

Remember, revolving credit allows borrowers to access a fixed credit limit that replenishes as the borrowed amount is repaid, like with credit cards.

Non-revolving credit, on the other hand, provides a one-time loan amount that cannot be reused once repaid, such as with student or auto loans.

Revolving credit offers flexibility with no fixed repayment term, whereas non-revolving credit typically has a set repayment schedule and fixed monthly payments and while taking on debt allows consumers to spend beyond their immediate earnings (for instance, buying a house with a mortgage or purchasing goods with a credit card), there's a limit to how much debt is sustainable.

However, as we have previously covered, expectations for future credit availability deteriorated. In June, perceptions of credit access compared to a year ago deteriorated slightly with a smaller share of respondents reporting that it is easier to obtain credit than 12 months ago., with the share of respondents expecting it will be harder to obtain credit in the year ahead increasing.

Recall, almost a year ago now that the Fed's Beige Book August 2023 showed "Some Districts highlighted reports suggesting consumers may have exhausted their savings and are relying more on borrowing to support spending."

So growth could slow if folks continue pile up too much debt and are then forced to cut back on this spending but boy are they still piling it on!

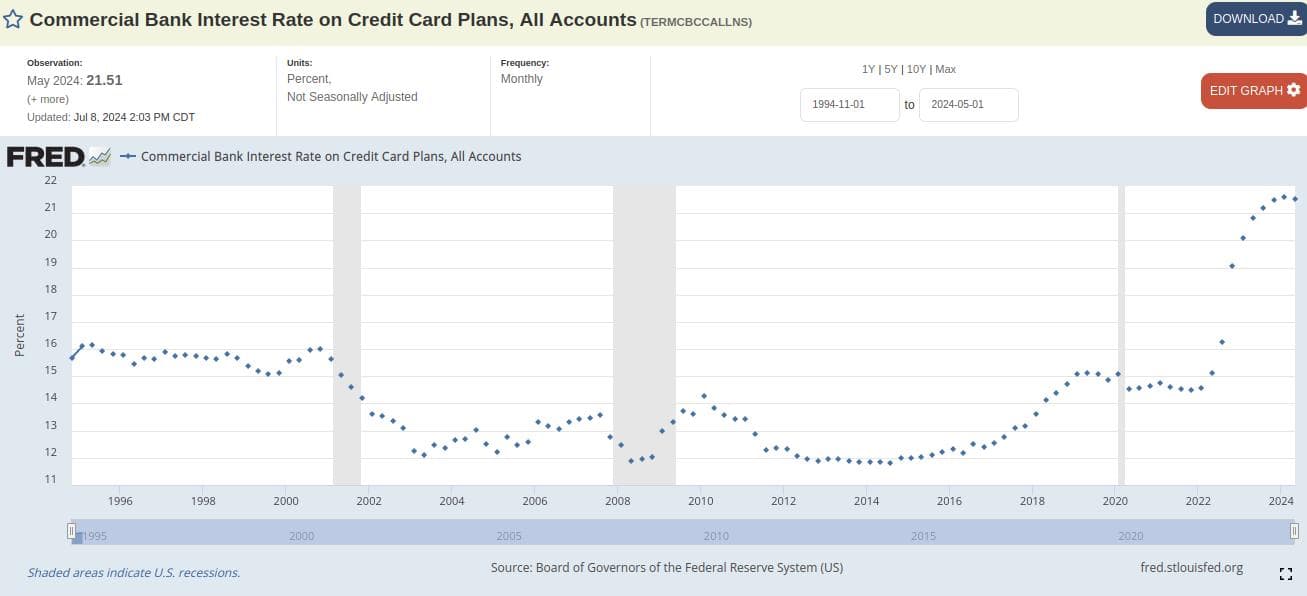

It just keeps climbing over $1 trillion all at killer interest:

Delinquencies are on the rise as well!

The New York Fed’s Center for Microeconomic Data released the 2024:Q1 Quarterly Report on Household Debt and Credit.

Nearly 9 percent of credit card balances and 8 percent of auto loans (annualized) transitioned into delinquency!

Some other nuggets: Total household debt rose by $184 billion to reach $17.69 trillion. Mortgage balances increased by $190 billion to $12.44 trillion, while balances on auto loans climbed $9 billion to $1.62 trillion, continuing their upward trajectory. Credit card balances declined, as is typical for the first quarter, falling by $14 billion to $1.12 trillion.

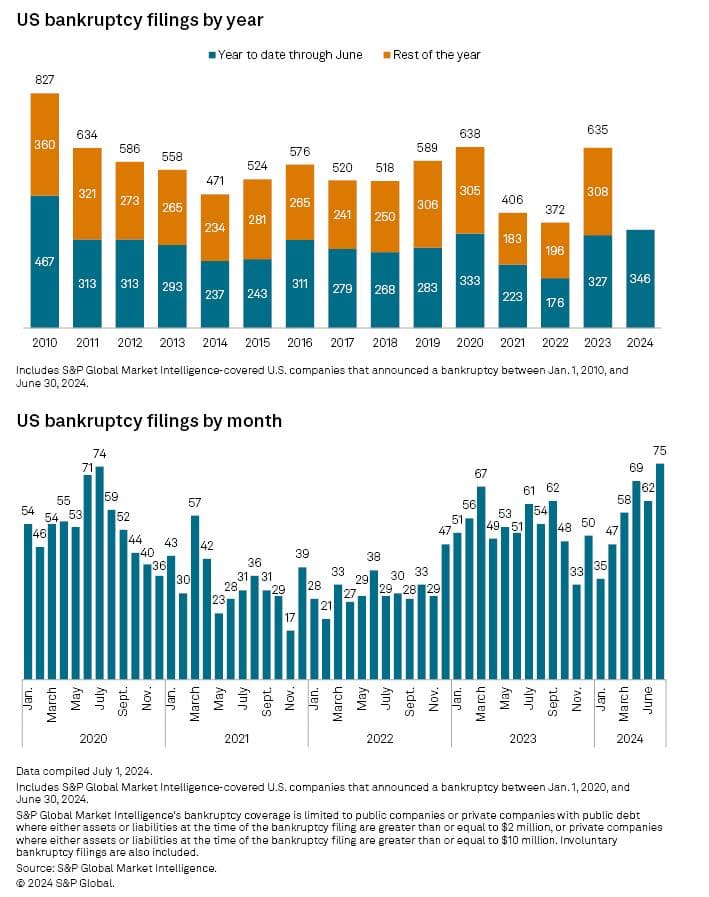

June saw an unprecedented spike in US corporate bankruptcy filings, the highest recorded in a single month since 2020, and outpacing half-year data from the past ten years.

June witnessed an unprecedented increase in US corporate bankruptcy filings, marking the highest number recorded in a single month since early 2020 and surpassing half-year totals not seen in over a decade.

According to S&P Global Market Intelligence, there were 75 new corporate bankruptcy filings in June. This uptick from the first months of 2024 is comparable only to the busiest months of 2020 when the pandemic caused a surge in bankruptcies. The total of 346 filings in 2024 so far is the highest in the last 13 years.

S&P calls out companies continue to struggle with high interest rates, supply chain issues, and slowing consumer spending.

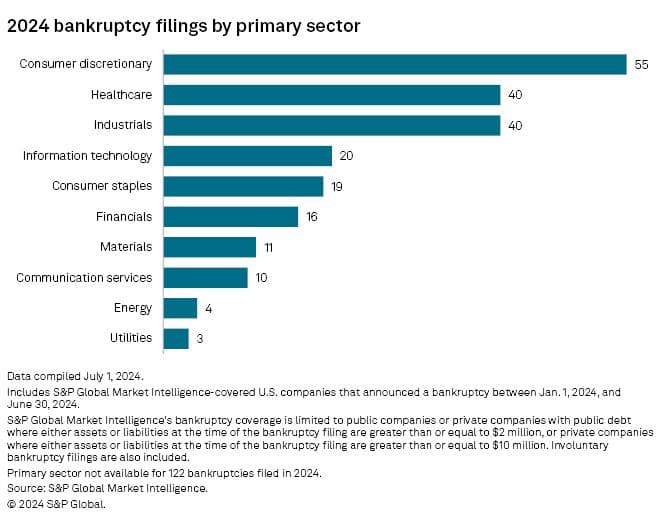

Consumer discretionary sector continued to lead others in 2024, with 55 total bankruptcy filings.

TLDRS:

- U.S. revolving credit (credit cards) grew by $7.02 billion (+6.3%) in May to $1.345 trillion, up from $1.338 trillion recorded in April.

- Consumer credit increased at a seasonally adjusted annual rate of 2.7 percent to $5.064 trillion.

- Nonrevolving credit increased at an annual rate of 1.4 percent to $3.718 trillion.

- Consumer Credit and Credit Card use continues to outpace the Fed's 2% inflation goal!

- A combination of slower wage growth, higher interest rates, and depleted savings indicate that the headwinds are mounting against consumers and this will continue to play heavily on consumer spending moving forward.

- Reminder, consumer spending is a major factor in the U.S. economy and its GDP, it goes down, companies fail.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.

U.S. Revolving credit (credit cards) grew by $7.02 billion (+6.3%) in May to $1.345 trillion, up from $1.338 trillion recorded in April. Consumer Credit (+2.7%) and Credit Card (+6.3%) use continues to outpace the Fed's 2% inflation goal!

by u/Dismal-Jellyfish in Superstonk

U.S. Revolving credit (credit cards) grew by $7.02 billion (+6.3%) in May to $1.345 trillion, up from $1.338 trillion recorded in April. Consumer Credit (+2.7%) and Credit Card (+6.3%) use continues to outpace the Fed's 2% inflation goal!https://t.co/qiuJvMIhcs

— dismal-jellyfish (@DismalJellyfish) July 8, 2024