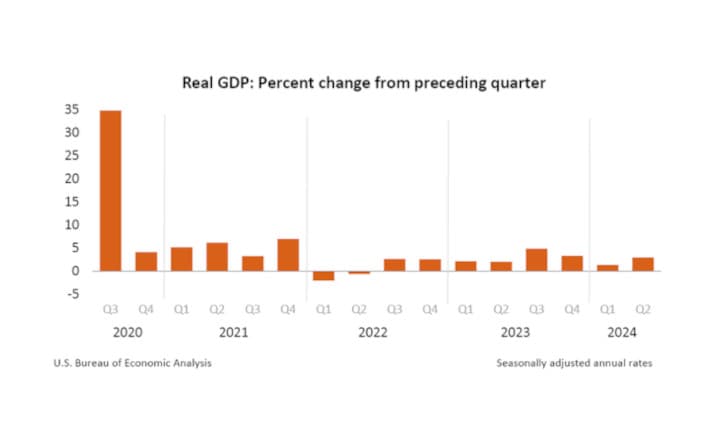

Real gross domestic product (GDP) increased at an annual rate of 3.0% in Q2:2024, according to the "second" estimate released by the U.S. Bureau of Economic Analysis, which was up from 2.8% in the 'advance' estimate.

U.S. GDP grows at 3.0% in Q2 2024, reflecting strong consumer spending:

The U.S. economy grew at an annual rate of 3.0% in the second quarter of 2024, according to the "second" estimate released by the U.S. Bureau of Economic Analysis. This marks a significant acceleration from the 1.4% growth recorded in the first quarter. The revised estimate is based on more complete data, up from the 2.8% initially reported.

- The increase in GDP was driven primarily by strong consumer spending, private inventory investment, and nonresidential fixed investment.

- Compared to the first quarter, the acceleration in GDP was due to a sharp upturn in private inventory investment and faster consumer spending, partially offset by a downturn in residential fixed investment.

Economic Indicators:

- Current-dollar GDP increased by 5.5%, or $383.2 billion, reaching $28.65 trillion.

- The price index for gross domestic purchases rose by 2.4%, while the personal consumption expenditures (PCE) price index increased by 2.5%.

- Excluding food and energy prices, the PCE price index increased 2.8%

- Still growing faster than the Fed's preferred 2% growth rate!

- Real gross domestic income (GDI) grew by 1.3%, consistent with the first quarter, and corporate profits rebounded by $57.6 billion after a decline in the first quarter.

Revisions and Updates:

- The upward revision to consumer spending was offset by downward revisions in several areas, including nonresidential fixed investment and government spending.

- Personal income saw a modest increase ($183.0 billion, or 3.6%), while the personal saving rate was revised down to 3.3%.

| Advance Estimate | Second Estimate | |

|---|---|---|

| (Percent change from preceding quarter) | ||

| Real GDP | 2.8 | 3.0 |

| Current-dollar GDP | 5.2 | 5.5 |

| Real GDI | … | 1.3 |

| Average of Real GDP and Real GDI | … | 2.1 |

| Gross domestic purchases price index | 2.3 | 2.4 |

| PCE price index | 2.6 | 2.5 |

| PCE price index excluding food and energy | 2.9 | 2.8 |

TLDRS:

- The U.S. economy grew at an annual rate of 3.0% in Q2 2024, a significant acceleration from the 1.4% growth in Q1.

- The revised GDP estimate, up from the initial 2.8%, was driven by strong consumer spending, private inventory investment, and nonresidential fixed investment.

- The GDP acceleration was primarily due to a sharp upturn in private inventory investment and faster consumer spending, partially offset by a decline in residential fixed investment.

- Current-dollar GDP increased by 5.5%, or $383.2 billion, reaching $28.65 trillion.

- The price index for gross domestic purchases rose by 2.4%, and the PCE price index increased by 2.5%; excluding food and energy, the PCE price index rose 2.8%, still above the Fed's preferred 2% growth rate.

- Real gross domestic income (GDI) grew by 1.3%, matching the first quarter, while corporate profits rebounded by $57.6 billion after a previous decline.

- Personal income increased modestly by $183.0 billion (3.6%), while the personal saving rate was revised down to 3.3%.

- Sure looks like an economy starved for rate cuts, right? /s

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to hold or even increasing interest rates--causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.

Real gross domestic product (GDP) increased at an annual rate of 3.0% in Q2:2024, according to the "second" estimate released by the U.S. Bureau of Economic Analysis, which was up from 2.8% in the 'advance' estimate.

— dismal-jellyfish (@DismalJellyfish) August 29, 2024

An economy starved for rate cuts! /shttps://t.co/85jxsmdiGl