Gary Gensler's Testimony to the Appropriations Committee About the 2024 Budget Request of $2.436B (Congress Funded at $2.364 billion). Staffing Surpassing 7-Year Levels, 35K+ Tips in 2022 (Double from 2016).

Source: https://www.sec.gov/news/testimony/gensler-testimony-fsgg-subcommittee-senate-appropriations-committee-071923

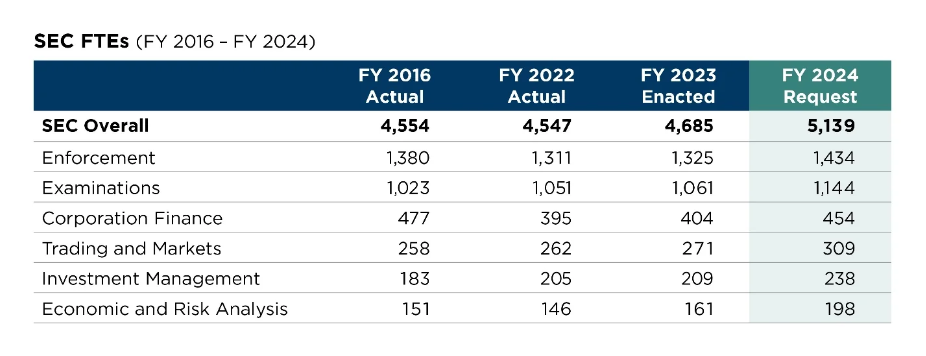

Full-time equivalents (FTEs) at the SEC and in individual Divisions. Overall SEC FTEs include all Offices and Divisions.

Budget Request

* FY 2024 request of $2.436 billion for SEC operations.

* The bulk of the increase would be to support currently authorized staffing