The Fed provides additional information on its program to supervise novel activities in the banks it oversees.

Novel activities include complex, technology-driven partnerships with non-banks to provide banking services to customers; & activities that involve crypto-assets, stablecoins & blockchain.

Wut Mean?:

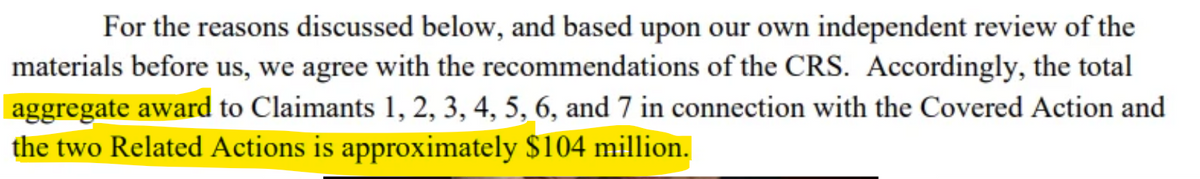

* The Federal Reserve has launched the Novel Activities Supervision Program to boost oversight of new activities by banking organizations.

* The focus is on activities related to