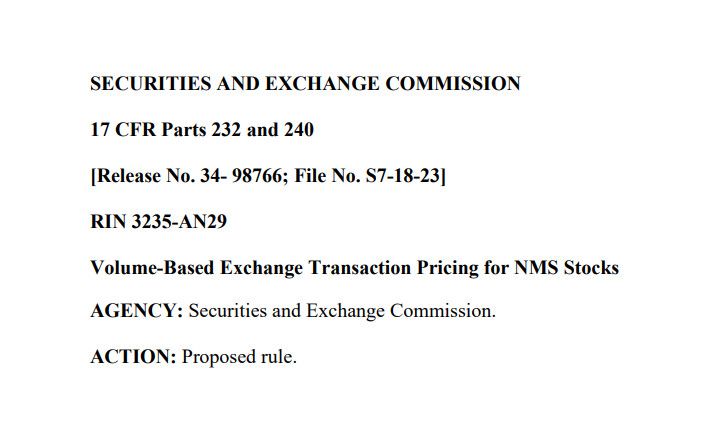

SEC Alert & OPEN for Comment Alert! SEC Proposes Rule to Address Volume-Based Exchange Transaction Pricing for NMS Stocks.

Background:

National securities exchanges (“exchanges”) that trade NMS stocks maintain pricing schedules that set forth the transaction pricing they apply to their broker-dealer members that execute orders on their trading platforms. As self-regulatory organizations under the Exchange Act, exchanges are subject to unique principles and processes that do not apply