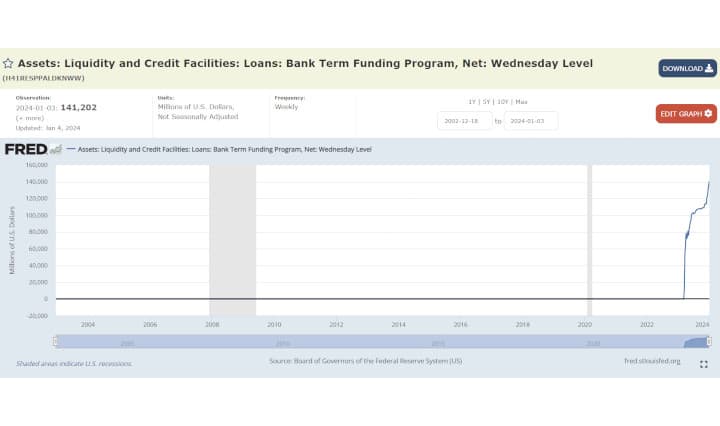

A deep dive into SEC greenlighting FICC's PD & MLA Rule changes & how they could be connected to MOASS.

What is happening?:

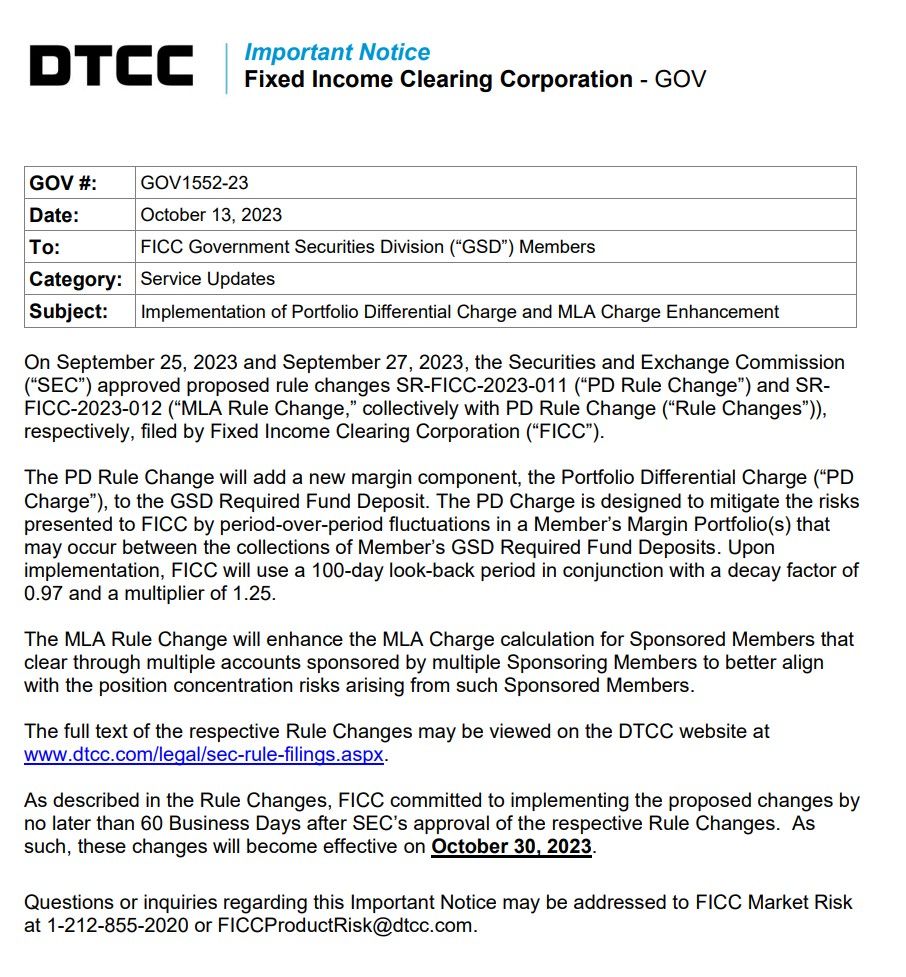

- The SEC approved proposed rule changes SR-FICC-2023-011 (PD Rule Change - 9/25/23) and SRFICC-2023-012 (MLA Rule Change - 9/27/23) filed by Fixed Income Clearing Corporation (FICC).

- The PD Rule Change will add a new margin component, the Portfolio Differential Charge (PD Charge), to the Government Securities Division (GSD) Required Fund Deposit.

- The PD Charge is designed to mitigate the risks presented to FICC by period-over-period fluctuations in a Member’s Margin Portfolio(s) that may occur between the collections of Member’s GSD Required Fund Deposits.

- Upon implementation, FICC will use a 100-day look-back period in conjunction with a decay factor of 0.97 and a multiplier of 1.25.

- The MLA Rule Change will enhance the MLA Charge calculation for Sponsored Members that clear through multiple accounts sponsored by multiple Sponsoring Members to better align with the position concentration risks arising from such Sponsored Members.

- FICC committed to implementing the proposed changes by no later than 60 Business Days after SEC’s approval of the respective Rule Changes.

- These changes will become effective on October 30, 2023.

SR-FICC-2023-011 (PD Rule Change)

Wut Mean?:

- FICC intends to improve its Required Fund Deposit calculation method for the GSD Clearing Fund via the PD Charge.

- This charge is designed to address the risks FICC faces from variations in a Member’s Margin Portfolio between collection periods of the Member's Required Fund Deposits.

Background:

Wut Mean?:

- FICC, via Government Securities Division (GSD), acts as a central counterparty and offers clearance and settlement services for U.S. Treasury securities and related transactions. GSD also handles certain transactions for securities backed by U.S. government agencies and sponsored enterprises.

- FICC uses Required Fund Deposits to the GSD Clearing Fund as a measure to manage its credit exposure to members. This deposit acts as a margin for each member.

- The primary goal of this margin is to cushion potential FICC losses if they need to liquidate a Member's portfolio due to a default. All members' margins together make up the GSD Clearing Fund. If a defaulting member's margin isn't enough to cover losses, FICC would utilize the GSD Clearing Fund.

- FICC updates the Required Fund Deposit for each member at least twice a day. They employ backtesting to check the deposit's adequacy. In instances where the deposit isn't enough to cover hypothetical liquidation losses based on historical data, it's seen as a deficiency. FICC examines causes of repeated backtesting deficiencies and checks if multiple members face deficiencies due to similar reasons.

- The GSD Rules outline various components for calculating each Member's Required Fund Deposit, addressing specific risks FICC may face. Components include the VaR Charge, Blackout Period Exposure Adjustment, and others. The VaR Charge, a significant portion of the deposit, is based on the sensitivity-based Value-at-Risk (VaR) methodology. This methodology aims to predict possible losses from liquidating a defaulting member's portfolio within normal market conditions in three days.

- FICC's addition of the PD Charge to the Required Fund Deposit calculation is a result of its ongoing review to ensure its margin methodology's efficacy.

What is changing:

The PD Charge is designed to capture variability in the VaR Charge collected from the Member over the look back period. FICC believes the proposed PD Charge would help mitigate the risks posed to FICC by the variability of clearing activity submitted to GSD throughout the day by measuring the historical period-over-period increases in the VaR Charge of a Member over a given time period.

Wut Mean?:

Introduction of the PD Charge:

- The Portfolio Differential (PD) Charge is a new measure proposed by FICC to address the variability in the Value-at-Risk (VaR) Charge collected from Members.

- The PD Charge aims to cover the potential exposure to FICC from trades executed throughout the day by considering the historical fluctuations in the VaR Charge over a given period.

Reason for the PD Charge:

- A Member’s Margin Portfolio can change significantly intraday due to trades they execute.

- These trades, once guaranteed by FICC, could lead to a gap in coverage because of large un-margined intraday fluctuations in the portfolio.

- The PD Charge is designed to bridge this gap and reduce exposure, helping to prevent backtesting deficiencies.

How the PD Charge Works:

- The charge increases a Member’s Required Fund Deposits based on their historical trading activity.

- It's calculated twice a day and, if applicable, is included in each Member’s Required Fund Deposit.

- Specifically, the PD Charge examines historical changes in a Member’s VaR Charge over a minimum of 100 days and uses an exponentially weighted moving average (EWMA) to stress more recent changes. A multiplier between 1 and 3, determined by FICC based on backtesting, is applied.

- This charge is designed to tackle the risks FICC might face from un-margined changes in a Member’s portfolio due to trading activities that occur during coverage gaps.

Definition and Rule Changes:

- FICC plans to add a definition for “Portfolio Differential Charge” or “PD Charge” to the GSD Rule 1 (Definitions). This definition explains that the PD Charge is an additional amount to be added to each Member’s Required Fund Deposit, calculated twice daily.

- FICC also proposes to adjust Section 1b of GSD Rule 4 (Clearing Fund and Loss Allocation) to include the PD Charge as an added component in the computation of each Member’s Required Fund Deposit.

Notices and Adjustments:

- FICC will inform Members at least 10 business days in advance about any modifications to the lookback period, decay factor, or the multiplier through an Important Notice.

- Initially, FICC will use a 100-day look-back period with a decay factor of 0.97. Adjustments might be made based on market conditions, but any such changes will undergo FICC's model governance process and be announced.

Impact Study:

Amendment No. 1 to SR-FICC-2023-011 (they had to revise the impact study):

1. Average daily PD Charge:

- Start-of-day: $661 million (2.4% of average daily Clearing Fund deposit).

- Noon: $822 million (3.0% of noon average daily Clearing Fund deposit).

2. Clearing Fund backtesting improvement: 36 bps (from 98.47% to 98.83%).

3. Backtesting deficiencies reduced by 107 (23% reduction, from 462 to 355).

4. 49 Members (38% of GSD membership) had improved backtesting coverage, with 14 brought back to above 99% coverage.

5. Average daily PD Charge per Member:

- Start-of-day: $5.5 million (2.4%).

- Noon: $6.8 million (3.0%).

6. Three largest average daily PD Charges for Members in dollars:

- Start-of-day: $37.31 million, $33.55 million, and $28.80 million.

7. Three largest PD Charges as percentages of Member’s deposit:

- Start-of-day: 17.89%, 16.78%, and 16.70%.

- Noon: 39.96%, 24.71%, and 24.64%.

1. Average daily PD Charge:

- Start-of-day: $660 million (2.2%).

- Noon: $839 million (2.9%).

2. Clearing Fund backtesting improvement: 25 bps (from 98.37% to 98.62%).

3. Backtesting deficiencies reduced by 77 (15% reduction, from 498 to 421).

4. 44 Members (34% of GSD membership) had improved backtesting coverage, with 14 brought back to above 99% coverage.

5. Average daily PD Charge per Member:

- Start-of-day: $5.4 million (2.2%).

- Noon: $6.9 million (2.9%).

6. Three largest average daily PD Charges for Members in dollars:

- Start-of-day: $41.09 million, $31.50 million, and $26.40 million.

- Noon: $104.06 million, $62.47 million, and $52.15 million.

7. Three largest PD Charges as percentages of Member’s deposit:

- Start-of-day: 16.74%, 15.76%, and 13.87%.

- Noon: 39.76%, 26.16%, and 22.47%.

Notable Differences

Duration of the Studies:

- The original Impact Study covered a period from November 2021 to October 2022, making it a 12-month study.

- The Revised Impact Study covered from November 2021 to March 2023, which is 17 months, adding an extra 5 months to the original duration.

Average Daily PD Charge:

- The start-of-day average daily PD Charge slightly decreased in the Revised Study ($660 million) compared to the original ($661 million). This is a minor difference, but it indicates that the projected average charge for start-of-day calculations dropped marginally.

- For the noon calculations, the average daily PD Charge increased in the Revised Study to $839 million from $822 million in the original. This suggests that by extending the study period, the noon average charge predictions increased.

Backtesting Improvements:

- The original study showed a more substantial improvement in the backtesting coverage ratio. It rose by 36 bps (from 98.47% to 98.83%), while the Revised Study showed a rise of only 25 bps (from 98.37% to 98.62%).

- The number of backtesting deficiencies decreased more in the original study, with a reduction of 107, versus the Revised Study's reduction of 77. This indicates the original study predicted a more significant improvement in backtesting results had the proposed PD Charge been applied.

Impact on Members:

- The original study predicted that 49 Members (or 38% of the GSD membership) would have improved backtesting coverage, while the Revised Study predicted this for 44 Members (34%).

- Both studies, however, showed the same number of members (14) being brought back to above 99% coverage.

- There's a variance in the predicted PD Charges for members in both studies, particularly for the three largest average daily charges. For instance, the highest start-of-day charge in the original was $37.31 million, while in the Revised Study, it went up to $41.09 million. The noon calculations also showed discrepancies, with the original predicting $86.59 million as the highest charge, while the Revised Study predicted $104.06 million.

Member PD Charge Percentages:

- The largest PD Charge percentages of Member's deposits also differed between the studies. The original study's start-of-day percentages were 17.89%, 16.78%, and 16.70%. In the Revised Study, these figures were 16.74%, 15.76%, and 13.87%.

- Noon calculations varied too, with the original showing percentages of 39.96%, 24.71%, and 24.64%, while the Revised Study had 39.76%, 26.16%, and 22.47%.

While both studies offer insights into the potential impacts of the proposed PD Charge, they differ in terms of the magnitude of these impacts. This could be due to the extended time frame of the Revised Study or changes in the underlying data or assumptions used in the studies.

Recall, assumptions in underlying data being subject to revisions is a problem called out in the September FOMC Minutes.

Still, the Revised Study generally predicts slightly more conservative improvements and variances in member charges.

"A few participants observed that there were challenges in assessing the state of the economy because some data continued to be volatile and subject to large revisions."

-September FOMC Minutes.

SRFICC-2023-012 (Margin Liquidity Adjustment Charge Rule Change)

Wut Mean?:

Enhancement of the MLA Charge Calculation for Sponsored Members:

- FICC is refining the calculation of the MLA Charge for Sponsored Members who clear through multiple accounts backed by various Sponsoring Members at GSD.

- When such Sponsored Members clear through these accounts, an additional charge called the "MLA Excess Amount" might be applied. This charge addresses the potential market impact costs if the Sponsored Member defaults and their respective Sponsoring Members, acting as guarantors, need to liquidate unsettled positions.

- The current method to distribute the MLA Excess Amount among each Sponsoring Member uses a market volatility risk-weighted approach. FICC is enhancing this method to better account for position concentration risks.

Revisions to the Language Describing Asset Groups/Subgroups:

- FICC is amending the descriptions of asset groups/subgroups in both Government Securities Division (GSD) and Mortgage-Backed Securities Division (MBSD) Rules. These groups/subgroups are utilized to calculate the MLA Charge.

- The change will let FICC determine and adjust the MLA Charge using a flexible schedule of asset groups/subgroups. This is a shift from the fixed definitions currently present in the GSD and MBSD Rules.

Clarification and Technical Adjustments:

- FICC aims to make the language in the GSD and MBSD Rules clearer about how the MLA Charge is determined.

- Technical modification in the GSD Rules.

Overview of the Required Fund Deposit and the Clearing Fund:

Wut Mean?:

FICC acts as a central authority for clearing and settling transactions in the U.S. government securities and mortgage-backed securities markets through its Government Securities Division (GSD) and Mortgage-Backed Securities Division (MBSD) divisions. GSD also handles certain transactions related to securities from U.S. government agencies and sponsored enterprises.

A crucial part of FICC's market risk management strategy involves managing its credit risk towards its Members. This is achieved by determining a 'Required Fund Deposit' for each Member and continually monitoring its adequacy as per the GSD and MBSD Rules.

This deposit acts as a margin for each Member and is designed to offset potential FICC losses if they need to liquidate a Member's portfolio in case of a default.

Furthermore, certain rules and regulations guide when and how FICC can act against a Member, such as suspending their membership or restricting their access to FICC's services, especially if the Member fails to meet their financial or other obligations to FICC.

The sum of all the Required Fund Deposits from all Members forms the 'Clearing Fund'. If a defaulting Member's deposit is not enough to cover the losses from liquidating their portfolio, FICC would tap into this Clearing Fund.

The amount each Member needs to deposit consists of various components, as detailed in the GSD and MBSD Rules, designed to address distinct risks FICC might face. One such component is the MLA Charge. This charge is implemented to manage the risk when a Member has significant unsettled amounts in a specific group of securities with alike risk characteristics or a certain type of transaction, termed as "asset groups".

Overview of the MLA Charge:

Wut Mean?:

FICC, as a central counterparty, manages its credit risk exposure by determining the appropriate Required Fund Deposit for members. This deposit serves as margin to mitigate losses if FICC stops acting for a member due to a default. The combined deposits from all members make up the Clearing Fund. If a member's deposit is insufficient during a default, FICC would use the Clearing Fund to cover the losses. One of the components of the deposit calculation is the MLA Charge, designed to address risks when a member’s portfolio has large unsettled positions in specific asset groups.

If a member defaults, FICC has the authority to close out and manage the positions of the defaulting member and apply their collateral. Closing out involves buying and selling securities that the defaulted member was meant to deliver or receive from FICC. Liquidating these positions might incur increased transaction costs for FICC, especially due to the unique aspects of a member's portfolio. The main costs come from the market impact, which increases with larger unsettled positions in a specific group of securities.

The MLA Charge is designed to address these market impact costs. It's essentially a fee to cover the risks of potential increased costs when liquidating large unsettled positions in specific asset groups. The MLA Charge is calculated based on different asset groups, comparing the total market value of unsettled positions to the trading volume available for that asset group.

FICC categorizes securities into various asset groups.

For example, at GSD, these include: U.S. Treasury securities categorized by maturity, Treasury-Inflation Protected Securities (TIPS), U.S. agency bonds, and mortgage pools transactions.

At MBSD, there's one mortgage-backed securities asset group.

To calculate the market impact cost, FICC uses different methods for various asset groups.

For some, like Treasuries with less than one year maturity, only the directional market impact cost is considered.

For others, both directional market impact cost and basis cost are added. The net value and gross value of unsettled positions are then divided by the average daily volumes of securities in that group.

FICC then compares the market impact cost to a portion of the VaR Charge related to unsettled positions in those groups. If the ratio exceeds a certain threshold, an MLA Charge is applied to that group. If not, no charge is applied. The threshold is based on the estimated market impact cost incorporated in the 1-day VaR Charge.

Lastly, for each member portfolio, the MLA Charges for each asset group are added to determine the total MLA Charge. This is calculated daily and included in the member's Required Fund Deposit when applicable.

MLA Excess Amount for Sponsored Members:

Wut Mean?:

- The MLA Charge addresses the market impact costs FICC might face when liquidating a defaulted Member's portfolio.

- Market impact costs increase when a portfolio has large unsettled positions in securities with similar risk profiles or transaction types. These might be more challenging to liquidate due to reduced marketability.

- The charge is specifically designed to cover the increased costs tied to these characteristics.

Calculation of MLA Charge:

- Securities are categorized into asset groups with similar risk profiles, such as U.S. Treasury securities, TIPS, U.S. agency bonds, and mortgage pools.

- For each asset group, FICC calculates the market impact cost considering the net unsettled positions of a Member.

- The calculation considers both the net directional market value and the gross market value of unsettled positions compared to the average daily volumes of securities in that asset group.

- The calculated market impact cost is compared to a portion of the Value at Risk (VaR) Charge tied to the unsettled positions in those asset groups.

- If the market impact cost exceeds a certain threshold compared to the VaR Charge, an MLA Charge is applied.

MLA Charge for Sponsored Members:

- The method to calculate the MLA Charge for Sponsored Members is similar to other members.

- For Sponsored Members with multiple Sponsoring Members, FICC computes an MLA Charge for the combined net unsettled positions across all Sponsoring Members, termed the "consolidated portfolio."

- If the consolidated portfolio's MLA Charge is greater than the sum of individual account MLA Charges, the difference is termed the "MLA Excess Amount."

- The MLA Excess Amount captures extra market impact costs potentially faced when many Sponsoring Members liquidate positions of a defaulting Sponsored Member.

- This amount is allocated among the Sponsoring Members using a risk-weighted method.

Revisions:

- FICC is suggesting changes to how the MLA Charge is calculated for Sponsored Members clearing through multiple accounts by multiple Sponsoring Members.

- Accounts with higher market impact costs but lower VaR Charges will bear a larger share of the additional costs.

- Due to these changes, FICC will eliminate the MLA Excess Amount, as they claim the enhanced calculation will already address the market impact costs it was meant to cover.

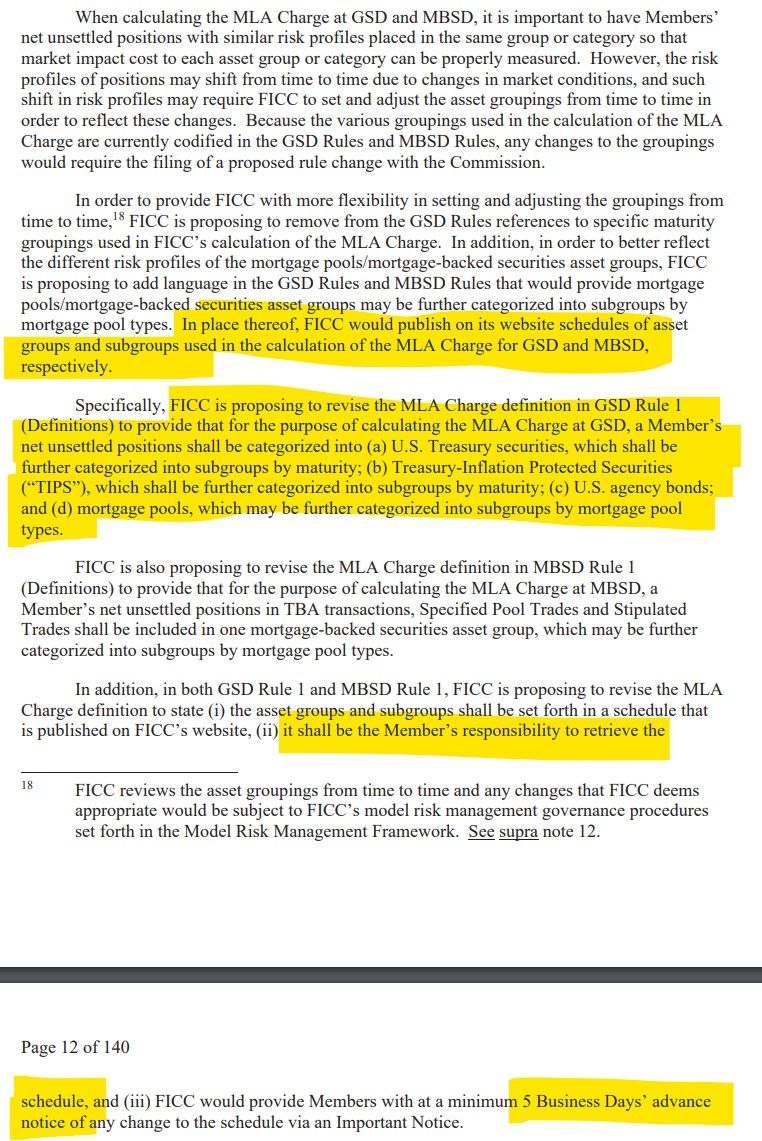

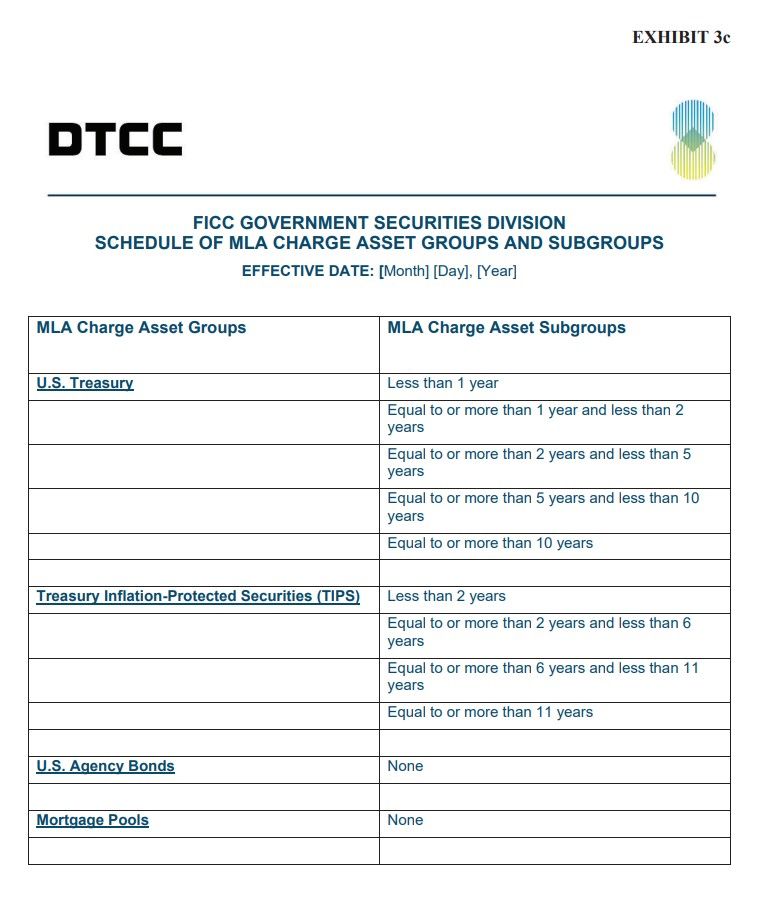

Asset Groups/Subgroups Used in the MLA Charge Calculation:

Wut Mean?:

FICC currently calculates the MLA Charge by categorizing securities into asset groups based on the GSD Rules. These groups are:

- Less than one year

- 1-2 years

- 2-5 years

- 5-10 years

- 10 years and above

2. Treasury-Inflation Protected Securities (TIPS), also categorized by maturity:

- Less than two years

- 2-6 years

- 6-11 years

- 11 years and above

3. U.S. agency bonds

4. Mortgage pools transactions

Additionally, there's one group for mortgage-backed securities as per the MBSD Rules.

FICC proposes to modify the GSD and MBSD Rules about these asset groups and subgroups. Instead of the current fixed categorizations, FICC wants the flexibility to define and change the MLA Charge's asset groupings as needed, rather than strictly following the existing codified rules. AKA they want the ability to change these a LOT faster moving forward...

Clarifying and Technical Changes:

Wut Mean?:

- Clarifying that the MLA Charge is calculated individually for each asset group/subgroup. After this, all these charges are summed up to get one MLA Charge for every Member portfolio.

- Stating that the market impact cost calculation is done for the combined net unsettled positions within each asset group/subgroup, rather than for each individual net unsettled position.

- Emphasizing that the associated VaR Charge allocation is also based on each asset group/subgroup, not on individual net unsettled positions.

What is changing:

Enhancing the MLA Charge Calculation at GSD for Sponsored Members that Clear Through Multiple Accounts Sponsored by Multiple Sponsoring Members

To implement the proposal as described above, FICC would amend GSD Rule 1 (Definitions) to modify the description of the MLA Charge. FICC would also amend GSD Rule 1 to remove MLA Excess Amount as it would no longer be needed under the proposal.

Wut Mean?:

When a Sponsored Member uses multiple accounts sponsored by various Sponsoring Members, FICC is refining how the MLA Charge is determined at GSD. The objective is to more closely mirror the potential market impact cost should the Sponsored Member default, compelling each Sponsoring Member to liquidate the positions of the defaulting Sponsored Member.

Key details of the change:

- For such Sponsored Members, GSD will determine the MLA Charge for each asset group/subgroup in two ways:

- Individually for each asset group/subgroup.

- For each asset group/subgroup within a consolidated portfolio.

2. Within the consolidated portfolio's context:

- Market impact cost for every asset group/subgroup will be calculated based on their aggregate net unsettled positions.

- This cost will be distributed proportionally across each asset group/subgroup in every Sponsored Member account.

- This allocated market impact cost will be weighed against the VaR Charge portion for that specific asset group/subgroup.

- An MLA Charge will be applied if the cost-to-VaR Charge ratio surpasses a set threshold; otherwise, no charge will be applied.

3. The MLA Charge within the consolidated portfolio will be derived from the ratio exceeding the set threshold and a segment of the VaR Charge for that asset group/subgroup.

4. GSD will then select the higher MLA Charge value between the standalone and consolidated portfolio calculations for every asset group/subgroup.

5. The determined charges for each group/subgroup will be combined to get a singular MLA Charge for the Sponsored Member's account.

To execute these changes, FICC will modify GSD Rule 1 to update the MLA Charge's description and eliminate the MLA Excess Amount, which will become redundant with this proposal.

Revise Asset Groups/Subgroups Language in the GSD Rules and MBSD Rules:

Wut Mean?:

To calculate the MLA Charge at Government Securities Division (GSD) and Mortgage-Backed Securities Division (MBSD), it's vital to categorize Members’ unsettled positions with similar risk profiles together for accurately measuring market impact cost.

Given that market conditions can and do change, altering the risk profiles of these positions, FICC sometimes needs to adjust the asset groupings. The challenge is that these groupings are set within the GSD and MBSD Rules, making changes to them bureaucratic, as they require a rule change proposal with the Commission.

To address this, FICC is implementing the following changes:

Increase Flexibility

FICC is removing specific maturity groupings from the GSD Rules related to the MLA Charge calculation. Instead of being fixed in the rules, FICC will post the asset group and subgroup schedules on its website. This allows for easier updates without the need for formal rule changes.

Adjustments in Group Definitions

GSD Rule 1: The MLA Charge definition will be updated to categorize net unsettled positions into:

- U.S. Treasury securities, further classified by maturity.

- Treasury-Inflation Protected Securities (TIPS), also further classified by maturity.

- U.S. agency bonds.

- Mortgage pools, potentially further categorized by mortgage pool types.

MBSD Rule 1: For MLA Charge calculation at MBSD, net unsettled positions in various transactions will be included in one mortgage-backed securities group, which could also have further subcategories based on mortgage pool types.

Transparency and Member Responsibility:

- FICC will detail the asset groups and subgroups in a schedule on its website.

- Members are responsible for retrieving this schedule.

- Any change to the schedule will be communicated to Members with a minimum of 5 Business Days' notice via an Important Notice.

Clarifying and Technical Changes:

Wut Mean?:

- Clarity on Calculation: The proposed changes will clarify that the MLA Charge at GSD and MBSD is determined by first calculating the charge for each asset group/subgroup. These individual calculations are then summed to determine a single MLA Charge for each Member's portfolio.

- Market Impact Cost Calculation: It's clarified that this calculation is done for the combined net unsettled positions within each asset group/subgroup, rather than for every individual unsettled position.

- VaR Charge Allocation: The changes will emphasize that the VaR Charge allocation happens per asset group/subgroup and not for every net unsettled position.

Technical Corrections:

- The term "mortgage pools transactions" in GSD Rule 1 (Definitions) will be changed to "mortgage pools".

- The term "MLA charge" will be replaced with "MLA Charge" in two instances for consistency.

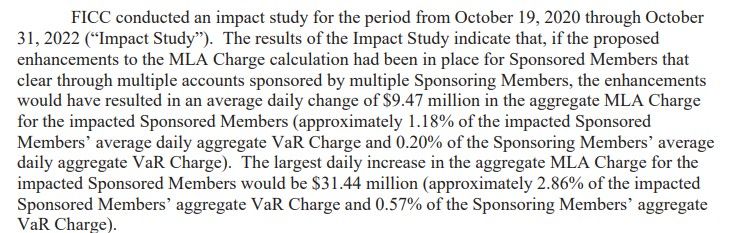

Impact Study:

Wut Mean?:

FICC carried out an impact study from October 19, 2020, to October 31, 2022.

Study results showed that the proposed MLA Charge calculation enhancements would have caused:

- An average daily change of $9.47 million in the total MLA Charge for impacted Sponsored Members.

- This change represents about 1.18% of the impacted Sponsored Members’ average daily aggregate VaR Charge.

- It also equates to 0.20% of the Sponsoring Members’ average daily aggregate VaR Charge.

The maximum daily increase in the aggregate MLA Charge for the impacted Sponsored Members would have been $31.44 million.

- This is roughly 2.86% of the impacted Sponsored Members’ aggregate VaR Charge.

- It's about 0.57% of the Sponsoring Members’ aggregate VaR Charge.

The approved changes to the MLA Charge calculation would have led to an increase in charges for the Sponsored Members.

Amendment No. 1 to SR-FICC-2023-012 (MLA Charge):

EXHIBIT 3c:

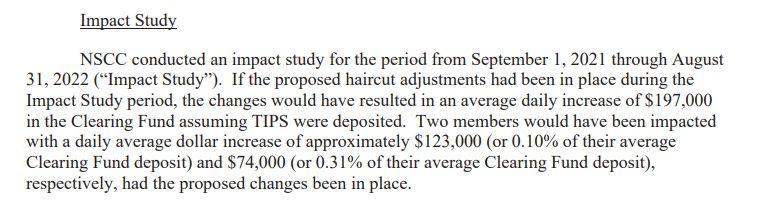

Why is this so interesting? Within 60 business days of 10/4/23 NSCC is implementing a new haircut schedule. Why? IDIOSYNCRATIC RISK!

"Haircuts"

Recall, it was on 9/22 NSCC submitted to update the definition around "Haircuts":

This is a whopper of a statement:

- "Through its review, NSCC has observed that under volatile market conditions with elevated frequency and magnitude of securities price movements, the collateral value of Eligible Clearing Fund Securities may shift in a relatively short period of time and the current haircuts may not sufficiently account for the change in value."

- "When the erosion in the value of the Eligible Clearing Fund Securities exceeds the relevant haircuts, NSCC is exposed to increased risk of potential losses associated with liquidating a member’s portfolio in the event of a member default when the defaulting member’s own margin is insufficient to satisfy losses to NSCC caused by the liquidation of that member’s portfolio."

- "Similarly, when a member’s portfolio contains large net unsettled positions in a particular group of securities with a similar risk profile or in a particular asset type, such securities could present additional risk to NSCC."

- "The additional risk exposures associated with liquidating a member’s portfolio in the event of a member default could lead to an increase in the likelihood that NSCC would need to mutualize losses among non-defaulting members during the liquidation process."

So why are they keen on doing all of this?:

It seems they are looking to speed up the process by which haircut changes are implemented--1 business day notices on the website vs having to go through the rules process.

"Concurrent with moving the haircuts and concentration limits from the Rules to the website, NSCC is also proposing to reconfigure the categories relating to Treasury securities haircuts by moving the Treasury Inflation-Protected Securities (“TIPS”) to a separate category and increasing the haircut levels for TIPS."

Bloomberg a month ago:

The market for Treasury Inflation-Protected Securities is teaching investors a harsh lesson about interest-rate risk, ramping up the focus on this week’s auction of the debt.

Despite sticky price pressures, long-maturity TIPS are on track for their biggest monthly loss this year. Investors have driven up yields on all manner of long-dated bonds this month amid concern over the Treasury’s swelling borrowing needs and — ironically for TIPS — the risk that inflation may spike again or not decline smoothly.

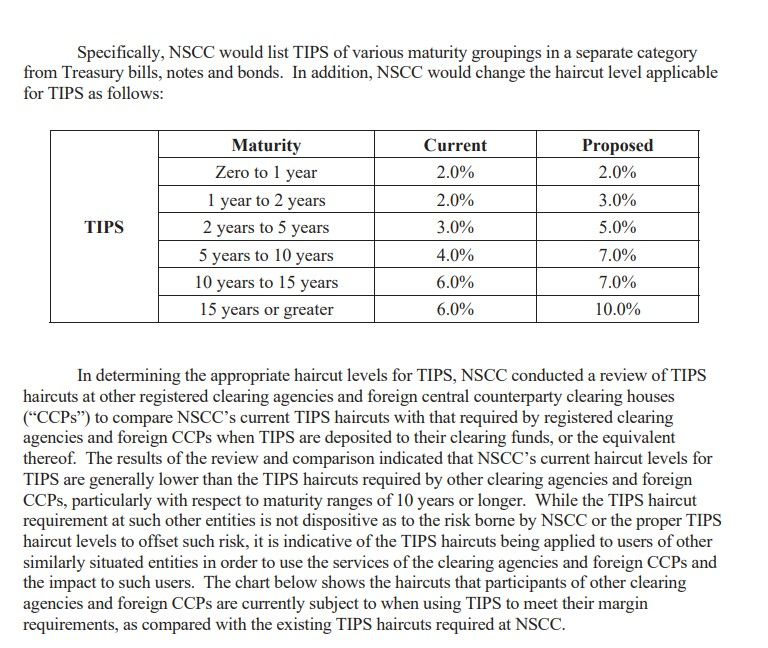

NSCC is changing the haircut level applicable for TIPS as follows:

Side note, notice how the NSCC has previously DRASTICALY under collected on haircuts compared to other SROs?:

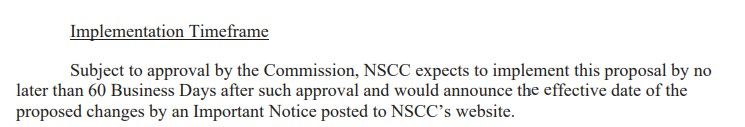

The rule will be implemented within 60 business days of 10/4/2023:

NSCC SCHEDULE OF HAIRCUTS FOR ELIGIBLE CLEARING FUND SECURITIES:

This is an interesting tidbit:

Wut Mean?

- It seems they are looking to speed up the process by which haircut changes are implemented--1 business day notices on the website vs having to go through the rules process.

- NSCC is also proposing to reconfigure the categories relating to Treasury securities haircuts by moving the Treasury Inflation-Protected Securities (“TIPS”) to a separate category and increasing the haircut levels for TIPS.

- This will be in effect within 60 days of the rule being approved.

So, why does this matter? 9/26:

This Follows up the planned implementation announcement from 8/25/23:

I'd like to call folks attention to something called out in the 8/25 announcement but not 9/26's:

Why are they doing this again? IDIOSYNCRATIC RISK!

Wut Mean?:

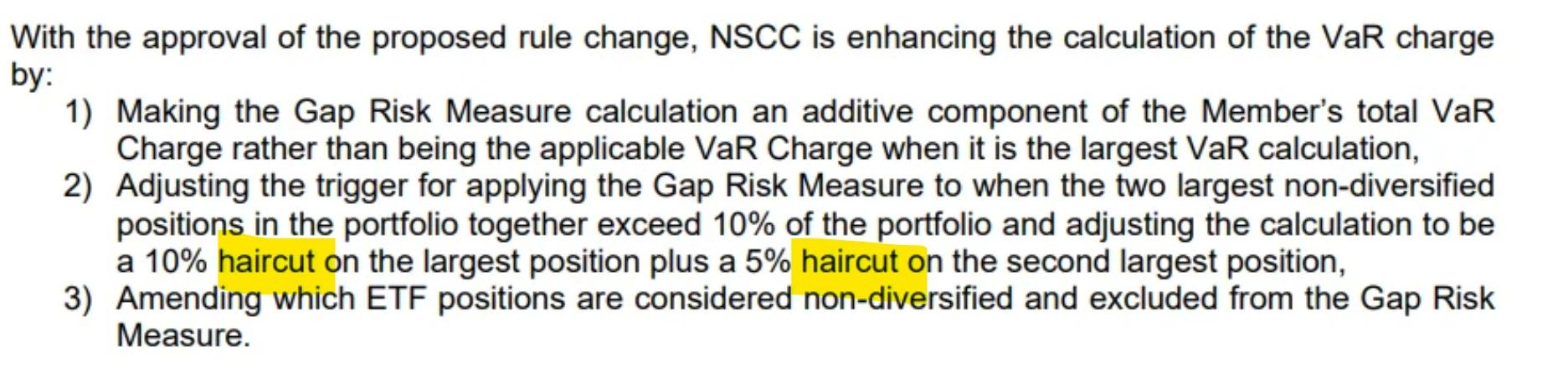

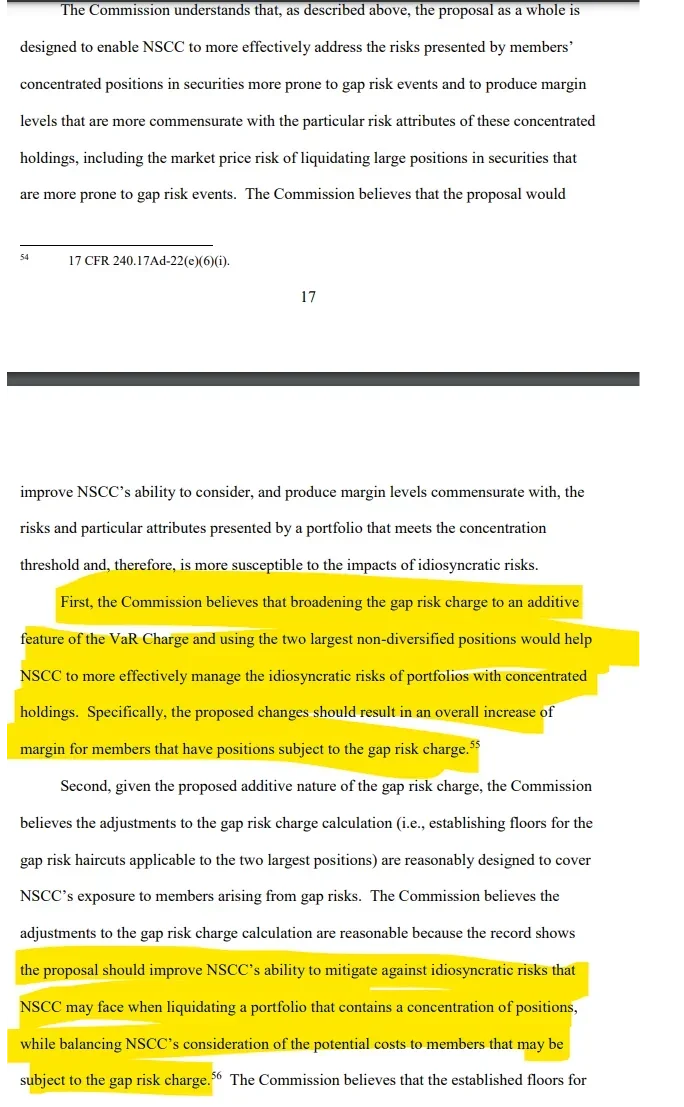

- The NSCC approved Enhancements to the Gap Risk Measure & the VaR Charge.

- VaR tinkers with the mechanics that would have defaulted Robinhood & Others 1/28/21.

- The NSCC, previously saved them by sacrificing retail, in allowing Robinhood and others to alter their margin charges and freezing the buy button.

- The gap risk charge will now be added to a member's total VaR Charge whenever it applies. Previously, it only replaced the VaR Charge when it was the largest of three calculations. This addition improves the ability to handle unique risks.

- The gap risk charge will now consider the two largest positions in a portfolio instead of just the single largest one. This means the charge could apply when the combined value of these two largest positions exceeds a certain concentration threshold. This change offers better coverage for potential concurrent gap events in two major positions.

- The way the gap risk haircut (a percentage reduction) is determined has been revised. The minimum haircut for the largest position will be reduced from 10% to 5%, and a new minimum of 2.5% will be set for the second-largest position. This change in methodology is to ensure an appropriate margin level.

- NSCC modified the criteria for ETF positions that are excluded from the gap risk charge. Instead of just excluding "non-index" positions, NSCC will exclude "non-diversified" positions, factoring in characteristics like the nature of the index the ETF tracks or whether the ETF is unleveraged. This change aims to be more precise about which ETFs are prone to gap risk and should improve transparency for members.

- Regarding the gap risk charge for securities financing transactions cleared by NSCC, the methodology of which already includes the gap risk charge as an additive component to margin and which would not change as a result of this proposal, (ii) to make clear that the gap risk charge applies to Net Unsettled Positions, (iii) to remove an unnecessary reference, (iv) to reflect that NSCC considers impact analysis when determining and calibrating the concentration threshold and gap risk haircuts, and (v) to make other technical changes for clarity).

- NSCC's changes approved for the gap risk charge, ensuring the collection of adequate margin to address risks from members’ portfolios.

- Based on provided confidential data and impact study, the changes offer better margin coverage than the current methodology.

- Making the gap risk charge additive should help NSCC address more idiosyncratic risk scenarios in concentrated portfolios compared to the existing methodology.

- Adjusting the gap risk calculation for the two largest positions with two separate haircuts, based on backtesting and impact analysis, allows NSCC to cover risks from simultaneous gap moves in multiple concentrated positions.

- Changing criteria for ETFs in the gap risk charge (from non-index to non-diversified) enhances NSCC's precision in determining which ETFs are susceptible to gap risk events, improving risk exposure accuracy.

- The Proposed Rule Change equips NSCC to better manage its exposure to portfolios with identified concentration risk, hence limiting its risk exposure during member defaults.

- NSCC's rule ensures uninterrupted operation in its critical clearance and settlement services, even during a member default, by having adequate financial resources.

- The changes minimize the chance of NSCC tapping into the mutualized clearing fund, thereby reducing non-defaulting members' risk exposure to shared losses.

- The Commission believes these proposed changes will help NSCC safeguard securities and funds in its custody or control, aligning with Section 17A(b)(3)(F) of the Act.

The approved rule aims to address the potential increased idiosyncratic risks NSCC might face, especially regarding the liquidation of a risky portfolio during a member default:

- After reviewing NSCC’s analysis, the Commission agrees that the new rule would result in improved backtesting coverage, reducing credit exposure to members.

- The Commission asserts that this rule will empower NSCC to manage its credit risks more effectively, allowing it to adapt to backtesting performance issues, market events, structural changes, or model validation findings.

- This proactive management ensures NSCC can consistently collect enough margin to cover potential exposures to its members.

- The goal is to produce margin levels that align with the risk attributes of these concentrated holdings, especially securities more vulnerable to gap risk events.

- The rule enhances NSCC's ability to recognize and produce margins that match the idiosyncratic risks and attributes of portfolios that meet the concentration threshold.

- Broadening the gap risk charge to an additive feature and focusing on the two largest non-diversified positions will help NSCC better manage the idiosyncratic risks tied to concentrated portfolios.

- Given the additive nature of the gap risk charge, the Commission agrees that the adjustments to its calculation, like establishing floors for gap risk haircuts for the two largest positions, are aptly designed to handle NSCC’s idiosyncratic risks exposure during member defaults.

- Introducing specific criteria to determine which securities fall under the gap risk charge will enable NSCC to pinpoint those more prone to idiosyncratic risks, ensuring ETFs identified as non-diversified are included.

Implementation:

As covered above, the VaR component is NOW in effect:

So what should these changes mean?:

- Increased Margin Requirements: With the changes in the methodology, members should face higher margin requirements. The addition of the gap risk charge to the VaR Charge (as opposed to it only replacing the VaR charge when it's the largest of three calculations) would mean that members should be required to deposit more funds to NSCC to cover this risk.

- Multiple Significant Positions Impact: Previously, the gap risk charge considered only the largest non-index position. By considering the two largest positions in a portfolio, the margin requirements should rise for members who have significant short positions in multiple securities, especially if those securities are prone to volatile price movements....

- Revised Haircut Percentages: The change in haircut percentages implies concerns about the risk. The lowered percentages (from 10% to 5% for the largest position and a new 2.5% for the second-largest position) mean the gap risk charge should be applied more frequently.

- New Criteria for ETFs: By moving from "non-index" to "non-diversified" as the criteria for exclusion from the gap risk charge, there's a more refined approach to evaluating which ETFs are prone to gap risk. This should impact members who previously used certain ETF positions as a strategy to manage their margins...

- Increased Transparency: Improved transparency in terms of which ETFs are prone to gap risk means that members can make more informed decisions. However, it also implies that any loopholes or strategies that were previously employed might no longer be valid, leading to strategy changes or potential increased costs for some members.

How does this lead to MOASS?:

- The changes should lead to higher margin requirements for those with short positions in volatile stocks like GameStop. The higher the costs, the more pressure on short sellers to close their positions, especially if they face liquidity challenges.

- If short sellers can't meet their margin requirements, they'll be forced to buy back the shares to close their positions, leading to a surge in demand and subsequently, a rise in share price.

- As the stock price rises due to forced buybacks, other short sellers face further margin calls, creating a snowball effect where more short sellers are forced to buy back shares, pushing the price up even further until lift off...

Oh yeah:

- They are REALLY concerned about idiosyncratic risk:

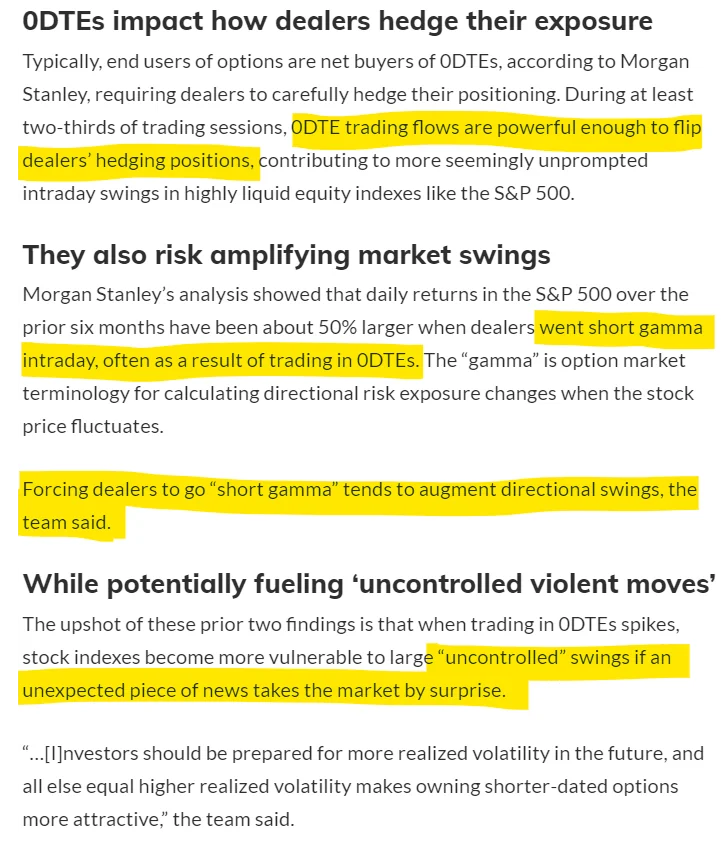

Where might all the volatility come from?

Before I go any further, this is not a post encouraging anyone to mess with 0DTE options or options in general.

Rather, this is a recap of a tool being leveraged to suppress volatility and the implications of it being out of control to the broader market.

Sources for this part of the post:

- https://www.marketwatch.com/story/trading-in-risky-0dte-stock-options-hits-record-and-could-a-stock-market-selloff-traders-say-41a35495

- https://www.reuters.com/markets/us/rise-0dte-stock-options-how-they-could-be-risk-markets-2023-02-22/

- https://www.washingtonpost.com/business/2023/06/13/what-are-zero-day-stock-options-why-do-they-matter-quicktake/2aa48fdc-09fd-11ee-8132-a84600f3bb9b_story.html

- https://www.marketwatch.com/story/here-are-5-ways-that-trading-in-0dte-stock-options-is-changing-how-the-market-works-607b03c5

What Are Zero-Day (0DTE) Options?:

- Options are contracts that allow traders to bet on the price direction of assets like stocks.

- They can choose to buy (call) or sell (put) at a specified price within a set time.

- 0DTE options have a super-short time frame of 24 hours, so decisions on whether to use them or lose the money spent on them must be made quickly.

Why Are They Used?:

- 0DTE options can be used for betting on market changes or for hedging against them.

- Investors can buy puts to protect against price drops or to bet on them.

- Traders can also sell options, hoping they expire with no value to earn extra income.

- Shorter options like 0DTE are cheaper due to their low chance of value by expiration. They are popular for betting on short-term price changes.

- An analysis by JPMorgan Chase & Co. found that two-thirds of profits from 0DTE came when the option was sold in the first minute after being originated.

Risks:

Short-dated options, which are very sensitive to changes in the price of their underlying asset.

- Take Oct. 28, 2022, when the S&P 500 jumped more than 2% to close above 3,900. Calls expiring that day with a strike at 3,850 surged to $45.80 from $2.90 — a stunning gain of 1,479%.

- On the other hand, puts maturing the next session with an exercise price of 3,750 tumbled 97% to 65 cents, after having more than doubling to $24.27 during the previous day.

How I understand this:

- Dealers who are short options (i.e., they have sold options) are typically short gamma.

- Being short gamma means that as the underlying asset's price moves, the dealer's position will become more and more unhedged in the opposite direction. If the underlying asset price goes up, a dealer who is short gamma will end up being more and more short the underlying. Conversely, if the underlying price goes down, they will become more and more long.

- Because of the increasing unhedged exposure as the underlying price moves, dealers who are short gamma often have to re-hedge their positions frequently. This means they have to buy when the underlying asset's price is rising and sell when it's falling. This can exacerbate price movements, especially in volatile markets.

- Being short gamma can be profitable in stable, non-volatile markets because the dealer collects the option premium when selling options. However, in volatile markets, the frequent need to re-hedge can lead to significant losses....

I believe 0DTE's will be the trigger of the gamma ramp:

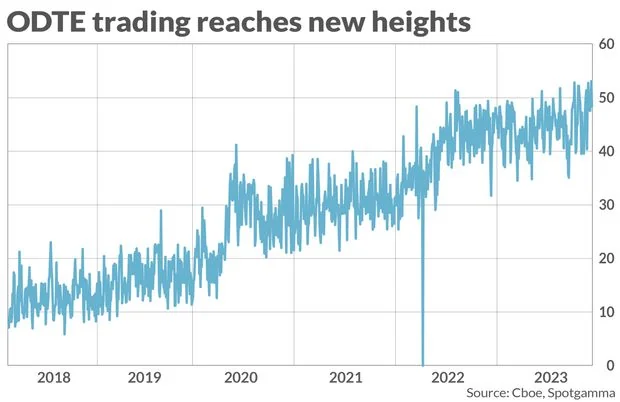

Trading in stock options with extremely limited lifespans is surging to record highs just as the 2023 U.S. stock-market rally is showing signs of stalling.

- In the past this this trade has been associated with subdued volatility in markets

- Peng Cheng, a managing director at JPMorgan Chase & Co., told MarketWatch that over the past month, only 4.3% of total 0DTE volume has been handled by retail traders, while the rest has been institutional traders and market makers.

- Data show volume tapered off in June after the S&P 500 index saw a decisive break above 4,200 as the 2023 stock-market rally accelerated.

- More recently, volumes have started to bounce back as the rally has slowed.

- 0DTE traders have re-emerged to try to profit from these wider swings, experts said

- Brent Kochuba, founder of SpotGamma, which provides options data and analytics, said elevated 0DTE volatility is typically associated with mean reversion.

- Data suggest 0DTE strategies could keep the market “pinned” to the 4,500 level on the S&P 500.

- “When the market tried to rally over 4,500 on Friday, a large 0DTE flow emerged and smacked the market back down.”

- Oppenheimer & Co. fear that overlapping crowded positions in derivatives markets that profit from a phenomenon known as “volatility suppression” could tip over into a selloff should the Cboe Volatility Index, otherwise known as the Vix or Wall Street’s “fear gauge,” continue to climb, as it has over the past week.

- The market has recently tested the daily ranges within which option market makers expect it to trade (for example the fitch downgrade)

- When this happens, it increases the risk that market makers will need to rapidly hedge their positions, potentially sparking a sudden surge in the Vix and corresponding selloff in stocks.

- 0DTEs are known for suppressing expectations about how volatile the market might be as measured by the Vix, since 0DTE trading volumes aren’t factored into the fear gauge.

Oh yeah, 0DTE's are spreading:

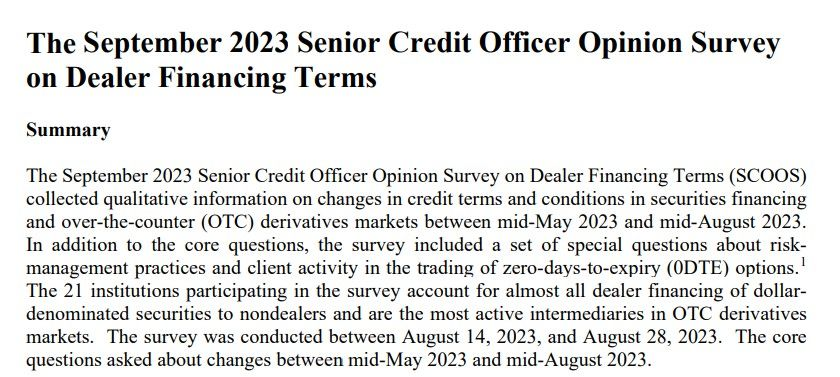

September 2023 Senior Credit Officer Opinion Survey, special questions about trading of zero-days-to-expiry (0DTE) options: "Two-fifths of the dealers do not collect margin on 0DTE options."

Highlights:

- Approximately two-fifths of dealers, on net, reported that they had increased the resources and attention they devoted to managing their concentrated credit exposure to other dealers and other financial intermediaries over the past three months--highest since June 2020.

- Approximately one-fourth of dealers, on net, indicated increased funding demand for equities (including through stock loans) over the past three months.

In 2022, the Chicago Board Options Exchange introduced additional expiration cycles for weekly options on the S&P 500 index and on several index-linked exchange-traded funds (ETFs), thereby providing daily expirations for those options. This development was accompanied by a large increase in trading volume in options that expire on the same day the option trades are initiated, known as 0DTE options. These options now account for about half of all trading volume of S&P 500 index options and options on some index-linked ETFs. In the special questions, dealers were asked about the activity of their institutional clients who are actively trading 0DTE options and the dealers’ management of counterparty risk associated with those clients. Only dealers with clients who regularly trade equity options and also actively trade 0DTE options were asked to complete the special questions. Approximately one-half of survey participants (10 out of 21) reported to have such clients. In this section, fractions of responses are stated relative to the sample of the 10 responding dealers.

Holy moly, so much % of trades, no idea what appetite for downside risk is!

At the same time, the Fed's Enhanced Financial Accounts (EFAs) on Hedge Funds:

Hedge Fund liabilities hit new all time high in 2023:Q1

- This table shows the aggregate assets and liabilities of hedge funds that file Form PF with the Securities and Exchange Commission.

- Unlike table B.101.f in the regular Financial Accounts publication, which reports assets and liabilities of domestic hedge funds only, this table presents data on all hedge funds that file Form PF, both domestic and foreign.

- The first part of the table reports the long position for the respective asset categories, with derivative exposure being excluded.

- The second part of the table reports the liability items, which detail the source of borrowing. A memo item reports total long derivative exposure.

| Date | Total assets | Foreign currency; asset | Deposits; asset | Other cash and cash equivalents; asset | Money market fund shares; asset | Security repurchase agreements; asset | Total debt securities; asset | Treasury securities; asset | Corporate and foreign bonds; asset | Other debt securities; asset | Total loans; asset | Leveraged loans; asset | Other loans; asset | Corporate equities; asset | Miscellaneous assets; asset | Total liabilities | Total security repurchase agreements; liability | Security repurchase agreements with domestic institutions; liability | Security repurchase agreements with foreign institutions; liability | Total loans; liability | Loans, total secured borrowing via prime brokerage; liability | Loans, secured borrowing via domestic prime brokerages ; liability | Loans, secured borrowing via foreign prime brokerages; liability | Loans, total other secured borrowing; liability | Loans, other secured borrowing from domestic institutions; liability | Loans, other secured borrowing from foreign institutions; liability | Loans, total unsecured borrowing; liability | Miscellaneous liabilities; liability | Total net assets | Derivatives (long value) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2012:Q4 | 4254.22 | 51.97 | 116.9 | 309.04 | 74.9 | 347.61 | 1708.78 | 654.49 | 993.65 | 60.64 | 133.35 | 108.84 | 24.5 | 1148.48 | 363.19 | 1834.19 | 602.76 | 294.72 | 308.04 | 976.64 | 764.23 | 599.9 | 164.34 | 209.83 | 139.66 | 70.18 | 2.58 | 254.78 | 2420.03 | 8311.76 |

| 2013:Q1 | 4729.57 | 75.49 | 105.4 | 294.93 | 76.49 | 412.56 | 1942.94 | 755.22 | 1135.35 | 52.37 | 136.65 | 110.5 | 26.15 | 1292.39 | 392.73 | 2137.6 | 657.58 | 306.58 | 350.99 | 1153.52 | 906.42 | 715.64 | 190.78 | 243.46 | 126.91 | 116.56 | 3.64 | 326.5 | 2591.97 | 5900.76 |

| 2013:Q2 | 4851.63 | 71.39 | 116.99 | 320.31 | 77.14 | 543.69 | 1884.14 | 664.32 | 1134.43 | 85.39 | 140.48 | 107.03 | 33.45 | 1332.26 | 365.23 | 2217.88 | 779.15 | 404.36 | 374.79 | 1205.52 | 948.27 | 714.11 | 234.16 | 251.49 | 118.5 | 132.99 | 5.76 | 233.21 | 2633.75 | 4844.51 |

| 2013:Q3 | 4998.9 | 70.3 | 125.02 | 336.5 | 85.55 | 508.26 | 1901.87 | 673.41 | 1171.91 | 56.56 | 143.17 | 108.38 | 34.79 | 1424.21 | 404.02 | 2248.64 | 668.15 | 327.45 | 340.7 | 1252.65 | 958.63 | 759.94 | 198.69 | 286.63 | 142.36 | 144.27 | 7.39 | 327.84 | 2750.26 | 4930.88 |

| 2013:Q4 | 5351.05 | 70.85 | 134.01 | 381.27 | 126.79 | 474.71 | 1930.15 | 657.51 | 1229.22 | 43.42 | 149.23 | 102.68 | 46.55 | 1618.21 | 465.82 | 2294.94 | 579.54 | 290.07 | 289.47 | 1392.8 | 1083.19 | 862.97 | 220.22 | 301.88 | 144.85 | 157.04 | 7.73 | 322.6 | 3056.11 | 5253.12 |

| 2014:Q1 | 5544.42 | 82.19 | 146.01 | 386.11 | 128.38 | 566.71 | 1987.79 | 679 | 1261.15 | 47.65 | 154.05 | 110.86 | 43.19 | 1661.02 | 432.17 | 2437.48 | 558.01 | 257.69 | 300.32 | 1461.47 | 1139.93 | 910.72 | 229.21 | 310.31 | 124.12 | 186.19 | 11.24 | 418 | 3106.94 | 5260.63 |

| 2014:Q2 | 5778.15 | 78.68 | 154.67 | 398.53 | 139.37 | 572.34 | 2046.01 | 623.27 | 1360.17 | 62.57 | 161.68 | 113.64 | 48.04 | 1775.19 | 451.68 | 2511.18 | 605.29 | 275.4 | 329.89 | 1433.12 | 1123.5 | 876.48 | 247.02 | 296.67 | 106.49 | 190.18 | 12.94 | 472.77 | 3266.97 | 5166.33 |

| 2014:Q3 | 5883.62 | 86.13 | 153.11 | 421.41 | 132.19 | 617.16 | 2131.29 | 710.54 | 1351.63 | 69.11 | 160.51 | 113.41 | 47.1 | 1742.82 | 439 | 2641.73 | 635.54 | 293.52 | 342.02 | 1441.53 | 1114.58 | 847.2 | 267.38 | 314.08 | 121.19 | 192.89 | 12.87 | 564.66 | 3241.88 | 5305.47 |

| 2014:Q4 | 5925.22 | 77.59 | 161.87 | 426.46 | 166.37 | 553.59 | 2058.62 | 659.94 | 1334.33 | 64.35 | 168.14 | 116.34 | 51.81 | 1809.85 | 502.72 | 2564.85 | 614.55 | 302.28 | 312.27 | 1486.4 | 1168.91 | 896.95 | 271.97 | 307.43 | 122.59 | 184.85 | 10.05 | 463.9 | 3360.36 | 4654.88 |

| 2015:Q1 | 6350.43 | 91.42 | 162.73 | 398.79 | 159.67 | 583.07 | 2337.87 | 754.92 | 1516.57 | 66.39 | 167.34 | 116.63 | 50.71 | 1887.13 | 562.41 | 2814.97 | 728.29 | 375.16 | 353.13 | 1527.28 | 1217.2 | 959.31 | 257.88 | 301.08 | 104.45 | 196.63 | 9 | 559.4 | 3535.46 | 5087.53 |

| 2015:Q2 | 6277.1 | 71.11 | 150.12 | 392.14 | 163.62 | 555.92 | 2243.31 | 727.8 | 1452.3 | 63.2 | 169.72 | 118.96 | 50.76 | 1974.95 | 556.2 | 2725.15 | 713.89 | 375.88 | 338.02 | 1554.87 | 1263.15 | 980.11 | 283.04 | 279.78 | 130.41 | 149.37 | 11.94 | 456.38 | 3551.95 | 4668.83 |

| 2015:Q3 | 6191.98 | 68.33 | 170.8 | 394.34 | 162.35 | 566 | 2268.08 | 743.58 | 1458.71 | 65.79 | 164.77 | 110.28 | 54.5 | 1800.15 | 597.16 | 2744.57 | 794.55 | 418.25 | 376.3 | 1470.24 | 1181.88 | 915.65 | 266.23 | 275.69 | 125.74 | |||||

| 2015:Q4 | 6037.1 | 62 | 179.52 | 397.97 | 178.31 | 519.42 | 2133.7 | 701.37 | 1371.95 | 60.38 | 164.3 | 108.7 | 55.61 | 1830.64 | 571.23 | 2592.98 | 673.07 | 358.14 | 314.93 | 1468.26 | 1161.42 | 893.64 | 267.78 | 295.21 | 138.36 | 156.85 | 11.63 | 451.65 | 3444.12 | 4607.14 |

| 2016:Q1 | 6063.07 | 75.49 | 184.03 | 417.65 | 163.11 | 550.11 | 2228.16 | 754.83 | 1410.53 | 62.8 | 169.06 | 109.05 | 60.01 | 1726.54 | 548.92 | 2703.13 | 783.41 | 413.82 | 369.59 | 1431.35 | 1117.15 | 859.15 | 257.99 | 302.45 | 149.97 | 152.47 | 11.75 | 488.37 | 3359.94 | 5060.3 |

| 2016:Q2 | 6241.18 | 86.93 | 193.71 | 416.13 | 181.42 | 561.88 | 2401.83 | 868.14 | 1451.78 | 81.91 | 173.09 | 112.86 | 60.23 | 1695.33 | 530.87 | 2838.07 | 794.74 | 412.3 | 382.43 | 1450.79 | 1132.82 | 845.21 | 287.61 | 306.84 | 150.52 | 156.32 | 11.14 | 592.54 | 3403.12 | 5232.76 |

| 2016:Q3 | 6399.52 | 86.4 | 175.25 | 385.57 | 177.06 | 615.05 | 2366.65 | 870.68 | 1436.1 | 59.86 | 186.48 | 120.69 | 65.79 | 1821.18 | 585.88 | 2932.54 | 839.24 | 454.07 | 385.17 | 1571.97 | 1251.56 | 955.62 | 295.94 | 307.53 | 153.07 | 154.46 | 12.89 | 521.33 | 3466.98 | 5415.58 |

| 2016:Q4 | 6409.75 | 86.5 | 160.47 | 370.89 | 189.46 | 690.74 | 2265.77 | 797.48 | 1415.76 | 52.54 | 191.79 | 123.29 | 68.5 | 1824.79 | 629.32 | 2908.51 | 772.28 | 406.66 | 365.62 | 1611.6 | 1260.23 | 956.93 | 303.3 | 337.18 | 166.42 | 170.77 | 14.18 | 524.63 | 3501.24 | 5137.43 |

| 2017:Q1 | 6697.45 | 92.85 | 166.77 | 369.45 | 166.07 | 796.3 | 2365.72 | 810.56 | 1498.32 | 56.84 | 193.77 | 124.16 | 69.61 | 1962.41 | 584.11 | 3111.79 | 829.93 | 416.59 | 413.34 | 1728.44 | 1360.75 | 1033.86 | 326.9 | 351.24 | 161.21 | 190.02 | 16.46 | 553.41 | 3585.66 | 5620.49 |

| 2017:Q2 | 6823.72 | 94.87 | 169.4 | 371.9 | 173.19 | 829.59 | 2307.48 | 757.62 | 1482.97 | 66.89 | 213.4 | 145.01 | 68.39 | 2017.64 | 646.25 | 3175.92 | 879.79 | 445.01 | 434.78 | 1804.35 | 1425.45 | 1061.63 | 363.82 | 365.83 | 171.42 | 194.4 | 13.08 | 491.77 | 3647.8 | 5459.67 |

| 2017:Q3 | 7075.97 | 131.16 | 182.01 | 362.75 | 186.75 | 850.96 | 2387.17 | 778.01 | 1544.82 | 64.34 | 211.87 | 137.38 | 74.49 | 2130.55 | 632.75 | 3329.76 | 796.67 | 390.93 | 405.74 | 1940.41 | 1544.41 | 1152.22 | 392.18 | 381.73 | 176.55 | 205.18 | 14.27 | 592.68 | 3746.21 | 6013.04 |

| 2017:Q4 | 7177.63 | 105.78 | 161.84 | 358.91 | 195.63 | 822.45 | 2368.83 | 778.11 | 1526.55 | 64.18 | 220.86 | 142.62 | 78.25 | 2273.14 | 670.19 | 3296.33 | 762.95 | 377.33 | 385.62 | 1982.3 | 1569.19 | 1180.71 | 388.48 | 396.29 | 182.35 | 213.94 | 16.81 | 551.09 | 3881.3 | 6587.96 |

| 2018:Q1 | 7357.27 | 130.56 | 157.23 | 367.04 | 186.32 | 919.25 | 2476.53 | 748.26 | 1667.25 | 61.01 | 236.6 | 149.87 | 86.73 | 2256.9 | 626.85 | 3425.32 | 860.21 | 413.19 | 447.02 | 2053.04 | 1601.24 | 1211.66 | 389.58 | 435 | 195.67 | 239.34 | 16.79 | 512.07 | 3931.95 | 9668.54 |

| 2018:Q2 | 7590.1 | 127.64 | 148.34 | 383.77 | 183.29 | 878.57 | 2648.6 | 892.3 | 1685.53 | 70.77 | 247.36 | 149.93 | 97.43 | 2305.13 | 667.4 | 3612.22 | 987.87 | 530.78 | 457.08 | 2166.83 | 1717.03 | 1311.81 | 405.21 | 433.24 | 201.77 | 231.47 | 16.56 | 457.52 | 3977.88 | 8131.63 |

| 2018:Q3 | 7732.51 | 117.6 | 166.24 | 380.91 | 193.03 | 905.24 | 2725.16 | 958.96 | 1689.49 | 76.71 | 257.14 | 155.13 | 102.01 | 2330.08 | 657.11 | 3734.72 | 958.05 | 521.28 | 436.77 | 2229.86 | 1793.77 | 1349.55 | 444.23 | 421.18 | 208.14 | 213.04 | 14.91 | 546.81 | 3997.79 | 6539.58 |

| 2018:Q4 | 7487.33 | 114.04 | 167.23 | 376.76 | 223.67 | 925.26 | 2790.3 | 1078.62 | 1631.33 | 80.35 | 265.68 | 159.57 | 106.11 | 1979.44 | 644.96 | 3732.07 | 1208.02 | 689.66 | 518.36 | 1899.05 | 1454.03 | 1103.42 | 350.6 | 431.05 | 208.03 | 223.02 | 13.97 | 625 | 3755.26 | 6297.7 |

| 2019:Q1 | 7864.09 | 124.9 | 168.29 | 426.82 | 184.83 | 976.42 | 2955.63 | 1206.47 | 1680.01 | 69.15 | 289.06 | 172.95 | 116.11 | 2200.95 | 537.18 | 3951.55 | 1357.05 | 764.55 | 592.51 | 2055.28 | 1595.8 | 1221.71 | 374.09 | 444.66 | 223.96 | 220.7 | 14.82 | 539.22 | 3912.54 | 7381.33 |

| 2019:Q2 | 8100.68 | 124.68 | 164.23 | 434.17 | 183.95 | 867.77 | 3146.99 | 1364.23 | 1715.78 | 66.99 | 296.54 | 180.93 | 115.61 | 2262.74 | 619.61 | 4112.08 | 1429.06 | 803.19 | 625.86 | 2100.64 | 1609.25 | 1255.51 | 353.74 | 473.52 | 234.31 | 239.21 | 17.88 | 582.38 | 3988.6 | 7484.9 |

| 2019:Q3 | 7958.43 | 131.83 | 156.36 | 444.55 | 190.97 | 797.95 | 3068.11 | 1303.95 | 1697.46 | 66.69 | 293.09 | 187.08 | 106.01 | 2168.55 | 707.03 | 3976.09 | 1467.03 | 832.63 | 634.4 | 1973.45 | 1515.52 | 1199.48 | 316.05 | 439.81 | 208.8 | 231.02 | 18.12 | 535.61 | 3982.34 | 7525.74 |

| 2019:Q4 | 8113.09 | 129.28 | 151.84 | 452.97 | 205.22 | 837.1 | 3008.97 | 1226.57 | 1718.94 | 63.46 | 315.39 | 199.01 | 116.38 | 2378.44 | 633.87 | 4015.67 | 1440.39 | 798.94 | 641.45 | 2099.78 | 1584.59 | 1245.72 | 338.88 | 494.74 | 241.69 | 253.06 | 20.45 | 475.5 | 4097.42 | 7337.23 |

| 2020:Q1 | 7628.47 | 118.36 | 189.92 | 461.32 | 251.32 | 902.31 | 2960.11 | 1208.01 | 1690.18 | 61.92 | 308.33 | 201.88 | 106.45 | 1787.47 | 649.34 | 3913.47 | 1520.92 | 808.16 | 712.76 | 1716.69 | 1204.6 | 975.03 | 229.57 | 488.4 | 250.39 | 238.01 | 23.69 | 675.86 | 3715 | 6798.38 |

| 2020:Q2 | 7682.04 | 134.47 | 162.54 | 392.09 | 221.31 | 827.93 | 2819.79 | 988.99 | 1770.78 | 60.01 | 329.63 | 211.2 | 118.43 | 2141.37 | 652.93 | 3644.13 | 1273.67 | 672.49 | 601.18 | 1910.14 | 1443.83 | 1176.38 | 267.46 | 451.38 | 219.98 | 231.4 | 14.93 | 460.31 | 4037.91 | 6190.88 |

| 2020:Q3 | 8117.87 | 106.14 | 164.11 | 365.65 | 200.63 | 936.13 | 2981.16 | 1030.2 | 1889.07 | 61.89 | 359.52 | 233.27 | 126.25 | 2351.88 | 652.64 | 3861.1 | 1437.49 | 703.89 | 733.6 | 2060.34 | 1564.39 | 1282.54 | 281.85 | 481.39 | 210.88 | 270.5 | 14.56 | 363.27 | 4256.77 | 7643.41 |

| 2020:Q4 | 8465.89 | 122.96 | 162.29 | 384.13 | 201.47 | 874.81 | 2878.84 | 913.46 | 1903.87 | 61.51 | 356.2 | 234.78 | 121.42 | 2757.51 | 727.68 | 3965.76 | 1302.01 | 655.28 | 646.73 | 2244.66 | 1792.32 | 1475.44 | 316.88 | 436.6 | 213.1 | 223.49 | 15.74 | 419.09 | 4500.13 | 7653.64 |

| 2021:Q1 | 8557.82 | 130.87 | 168.94 | 430.53 | 205.06 | 1006.22 | 2629.75 | 813.52 | 1761.41 | 54.82 | 389.34 | 258.91 | 130.43 | 2898.36 | 698.75 | 3938.54 | 1151.13 | 576.73 | 574.4 | 2426.77 | 1889.83 | 1546.33 | 343.49 | 519.39 | 264.59 | 254.8 | 17.56 | 360.63 | 4619.28 | 8560.49 |

| 2021:Q2 | 9225.03 | 138.53 | 184.52 | 507.72 | 200.78 | 1122.86 | 2801.85 | 871.89 | 1879.07 | 50.88 | 399.86 | 266.19 | 133.67 | 3164.71 | 704.18 | 4284.45 | 1191.76 | 567.54 | 624.22 | 2724.53 | 2123.99 | 1774.41 | 349.57 | 581.73 | 293.65 | 288.08 | 18.81 | 368.16 | 4940.58 | 8881.29 |

| 2021:Q3 | 9617.96 | 167.24 | 206.53 | 455.28 | 209.29 | 1227.46 | 3044.11 | 965.09 | 2016.55 | 62.47 | 420.68 | 279.92 | 140.76 | 3069.39 | 817.98 | 4584.27 | 1284.34 | 599.57 | 684.77 | 2721.68 | 2101.39 | 1727.9 | 373.49 | 584.73 | 306.39 | 278.33 | 35.56 | 578.25 | 5033.69 | 8891.96 |

| 2021:Q4 | 9678.89 | 157.92 | 189.41 | 483.35 | 241.35 | 1251.58 | 2918.89 | 951.6 | 1908.63 | 58.66 | 445.19 | 296.67 | 148.52 | 3189.85 | 801.34 | 4574.54 | 1229.59 | 589.05 | 640.54 | 2878.38 | 2146.13 | 1766.88 | 379.24 | 678.9 | 358.4 | 320.5 | 53.35 | 466.58 | 5104.35 | 8542.37 |

| 2022:Q1 | 9974.14 | 172.36 | 187.36 | 697.24 | 240.1 | 1296.76 | 3078.6 | 1068.93 | 1955.58 | 54.08 | 472.09 | 319.34 | 152.75 | 3029.79 | 799.86 | 4565.89 | 1168.17 | 490.83 | 677.34 | 2711.84 | 2023.45 | 1697.72 | 325.73 | 645.25 | 328.92 | 316.33 | 43.13 | 685.88 | 5408.26 | 9217.8 |

| 2022:Q2 | 9283.37 | 186.15 | 176.34 | 481.99 | 266.3 | 1228.68 | 3027.93 | 1134.42 | 1838.67 | 54.85 | 480.44 | 320.29 | 160.15 | 2540.71 | 894.83 | 4506.87 | 1233.35 | 537.43 | 695.92 | 2503.04 | 1829.5 | 1546.22 | 283.28 | 636.43 | 353.15 | 283.27 | 37.11 | 770.48 | 4776.5 | 7905.95 |

| 2022:Q3 | 9079.39 | 162.14 | 165.89 | 476.7 | 256.18 | 1160.66 | 3072.32 | 1086.91 | 1931.6 | 53.81 | 481.66 | 323.31 | 158.35 | 2444.94 | 858.9 | 4377.01 | 1233.29 | 550.02 | 683.27 | 2413.51 | 1757.71 | 1488.78 | 268.93 | 615.95 | 394.54 | 221.41 | 39.85 | 730.21 | 4702.37 | 7933.63 |

| 2022:Q4 | 9107.08 | 172.98 | 179.04 | 484.44 | 248.73 | 1103.65 | 3080.58 | 1095.51 | 1924.71 | 60.36 | 495.36 | 335.27 | 160.09 | 2519.74 | 822.57 | 4431.14 | 1241.39 | 588.74 | 652.66 | 2432.76 | 1755.5 | 1439.01 | 316.49 | 634.42 | 484.52 | 149.9 | 42.84 | 756.99 | 4675.94 | 7936.64 |

| 2023:Q1 | 9381.54 | 159.09 | 228.54 | 467.67 | 217.45 | 1186.12 | 3160.01 | 1198.64 | 1908.85 | 52.51 | 515.88 | 354.01 | 161.87 | 2595.61 | 851.17 | 4597.25 | 1528.12 | 745.67 | 782.45 | 2547.28 | 1891.67 | 1532.26 | 359.41 | 613.53 | 452.25 | 161.27 | 42.09 | 521.85 | 4784.29 | 8291.55 |

Source: https://www.federalreserve.gov/releases/efa/all_hedge_funds_balance_sheet.csv

- The Fed's Enhanced Financial Accounts (EFAs) on Hedge Funds: Hedge Fund liabilities hit new all time high in 2023:Q1.

- Hedge Fund exposure from derivatives grew 4.47% or $354.91 Billion from 2022:Q4 to 2023:Q1

- Leveraged Loans hit a new all-time high.

- Security repurchase agreements also hit an all-time high.

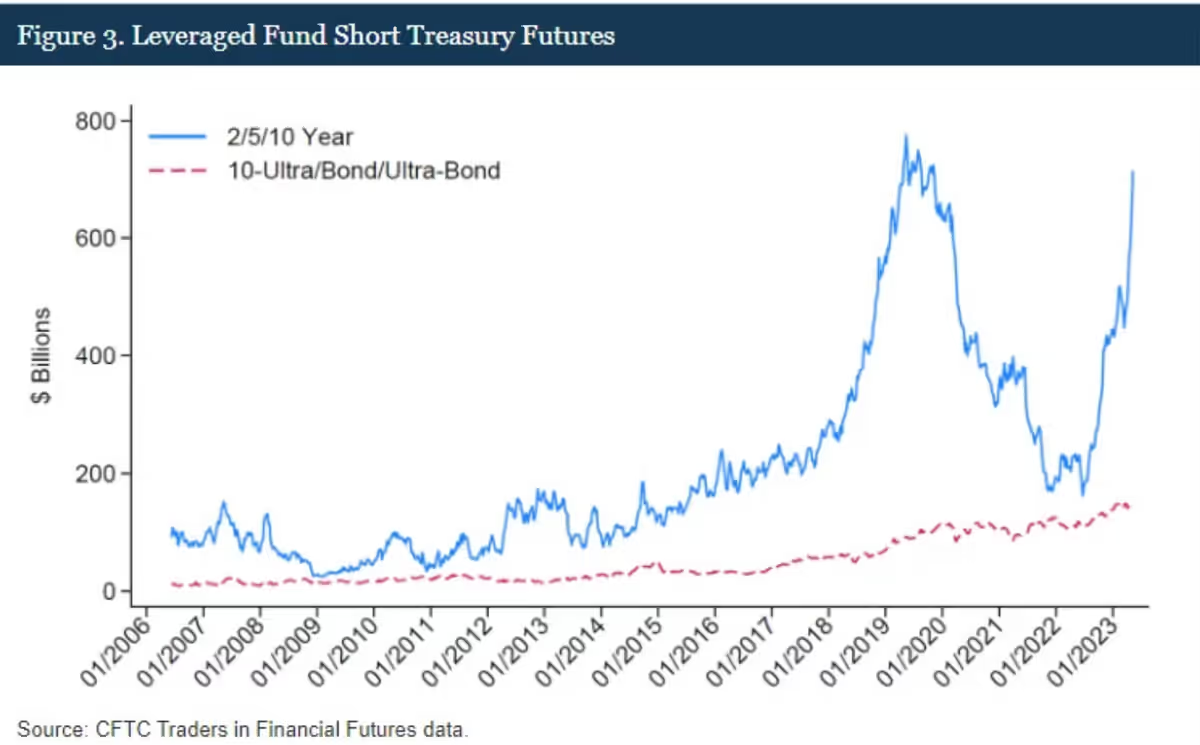

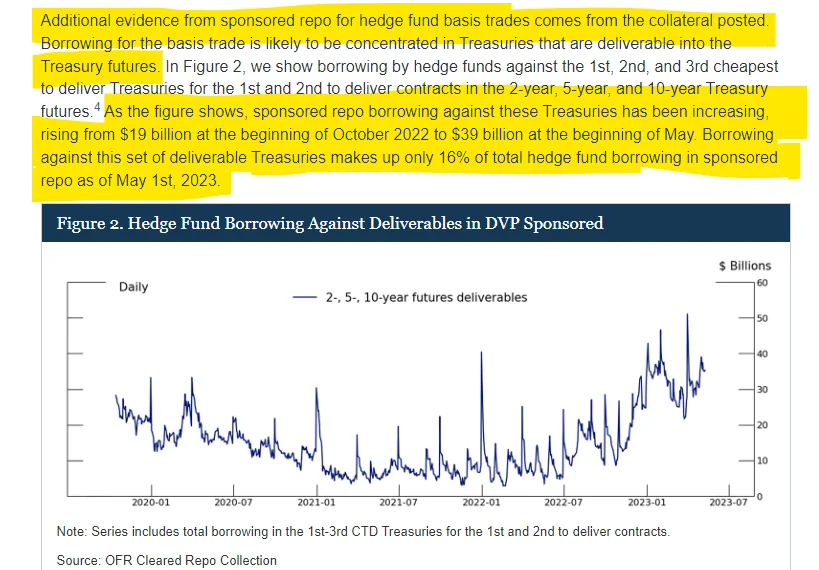

"We also note that, since the data ending date of May 9th, 2023, when this note was drafted, hedge fund short futures positions have continued to rise"

"Should these positions represent basis trades, sustained large exposures by hedge funds present a financial stability vulnerability"

Then there is this form Friday:

SEC Adopts Rule to Increase Transparency in the Securities Lending Mark"et

Background:

Overview of Final Rule:

The final rule requires covered persons to provide securities loan information concerning reportable securities to an RNSA, in the format and manner required by an RNSA, and within specified time periods (“Rule 10c-1a information”). The term “covered person” is defined to mean: (1) any person that agrees to a covered securities loan on behalf of a lender (“intermediary”); (2) any person that agrees to a covered securities loan as a lender when an intermediary is not used unless 17 CFR 240.10c-1a(j)(1)(iii) (“final Rule 10c-1a(j)(1)(iii)”) applies to a broker or dealer borrowing fully paid or excess margin securities; or (3) a broker or dealer when borrowing fully paid or excess margin securities. In addition, 17 CFR 240.10c 1a(a) (“final Rule 10c-1a(a)”) specifies that any covered person that agrees to a covered securities loan must comply with the rule.

If any person agrees to a covered securities loan on behalf of the lender (an “intermediary”), the intermediary has the obligation to provide Rule 10c-1a information to an RNSA. If an intermediary is not used, the lender is required to provide Rule 10c-1a information to an RNSA. If a covered securities loan consists of a broker or dealer borrowing fully paid or excess margin securities, only the broker or dealer is required to provide the Rule 10c-1a information to an RNSA, not the lender.

However, in a change from the proposed rule, as discussed below, in Part VII.A, the final rule excludes from the definition of the term “covered person” a clearing agency when providing only the functions of a central counterparty as defined pursuant to 17 CFR 240.17Ad-22(a)(3) (“Rule 17Ad-22(a)(2)”) of the Exchange Act or a central securities depository as defined pursuant to 17 CFR 240.17Ad-22(a)(3) (“Rule 17Ad-22(a)(3)”) of the Exchange Act. Thus, a clearing agency is not required to report Rule 10c-1a information to an RNSA for a covered securities loan when acting in the capacity or engaged in activities as a central counterparty or a central securities depository in connection with a covered securities loan.

The final rule permits a covered person to rely on a reporting agent that is a broker, dealer, or registered clearing agency to provide Rule 10c-1a information to an RNSA to fulfill such covered person’s reporting obligation. To do so, the covered person must enter into a written agreement with a reporting agent, that agrees to provide Rule 10c-1a information to an RNSA, and provide such reporting agent with timely access to such information. If the reporting agent receives the Rule 10c-1a information from the covered person on a timely basis, the reporting agent assumes responsibility for compliance with the reporting requirements under the final rule.

The final rule defines a “covered securities loan” as a transaction in which any person on behalf of itself or one or more other persons, lends a “reportable security” to another person (except for a position at a clearing agency that results from certain central counterparty or central securities depository services). In addition, the use of margin securities, as defined in 17 CFR 240.15c3-3(a)(4) (“Rule 15c3-3(a)(4)”) of the Exchange Act, by a broker or dealer is not a covered securities loan for purposes of the final rule unless the broker or dealer lends such margin securities to another person.

The term “reportable security” is defined as any security or class of an issuer’s securities for which information is reported or required to be reported to the consolidated audit trail as required by Rule 613 of the Exchange Act and the CAT NMS Plan (“CAT”), the Financial Industry Regulatory Authority’s Trade Reporting and Compliance Engine (“TRACE”), or the Municipal Securities Rulemaking Board’s (“MSRB”) Real-Time Transaction Reporting System (“RTRS”), or any reporting system that replaces one of these systems.

The final rule requires a covered person, directly or indirectly through a reporting agent, to report three types of data, which together comprise the Rule 10c-1a information. The first type of data concerns the material terms of the covered securities loan and must be provided to an RNSA by the end of the day on which the covered securities loan is effected (“data elements”). The second type of data concerns modifications to a covered securities loan and must be provided to an RNSA by the end of the day on which a covered securities loan is modified, if the modification occurs after other information about the covered securities loan has already been provided to an RNSA, and results in a change to such information. The third type of data concerns confidential information in connection with a covered securities loan and must be provided to an RNSA by the end of the day on which a covered securities loan is effected. The final rule requires that an RNSA keep the third type of information confidential subject to applicable law. The final rule also requires an RNSA to make the Rule 10c-1a information available to the Commission; or other persons as the Commission may designate by order upon a demonstrated regulatory need.

An RNSA is required to make publicly available the following information not later than the morning of the business day after the covered securities loan is effected: (1) the unique identifier assigned to a covered securities loan by an RNSA and the security identifier; (2) the data elements, except for loan amount; and (3) information pertaining to the aggregate transaction activity and the distribution of rates among loans and lenders (“distribution of loan rates”) for each reportable security and related unique identifier. An RNSA is also required to make publicly available the loan amount on the twentieth business day after the covered securities loan is effected along with loan and security identifying information.

In addition, an RNSA is required to make publicly available any modification to the data elements, except for modification to the loan amount, not later than the morning of the business day after the covered securities loan is modified. An RNSA is also required to make publicly available modifications to the loan amount on the twentieth business day after the loan amount is modified along with loan and security identifying information.

The final rule requires an RNSA to implement rules regarding the format and manner of its collection of information and make publicly available such information in accordance with rules promulgated pursuant to 15 U.S.C. 78s(b) (“section 19(b)”) and 17 CFR 240.19b-4 (“Rule 19b-4”) of the Exchange Act. The final rule also contains requirements regarding an RNSA’s data retention and availability. Specifically, an RNSA must maintain the information on its website or a similar means of electronic distribution, without use restrictions, for a period of at least five years. In addition, the final rule permits an RNSA to establish and collect reasonable fees pursuant to rules promulgated pursuant to section 19(b) and Rule 19b-4.

Final Rule 10c-1a is designed to provide access to timely, comprehensive securities loan information to market participants, the public, and regulators, which will help provide borrowers and lenders with better tools to assess the terms of their securities loans and enhance the ability of regulators to oversee the securities lending market. In addition, the final rule will result in the public availability of new information for investors and other market participants to consider in the mix of information about the securities lending market and the securities markets generally to better inform their decisions.

The final rule will also provide regulators with information that may be used in conjunction with other information that is currently available to regulators to help assess market events.

Fact Sheet:

Rule 10c-1a will require any “covered person” who agrees to a “covered securities loan” to provide specified information to an RNSA. A covered person refers to (1) any person that agrees to a covered securities loan on behalf of the lender (intermediary) other than a clearing agency when providing only the functions of a central counterparty or a central securities depository, (2) any person that agrees to a covered securities loan as the lender when an intermediary is not used, or (3) the broker or dealer when borrowing fully paid or excess margin securities.

A covered securities loan refers to a transaction in which one person – either on that person’s own behalf or on behalf of one or more other persons – lends a “reportable security” to another person, with exclusions for (1) positions at a registered clearing agency that result from central counterparty services or central depository services, and (2) the use of margin securities by a broker or dealer unless such broker or dealer lends such securities to another person. A reportable security is a security for which

Press Release:

The Securities and Exchange Commission today adopted new Rule 10c-1a, which will require certain persons to report information about securities loans to a registered national securities association (RNSA) and require RNSAs to make publicly available certain information that they receive regarding those lending transactions. The rule is intended to increase the transparency and efficiency of the securities lending market.

“Securities lending played a role in the 2008 financial crisis, and, currently, the securities lending market is opaque,” said SEC Chair Gary Gensler. “In the Dodd-Frank Act, Congress mandated that the Commission enhance the transparency of the securities lending market. Such transparency gets to the heart of the SEC’s mission. It promotes competition. It promotes fair, orderly, and efficient markets. In fulfilling Congress’s mandate, today’s adoption will promote greater transparency in the securities lending markets both to regulators and the public.”

Rule 10c-1a will require certain confidential information to be reported to an RNSA to enhance the RNSA’s oversight and enforcement functions. Further, the new rule requires that an RNSA make certain information it receives, along with daily information pertaining to the aggregate transaction activity and distribution of loan rates for each reportable security, available to the public. The Financial Industry Regulatory Authority (FINRA) is currently the only RNSA.

The adopting release will be published in the Federal Register. The final rule will become effective 60 days after publication in the Federal Register. The compliance dates for the new rule will be as follows: (1) an RNSA is required to propose rules within four months of the effective date; (2) the proposed RNSA rules are required to be effective no later than 12 months after the effective date; (3) covered persons are required to report information required by the rule to an RNSA starting on the first business day 24 months after the effective date; and (4) RNSAs are required to publicly report information within 90 calendar days of the reporting date.

Wut Mean?:

- SEC Adopts Rule to Increase Transparency in the Securities Lending Market.

- Rule 10c-1a will require any “covered person” who agrees to a “covered securities loan” to provide specified information to an RNSA.

A covered person refers to:

- Any person that agrees to a covered securities loan on behalf of the lender (intermediary) other than a clearing agency when providing only the functions of a central counterparty or a central securities depository.

- Any person that agrees to a covered securities loan as the lender when an intermediary is not used.

- The broker or dealer when borrowing fully paid or excess margin securities.

A covered securities loan refers to

- A transaction in which one person – either on that person’s own behalf or on behalf of one or more other persons – lends a “reportable security” to another person, with exclusions for:

- positions at a registered clearing agency that result from central counterparty services or central depository services.

- the use of margin securities by a broker or dealer unless such broker or dealer lends such securities to another person.

Rule 10c-1a will require covered persons to provide certain terms of the covered securities loans to an RNSA, if applicable, including the:

- Legal name of the issuer of the securities to be borrowed;

- Ticker symbol of those securities;

- Time and date of the covered securities loan;

- Name of the platform or venue, if one is used;

- Amount of reportable securities loaned;

- Rates, fees, charges, and rebates for the loan;

- Type of collateral provided for the covered securities loan and the percentage of the collateral to the value of the reportable securities loaned;

- Termination date of the covered securities loan; and

- Borrower type, e.g., broker, dealer, bank, customer, bank, clearing agency, custodian. Additional loan terms that will be provided to the RNSA but will not be made public include:

- The legal names of the parties to the loan;

- When the lender is a broker-dealer, whether the security loaned to its customer is loaned from the broker-dealer’s inventory; and

- Whether the loan will be used to close out a fail to deliver pursuant to Rule 204 of Regulation SHO or whether the loan is being used to close out a fail to deliver outside of Regulation SHO.

- Effective within 60 days of publishing in the Federal Register

SEC Adopts Rule to Increase Transparency Into Short Selling and Amendment to CAT NMS Plan for Purposes of Short Sale Data Collection

Fact Sheet

Press Release:

The Securities and Exchange Commission today adopted new Rule 13f-2 to provide greater transparency to investors and other market participants by increasing the public availability of short sale related data. Congress directed the SEC in Section 929X of the Dodd-Frank Act of 2010 to promulgate rules to make certain short sale data publicly available.

“In the wake of the 2008 financial crisis, Congress directed the SEC to enhance the transparency of short selling of equity securities,” said SEC Chair Gary Gensler. “Today’s adoption will promote greater transparency about short selling both to regulators and the public. This rule addresses Congress’s mandate and improves upon existing sources of short sale-related data in the equity markets. Given past market events, it’s important for the Commission and the public to know more about short sale activity in the equity markets, especially in times of stress or volatility.”

Specifically, Rule 13f-2 will require institutional investment managers that meet or exceed certain thresholds to report on Form SHO specified short position data and short activity data for equity securities. The Commission will aggregate the resulting data by security, thereby maintaining the confidentiality of the reporting managers, and publicly disseminate the aggregated data via EDGAR on a delayed basis. This new data will supplement the short sale data that is currently publicly available.

Relatedly, the Commission today also adopted an amendment to the National Market System Plan (NMS Plan) governing the consolidated audit trail (CAT). The amendment to the NMS Plan governing the CAT (CAT NMS Plan) will require each CAT reporting firm that is reporting short sales to indicate when it is asserting use of the bona fide market making exception in Rule 203(b)(2)(iii) of Regulation SHO.

The adopting release for Rule 13f-2 and related Form SHO, as well as the notice of the amendment to the CAT NMS Plan, will be published in the Federal Register. The final rule, Form SHO, and the amendment to the CAT NMS Plan will become effective 60 days after publication of the adopting release in the Federal Register. The compliance date for Rule 13f-2 and Form SHO will be 12 months after the effective date of the adopting release, with public aggregated reporting to follow three months later, and the compliance date for the amendment to the CAT NMS Plan will be 18 months after the effective date of the adopting release.

Uyeda goes on to say:

- "In this case, the Commission has exercised it discretionary authority in a manner that could discourage short selling."

- "Why should anyone make the effort to conduct research if there will no individualized reward for such efforts? This can lead to superior price discovery. If a person determines that a security is underpriced relative to its intrinsic value, they can purchase the security and go “long.”"

- "The benefits of short selling go beyond improved general price discovery. Short selling often proactively reduces market manipulations that would otherwise occur."