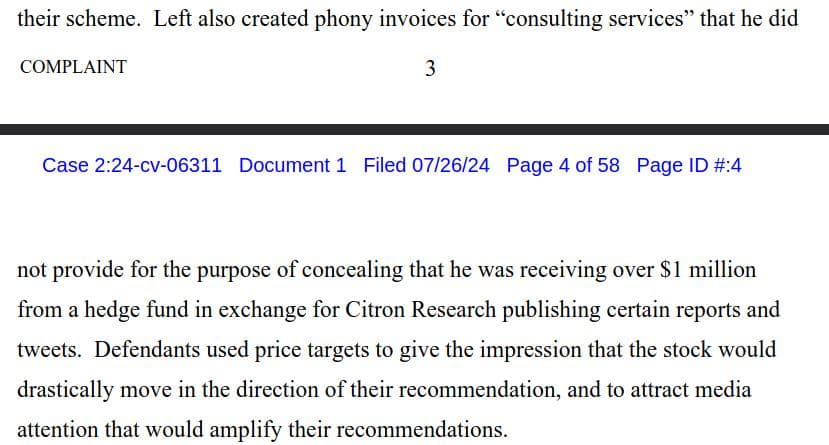

SEC Complaint against Andrew Left: "did not provide for the purpose of concealing that he was receiving over $1 million from a hedge fund in exchange for Citron Research publishing certain reports and tweets."

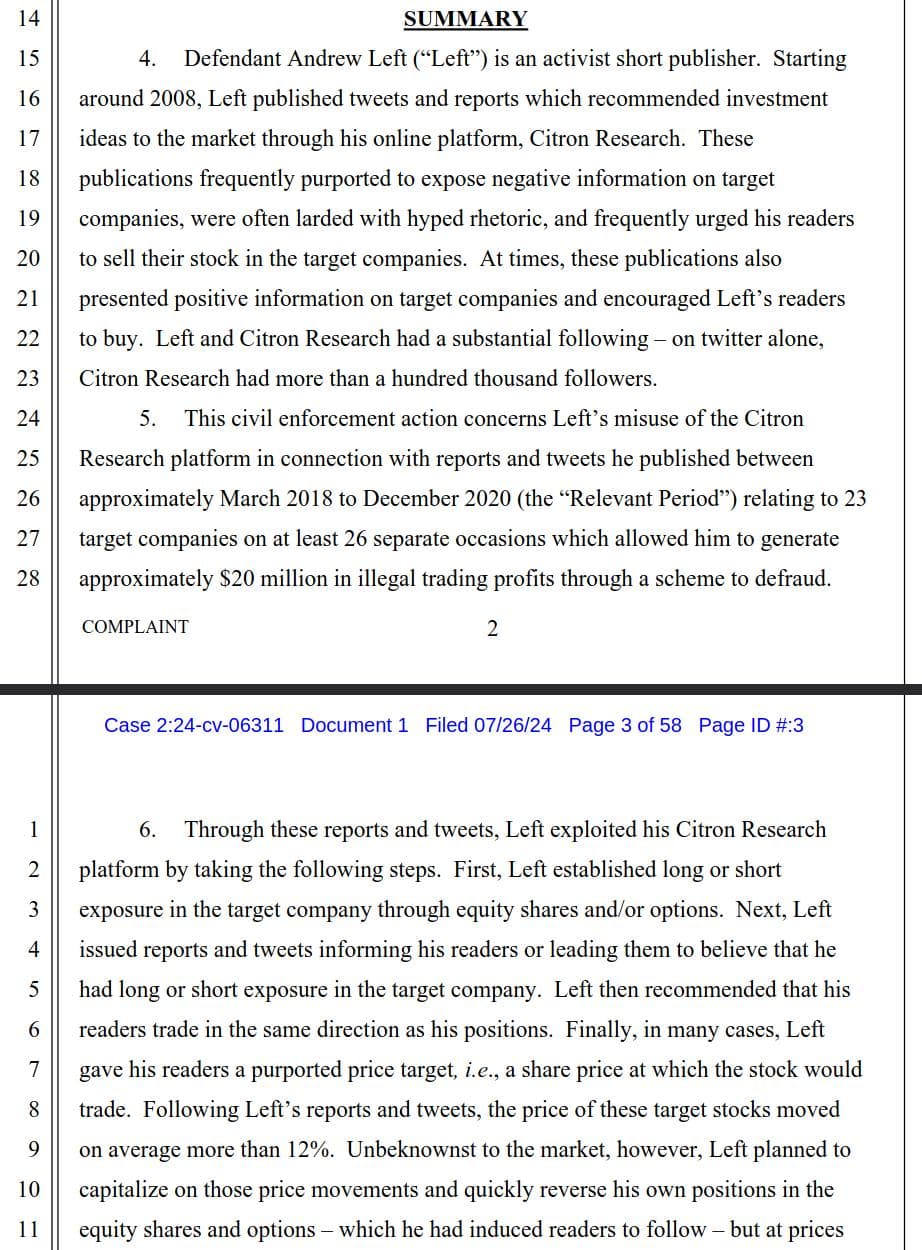

The Securities and Exchange Commission (SEC) announced charges today against activist short seller Andrew Left and his firm, Citron Capital LLC, accusing them of a multi-year scheme to defraud followers by publishing false and misleading stock trading recommendations, netting $20 million in profits.

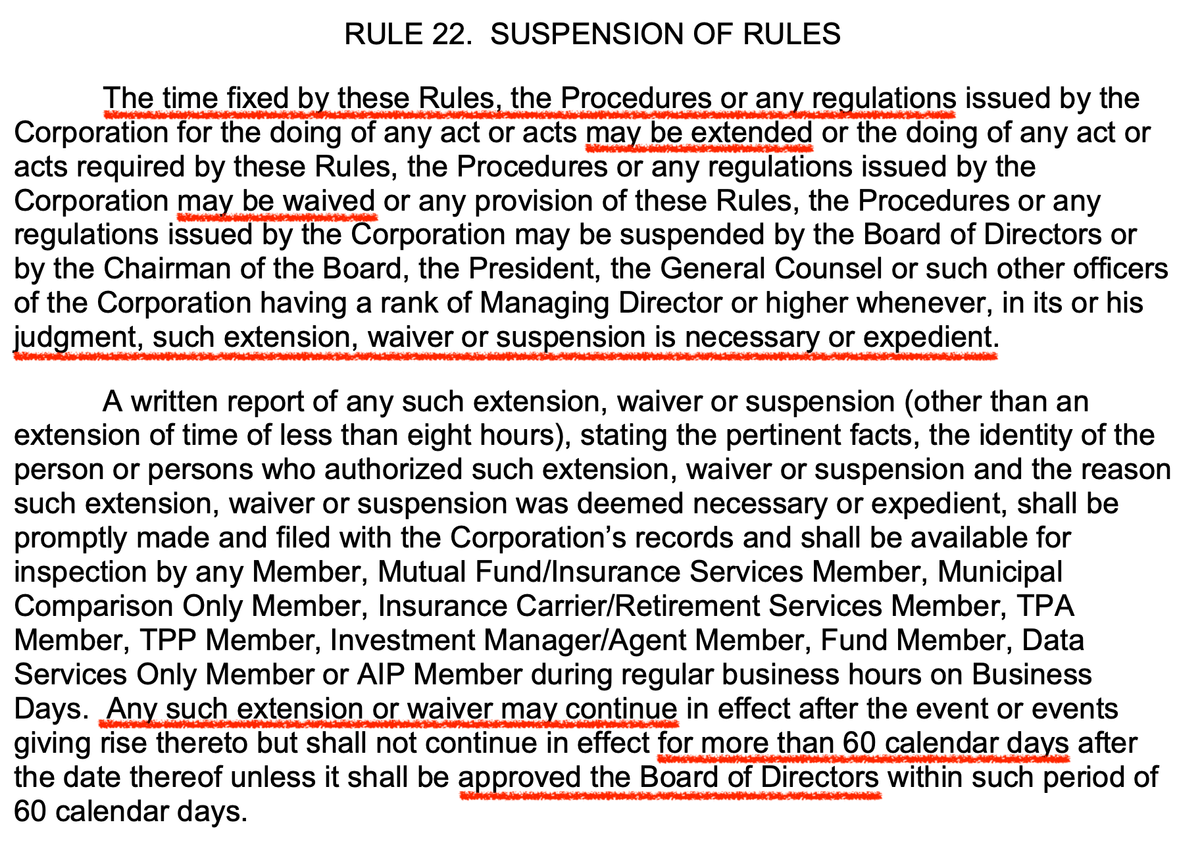

According to the SEC's complaint, Left used his Citron Research website and related social media platforms on at least 26 occasions to recommend long or short positions in 23 companies, presenting these positions as aligned with his own and Citron Capital's. These recommendations led to an average stock price movement of over 12%. However, the SEC alleges that Left and Citron Capital quickly reversed their positions after the recommendations, buying stocks they advised selling and selling stocks they advised buying.

"Andrew Left took advantage of his readers. He built their trust and induced them to trade on false pretenses so that he could quickly reverse direction and profit from the price moves following his reports. We uncovered these alleged bait-and-switch tactics, which netted Left and his firm $20 million in ill-gotten profits, and we intend to hold Left and his firm accountable for their actions." -Kate Zoladz, Director of the SEC's Los Angeles Regional Office

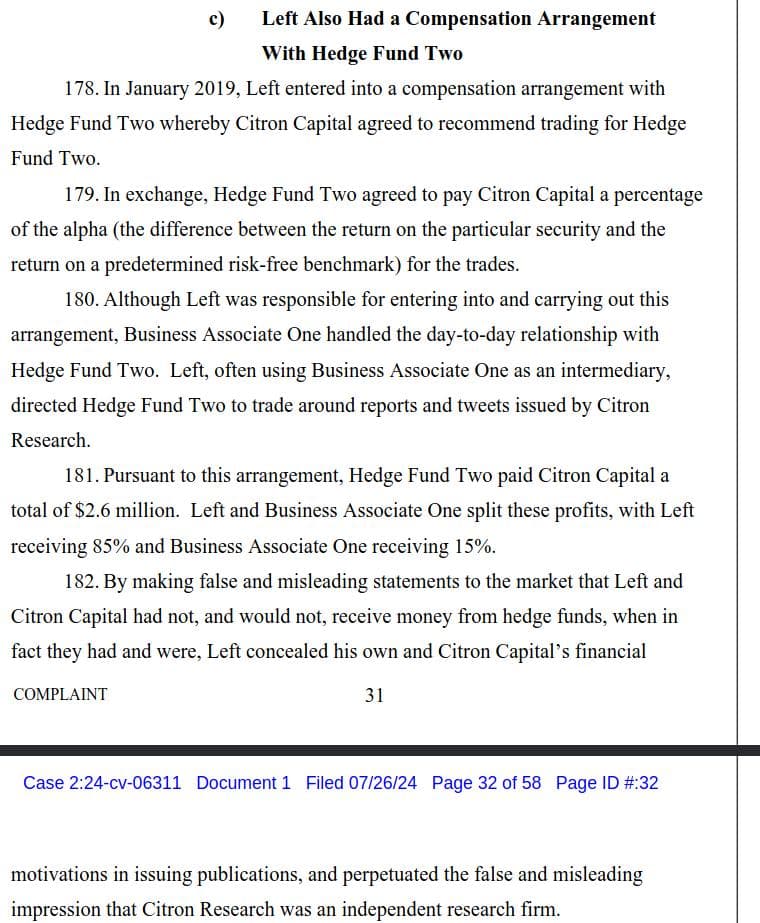

The complaint also alleges that Left and Citron Capital made several false and misleading statements, such as claiming they would stay long on a stock until it reached $65 while selling it at $28. Additionally, they falsely represented Citron Research as an independent outlet without compensation from third parties, despite having compensation arrangements with hedge funds.

In a parallel action, the Department of Justice's Fraud Section and the U.S. Attorney’s Office for the Central District of California also announced charges against Left.

Tickers called out in the complaint as manipulated by Left:

- NVTA

- ROKU

- CRON

- GE

- BYND

- XL

- AAL

- VUZI

- NAMASTE

- IGC

- PLTR

- NVAX

- INO

- LK

- NVTA

- FB

- TWTR

- VEEV

- NVDA

- TSLA

- PTE

- ABBV

- SNAP

- BABA

Left was taking hedge fund money for these recommendations:

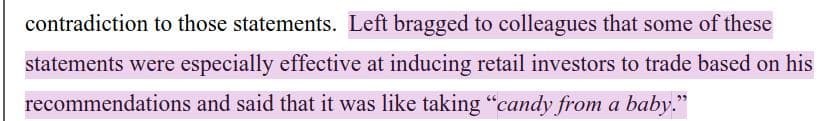

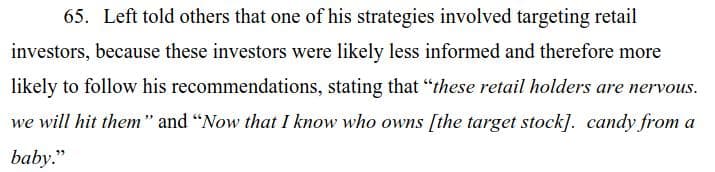

Left bragged to colleagues that some of these statements were especially effective at inducing retail investors to trade based on his recommendations and said that it was like taking “candy from a baby.”

![he was confident he could “destroy” or “kill” companies by publishing a tweet or report, and told a colleague in August 2018 that he had a “hot voice” that he planned to “take a vantage [sic] of.”](https://dismal-jellyfish.com/content/images/2024/07/193.jpg)

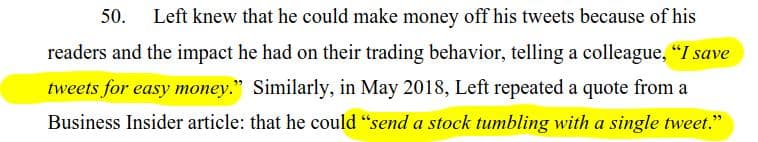

he was confident he could “destroy” or “kill” companies by publishing a tweet or report, and told a colleague in August 2018 that he had a “hot voice” that he planned to “take a vantage [sic] of.”

DOJ filing:

A federal grand jury in the Central District of California returned an indictment yesterday charging a prominent activist short seller with multiple counts of securities fraud for a long-running market manipulation scheme reaping profits of at least $16 million. According to the indictment, Andrew Left, 54, formerly of Beverly Hills, California, and now a resident of Boca Raton, Florida, was a securities analyst, trader, and frequent guest commentator on cable news channels such as CNBC, Fox Business, and Bloomberg Television. Left conducted business under the name “Citron Research” (Citron), an online moniker he created as a vehicle for publishing investment recommendations. Citron’s online presence included a website and a social media account on X, formerly known as Twitter.

As alleged in the indictment, Left commented on publicly traded companies, asserting that the market incorrectly valued a company’s stock and advocating that the current price was too high or too low. Left’s recommendations often included an explicit or implicit representation about Citron’s trading position—which created the false pretense that Left’s economic incentives aligned with his public recommendation—and a “target price,” which Left represented as his valuation of the company’s stock. Sometimes, the commentary represented Left’s own work. Other times, Left disseminated the commentary of third parties as his own. The commentary routinely included sensationalized headlines and exaggerated language to maximize the reaction it would get from the stock market. As alleged, Left knowingly exploited his ability to move stock prices by targeting stocks popular with retail investors and posting recommendations on social media to manipulate the market and make fast, easy money.

As further alleged in the indictment, in the leadup to publication of Citron’s commentary, Left established long or short positions in the public company on which he was commenting in his trading accounts and prepared to quickly close those positions post-publication and take profits on the short-term price movement caused by his commentary. Left allegedly used his advance knowledge and control over the timing of a market-moving event to build his positions using inexpensive, short-dated options contracts that expired from the same day that he published his commentary to within five days. Left also allegedly submitted limit orders, often prior to publication of his commentary, to close his positions as soon as the company’s shares reached a certain price and at prices vastly different from the target prices that Left recommended to the public. While Left made false representations to the public to bolster his credibility, behind the scenes, Left allegedly took contrary trading positions to reap quick profits off the stocks he either promoted or pilloried through Citron.

To further the scheme, Left allegedly advanced the false pretense that his investment recommendations were credible because he was independent and free from any financial conflicts of interest. However, Left allegedly concealed Citron’s financial relationships with a hedge fund by fabricating invoices, wiring payments through a third party, and making false and misleading statements to the public about Citron’s relationship with hedge funds. In addition, Left allegedly lied to law enforcement, stating that Citron “never” exchanged compensation with a hedge fund or coordinated trading with a hedge fund in advance of the issuance of its commentary.

Through his publishing of research reports, Left gained influence and a public platform on social media and through regular appearances on podcasts and cable news programs. Left allegedly furthered his scheme by misrepresenting his trading positions during media appearances. For example, after denouncing one company as a “fraud” on CNBC’s “Fast Money,” Left allegedly falsely claimed to have covered only a “small size” of his position in the company’s stock when, earlier that same day, he allegedly closed out more than sixty percent of his position.

Left is charged with one count of engaging in a securities fraud scheme, 17 counts of securities fraud, and one count of making false statements to federal investigators. If convicted, he faces a maximum penalty of 25 years in prison on the securities fraud scheme count, 20 years in prison on each securities fraud count, and five years in prison on the false statements count.

Principal Deputy Assistant Attorney General Nicole M. Argentieri, head of the Justice Department’s Criminal Division; U.S. Attorney Martin Estrada for the Central District of California; Executive Assistant Director Michael A. Nordwall of the FBI’s Criminal, Cyber, Response, and Services Branch; Assistant Director in Charge Akil Davis of the FBI Los Angeles Field Office; and Inspector in Charge Eric Shen of the U.S. Postal Inspection Service (USPIS) Criminal Investigations Group made the announcement.

The FBI Los Angeles Field Office and USPIS are investigating the case.

Trial Attorneys Lauren Archer and Matthew Reilly of the Criminal Division’s Fraud Section and Assistant U.S. Attorneys Brett Sagel and Alexander Schwab for the Central District of California are prosecuting the case.

TLDRS:

- The SEC has charged activist short seller Andrew Left and his firm, Citron Capital LLC, with defrauding followers through false and misleading stock trading recommendations, earning $20 million in profits.

- Left allegedly used his Citron Research website and social media platforms to recommend long or short positions in 23 companies, claiming these positions matched his own and Citron Capital's, causing stock prices to move over 12% on average.

- The SEC claims that after making these recommendations, Left and Citron Capital quickly reversed their positions, buying stocks they advised selling and selling stocks they advised buying.

- Kate Zoladz, Director of the SEC's Los Angeles Regional Office, stated that Left exploited his readers' trust, inducing them to trade based on false pretenses for his own profit.

- The complaint also alleges that Left and Citron Capital made false claims, such as pledging to stay long on a stock until it hit $65 while selling it at $28, and misrepresented Citron Research as independent despite receiving compensation from hedge funds.

- In addition to the SEC's charges, the Department of Justice's Fraud Section and the U.S. Attorney’s Office for the Central District of California also announced charges against Left.

- Stocks cited in the complaint as manipulated by Left include NVTA, ROKU, CRON, GE, BYND, XL, AAL, VUZI, NAMASTE, IGC, PLTR, NVAX, INO, LK, NVTA, FB, TWTR, VEEV, NVDA, TSLA, PTE, ABBV, SNAP, and BABA.

- Left bragged to colleagues that some of these statements were especially effective at inducing retail investors to trade based on his recommendations and said that it was like taking “candy from a baby.”

- he was confident he could “destroy” or “kill” companies by publishing a tweet or report, and told a colleague in August 2018 that he had a “hot voice” that he planned to “take a vantage [sic] of.”

SEC Complaint against Andrew Left: "did not provide for the purpose of concealing that he was receiving over $1 million from a hedge fund in exchange for Citron Research publishing certain reports and tweets."

by u/Dismal-Jellyfish in Superstonk

SEC Complaint against Andrew Left: "did not provide for the purpose of concealing that he was receiving over $1 million from a hedge fund in exchange for Citron Research publishing certain reports and tweets."https://t.co/hT0CZ2grPA

— dismal-jellyfish (@DismalJellyfish) July 26, 2024