Recession Alert! The Conference Board Leading Economic Index for the U.S. decreased by 0.4 percent in September 2022.

Recession Alert! The Conference Board Leading Economic Index for the U.S. decreased by 0.4 percent in September 2022. “The US LEI fell again in September and its persistent downward trajectory in recent months suggests a recession is increasingly likely before yearend,”

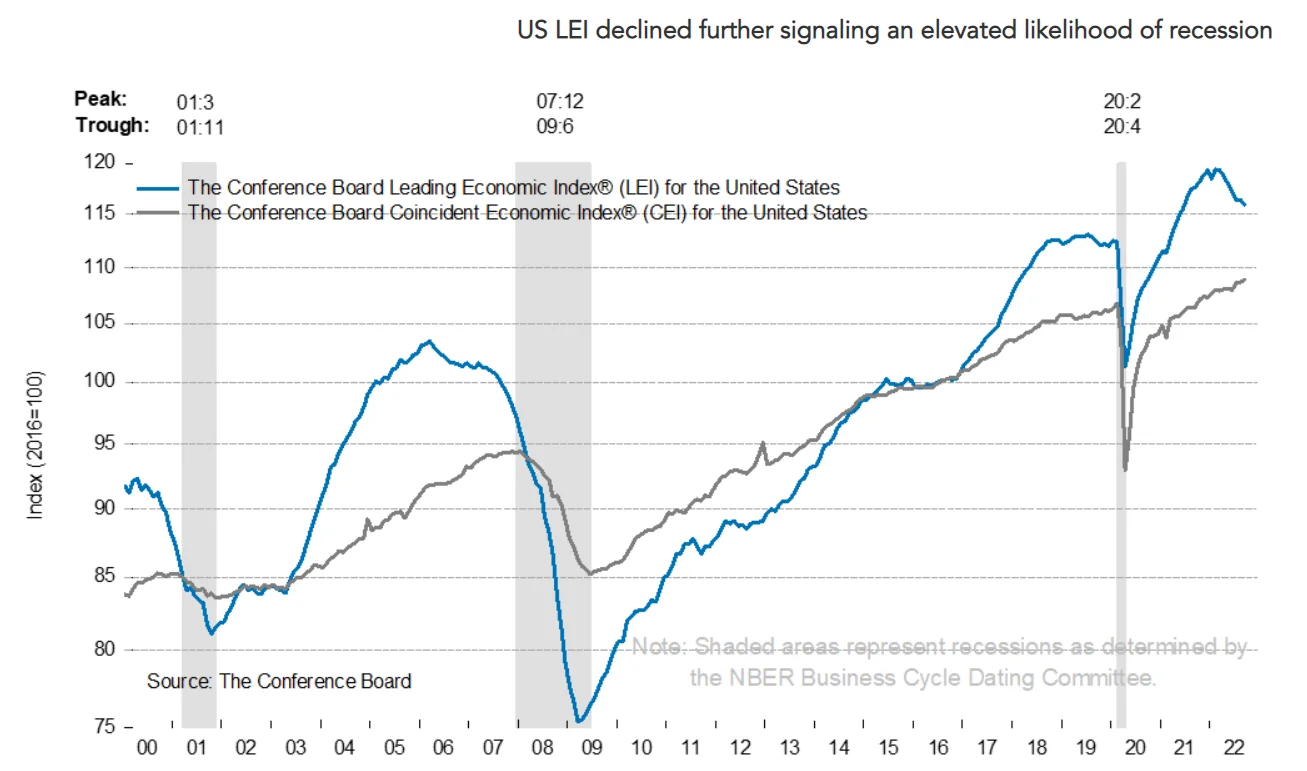

The Conference Board Leading Economic Index® (LEI)for theU.S. decreased by 0.4 percent in September 2022 to 115.9 (2016=100), after remaining unchanged in August. The LEI is down 2.8 percent over the six-month period between March and September 2022, a reversal from its 1.4 percent growth over the previous six months.

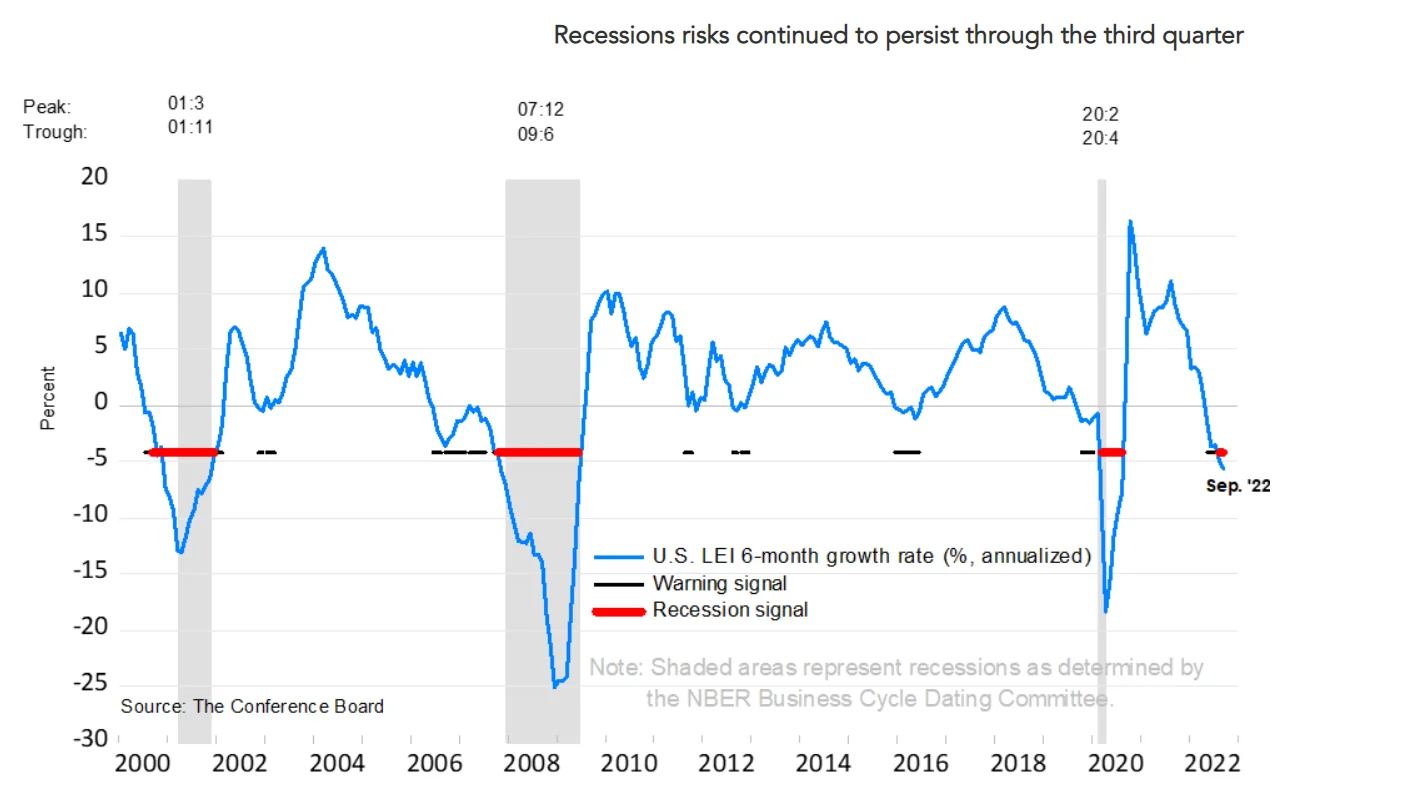

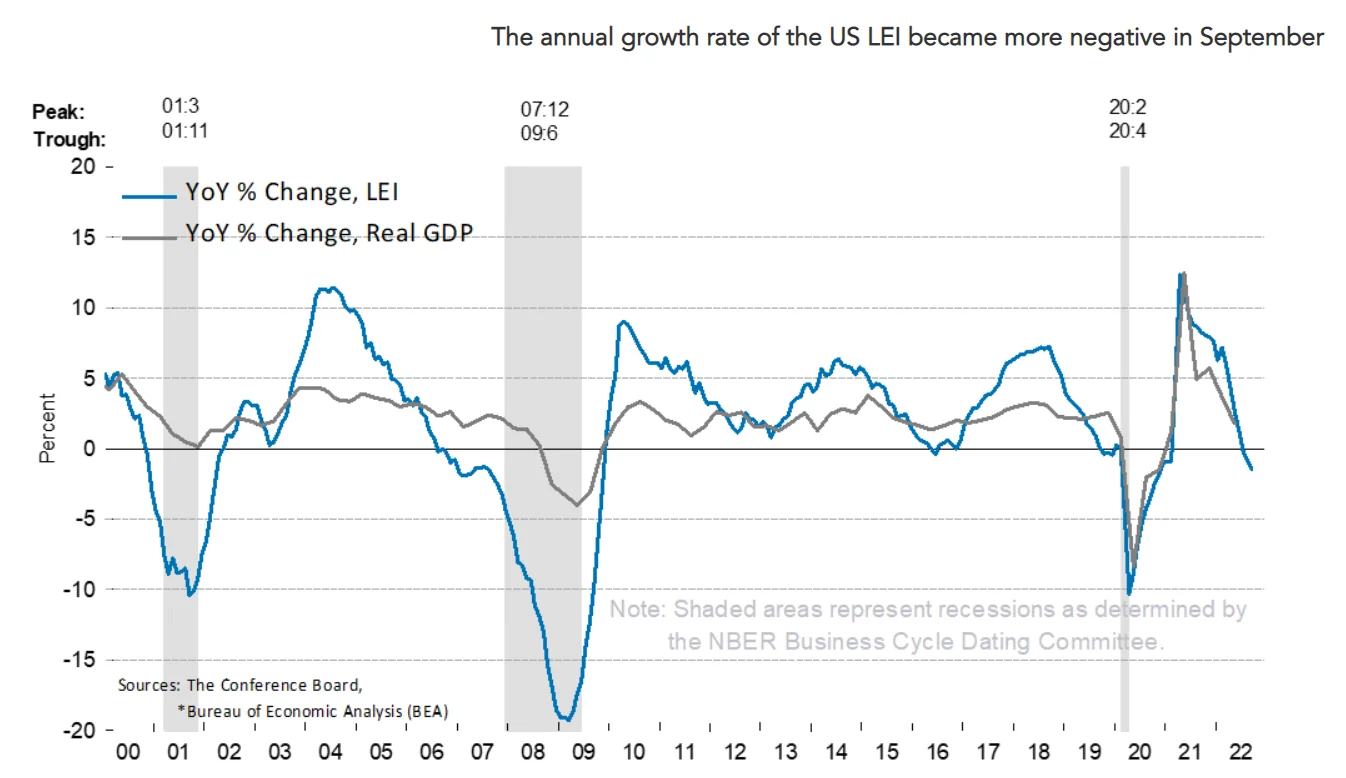

“The US LEI fell again in September and its persistent downward trajectory in recent months suggests a recession is increasingly likely before yearend,” said Ataman Ozyildirim, Senior Director, Economics, at The Conference Board. “The six-month growth rate of the LEI fell deeper into negative territory in September, and weaknesses among the leading indicators were widespread. Amid high inflation, slowing labor markets, rising interest rates, and tighter credit conditions, The Conference Board forecasts real GDP growth will be 1.5 percent year-over-year in 2022, before slowing further in the first half of next year.”

The Conference Board Coincident Economic Index® (CEI) for the U.S. increased by 0.2 percent in September 2022 to 108.9 (2016=100), after increasing by 0.1 percent in August. The CEI rose by 0.9 percent over the six-month period from March to September 2022, slower than its growth of 1.4 percent over the previous six-month period.

The Conference Board Lagging Economic Index® (LAG) for the U.S. increased by 0.6 percent in September 2022 to 116.2

(2016 = 100), following a 0.8 percent increase in August. The LAG is up 4.1 percent over the six-month period from March to September 2022, faster than its growth of 2.7 percent over the previous six-month period.

About The Conference Board Leading Economic Index® (LEI) for the U.S.: The composite economic indexes are the key elements in an analytic system designed to signal peaks and troughs in the business cycle. The indexes are constructed to summarize and reveal common turning points in the economy in a clearer and more convincing manner than any individual component. The CEI is highly correlated with real GDP. The LEI is a predictive variable that anticipates (or “leads”) turning points in the business cycle by around 7 months. Shaded areas denote recession periods or economic contractions. The dates above the shaded areas show the chronology of peaks and troughs in the business cycle.

The ten components of The Conference Board Leading Economic Index® for the U.S. include: Average weekly hours in manufacturing; Average weekly initial claims for unemployment insurance; Manufacturers’ new orders for consumer goods and materials; ISM® Index of New Orders; Manufacturers’ new orders for nondefense capital goods excluding aircraft orders; Building permits for new private housing units; S&P 500® Index of Stock Prices; Leading Credit Index™; Interest rate spread (10-year Treasury bonds less federal funds rate); Average consumer expectations for business conditions.